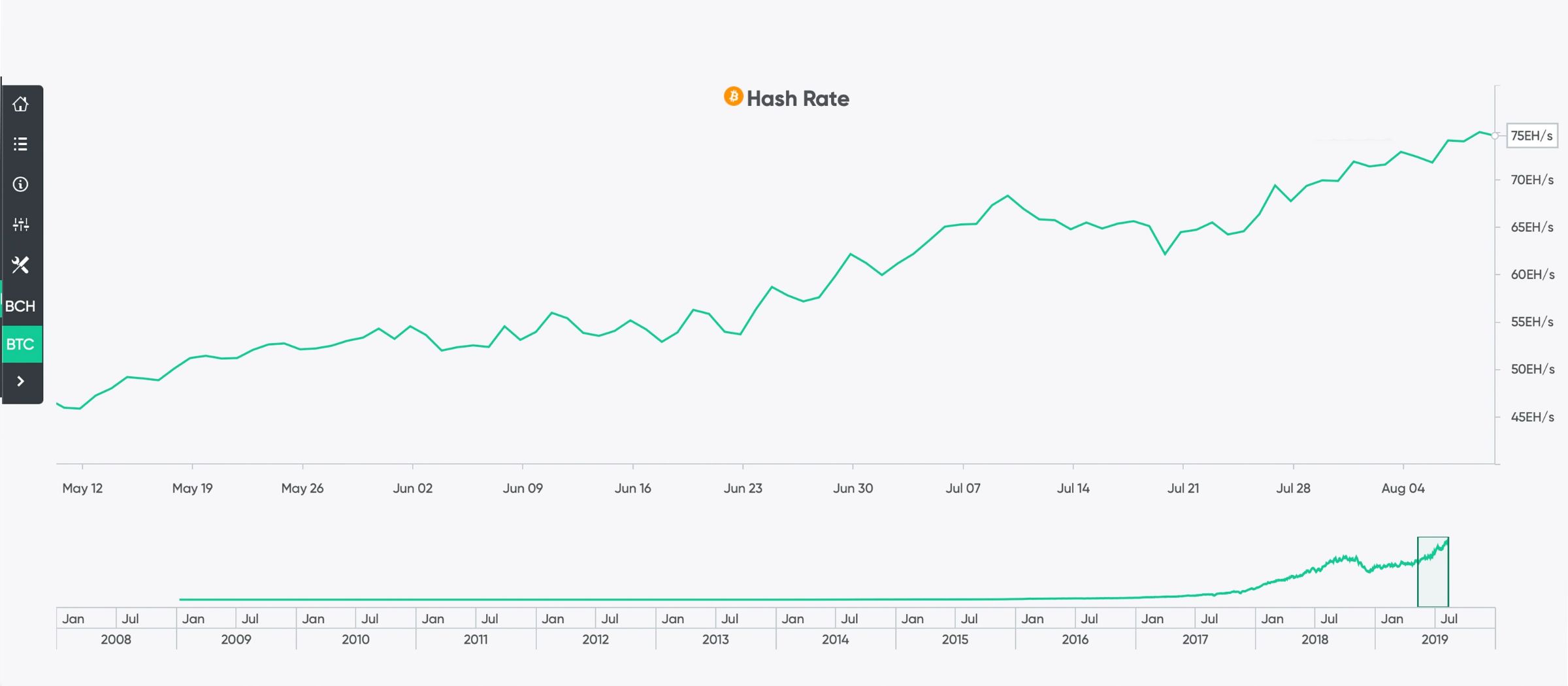

The Bitcoin Mining Index has continued to grow in recent years. What is the trend of 2019?

Mine Pool & ASIC changes game rules

In general, miners in large mining pools come from all over the world. Before 2010, people could use the central processing unit (CPU) to dig bitcoin; then, an anonymous identity named Artforz used a graphics processor (GPU) to dig out bitcoin, which became a hot topic in the Bitcoin community. . In July 2010, Artforz said he dug up 1,700 bitcoins in six days and had about 4% of the world's computing power. In less than three months, some people claimed that "Artfarm" controlled 20~30% of the computing power of the whole network.

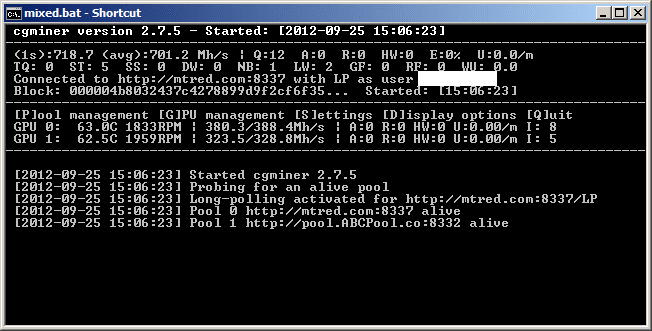

In September 2012, the second year of B's new BTC network, the processing capacity was only 1000000000000 (10 trillion) per second.

- Seed CX tests physical settlement of bitcoin swap contracts, scheduled to launch within three months

- Babbitt Column | Cai Weide: Only Digital Gold Can Fight Digital Dollars

- Bitcoin is not a value store, it will never be, Bitcoiners may be wrong.

The year before Artforz created GPU Farm to dig bitcoin, Nakamoto said: "We should have a gentleman agreement to delay the GPU arms race for the benefit of the network; adding new users without worrying about GPU drivers and compatibility, Then they can get started quickly, and I am happy that people with CPU can participate in fair competition now.” In November 2010, the GPU arms race led to the establishment of the mine pool, when Marek Palatinus (Slush) created the first mine pool – SlushPool, mining has become very difficult for others because of the addition of GPU computers. The phenomenon of joining the mining pool and sharing profits began to gradually become popular. In the summer of 2011, FPGAs appeared.

Artforz was one of the first individuals to build a GPU mine, and it is estimated that in 2010 it will control 20-30% of the network computing power.

Many miners realize that once an FPGA is created, a specific integrated circuit (abbreviated ASIC) will be available soon. Unlike the machines used in the past, the ASIC mining machine is an integrated circuit mining machine with a specific task of using the SHA-256 algorithm to participate in mining; the emergence of ASIC mining machines and mining pools has rapidly transformed bitcoin mining into an industry. While the amateur miners gradually disappeared under the circumstance of the times; the mining of CPU, GPU and FPGA gradually subsided, and finally left the mining stage in 2013. Subsequently, Avalon released the first ASIC mining machine, and Bitcoin witnessed the birth of companies such as Bitmain, Kncminer, Hashfast, Bitfory, Cointerra and Butterfly Labs (BFL). From here, the mining ecosystem has entered an overspeed state, and some large mines like Ghash.io and Btcguild have gathered about 51% of the computing power of the BTC network. Although many mines have gone bankrupt due to poor management, companies like Bitmain, Bitfory and Slushpool have been sticking to and growing for years.

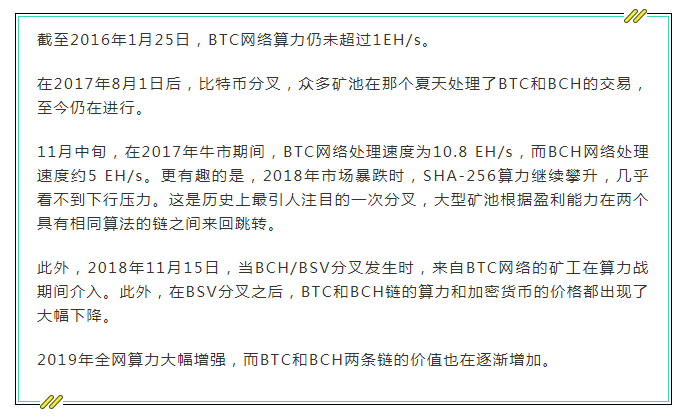

Until January 2016, the BTC network computing power reached 1EH/s.

Exahash era

The BTC calculation power is August 11th, 2019 – 75-80 EH/s.

Currently, the BTC and BCH chains have a processing speed of 75-80 EH / s, a BTC of 75 EH / s, and a BCH network of 2.24. There is no doubt that 80EH/s is an important milestone for the BTC network, and the indicator is steadily approaching 100 EH/s, which will be 20% of a Zethash. One Zetahash (ZH/s) per second is a hash of 10,000000000000000 (one sixth power) per second. After the power battle in November 2018, the processing capacity of 4-5 EH/s was split into two parts (BCH and BSV), both of which were below 1 EH/s. Today, the computing power of the BCH chain has gradually increased, and has accumulated more than 2EH/s in recent months.

BCH is calculated on August 11, 2019 – 2+EH/s.

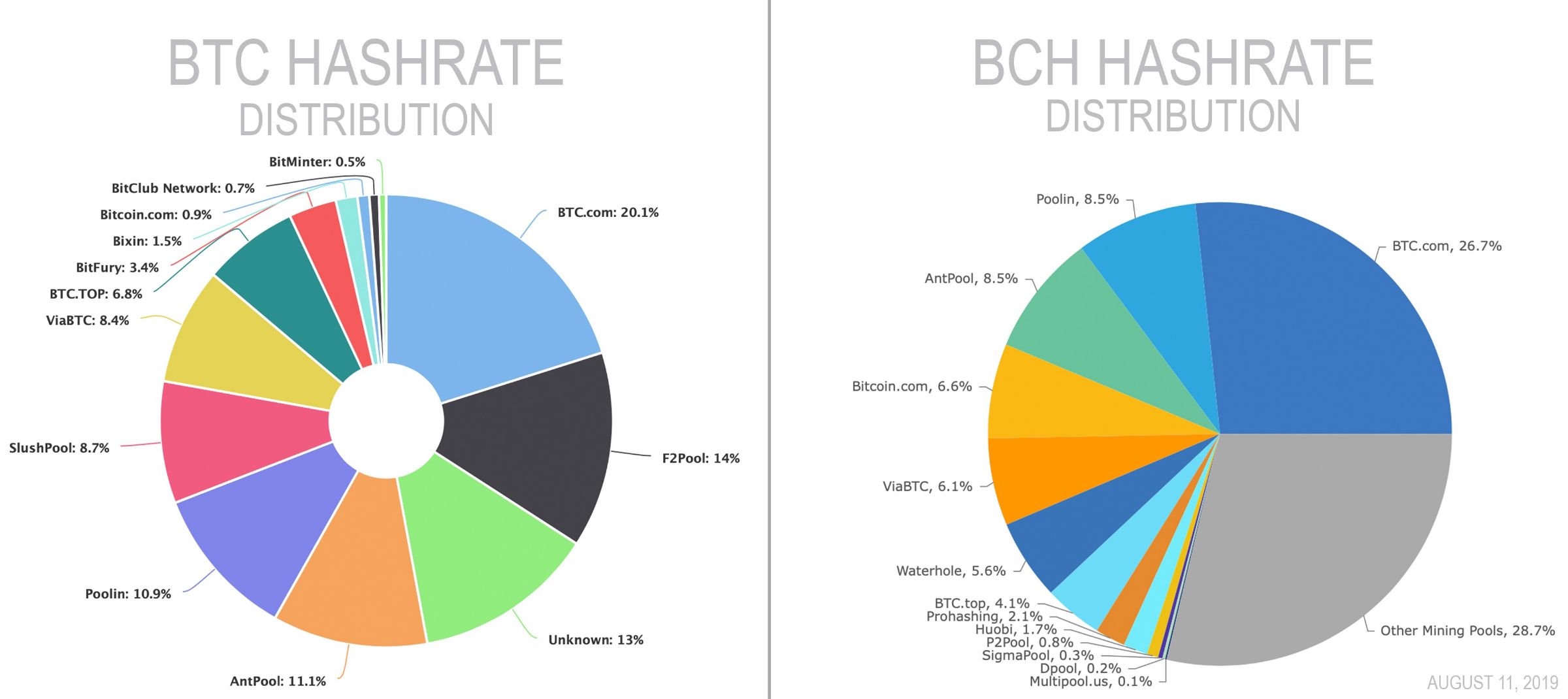

In the second year, the BTC network has a processing capacity of only 1000000000000 (10 trillion) hashes per second (10 times/second). Due to the great technological advancement, the speed of a single mining machine can now exceed 10 times/second. After the two-year anniversary of the fork in 2017, BCH's computing power has increased to several thousand times. There are nearly 14 to 15 known mines in the BCH chain, and about 29% of the calculations come from unknown mines. There are currently 12 known mines that are processing BTC transactions, and 14% of mining rights are controlled by unknown mines. In addition, the six well-known BTC pools also support the BCH chain, so there is always a constant computing power dedicated to both networks. The four largest BCH pools are btc.com, antpool, poolin and bitcoin.com.

The distribution of BTC and BCH calculations on August 11, 2019.

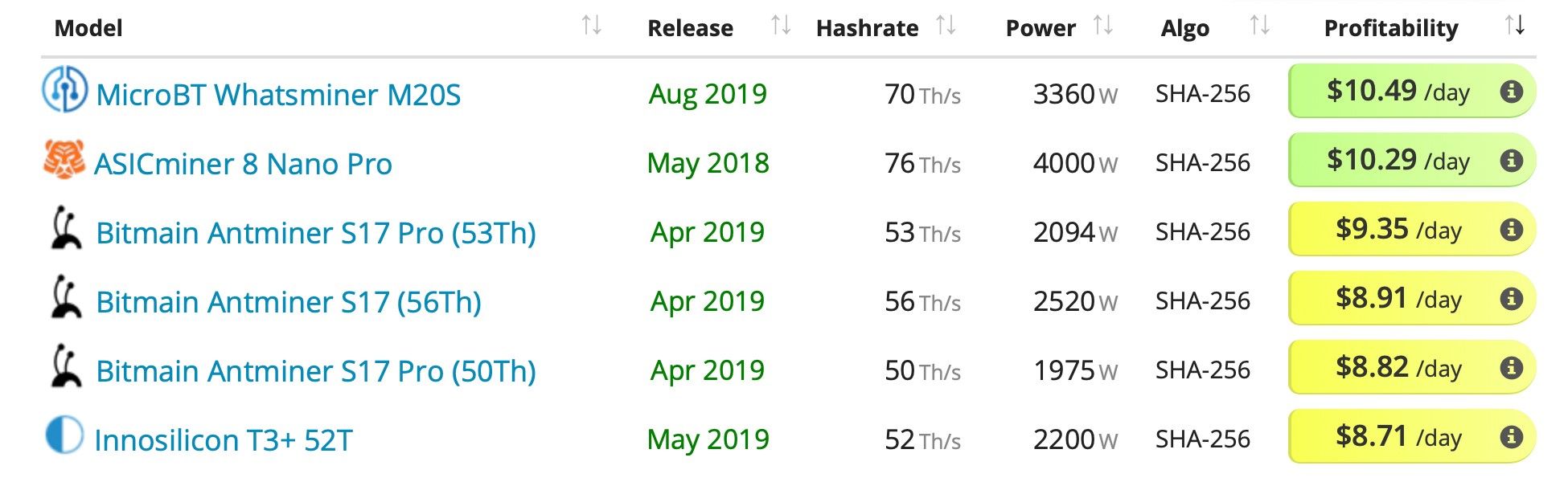

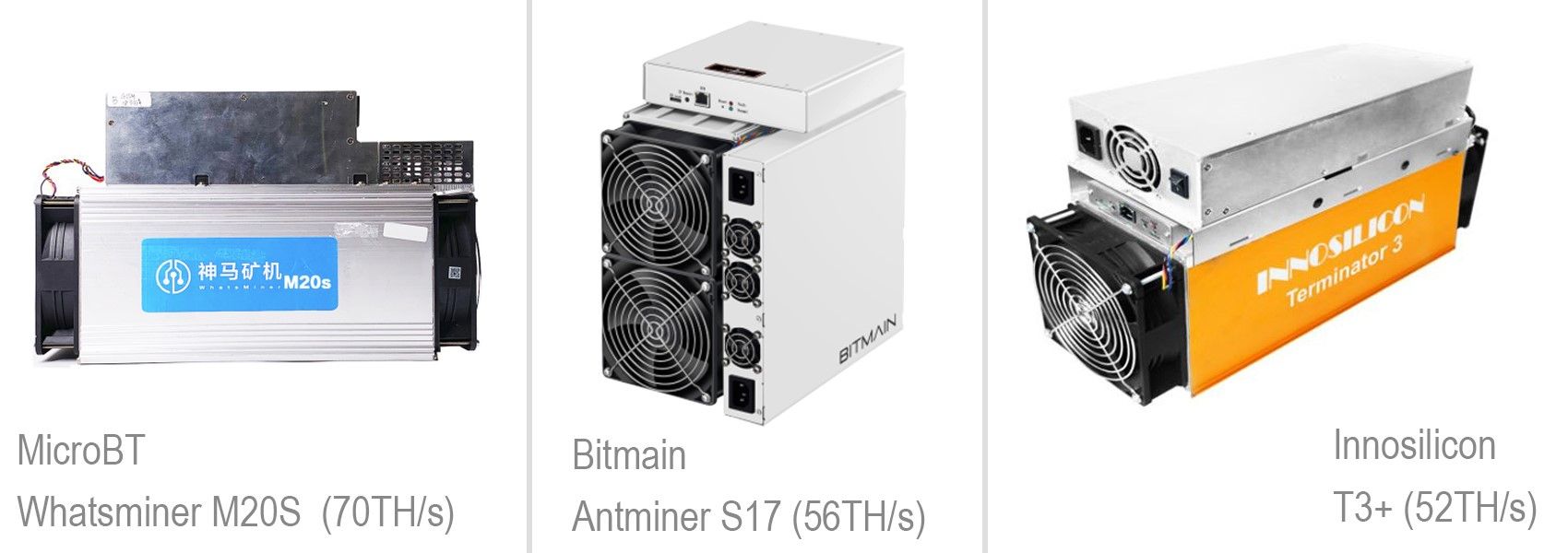

Mining equipment upgrade in 2019

In August 2019, the six most profitable SHA-256 mining equipment (average electricity cost was $0.13 per kWh).

The development of mining in the next 10 years will be very interesting. There will be a lot of money and power resources being used to dig SHA-256 cryptocurrencies. Many of the miner's chip makers mentioned above have been filled up and become the world's top IT companies. Therefore, in December last year, large mining companies such as Canaan and BIT applied for an initial public offering (IPO) in the US, and mining machine manufacturer EBON also submitted a draft IPO prospectus to the Hong Kong Stock Exchange (HEXEX).

You can connect your mining machine to the world's most profitable mining pool, or you can make a profit by buying a Bitcoin cloud computing contract.

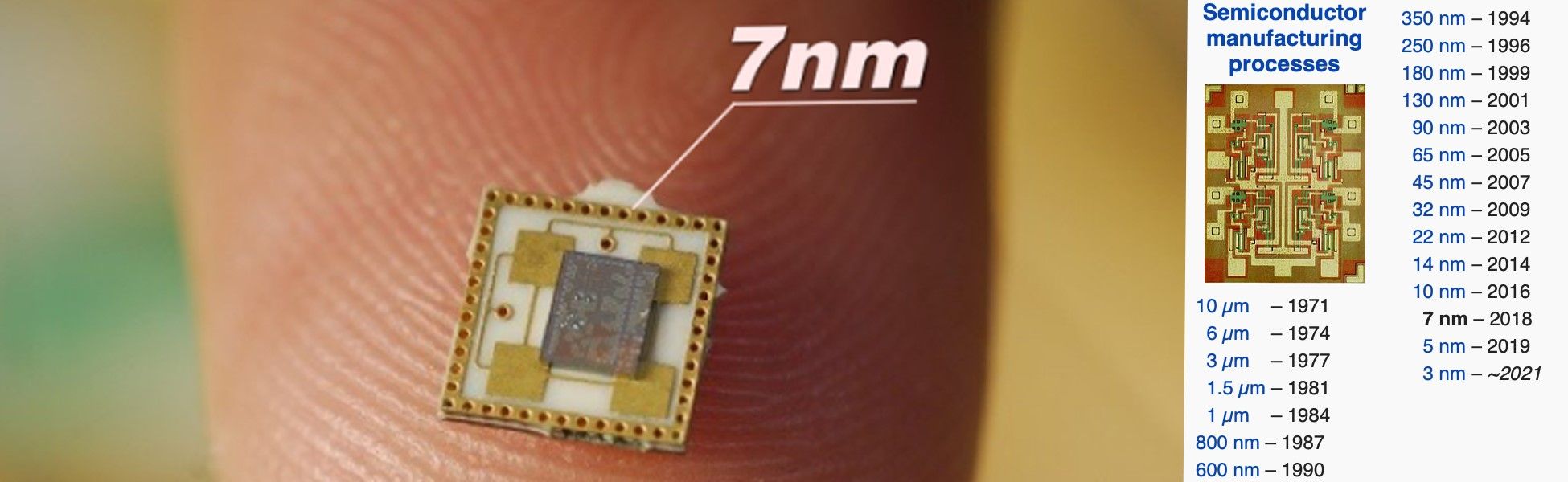

The mining industry also supports the development of an international technology roadmap for semiconductors by introducing machines designed with 7 nm (nanometer) nodes. In 2017, 256 Mbit SRAM semiconductors were produced in Taiwan using the 7nm process. Chinese mining machine manufacturers have released new mining machines using the next generation of 7nm semiconductors. BitInland released more than five different types of mining machines in 2019, including the 7nm chipset from Taiwan Semiconductor Manufacturing Corporation (TSMC). According to local reports in China, Bitcoin recently ordered 30,000 7nm semiconductors.

7nm semiconductors play a big role in SHA-256 mining

According to reports, due to a large number of orders from IT companies such as Bitcoin, Taiwan's semiconductor foundries have expanded the production capacity of 7nm semiconductors. According to the 2019 equipment specification, the power of the SHA-256 mining machine using 7nm technology is between 30-70+TH/s. If the mining heat is not reduced and there is enough demand to improve the mining process and process, then everyone will see more and faster machines in the next few years. For example, Taiwan Semiconductor Corporation announced an ongoing 6-nanometer (N6) process, which is scheduled to be put into risk production in the first quarter of 2020.

Currently, SHA-256 mining is still a lucrative industry. Since the birth of Butterfly Lab, Cointerra and Hashfast, the ecosystem has matured. People who hold a lot of computing power like Artforz have gradually become a thing of the past, and the news of large-scale mining pools competing to grow is no longer unusual. But what is certain is that the mining industry will continue to develop at an alarming rate. Even the largest mining pool must always be vigilant and keep up with the development of the industry.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Pushing the SuperNode program, the "old" brand D network (DigiFinex) opens the transaction "new" world

- "Reverse refers to the king" Goldman Sachs strongly bullish bitcoin, the letter still does not believe?

- The other side of the three strikes of the Argentine bond: the government step by step to push the people from the peso to Bitcoin

- XRP investors filed a new lawsuit against Ripple to add that it meets securities standards and violates advertising laws

- New breakthroughs in cross-border payments in Latin America: more than 60 banks in 14 countries can use Bitcoin for cross-border transfers

- Viewpoint | Why is the correlation between digital currency prices so high?

- The Beijing News: The central bank’s digital renminbi is coming out, and the Bitcoin Librae currency is going to be cool?