Chainlink CCIP goes live on the mainnet, an article to understand its technical characteristics and application scenarios.

Chainlink CCIP, a technical article on its characteristics and application scenarios, is now live on the mainnet.

We are pleased to announce that the Chainlink Cross-Chain Interoperability Protocol (CCIP) has officially integrated with Avalanche, Ethereum, Optimism, and Polygon, launching the early access phase. Several mainstream DeFi protocols in the derivatives and lending tracks have already integrated CCIP. Synthetix has already gone live on the CCIP mainnet, and BGD Labs has officially integrated CCIP into the Aave protocol.

CCIP will be open to all developers on the five testnets on July 20, including Arbitrum Goerli, Avalanche Fuji, Ethereum Sepolia, Optimism Goerli, and Polygon Mumbai.

Connecting the Multi-chain World

Web3 has now entered the era of multi-chains. There are hundreds of blockchain, L2, sidechain, subnet, appchain, and parallel chain environments for developers and users to choose from. These emerging on-chain ecosystems drive innovation and technology adoption, but they also disperse applications, on-chain assets, and market liquidity across isolated networks. In addition, there are various types of existing cross-chain solutions, and protocols and blockchains adopt different technology stacks, often lacking security, resulting in over $2 billion in accumulated cross-chain asset theft. The lack of interoperability hinders innovation and slows down the progress of Web3 in achieving mass adoption.

- Generative AI management rules are implemented and the era of large-scale models is coming.

- Is it a “gimmick” or a subversion? What is the Web4 technology proposed by the European Commission?

- DeFi Economic Model Explained: Four Incentive Models from Value Flow Perspective

However, solving this problem is extremely challenging. We not only need to develop good products but also establish industry-wide standards for interoperability and composability. Building cross-chain standards requires consideration of security, flexibility, and community support. Security must be guaranteed because there is no room for error in the process of cross-chain asset transfer. Flexibility is necessary because the standard must be applicable to all potential use cases and compatible with all deployed blockchains. The last aspect is community support, meaning that the standard must be adopted by a large number of community members to be valuable. Chainlink has already established unified industry standards for Web3 data. With the support of all users and partners, we have built a strong community. In summary, Chainlink has a unique advantage to further expand on the established standards and use them to solve cross-chain problems and drive a new round of innovation in Web3.

Web2 needed the TCP/IP protocol to connect isolated computer networks one by one. Similarly, Web3 also needs interoperability standards to connect isolated blockchain networks one by one.

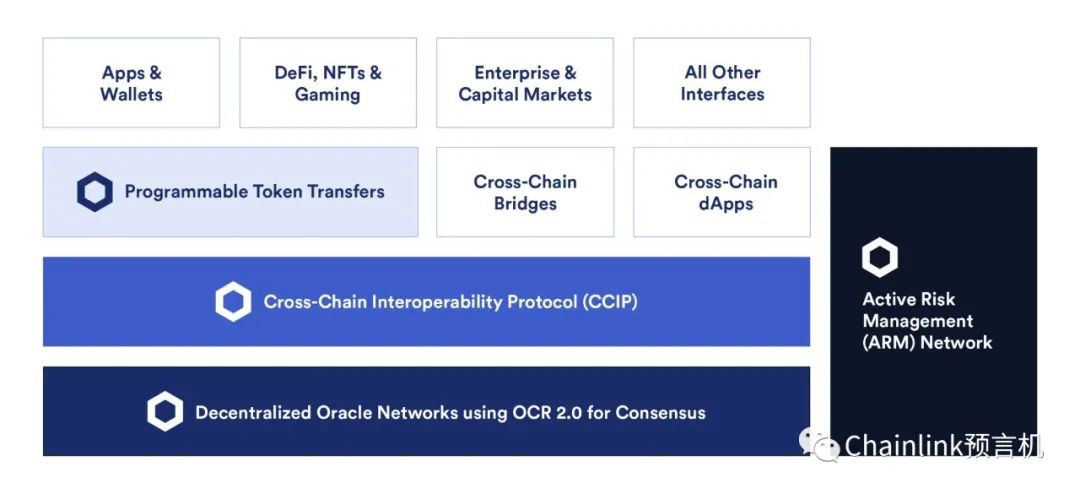

CCIP is the most secure, reliable, and user-friendly interoperability protocol that can be used to build cross-chain applications and services. Developers can use the Arbitrary Messaging feature to flexibly create their own cross-chain solutions. Moreover, CCIP also enables Simplified Token Transfer functionality. Therefore, the protocol can transfer tokens across chains using their own controlled and audited token pools without the need for custom code, saving a significant amount of time compared to developing a cross-chain bridge from scratch.

CCIP is powered by Chainlink’s decentralized oracle network, which has an impressive track record, securing billions of dollars in assets and enabling over $80 trillion in on-chain transaction value. CCIP shares the same underlying infrastructure as other services launched by Chainlink, so there is almost no need to add new trust assumptions. If a dApp has already integrated Chainlink Price Feeds, there is no reason not to choose CCIP for cross-chain interactions. CCIP also adds additional security mechanisms that other cross-chain solutions cannot compare to. For example, it allows for setting arbitrary limits on the number of cross-chain tokens (rate limit). Additionally, a separate Active Risk Management (ARM) network has been established to monitor the validity of all cross-chain transactions.

Developers, applications, and enterprises can use CCIP to unlock a range of use cases, such as:

- Cross-chain tokenized assets: Cross tokens using a unified interface, without the need to develop cross-chain bridges.

- Cross-chain collateralized assets: Launch cross-chain lending applications where users can deposit collateral assets on one chain and borrow assets on another chain.

- Cross-chain liquidity staking tokens: Cross liquidity staking tokens to different blockchains to increase the utilization of tokens in DeFi applications on other chains.

- Cross-chain NFTs: Users can mint NFTs on one chain and receive them on another chain.

- Cross-chain account abstraction: Develop smart contract wallets integrated with CCIP to enhance the user experience of cross-chain function calls. For example, users can sign transactions on any blockchain using the same wallet.

- Cross-chain gaming: Create gaming experiences that span across any blockchain. Players can store high-value game items on chains with higher security and perform gaming operations on chains with higher scalability.

- Cross-chain data storage and computation: Develop data storage solutions where users can store arbitrary data on the target chain and perform computations based on transaction pairs on the original chain.

Mainstream applications in the market are using CCIP for cross-chain interactions

Synthetix integrates CCIP for cross-chain liquidity

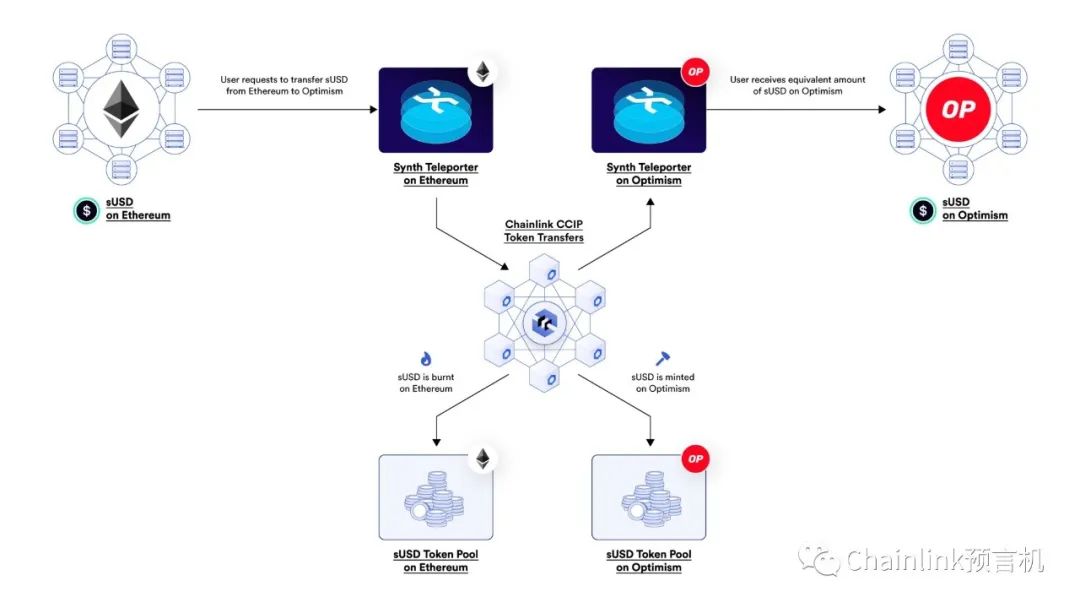

Synthetix is a DeFi protocol that provides liquidity for the on-chain derivatives and financial instrument ecosystem. Synthetix V3 recently added the Synth Teleporter feature, allowing users to easily transfer Synth liquidity across chains. The specific process involves destroying sUSD (the accounting unit of the Synthetix protocol) on the original chain and minting an equivalent amount of sUSD on the target chain.

The Synth Teleporter utilizes Chainlink CCIP to securely and reliably perform cross-chain token destruction and minting. This unique approach effectively improves capital efficiency without the need to create liquidity pools. The Synth Teleporter allows Synthetix liquidity to flow to the highest-demand areas and avoids the limitations of traditional token bridges.

“Security is crucial for cross-chain asset transfers. That’s why we integrated Chainlink CCIP into the cross-chain Synth Teleporter. We are one of the first users of Chainlink Data Feeds and are excited to be among the first users of CCIP, benefiting from the new features it unlocks for Synthetix.” – Kain Warwick, Founder of Synthetix

With CCIP, Synthetix can securely transfer tokens across chains using the burn-and-mint model.

Aave implements cross-chain governance with CCIP

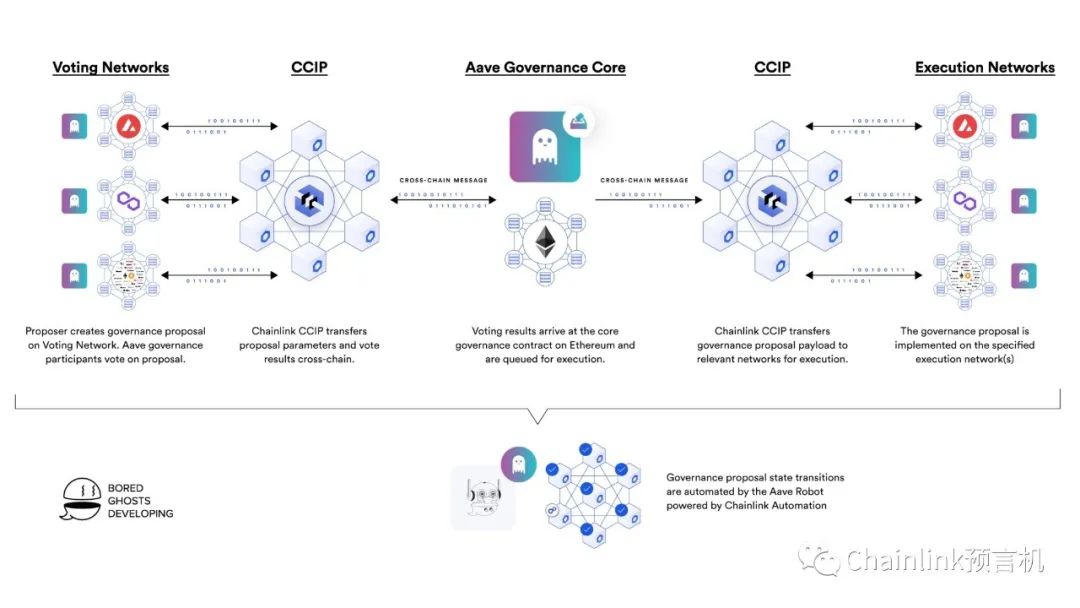

Aave is a non-custodial liquidity protocol where users can borrow and lend assets on-chain. Previously, Aave integrated several cross-chain bridges for cross-chain governance and used Ethereum as the voting network. This cross-chain architecture not only resulted in high voting costs for participants but also incurred significant development and maintenance costs. As soon as Chainlink CCIP was launched, the Aave community voted to integrate CCIP into their governance system. The reasons behind this decision were that CCIP has lower gas fees, a mature infrastructure that can easily scale to new networks, and is easy to integrate. Therefore, BGD Labs, a Web3 development project, is integrating Chainlink CCIP into Aave Governance V3 to meet future cross-chain governance needs.

“We are excited to integrate Chainlink CCIP in the next iteration of the Aave protocol to achieve secure, reliable, and scalable cross-chain communication. CCIP can seamlessly integrate into our cross-chain governance mechanism, saving us a significant amount of development time and allowing us to focus more on core functionalities.” – Ernesto Boado, Co-founder of BGD Labs

With CCIP, Aave can execute governance decisions approved across different blockchains

Enabling cross-chain interactions for capital markets

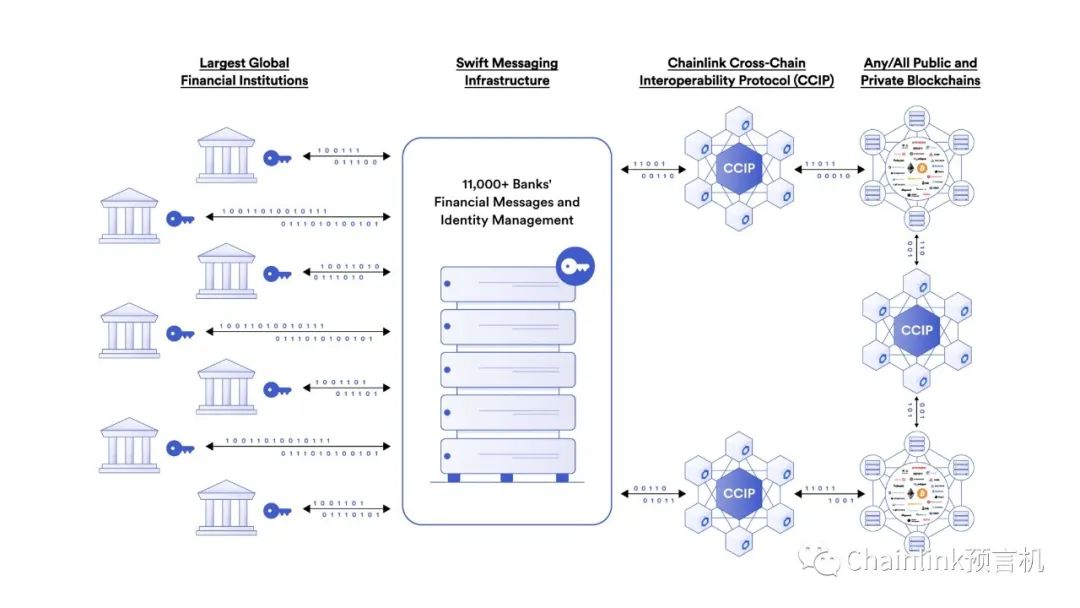

CCIP is a blockchain abstraction layer that allows enterprises to directly connect any public or private blockchain from their backend systems and achieve interoperability. Swift has partnered with over a dozen financial institutions and market infrastructure providers to explore CCIP, using Swift’s existing message transmission infrastructure to transfer tokens across various public and private blockchains. Institutions participating in the blockchain interoperability collaboration include ANZ Bank, BNP Paribas, BNY Mellon, Citigroup, Mizuho Bank, European Central Counterparty Limited, Lloyd’s Banking Group, SIX Digital Exchange (SDX), and The Depository Trust & Clearing Corporation (DTCC).

Simple illustration of how banks and financial market infrastructures adopt CCIP via the Swift network

Setting new standards in cross-chain functionality, security, reliability, and user experience

Here are the distinguishing features of CCIP compared to other cross-chain solutions:

Simplified Token Transfers

CCIP’s Simplified Token Transfers is a plug-and-play solution that includes audited token pool contracts. These contracts handle the burning/minting or locking/unlocking of cross-chain tokens, and token owners have full control over their token pool contracts. Simplified Token Transfers also include additional security features, such as cross-chain token quantity limits, and enhance the composability of the protocol’s native tokens, enabling ecosystem partners to easily integrate and develop new functionalities for protocol tokens through the CCIP interface.

Programmable Token Transfer

While transferring tokens, additional instructions can be added to define the purpose of the tokens in the smart contract on the target chain, such as immediate exchange or staking once the tokens arrive on the target chain. With programmable functionality, the message (i.e., token + data) becomes an atomic cross-chain transaction, and the tokens can always be assumed to be available when the instructions are executed on the target chain.

Active Risk Management (ARM) Network

The ARM network is an independent network that continuously monitors and verifies the CCIP network. This network is responsible for independently validating cross-chain processes and identifying errors, providing an additional layer of security. The ARM network implements a minimal version of Chainlink node software in the Rust language. This enhances client diversity and robustness and minimizes external dependencies to avoid supply chain attacks.

CCIP Cross-Chain Technology Stack

Cross-Chain Token Rate Limits

CCIP allows flexible setting of the maximum number of cross-chain tokens within a certain period. This parameter can be set individually for a specific token in a cross-chain channel and coordinated with the token issuer. In addition, a total limit on the sum of cross-chain quantities can be set for all tokens in a cross-chain channel to ensure that attackers do not simultaneously reach the individual limits of each token. This feature is in the CCIP code repository and has undergone strict auditing. Only CCIP Token Transfer can use this feature, while Arbitrary Messaging cannot.

Smart Execution

CCIP uses the gas fee lock payment mechanism, known as Smart Execution, to ensure that cross-chain transactions are not affected by fluctuations in gas fees on the target chain. For developers, this means that they only need to pay on the original chain and CCIP will take care of the execution on the target chain.

Upgrade Using Time-Lock Smart Contracts

All major on-chain configuration updates and upgrades in CCIP must go through a time-lock smart contract. During this period, proposals can be vetoed by a threshold number of CCIP node operators. In addition, updates and upgrades can also be directly approved by a threshold number of node operators without going through the time-lock contract. Therefore, users and protocols using CCIP can fully research and make judgments before the updates take effect. Any on-chain updates not vetoed within the time-lock window can be executed by anyone. The community can run a timelock-worker to handle executable upgrades. This on-chain upgrade pattern marks another step towards decentralization and robustness for the Chainlink network.

Payment Models

In our recent blog posts “Chainlink Network Outlook 2023” and “Sustainable Oracle Economic Models,” we mentioned the development of an enhanced payment model to establish monetization and ensure the long-term sustainable development of Chainlink services. One of the main objectives is to lower the payment threshold for dApps, enterprises, and end users and attract more fee revenue for Chainlink service providers.

- “Chainlink Network Outlook for 2023”:

- “Sustainable Oracle Economics”:

Sustainable Oracle Economics Are Critical to the Success of Web3

As CCIP develops into the most secure and user-friendly cross-chain solution in the industry, fee payment scenarios will appear on various blockchains. Therefore, reducing the payment threshold for users is essential for CCIP to quickly expand to more blockchains. CCIP supports payment with LINK and other tokens. Currently, other tokens include on-chain native tokens and ERC20 wrapped tokens of these tokens. Compared to paying with LINK, the fees for paying with other tokens are higher.

We are developing an on-chain automatic conversion system that can automatically convert other tokens into LINK when paying with other tokens. Before the conversion system goes live, when users pay with other tokens, the tokens will be withdrawn to their respective maintenance pools, and LINK will replace the tokens in the CCIP contract. The amount of LINK will be calculated based on the exchange rate at the time of payment. Finally, the service provider (i.e., node operator) will be paid with LINK. Once the on-chain automatic conversion system goes live, the other token assets stored in the maintenance pools will be converted into LINK.

CCIP charges a fixed fee per message for message transmission, while the transfer of CCIP tokens is charged based on a certain percentage of the token value. In addition, the fees for CCIP also include gas fees. When paying with other tokens, the fees will be 10% higher than paying with LINK. Currently, CCIP’s fees comply with the industry standard of the cross-chain ecosystem, but the fees may be adjusted in the future.

As the scope of Chainlink Staking continues to expand, covering more oracle services including CCIP, we plan to allocate a portion of the user fees to the stakers as a reward for their contribution to the security of the Chainlink cryptographic economy.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analyzing Four Token Economic Models: Ve, Ve (3,3), Es, Lending

- 10 Diagrams Analyzing 4 Classic Tokenomics Models

- Comprehensive interpretation of DeFi options: market overview, product model and potential protocols

- Hong Kong Financial Secretary Paul Chan: There is no problem with the underlying blockchain technology of virtual assets.

- OKX will launch a signal strategy and has now opened a signal provider recruitment.

- Messari: Interpreting the Success of the Blur Airdrop Model from a User Retention Perspective

- White hat disclosure: Huobi leaked OTC trading information, big account information, customer information, internal technical architecture, etc. on a large scale in 2021.