DeFi Economic Model Explained: Four Incentive Models from Value Flow Perspective

DeFi Economic Model: 4 Incentive Models from a Value Flow PerspectiveTable of Contents

01. Incentive Compatibility in Token Economics

02. Different Economic Model Classifications, Goals, and Designs

03. DeFi Economic Model from Incentive Patterns

- Analyzing Four Token Economic Models: Ve, Ve (3,3), Es, Lending

- 10 Diagrams Analyzing 4 Classic Tokenomics Models

- Comprehensive interpretation of DeFi options: market overview, product model and potential protocols

04. Voting Custody Model

– Curve: Pioneer of ve Model

– Different Innovations for vetoken Mechanism

– Velodrome: The Most Representative ve(3,3)

05. ES Mining Model

– ES: Incentivize Loyal Users to Participate in the Game of Real Revenue

– Camelot: Introduce Partial ES Mining Incentives

– GMX: Encourage the Competition for Real Revenue Distribution

06. Core Elements in DeFi Economic Model Design From Value Flow Perspective

– Composition of Value Flow

– Tokenomics Reshapes Value Flow

– Key Mechanisms in DeFi Tokenomics: Game and Value Redistribution

“[Money] it drives the world, for better or worse. Economic incentives drives entire swathes of human populations to behave” – Chamath Blockinglihapitiya

01 .

Incentive Compatibility in Token Economics

Decentralized P2P systems based on cryptography were not new when Bitcoin was introduced in 2009.

You may have heard of the BitTorrent protocol, commonly known as BT download, which is a P2P file-sharing protocol used primarily for distributing large amounts of data to users on the Internet. It uses some form of economic incentive, for example, “seeds” (users who upload complete files) can get faster download speeds, but this early decentralized system introduced in 2001 still lacked a sound economic incentive design.

The lack of economic incentives stifled these early P2P systems, making it difficult for them to flourish over time.

(Coincidentally, in 2019, the developers of the BitTorrent protocol introduced BitTorrent Token (BTT), which was later acquired by TRON, they chose to use cryptocurrency to provide economic incentives to improve the performance and interaction of the BitTorrent protocol. For example, users can spend BTT to increase their download speed, or earn BTT by sharing files.)

In 2009, when Satoshi Nakamoto created Bitcoin, he incorporated economic incentives into the P2P system. Despite experiments in creating decentralized digital cash systems from DigiCash to Bit Gold, no one had completely solved the Byzantine Generals’ Problem. However, Nakamoto implemented a Proof-of-Work consensus mechanism plus economic incentives, solving what appeared to be an unsolvable problem: how to reach consensus among nodes. Bitcoin not only provides a means of storing value for those who want to replace the existing financial system, but also combines cryptocurrency and incentives to provide a new, universal design and development method, ultimately forming the powerful and dynamic P2P payment network we have today.From Nakamoto’s “Galileo era,” the field of cryptoeconomics has evolved into Vitalik’s “Einstein era.” More expressive scripting languages have led to the implementation of complex transaction types, resulting in a more general decentralized computing platform. After Ethereum switched to Proof-of-Stake (PoS), token holders became validators of the network and earned more tokens in the process. Controversially, this was a “more inclusive token distribution method” than Bitcoin’s current ASIC mining method.”Designing a token economic model is essentially designing an ‘incentive-compatible’ game mechanism.” – Hank, BuilderDAOIncentive compatibility is an important concept in game theory, first proposed by economist Roger Myerson in his classic work “The Theory of Cooperative Games.” Published in 1991, the book became one of the important reference books in the field of game theory. In it, Myerson detailed the concept of incentive compatibility and its importance in game theory.Its academic definition can be understood as a mechanism or rule design in which participants act according to their true interests and preferences, without resorting to fraud, cheating, or dishonest behavior to pursue better results. “This game structure can enable individuals to maximize their personal interests while also achieving maximum collective benefits.” For example, in the design of Bitcoin, when expected income > input cost, miners will continue to invest in computing power to maintain the network, and users can continue to conduct secure transactions on the Bitcoin ledger – this trust machine now stores more than $40 billion in value and processes transactions worth more than $600 million every day.

Placing it in Tokenomics, using Token incentives and rules, guiding the behavior of multiple participants, and achieving better incentive compatibility in design, expanding the scale and upper limit of decentralized structures or economic benefits that can be achieved. An eternal proposition.

Tokenomics plays a decisive role in the success or failure of cryptocurrency projects. And how to design incentives to achieve incentive compatibility also plays a decisive role in the success or failure of Tokenomics.

This is similar to monetary and fiscal policies for national governments.

When the protocol acts as a country, it needs to formulate monetary policies, such as token issuance rates (inflation rates), and decide under what conditions new tokens are minted. It needs to regulate fiscal policy to regulate taxation and government spending, usually manifested as transaction fees and treasury funds.

This is complex. As has been proven in the economic experiments and governance construction of humans in the past few thousand years, designing a model to coordinate human nature and the economy is extremely difficult. There are errors, wars, and even setbacks. In less than 20 years of Crypto, it also needs to create better models in these iterations of trial and error (such as the Terra incident) to meet a long-term successful and resilient ecosystem. And this is obviously a kind of thinking reset that the market needs more in the long winter of encryption.

02 .

Different economic model classifications, objectives, and designs

When designing an economic model, we need to clarify the object of token design. Public chains, DeFi (decentralized finance), GameFi (gamified finance), and NFT (non-fungible tokens) are different categories of projects in the blockchain field, and they have some differences in designing economic models.

Public chain token design is more like macroeconomics, and others are closer to microeconomics; The former needs to focus on the overall supply and demand dynamic balance within the entire system and ecology, and the latter focuses on the supply and demand relationship between products and users/markets.

Different categories of projects, their design goals and core design points of economic models are also completely different. Specifically:

-

Public chain economic model:

Different consensus mechanisms determine different economic models of public chains. However, the same is that the design goal of its economic model is to ensure the stability, security, and sustainability of the public chain. Therefore, the core is to use token incentives to verify, attract enough nodes to participate and maintain the network . This usually involves the issuance of cryptocurrencies, incentive mechanisms, and node rewards and governance to maintain the sustained stability of the economic system.

-

DeFi economic model:

Tokenomics originated from public chains, but it has developed and matured in DeFi projects, which will be the focus of analysis later. The economic model of DeFi projects usually involves lending, liquidity provision, trading, and asset management. The design goal of the economic model is to encourage users to provide liquidity, participate in lending and trading activities, and provide corresponding interest, rewards, and returns to participants. In the DeFi economic model, the design of the incentive layer is the core , such as how to guide token holders to hold tokens rather than sell them, and how to coordinate the interests of LP and governance token holders.

-

GameFi economic model:

GameFi is a concept that combines game and financial elements, aiming to provide game players with financial rewards and economic incentive mechanisms. The economic model of GameFi projects usually includes the issuance, trading, and revenue distribution of virtual assets in the game. Compared with DeFi projects, the model design of GameFi is more complicated, the core of which is to increase the user’s repurchase demand by deciding how to increase transaction fees as the income core , but the natural design also poses design challenges for game mechanics. This makes most projects inevitably show the Pareto structure and spiral effect.

-

NFT economic model:

The economic model of NFT projects usually involves the issuance, trading, and rights of NFT holders. The design goal of the economic model is to provide NFT holders with opportunities to create value, trade value, and income, and encourage more creators and collectors to participate . This can be further divided into NFT platform economic models and project economic models. The former’s focus is on royalties, and the latter’s focus is on how to solve economic scalability, such as increasing repeat sales revenue and fundraising in different fields (refer to Yuga Labs).

Although these projects have their own unique economic model designs, there may also be cross-cutting and overlapping aspects. For example, NFTs can be integrated as collateral in DeFi projects, and DeFi mechanisms can be used for fund management in GameFi projects. In the evolution of economic model design, the development of DeFi projects is more diversified, and many of DeFi’s models are also widely used in projects such as Gamefi and Socialfi. Therefore, the economic model design of DeFi is undoubtedly an area worthy of in-depth research.

03.

Looking at DeFi economic models from incentive mechanisms

If we divide DeFi economic models into three main categories according to the business logic of different projects, we can roughly divide them into DEX, Lending, and Derivatives. If we divide them according to the characteristics of the incentive layer of the economic model, we can divide them into four modes: governance mode, pledge/cash flow mode, voting custody (including ve and ve(3,3) modes), and es mining mode.

Among them, the governance mode and pledge/cash flow mode are relatively simple, representing projects are Uniswap and SushiSwap. They can be summarized as follows:

-

Governance mode: The token only has governance function over the protocol; for example, UNI represents the governance right over the protocol. Uniswap DAO is the decision-making body of Uniswap, where UNI holders initiate proposals and vote to decide on decisions that affect the protocol. The main governance content includes managing the UNI community treasury, adjusting the fee rate, etc.

-

Pledge/cash flow mode: The token can bring continuous cash flow; for example, when Sushiswap was launched, it quickly attracted liquidity by distributing its SUSHI tokens to early LPs and completed the “vampire attack” on Uniswap. In addition to transaction fees, SUSHI tokens also have the right to allocate 0.05% protocol revenue.

They have their own advantages and imperfections. The governance function of UNI has been criticized for its inability to bring value realization and feedback to early LPs and users who took on greater risks; while Sushi’s large issuance has led to a decline in its token price, and some liquidity has been migrated from Sushiswap back to Uniswap by LPs.

In the early development of DeFi projects, these two economic models were relatively common. Later economic models were iterated on this basis. Next, we will focus on analyzing the voting custody and es mining models in combination with Token Value Flow.

This article mainly uses the Value Flow method to study the project, aiming to abstract the value flow of the project, including starting from the real income of the protocol, drawing the redistribution path of the income in the protocol, the incentive link, and the flow of tokens. All of this constitutes the core business model of the protocol and is constantly adjusted and optimized through Value Flow. Although Value Flow does not include all Tokenomics, it is a product value flow designed based on Tokenomics. On this basis, combined with factors such as the initial distribution and unlocking of tokens, the Tokenomics of the protocol can be fully presented. In this process, the supply and demand relationship of tokens is adjusted to achieve value capture.

04.

Vote Custody

The background of the birth of vote escrow comes from the dilemma of early DeFi projects that mine and provide liquidity. The solution is how to stimulate users’ holding power and coordinate the interests of multiple parties to contribute to the long-term development of the protocol. After Curve first proposed the ve model, other protocols subsequently made iterations and innovations on the basis of Curve’s economic model, mainly still ve model and ve(3,3) model.

Ve model: The core mechanism of ve is that users obtain veToken by locking tokens. VeToken is a non-transferable and non-circulating governance token. The longer the lock-up time selected (usually with a lock-up time limit), the more veToken can be obtained. According to its veToken weight, users can obtain the corresponding proportion of voting rights. Part of the voting rights is reflected in the ability to decide the allocation of token reward pools, which has a substantial impact on users’ own benefits and enhances users’ holding power.

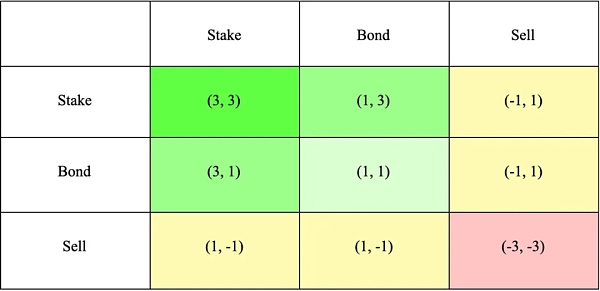

Ve(3,3) model: The VE(3,3) model combines Curve’s ve model and OlympusDAO’s (3,3) game model. (3,3) refers to the game results of investors under different behavioral choices. The simplest Olympus model contains two investors who can choose to pledge, bond, or sell. From the table below, it can be seen that when both investors choose to pledge, the joint income is the largest, reaching (3,3), which is intended to encourage cooperation and pledge.

Curve: The Pioneer of veCRV Model

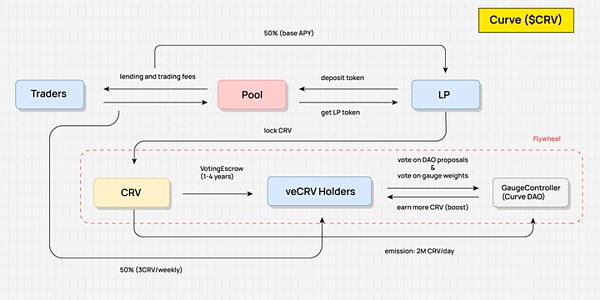

In the value flow diagram of Curve shown below, we can see that CRV holders do not receive any related benefits of the protocol, and only when LP locks CRV in exchange for veCRV can they capture the value of the protocol. This is reflected in transaction fees, market-making revenue acceleration, and governance voting rights of the protocol, respectively.

-

Transaction fees: After users pledge and lock CRV tokens, they can obtain 0.04% transaction fee sharing from most trading pools on the platform based on the number of veCRV pledged, and the sharing ratio is 50% of the total transaction fee (the other 50% goes to liquidity providers), which is distributed through the 3CRV token.

-

Market-making revenue acceleration: After Curve liquidity providers lock CRV, they can use the Boost function to increase the CRV reward income they receive from their market-making, and thereby increase the overall APR of their market-making. The amount of CRV required for Boost is determined by the funds in the pool and the LP.

-

Governance voting rights of the protocol: Curve’s governance also needs to be implemented through veCRV. In addition to modifying the parameters of the protocol, the scope of governance also includes voting on the addition of new liquidity pools to Curve and the allocation of weight of CRV liquidity incentives among various trading pools.

In addition, holding veCRV can also have the possibility of receiving airdrops of tokens from other projects supported and cooperated by Curve, such as CVX, the token of Convex, a liquidity and CRV pledge management platform based on Curve, which will airdrop 1% of the total amount to veCRV users.

As we can see, CRV and veCRV capture the value of the overall protocol quite sufficiently, not only can they receive protocol transaction fee sharing and accelerated market-making revenue, but their role in governance is also very significant, which creates a huge demand and stable buying pressure for CRV.

Curve Value Flow Diagram: DODO Research

Due to the strong demand of stable asset operators for anchoring and liquidity of their own issued assets, it is almost their inevitable choice to land their stable assets on Curve to establish liquidity pools and obtain CRV liquidity mining incentives to maintain sufficient trading depth. Around the daily output of CRV used for liquidity mining incentives, its distribution is determined by Curve’s DAO core module “Gauge Weight Voting”. Users can decide the allocation ratio of CRV in each liquidity pool for the next week by voting with their own veCRV in “Gauge Weight Voting”. The higher the allocation ratio of the pool, the easier it is to attract sufficient liquidity.

This non-violent infighting is about “the judgment right of being listed” and “the distribution right of liquidity incentives”. Of course, while obtaining project governance rights through CRV, these projects will also receive stable dividends from the Curve platform as a cash flow income. The game and infighting of various projects on Curve have created a sustained demand for CRV, stabilized the price of CRV under a large amount of issuance, supported the APY of Curve’s liquidity provision, attracted liquidity, and achieved a cycle. Therefore, the war of CRV has bred a complex bribery ecosystem based on veCRV construction. At present, as long as Curve still occupies the head of the stable asset exchange field, this war will not end.

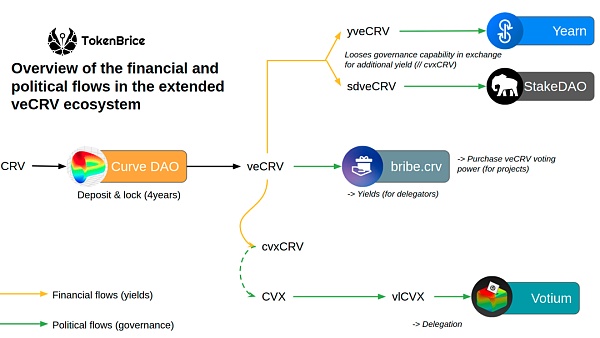

Ecological system based on veCRV construction source: https://tokenbrice.xyz/crv-wars/

We briefly summarize the pros and cons of the veCRV mechanism:

-

Pros

-

Reduced liquidity after locking, reducing selling pressure, and helping stabilize the token price (currently 45% of CRV has been voted and locked, with an average lock time of 3.56 years.)

-

Make the long-term interests of all parties relatively coordinated (veCRV holders also enjoy fee sharing, that is, the interests of liquidity providers, traders, token holders, and protocols are coordinated together)

-

Weighting of time and quantity, better governance possibility

2. Cons

-

More than half of the governance power on Curve is in the hands of Convex (53.65%), and the governance power is quite concentrated

-

The liquidity within Curve has not been fully utilized (the boost mining rewards and governance voting rights obtained by locking CRV at an address are limited to this address and cannot be transferred; it has attracted a large amount of liquidity through high subsidies, but these liquidity have not played its high-speed liquidity The function of, can not produce external benefits)

-

The hard lock-up time is not friendly to investors, and 4 years is too long for the crypto industry

Different innovations for the vetoken mechanism

In a previous article by DODO Research, we analyzed in detail the 5 innovations in the incentive design of the veToken model. Each protocol has made different adjustments to the key aspects of the mechanism according to its own needs and focus. Specifically, they are:

- Design veNFT to improve the liquidity problem of vetoken

- How to better allocate token releases to vetoken holders

- Incentivize healthy development of liquidity pool trading volume

- Layer the profit structure to give users the opportunity to choose

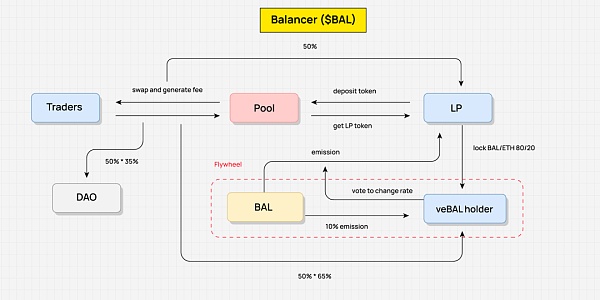

Take Balancer as an example. In March 2022, Balancer launched V2, which modified the original economic model. Users can lock the BPT (LP token of the Balancer fund pool) of the 80/20 BAL/WETH pool to obtain veBAL, thereby deeply binding the governance and protocol dividend rights of Balancer V2 with veBAL.

Users need to lock BAL and WETH in a ratio of 80:20, instead of just locking BAL. Using locked LP tokens instead of single token locking can increase market liquidity and reduce volatility. Compared with veCRV of Curve, the longest lock-up period of veBAL is set to 1 year, and the shortest lock-up period is 1 week. This also greatly reduces the lock-up time.

Regarding fee sharing, 50% of the protocol fees obtained by Balancer will be distributed to veBAL holders in the form of bbaUSD. The remaining Boost, Voting, and governance rights are not much different from Curve.

Balancer Value Flow: DODO Research

It is worth mentioning that in response to the “liquidity waste-unable to increase external revenue for the product” issue in the vetoken model, Balancer uses the Boosted Pool mechanism of the interest-bearing trading pool to increase LP income (the LP token issued by the LP pool is called bb-a-USD, which can be paired with various assets as a pairing asset in the AMM pool, and asset leverage is realized through the issuance of LP tokens, thereby increasing LP income). Later, Core Pools were proposed (to improve the fact that Boosted Pools can only benefit LPs), and the official bribed veBAL holders to vote for Core Pools, which would shift a large amount of $BAL to Core Pools, increasing external interest-bearing asset income and changing the profit structure of the Balancer protocol itself.

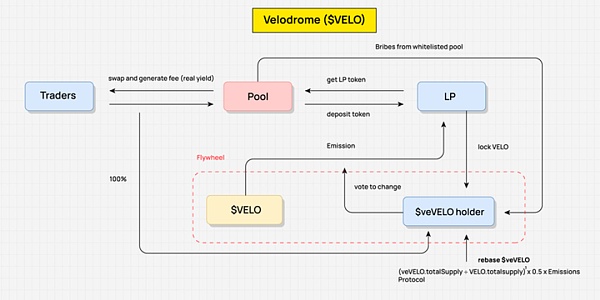

Velodrome: The most representative ve(3,3)

Before we talk about Velodrome, let’s define ve(3,3) simply again: veCRV economic architecture of Curve + Olympus’ (3,3) game theory.

As shown in the figure below, there are mainly two ways for the incentive of OHM in Olympus: one is the bonding mechanism, and the other is the staking mechanism. The Olympus official sells OHM lower than the market price to users in the form of bonds. The official obtains USDC, ETH, and other assets paid by users, so that the treasury has value asset support and generates OHM to be distributed to OHM stakers through the rebase mechanism. In the ideal state, as long as users choose long-term staking, that is, the so-called (Stake,Stake) —— that is, (3,3), the OHM balance in their position can grow continuously by compound interest, and stakers have a positive cycle effect of high APR. However, if there is severe selling pressure on OHM in the secondary market, this flywheel cannot continue. This is of course a game, and the ideal state is Nash equilibrium, achieving win-win.

Olympus Value Flow Map: DODO Research

At the beginning of 2022, Andre Cronje launched Solidly on Fantom, the core of which is veNFT and voting rights optimization. The veSOLID position is represented by veNFT, which seems to liberate liquidity. Even if users transfer NFTs, any NFT holder has voting rights to decide the distribution of rewards; veSOLID holders will receive a certain base proportionate to the weekly emission, which enables them to maintain voting shares even without locking new tokens; at the same time, stakers get 100% transaction fees, but can only earn rewards from the pools they have voted for, avoiding the situation where voters on Curve vote for pools just to get bribes.

AC announced on Twitter that the distribution of Solidly tokens will be airdropped directly to the top 20 holders with the largest locked positions on the Fantom protocol, triggering a vampire attack between protocols on the Fantom chain, and 0xDAO and veDAO were born, starting a TVL battle. A few months later, the veDAO team incubated another project of ve(3,3) called Velodrome.

So why will Velodrome Solidly become a forking template for standards on layer2 such as Arbitrum or zkSync?

In the initial design, Solidly had some critical weaknesses, such as high inflation and complete lack of permission, allowing any pool to receive SOLID rewards, resulting in a large number of worthless tokens. Rebase or “anti-dilution” has not brought any value to the entire system either.

What changes has Velodrome made?

-

A whitelist mechanism has been adopted for the incentive distribution of Velo tokens, and the whitelist is currently open to applications and does not follow the on-chain governance process (avoiding voting to decide token incentives)

-

For liquidity bribes for pools, only rewards that can be claimed in the next cycle are available

-

(veVELO.totalSupply ÷ VELO.totalsupply)³ × 0.5 × emissions – reduces the rate of issuance rewards for ve token holders. In the adjusted Velo mode, veVELO users will only receive 1/4 of the total emissions in the traditional mode. This improvement has actually greatly weakened the (3,3) part of the ve(3,3) mechanism.

-

The LP Boost mechanism has been canceled

-

3% of Velo’s emissions will be used as operating expenses

-

Exploration of the veNFT mechanism extension: including veNFT can be traded even when pledged/voted, veNFT can be divided, veNFT lending, etc.;

-

More reasonable token distribution and issuance rhythm: Velodrome distributed 60% of the initial supply to the community on the first day of the project launch, and joined hands with the Optimism team to help cold start, and airdropped several protocols with veVELO NFTs, without additional conditions, which greatly helped attract initial voting and bribery activities.

Velodrome Value Flow Mapping: DODO Research

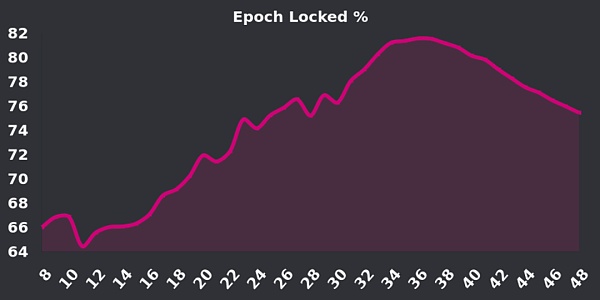

After going online, Velo’s staking rate has been on the rise. The high point of 70%-80% is a high lock-up rate (the staking rate of Curve, which also uses the ve model, is currently 38.8%). Many people questioned that as the “Tour de OP” plan, which began in November last year, comes to an end, the incentive of 4 million OP rewards will come to an end, and the incentive for lock-up will further decline, forming potential selling pressure. However, the staking rate of Velo is still at a good level (~70%). The upcoming V2 upgrade is also aimed at encouraging more holders to lock up their tokens, which is worth keeping an eye on.

Velo staking rate curve, image source: Velo official DC, source:mint ventures

05.

ES Mining Mode

ES: Playing against real returns, incentivizing loyal users to participate

The ES mining mode is an intriguing and challenging new tokenomics mechanism, with its core concept aimed at reducing the cost of protocol subsidies by unlocking thresholds and increasing its attractiveness and inclusiveness by incentivizing real users to participate.

Under the ES model, users can earn rewards in ES tokens by staking or locking them up. While this type of reward makes the yield look higher, in reality, due to the existence of unlock thresholds, users cannot cash in these benefits immediately, making the calculation of real returns complex and difficult to predict. This adds to the challenge of the ES mode and enhances its attractiveness.

Compared to the traditional ve model, the ES model has a significant advantage in the cost of protocol subsidies, as its designed unlock threshold reduces the cost of subsidies. This makes the ES mode more realistic in the game of allocating real returns, making it more universal and inclusive, and potentially attracting more users to participate.

The essence of the ES model is that it can incentivize real users to participate. If a user leaves the system, they will forfeit their ES token rewards, which means that the protocol does not need to pay additional token incentives. As long as the user stays in the system, they can receive ES token rewards, although this part of the reward cannot be quickly realized. This design incentivizes the participation of real users, maintains their activity and loyalty, and does not impose excessive incentives on users. By controlling the spot ratio of staking or locking up and the unlock cycle, the project can achieve a more interesting and attractive token unlocking curve.

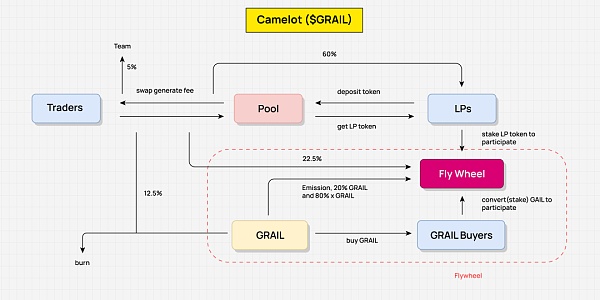

Camelot: Introducing Partial ES Mining Incentives

When exploring Camelot’s value flow method, the abstract value flow of Camelot clearly shows how Camelot’s tokenomics work. Here, we do not elaborate on each link in detail, but abstractly show the main value flow parts to better understand its overall framework.

Camelot’s core incentive is to encourage liquidity providers (LPs) to continue providing liquidity to ensure traders can enjoy a smooth trading experience with ample liquidity. This design ensures the smoothness of transactions through incentive mechanisms and helps LPs and traders share the generated profits.

The real income of the Camelot protocol comes from the interaction between traders and the pool, which generates fees. This is the real income of the protocol and the main source of income used for profit redistribution. In this way, Camelot ensures the sustainability of its economic model.

As for profit redistribution, 60% of the fee is allocated to LPs, 22.5% is redistributed to the flywheel, 12.5% is used to purchase GRAIL and destroyed, and the remaining 5% is allocated to the team. This redistribution mechanism ensures the fairness of the protocol and also provides motivation for continuous operation.

Furthermore, this profit distribution also encourages and drives the flywheel to operate. In order to obtain redistributed income, LPs must pledge LP tokens, indirectly incentivizing them to provide liquidity for a longer period of time. In addition to the 22.5% real income from fees, Camelot also allocates 20% of GRAIL tokens and xGRAIL (ES tokens) as incentives. This strategy not only incentivizes LPs but also encourages ordinary users to participate in profit distribution by pledging GRAIL, enhancing the activity and attractiveness of the entire protocol.

Camelot Value Flow Mapping: DODO Research

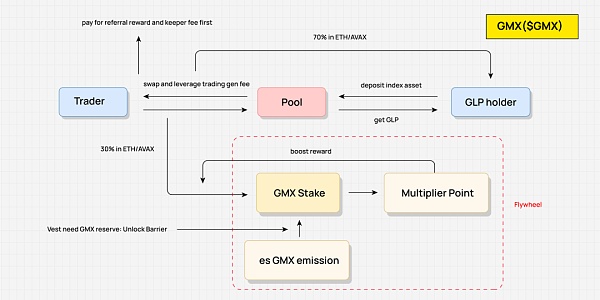

GMX: Encouraging Real Income Distribution

GMX’s tokenomics is a highly interesting and interactive design that aims to achieve continuous liquidity supply and encourage traders to continue trading with liquidity providers (LPs). This design aims to ensure the liquidity and trading volume of the protocol, while incentivizing continuous locking of GMX.

The real income of this model comes from the fees generated by exchanges and leveraged trading by traders, which is the main source of income for the protocol. To ensure fair profit distribution, income is first used to deduct referral and keeper fees. 70% of the remaining part is allocated to GLP holders (actually LPs), and the remaining 30% is redistributed. GMX uses a game mechanism to distribute this part of the income, which is the core mechanism of this model.

GMX’s core game mechanism is designed to redistribute 30% of real revenue. This ratio is fixed, but GMX holders can affect the proportion of revenue they can earn through different strategies. For example, users can earn esGMX rewards by pledging GMX, and the unlocking of esGMX requires GMX spot pledge and a certain unlocking period. In addition, pledging GMX will also receive Multiplier Point rewards. Although this part of the reward cannot be directly cashed, it can increase the user’s share ratio.

In this game mechanism, GMX, esGMX, and Multiplier Point all have weight in revenue sharing. The only difference is that Multiplier Point cannot be cashed; esGMX requires GMX pledge to gradually unlock; while GMX can be quickly cashed, it will clear Multiplier Point and give up esGMX rewards.

This design allows users to develop strategies based on their own needs. For example, for users pursuing long-term returns, they can choose to lock in continuously to get the maximum weight and higher relative returns. If users want to withdraw from the protocol quickly, they can choose to extract and cash out all pledged GMX, at which time the unrealized esGMX rewards will remain in the protocol, and the protocol does not need to actually distribute subsidies, but will distribute the real revenue during this period to users.

GMX’s token economic model encourages GLP holders to continue to provide liquidity in this way, and fully utilizes the value of real revenue redistribution. This makes GMX’s continuous lock-in possible, further strengthening the stability and attractiveness of its economic model.

GMX Value Flow Chart: DODO Research

06 .

Core Elements in DeFi Economic Model Design from Value Flow

In DeFi economic model design, the core elements include basic value, token supply, demand, and utility. These constituent elements are relatively discrete, and some previous analyses cannot be combined intuitively. The Value Flow method used in this article abstracts the value flow within the protocol by studying the project’s Tokenomics mechanism, and combines the product logic to comprehensively analyze the project’s value flow, including the composition of the flywheel, the direction of revenue distribution, the links of incentives, and combined with the distribution of token chips and unlocking periods , which can intuitively understand the Tokenomics of a project.

Below is the Value Flow that was not elaborated on in detail in the previous text:

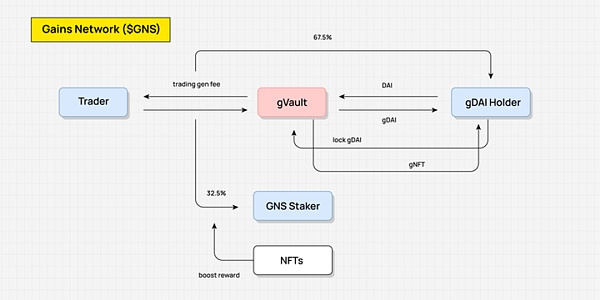

GNS Value Flow (realizing the membership mechanism through NFT, and then redistributing income) Diagram: DODO Research

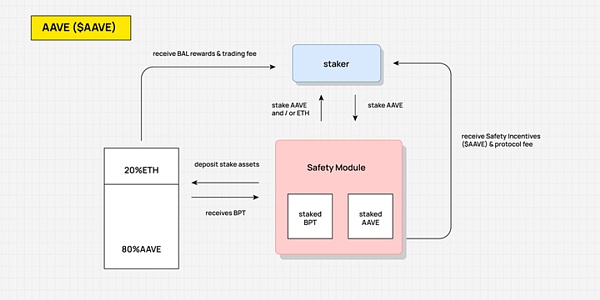

AAVE Value Flow (users pledge AAVE to share part of the protocol’s revenue) Diagram: DODO Research

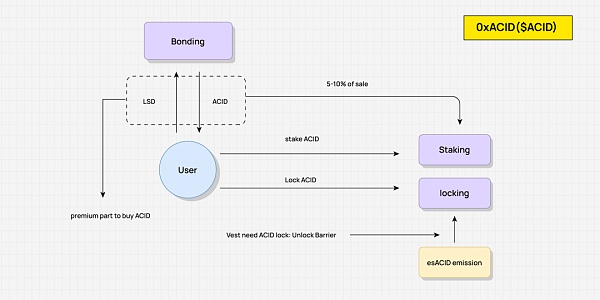

ACID Value Flow (combined with the ES mechanism and Olympus DAO mechanism to achieve flywheel effect) Diagram: DODO Research

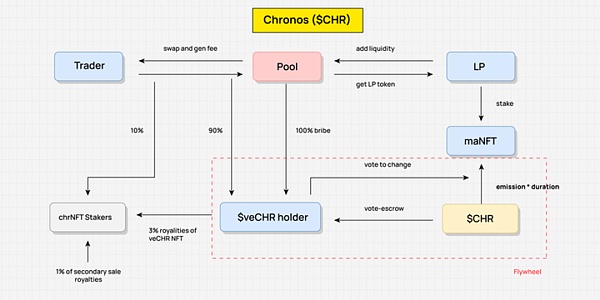

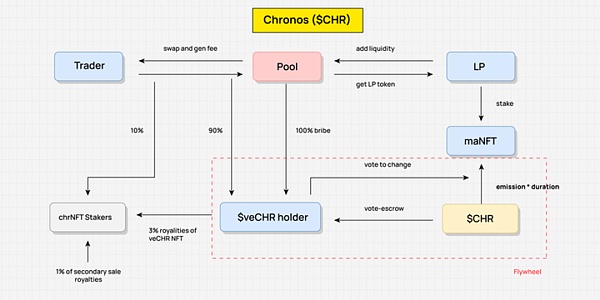

CHR Value Flow (ve(3,3) without rebase mechanism to prevent voting rights concentration) Diagram: DODO Research

Composition of Value Flow

DeFi protocols generate real income more or less, and real gold and silver flow in the protocol, creating value accordingly.

Value Flow is the abstraction of the value flow of the protocol itself. First of all, starting from the real income, the redistribution of the protocol’s real income is characterized; secondly, the flow and acquisition conditions of token incentives are abstracted, so as to clearly see the value capture of tokens, incentive links, and the flow of tokens. These value flows constitute the entire business model, and token release will be reallocated through Value Flow during the continuous operation of the protocol.

Taking Chronos as an example, when abstracting its Value Flow, we need to first abstract the key stakeholders, such as Traders, LPs, and veCHR holders. The key stakeholders are participants in the redistribution and nodes in the Value flow, and the value flows between these stakeholders and the revenue distribution are carried out according to the mechanism design.

The key to abstracting Value Flow is to abstract the flow and mechanism of income distribution. It is not necessary to be specific to each link, but to aggregate various small flow branches, and abstract and integrate them when necessary to form a complete flow. In this example, the source of real income is the transaction fees generated by Traders, 90% of which are allocated to veCHR holders for redistribution through the ve mechanism, thus realizing incentives for the native tokens. After abstracting Value Flow, we can clearly see how value flows within the protocol and how revenue distribution evolves over time.

Value Flow is not all of Tokenomics, but it is the product value flow itself based on Tokenomics design. If the initial distribution and unlocking of tokens are added, a protocol’s Tokenomics is fully presented.

Tokenomics Reshapes Value Flow

Why is the early mining and selling economic model becoming less and less visible?

In the early days, Tokenomics design was relatively rough, and tokens were seen as a means to incentivize users and a tool for short-term profits. However, this simple and direct incentive method lacked effective redistribution mechanisms. Taking DEX as an example, when the emission and all transaction fees are directly distributed to LP, there is a lack of long-term incentives for LP. This model is prone to collapse when the token price has no other source of value, as the migration cost of LP is too low, resulting in collapsed mining pools.

Over time, the design of DeFi protocols on Tokenomics has become more refined and complex. In order to achieve incentive goals and regulate token supply and demand, various game mechanisms and revenue redistribution models have been introduced. Tokenomics and the logic and revenue distribution of the protocol itself are tightly coupled. Reshaping Value Flow through Tokenomics has become the primary function of Tokenomics, in which real profits are redistributed, token supply and demand are regulated, and token value is captured.

Key Mechanisms of DeFi Tokenomics: Game and Value Redistribution

In the late stage of DeFi summer, many protocols actually improved their economic models. Essentially, they all reintroduced game mechanisms and redistributed some profits to make the user stickiness stronger throughout the chain. Curve has redistributed the token reward mechanism and redistributed emission rewards through voting, which has even spawned bribe value and various combinable platforms. In addition, another core of Tokenomics mechanism is to drive the rotation of the entire flywheel by introducing additional token rewards and capturing more traffic and funds.

In summary, under such mechanisms, tokens are no longer just a simple medium of value exchange, but also a tool for capturing users and creating value. This process of redistributing profits can not only increase user activity and stickiness, but also stimulate user participation and promote the development of the entire system through token rewards.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Hong Kong Financial Secretary Paul Chan: There is no problem with the underlying blockchain technology of virtual assets.

- OKX will launch a signal strategy and has now opened a signal provider recruitment.

- Messari: Interpreting the Success of the Blur Airdrop Model from a User Retention Perspective

- White hat disclosure: Huobi leaked OTC trading information, big account information, customer information, internal technical architecture, etc. on a large scale in 2021.

- Deep analysis of the latest vulnerability “Hamster Wheel” in Sui blockchain

- Analysis of the technical details and in-depth of the latest Sui vulnerability “Hamster Wheel”

- How to determine the quality of an X to Earn project’s economic model?