Chinese cryptocurrency, from the center of the stage to the edge

The wheel of history is rolling forward, and the trend of the times is vast.

The past ten years have been both a history of development of Bitcoin and a history of the struggle for bitcoin.

Flowers without hundred red

The concept of Bitcoin was originally proposed by Satoshi Nakamoto in 2008. “The Times 03/Jan/2009 Chancellor on brinkof second bailout for banks”, January 3, 2009, Satoshi Nakamoto wrote this sentence when he dug out the Bitcoin creation block. The prelude to the mining era. In his vision, anyone can use the CPU of a normal computer to mine to obtain bitcoin.

- Market Analysis: Bitcoin price rebounds or represents market recovery

- Reduction of Ethereum and XRP, senior investment fund Grayscale adjusted position ratio

- 1 BTC = $ 5224, does Bitcoin usage currency make sense?

In the development process in recent years, with the enthusiasm for mining and trading bitcoin, and the cheap power supply in some areas, China's mining power has once occupied more than 90% of the world's share.

The invasion of the mining boom has made many people unable to sit still. In June 2017, Lei Hua, the principal of Puman Middle School in Jiahe County, Hunan Province, after listening to others introducing Bitcoin, studied the cryptocurrency in depth and found that it was profitable. In July 2017, Leihua paid a purchase of an Ethereum mining machine. Due to the high power of the mining machine, it consumed nearly 21 kWh per day. Leihua moved the mining machine to the school's personal dormitory. Under the temptation of “getting money while lying down”, during the period from July to August 2017, Leihua purchased several mining machines and placed them in the school classroom, officially becoming a “miner”.

However, the inexplicable rise in electricity consumption, noise, and network cards made some embarrassing teachers unable to sit still. Under some investigations, Leihua’s mining machine was exposed, and the “Fortune Freedom Dream” was completely attacked. broken.

Although Leihua is only a microcosm of countless miners in China, we can see that the profits brought by mining are indeed quite rich. Take Bitcoin as an example. In 2017, Bitco's mining chip business monopolized 80% of global shipments, with operating profit of $3 billion to $4 billion.

But today's mining business has to start to survive after experiencing the scenery. Especially after the bitcoin market plunged last year, the "mine machine sold by the pound" even became a hot search. At the same time, as China's supervision of the bitcoin mining industry has become stricter, mining costs have begun to surge, and the mining industry is no longer thriving.

The era of prosperity that can't go back

All along, China’s attitude towards the suppression of bitcoin is no exception to the mining industry. In January 2018, according to the First Financial Report, the Leading Group for the Internet Financial Risk Special Rehabilitation Office issued a bitcoin mining activity to the provincial (district, municipal) and Shenzhen Internet Finance Risk Special Restruction Leading Group Offices. According to the notice, according to relevant departments, there are some so-called “mining” enterprises that produce “virtual currency”. While consuming a lot of resources, they also encourage the “virtual currency” investment speculation. According to the spirit of the National Financial Work Conference on preventing risks, limiting the need to deviate from the real economy, and avoiding supervision, the Mujin Remediation Office put forward two requirements: First, actively guide enterprises within the jurisdiction to withdraw from the “mining” business in an orderly manner, and Actively coordinate relevant departments within the jurisdiction, take multiple measures, comprehensively adopt measures such as electricity price, land, taxation and environmental protection, and guide relevant enterprises to withdraw in an orderly manner. The local rectification offices will report the current situation of “mining” enterprises under the jurisdiction before January 10 and The second is to timely grasp the progress of local work, and ask the local rectification office to fill in the relevant information about the “mining” enterprises within the jurisdiction before the 10th of each month.

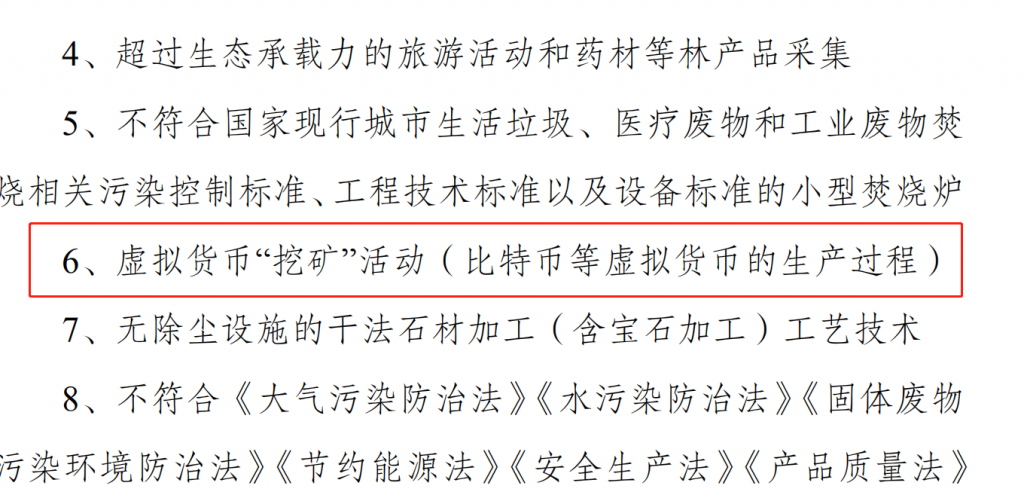

Yesterday, the National Development and Reform Commission issued the "Industrial Structure Adjustment Guidance Catalogue (2019, Draft for Soliciting Opinions)", stating that the "virtual currency 'mining' activity (the production process of virtual currency such as bitcoin) is a phase-out industry. According to the "elimination class" regulations, the elimination categories are mainly backward processes, technologies, equipment and products that do not meet the requirements of relevant laws and regulations, do not have safe production conditions, seriously waste resources, pollute the environment, and need to be eliminated. At the same time, the regulations also show that the year in the brackets after the entry is the phase-out period, and the phase-out period is January 1, 2021, which means that it should be phased out before January 1, 2021; the items with the phase-out plan are eliminated according to the plan; The entry for the deadline or phase-out plan is that the national industrial policy has been explicitly phased out or eliminated immediately.

Obviously, this shows that mining behavior and cryptocurrency trading are not supported by the Chinese government. Perhaps this time it is no longer a thunderstorm.

“Most of the mines will choose to be in the power-rich areas of Sichuan, Inner Mongolia, Xinjiang, etc. In addition to driving local employment, they can also provide a considerable income for the local government. The National Development and Reform Commission is undoubtedly difficult for domestic mines to survive. Unless it is moved abroad, in theory, the time for public comment is from April 8, 2019 to May 7, 2019, but this time the “virtual currency mining activity” is explicitly included in the “elimination class”. Obviously, there is not much turning." A digital currency analyst expressed his knowledge of the blockchain.

At the same time, a veteran investor said, “At present, China occupies most of the computing power. If the domestic mines migrate, it is good for decentralization, and it also promotes the overall digital currency price. The only Regrettably, our country’s superiority in digital currency will no longer exist."

"One day, they will classify Bitcoin mining as an encouraged industry. I just hope that this day is not too late. Bitcoin is a historical trend. Bitcoin is a "money laundering" because his brain is too dirty. So I thought that others are not clean." Last night, DGroup founder Zhao Dong said on Weibo.

For the time being, China's mining and digital currency industries are gradually retreating from the center of the world to the edge of the stage.

Author: Nancy

Note: This article is an original article of zero-identification blockchain, please indicate the author and source.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The network effect of value storage: Is it the moat for encrypting world projects?

- The National Development and Reform Commission plans to phase out the virtual currency "mining", causing a big discussion inside the circle

- Jingdong released the "White Paper on Blockchain Technology Practice (2019)", and the blockchain ranks among the four core technical capabilities of Jingdong Digital Technology

- The world's first lightning atom exchange exchange – Sparkswap

- The 0.18 version of Bitcoin Core will be released soon, allowing Bitcoin to connect to the hardware wallet

- Asian encryption market in the eyes of a Western investor

- The origin of cryptocurrency – science fiction "cryptography"