A review of the TG BOT dark horse Banana Gun token economy and the sniping opening gameplay.

Review of TG BOT Banana Gun token economy and sniping opening gameplay.Author: Joyce, BlockBeats

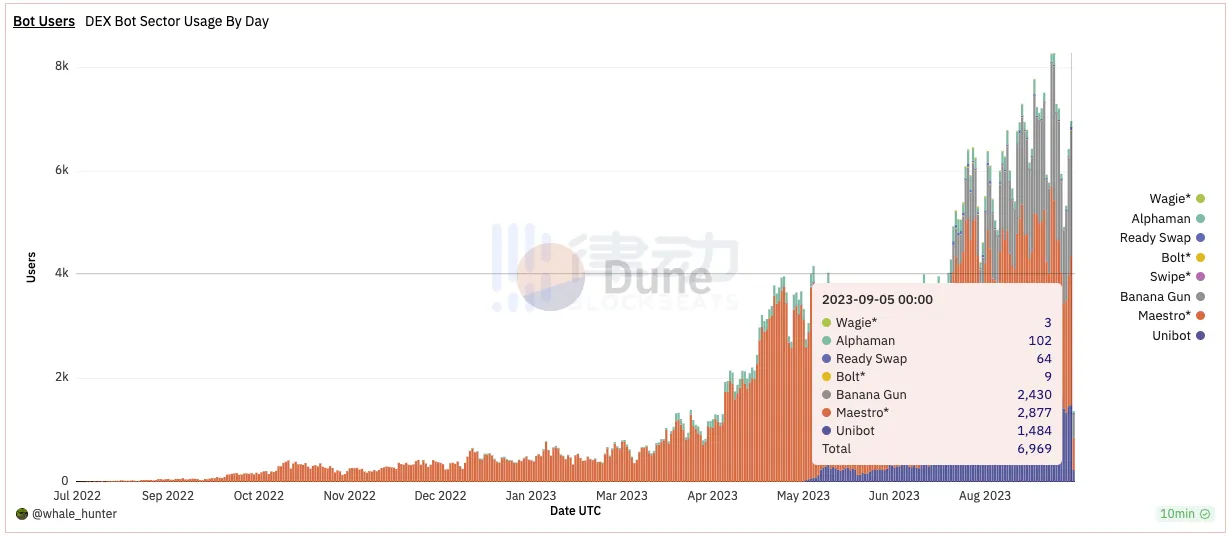

The iteration of the TG bot track is much faster than most people imagine. Maestro has surpassed the leading Unibot in terms of user volume without issuing coins, and now Banana Gun is also gaining momentum.

According to the latest data from Dune, the number of daily active users of Banana Gun has far exceeded Unibot and is approaching Maestro.

- MetaMask will launch the Snap feature, enabling interoperability with non-EVM chains.

- Yugalabs launches a new decryption game. The winner will receive a reward of 0.12 BTC.

- World League Live! has launched the KICK OFF Genesis Test, participating in the game can win Power rewards.

Image source: Dune

Like Unibot, Banana Gun is a Telegram bot that helps users quickly obtain tokens by sniping contracts. Its most famous feature is the Sniper feature for sniping openings, which is expected to become the preferred sniper and manual buyer for users on Ethereum.

Income is one of the factors to evaluate TG bots. It is worth noting that before the token sale, Banana Gun’s Telegram group had less than 300 members, but it was able to achieve stable daily income of 10-25 ETH.

Token Economics for the upcoming token sale?

Banana Gun sees the issuance of tokens as a way of brand marketing and achieving a positive flywheel effect. The presale will be conducted on their own dApp. During the first three weeks of the sale, Banana Gun filtered out robot users who completed tasks and issued NFTs to them, although the use of NFTs was not announced at that time.

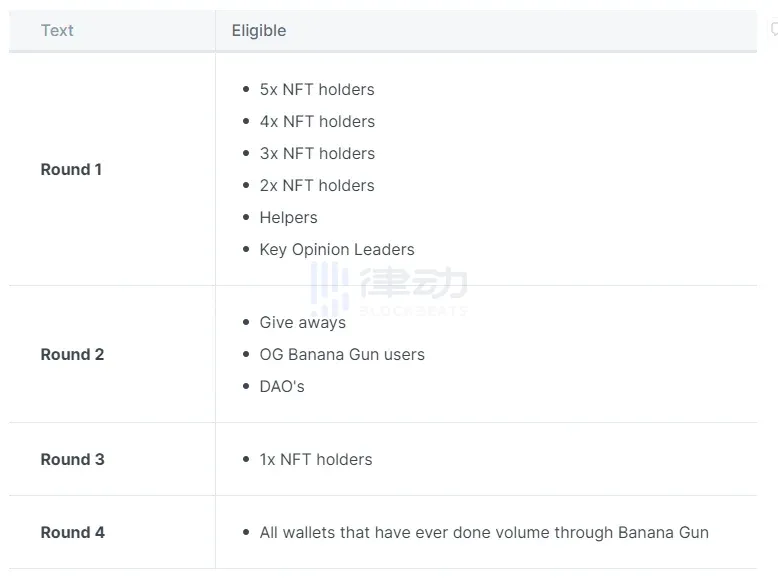

In this presale, the upper limit is expected to be 800 ETH, and the presale price is $0.65. To ensure fair distribution, the team will introduce a tiered system during the presale, which will be hosted on their own decentralized application (dApp).

There are four rounds of distribution, first come, first served. The first round will not be oversubscribed and is open to users who hold 2-5 Quest NFTs, users who have helped the project, and KOLs. The next three rounds will be oversubscribed and will focus on early loyal users. Considering that Banana Gun has generated 500 ETH in revenue in just three months, the token sale may end in the second round.

Image source: Banana Gun

To ensure a stable release, Banana Gun will leave a few days between the release, income sharing, banana bonuses, and airdrops.

This time, 10 million $BANANA will be released, with the presale accounting for 20%, the liquidity pool accounting for 3%, airdrops accounting for 1.2%, the team reserving 10%, half of which will be locked for 2 years and released linearly over 3 years, the other half will be locked for 8 years and released linearly over 3 years, and the treasury reserving 65.8%, most of which will be locked, and the released portion will be used as rewards for users using the bot.

The presale price is $0.65 per $BANANA, corresponding to an initial market value of $1.56 million and an initial FDV of $6.5 million. The initial liquidity will be injected with $300,000 worth of $BANANA and $195,000 worth of liquidity, with a total liquidity of $390,000. Ideally, the liquidity ratio of $BANANA will reach 25% of the circulating market value, which can maintain the health of the token market in terms of volatility and depth.

There will be 2.4 million tokens in circulation, accounting for 24.2% of the total tokens. The buy and sell tax is both 4%, and the team promises to “reduce taxes when the market value increases significantly”. Currently, 2% of the buy and sell tax is allocated to token holders, 1% to the team, and 1% to the treasury.

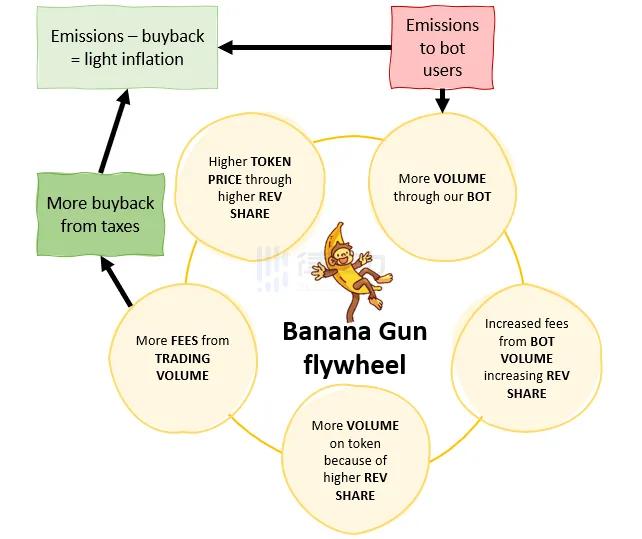

Banana Gun Ecological Mechanism

Banana Gun provides a mechanism in its constructed ecosystem that allows for the conversion of three roles: robot users, $BANANA holders, and Banana Gun investors. Every transaction made using Banana Gun will receive $BANANA as a reward, with the calculation method being transaction fees * X, where X is between 0.05 and 1. The team claims that they will adjust it according to market conditions. $BANANA holders can receive a share of income on the dApp, including 40% of transaction fee income and 50% of token transaction tax. The transaction fee for using Banana Gun is 1%, and the transaction fee for manual buying and selling is 0.5%. The token transaction tax is 4%.

To address the potential risk of token inflation, Banana Gun has also made considerations to control the deflation/inflation rate within 30%. Token price, number of robots, and trading volume are factors to consider. Firstly, 1% of the treasury tax will be used for buybacks, which can usually offset most of the inflation issues. In addition, the issuance of $BANANA is adjustable, and the characteristics of its ecological mechanism will also encourage users to actively participate in trading and hold $BANANA. The team also stated that they will launch functions that consume tokens in the future.

According to the content of the official document, Banana Gun has prepared two rounds of airdrop plans for users who invest time and effort: 100,000 and 20,000 tokens respectively. The first airdrop will be based on the user’s previous collection of NFTs on Banana Gun, where NFTs of different difficulties correspond to different scores. After calculation, the number of tokens that can be obtained will be determined and can be directly viewed on the dApp. The second airdrop will be released in subsequent social media marketing activities.

How to Sniper the Opening with Banana Gun?

Unlike Unibot, the characteristics and most famous function of Banana Gun are sniping the opening (Sniper function) and trading function. Now let’s take a look at how to play Banana Gun, which has an excellent sniping opening function and a clear airdrop plan.

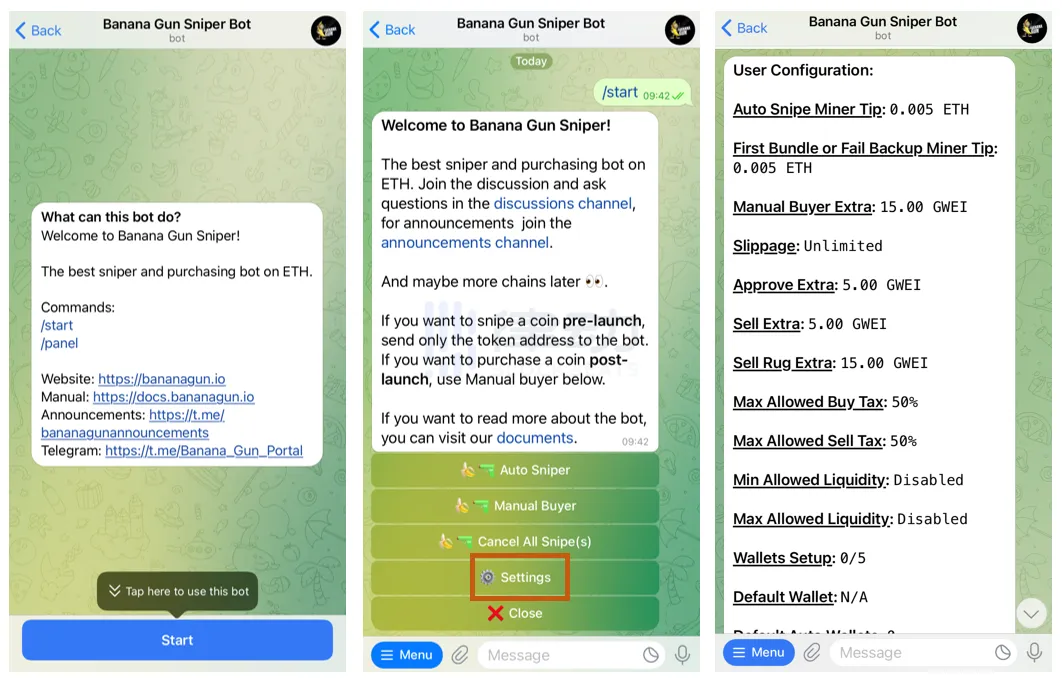

Enter the Telegram bot channel of Banana Gun, click “start” to enter the guide, and go to the Sniper setting page through “setting”.

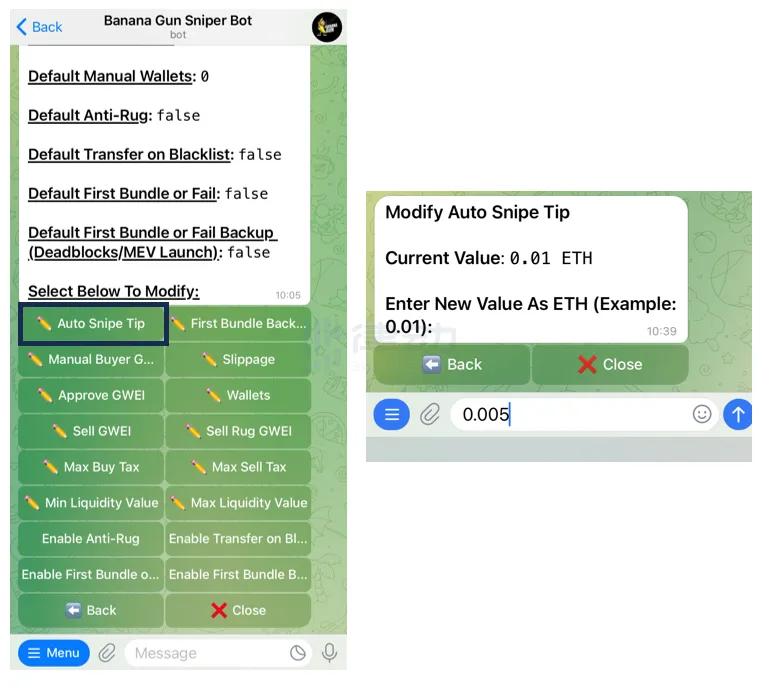

Below the parameter display area, select the parameter you want to modify.

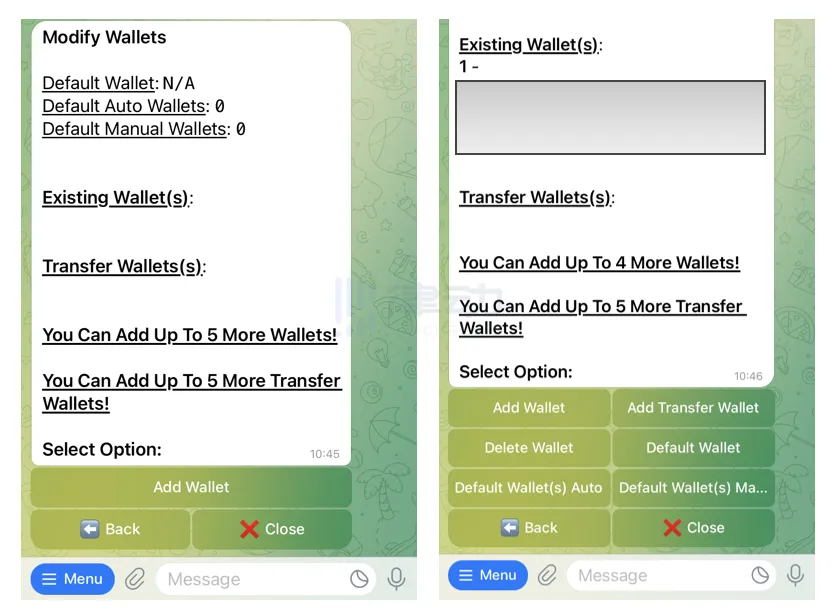

After setting successfully, click on Wallets to add a wallet, you can import private keys or generate them directly. Each Telegram account can use up to 5 wallets. After the wallet is generated, continue to set up automatic wallets and manual wallets. Then set the fees to be paid. Banana Gun uses a unified package bribery form, in the same contract, the queuing order is determined by the highest fees given, so different amounts of fees need to be set according to different projects.

After the basic settings are completed, you can enter the contract you want to “snipe” and the maximum expenditure for each wallet. Banana Gun can automatically fetch messages from Telegram channels to obtain any messages containing Ethereum contract addresses from bots or administrators. Once found, it will initiate a purchase or launch an automatic sniper.

The Battle between Bots in the Bot Track

Many people in the community also believe that there is still a lot of room for growth in the Bot track. In the short term, the token economics of bots have opened up new ideas for the empowerment of funds and token prices. Pay attention to new products and new iterations like Banana Gun, which may have the opportunity to capture a new round of market uptrend.

Last month, Unibot’s trading volume accounted for 2% of Uniswap’s volume. Considering Uniswap’s absolute leadership in the DEX track, Unibot’s trading volume may exceed some famous VC-supported DEXs. No wonder some people in the community think that the relationship between Unibot and Banana Gun is like that between Uniswap and Sushi.

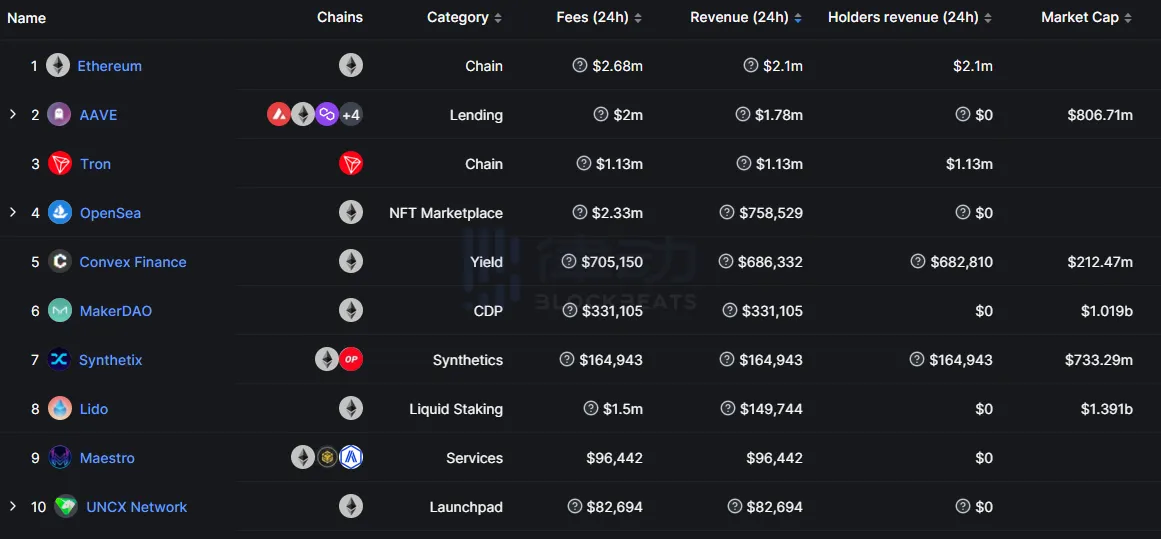

Image source: DefiLlama

From the latest revenue data, Maestro’s revenue has ranked ninth, which may indicate that the Bot track is not a false narrative, but has real demand.

Bot tools solve some long-standing problems for cryptocurrency users. These functions include copy trading, sniping new coins, automated airdrop interactions, and generating smart contracts or NFTs using AI. Without these advanced bot tools, individual cryptocurrency traders would face significant challenges in improving their technical advantages.

With the support of 550 million monthly active users on Telegram, the Bot ecosystem is becoming more and more enriched, and we will continue to pay attention to the Telegram ecosystem.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Overview of the Four Major Use Cases Achievable by Modular Smart Account Architecture

- Interview with Hash Global Founder KK What is the perspective of investors on Web3 and NFT?

- Starting with three escape methods Why doesn’t MakerDAO build Layer2 scaling solutions based on Ethereum?

- StarkNet’s Decentralization Proposal – An Optimal Solution for L2 Decentralization

- IOSG Weekly Report EigenLayer, the Year of Heavy Staking

- Casio will release virtual G-SHOCK NFT on Polygon.

- The Battle of Cross-Chain Thrones Strategies, Dominators, and Challenges.