Penetrating the current stablecoin landscape Opportunities and challenges for newcomers beyond USDT and USDC.

Opportunities and challenges for newcomers in the stablecoin landscape beyond USDT and USDC.Author: Caesar; Translation: Deep Tide TechFlow

Due to the significant consistency between stablecoins and market demand, it remains a central topic of discussion within the ecosystem. Therefore, developers and enthusiasts are actively exploring ways to create stablecoins that can have a lasting impact on the ecosystem. However, progress in this effort has been relatively limited so far.

I believe that the inherent limitations of cryptocurrency-backed stablecoins have not been sufficiently discussed. As we will discuss in this article, current projects have failed to attract users because cryptocurrency-backed stablecoins have limitations in terms of capital efficiency, settlement risk, limited use cases, and liquidity compared to fiat-backed stablecoins.

In this article, I will present some statistical data on the current stablecoin market and share some thoughts on it. Then, I will discuss the concept of stablecoin functionality to help us understand the reasons for the stablecoin market situation. Finally, I will focus on cryptocurrency-backed stablecoins and address their issues.

- LianGuai Morning News | Ark Invest Applies to Launch the First US Spot Ethereum ETF

- A review of the TG BOT dark horse Banana Gun token economy and the sniping opening gameplay.

- MetaMask will launch the Snap feature, enabling interoperability with non-EVM chains.

Current Stablecoin Market Statistics

The following data is from DeFiLlama:

-

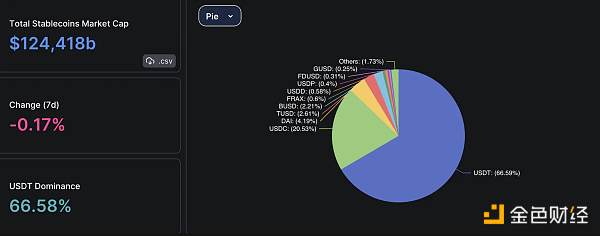

The total market value of stablecoins is about $125 billion, of which nearly 87% is USDT and USDC.

-

About 92% of the market share is held by fiat-backed stablecoins, totaling about $116 billion.

-

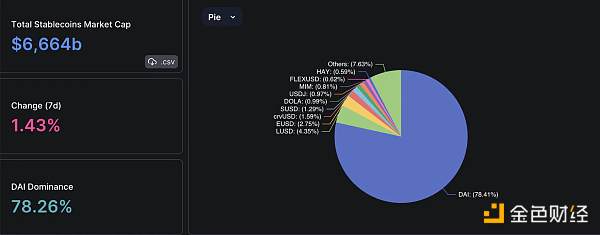

Only about $7 billion is held by cryptocurrency-backed stablecoins, with DAI holding about $5 billion.

-

The total market value of algorithmic stablecoins is about $2 billion, of which FRAX and USDD account for 75% of the market share.

These data provide several insights into the market situation:

-

USDT and USDC are projects that have achieved product-market fit and remain consistent with market and user demand.

-

Although the number of projects in the category of cryptocurrency-backed stablecoins continues to increase, the dominant market share of USDT and USDC proves that there is currently no demand for alternatives.

-

Although the increase in the savings rate of DAI once helped it gain market share for a period of time, DAI has failed to maintain its market value calculated in US dollars over the past year, and it is undisputedly dominant among cryptocurrency-backed stablecoins.

-

As a widely adopted cryptocurrency-backed stablecoin, DAI’s shift toward tangible assets, including US government bonds, highlights the lack of a scalable stablecoin that can resist censorship and be immune to counterparty risk.

-

Except for DAI, the adoption rate of other cryptocurrency-backed stablecoins is limited, indicating that their success and potential may have been overestimated.

-

The feasibility of algorithmic stablecoins is uncertain, as FRAX is also attempting to move away from algorithmic mechanisms.

-

Unless there are major events that disrupt the credibility of USDT and USDC, or breakthrough projects emerge, the stablecoin market landscape is unlikely to undergo significant changes.

Why do users prefer USDT and USDC?

Initially, cryptocurrency was a movement that believed in freedom, decentralization, and skepticism towards centralized participants. However, the current state of the stablecoin market is the opposite. It is evident that as the adoption rate of the ecosystem increases and more people join the field, the purity of the ecosystem decreases because most new entrants are not for decentralization or resistance to censorship.

The most centralized and perhaps the least transparent projects have become market leaders. The main reason for this situation can be explained by a new concept that I propose, called stablecoin functionality:

Stablecoin functionality is a new concept used to understand some key issues in the stablecoin field:

-

Market dynamics between users and stablecoin projects;

-

Why some stablecoins are adopted while others are not;

-

The vision that stablecoin project developers should possess.

I believe that stablecoins should be viewed as digital versions of the off-chain assets they are pegged to. Therefore, in our case, a USD-backed stablecoin needs to represent the functions of the USD. These functions can be integrated into stablecoins, including:

-

Medium of exchange: Stablecoins should be seen by users as a tool for exchanging cryptocurrencies or conducting transactions with others, and need to be available in major protocols (such as centralized exchanges and established DeFi projects like Uniswap, Balancer, Curve, etc.) and have basic trading pairs.

-

Store of value/anchor stability: Stablecoins should have a history of maintaining their anchor stability, so that even a 1% fluctuation can be seen as a failure from the user’s perspective.

-

Capital efficiency: If a stablecoin requires over-collateralization or carries liquidation risks, it lacks capital efficiency, which will limit user adoption because most users understandably want their assets to not have these risks or limitations.

-

Fiat exchange channels: If a stablecoin does not provide a solution for fiat currency exchange, it becomes more difficult to use, as the lengthy process of converting crypto assets into cash dollars can make the entire process expensive and cumbersome.

-

Censorship resistance: Stablecoins should protect their users from the arbitrary actions of centralized participants by becoming a secure haven for privacy and self-custody, without relying on centralized entities such as banks.

It can be understood that USDT and USDC have most of the functions, including medium of exchange, store of value, capital efficiency, and fiat exchange channel solutions, but these two stablecoins are centralized and therefore lack censorship resistance. Although USDT and USDC cannot achieve complete success within the framework of stablecoin functionality, they are the most successful within this framework, making them a market fit. Additionally, the early advantages and brand recognition of these projects have made them widely adopted by users.

From this, it can be seen that stablecoin projects that want to threaten the dominant positions of $USDT and $USDC need to meet these five main requirements and have brand recognition in the community.

However, we need to consider whether it is possible to challenge $USDT and $USDC in the current model/technological development of stablecoins supported by cryptocurrencies. Let’s take a closer look at some existing stablecoin projects that could be considered challengers to $USDT and $USDC.

Cryptocurrency-backed Stablecoins

In this section, I will focus on several stablecoins that I believe are worth analyzing because they cover various aspects of stablecoins supported by cryptocurrencies that must be considered.

Before delving into each stablecoin, I want to emphasize that I believe the limitations of the Collateralized Debt Position (CDP) model are a major issue faced by every cryptocurrency-backed stablecoin. CDP requires users to lock their cryptocurrency assets in an over-collateralized loan, which poses liquidation risks and therefore has inherent limitations in terms of scalability.

There are several issues with the borrowing and lending relationship between users and protocols that are not suitable for the functionality of stablecoins:

-

Medium of exchange: Since users create borrowing positions by minting, they do not use this type of stablecoin as a medium of exchange, except for leverage mining and leverage trading. Therefore, cryptocurrency-backed stablecoins are not considered as a medium of exchange.

-

Capital efficiency: From the users’ perspective, the CDP’s requirement for over-collateralization and the existence of liquidation risks do not make it highly capital efficient, as there are more capital-efficient ways.

Therefore, we can say that cryptocurrency-backed stablecoins do not meet the market demand for products. However, we need to analyze these stablecoins separately in order to better understand their limitations and disadvantages, as well as highlight opportunities.

$DAI

$DAI is an over-collateralized CDP stablecoin issued by MakerDAO and is one of the largest cryptocurrency-backed stablecoins, attracting billions of dollars in funds and achieving good adoption in the DeFi ecosystem. However, with the launch of new cryptocurrency-backed stablecoins and the decoupling of $DAI from $USDC, this stablecoin has lost some market share. However, with the introduction of Enhanced DAI Savings Rate, the protocol has regained some momentum, although discussions about its sustainability are still ongoing.

Although it is one of the most profitable businesses in the ecosystem, the protocol also faces issues in the future, such as why should I use $DAI instead of $USDC?

As far as I know, $DAI will face the following challenges:

-

Lack of innovation: $DAI is minted through over-collateralized CDP positions, so it does not have any significant technological advantages compared to its competitors. The launch of Enhanced DAI Savings Rate also indicates that the project has encountered difficulties in attracting users.

-

Dependency on centralized participants: $DAI is not a fully decentralized stablecoin, as its asset reserves are mainly $USDC and RWA, and income is generated through treasury bonds, which means asset custody is handled by centralized participants.

-

No clear value proposition: The main value proposition of cryptocurrency-backed stablecoins is decentralization and resistance to censorship. As a trade-off, these protocols implement the CDP model, which requires over-collateralization and poses liquidation risks. However, although $DAI maintains these drawbacks, it does not provide any value proposition in terms of decentralization. Therefore, it combines the worst parts of fiat-backed stablecoins and cryptocurrency-backed stablecoins.

On the other hand, there are opportunities for $DAI:

-

High Adoption Rate: $DAI is one of the most well-known and adopted stablecoins in the ecosystem. Additionally, $DAI exists in most mature DeFi protocols, providing strong liquidity. Considering that launching liquidity for each stablecoin project is the most challenging part, $DAI is in a very favorable position.

-

Medium of Exchange: Many consider $DAI as a medium of exchange, which is evidenced by its use by many for trading and buying/selling crypto assets, as well as its deep liquidity in different protocols.

-

Store of Value: By distributing treasury coupon income to DAI holders through enhanced DAI savings rates, $DAI can become a secure and reliable source of income and store of value, increasing its adoption rate.

$FRAX

$FRAX was originally an algorithmic stablecoin backed by algorithmic mechanisms and undercollateralized crypto reserves. However, the collapse of $UST led to a loss of trust in algorithmic stablecoins, causing the FRAX team to change this model. As a result, they decided to use $USDC as reserves for a 100% collateral ratio. However, with $FRAX becoming the “poor man’s $USDC,” this model has faced criticism.

However, with the upcoming release of FRAX v3, this model will also change. While not all details are public, there are rumors that they will abandon reliance on $USDC, and the FRAX ecosystem and its stablecoin $FRAX will be backed by US Treasury bonds.

$FRAX will face several challenges:

-

Dependence on Centralized Participants: One of the most common criticisms is that $FRAX relies on $USDC. If $FRAX is backed by $USDC reserves, then what is the reason for holding it? Although they are changing the model, reliance on centralized participants will continue as they collaborate with other centralized participants for FED main account transactions.

-

Indecisive Leadership Team: There is controversy over whether this criticism is valid, but the FRAX leadership team has indeed focused on excessive development in a short period of time and has frequently changed the roadmap.

-

Lack of $FRAX Holders/Users: According to statistics from Etherscan, $FRAX has approximately 8,000 holders with a market value of about $800 million. The value proposition of $FRAX is not as an exchange medium, thus limiting its potential compared to $USDT and $USDC. Frax is not widely used in the ecosystem aside from products built on top of Frax. The reason is the incentives paid to the $FRAX pool by Curve, which is due to the position of Frax in Curve Wars. The sustainability of Curve is also an important parameter for $FRAX.

On the other hand, $FRAX also has some opportunities:

-

Capital Efficiency: Currently, users can deposit 1 $USDC and receive 1 $FRAX, which is a capital-efficient way. It can be assumed that this capital efficiency will continue to exist through the migration to the new model, making it a competitive advantage of $FRAX.

-

Established FRAX ecosystem drives the use cases of $FRAX: Most stablecoins face the problem of lack of use cases, meaning there is no place to utilize the underlying stablecoin. However, $FRAX can be effectively used through the universal FRAX ecosystem, including Fraxswap, Fraxlend, and Fraxferry, and perhaps in the future on Fraxchain.

$LUSD

$LUSD is one of the most forked stablecoin projects in the ecosystem, as it offers a unique solution for providing censorship-resistant stablecoins. It is backed by $ETH, and users can borrow against their $ETH holdings with a minimum collateralization ratio of 110%.

Some competitive features of $LUSD are:

-

Immutable smart contracts;

-

No governance required;

-

No interest charged;

-

Collateral quality.

Furthermore, from the latest announcement of Liquity Protocol, it can be seen that with the launch of Liquity v2, they will develop a new stablecoin that maintains collateral value using a risk-free method. This will be a new stablecoin separate from existing projects.

$LUSD will face several challenges:

-

Limited scalability: Although $LUSD is one of the most inspiring projects in the ecosystem, it is also one of the least scalable projects due to the requirement of over-collateralization, liquidation risk, and only accepting $ETH as collateral.

-

Lack of $LUSD holders/users: Due to the lack of scalability of $LUSD, the stablecoin has only around 8,000 holders with a market cap of approximately $300 million, according to data from Etherscan.

-

Lack of use cases: Due to the lack of scalability of $LUSD, there is insufficient liquidity in major protocols, hindering the adoption of $LUSD.

-

Inadequate capital efficiency: Liquidity requires over-collateralization and carries liquidation risk, making it not a good choice in terms of capital efficiency, which limits its ability as an exchange medium.

On the other hand, $LUSD also has some opportunities:

-

Censorship resistance: The most unique aspect of $LUSD is that it is the best project in terms of decentralization and censorship resistance. I believe there is no competition in this field.

-

Strong brand: The long-term success of $LUSD in decentralization and stable anchoring, as well as the team’s success in gaining trust within the community, make $LUSD a powerful brand that the team can leverage.

-

Liquity v2: The Liquity team is aware of the scalability issues of the protocol, and their goal is to scale without breaking things. Developing a risk-free model that uses primary protection methods to prevent losses from volatility can partially address the scalability problem.

$eUSD

$eUSD is a stablecoin collateralized by pledged $ETH. Holding $eUSD will generate stable income with an annual yield of approximately 8%. It is a CDP stablecoin that requires over-collateralization and carries liquidation risks.

From my perspective, $eUSD will face several challenges:

-

Lack of capital efficiency: The over-collateralization model means that $eUSD is limited in terms of capital efficiency, as users need to invest more funds than they receive and bear liquidation risks.

-

Limited use cases: Due to insufficient stablecoin demand to provide liquidity for multiple pools, $eUSD has limited use cases, which restricts its scalability.

-

Limited growth potential: Emerging stablecoins need to have growth potential and a unique value proposition. However, although utilizing LSD products can be seen as a good way to expand, it is limited due to fierce market competition.

-

Not a medium of exchange: $eUSD is a yield-bearing stablecoin, and the protocol does not prioritize its use as a medium of exchange. Although this is also an important value proposition, it limits its growth potential.

-

Anchor stability: eUSD holders are eligible to receive rewards in the form of pledged $ETH. Due to this reason, the demand for eUSD exceeds the supply, resulting in its anchoring above $1.00. Unless the system changes, eUSD will not be able to maintain its anchor.

On the other hand, $eUSD also has some opportunities:

-

Income-generating asset: As $eUSD can generate income for holders, there will certainly be demand to use it as a store of value. If users trust the anchoring stability, it can be a good way to earn $ETH income.

-

Access to LSD products: LSDfi is a growing market that has certainly achieved product-market fit. Leveraging LSD to mint stablecoins is a profitable business for the protocol and users.

$crvUSD

$crvUSD is a CDP stablecoin project that requires over-collateralization and carries liquidation risks. The unique feature of $crvUSD is its liquidation mechanism called LLAMMA. Through this method, LLAMMA gradually sells parts of the collateral at different price ranges instead of immediately selling all collateral at a specified liquidation value. As a result, as the price of the collateral decreases, some of the collateral will be auctioned off in exchange for $crvUSD.

So far, stablecoins have achieved gradual market value growth without any major decoupling. However, although it has approximately $100 million in liquidity, it only has about 600 holders, which raises concerns about the scalability of the product.

Based on my knowledge, $crvUSD will face several challenges:

-

Inefficiency in capital utilization: As $crvUSD is over-collateralized CDP position, it carries liquidation risk and lacks differentiation in terms of capital efficiency compared to competitors, thus it can only scale to a certain extent.

-

Limited utility: Due to low liquidity and lack of scalability, the use cases for $crvUSD are limited. Although there are several $crvUSD staking pools, it is not very attractive considering the trade-offs.

-

Insufficient holders: As mentioned earlier, $crvUSD has only about 600 holders, which is due to the insufficient demand for CDP stablecoins. Therefore, despite providing a unique liquidation mechanism superior to other CDP stablecoins, $crvUSD will face the challenge of attracting new holders.

On the other hand, $crvUSD also faces some opportunities:

-

Unique liquidation mechanism: The soft liquidation mechanism of $crvUSD is a great innovation that competitors will surely imitate, as it can increase the scalability of CDP stablecoins to some extent and avoid hard liquidation.

-

Curve support: Curve is a mature stablecoin exchange platform that has been present in the ecosystem for years, with deep liquidity. $crvUSD can leverage this in the future to effectively enhance its scalability.

Conclusion

Although this article is long, there is one simple thing you should remember.

The future of stablecoins backed by crypto assets will be determined by a simple question:

“Can users purchase stablecoins instead of just borrowing them?”

The current model does not provide a good solution in terms of achieving stablecoin functionality. Therefore, $USDT and $USDC can continue to dominate this field.

However, they also have limitations, especially in terms of decentralization, censorship resistance, and self-custody. I believe there can be new models to address these issues and achieve stablecoin functionality, but I am also certain that the current model has its flaws and is difficult to succeed.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Yugalabs launches a new decryption game. The winner will receive a reward of 0.12 BTC.

- World League Live! has launched the KICK OFF Genesis Test, participating in the game can win Power rewards.

- Overview of the Four Major Use Cases Achievable by Modular Smart Account Architecture

- Interview with Hash Global Founder KK What is the perspective of investors on Web3 and NFT?

- Starting with three escape methods Why doesn’t MakerDAO build Layer2 scaling solutions based on Ethereum?

- StarkNet’s Decentralization Proposal – An Optimal Solution for L2 Decentralization

- IOSG Weekly Report EigenLayer, the Year of Heavy Staking