Cryptocurrency overwhelming, Trump releases fiscal 2021 budget to increase regulation

Author: Joyce

Source: Blockchain Outpost

Introduction: "At present, one in ten cryptocurrency owners is in the United States. By 2021, one in five American millennials will own cryptocurrencies; by 2025, the rapid rise of IoT devices will bring maximum security Risk; 70% of Americans will own cryptocurrency by 2030. "

On Monday, U.S. President Donald Trump released a $ 4.8 trillion budget proposal for fiscal year 2021, aimed at expanding the Treasury's regulation of cryptocurrencies by reintegrating the US Secret Service into its jurisdiction. The adjustment will "create new efficiencies" in the Secret Service's investigation into criminal acts involving cryptocurrencies and financial markets. And the Treasury will assume more powers and responsibilities: "Break down terrorist financing, hold rogue states and human rights abusers accountable, and detect and curb financial crimes."

- In the face of the epidemic, how can blockchain improve the ability to govern according to law?

- Destiny and reincarnation: the moment of Bitcoin's production reduction

- Perspectives | Zheng Lei, Hong Kong International New Economic Research Institute: Blockchain is naturally suitable for social welfare scenarios

At the same time, the budget will "ensure that the United States continues to lead the world in key technologies such as artificial intelligence and quantum technology. The economic strength and national security of the United States depend on this." The budget is expected to allocate funding for artificial intelligence research by 2022 Nearly $ 2 billion, higher than the current $ 973 million, and $ 860 million will be allocated for "quantum information science" over the next two years, which is twice the amount in 2020.

For the first time in July last year, Trump made clear his attitude towards Bitcoin. Shortly after Trump announced the Libra crypto plan on Facebook, Trump tweeted that he was not a fan of Bitcoin and other cryptocurrencies. Cryptocurrency is not a currency, and its value fluctuates so much that nothing comes out of nothing. Bitcoin and other cryptocurrencies are "unregulated crypto assets" that can fuel illegal behavior, including drug transactions and other illegal activities. Trump's move also made "Bitcoin" a hot search term for Twitter at the time.

"Only the U.S. dollar is the real currency, and the U.S. dollar is stronger now than ever. The U.S. dollar is still the world's leading currency and will remain that way forever," Trump said in a subsequent Twitter post. .

Although the current budget is far from legally valid, we can see Trump's "dislike" of cryptocurrencies and the maintenance of the dollar's status.

However, the Trump administration supports and participates in the blockchain industry. Acting Deputy Secretary of State for Economic Growth, Energy and Environmental Affairs, Manisha Singh, has stated that he hopes to "maintain competitiveness and strengthen the United States in the blockchain Leadership in chain development. "

U.S. cryptocurrencies are becoming more widely used

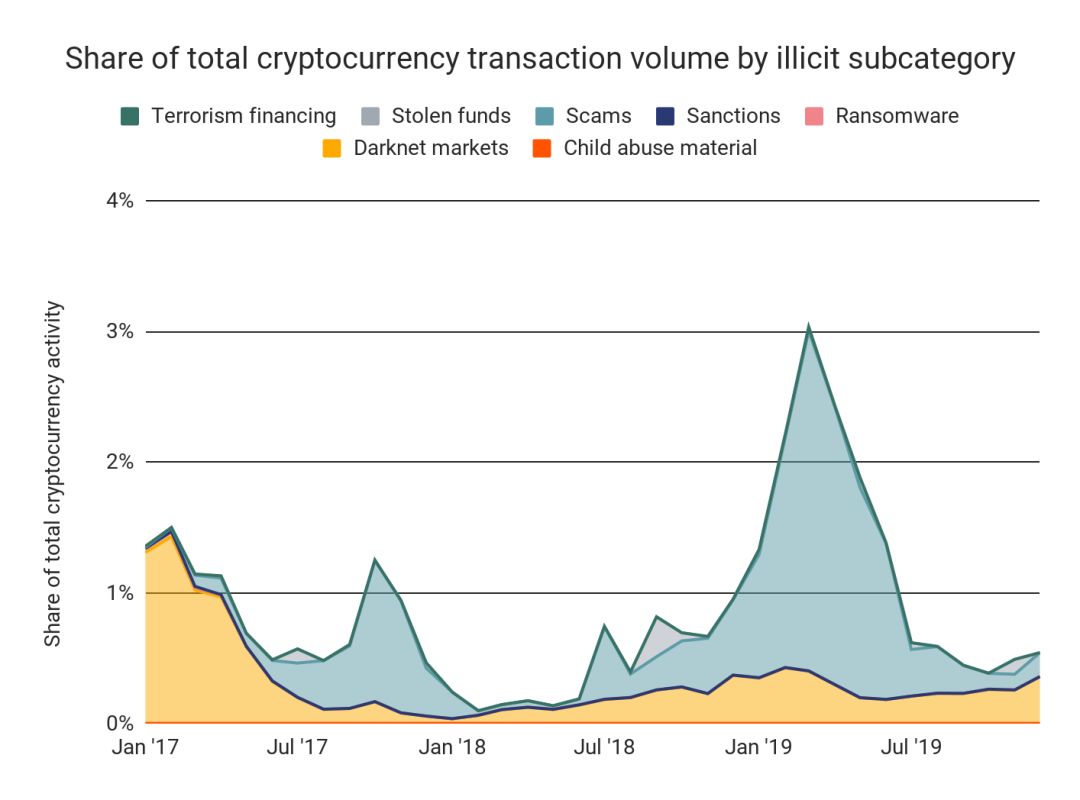

Chainalysis data shows that a total of $ 11.5 billion in cryptocurrency transactions related to criminal activity last year, accounting for 1.1% of total criminal activity. The chart below shows the change in the share of all types of criminal activity in all cryptocurrency activities since 2017. It can be seen that the proportion of terrorist financing is increasing, and terrorism is being severely cracked down by the United States.

Currency includes: BTC, ETH, LTC, BCH, USDT, PAX, ZRX, BNB, OMG, USDC, TUSD, DAI, WETH, HT, GNO, ZIL, Source: chainalysis

Even so, U.S. cryptocurrency adoption is on the rise.

According to survey data released by Charles Schwab, a comprehensive financial services company in the United States, GRAYSCALE's Bitcoin Trust ranks fifth among the top ten securities assets held by American millennials (after 80s and 90s), with a share of 1.84%. Last year, mainstream financial institutions such as JPMorgan Chase were involved, and popular retailers such as Amazon and Starbucks now allow customers to pay in bitcoin.

According to the nobl Insurance report, one in ten cryptocurrency owners is in the United States ; by 2021, one in five American millennials will own cryptocurrencies; by 2025, the rapid rise of IoT devices will bring the largest Security risks; by 2030, 70% of Americans will have cryptocurrencies, which is comparable to credit card usage.

Currently, the U.S. federal government has invested a large amount of funds to track Bitcoin and other cryptocurrency trading networks to prevent various criminal acts. Branches within the Department of Homeland Security, the Secret Service, and the Ministry of Finance have spent more than $ 500 million on blockchain data analysis alone last year.

Fintech into regulatory technology

The US's regulatory attitude towards cryptocurrencies not only gives some room for development, but also requires it to be applicable to the existing regulatory framework.

The U.S. Securities and Exchange Commission proposed that the use of blockchain in financial activities is nothing more than the traditional central bookkeeping method of distributed account bookkeeping. This form of change has not changed the nature of the transaction, so digital virtual currencies still need to comply with the laws and regulations of securities activities and be regulated.

The American academic community has also consistently stated that although virtual currencies such as Bitcoin are used by criminals and there are many frauds in the virtual currency market, these phenomena do not represent that blockchain technology or digital virtual currencies themselves are defective or guilty. of.

At the same time as government and academic supervision attitudes continue to improve, some related supervision work has also begun.

The NASDAQ exchange in the United States has been conducting research on cryptocurrency related technologies and applications since 2013. Last February, NASDAQ officially launched the Bitcoin Liquidity Index (BLX) and Ethereum Liquidity Index (ELX) quoted in US dollars. U.S. regulators and Nasdaq have always maintained a positive interaction. U.S. regulators can obtain a large amount of first-hand data through Nasdaq, and convert these evaluation indicators into regulatory evaluation indicators, transforming financial technology into regulatory technology.

And Grayscale's Grayscale Bitcoin Trust also became the first digital investment vehicle to gain SEC reporting status this year. At this point, its grayscale Bitcoin Trust has filed its quarterly annual report and audited financial statements as Form 10. In addition to complying with its obligations under the Transaction Law, it has also raised inquiries with the SEC, etc., and these submitted reports will be listed on the National Stock Exchange. Corporate and exchange traded products follow the same standards.

The premise of supervision is to characterize a certain behavior, but currently there is no uniform definition of the relevant attributes of cryptocurrencies, which is also one of the current difficulties in supervision.

Telegram ICO raised $ 1.7 billion in early 2018. The SEC sued the company in October 2019, claiming that Gram tokens were unregistered securities, and required Telegram to stop launching the TON blockchain. The main issue in this lawsuit is whether the attribute of the cryptocurrency "Gram" of the Telegram TON blockchain network is securities or commodities. Since it has not been determined for a long time, this lawsuit is still ongoing.

In response to the central bank's digital currency in the global focus, Digital Federal Reserve Director Brainerd said that the Fed is studying a wide range of issues related to the regulation and protection of digital payments and digital currencies, including the cost and potential benefits of issuing its own digital currency.

Full text of US budget proposal for fiscal year 2021: https://www.whitehouse.gov/wp-content/uploads/2020/02/budget_fy21.pdf

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analysis: Is 2020 the first year of the blockchain?

- Is the privacy feature useful? A quick overview of the usage of privacy coins and coin mixing services

- Italian securities regulator establishes cryptocurrency regulations, has closed 2 cryptocurrency trading sites

- Investment is risky: who is more at risk from Bitcoin and Apple stocks?

- In-depth analysis: the transition of the national digital governance system after the epidemic

- These two crypto companies are valued at hundreds of millions of dollars. Which big-name investors are investing?

- The members of the Golden Chain Alliance have “stand on their own feet”, where is the path of the Chinese Alliance-type blockchain open source platform?