Deep observation of the NFT market in 2023

Ranking of actual trading volume in various trading markets this year, data source: NFTGo

- Blur’s royalty share exceeds OpenSea

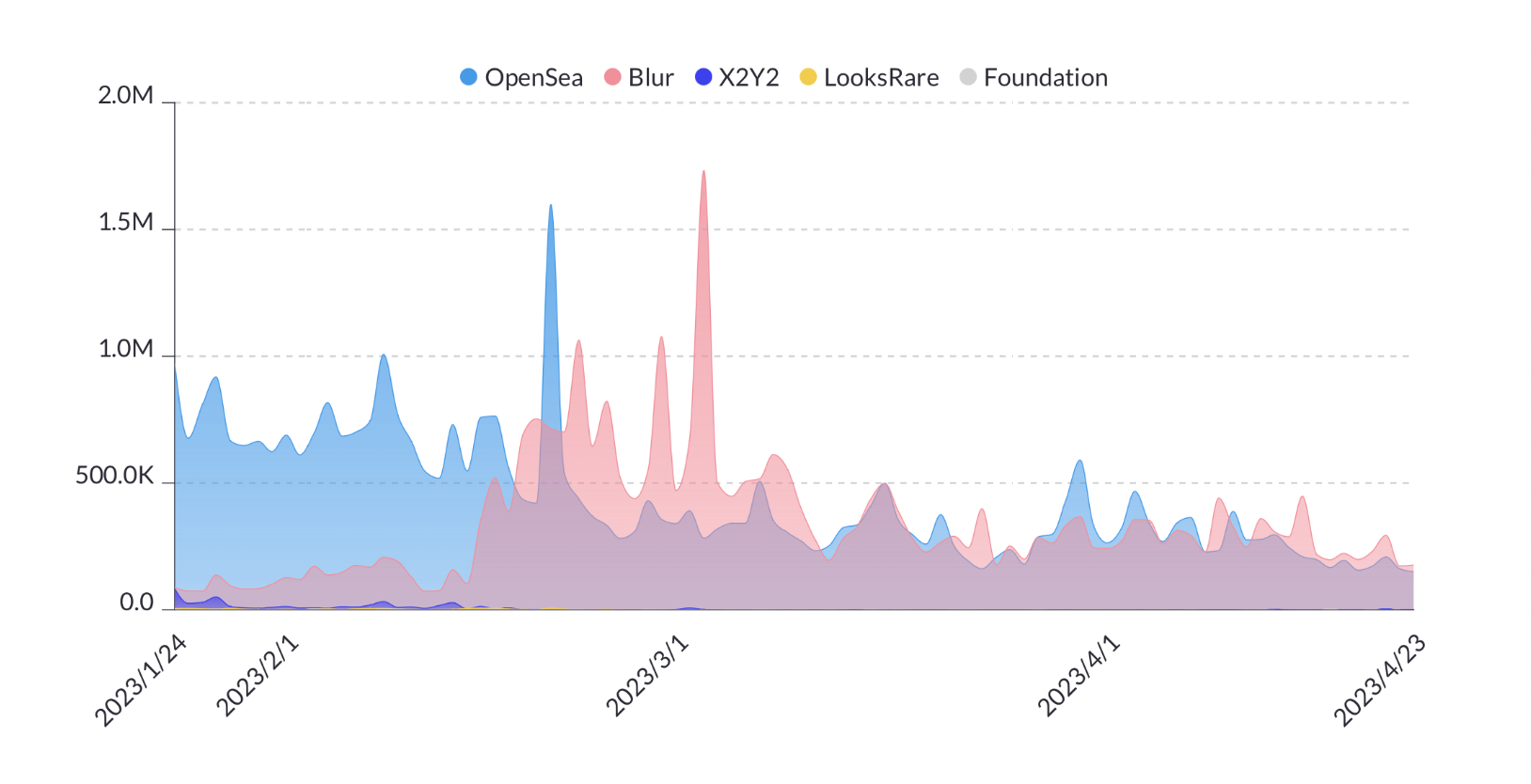

In terms of royalties, according to hildobby’s data, OpenSea has always been at the top of the list, but since mid-February, Blur’s royalty income has surpassed OpenSea and maintained a trend of parity with it. After March, the main share of royalties was divided between Blur and OpenSea. On March 3, Blur reached a peak royalty of approximately $1.7 million, while OpenSea reached a peak of $1.5 million on February 20 and fell to a low of $300,000 at the end of February. This difference shows that Blur has taken a significant share of the royalty market. The main reason for the change is that in mid-February, Blur targeted some NFT traders through optional royalties and zero transaction fee markets, taking the lead in occupying the group of price-sensitive users in the NFT market.

Changes in royalty transaction volume. Source: Dune Analytics

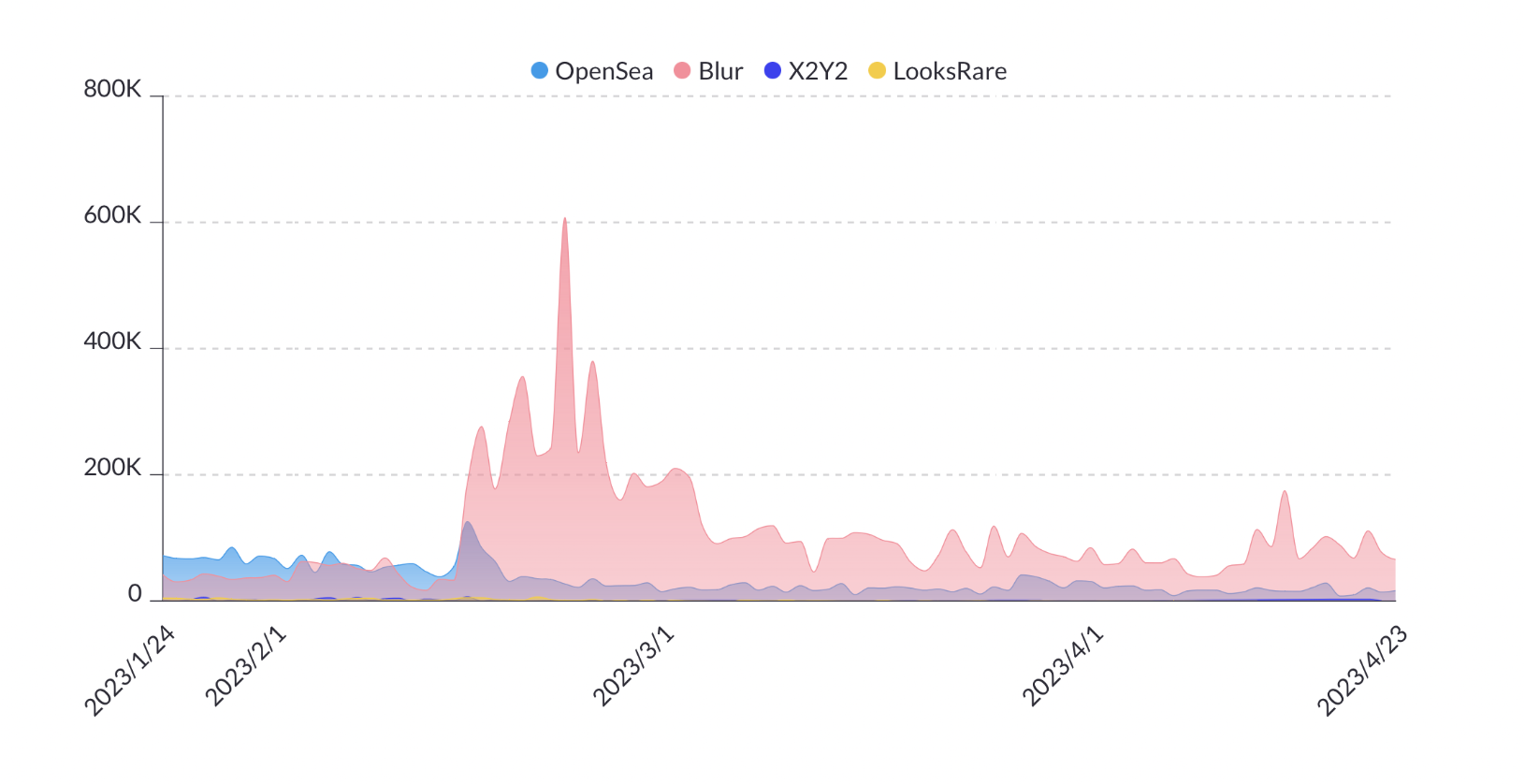

- Blue chip royalties surged under the OpenSea and Blur royalty war

Since the royalty war between OpenSea and Blur began in mid-February, the royalty volume of blue chips on the Blur platform, including BAYC, MAYC, Otherdeed, Azuki, and CloneX, has grown rapidly. Many traders bid on blue chips to get more platform airdrops and tokens in order to earn points.

- Opinion | When Bitcoin prices plummet in the next few years, gold will "land on the moon"

- Institutional investors boost Bitcoin to $ 7,000

- Babbitt column | How to predict the extreme price of cryptocurrency? Here are a few data to help you

Royalty fees for blue chip transactions. Source: Dune Analytics

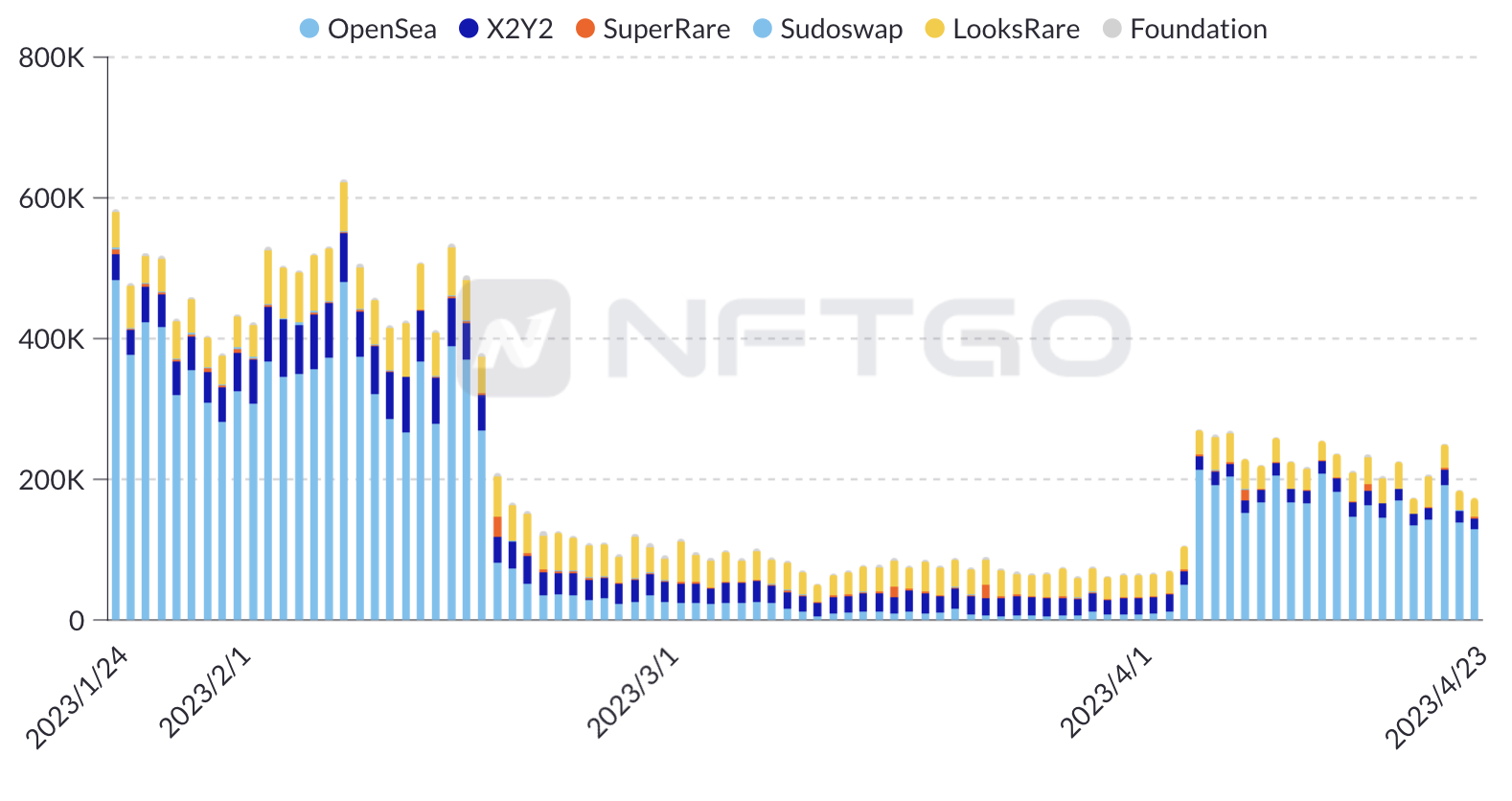

- Competition for transaction fees in the NFT market

Since mid-February, the total market fees of mainstream NFT trading platforms have rapidly decreased. In order to cope with the competition from Blur’s low fees, and attract more users to maintain their market position, OpenSea also announced a limited-time 0 transaction fee trading and optional royalty service. OpenSea’s total transaction fees dropped from a peak of over $600,000 in January to a low of about $50,000 in March.

NFT Market Fees. Source: Dune Analytics

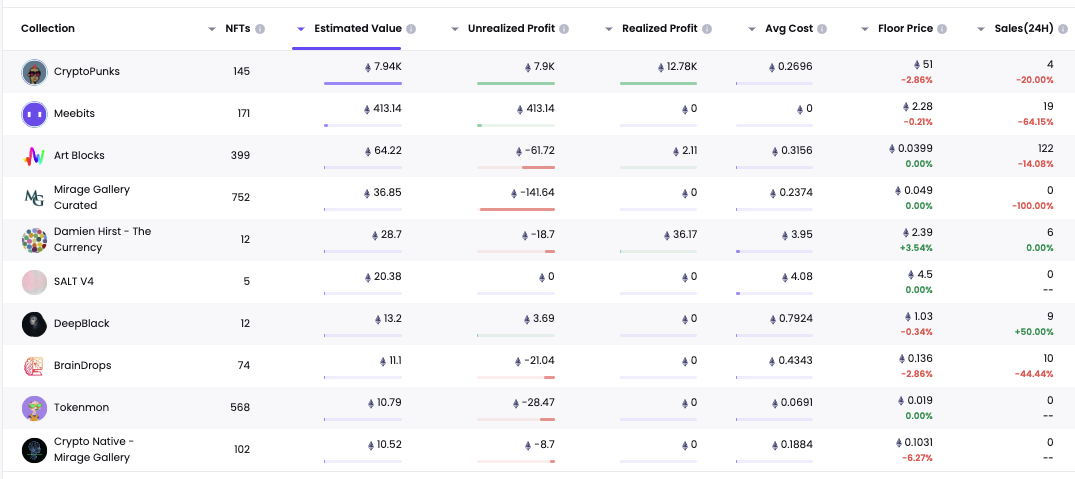

2. Mass production of niche projects and completion of high-priced sales, such as the user in the following image who bought a large number of NFTs and sold them at a high price point to complete the sale.

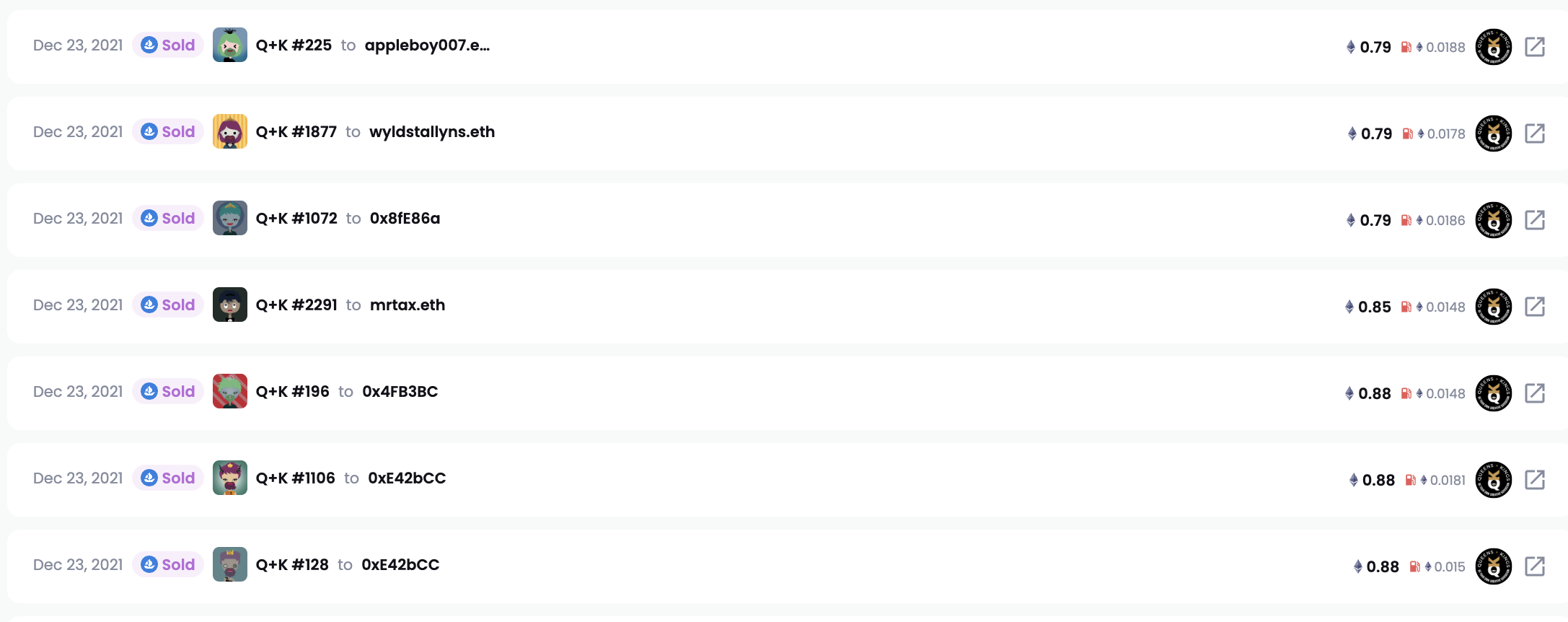

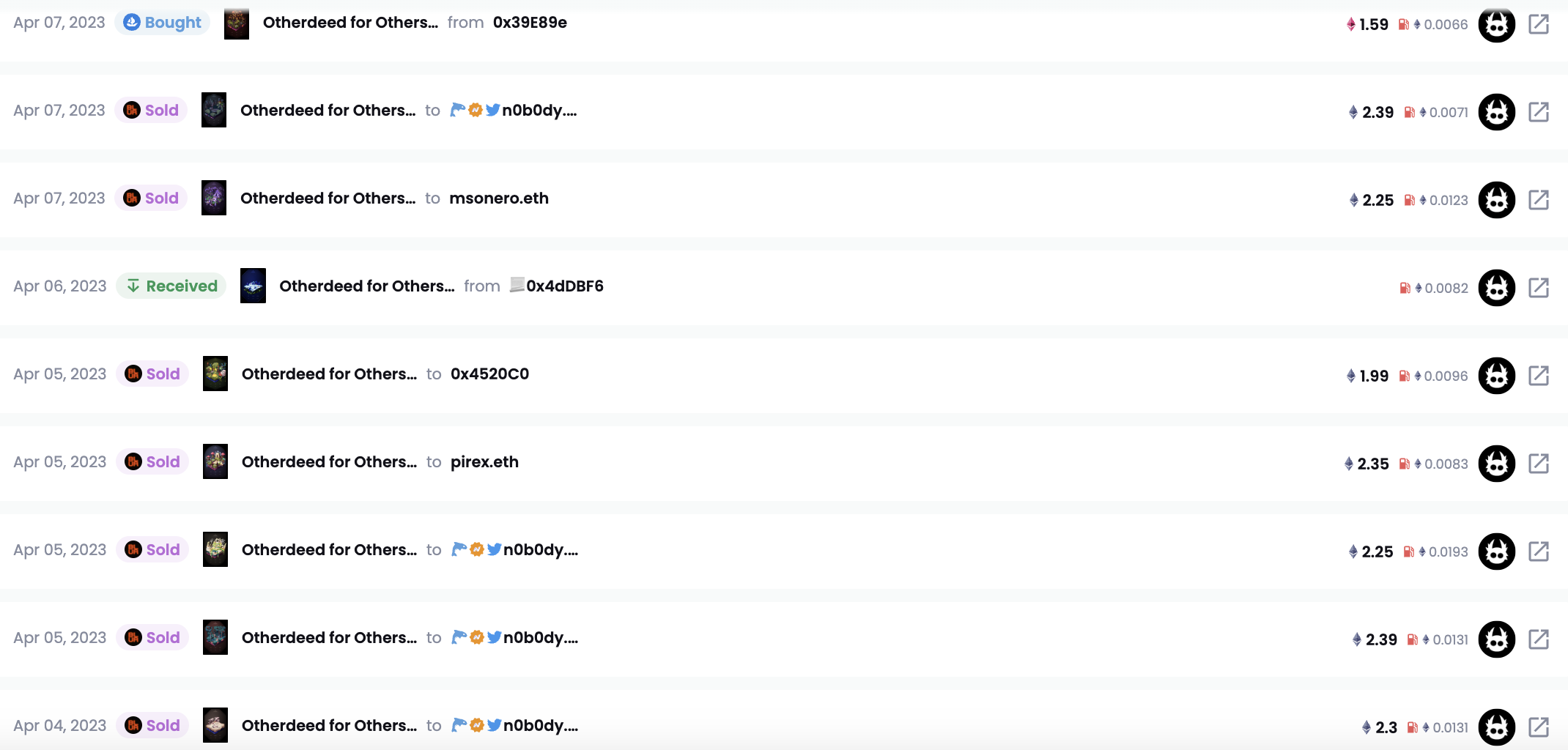

3. Trading fixed types of NFTs with high frequency, such as the user in the following image who selected Otherdeed as the trading target and made profits through frequent buying and selling.

- Logic for buying low and selling high

- For a single NFT, purchase in batches according to the interval (3 batches) and only buy when it enters its own valuation range.

- Buy according to the degree of decline rather than time, and buy more when the decline is greater.

- Try offering a bid to buy low, sometimes there can be good purchase costs.

- For large blue chips, buy low based on rarity, and for new blue chips, use a diversified combination.

- You can try multiple platforms such as Blur, X2Y2, and LooksRare, not just OpenSea.

Chapter 5 NFTFi and Valuation

Development Status of NFTFi

The NFT market currently faces two major problems. First, the value evaluation of NFTs depends on market liquidity, and the lack of rich and multi-dimensional value evaluation methods reduces the value discovery and liquidity of NFTs. Secondly, the practicality and functionality of NFTs themselves are limited, and they cannot be linked to mainstream cryptocurrency markets, and can only be used for small-scale dissemination. This has also created many opportunities for the “NFT + Finance” track.

- Comparison of NFTFi projects

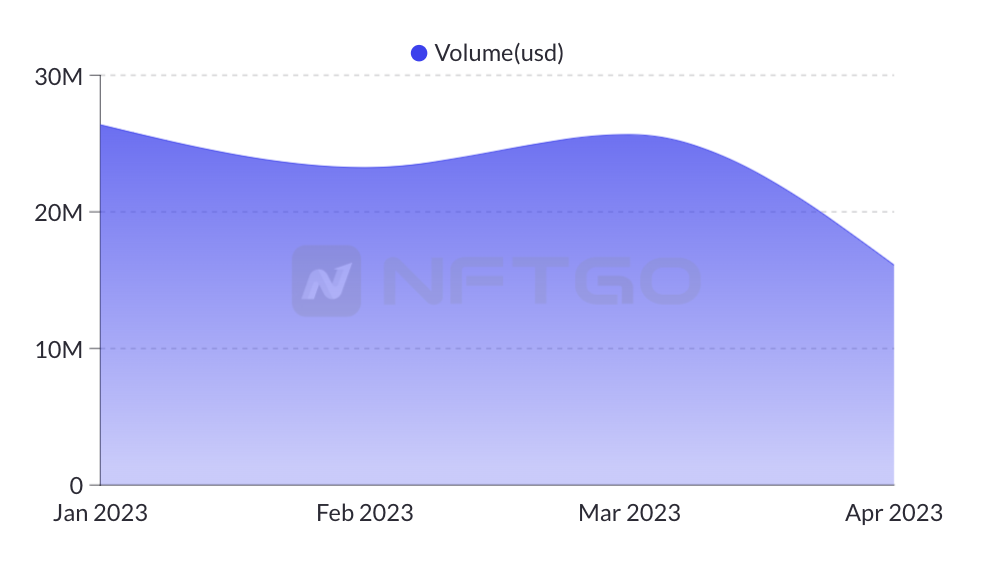

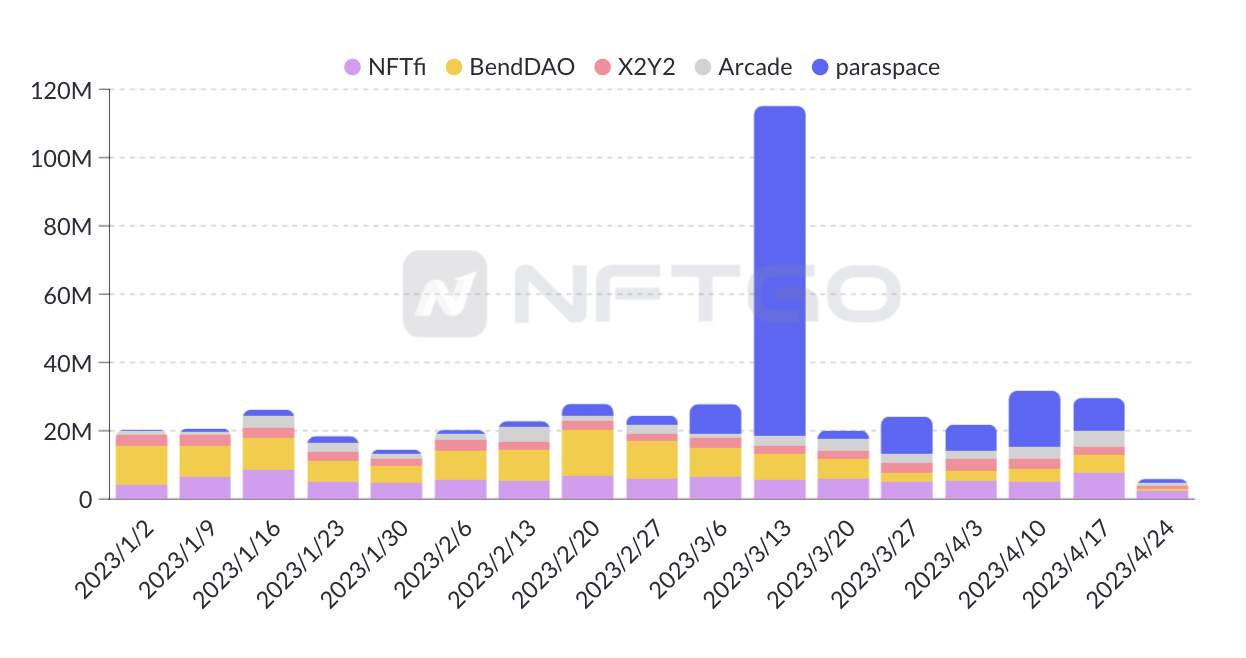

In Q1 of 2023, the NFTFi lending market has a trend of recovery. From January to March, the total amount of NFT loans was around $25 million per month.

NFTfi monthly loan total (USD, 2023.01-2023.04), data source: Dune Analytics

Paraspace is the platform with the largest market share in the total lending market this quarter, with a cumulative market share of $134 million in the first quarter, mainly due to the attention received by Paraspace’s V3 LP NFT collateralized lending protocol in early March, with over 1,000 MAYC tokens being pledged on Paraspace at its peak. Benddao and NFTfi are second and third with market shares of $107 million and $76 million respectively, with the three major lending platforms accounting for 65% of the market share.

Weekly market share of NFT lending by institutions (USD, 2023.01-2023.04), data source: Dune Analytics

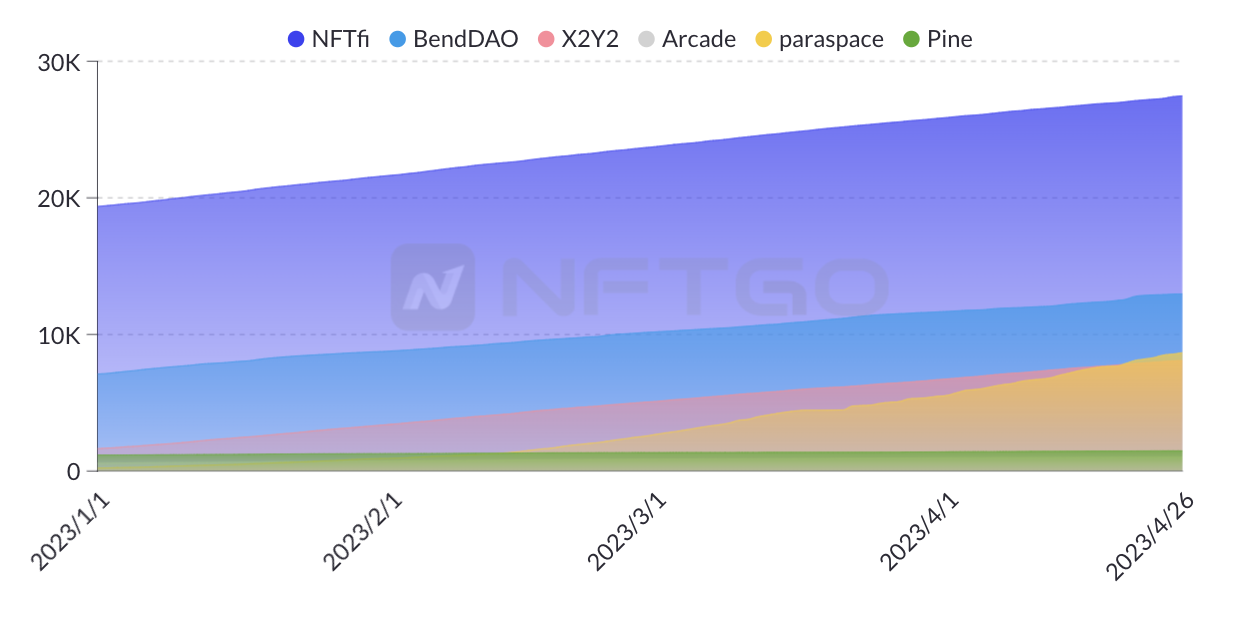

As of 2023, NFTfi still leads BendDAO with twice the number of users in the NFT lending user count, and the total number of users among the seven major lending platforms increased by 45% in the first quarter. Paraspace’s total user count has doubled, X2Y2 has increased by 80%, BendDAO and Arcade have increased by 45%, and the user count of the remaining platforms has also increased by around 20%, indicating that the NFT lending business is still in a high-speed growth trend.

Accumulated number of NFT lending users (2023.01.01-2023.04.26), data source: Dune Analytics

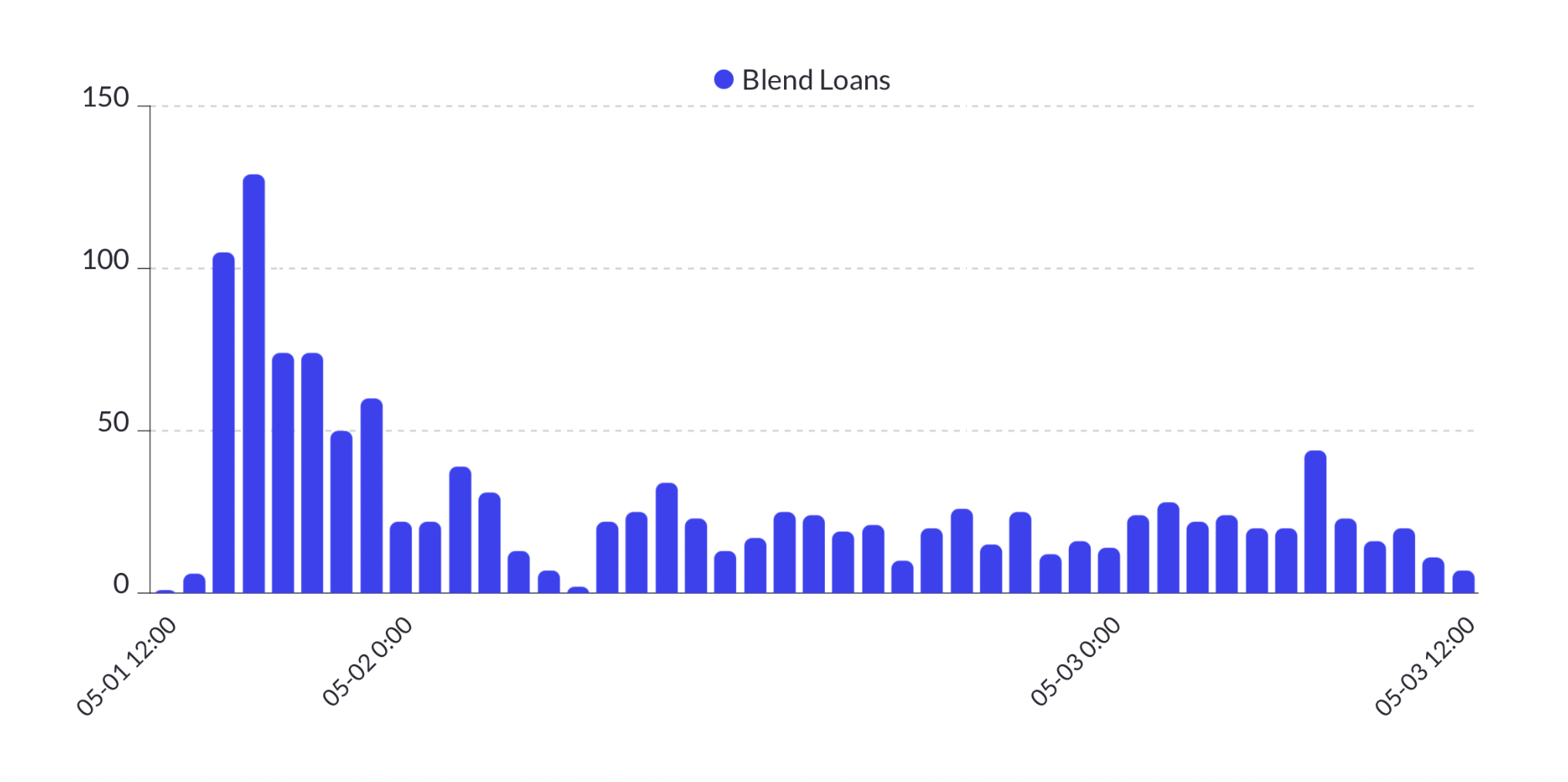

As of May 3rd, Blend has lent out a total of over 10,000 ETH, and Blur’s NFT peer-to-peer perpetual lending protocol has become a hot project on Ethereum. Among a total of 911 loans, active loan transactions account for about 50%, with a total of 6047 ETH in active loans. Blend provides NFT holders with an opportunity to obtain liquidity, with Blend loans having no maturity date, but a fixed amount and interest rate that accrue until the balance is repaid. The strong attraction of Blend’s liquidity advantages to users can be seen from the changes in hourly lending over the first three days, with about 500 transactions per day.

Blend hourly lending frequency, data source: Dune Analytics

- NFT Valuation Framework

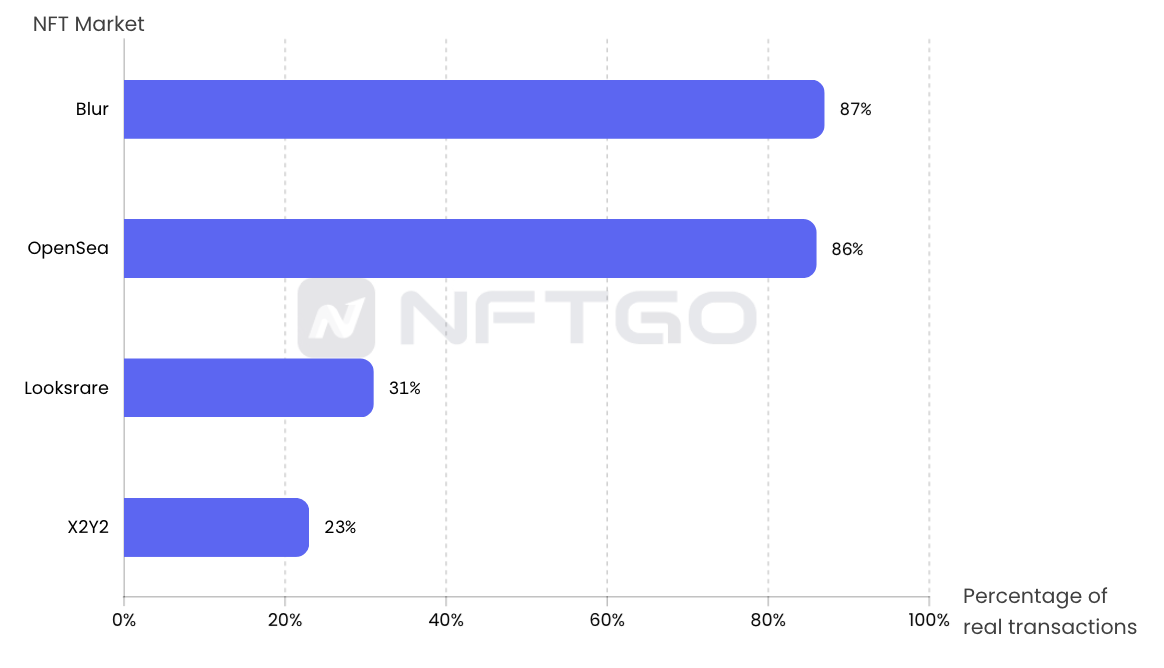

Currently, NFT valuation is generally divided into several methods, including weighted average price, machine learning algorithm pricing, industry evaluation pricing, manual bidding, and game theory pricing. Each method has its own advantages and disadvantages. Firstly, predictions such as TWAP and quantitative models are heavily influenced by data (market trading volume, NFT quantity in the collection, etc.) and are easily affected by the overall market, making it difficult to respond to unforeseen events in the future and subject to manipulation (e.g. wash trading).

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- QKL123 market analysis | It is obviously related to dark web activities, and the demand for Bitcoin has dropped sharply? (0402)

- Over 30% of mined BTC is inactive, and the exchange becomes the largest HODLer

- For a story after a thousand years-Github bitcoin source code freezes Norway

- Max Kaiser: Gold is the “toilet paper” of the rich and Bitcoin is the “toilet paper” of the poor

- Bitcoin broke through $ 7,200 in the early morning, and the surge in US unemployment applications made Bitcoin a safe-haven asset?

- Introducing 7 million users, Revolut, a digital bank valued at US $ 5.5 billion, announced that it will provide users with bitcoin trading services in advance

- Institutional investors continue to lurking, it will take time for bitcoin futures trading volume to recover