Exploring DeFi Economic Models Design and Evolution of Incentive Mechanism

DeFi Economic Models and Incentive MechanismAuthor: Hotcoin Research Institute

The design of DeFi protocol’s economic model is to better achieve its long-term incentive goals, while improving the sustainability and market stability of tokens. Through continuous optimization and adjustment of the economic model, the protocol can better adapt to the ever-changing market and user needs, thus achieving healthier development.

1. Evolution of DeFi Economic Models: From Simple to Complex

In the early days, many protocols adopted simple economic models of mining and providing liquidity, treating tokens as a simple means of incentives to attract users to participate and pursue short-term profits. However, although this incentive method is direct, it lacks effective redistribution mechanisms. Take decentralized exchanges (DEX) as an example, when token issuance and all transaction fees are directly allocated to liquidity providers, there is a lack of long-term incentives for liquidity providers. This model is prone to collapse when the token value has no other sources of support, as liquidity providers can easily migrate to other protocols, causing successive collapses of various liquidity pools.

Over time, DeFi protocols have become more refined and complex in terms of economic model design. In order to achieve longer-term incentive goals, various game mechanisms and profit redistribution models have been introduced to regulate token supply and demand. The economic model and the logic of the protocol’s products and profit distribution have become closely intertwined. Reshaping the flow of value through the economic model has become the main function of the economic model. In this process, the supply and demand of tokens can be precisely regulated, and tokens can also capture value more effectively.

- Layer2 Public Chain Token Valuation Model Analysis

- Cosmos, Polkadot V.S Layer2 Stacks Chapter (1) Technical Solution Overview

- Interview with Mysten Labs Product Director Why is Sui’s technology particularly suitable for enterprise services?

2. Economic Model Design for Different Protocol Categories

When designing an economic model, we need to clarify the objectives of token design. In the field of blockchain, protocols of different categories such as public chains, DeFi (decentralized finance), GameFi (gamified finance), and NFT (non-fungible tokens) all have their own unique economic model design points. Therefore, we will explore their design goals and core principles in more detail.

1. Public Chain Economic Model: The economic model of a public chain is influenced by the consensus mechanism, but its design goals are always to ensure the stability, security, and sustainability of the public chain. Core tasks include effectively utilizing token incentives to validators, attracting a sufficient number of nodes to participate in and maintain the network. This usually includes cryptocurrency issuance, incentive mechanisms, node rewards, and governance mechanisms to maintain the stability of the entire economic system.

2. DeFi Economic Model: DeFi protocols extend the concept of economic models, which involve aspects such as lending, liquidity provision, trading, and asset management. The design goal is to incentivize users to provide liquidity, participate in lending and trading, and provide corresponding interest, rewards, and profits to participants. In the design of DeFi, the incentive layer is the core, including how to guide token holders to hold tokens instead of selling them, and how to coordinate the interests distribution of liquidity providers and governance token holders.

3. GameFi Economic Model: GameFi combines gaming and financial elements to provide financial rewards and incentives for gamers. The economic model of the GameFi protocol includes the issuance, trading, and distribution of virtual assets within the game. Unlike DeFi, the design of the GameFi model is more complex because it needs to address how to increase users’ reinvestment demand while considering the playability of the game mechanics. This has led to the emergence of many protocols with sidechain structures and spiral effects.

4. NFT Economic Model: The economic model of an NFT protocol typically involves the issuance, trading, and rights of NFT holders. The design goal is to provide NFT holders with opportunities for value creation, trading, and profit to encourage more creators and collectors to participate. This can be divided into NFT platform economic models and protocol economic models. The former focuses on royalties, while the latter focuses on solving economic scalability, such as increasing repeat sales revenue and funding in different fields.

Although these protocols have their unique features in their economic models, there are also some intersections and overlaps. For example, DeFi protocols can integrate NFTs as collateral, and GameFi protocols can use DeFi mechanisms for fund management. With the continuous evolution of economic model design, the development of DeFi protocols is more diversified, and its models are widely applied in protocols such as GameFi, Socialfi, etc.

3. Major DeFi Economic Models: Advantages, Disadvantages, and Representative Protocols

If we classify DeFi economic models according to the business logic of different protocols, we can roughly divide them into three main categories: DEX, Lending, Derivatives. If we classify them according to the characteristics of the incentive layer in the economic model, we can divide them into four modes: governance mode, staking/cash flow mode, voting trustee mode (including ve and ve(3,3) modes), and real income incentive mode.

(1) Governance Mode

The governance mode is a way for a protocol or a protocol to make decisions and manage resources. It usually includes rules and processes for power allocation, voting processes, decision-making, proposal submission, and resource allocation.

Representative Protocol:

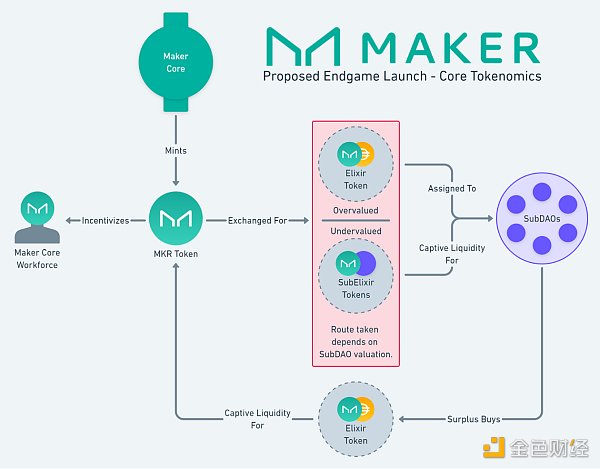

MakerDAO: MakerDAO is a representative decentralized autonomous organization (DAO) that adopts a decentralized governance mode, allowing MKR token holders to vote to influence the policies and parameters of the stablecoin DAI.

Advantages:

-

Decentralization: The governance mode allows community members to participate in protocol decision-making, reducing the risk of centralization.

-

Transparency and openness: Governance mode is usually transparent and open, and anyone can view the decision-making and voting process.

-

Community participation: Community members of the protocol have the opportunity to influence the direction of protocol development, which can increase user loyalty and participation.

Disadvantages:

-

Decision efficiency: Decentralized governance may lead to slower decision-making processes as time is needed to gather votes and reach consensus.

-

Attack risk: Some governance models may be susceptible to malicious attacks or manipulation, especially in cases where token distribution is uneven.

-

Complexity: The design and management of governance models can be very complex, requiring significant time and resources from the community and protocol teams.

(2) Staking / Cash flow model

The staking / cash flow model is an economic model where users can lock (stake) their assets to receive stable cash flow or returns over a period of time. This model typically incentivizes users to hold and support the protocol long-term while providing a stable source of funding and liquidity for the protocol.

Representative protocol:

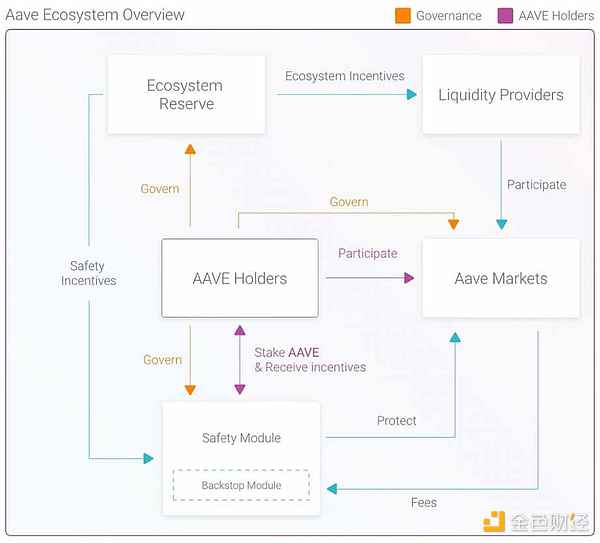

DeFi lending platforms, such as Aave, allow users to stake their cryptocurrency assets to borrow stablecoins and other assets, while also earning a portion of the loan interest as income.

Advantages:

-

Provides stable income: The staking / cash flow model can provide holders with predictable cash flow or returns, which helps attract long-term holders and supporters of the protocol.

-

Increases liquidity: This model encourages users to lock their assets in the protocol, increasing the protocol’s liquidity and enabling more lending opportunities and transactions.

-

Incentivizes holding and participation: Users have an incentive to hold and stake assets to earn additional income, which can increase the loyalty and participation in the protocol.

Disadvantages:

-

Risks: Staked assets are often exposed to price fluctuations and smart contract risks, and users may lose a portion or all of their assets.

-

Complexity: Some protocols’ staking / cash flow models may involve complex rules and conditions that may not be user-friendly.

-

Market dependency: Cash flow typically depends on the overall success of the protocol and market conditions. If the protocol is not robust or the market trends are unfavorable, cash flow may decrease or be interrupted.

(3) ve Voting Custody Model

The ve voting custody model is a governance model where token holders gain governance rights by staking or locking their tokens, allowing them to participate in the protocol’s decision-making and governance processes.

Representative protocol:

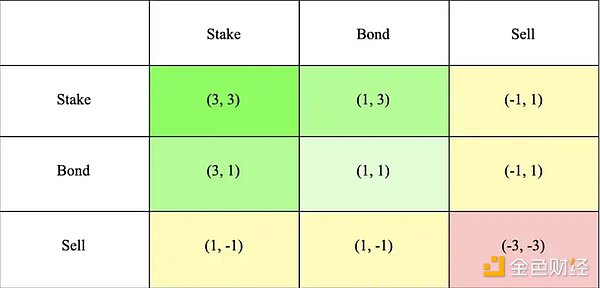

Curve is a typical representative of this governance model, adopting the ve and ve(3,3) models to empower token holders with governance rights. Users can vote on “Gauge Weight Voting” using their veCRV to determine the allocation ratio of CRV in various liquidity pools for the next week. Pools with higher allocation ratios receive more CRV rewards and are more likely to attract sufficient liquidity.

Advantages:

-

Decentralized decision-making: The voting custody model enhances the decentralized nature of governance, with most decisions being made through voting by token holders.

-

Encouragement of long-term participation: Users are required to lock or pledge tokens, encouraging them to hold them for the long term and actively participate in protocol governance.

-

Improved protocol security: Increasing the threshold for governance rights can enhance the security of the protocol and reduce the risk of malicious manipulation.

Disadvantages:

-

Instability of voting: The voting custody model may lead to voting instability as tokens may be unlocked or withdrawn, causing fluctuations in governance decisions.

-

Risk of manipulation: Some token holders may attempt to manipulate governance voting, especially in cases where a few tokens control the majority.

-

Complexity: The voting custody model may be complex for beginners, requiring an understanding of the pledging and locking conditions of different tokens.

(4) Real Income Incentive Model

The real income incentive model is an economic model mechanism designed to reduce the cost of protocol subsidies by rewarding the participation of real users and encourage users to pledge or lock tokens to receive token rewards. This model emphasizes user loyalty and participation while increasing the complexity of rewards through unlocking thresholds.

Representative Protocol:

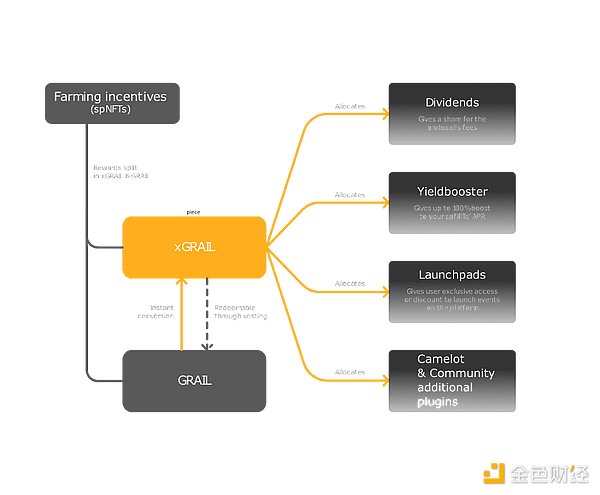

Camelot, whose core incentive objective is to encourage liquidity providers (LPs) to continuously provide liquidity to ensure the smoothness of transactions and help LPs and traders share the generated income. The real income of the Camelot protocol comes from the interaction between traders and the pool, resulting in transaction fees. This is the real revenue of the protocol and the main source of income redistribution. In this way, Camelot ensures the sustainability of its economic model.

Advantages:

-

Reduced protocol costs: By setting unlocking thresholds, the real income incentive model reduces the cost of protocol subsidies, making the protocol more attractive.

-

Incentivizing real users: Users need to remain engaged to receive token rewards, which encourages active participation by real users.

-

Enhanced protocol inclusivity: Due to the complexity of real income calculations, the real income incentive model is more attractive and can attract more users to participate.

Disadvantages:

-

Complex income calculations: Since rewards need to meet unlocking thresholds, actual income calculations become complex and difficult to predict.

-

May lead to inactive users: If users leave the system, they will lose token rewards, which may reduce activity.

-

User education required: Users need to understand how to participate in pledging or locking, which may not be beginner-friendly.

4. Summary of the Evolution of DeFi Economic Models

With the continuous development and innovation of DeFi protocols, many protocols have been improving their economic models. The core of these improvements lies in the introduction of game mechanisms to reallocate a portion of the profits and enhance user stickiness within the entire ecosystem. This process has even led to the emergence of value capture and various compound platforms. On the other hand, the economic model mechanism also introduces additional token rewards to drive the operation of the entire ecosystem and attract more traffic and capital.

In summary, these improvements to the mechanisms have transformed tokens from a simple medium of value exchange to a tool for capturing users and creating value. By reallocating profits, it not only increases user activity and stickiness but also incentivizes user participation through token rewards, driving the development of the entire system. The evolution of this economic model helps build a more attractive and sustainable DeFi ecosystem, providing more value and opportunities for users and protocols.

The continuous evolution of the economic model helps build a more attractive and sustainable DeFi ecosystem, providing more value and opportunities for users and protocols, realizing the vision of financial innovation, decentralized governance, and community participation, and driving the transformation of the future financial system. Therefore, understanding the development of these economic models will become an indispensable part of entering the cryptocurrency industry. With the continuous development of technology and the growth of the community, DeFi will continue to lead the wave of financial innovation, providing more inclusive and innovative financial services worldwide.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Puffer Finance Research Report LSD Track, a technology-driven seed player with dual staking and dual rewards.

- The security model of Bitcoin withstands the test of halving block rewards; both the market and technology prove that defending against 51% attacks does not require breaking the upper limit of 21 million.

- Inspiration from the (3,3) and ve(3,3) flywheel models How to create a Ponzi scheme on friend.tech?

- Revolutionary Progress of Zero-Knowledge Proof Technology In-depth Exploration of the Nova Algorithm

- Restaking King Is EigenLayer’s business model a great idea or a waste?

- IDO&IEO Inventory of 8 Hot Projects to Be Launched Soon (September First Wave)

- Financial History, Legal System, and Technological Cycle The Trillion Dollar Narrative of RWA Cannot Withstand Scrutiny