Inspiration from the (3,3) and ve(3,3) flywheel models How to create a Ponzi scheme on friend.tech?

Inspired by the (3,3) and ve(3,3) flywheel models, how to create a Ponzi scheme on friend.tech?A social product can exist in the long term by giving users a reason to be trapped in your system.

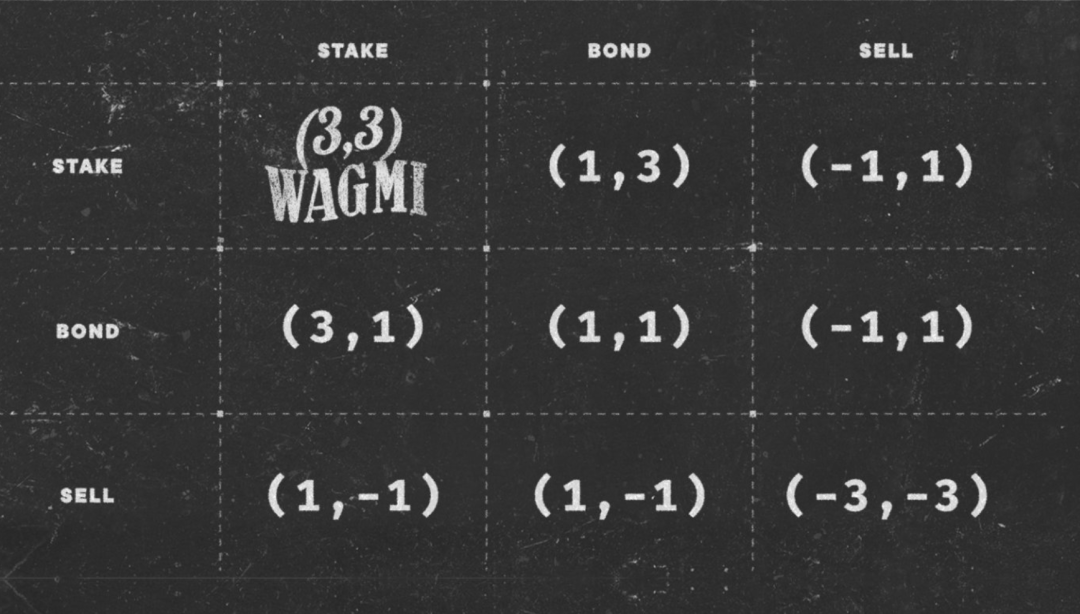

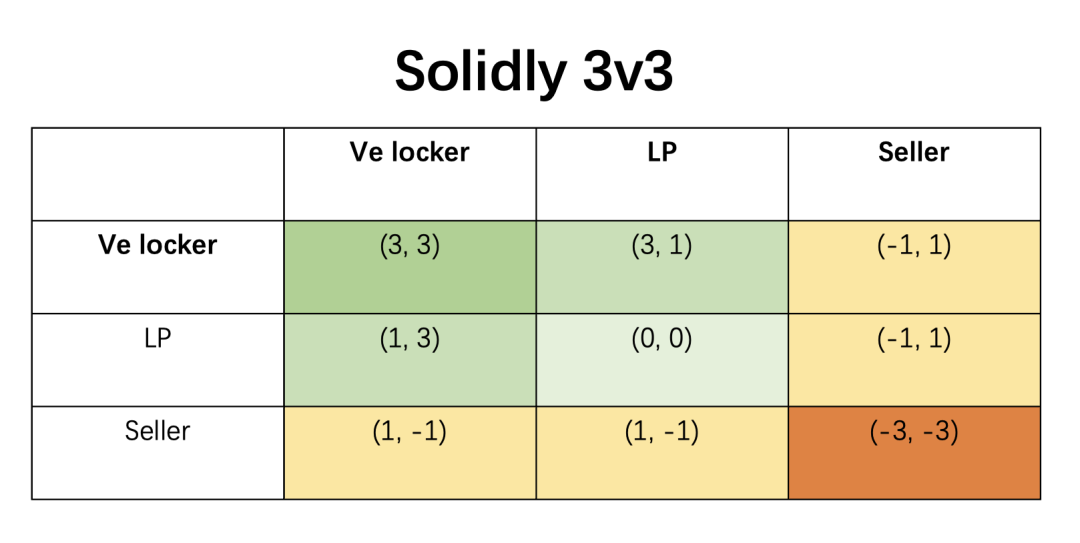

Before getting into the specific operations, let’s first review how the (3,3) and ve(3,3) flywheels used by large-scale Ponzi schemes work:

First, the (3,3) strategy. OHM uses a classic case in game theory called the prisoner’s dilemma, which is a type of non-zero-sum game. In simple terms, when users choose to either stake or bond, the bubble will continue to expand.

- Revolutionary Progress of Zero-Knowledge Proof Technology In-depth Exploration of the Nova Algorithm

- Restaking King Is EigenLayer’s business model a great idea or a waste?

- IDO&IEO Inventory of 8 Hot Projects to Be Launched Soon (September First Wave)

Next, the ve(3,3) strategy. This is a combination of Curve’s ve (vote escrow) model and OlympusDao’s (3,3) model. ve refers to when users lock CRV tokens, they can receive a share of Curve’s transaction fees, boost LP profits, vote for projects, and receive airdrops from other collaborating projects. ve(3,3) adjusts the token issuance based on the locked token amount, encouraging users to lock their tokens together and prevent dilution of token value (the founder AC has already run away).

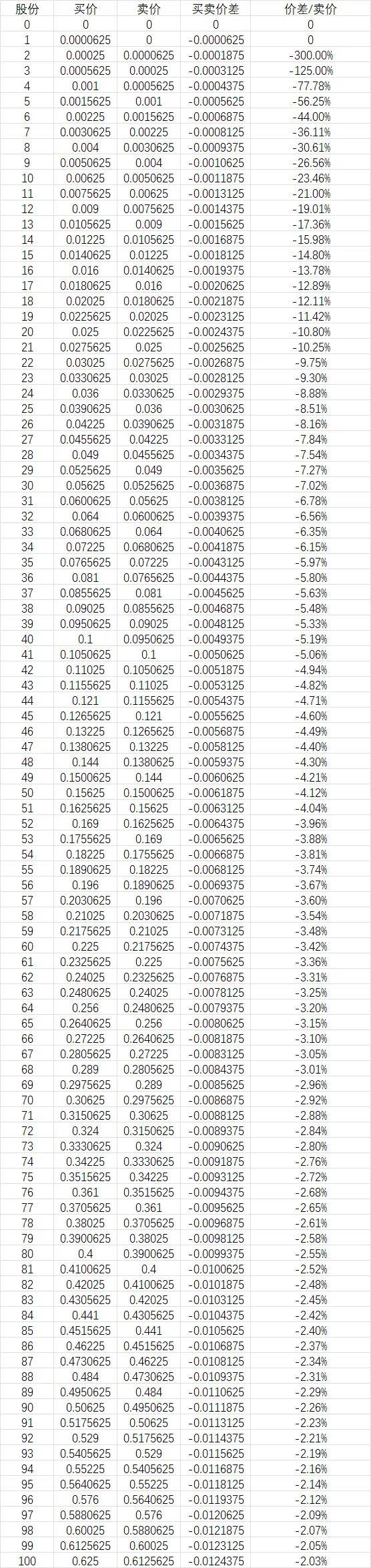

Now let’s go back to the economic model of FT. The pricing formula for FT shares is (ETH) = (supply^2) / 16000.

To explain this formula simply, squaring the total share quantity represents the market value of KOL. For example, if you have 10 holders, your market value would be 100. Dividing it by 16000, the price of one Key would be 0.00625 ETH.

We can see that this is a typical prisoner’s dilemma problem.

The number of supply increases exponentially. When the 10th person buys in, the first buyer earns 100 times the profit. When the 100th person buys in, the 10th buyer earns 100 times the profit.

There is always a price difference in buying and selling, with the difference being (2n + 1) / 16000. This equation shows that as n increases, the price difference will linearly increase. For every unit increase in n, the price difference will increase by 2/16000, which is 0.000125.

Therefore, selling is a typical weak equilibrium behavior (-3, -3).

So, let’s take these two models as an opportunity to explain how an FT blogger can turn themselves into a Ponzi scheme model:

Actually, the core of a Ponzi scheme involves a few things:

1. Using game theory to convince holders not to sell their coins and incentivize users not to cash out rewards. Find ways to lock their tokens or encourage users to delay selling, keeping users trapped in the system and reducing selling pressure.

2. Creating a frenzy to increase influence, using a word-of-mouth referral model to achieve early network effects, continuously attracting new members and external funds.

3. Generate income cash flow, incentivize users, and achieve positive externalities.

I have always said not to underestimate Ponzi. The ideal form of Ponzi is actually a win-win situation, that is, a Nash equilibrium, provided that the speed of obtaining positive externalities is equal to the speed of new members joining.

This FT group is designed as follows:

1. Establish rules, incentive mechanisms, and ranking systems:

a. Users must purchase the Key of this KOL to join the group. After joining, they need to leave their Twitter account and self-introduction, as well as the value they can bring to the community, and promise to never sell and be a family with everyone. The KOL replies to the user, making his message visible to everyone, and other members of the group will follow his Twitter/buy his Key.

b. Design incentive mechanisms to provide users with more benefits without leaving the group, such as 1) gaining attention from users in the group, self-promotion, and obtaining social value from the community; 2) obtaining high-quality alpha information within the group; 3) upgrading within the group, negotiating cooperation with the community to obtain whitelist, airdrops/advertising, and other benefits.

c. Establish a ranking system and create a sense of community identity.

Regularly elect community managers, appointing 10% of the members in the community as administrators, responsible for maintaining an active community atmosphere, planning activities for the community, attracting new members, etc.

The group owner shares a portion of the fees with a small number of people in the group as incentives, triggering competition.

Ensure that everyone has a presence in the community, for example, electing high-quality content output by group members every day, publishing it externally, absorbing new members, and sharing benefits.

d. After inviting someone to join the group, new privileges will be unlocked.

2. Establish a penalty mechanism other than 0.000125:

a. Sellers will be publicly exposed, and everyone will unfollow the seller’s account on Twitter and write words like “shame on you”.

b. For each person who leaves the group, the group owner will repurchase the Key using fees, and call on group members to buy together. By raising the price together (3,3), the cost for sellers to join the group will increase.

3. Create a VE model for the community to seek external benefits and distribute dividends

a. After the community expands, it can host AMA sessions with project parties.

b. Decide the direction of future profits for the community through voting.

c. Moral lockup, where each user promises not to sell until a certain time.

d. Repurchase using fees.

If we look at the mechanism, I am quite interested in making changes on that 16000, which means that if group members choose to lock up their tokens, the more people who lock up, the smaller the divisor of the number 16000 will become. (Just a small idea, not sure what will happen.)

Based on this model, we will obtain a profit matrix for Friend Tech:

In this matrix, if users choose not to sell, the community will grow, and each user will receive exponential returns, that is, (+3, +3). Selling the Key will result in a penalty of 0.000125 in price difference.

In fact, I have seen many people criticize FT for not having a social graph and for having no content, just being a Ponzi scheme. The previous launch of Facebook’s Thread and Nostr Damus’s short-lived success all illustrate one truth: short-term traffic input cannot sustain a social product.

What is the fundamental reason for a social product to exist in the long term?

It is to give users a reason to be trapped in your system.

The fundamental way to trap users is to improve the efficiency of establishing relationships of interest.

For example, Taobao, a social app, connects merchants and users.

So what are users looking for in Friend Tech? I think besides the so-called airdrop expectations, there is also the opportunity to have conversations with top users. This is similar to the essence of high-end communities, MBA classes, and paid communities, which means that I have the people you want to meet here, and you just need to pay to have conversations with top KOLs. And if you come late, the price will go up.

What about you? Are you FOMOing or not? After all, going to Singapore to attend Token2049 will cost you a few thousand dollars in travel expenses. This fraction of an E is definitely not a loss.

How to achieve the early launch of a social product? Who says using Ponzi is not a good way?

Of course, I also think that Friend Tech has obvious flaws when designing this economic model:

1. The “sell out” is very random. When the value rises and the buying pressure decreases, the subsequent selling pressure cannot be stopped.

2. Other people cannot see another person’s posts unless the group owner replies. This reduces the sense of community presence and decreases stickiness. It is difficult to classify users within the group, which means the group owner becomes a super node facing a large number of users. If there are more than 100 users, the group owner will be unable to manage them all. Without user classification and user management, the group will die. It has been proven effective to draw in top users and let them interact with middle-tier users. However, Friend Tech seems to be one-to-many, and many ordinary users remain silent and struggle to gain attention, making it difficult to achieve sustained growth.

3. The functionality is too simple, unable to accumulate valuable content, and it is even more difficult to expand with social functions such as red envelopes, voting, and greetings.

4. Compared to traditional social media, it has functional and product flaws. Therefore, it is difficult to expand external users except for degenerate users in the crypto community, and subsequent growth is weak. The story cannot be told.

So currently, it is only supported by the expectation of token issuance. I don’t think there are any other ways to continue to incentivize the project after the tokens are issued unless it becomes like Curve.

The problems that need to be urgently addressed at this stage:

1. Increase the lock-up function, such as locking up a key, allowing users to freely post in the group without needing the group owner to reply.

2. Grant corresponding privileges based on the lock-up duration to unlock more functionality.

3. Develop a multi-chain ecosystem, no longer using ETH for payment, but instead using other currencies or even developing a traditional knowledge-based model, running advertisements, and attracting external funds. Of course, from the perspective of the interests of the Base chain and ETH, this matter is not of high priority.

This HTML code displays an image. The source of the image is “https://cdn-img.panewslab.com//panews/2022/9/13/images/ecd746e7b7add05fb8dbc0fed217fdda.png”.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Financial History, Legal System, and Technological Cycle The Trillion Dollar Narrative of RWA Cannot Withstand Scrutiny

- Financial History, Legal System, and Technological Cycles The Trillion-dollar Narrative of RWA Cannot Withstand Scrutiny

- In-depth analysis of Flashbots’ investment logic, technical framework, market size, and major risks.

- Mantle Network 20,000-word research report From technical features to token models, in-depth understanding of modular Layer2 new stars

- Model interpretation SOL unlocking market pressure will not bring massive selling pressure. This is a difficult but healthy reset.

- Coin Center Research Director Tornado Cash’s latest allegations appear to contradict Financial Crimes Enforcement Network’s documents.

- DeFi New Narrative? The Security Model of Smart Contracts without Oracle