Interpreting the Current Situation of Cryptocurrency Markets Outside the United States

Analysis of Cryptocurrency Markets Outside the USAuthor | Mitchell Hammer

Translation | Odaily Planet Daily 0xAyA

Editor’s note: Mitchell Hammer, an analyst at Electric Capital, shared the current situation of the non-US cryptocurrency market on Twitter and expressed optimism about its future. He also expressed dissatisfaction with the execution and legislation of US domestic cryptocurrency policies. The following is a compilation of the highlights by Odaily Planet Daily.

The United States still maintains a wait-and-see attitude towards cryptocurrencies. But policy-makers in other parts of the world are no longer standing by. Non-US policy-makers are embracing cryptocurrencies, and non-US consumers are using cryptocurrencies. Let’s take a closer look:

- Block space is a scarce commodity, how to objectively evaluate it?

- How do the interest rates and future prospects of the Federal Reserve affect the cryptocurrency market?

- Data What is the crypto market like outside of the United States?

In the past six months, global policy-makers have accepted the existence of cryptocurrencies:

- The EU has approved MiCA.

- The UK has passed new cryptocurrency laws.

- Hong Kong is approving cryptocurrency exchange licenses.

- Dubai has created a cryptocurrency regulatory agency.

- Brazil has created a virtual service provider license.

- Japan aims to become a cryptocurrency hub.

Together, these six jurisdictions have more than 850 million consumers. Their combined GDP exceeds $23 trillion, and these countries see cryptocurrencies as a major potential economic driver. They hope to share the millions of job opportunities and trillions of dollars in value created by cryptocurrencies.

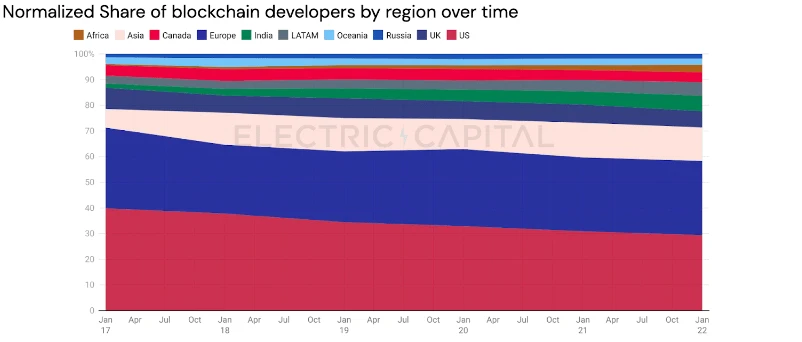

Cryptocurrency-friendly policies outside the United States are already taking effect, and non-US regions are capturing a share of the US cryptocurrency development market. In the past five years, the US has lost about 30% of its development market share to Asia, Africa, and Latin America.

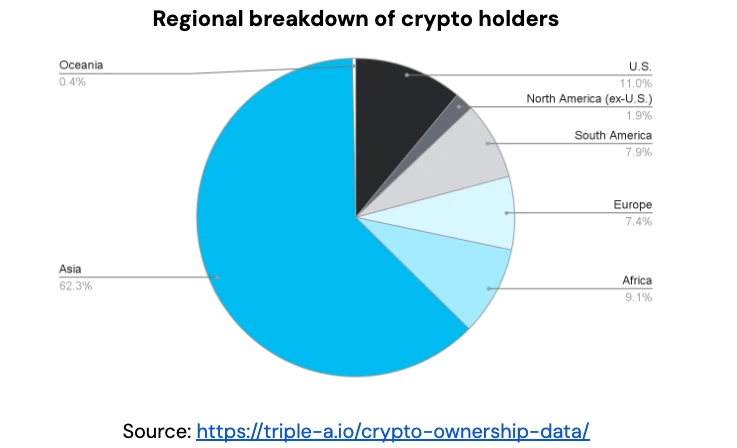

I can’t help but wonder, can the cryptocurrency industry really develop so big without the US market? However, the fact is that the US only accounts for a small fraction of cryptocurrency users:

-

90% of the 420 million cryptocurrency users reside outside the US.

-

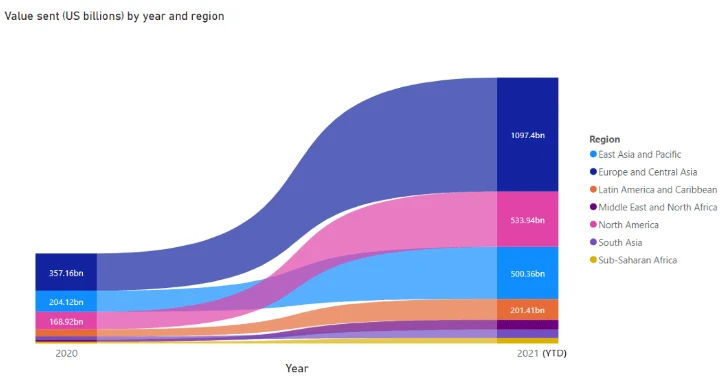

80% of the cryptocurrency volume comes from outside the US.

-

Binance, the world’s largest CEX, has almost no US customers.

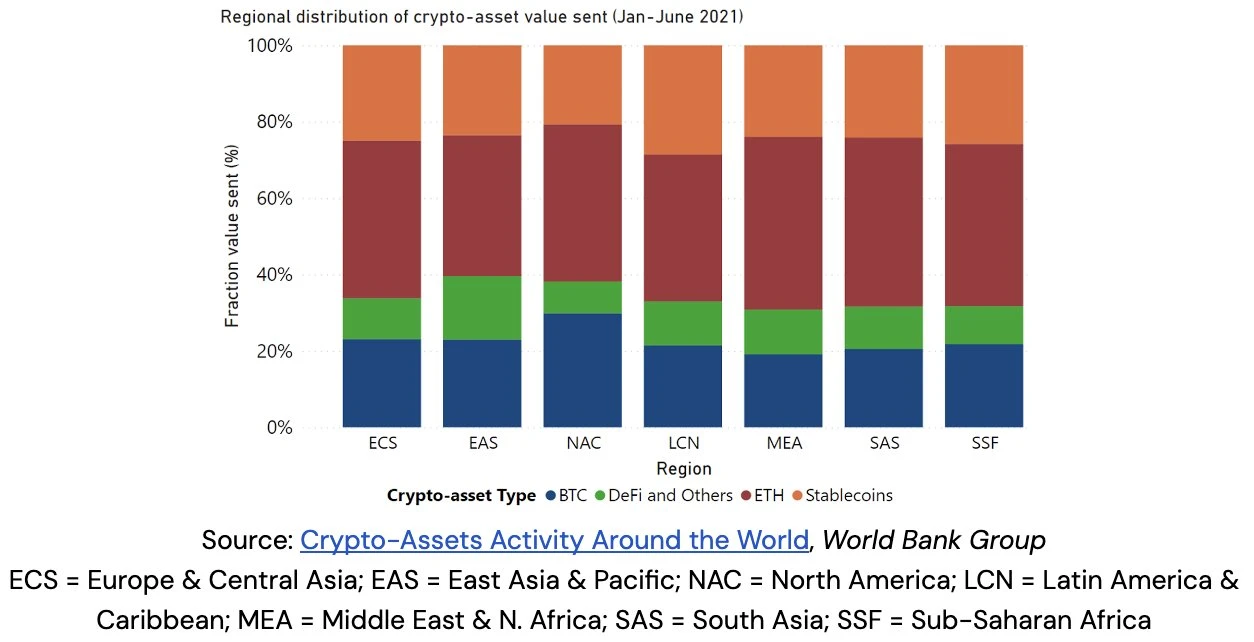

Crypto already has a product market suitable for non-US consumers. Many of them cannot obtain stable fiat currency, they cannot access basic and affordable financial services, they use stablecoins to obtain US dollars, and they use DeFi for trading, lending, and earning profits.

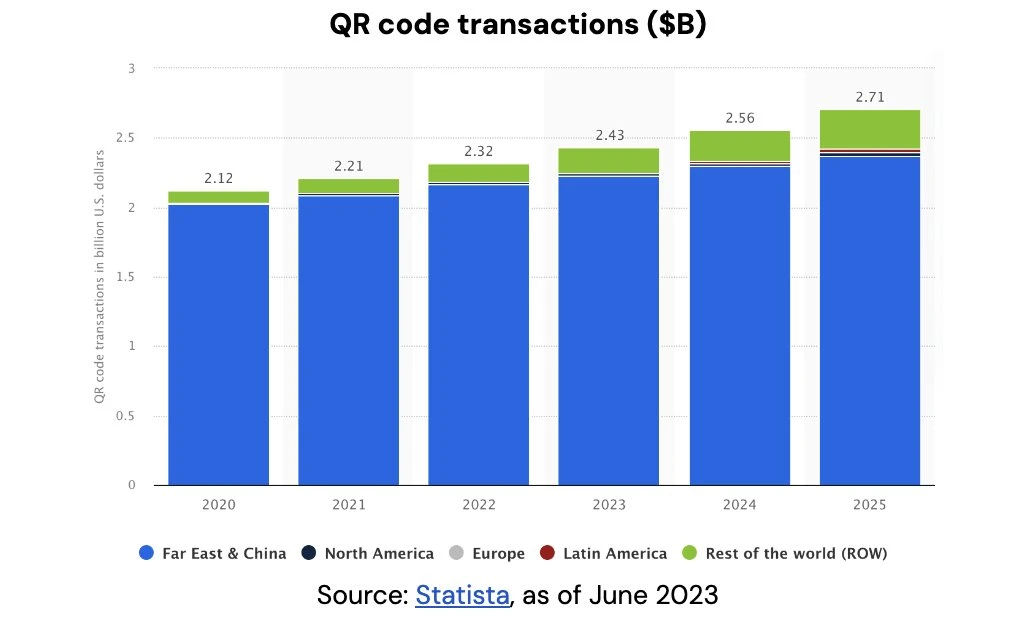

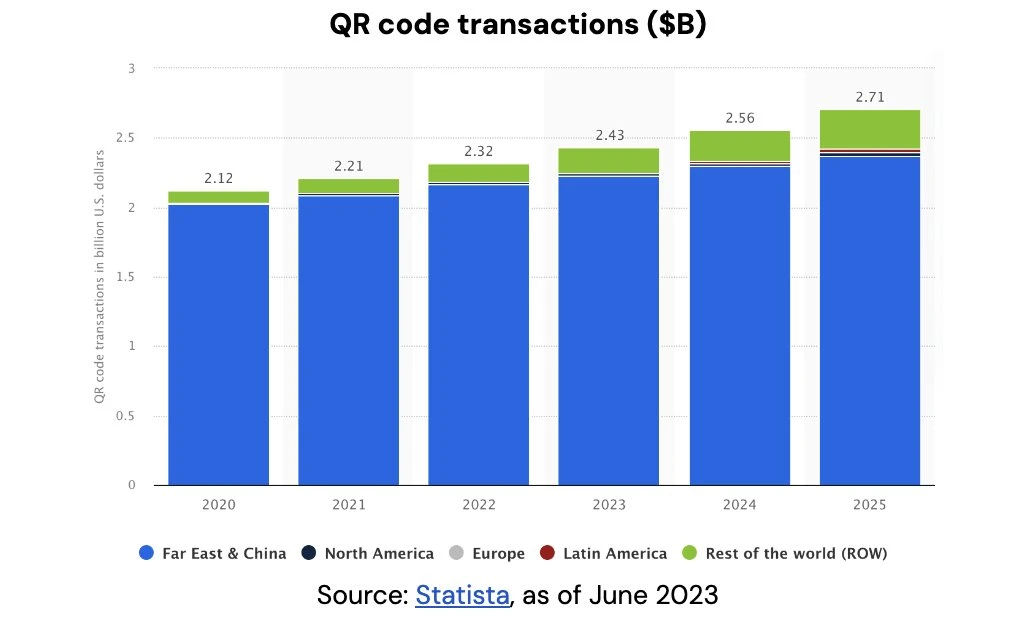

Cryptocurrency will not be the first technology to surpass the United States in terms of global adoption. Mobile payment and QR code have already covered billions of users and trillions of transaction value without American consumers. Even today, the adoption in the United States still lags behind.

Despite almost zero American consumers... WeChat Pay, created by Tencent, is still a $25 billion business, while Ant Group, the parent company of Alipay, is valued at $80 billion.

Existing infrastructure makes it difficult for American consumers to see the practicality of new payment systems. Most Americans have credit cards. The existing payment systems are already good enough, but in the end, the United States adopted this new technology of mobile payment. Over the past 6 years, mobile payment volume in the United States has grown over 500%.

Just like mobile payment and QR code, cryptocurrency can cover billions of users and create trillions of value without American consumers. Once this happens, the United States will surrender again, and local participants will need to adapt to the use of cheap and more efficient cryptocurrency tracks to keep up with global competitors.

In the end, the political war on cryptocurrency has harmed American consumers and businesses. Currently, American consumers cannot use products that can be used in other parts of the world. Businesses cannot use cryptocurrency to maintain global competitiveness.

Fortunately, recent judicial and congressional actions seem to indicate that the United States is slowly moving in the right direction. This is undoubtedly good news, but regardless of what happens in the United States in the near future, cryptocurrency is global… always has been and always will be.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Dialogue with Circle CEO How can USDC recover the market lost due to SVB’s bankruptcy?

- Common situations and criminal defense strategies for embezzlement of executive positions in the cryptocurrency industry

- 3 NFT markets restrict ‘Stoner Cats’ transactions after SEC takes action

- The Flow of Traffic behind Tip Coin User Profit Expectations and Internal Market Game

- Approval of Bitcoin ETF may trigger the withdrawal of $1 billion in funds from Grayscale’s GBTC.

- LD Capital Will the market remain bearish until the end of the year? What is the core of market speculation?

- The Rebirth of TON Renewing Ties with Telegram, Enabling Web3 Applications for 800 Million Users