Demystifying the data on the Bitcoin chain in 2019: Global miners' annual total revenue is about $ 5.2 billion, and Coinbase has become the "gold king"

PAData Insights:

- Popular Science | Eth 2.0 Staking Logic

- 2019 Blockchain Security and Privacy Ecology Memorabilia

- From the network layer, consensus layer, data layer, smart contract layer and application layer, talk about the technical architecture of blockchain commerce

The average monthly income of global miners is $ 461 million, and the handling fee only accounts for about 2.8%

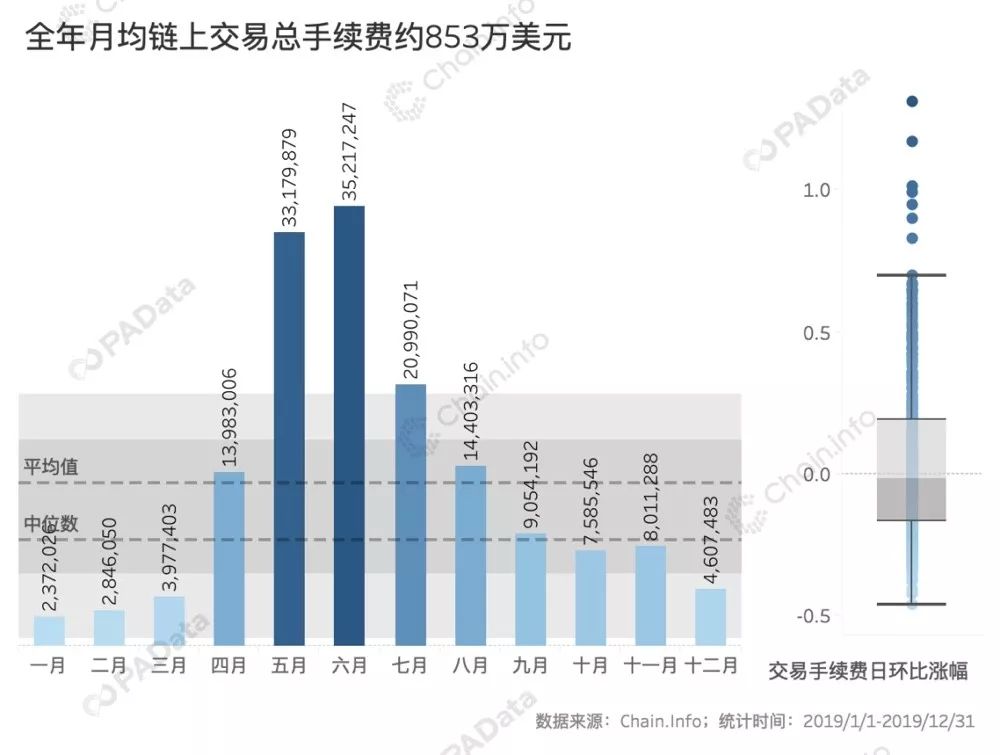

In 2019, the total transaction fee of the Bitcoin chain reached US $ 156 million , of which US $ 35.172 million in June and US $ 33.179 million in May. The total two-month transaction fee accounted for 43.84% of the annual transaction fee. However, the lowest annual fee in January was only $ 2.3720 million. Therefore, from the perspective of the total monthly fee, the monthly difference is large. Looking at the median, which is closer to the average, the total monthly on-chain transaction fee for the year is about $ 8.53 million.

From the point of view of the daily change of the daily fee, the value range is widely distributed, which means that the total daily fee has changed drastically. The total transaction fee is the sum of the transaction fees for each transaction. For a block, it is the first transaction (coinbase) of each block, that is, its amount is not directly related to the transaction volume, but to the number of transactions. Related to network congestion. The large daily fluctuations in handling fees may also imply that the number of daily transactions fluctuates greatly, or that the network operation status is not very stable.

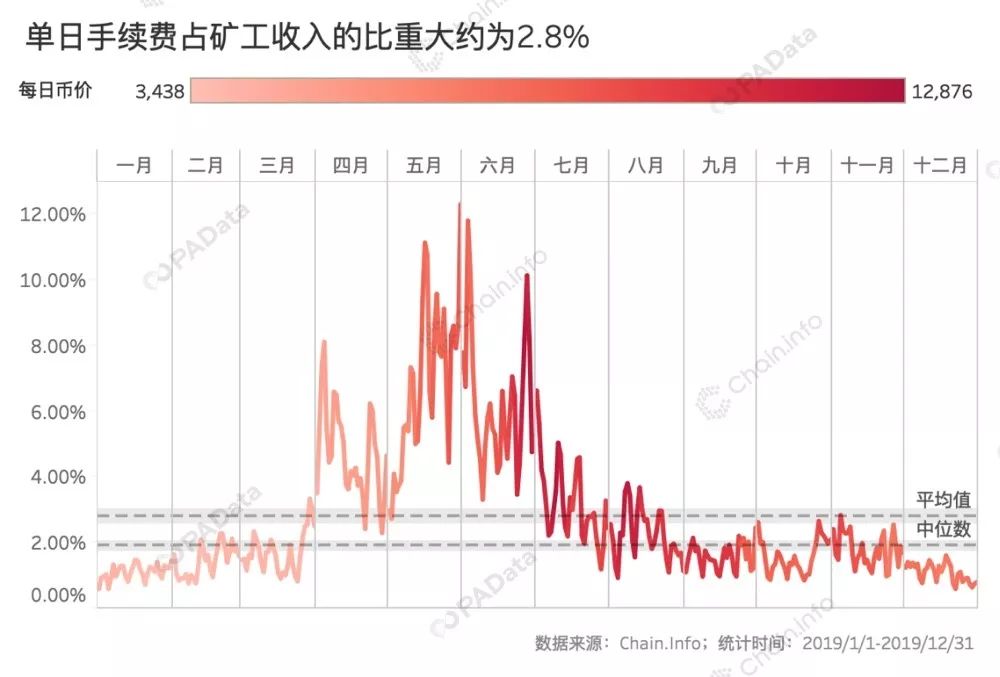

The fee is a component of the miner's income, and another part of the miner's income comes from the block reward. For each block mined in 2019, the system will reward miners with 12.5 bitcoins.

The income fluctuation of miners is basically consistent with the fluctuation of currency prices. According to statistics, the total annual income of global miners is about 5.209 billion US dollars, and the average monthly income is about 461 million US dollars (median). Among them, July was the month with the highest income for miners. The total income of global miners reached 657 million US dollars. The three months with the highest incomes were the three months with the highest currency prices in the year. February was the lowest month for miners 'income, with total global miners' income only $ 196 million.

At present, the income of miners still mainly depends on system rewards, and the handling fee only accounts for about 2.8% of the income of miners on average. But as the Bitcoin network rewards are halved every four years, the fee will gradually become the main source of income for miners. If the halving cannot bring the currency price up, then the miner's income pressure will increase, which does not rule out the possibility of rising transaction costs, which will affect the operation of the Bitcoin network.

Coinbase's stock funds flowing in throughout the year are the most frequent among the three major domestic capital exchanges.

Although the global market size of bitcoin is close to 4 trillion U.S. dollars, this is still a niche market, especially in the past two years when bitcoin's "out-of-circle" effect has been poor and there has been no substantial breakthrough in user scale. Gambling has become the status quo in the Bitcoin trading market.

Chain.Info has established a global exchange wallet database containing more than 10 million address tags through machine learning algorithms. As of January 14, the largest BTC balance on the exchange's chain was Coinbase, with a total of about 98,131,000 bitcoins, followed by Huobi and Binance, which had on-chain balances of 336,700 bitcoins and 247,400 bitcoins. Bitfinex, Bitstamp, Kraken, Bittrex, Bitflyer, OKEx, and Coincheck are ranked 4-10, and the balance on the chain is more than 30,000 Bitcoins.

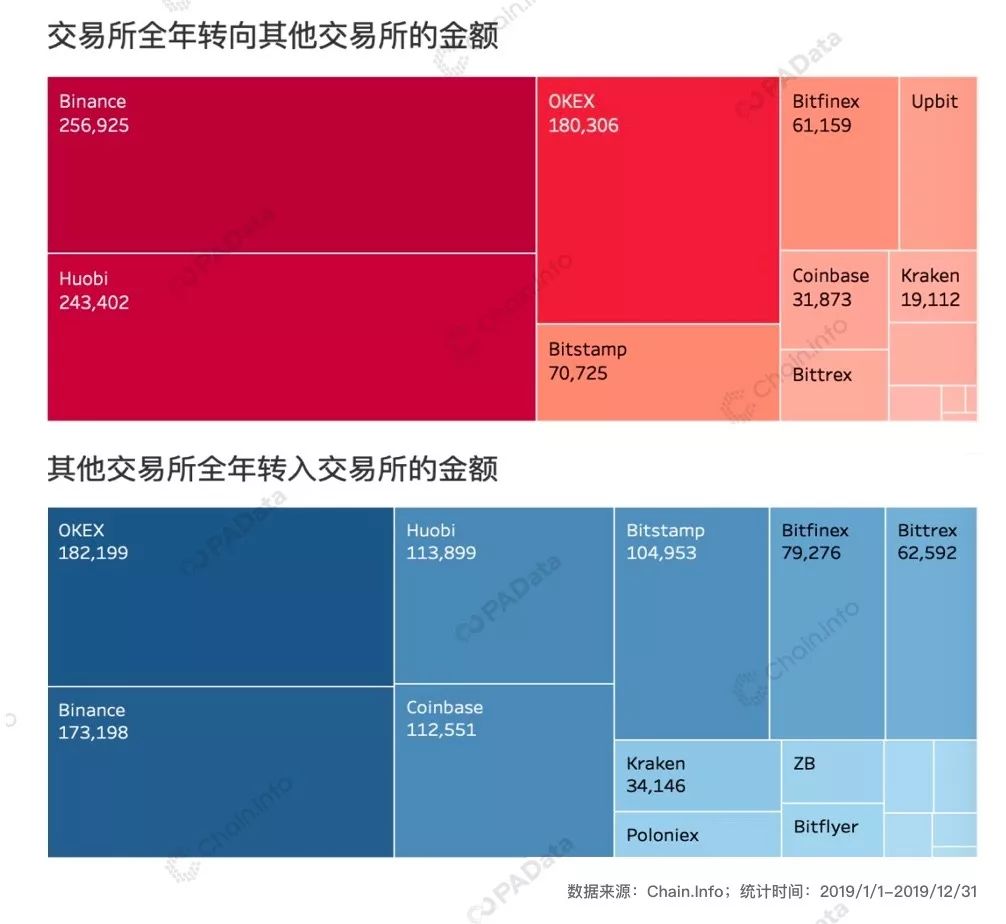

According to the statistics of the inflow and outflow of funds by the exchange throughout the year, Binance outflowed other exchanges with the most bitcoin in 2019, reaching approximately 256,900, followed by Huobi, with approximately 234,400 bitcoins flowing out of other exchanges. OKEx outflowed about 180,300 bitcoins to other exchanges, Coinbase only outflowed 31,900, and Kraken only outflowed 19,100.

From the perspective of bitcoin transferred from other exchanges, OKEx received the most bitcoin transferred from other exchanges, reaching 256,900, followed by Binance, which received 173,200, and Huobi and Coinbase, which respectively received 113,900. And 11.26 million.

If the difference between the outflow of bitcoin to other exchanges and the receipt of bitcoin from other exchanges is regarded as the exchange obtaining funds in the stock market throughout the year, then according to calculations, Huobi outflowed 129,500 in the stock market throughout the year. Binance, which is also one of the three major domestic institutions, also outflowed 83,700 bitcoins , and Upbit also outflowed 30,800 bitcoins.

On the other hand, Coinbase became the biggest winner in the stock market. In 2019, the net inflow of stock funds reached 80,700 bitcoins , followed by Bittrex and Bitstamp, and the net inflow of stock funds in the year exceeded 30,000. Of the three major domestic firms, only OKEx has a net inflow of stock funds, but only 1893 bitcoins.

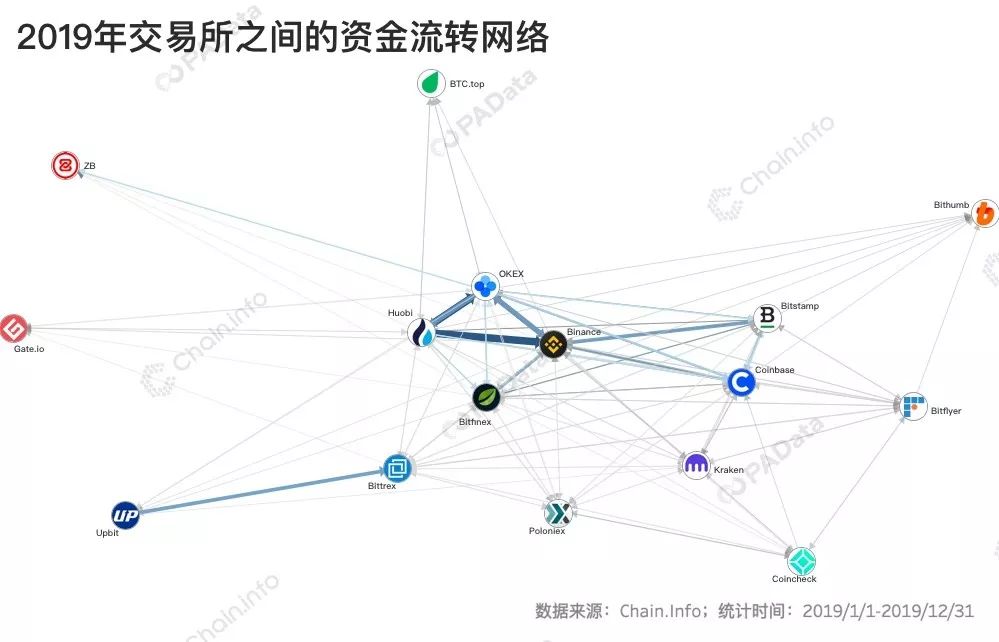

PAData draws a network of transfers between exchanges throughout the year. The arrows indicate the transfer direction, and the thickness of the lines represents the amount of transfers. The position of the exchange in the capital network [1] is closer to the center, which means that it is more central in the entire network relationship. Conversely, closer to the periphery means that its position in the entire network relationship is more marginal. The less active the interaction is.

Although the performance of the three major domestic stock markets is mediocre, the three are still the center of the Bitcoin trading network and exchange large amounts of capital with each other frequently. Among them, Huobi made 862 large transfers to OKEx throughout the year, with a cumulative transfer amount of 97,900 BTC, and Huobi made 630 large transfers to Binance throughout the year, with a cumulative transfer amount of more than 91,800 BTC. OKEx made 590 large transfers to Huobi throughout the year, with a cumulative transfer amount of approximately 59,800 BTC, and Binance made 557 large transfers to OKEx throughout the year, with a cumulative transfer amount of approximately 62,100 BTC. These four types of bitcoin capital flows are the four flows with the largest number of transfers and the largest amount of transfers between exchanges in 2019.

In addition, there are also a lot of Bitcoins that Upbit has flowed to Bittrex, with a large amount of 445 transfers throughout the year and a cumulative transfer amount of 39,900 Bitcoins. The exchange that "harvested" the most stock funds in 2019 is Coinbase, of which Binance, Bitstamp, OKEX, and Huobi all "contributed" more than 10,000 Bitcoins, and Binance "contributed" the most, totaling more than 31,900 Bitcoins.

Another concern is the regional flow of bitcoin behind the flow of funds from the exchange. According to statistics, in 2019, the total amount of Bitcoin that Binance flowed to Bitstamp, Bitfinex, and Coinbase reached 106,800 bitcoins, accounting for 41.57% of Binance's "lost" stock funds. If you count the funds that Binance flows to foreign exchanges such as Bitflyer, Bithumb, Bittrex, Coincheck, Kraken, Poloniex, and Upbit, the total amount reaches 159,000 Bitcoins, accounting for 61.90% of the total amount of Binance flows to the exchange. The total amount of funds Huobi flows to these exchanges is approximately 50,300 BTC, accounting for 20.67% of the total amount of flows to the exchanges, and the total amount of funds flowed by OKEx to these exchanges is approximately 55,900 BTC, accounting for 31.05% of the total amount of flows to the exchanges. Although Huobi and Binance also "lost" the stock market in 2019, Huobi's outflow of funds was mainly absorbed by the other two domestic exchanges Binance and OKex, while Binance's outflow of funds was more absorbed by foreign exchanges.

the data shows:

[1] The Fruchterman-Reingold algorithm is used here to lay out social network relationships.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Venezuelan President Maduro claims to revive Petro Coin in State of the Union address

- What data have we neglected during the ten-year development of Bitcoin?

- Blockchain written into Chinese government decision-making documents on a large scale: the experimental period has passed

- Comments | There is no "prospect" for the public chain. Is it easy for the alliance chain?

- Morning Quotes: Crypto Markets Collective Up, Bitcoin SV Goes Crazy

- "No madness, no survival" —— The refining of the demon coin BSV

- "Blockchain First Share" Financial One Account Suddenly Dropped Over 20%