Depth | Jia Nan Technology: the first share of the global mining machine, industry extension to see AI

Author: Song Jiaji

Source: Ji Shi Communication

Editor's Note: The original title is "Guosheng Communication Song Jiaji | Jia Nan Technology Depth: Global Mining Machine First, Industry Extension to See AI"

Summary

- QKL123 market analysis | megatrend has gone bad, miners are on the verge of loss (1125)

- Analysis: Why people don’t use Bitcoin to pay in their daily lives

- US SEC "Encryption Mom": The cryptocurrency regulatory framework needs to be adjusted, and the SEC has forgotten that "change can also be beneficial"

Seize the historical opportunity of Bitcoin to build a mining machine and expand to the AI market in the future. Founded in 2013, Jianan Zhizhi is the world's leading supercomputer chip designer, blockchain computing device manufacturer and digital blockchain computing software and hardware solution provider. The company's main business is the AvalonMiner brand mining machine chip design and machine sales, providing chip design and system products and solutions for the global bitcoin network "mining". In addition, the company is driven by the pursuit of breakthrough design ideas and the pursuit of cutting-edge technology. With high-performance ASIC chip design capabilities as a weapon, the company extends its products and services to artificial intelligence solutions through integrated solutions. Mining machines can be seen as “call options” for bitcoin prices, with higher industry thresholds.

When the miners buy the miners, they get a relatively certain amount of bitcoin in the future, and the miners’ idea of buying a miner comes from their expectation that the bitcoin price will be higher than the current, resulting in a high “expected mining revenue”. The current mining revenues bring excess returns. It is equivalent to the miners buying Bitcoin at a price lower than the market in the future. The mining machine can be regarded as a “call option” for the price of the currency. The mainstream of Bitcoin mining machine suppliers adopts the fabless mode. Its competitive advantage is mainly reflected in the design of ASIC mining machine chips. The ASIC chip design belongs to the high-tech industry and requires enterprises to launch better-performing generations according to the market in time. Products, thus put forward a relatively high barrier to entry for the company's research and development capabilities, capital investment, supply chain management, financing capabilities.

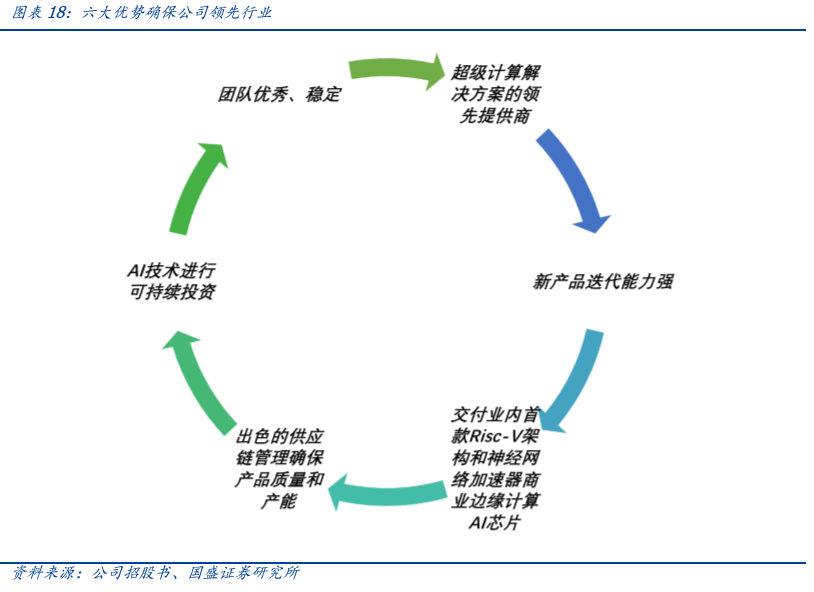

Master the high-performance computing chip and deploy artificial intelligence chips. The company continues to introduce chip products that update computing power and iterate faster, and continue to lead the industry. In 2018, the world's first 7nm chip was introduced. After two years of research and development, Jianan has evolved and breakthroughs in chip development and hardware manufacturing. It also uses chips as a strategy to combine software management systems and solutions to inject diversified applications into the field of artificial intelligence. Computing provides another market strategy that opens up new eras of artificial intelligence with developers. As of September 30, 2019, the company has delivered more than 53,000 chips and development modules to AI product developers, and has worked with more than 30 AI algorithm companies to develop integrated AI solutions for end consumers, and continue to advance in AI. Market expansion.

Earnings forecasts and investment advice. Unlike ordinary electronics, mining machines are not cost-priced, but are subject to fluctuations in BTC spot prices. Combining the halving expectations and computing power share in 2020, we forecast the company's gross profit for 2019-2021 to be 240 million yuan, 620 million yuan, 1.45 billion yuan, and net profit of 42.06 million yuan, 197 million yuan, 807 million yuan, EBITDA. They were 104 million yuan, 342 million yuan and 1.145 billion yuan respectively. We use EV/EBITDA to value the company. In 2020, the average market value/EBITDA of comparable companies in the same industry was 27.99. We expect the company's EBITDA in 2020 to be 342 million yuan, based on the industry average, based on the company's scarcity status. And profitability elasticity, we covered for the first time, target price of 12.04 US dollars / ADS (75.66 yuan / ADS corresponding to 2020 35 times EV / EBITDA).

Risk warning: 1. The cryptocurrency-related risk events occur; 2. The project's technical progress and application fall short of expectations; 3. The regulatory policy is uncertain.

1. Industry leading mining machine chip design manufacturer

Founded in 2013, Jianan Zhizhi is the world's leading supercomputer chip designer, blockchain computing device manufacturer and digital blockchain computing software and hardware solution provider. The company's main business is the AvalonMiner brand mining machine chip design and machine sales, providing chip design and system products and solutions for the global bitcoin network "mining". In addition, the company is driven by the pursuit of breakthrough design ideas and the pursuit of cutting-edge technology. With high-performance ASIC chip design capabilities as a weapon, the company extends its products and services to artificial intelligence solutions through integrated solutions. The company is registered in the Cayman Islands holding company, and through the Chinese subsidiary – Hangzhou Jianan Yuzhi Information Co., Ltd. to conduct business.

1.1 The leader in the ASIC chip design industry is a leader in the ASIC chip design industry. Its main business includes AvalonMiner brand cryptocurrency mining chip design, machine supply sales and industry solutions. The company developed its own IC chips, which were manufactured, packaged and tested by leading semiconductor manufacturing companies (TSMC, Samsung STATS ChipPac, ASE and SPIL). Finally, the company completed the assembly and sales of the whole machine. Its downstream customers are Bitcoin “miners”. Relying on powerful system power, excellent energy consumption ratio and high reliability, the company's products are widely recognized in the market.

Specific services include:

- Cryptographic system products (mining machine): products sold by the company AvalonMiner is the world's leading cryptocurrency mining machine brand, which is sold to more than 60 countries and regions around the world, and the ASIC built by the product. The chips are independently developed by Jianan Zhizhi. So far, Avalon's custom servers have been performing 12 iterations and performance continues to lead the industry.

- Artificial intelligence chip development: Jianan Zhizhi developed the edge computing AI chip (KPU), which is applied to multiple scenarios and cases, such as smart home, medical guardian, smart industry, education care and agricultural technology.

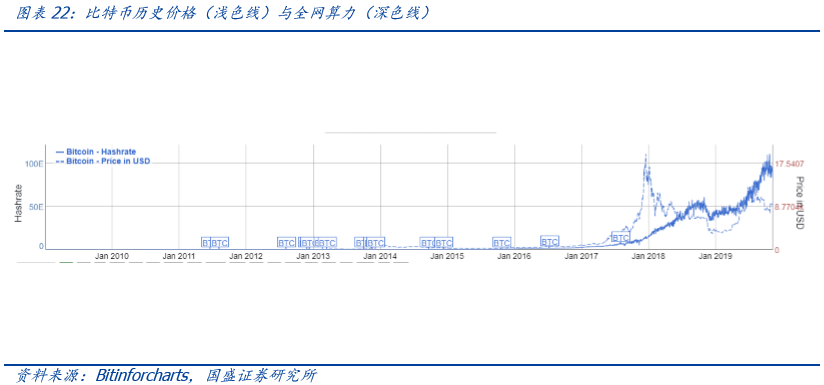

In 2018, the price of the currency fell, and the calculation power and the currency price were not synchronized, which caused the industry to fluctuate. In 2018, bitcoin prices fell rapidly, and the currency market entered a bear market, but the computing power continued to grow in January-November. In November, the computing power began to retreat, and then entered a period of shock. The slowdown in the growth of computing power is the main reason for the decline in the performance of the mining industry. In December 2017, bitcoin prices hit a record high, approaching $20,000, and then turned sharply. In November 2018, it fell to about $6,000, but during this period Bitcoin's overall network computing power has been rising. Until November 2018, when the low of $6,000 appeared, the bitcoin computing power began to decline – showing that the calculation power and the currency price are not completely synchronized. This is mainly due to the conversion of hydropower in the southwest of China, the rigidity of the mine's electricity costs (the bottom-up agreement), and the low cost of a considerable number of miners. In 2019, the power of the mining industry was fluctuating.

The global bitcoin mining machine market is relatively concentrated in a small number of large competitors. Most of the industry's leading competitors are in the country. According to Frost & Sullivan, Jia Nan is currently the world's second largest supplier of bitcoin mining machines, accounting for nearly 20% of the market. At present, the market presents a situation in which the two countries are uniquely dominated by Bitian and Jianan.

The Bitcoin mining machine is the main source of revenue for the company. The 2019H1 industry is affected by the currency market, the market power fluctuation and the new mass production capacity. It is expected that the performance will stabilize in the second half of the year. In recent years, the company's revenue is mainly based on Bitcoin mining machines, accounting for more than 99%. From 2017 to 2018 and the first half of 2019, the company's revenue was 1.308 billion yuan, 2.705 billion yuan, and 289 million yuan respectively; net profit was 376 million yuan, 57.2 million yuan, and -314 million yuan. In terms of gross profit margin, bitcoin is in a bull market in 2017, the mining machine market is booming, the company's mature products quickly occupy the market, so the gross profit margin is as high as 46.2%; in August 2018, the company launched the world's first 7nm ASIC chip, the latest process chip research and development It is conducive to the company to maintain industry leadership, but the chip research and development, pre-film cost investment is large, in the bear market background, the company's gross profit margin continued to decline, the first half of 2019 gross profit margin of 3.88%. In the third quarter of 2019, the company realized revenue of 670 million yuan (+40%) and net profit of 91.14 million yuan, turning losses into profits in the same period last year. As the currency price and computing power grow steadily, the company's performance is expected to accelerate.

The management of the company is excellent, the research and development strength is strong, and the team is stable. The management of the company has complementary expertise in IC design and manufacturing and software development. Under the leadership of Chairman Zhang Nanyi, the company's core team is stable and grows with the company; as of June 30, 2019, the company has a 127 The R&D team consisting of members accounts for 44.4% of the total number of employees and has an average of 7 years of industry experience, of which 61 have master's or higher degrees. Relying on strong research and development strength, supporting the company's strategy and development. The company was recognized as a high-tech enterprise by the Ministry of Finance and the State Administration of Taxation in 2016-2018.

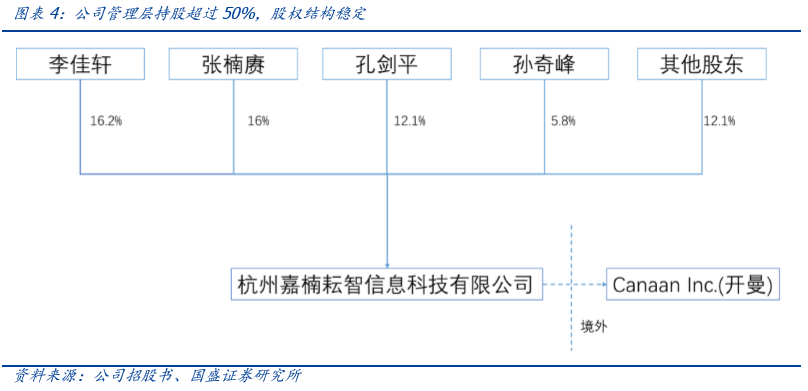

The main management of the company holds more than 50% of shares and the ownership structure is stable. The management of the company held 50.8% of the shares. Among them, Li Jiaxuan, Zhang Nanxuan, Kong Jianping and Sun Qifeng held 16.2%, 16.0%, 12.1% and 5.8% respectively. The shareholding structure was stable. The founding team and the core team grew up with the company for many years. To lay the foundation for the stable development of the company. Among them, the founder of the company, Zhang Nangeng, owns 74% of the company's voting rights, paving the way for the company to concentrate resources and form a joint force to build chip power.

1.2 Follow the industry growth, build a mining machine faucet

The emergence of artificial intelligence, big data, cloud computing and blockchain has driven the rapid growth of the ASIC chip industry. Because ASIC chip has the ability to repeatedly perform calculations and high energy efficiency ratio, it has outstanding advantages in applications such as blockchain, cryptocurrency mining, edge computing, and machine learning. According to Frost & Sullivan, the market size of the global bitcoin mining industry has increased from 1.1 billion yuan in 2014 to 21.4 billion yuan in 2018, with a compound annual growth rate of 110.0%. The market size of the global bitcoin mining machine market in the next five years is expected to reach 31.7 billion yuan in 2023, with a compound annual growth rate of 8.2%. Especially in recent years, the blockchain and cryptocurrency mining industry has developed rapidly, and the demand for rapid expansion has driven the rapid development of blockchain miner chip design and production.

The company's six-year period is the stage of rapid development of the blockchain industry. The company successfully seized the opportunity and quickly grew into the industry leader. Based on the blockchain mining machine, the company extends to a wider range of areas such as AI and IC to build a powerful mining machine and chip maker. Future development strategies are:

- Maintaining blockchain applications and the leading position of Bitcoin mining machines: The Bitcoin mining industry is gradually becoming an industry with long-term potential. The company needs to seize the opportunity to continuously improve the performance of Avalon's customized servers and become a mining machine.

- Broaden the scope of the IC field: continue to develop KPU and other artificial intelligence application ASIC chips, provide product cross-services, create a series of products, and make ASIC chips and other products suitable for more scenarios and cases.

- Expanding customer base: Enhance product and brand awareness globally through technology exchanges, trade shows and social media, expand market share under regulatory conditions, attract new customers at home and abroad, maintain old customers, and provide one-stop service to customers To provide a better user experience.

The company plans to list on NASDAQ in the form of an ADS. As of the date of the prospectus, the company has issued 2.22 billion shares of outstanding common stock (of which 52.027 million shares are restricted shares), including Class A common shares and Class B common shares (B class 356624444 shares are all held by Zhang Nangeng). Among them, Class A common shares have 1 vote for every 1 share, and Class B common shares have 15 votes for each share. The fundraising will be used for the development of ASIC algorithms and application-related ASIC chips, the development of ASIC chips related to blockchain algorithms and applications, and the expansion of AI and blocks globally through strategic investments and overseas offices. Chain business, optimized supply chain, etc.

2. Bitcoin mining machine: the cornerstone of trust and value barrier of “digital gold”

2.1 Consolidation of the “Digital Gold” consensus, Bitcoin's achievements in the mining industry bitcoin are condensing the “digital gold” consensus. 11 years ago, Nakamoto published a white paper on Bitcoin, which opened up a wave of digital assets in the blockchain and a wealth revolution that subverted social cognition. In 2010, it was reported that a programmer "purchased" two of 10,000 bitcoins. Pizza, in 2013, with bitcoin prices breaking through $1,000, Bitcoin enthusiasts around the world have been involved in bitcoin mining. Today, six years later, bitcoin prices exceeded $8,000 per piece (at the end of 2017, it was approaching $20,000 per piece). Bitcoin originally started from the "money game" of niche geeks to the huge price fluctuation of "digital gold", which created a wealth legend that spanned ten years. Today, the consensus of "digital gold" was initially established and has been in traditional financial transactions. The platform establishes the futures market (represented by the Chicago Mercantile Exchange (CME) and the Chicago Board Options Exchange (COBE)). There is no doubt that Bitcoin has begun to enter the mainstream market. The bottom of the Bitcoin ledger uses blockchain technology, and the blockchain becomes synonymous with the industry.

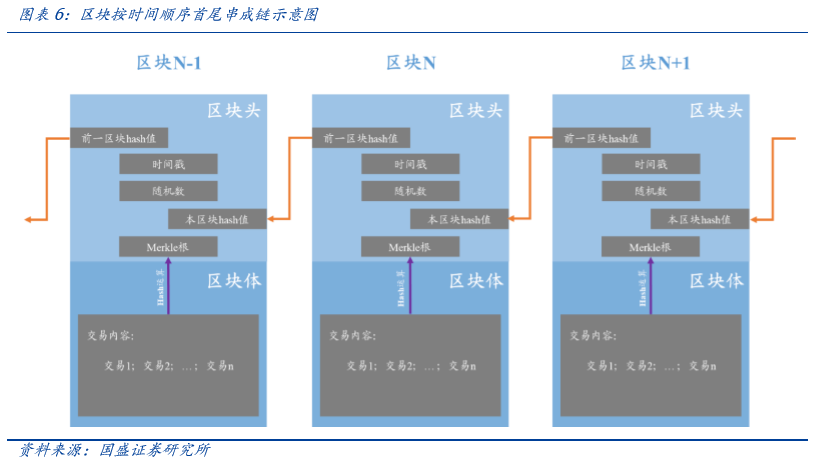

Blockchain (Blockchain) is a non-tamperable and unforgeable distributed ledger that combines data blocks into a chained data structure in chronological order and cryptographically guaranteed. Simply put, if you want a fully point-to-point implementation of the payment/exchange market (this market does not require any intermediary, such as banks, service intermediaries, etc.), the blockchain can provide decentralized accounting. Taking payment transfer as an example, the traditional payment transfer system needs to be used by the bank as a third party (corresponding to the concept of “centralization” and “third-party trust endorsement”). According to the request of the two parties, the corresponding amount will be transferred. The account balance under the name of both parties, the bookkeeping right in this process is completely attributable to the bank. In the payment transfer system equipped with the blockchain technology, users can directly conduct peer-to-peer transactions (corresponding to the concept of "decentralization"). Instead of centralizing the organization to account for the user, each user in the system can participate in competitive accounting according to specific rules. During a certain period of time, the user competing for the billing right writes the transaction for this period into a block, just like writing an account page. After other users in the system confirm that the account page is not a false account, back it up and complete the whole action. In the next period of time, each block is connected end to end to form a complete chain. Through the principle of cryptography, the order of blockchains and timestamps naturally form tamper-proof protection.

Since there is no centralized organization, the blockchain operates automatically according to pre-set procedures, which can greatly reduce costs and improve efficiency, and ensure that the data recording process and results are transparent. In addition to payment transactions, blockchain can also be used in a wider range of areas, such as healthcare, supply chain management, the Internet of Things, security certification, social networking, and artificial intelligence, which can have a profound impact on social structure. Point-to-point value transfer, blockchain leads the future "value Internet." The advent of the Internet era has broken people's barriers in peer-to-peer information transmission, and the emergence of blockchain technology has enabled the Internet to serve not only as a carrier for peer-to-peer information, but also for point-to-point value transfer.

On October 31, 2008, a network ID called "Zhong Ben Cong" published a 9-page bitcoin white skin called "Bitcoin: A Peer-to-Peer Electronic Cash System" ("Bitcoin: A Kind Peer-to-peer electronic cash system), for the first time in human society, brings decentralized electronic cash applications. In the design of Bitcoin, Satoshi Satoshi followed the laws of economics. Bitcoin is an electronic cash system, or Bitcoin itself is a decentralized, peer-to-peer accounting system for electronic cash accounting. Bitcoin network is the first payment transaction system that successfully applied blockchain technology. Without the endorsement of centralized institutions, the “trust value” of the system is created by its encryption algorithm and consensus mechanism. At the same time, Nakamoto has introduced the first blockchain token (Token) – Bitcoin (bitcoin, here is the tradable coin, not the network system of the same name), the certificate as a system The only wealth expression – the electronic cash (bitcoin) transfer in the Bitcoin network, you need to pay bitcoin as a handling fee. Computer computing resources that support the safe and reliable operation of the network are provided by miners, and fees and a fixed amount of newly issued bitcoin are paid to the miners as a reward – a process called mining. The “mining” behavior encourages more network nodes to join in and provide computing resources for the system. At the same time, the “six block confirmation” mechanism ensures that the current block will be confirmed 6 times by subsequent blocks to avoid “false” Accounts, maintain and increase the "trust value" of the system. Bitcoin mining, in one sentence, is "competing the system's billing rights, getting bitcoin as a reward" — is the process of competing for billing rights, but also the process of bitcoin issuance. To expand the concept, you need to know “how to dig” (PoW consensus mechanism) and “dig what” (incentive mechanism).

Bitcoin mining follows the market competition mechanism of computing power. The mechanism of bitcoin mining is the PoW consensus mechanism, the Proof of Work, which is the “rules of the game” for users to compete for billing rights. To put it simply, miners are free to compete through computing power, and those with the strongest computing power can win the bookkeeping rights, generate the latest blocks in the chain, and get the rewards of Token (here, Bitcoin). It ensures that a large distributed network can reach a consensus, and because the user has to pay for the billing rights (computing resources and time), the PoW consensus mechanism also limits the noise and intentional attacks in the network, ensuring the network's safety.

The Bitcoin mining machine is essentially a computer that provides physical computing resources for the system and is the cornerstone of value interconnection. In the growing process of bitcoin price and blockchain network, the computing power provides physical resource support for the system. This is also the case that Bitcoin has never been mistaken and successfully attacked in the past 10 years. Specifically, the current mainstream bitcoin mining machine is mainly composed of the following parts: a computing board including a computing chip, a heat sink, a fan, a controller circuit board, an aluminum alloy casing, and an external power supply. The core component of this is the computing chip. The calculation performance and power consumption of the mining machine are determined by the computing chip, and its cost accounts for about 80% of the total manufacturing cost of the mining machine.

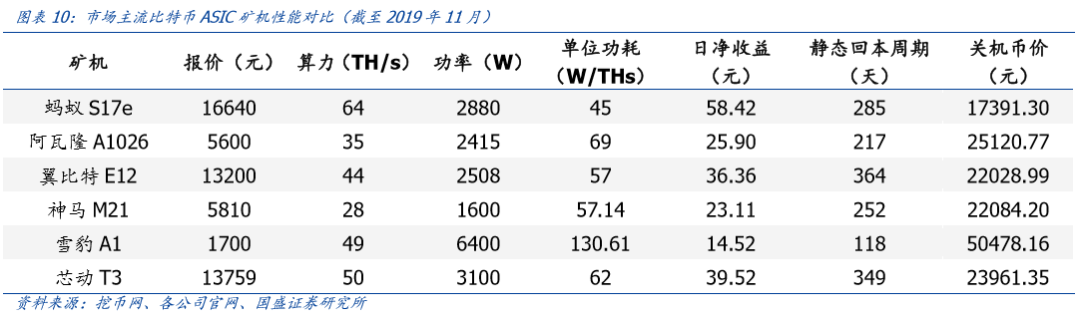

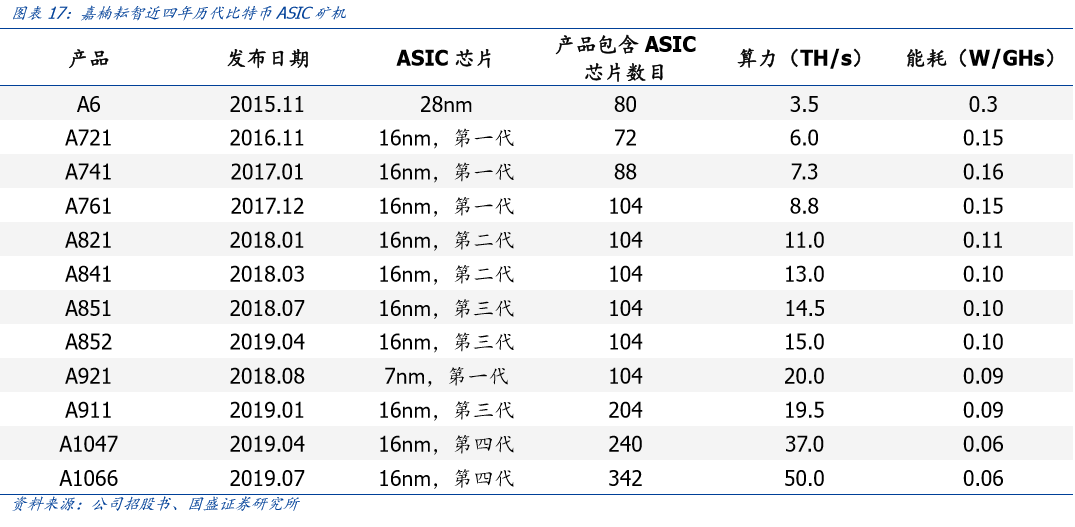

“Unit power consumption” is the core indicator for evaluating the performance of mining machines. Under the same computing power, the smaller the power consumption of the mining machine means the better the performance of the mining machine. The so-called "unit power consumption" is the power consumption/computing power of the mining machine. With the overall improvement of the overall network computing power, the difficulty of mining success will become more and more difficult, so the mining machine needs to be constantly replaced to maintain the original income. In recent years, mainstream manufacturers usually upgrade the product series once a year, which may be based on The market release releases an updated version that fine-tunes performance, power consumption, and price. In this process, the computing power of a single mining machine is continuously improved, while the core indicator “unit power consumption” is continuously decreasing.

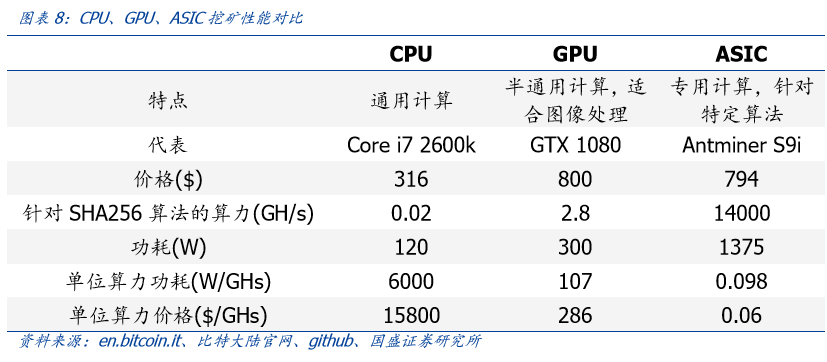

Optimizing the "unit power consumption" requires a dedicated chip instead of a general-purpose chip. The development of Bitcoin mining machine chips has gone through four processes from CPU, GPU, FPGA to ASIC. In this process, the chip that provides the computing power has gradually shifted from the general type to the mining-specific type. An ASIC chip (Application-Specific-Integrated-Circuit chip) refers to an integrated circuit designed for a specific purpose. ASICs are characterized by specific algorithm requirements and are smaller in size, lower in power consumption, higher in reliability, and lower in unit cost compared to general-purpose integrated circuits. Bitcoin mining is a repetitive calculation under a specific algorithm, so the application of ASIC solutions will greatly improve the performance of the chip.

2.2 chip design entry threshold is high, need rapid research and development iteration to maintain competitive advantage

The mainstream of Bitcoin mining machine suppliers adopts the fabless mode. Its competitive advantage is mainly reflected in the design of ASIC mining machine chips. The ASIC chip design belongs to the high-tech industry and requires enterprises to launch better-performing generations according to the market in time. Products, and therefore put forward a relatively high barrier to entry for the company's research and development capabilities, capital investment, etc., companies need to have the following resources to be unbeaten in the industry:

1) Strong research and development capabilities. In view of the increasing computing power of the downstream mining industry, upstream ASIC mining chip designers need to be able to adapt to the rapid change of products. Only by introducing industry-leading speed and continuously launching more cost-effective products can we take the lead in the market of similar new products and get the corresponding premium and more customers. At the same time, rapid and effective R&D capabilities can also reduce the number of failures of companies in R&D, thereby reducing unnecessary R&D expenses. All of this requires a chip designer with a strong R&D team, years of R&D experience and accumulated R&D data.

2) Strong capital guarantee. The chip design has the characteristics of large investment in the early stage and long cycle. Therefore, the company needs to invest a large amount of research and development funds in the early stage, and has the ability to withstand the potential losses. This puts a certain threshold on the liquid assets and cash flow of the company.

3) Good cooperation with upstream quality foundries. Only the most efficient ASIC mining machine can gain market favor, and in the production process of the foundry, the process technology used by the mining machine chip is extremely critical to its performance. In view of the limited production capacity of high-end process pipelines, only the orders of enterprises are prioritized by the foundries, so that the latest products of the company can enter the market in time and take the lead. This requires a good relationship between the company and the quality foundry, which is often not available to potential entrants.

4) Economies of scale. In general, the hardware cost of the chip = (wafer cost + test cost + package cost + mask cost) / final yield. Efficient ASIC chips require the most advanced process technology, and at the beginning of the latest process technology, the cost of masks is quite high, as much as $1 billion (a mature process may be only a few million dollars). Only after the enterprise has formed the economies of scale, can the cost of the mask be apportioned, so that the unit cost will fall and the cost advantage of the product will be formed.

The industry is in the midst of a few melee wars. At present, the ASIC-based Bitcoin mining machine market participants are mainly concentrated in several giants in the industry, and most of the leading companies are located in China. According to Frost & Sullivan, in the first half of 2019, Jianan Zhizhi ranked second in the world (China) in terms of total share of ASIC-based bitcoin mining machine manufacturers in terms of shipments and computing power. As of June 30, 2019, the company's market share in computing power was 21.9%, higher than 15.3% in the same period of 2018, while the market share of Bitcoin mining machine shipments was 23.3%.

The future competition pattern of the Bitcoin mining machine industry remains unchanged, and the two leading companies are better than other companies in terms of core resources. Through product comparison, we can find that the market leader Bit China and Jia Nan Zhizhi have advantages in the two core parameters of the product ("unit power consumption", "unit power price"), and new products are changed every year. It also proves the sustainability of the R&D capabilities of the two companies; in contrast, other miner suppliers may have problems with insufficient scale effects, high product pricing, and insufficient series development capabilities.

2.3 The financial nature of the mining machine: the “call option” of the currency price

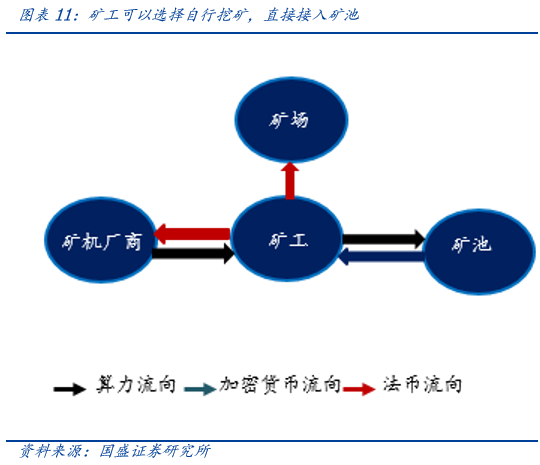

The mining industry has formed a clear industrial chain and ecology: (1) The mining machine manufacturer is the original supplier of computing power. The miner's usage currency, from the mining machine manufacturer to buy mining machines, to obtain computing power; (2) the mine is the physical custodian of computing power. The miners will host the mine in the mine (mainly distributed in northwest and southwest China); (3) the miners can choose to directly connect the calculation power to the mine or sell it to the cloud computing platform. Among them, 1) the function of the mining pool is to collect the miners' power and ensure the income of the miners; 2) The role of the cloud computing platform is to withdraw funds for the miners.

In practice, mainstream miners and mines charge French currency (some illegal mines are cryptocurrencies for tax avoidance), and the computing power of the cloud computing platform is denominated in French currency, but for convenience and compliance, The cryptocurrency actually collected by some cloud computing platforms. In general, the legal currency is still the means of payment for the mining industry chain, and the cryptocurrency exists only as a mining revenue.

Bitcoin-related value chain participants are as follows: upstream for mining machine design, production & test packaging, and sales; midstream for mining mines and mines; downstream for bitcoin exchanges and wallets.

The upstream provides mining machines for Bitcoin mining. Including fabless manufacturers, such as Bitian, Jianan, etc., which are mainly responsible for chip design, mining machine assembly and sales, and the production, testing, and packaging of the mining machine chips to the foundry; Test and packaging foundries, such as TSMC, ASE. The middle reaches for mining, confirming the transactions in the network, and the system's additional Bitcoin flows into the market through it. Due to the exponential increase of the computing power of the whole network, the probability of successful individual mining is almost zero. Therefore, large and small mines and mining pools have emerged, and the accounting power of the large number of mining machines is used to compete for the accounting rights. The probability of successful mining. The main players are Bitland, Bitfury, BTC.com, Antpool, F2pool, etc. Downstream is Bitcoin's trading, usage and storage service provider. The Bitcoin exchange can provide exchange of transactions between French and Bitcoin, Bitcoin and other cryptocurrencies.

Bitcoin mining machine suppliers typically use a fabless mode. That is, it is only responsible for the design of the mining machine chip, and the production, testing and packaging of the chip are handed over to a third party OEM. Because the chip manufacturing process requires huge capital expenditures, this model allows Bitcoin mining machine suppliers to focus on the core of the product – chip development, while at the same time obtaining a reasonably priced, process-advanced capacity. The upstream production capacity of the upstream foundry is limited, and the new capacity expansion is slow. Due to the high performance requirements of the Bitcoin ASIC miners, new products require the most advanced manufacturing and packaging processes. This puts a certain threshold for the corresponding foundry. Only the foundries with advanced process flow lines and high quality packaging standards (high product integration and good heat dissipation) can take orders. In the chip field, such foundries usually have a small number and a large market share. In view of the 7nm process pipeline that will be put into mass production, the global related market is dominated by TSMC. On the other hand, as the new technology is in the initial mass production stage, the production capacity of the corresponding assembly line is limited, and the construction of new production capacity often requires a large amount of capital and time investment, and it is difficult to improve in the short term. The upstream foundry has a strong voice, and only customers with large orders, high prices, and prepayments can prioritize capacity lock-up. Due to the selection of foundries as the industry leader, while the limited capacity, coupled with the share of the competition manufacturers in the same period, there are major mobile phone chip makers (Apple, Qualcomm, Huawei, etc.), so the mining machine supplier to the upstream foundry The right to speak is relatively weak. Only the large order quantity and high price can become the priority customers of the foundry, and the capacity needs to be locked in advance in the form of prepayment. This puts a threshold on the scale of the mining machine supplier and the flow of funds.

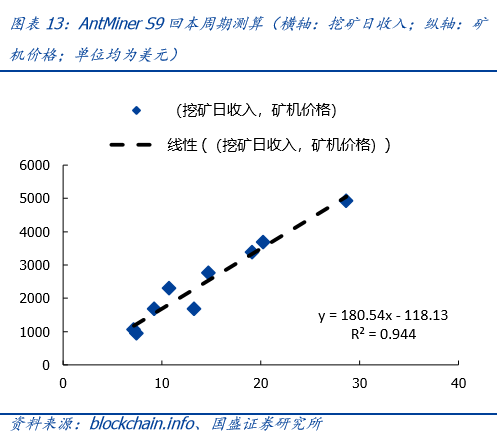

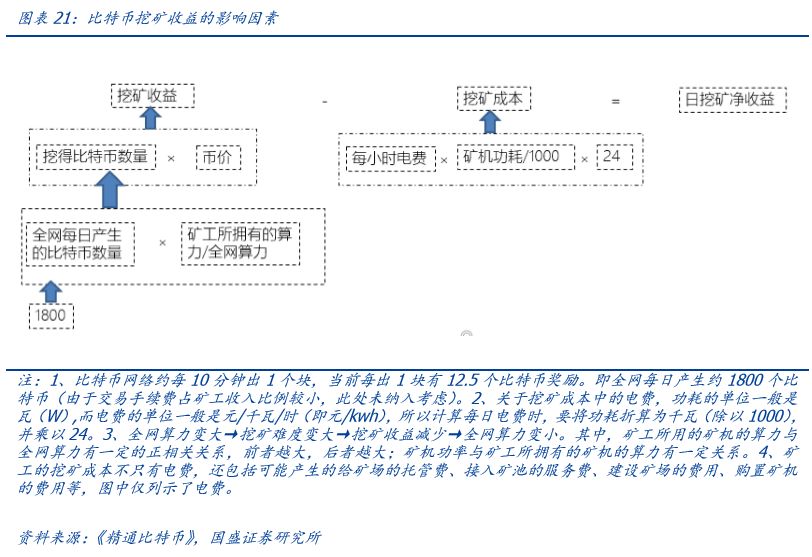

The supply side looks at the mining machine: grips the pricing power, and the price is adjusted synchronously with the mining revenue. Limited production capacity + oligopoly, making bitcoin mining machine suppliers extremely strong bargaining power downstream. In recent years, bitcoin prices have been rising, driving new demand for mining machines. Upstream mining machine suppliers have absolute pricing power for mining machines under limited production capacity (limited by OEM capacity) and oligopoly. Natural mining machine prices At the beginning of this year, when the bitcoin price soared, the ant mining machine S9 once sold a futures unit price of 34,000 yuan in the Huaqiangbei market. So, how is the mining machine priced? Using historical price data, we make the following analysis: current mining machine price = fixed return period × current mining day income. By plotting the historical monthly mining machine price and the average mining day income of the month (here only for income, not income, that is, the cost of electricity, rent, etc.), the current mining day income and the current mining machine price There is a linear relationship between them. We interpret this as the following formula: P = D × (R – C), where P is the mining price, D is the return period, R is the current mining income, C is the current mining cost, and R – C is Current mining revenue. That is, the price of the current mining machine is directly proportional to the daily mining income.

Based on the above formula and linear regression results, we get the pricing strategy of the mining machine supplier: the fixed return period is about 180 days, and the mining machine price is dynamically adjusted according to the mining income of the current period.

It is worth noting that the mining day revenue in this pricing strategy is static, that is, the future return mining period is assumed to be 180 days. If the future currency price rise causes the daily mining revenue to increase, the actual return period becomes shorter, and vice versa.

In addition, when we actually purchase the mining machine, we often have a deviation from 180 days when calculating the static return period, mainly due to the following factors:

1. The price adjustment of the mining machine belongs to the low frequency times relative to the mining revenue, so there is an unsynchronization phenomenon, which causes the static return period to deviate. Specifically, the mining revenue will change according to the BTC price every day, but the price adjustment of the mining machine is not so high frequency. Take the Bitland as an example, the same mining machine may issue three batches of goods within one month. Therefore, only three prices are adjusted within one month.

2. The mining machine supplier will also take into account the expected changes in future mining revenues when actually pricing. Especially in the case of a skyrocketing market, it will make an optimistic judgment on the future mining revenue, thereby increasing the price of the mining machine, resulting in a longer static return period.

3. Mining machine suppliers may be reluctant to compress their profit margins in the case of a decline in downstream mining revenue. The price synchronous decline is less than the decline in mining revenue, thus making the static return period longer.

From the perspective of mines and miners, the purchase of mining machine mining is an investment activity, and its demand is affected by the “expected rate of return”. As an investment product, only the higher the expected rate of return on investment and the lower the risk, the higher the demand for mining machines. It is generally believed in the market that the demand for mining is “mining income”. However, through analysis, we find that the purchase price of the mining machine will be dynamically adjusted with the current “mining income”, so the mining yield and static return period There is no change in theory, and there is no way to influence demand. What really affects demand is the “expectation of mining revenue”. Specifically, if you expect future mining gains to be higher than current mining revenues, then the expected return cycle will be shortened and the “expected yield” will increase, which in turn will increase downstream demand.

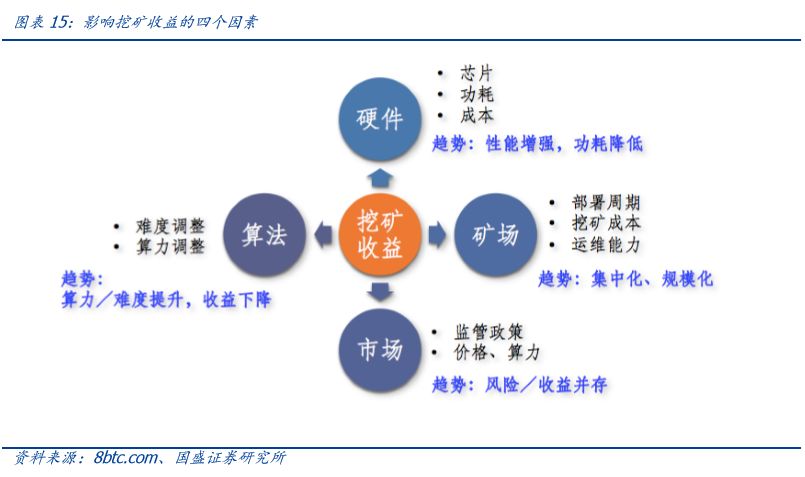

The “expected price” of Bitcoin is the main reason for the “expected rate of return”, which in turn leads to the “expected price” of Bitcoin affecting downstream mining demand. There are four factors that affect the mining revenue: algorithm, market, mine, hardware, and we will not repeat the specific factors here. Among the four influencing factors, market factors dominate, mainly because bitcoin prices fluctuate significantly relative to other factors. Take Jianan's Avalon Miner A721 as an example. When it is denominated in bitcoin, its daily mining income decays exponentially with time, which is mainly caused by the increasing net computing power; when it is denominated in US dollars. The trend of daily mining gains over time is similar to the bitcoin price time curve. This fully demonstrates that the biggest factor affecting mining revenue is the bitcoin price. As a result of this extrapolation, the main factor affecting the “expected rate of return” is the “expected price” of Bitcoin.

The above viewpoint is further refined, that is, the mining machine can be regarded as a "call option" for the price of bitcoin. When the miners buy the mining machine, they obtain a relatively certain amount of bitcoin in the future at a determined price (the future network computing power is uncertain, but the approximate interval can be estimated), and the idea of the miner buying the mining machine comes from its expected future. Bitcoin prices will be higher than the current, resulting in "expected mining revenue" higher than the current mining revenue, resulting in excess returns. From this perspective, it is equivalent to the miners buying Bitcoin at a price lower than the market in the future. The mining machine can be regarded as a “call option” for the currency price.

With its rapid R&D and iterative capabilities, strong supply chain management capabilities and appropriate capital operation capabilities, Jianan Zhizhi has become the industry leader. During the establishment of the company, it was the tail market of the bitcoin market, attracting geeks and enthusiasts from all over the world to invest in the “Spring and Autumn Warring States” period. Then the market entered a slow bear market, and the mining machine manufacturers ushered in the first big waves. . The basic principle of bitcoin mining is competition, and the growing computing power attracts many entrepreneurs to invest in the development of mining machines. However, with the skyrocketing price of bitcoin plunging, the bitcoin mining machine has emerged from the development of “hundred schools of contention” to oligopoly. At present, Jianan Zhizhi and Bitian has become the absolute hegemon of the mining machinery industry.

3, based on the mining machine industry, to create a chip powerhouse

3.1 Bitcoin mining machine chip industry continues to lead, the competitive advantage is clearly introduced to update the computing power, iteratively faster chip products, continue to lead the industry. The advanced chip process technology can improve the precision of the integrated circuit, so that the feature size of the electronic device is continuously reduced, so that the chip integration degree is continuously improved, and the power consumption is reduced while the chip computing power is improved. With the wider acceptance of Bitcoin, Bitcoin mining under the PoW computing competition mechanism, mining machine manufacturers must accelerate the development of better computing chips to achieve optimal performance. The company's ASIC mining machine chip design and manufacturing has been at the forefront of the chip industry. At present, the mainstream ASIC miner chips on the market have been upgraded from 110nm, 55nm, 28nm to ASIC miner chips of 16nm and 7nm processes. The following is the company's AvalonMiner product, chip replacement:

Matching market demand, stable and continuous iteration, the company has obvious advantages. The company's mining machine price is relatively moderate compared to other mining machines, and the calculation power, power and other indicators are also guaranteed. Overall, the cost performance is higher. Due to the high cost and inaccuracy of chip pre-development and filming, in order to match the actual demand of the market, the company has consistently and continuously iterative products, carefully select third-party production partners, and consider various standards such as cost and quality control to ensure The performance of the chip product. As of September 30, 2019, the company had registered 68 patents in China, including 6 inventions, 49 utility model patents and 13 design patents. 80 software copyrights and 30 IC layout design rights have been registered in China. . The company launched the industry's first 7nm chip product in August 2018, and plans to mass produce 8nm chips in the second half of this year. The company's product update iterations always stay ahead.

3.2 The deep extension of the chip industry: to develop into AI Blue Ocean

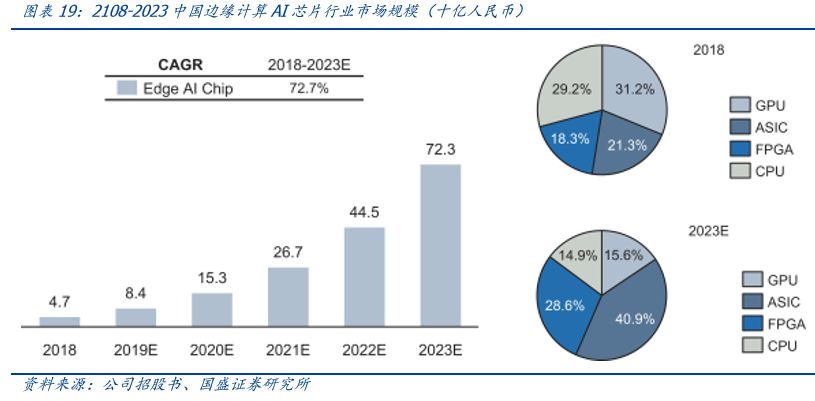

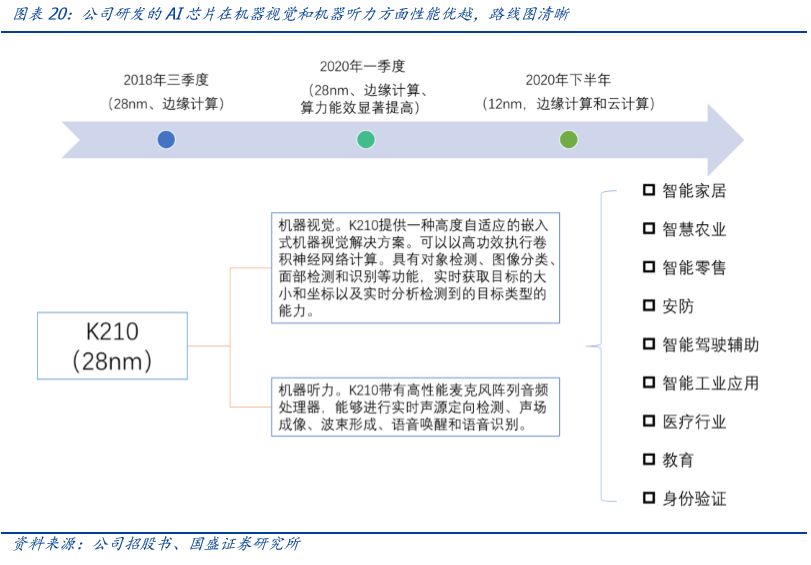

With the rapid growth of the number, the development and demand growth of artificial intelligence (AI) in the edge computing scenario has become increasingly significant, driving the new growth of AISC chips. In addition to high computational power and high energy efficiency, edge-based AI processors also have lower latency and better encryption characteristics; therefore, ASIC chips can play an important role in scenarios such as edge AI. In 2016, the company began to develop and apply ASIC to AI solution. In September 2018, the first generation of AI chip K210 was released. The chip is embedded with the company's self-developed neural network accelerator, which can realize leading voice and image recognition functions. Used in smart homes, smart buildings and other IoT applications. According to Frost & Sullivan, the global AI industry is expected to continue to grow at a compound annual growth rate of 33.2% from 396.3 billion yuan in 2018 to 1.67 trillion yuan in 2023, including the compound year of the Chinese market. The growth rate is estimated at 51.0%, reaching 205.8 billion yuan in 2023. With the advent of 5G, AI applications are becoming more widespread in edge computing scenarios. Frost & Sullivan expects ASIC-based edge AI chips to grow at a faster compound annual growth rate, thanks to lower cost, higher power efficiency and a wider range of IoT applications. 21.3% in 2018 to about 40.9% in 2023.

The AISC chip is the mainstream trend of AI chips, and the company has obvious advantages in edge computing chips. In 2016, the company began to develop ASIC chips for AI, and began mass production of edge computing chips in the fourth quarter of 2018. Its advantages are miniaturization, high performance and low power consumption of AI chips. Each AI chip is designed with an AI neural network and a high-performance processor that provides diverse, real-time and offline AI applications. In September 2018, the company released the first generation of AI chip Kendrye K210, and began mass production in the fourth quarter of 2018. The K210 is an SoC that integrates machine vision and machine hearing. The company became the first company in the industry to offer Risc-V-based commercial edge computing AI chips, and designed and developed a neural network accelerator with outstanding performance.

The company has accumulated a lot of industry experience in the development of Bitcoin mining machine chips; especially in small size, high efficiency and high computing power, which is crucial for ASIC chip design for AI applications. The K210 uses TSMC's ultra-low-power 28nm advanced technology and dual-core 64-bit processor for better energy efficiency, stability and reliability compared to other systems with the same processing power. According to Frost & Sullivan, the K210 has a computing power of 0.576 TOPS and the SoC consumes 300 mW, which is more power efficient than the power efficiency offered by competitors.

With years of accumulation in the field of chip design, the company's chip products have demonstrated outstanding performance in the AI field. As of September 30, 2019, the company has delivered more than 53,000 chips and development modules to AI product developers, and has worked with more than 30 AI algorithm companies to develop integrated AI solutions for end consumers, and continue to advance in AI. Market expansion.

4. Valuation and profit forecast

4.1 The mining machine sales revenue forecast assumes that the reasons for the mining machine sales are distributed at both ends of “supply” and “demand”. The relevant influencing factors are:

- Factors affecting the supply of miners: the capacity of the foundry that can be distributed to the miners and the success rate of the chip

- Influencing factors of mining machine demand: net income from mining (mining income deducts mining cost)

- Mining revenue: the amount of coins available for mining (depending on the number of blocks, the difficulty of mining, the difficulty of mining is directly related to the calculation of the whole network), the price of the currency

- Mining cost: electricity bill.

Key assumption 1: Bitcoin prices are basically stable

Although bitcoin prices have changed dramatically since the launch in 2009, especially in 2017-2019, bitcoin prices have risen above $8,500 since June 2019 and have remained relatively stable in this range. The market's optimism comes from the halving of Bitcoin in 2020, which will push the price up. At the same time, with the global round of popularity, Bitcoin as a native digital asset is being accepted by high-risk investors. It is growing; but at the same time we have to see that global regulatory tightening will put some pressure on BTC, so we have a neutral judgment on the currency price.

We assume that bitcoin prices are relatively stable in 2019-2021.

It is important to note that it is known that every 10 minutes, a block is successfully packaged by the miners, and the miners receive block rewards from the first transaction. The award is initially 50 bitcoins, every four Half-year halving, two halvings have occurred in November 2011 and July 2016, and the next halving is expected to occur in May 2020. Bitcoin prices and computing power have increased significantly when the Bitcoin block awards were halved two times before. We expect this factor to affect the demand for Bitcoin.

Key hypothesis 2: Bitcoin computing power continues to grow

From the perspective of the supply of bitcoin mining machines, as long as the miners believe that mining is profitable, the reason for restricting the increase in bitcoin computing power is only related to the capacity of mining machine manufacturers. That is to say, at this time, as long as the mining machine manufacturers have sufficient capacity, the bitcoin computing power will rise. The main factor that restricts the capacity of mining machine manufacturers is the success rate of the mining chip. We assume that from 2019 to 2020, the miners' chip yields will be stable and will continue to ship, and the bitcoin computing power will continue to grow. We expect the total computing power of Bitcoin at the end of 2019, the end of 2020 and the end of 2021 to be 95EH/s, 191EH/s and 286EH/s respectively.

Key Hypothesis 3: Jianan Xinzhi's new A11 series will be mass-produced in 2020, and its market share will gradually increase.

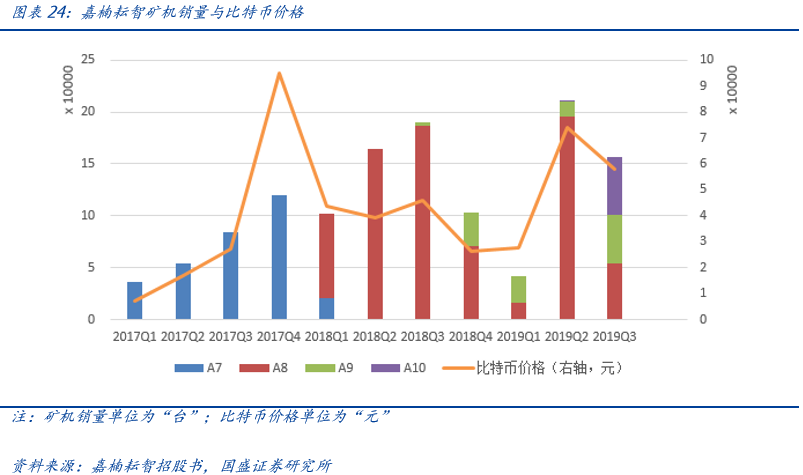

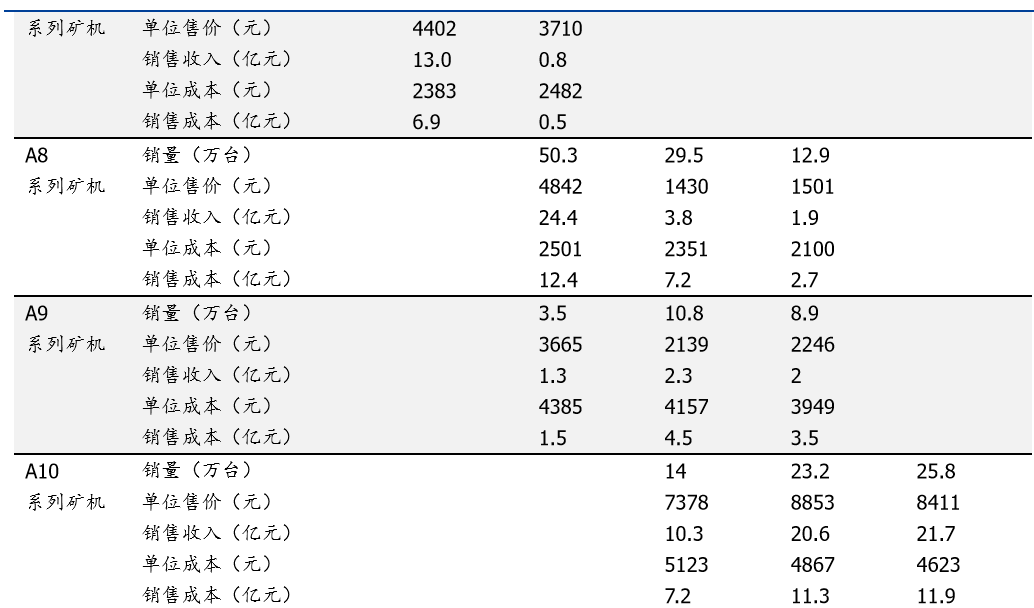

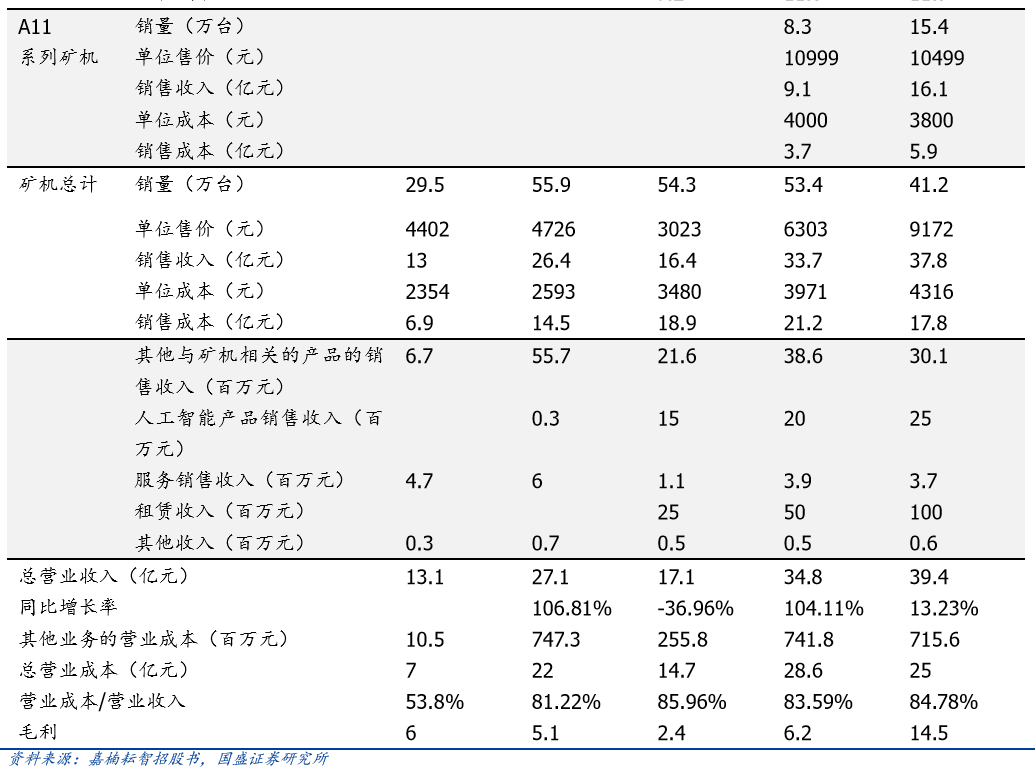

In October 2019, Jia Nan Zhizhi released the A11 series mining machine. Its computing power is divided into 56TH/s and 68TH/s. It is expected to be mass-produced in January 2020. We expect the price to be 2020 and 2021 respectively. 9999 yuan, 9499 yuan, unit sales cost is 4,000 yuan, 3800 yuan, the proportion of sales to total sales in the 2020 and 2021 respectively 30%, 50%, A8 series sales accounted for 2020 and 2021 respectively For 10%, 0, A9 is 10%, 0 in the two years, and the A10 series is 50% in both years.

Key hypothesis 4: Jianan's market share increased

We estimate that the calculation power of Jianan Zhizhi in the fourth quarter of 2019, 2020, and 2021 accounted for 16%, 18%, and 20% of the total computing power of the whole network.

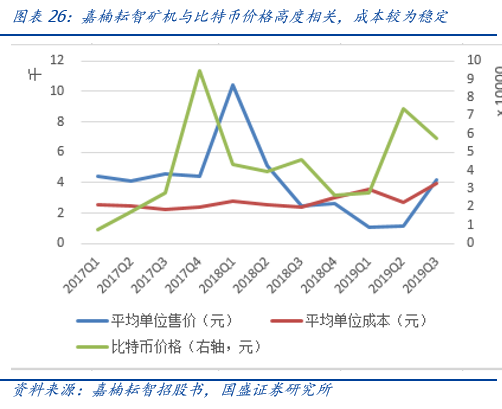

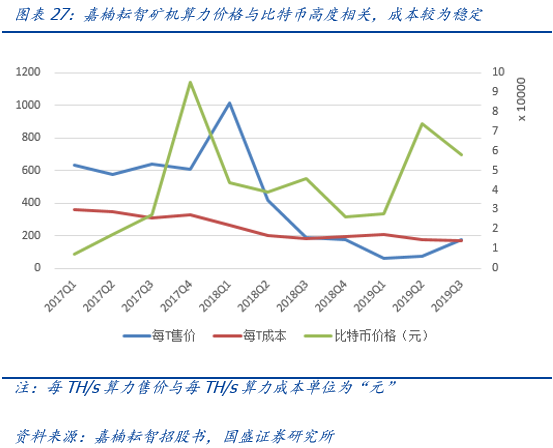

Key hypothesis 5: Jianan Minzhi mining machine price rises steadily and costs remain stable

We found that the price trend of Jianan Minzhi mining machine is highly correlated with the price of Bitcoin. The selling price is about one quarter behind the price of Bitcoin, and the cost is relatively stable. We assume that this situation continues.

4.2 Mining machine sales revenue forecast results

We forecast that the company's gross profit in 2019-2021 will be 240 million yuan, 620 million yuan and 1.45 billion yuan respectively. The net profit will be 42.06 million yuan, 197 million yuan and 807 million yuan respectively. EBITDA will be 104 million yuan, 342 million yuan and 11.45 yuan respectively. 100 million yuan.

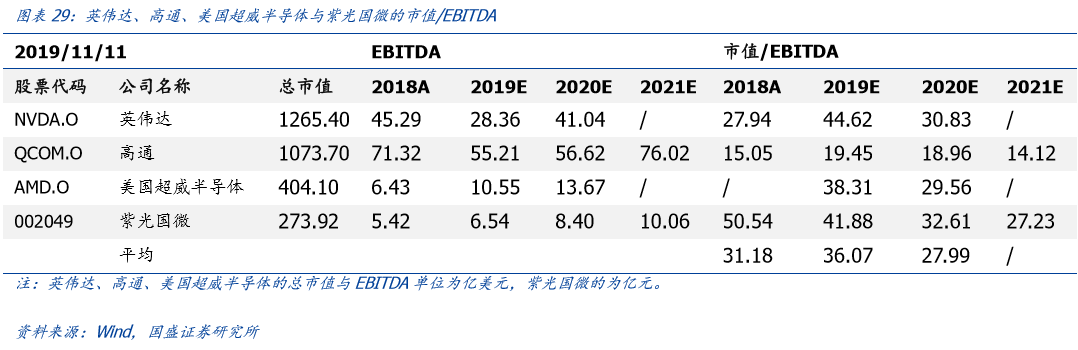

4.3 Valuation by comparable company

Since Jia Nan is the world's first mining company, we select a typical semiconductor company as a reference. In 2020, the average market value/EBITDA of comparable companies in the same industry is 27.99. We expect the company's EBITDA in 2020 to be 342 million yuan. If the valuation is based on the industry average, the company's market value in 2020 is about 9.57 billion yuan. What we still want to emphasize is that the mining machine is a special kind of electronic product, and the fluctuation of the currency price is an important leading indicator.

risk warning

A cryptocurrency-related risk event occurs. The sales forecast of the mining machine market is closely related to the change of bitcoin price, which is greatly affected by the price of bitcoin. Market risks associated with cryptocurrencies may result in negative impact on mining machine sales expectations. Regulatory policy uncertainty. At present, the blockchain is in the early stage of development. There are certain uncertainties in the management of blockchain technology, project financing and tokens in various countries around the world. Therefore, there is uncertainty in the development of industry company projects. Blockchain infrastructure development is not up to expectations. Blockchain is the core technology for solving supply chain finance and digital identity. At present, blockchain infrastructure can not support high-performance network deployment. Decentralization and security will have some restraint on high performance. Blockchain infrastructure exists. Develop risks that are not up to expectations.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain game studio Mythical Games completed $19 million in financing, with total financing of $35 million

- I understand the blockchain product layout of JPMorgan Chase

- From the hacker culture to see the self-organization and success of the blockchain open source community

- Interview with Li Ming, Ministry of Industry and Information Technology: How to Understand the Value of Blockchain

- What challenges does the insurance industry need to face in rebuilding the trust relationship in the insurance industry?

- The market is accompanied by bad news, and the short-term crisis has not been lifted.

- People's Daily Overseas Edition: China pushes blockchain technology to innovate independently, but still faces four major challenges