Digital currency talent halves: more deadly than halving assets, halving employees

Source of this article: Block Ark , original title "Second Half Tide of Digital Currency Practitioners"

Author: Warren captain

Crash

On March 9, 2020, after experiencing a sharp drop in the price of Bitcoin from 9200 to 7700 in the first two days, digital currency investors who thought the market had stabilized did not expect that 3 days later, on March 12, The digital currency industry will usher in a historic crash.

This is a crash that is enough to be recorded in history. In 24 hours, the price of bitcoin has fallen by more than 40%. Other digital currencies have been cut from 50% to 80%. The entire network ’s short positions have exceeded 10 billion. The coin circle was wailing and mourning, and many WeChat groups began to spread the video of Ding Crab and his son jumping out of stock after the disaster in Hong Kong drama "The Great Era", as if an era had ended. Investors who were still dreaming of "halving the market" a few days ago have to face the ending of "halving the assets".

- Steemit civil war continues, or forks out of new chain Hive

- Data show that recent bitcoin selling has been driven by short-term holders, and BitMEX has become a major slaughterhouse

- Free and easy week review | 6 years of sword grinding, past and present of Ethereum PoS magic

"The Era" ending screen

More deadly than halving assets, however, is halving the number of employees . A rough estimate is that this time the cliff-like decline will cause the number of practitioners in the digital currency industry to halve for the second time.

The first talent cut in half

On December 17, 2017, Bitcoin hit a 19890 high and began to fall rapidly. When I thought it was just a "technical adjustment", when I asked a big brother in the bond market about the price of Bitcoin, he said that it would fall to 10,000 points. , Waist cut, I asked why, and said, " Half cut is the easiest mathematical calculation for humans. "

Subsequently, Bitcoin began a long decline. Throughout 2018, practitioners in the digital currency industry went from enthusiasm to full confidence, to their ideals, and finally disappointed to leave. This is the first halving of employees in the digital currency industry.

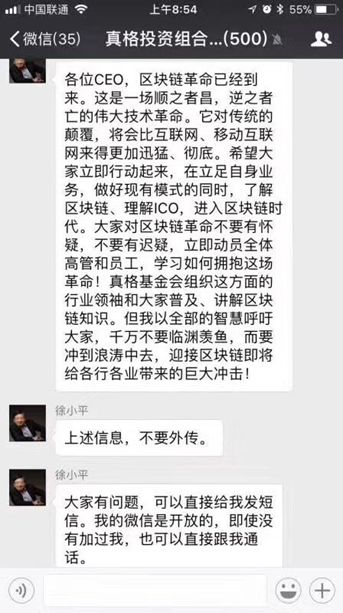

Prior to this, the price of digital currencies had risen and fallen, but the scale was far from sufficient to form an "industry". Until 2017, this 1CO-driven bull market completely detonated people's deep-seated illusions of wealth and began to flood Into this industry. For a time, countless hot money and entrepreneurs began to flow in in succession, blossoming around the 1CO industry chain, "blockchain + Everything" projects, investment institutions, incubation institutions, financial media, 1CO platforms, digital currency exchanges … Everything. Many of the companies that we are now named have been born in the rough age of 2017, including ourselves, the Block Ark. Everyone was full of chicken blood, and this sentiment reached the zenith of Xu Xiaoping's command of the "blockchain" revolution. He stayed up at three o'clock every night and was racing against time.

Real Fund Founder Xu Xiaoping's "Leaked" Chat Record

When everyone was dazzled by this optimism and blindness, they did not know that the bear market had arrived. Those young people who shouted the slogan of "one coin and one villa" at the time of 20,000 bitcoin were completely at risk. I don't know, I was still enthusiastically excited, and then I didn't wake up until the prosperity faded.

After reviewing the scene in 2017, we found that most of the entire industry's wealth comes from the obsession with “rich money”. When this confidence disk game continued to expand, countless people's money was only recharged and not withdrawn, only this story The bigger it gets, the bigger it gets. Most practitioners are not only the builders of the entire industry ecology, but also market participants and speculators . Investment institutions and incubation institutions help project parties “make up stories” in the early stages, from white papers to platform staff, from crowdfunding amounts to online exchanges. Everyone has a cut, and all their funds are traced back to the hot money attracted by this "story." After the collapse of the secondary market in 2018, the story is no longer there, the confidence is no longer there, the primary market is collapsing, and the market ’s funds have started to withdraw. These companies have fallen like dominoes.

Of course, there are many people in the market who are trying new stories and gameplay, hoping to use this to turn the tide. Zhang Jian's "transaction is mining" Fcoin, uses DPOS and super nodes to cover many large EOS, DApp, STO, etc. And so on, but without exception, the death sentence was pronounced before the wave broke. With each rebound of Bitcoin less than the previous high, the panic of the bear market began to spread. Eventually, those practitioners who dreamed of turning over by digital currency / blockchain did not get a penny, but instead lost in most of their lives. Had to be disappointed to leave. By the end of 2018, the price of bitcoin had dropped from 20,000 to 3,000 at the beginning of the year, and countless altcoins were almost zero. The digital currency industry ushered in a dark moment. The project party / exchange / investment institution went bankrupt. On the catwalk, the industry is falling apart . The big guys on poker cards, the teachers who guide us to "self-cultivation", and the entrepreneurs who are determined to change the Internet industry, mostly leave the industry quietly with the collapse of prices. Look for the next holy grail.

The second talent cut by half

If an industry needs to flourish, a large number of talents must be introduced. Capital is for profit, and so is talent . We put aside the ideal of "decentralization". What most people in the world aspire to is still centralized money. Except for a few "crypto punks" who believe in "liberalism" and decentralization, the dream of "prosperous wealth" that the digital currency industry is proud of is the reason for attracting many talents . Some talents have to leave the field to find new dreams.

Those who stayed, finally survived the recovery in 2019. After the industry was cleared, the remaining people restructured a new monopoly structure. The exchanges led by the three major exchanges ushered in their own spring again. Left-handed IEO With the right hand and leverage, the beauty CMO pushed digital currency back into people's vision. Compared with 2017 where flowers bloom, 2017 practitioners in 2019 are more concentrated in digital currency exchanges. With the blockchain being listed as a national strategy on October 24, the industrial blockchain has also changed the tragic appearance that the original "chain circle" is not full and has become a huge cake.

The quiet group began to be active. With the listing of Jia Nan Yunzhi on the NASDAQ and the listing of Huobi OK's Hong Kong stock backdoor, the prospect of the blockchain seems bright. On the day Wu Jihan regained control of Bitmain's power, countless people excitedly sent a circle of friends "back, all back", as if the bull market was ahead. Although the price of bitcoin continued to fall in the second half of 19 years, the market's confidence has become more and more frenzy as the day of bitcoin production halving approaches.

As a result of this frenzy, countless people began to increase leverage. There are a wealth of derivatives on the market to let people enjoy studs. There are also miners who allow mortgages to lend fiat currency to continue to buy mining machines or pay electricity bills.

It should be noted that throughout 2019, the digital currency industry, or the blockchain industry, has not had a lot of fresh blood except for the small number of people brought by the capital disk at the beginning of the year. The fiery exchange and the blessing of leverage have promoted the rise in the currency price, which has made people inside the market begin to regain confidence and gradually increase their positions. Most industry practitioners are also deploying a large number of digital assets on the market, and some of them are trading. The platform began to issue platform coins as compensation, wrapping company employees in this carnival.

Different from 18 years, this time, most of the people in the field are practitioners in the industry. They think they are rational and faithful. The rise in the first two months of 2020 just proves that they insist on this. The correctness of the road. However, people are not as good as the sky. The global outbreak of the new crown virus completely ignited the market's fuse. The liquidity crisis in the financial market has caused overseas institutions to start selling digital currencies regardless of cost, which has left the digital currency market without additional capital It got worse, started to stamp out, and eventually collapsed on March 12.

Most of the participants in the digital currency market lost their money this time. Even if a small number of short-sellers made a lot of money, but once again in the early morning of March 13th, these "big shorts" fell on their heads. Wipe the cold sweat. "When a systemic crisis occurs, no one is immune." As Bitcoin gradually fell below the cost of mining, people began to worry that the foundation of the industry would be shaken. If it continues to fall, the off-exchange leverage will face liquidation and the industry will face complete Big cleaning.

If bitcoin continues at its current price for a period of time, or drops rapidly again after a rebound, it is foreseeable that the number of practitioners in the industry will decrease again, and if there is no hope, there will be few remaining believers.

where is the road?

The reduction of practitioners is definitely not a good thing for the development of the industry. Although "Bitism" has always despised other altcoins, there is no doubt that in a market full of flowers, there can be more innovations, and innovation in the industry must be constantly trial and error. When there is capital willing to provide the cost of trial and error for entrepreneurs, errors may become cheaper, but it is more worth looking forward to the birth of new things; but capital is reluctant to invest in this market, and even the bottom-level supporters have started to withdraw. , Then the prosperity of the industry will be impossible to talk about.

The application of digital currency returned to the transaction itself in the early 20's. Whether it is the expanded monopoly of centralized exchanges, or the decentralized DeFi and DEX, it is all about the transaction itself. Perhaps this is a long-term direction in the future. With the improvement of financial derivatives and the sell-off of "whales", digital currencies have gradually changed from the original revolution wrapped in the "next-generation Internet" innovation revolution to trading commodities. Although the dream of "rich money" is no longer, the huge fluctuations still bring a considerable profit to traders.

In another dimension, the underlying logic of Bitcoin has not changed, and it remains one of the best safe-haven assets in the world. Of course, what is avoided is not the risk of depreciation of the relative legal currency, but the risk of additional legal currency issuance in sovereign countries, and the risk of individual ownership of assets. Despite the frequent occurrence of the Black Swan incident, the price of Bitcoin has experienced several huge fluctuations, but the underlying logic has never changed, which is why he can continue to survive.

What about the cryptocurrency industry? With the further compromise of Libra, Chinese enterprises have started to develop towards a currencyless blockchain. The major public chains are broken when they go online. The cross-chain system does not know where to go. The industry seems to have reached a freezing point. Do "crypto punks" around the world still have the motivation to continue to create a new world? Can digital currencies born in the last round of economic crisis survive this round of economic crisis? As "authorities" in the industry, we cannot predict and can only continue to look forward to this.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain startup Fluree announces completion of new round of financing and announces strategic cooperation with the U.S. Air Force

- Babbitt Column | 3 Thinking Differences to Help You Better Understand Blockchain Investment

- Witness history! Bitcoin plunges sentient beings: mining circle under pressure, exchange shuffled

- "Draining Promotion" Secret of the Coin Circle Revealed: Frequently changing Douban, Post Bar, etc. of the blockchain projects recommended in the group are the main positions

- Chang Yan: Bitcoin risk aversion consensus will reach its peak at the end of the year, and it will be spring after the winter

- ETC cuts finally come, but the dream of halving is broken

- PlusToken still has more than 60,000 BTC unsuccessfully transferred, or it will affect the crypto market