Digital Democracy and Governance 2.0: How Does Blockchain Innovation Affect From Bitcoin to DAO?

The term "governance" is a general term that covers the methods and processes of how we coordinate at scale. How we organize our society, how to define and enforce rules, and how to make collective decisions. Today, our coordination depends primarily on the government and private companies protected by law.

By moving some rules and processes from our existing systems (supported by lawyers and human management) to automated, trust-minimized protocols, a decentralized network enables us to create new ways of governance at scale (as smart contracts (As claimed by Father Nick Szabo), and these agreements are adjusting the economic motivation of participants.

The results show that by using cryptoeconomic incentives in the blockchain, we can experiment with:

- Control of decentralized protocols and networks

- Models of fiscal management and public product financing

- Optimize decentralized protocols and networks to promote human cooperation.

- Create new organization and entity types, such as DAOs, COs

- Test and implement different governance models (e.g. Futarchy, Liquid democracy or Radical markets)

We believe that if decentralized digital networks can successfully create new types of governance and combine governance systems with the use of local crypto assets, they will generate great value. These assets (tokens) can be a tool for capturing and leveraging political influence throughout the ecosystem, and can also help us achieve better processes and adjust incentives in our current political system.

- Are Bitcoin's soaring and plunging all "giant whale" control disks? Data revealed on the chain

- Investors ask two core questions after FCoin Zhang Jian's "truth"

- Babbitt Weekly Selection 丨 A DeFi crisis triggered by a new species of "lightning loan"; Blockchain + Epidemic application opens the door to blockchain social governance

Governance is very important, but vertical blockchain innovation is often overlooked. Thanks to the encrypted network, we can try to coordinate the motivations of multiple parties, improve the reliability of voting schemes and political structures, and help our society more effectively coordinate, fund public goods and allocate resources.

In this article, you will find a detailed overview of these concepts and projects that directly address and govern social coordination issues, including links and suggestions for further research.

Bitcoin Beyond Trust Minimization

(Ethereum, multi-asset platform, smart contract, programmable assets)

As we all know, Bitcoin is the first truly scarce digital commodity, serving as a medium for exchange and value storage. Using Bitcoin as a type of digital gold, without trusted parties, users can store and trade Bitcoin units without the risk of counterparties. Bitcoin's technical design goals are high robustness, simplicity and security, using redundancy (decentralization), but currently sacrificing programmability and flexibility. This robustness has given Bitcoin a lot of appeal, making it the backbone of a new open financial system. However, due to technical limitations in design, the Bitcoin protocol layer cannot implement more complex functions.

This is why Ethereum was born, it was inspired by Bitcoin, but it has different trade-offs. Ethereum's design is more programmable and flexible. We can use Ethereum to write more complex logic to make smart contracts an unstoppable, automated, permanent script. We can rely on these scripts to execute without trusting any particular third party. Thanks to smart contracts, Ethereum is not just a single cryptocurrency (like Bitcoin), but a complete platform and ecosystem that allows many other digital assets and other decentralized services to be created on it, such as:

- Create your own Token (digital asset) on Ethereum, with many different functions (certificates, equity, Token derivatives, voting mechanism, access keys, digital game projects …), interoperable in the Ethereum ecosystem .

- Complex decentralized financial applications (staking, borrowing, betting, margin trading, and automatic donation of loan interest to charities, etc.).

- Alternative monetization models (automatic taxation, donation of fees and interest returns, decentralized charities, etc.), transparency, reduced friction, and reduced counterparty risk.

- A digital organization with different governance and voting rules that are enforced and made transparent by the underlying Etherum network.

- Peer-to-peer markets and prediction markets have no centralized counterparties, only reputation and superficial mechanisms. These mechanisms are enforced by the underlying Etherum network and made transparent.

Unlike a single asset platform such as Bitcoin, Ethereum has become a multi-asset and feature-rich platform. However, the trade-offs for Ethereum to have these characteristics also mean a larger attack surface, more risk, and more frequent adjustments.

Please note that although Ethereum allows the creation of many different governance models, the Ethereum network itself does not have a clear formal governance mechanism and humans rely on a "soft" layer (developers, corporate users, investors, miners and other interested parties) Achieve progress that determines the ecosystem.

At present, this is not a problem, because the investment of social capital into the development of Ethereum usually promotes the community to develop together in the ideal direction. However, in the event of major differences between key stakeholders, this could lead to the "branch" separation of the blockchain. Forking is not necessarily bad. They can lead to the creation of two valuable projects with different visions. However, Ethereum lacks a hard-coded governance model and therefore needs to rely on human leadership, which may be seen by some as a weakness.

Manage encrypted networks

(Decred, Tezos, on-chain governance, coin voting)

Both Bitcoin and Ethereum are widely known and widely used. Their governance is quite simple. At the protocol level, Bitcoin and Ethereum provide miners with compensation and newly minted tokens, rewarding them for making new transaction blocks and organizing them. Miners compete with each other by using their computing power. Miners with larger hash rates have a higher chance to generate the next block and get rewarded. Therefore, the network encourages miners to generate measurable actions within the network and compete with each other to make the network more secure.

However, entities have no direct motivation to provide the network with other kinds of useful work (such as writing code). When it comes to decisions about strategic direction (such as a technology roadmap), Bitcoin or Ethereum does not have clear rules that will define who makes decisions on behalf of the network. Both networks rely on human-level consensus among developers, entrepreneurs, and other stakeholders.

All technical changes in Bitcoin or Ethereum are proposed, discussed and implemented or rejected through the so-called BIP (Bitcoin Improvement Proposal) or EIP (Ethereum). This process, although fairly transparent, has bottlenecks-for example, a gatekeeper protects the code base. In addition, differences in the community may lead to a fork of the blockchain, where the network is split into two separate networks that have the same history but different rules in the future. Due to serious differences and lack of a formal decision-making process, Bitcoin forked out BTC and BCH in 2017, and Ethereum forked out ETH in 2016.

However, there are alternative networks with the same goals as Bitcoin and Ethereum, but with clear governance rules. Instead of simply rewarding a group of entities, these networks use different trade-offs, governance mechanisms, and economic incentives.

Let's take two such projects: Decred (DCR) and Tezos (XTZ) compete with Bitcoin and Ethereum (Ethereum is a smart contract platform), respectively. In both cases, the biggest difference is governance. Both Decred (using its off-chain Politeia) and Tezos (using on-chain voting) have achieved formal and binding governance.

The formal governance of these projects manifests itself as a system-embedded rule that allows stakeholders to vote and decide on important issues, changes in agreements, and allocation of funds. This is a mix of corporate governance and weighted voting.

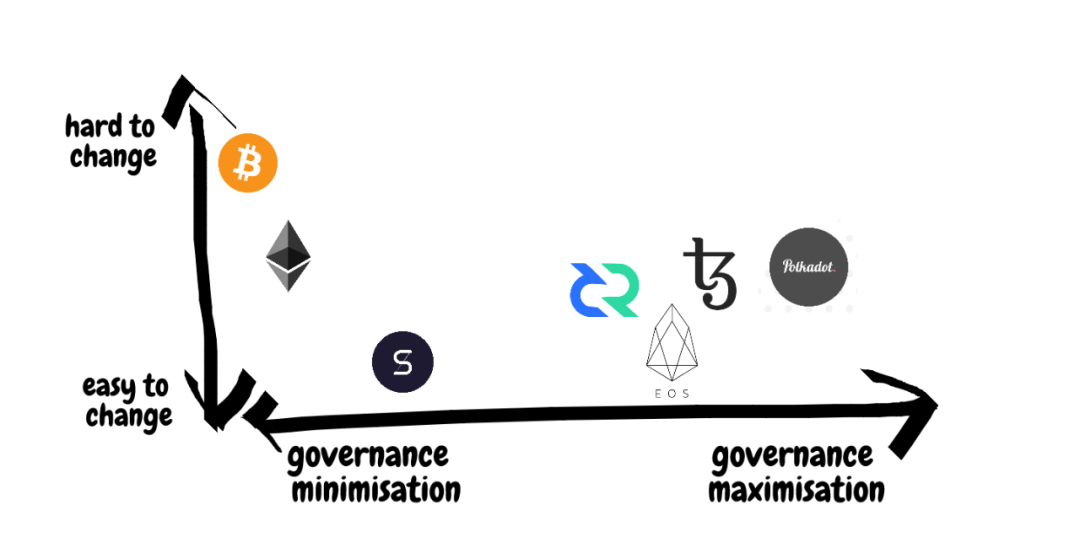

Minimize or maximize governance?

In decentralized crypto networks, there is a heated debate between supporters and critics of formal governance rules.

There are two reasons for opposing formal (on-chain governance):

1. Blockchain and similar protocols should be neutral and minimize trust.

2. Every governance needs a soft "human dimension", otherwise the system will be hijacked or deceived by bad people or powerful elites.

This hijacking has happened in EOS, which is an encrypted network controlled by 21 block producers ("BPs"), and they agreed. These block generators are selected by EOS token holders. In theory, all 21 BPs should be independent, but behind the scenes, powerful stakeholders colluded to gain control of multiple BPs, making the network more centralized than expected.

We may see many governance models struggling in a similar way-captured by big stakeholders. But sometimes these attacks can be good for the network, if they can be carried out in a manner similar to the way that aggressive investors buy businesses.

On the other hand, networks without formal governance rules may suffer from “unstructured tyranny”. In short, the lack of a formal and open governance process leads to chaotic and opaque structures, and elites rise and consolidate their power. The lack of a process can also lead to disputes and disagreements that cannot be formally resolved, and can lead to divisions (forks in the case of blockchains).

Therefore, the clearer the governance rules and the more transparent the decision-making process, the easier it is for network participants to reach consensus on a given topic. If the process is legal, all participants will accept the result, even if they have different voting preferences.

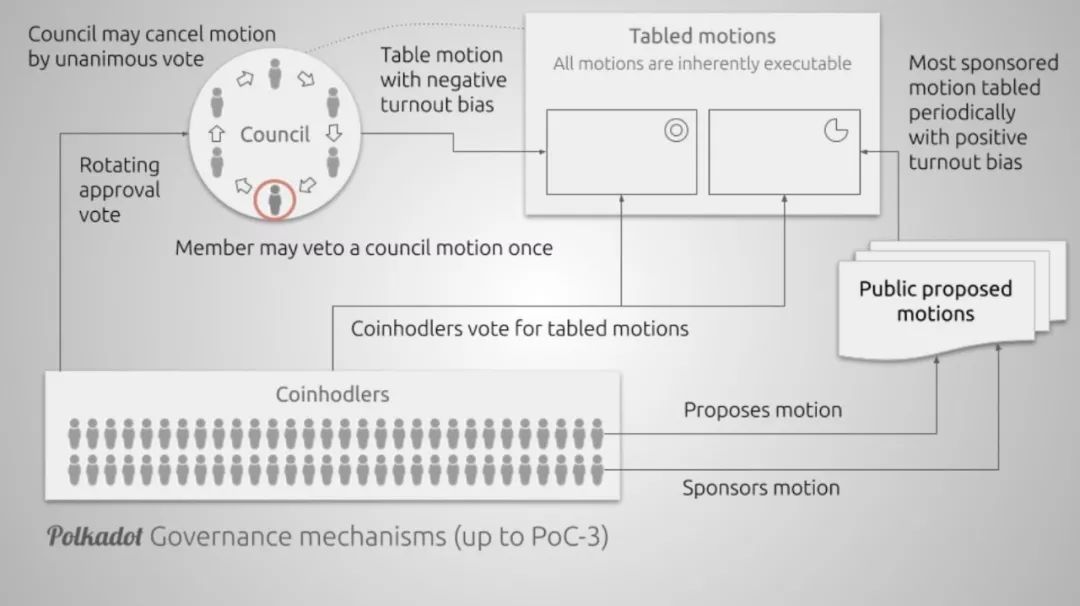

Another crypto network, Polkadot, is building a fully interoperable "blockchain network" that is maximizing formal governance, putting itself together with Bitcoin that minimizes governance and trust.

Early Polkadot governance options

Polkadot's governance consists of a committee of elected members and voters (DOT holders), with a variety of different voting mechanisms. The complexity of Polkadot's multi-governance is similar to that of the British Parliament (one of the longest running political institutions), surpassing anything else in the crypto ecosystem. This complexity generates many different interrupts, which increases the security of the system. On the other hand, it breaks the "simple rule" of "trustworthy neutrality" as defined by Vitalik Buterin. However, it remains to be seen whether the closed elite camp can occupy the entire ecosystem like EOS.

Sometimes governance is not integrated into the system, but instead appears organically around the project, as is the case with Synthetix. Synthetix does not have any formal governance rules, but the community is actively proposing changes and voting on them, and developers respect the community's wishes. Eventually, the project itself becomes more decentralized as it will evolve into a DAO, managed directly by the community of token holders.

We look forward to more experiments on blockchain governance-some network governance optimizes the defense attributes (difficult to change), and others optimize the speed of innovation (easy to change). Some promote the minimization of governance, relying on social contracts and informal processes at the human level, and some maximize governance by including formal rules and governance structures.

Whether formal governance is better than minimizing governance is inconclusive. Both sides of the argument have compelling reasons, and we will see many different models emerge and compete in the free market.

Digital democracy

(Bottom-up, alternative voting model, Futarchy and Radical Markets)

So far, we have discussed governance in a decentralized blockchain network. But how can we use these technologies in the real world to improve governance (consistent with democratic principles)?

Take political voting as an example. As we know today, elections and referendums are the second best way to make collective decisions. These events often produce extreme narratives and debates, often captured by populism. Voters were forced to make dual choices, which led to polarization and tribalism. As a result, politics has become a big "zero-sum game" with a lot of noise and inefficiency.

We live in a world where your daily behavior, shopping choices and content consumption are broken down into the smallest data blocks and used by artificial intelligence for e-commerce, marketing and business profit analysis. Why don't we deal with governance recommendations (such as political commitments and projects) and the strategic direction of society in the same complex way?

I believe in the digital age, it is entirely possible to provide voters with a wider choice and more complete information. Making the political process more transparent and inclusive, empowering the people, making their representatives more accountable under specific time frames and under the supervision of the Ministry of Finance, has become more realistic.

In the 19th century, representative democracy prevailed as a model of governance because it was the only logically feasible way to implement democratic principles. In the past, collecting detailed preferences of all voting populations within a reasonable time frame was feasible. In the slow-paced physical world, the number of governance options is limited. But today we have all the tools to fundamentally improve centuries-old political systems, voting models, and governance structures.

Therefore, the concept of digital democracy, which protects all the key principles of democracy, but the use of innovation and game theory improves the negative effects of the legacy system of corruption and failure, making the "political game" more balanced.

Most likely, change will not come from the incumbent political authorities, who are motivated to maintain their deep-rooted status quo. It is difficult to design a new system that is enforced from top to bottom.

We should also focus on bottom-up experiments that will compete in the free market, scale up, and experiment repeatedly until they are strong enough and field-tested for large-scale, nation-state adoption. .

These structures can initially be similar to the Swiss cantons, where small communities, industries and possible non-profit organizations announce their goals on the blockchain in a transparent manner and seek political or economic from this group on a voluntary basis ( Funding) authorization. In other words, technology does not necessarily lead our governance to globalism, but it may increase sovereignty and the ability to coordinate at the local level.

The above concept is no longer "wishful thinking". Due to the existence of a decentralized network, we can participate in new governance models and conduct online tests with actual economic value.

Innovation in digital democracy

Please note that many of these innovations were not entirely invented by blockchain researchers and digital innovators. But blockchain (and the open digital economy formed around it) allows us to test these technologies in practice, and many participants are economically motivated.

For example, the "Win-Win Election Act" was invented in 1890. It has never been deployed on a large scale in the real world, but 130 years later, it will be used to "select" validators in the Polkadot network.

Modern democratic governance can be divided into two basic components:

1. Power distribution-who decides (e.g. electing representatives)

2. Decision making process-how do we decide? (E.g. submit and accept / reject proposals)

The open digital economy supported by the blockchain is serving as a sandbox for experimenting with these two components.

Tools like smart contracts make it easy to implement complex rules at scale in an automated manner, without the need for centrally trusted participants.

Eliminating centralization is key in any innovation governance process, because central parties often incentivize their use of power by excluding or reviewing certain actors, effectively making innovation impossible. In contrast, smart contracts that lack trust automatically process inputs, apply governance rule sets, and generate 100% immutable and publicly auditable results.

An early example of this (possibly unwanted) blockchain transparency is DigixDAO. Shareholders holding DGD tokens can vote on the proposal to dissolve the project and distribute the remaining ETH to DGD shareholders in proportion.

Many of the experiments we have seen are directly applicable to the "real world" outside of the blockchain. Below we list some of the most interesting.

Weighted and staked voting

In some networks, it may be beneficial to weight votes based on the number of shares held by the voting party (or quantifiable work performed by the party on behalf of the system). The idea is that if you have more skin in the game, you will be more committed to producing the right results.

Earlier we discussed Decred and Tezos. Both projects use fixed voting to make decisions about the network and may authorize voting. Tezos uses a token voting process (with the option to delegate your vote to larger participants), and Decred uses a ticket system in which voters do not directly use their DCR to vote, but It is competition on scarce governance objects-tickets. Both Decred and Tezos have high turnout rates (50% of tokens often participate in proposals), but this is not a given. Many other projects suffer from indifference by voters and / or hijacked by rich whales.

These voting systems are beneficial to more involved and affected decision-makers. On the other hand, naive capital voting may lead to rich politics and oligarchy, with large voters having an advantage over smaller voters.

In a general corporate structure, this is more or less okay, but in a more political environment, such as funding public goods, this may fail. Here, other mechanisms need to be established to protect minority voters. Many different protection measures have been tried in the blockchain ecosystem (such as ragequit from MolochDAO), with varying degrees of success.

Futarchy

A new model of government was proposed by Robin Hanson, a professor and author of economics. At Futarchy, decisions are made through voting and market speculation. First, delegates vote on which values we should strive for. Second, predict what market participants in the market are using funds for betting (speculation), and which policies are most likely to maximize the value we vote for.

Market participants are motivated to speculate for profit, and the outcome of this "predictive market" (which policy is used) is binding. The core idea of "voting value, betting on belief" stems from the idea that the market is smarter in predicting outcomes than a centrally elected decision-maker.

Gnosis's goal is to try Futarchy in terms of project governance. DAOstack implements a loose variant of Futarty called Holographic Consensus, where DAO members make governance recommendations, while market participants bet whether the proposal is passed or rejected.

Radical Markets

Radical Markets is another new concept (proposed by E. Posner and G. Weyl in their book) that can be leveraged in a purely digital ecosystem. Radical Markets is a general term for a set of policies. We will outline two of them to illustrate the direction of these concepts.

Harberger Tax is a self-assessment tax combined with compulsory sale of properties. Each owner evaluates the price of the property once a year and pays taxes based on its value. The problem is that if a buyer is willing to buy a given property at a valuation, then the homeowner must sell the property. This makes owners unwilling to evaluate prices and pay too low taxes, while also ensuring that the property ends up in the hands of those who can make the most of it. This system may not exist on a large scale because it violates many of the private rights that our society takes for granted. However, in certain areas, especially in the digital, closed-loop economy, it may find its place in some niche markets.

ENS is one of the projects that is considering implementing the concept of Harberger Tax and eventually refuses to sell the Ethereum domain. However, there are other blockchain projects that might try the idea of some form of Harberger Tax, such as digital art collectibles.

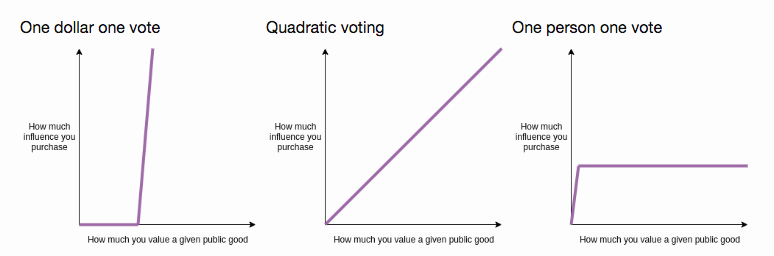

Quadratic voting is an alternative voting process designed by Weyl that allows nuances (or spectrum) in voting, not just binary yes / no results. Each voter has a fixed number of voting points, but the cost of every four votes is higher than the previous one:

Cost = (votes) ²

This mechanism allows voters to express their particularly strong views on a problem / policy, which can lead to better minority representation. It also solves the weight problem, finding a good middle ground between the two extremes of "one dollar = one vote" and "one person = one vote," as described by Vitalik Buterin:

The most well-known smart contract tool on Ethereum to implement secondary voting is Democracy.earth, and the secondary payment grant is tested by Gitcoin (encourage you to try it yourself-donate DAI to the selected project and you will see it How many will match).

There are many other voting models that can be easily tested in decentralized digital ecosystems and organizations, such as negative voting and voting markets. Let's wait and see how these will be adopted (or not adopted) in the future wave of innovation, and whether they can solve some common problems in public choice theory, such as rational ignorance.

In addition to voting, we are also building tools to reuse public funds, divert revenue sources, create new business models, support the financing of public goods, and address the tragedy of public resources (such as in open source development.

Digital organization

(DAO use cases, frameworks and infrastructure)

A decentralized (or distributed, or digital) autonomous organization (DAO) is similar to a legal entity. But instead of relying on law enforcement in their jurisdictions, they exist in a digital world, relying on smart contracts and economic incentives.

Coase's business theory explains how companies and companies are formed. We see DAOs as the evolution of the company. New collaborative technologies, such as smart contracts, online community tools, and blockchain, make this evolution possible. DAOs thus further improve social coordination and scalability, and may obsolete legacy corporate structures. They will:

- Replace deep layers with flat networks (or markets)

- Replace law and bureaucracy with code that minimizes trust

- Replace closed audits with open data access and pre-validation

dao is a collaborative network with economic strength. Some DAOs will create new peer-to-peer cooperation models. Bitcoin, Ethereum, Tezos, and Decred can all be considered dao, but their governance and structure are different. Other companies can still operate like companies, investment funds, and nonprofits today, but the use of smart contracts, transparency, globalization, and full digitalization brings additional benefits.

Just as the Pioneers sometimes happen, the first formal "DAO" ended up in ruins due to software defects, but the DAO ecosystem has experimented with various use cases in mind.

Many Dao are open to participation. We encourage you to do some research and become an active member of the DAO of your choice.

Public goods funding, subsidies

An open source project (like most blockchain protocols) is basically a widely used public product. Many entities rely on open source software. However, there is still no sustainable way to fund open source projects. They are not financed by taxes (like many other public goods) but by voluntary donations and grants from private companies. Gitcoin is an example of a decentralized platform that solves this problem.

Moloch DAO and MetaCartel DAO are DAOs built on Ethereum to promote donations and grants to support R & D, marketing, and development of the Ethereum ecosystem. Members provide funds (in the form of cryptocurrencies, tokens or stablecoins) and vote on the distribution of funds.

DAO funding is also being tested by political goals. YangDAO was created in support of Andrew Young, the US presidential candidate. Yang's fans use it to raise money and fund viral marketing campaigns.

Financing and investment

During the ICO boom in 2017, we saw huge improper capital allocations and misaligned incentives. But the market is growing rapidly, and new and smarter approaches are being tried, including DAICO (currently tried by Aragon), DAT (Decentralized Autonomous Trust), and so-called continuous organizations.

Rather than selling tokens directly in ICO activities, decentralized projects use innovations such as connection curves to better coordinate incentives among investors, users, and project teams. Simply put, investors and supporters will buy and sell tokenized stock for a project through a specific smart contract. The smart contract will automatically generate or destroy shares and adjust prices automatically based on user needs.

Investment funds and for-profit companies can also form a DAO. MetaCartel Ventures (managed by the community behind Moloch and MetaCartel) is also interesting because it combines blockchain-backed digital governance and legal entities (LLCs), where legal events are triggered by blockchain voting.

KeeperDAO is another example of a for-profit DAO. Its goal is to provide liquidity for decentralized exchanges.

Project and community coordination

DAOs are also being formed around decentralized projects that already exist. In dxDAO, members use the DAOstack framework to manage DutchX, a decentralized, auction-based exchange protocol. DutchX was originally built by Gnosis, but was later handed over to community management. The Daostack framework allows community members of the dxDAO tool to vote, allocate resources, track reputation, and pass proposals that affect the project.

Deversifi (formerly Ethfinex) also turned to dao-based governance. As a blockchain infrastructure project, Pokt.network is considering decentralized governance, trying to solve the challenges sustainably through community regulation.

Thanks to the blockchain, we see shared and widely distributed ownership projects-owned and managed by the user community.

DAO builders and infrastructure

DAO builders and infrastructure providers are projects designed to provide tools and platforms to build decentralized organizations on a large scale. The most well-known DAO builders and infrastructure platforms that support decentralized governance are:

Aragon: Establish your own DAO "operating system" and Ethereum's entire alternative digital jurisdiction to resolve disputes between digital organizations. They will also publish their own public chain on Tendermint, which can interoperate with Ethereum.

DAOstack: Focus on building a larger-scale coordination platform for DAOs, using the so-called holographic consensus and prediction market to find out what members of the organization should focus on (taking attention as a scarce resource).

Colony: Digital company platform with plugin-like collaboration and payment tools that can be used by ordinary companies to take advantage of some of the advantages of community-led DAOs.

Democracy.Earth: A digital organization that enables a democratic organization with open participation and political inclusive decentralization. Democracy.Earth has conducted a successful secondary voting experiment in Colorado and is working with a radical change community.

DAOHaus: A framework for creating simple digital organizations that are optimized for non-profit organizations and allocation of grants.

Commonwealth Labs: Their project Edgeware is built on Polkadot, and their goal is to build a test laboratory of various governance models based on economic incentives.

Kleros: Established a decentralized judicial system to resolve disputes in the digital ecosystem.

Gitcoin: open source development of the platform's decentralized funds and distribution of bonuses to freelancers.

Bounties network: Similar to Gitcoin, this platform can issue crypto bounty.

Bitnation: One of the first attempts (2014) to create a purely digital, borderless country with its own citizens, notaries and governance.

Managed content

(Token and Reputation Planning Registry)

In decentralized networks and organizations, due to economic incentives, open access, and smart contracts that enforce rules, we have discovered new ways to effectively manage content.

Token Curated Registries ( TCR)

TCR is a decentralized system that encourages users to create and manage content lists. The collective community maintains the TCR, not the central authority as a curator. There are already some sites that offer free content, such as Reddit, which is managed by "Like" and "Poor". However, TCRs also bring monetary incentives. Adding new items to the list has a monetary cost, and administrators provide content based on system rules. There are controls to ensure that all curators follow the rules.

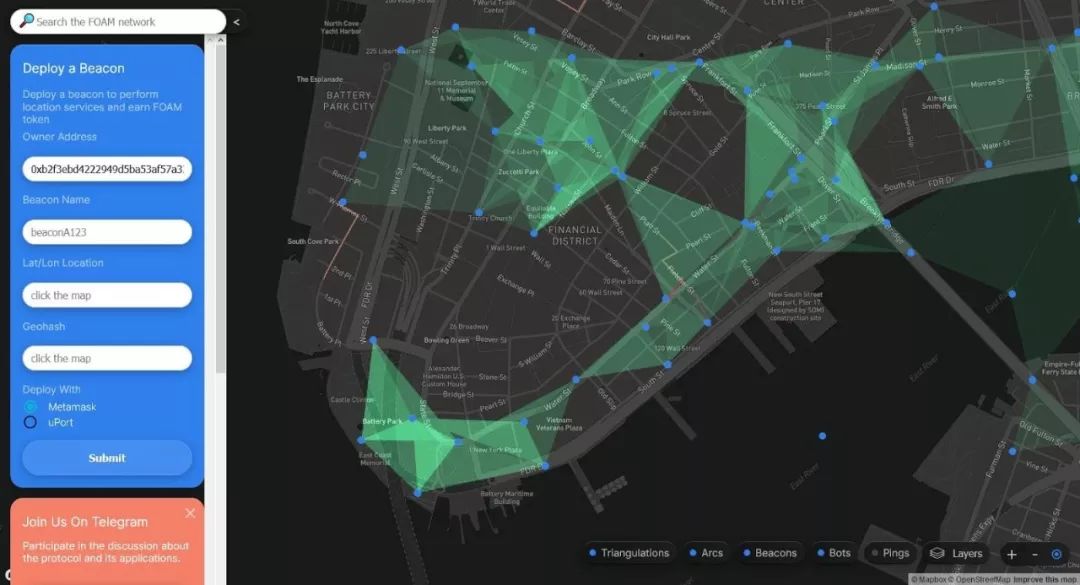

Foam.space may have the largest TCR to date, with more than 8,500 items on the list. It is essentially a digital map that provides "proof of location" technology. Users can add points of interest on the map, but they need to lock the token on each point. When a point added on the map does not match the reality (such as an incorrect address, incorrect description, etc.), other users can set a token at that point, refute it, and call on other members of the community to set up a token to resolve the dispute. The losing party lost the marked tokens, and according to the outcome of the dispute, the points of interest were either removed / modified or remained on the map.

Reputation Curated Registries (RCR)

RCR uses a non-transferable reputation (not tokens) in the ecosystem, which actually has no market price. The goal of RCRs is to better prevent bribery and bribery in the system.

Management through prediction markets

Management through the predictive market is a mix of centralized regulation of content blocks and up / down voting, but with the addition of a bet element. The user will bet on whether the authority (official moderator / admin) approves or deletes the content block. Users can "support" or "oppose" the approval of a content block with their currency unit (such as ETH). Thanks to this "forecast market" mechanism, you can see the "expected reputation" of the block before official review / plan /quality".

in conclusion

You now know the path from Bitcoin as a network with minimal governance, through Ethereum smart contracts and formal governance to the innovative concept of digital democracy. You learned about various governance models, blockchain tools, and infrastructure projects that can power new ways of organizing across markets and societies.

The main principles of decentralized governance can be summarized as follows:

- Bottom-up instead of top-down. This is necessary because politicians are motivated to maintain the status quo.

- Enhance personal strength. The goal is to reduce barriers to entry into the political process and enable participants to express their views in a more specific way.

- Governance depends on the wisdom of the masses (through open markets and in-game interests), not on the authorities' undisputed power.

- Avoid centralized gatekeepers, or they will become censorship or bottlenecks.

- Make the political process more transparent and data-oriented.

- Collaborative intelligence promotes cooperation rather than competition.

- Use positive economic incentives in a political context.

- The governance model needs to resist the hijacking of malicious actors.

- Reduce barriers to entry, as physical justice and geographic isolation are outdated.

I am optimistic that blockchain-related innovations will solve at least some of our coordination problems. Although the road ahead is rough and financial and political systems that have failed in the past can have serious consequences for these innovative efforts, we have many reasons to be excited because they give us hope for a better future for our society.

Author: Fiskantes

Source link:

https://medium.com/the-capital/digital-democracy-and-governance-2-0-2cdb4533e379

Compilation: Share Finance Neo

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- FCoin thunders, Zhang Jian confesses that over 900 million yuan cannot be paid, and foreign exchanges have significant financial risks

- How to achieve effective supervision through distributed key technology?

- Detailed DCEP future use scenarios-low-cost cross-border payments

- Research | How Blockchain Solves Financing Problems

- Half a year of research and development can't beat BM's mouth? Isn't Voice worth looking forward to?

- Perspective | How will blockchain develop with the development of quantum computing and AI

- Zhang Jian: FCoin is expected to be unable to pay approximately 7000-13000 BTC