Are Bitcoin's soaring and plunging all "giant whale" control disks? Data revealed on the chain

Author: Odaily Planet & Chain.info

Produced by: Odaily Planet Daily

In May of this year, Bitcoin is about to usher in a third halving. Recently, the price has repeatedly rushed higher, approaching $ 10,500 after breaking through the 10,000-dollar mark, and then quickly retreated this weekend. The price was -9,900 US dollars.

- Investors ask two core questions after FCoin Zhang Jian's "truth"

- Babbitt Weekly Selection 丨 A DeFi crisis triggered by a new species of "lightning loan"; Blockchain + Epidemic application opens the door to blockchain social governance

- FCoin thunders, Zhang Jian confesses that over 900 million yuan cannot be paid, and foreign exchanges have significant financial risks

Despite the slight correction, there is not much panic in the industry. After all, the "halving of the dividend" has become the industry consensus.

However, many viewpoints believe that the so-called "half dividend" is just a weight for the dealer to manipulate the market. The sharp price hike and short-term decline are the result of artificial manipulation.

For example, when the BTC price was $ 9,000, Joe007, one of the well-known "giant whales", said that this round of gains was manipulated by false buying walls and false orders, that is, some "giant whales" guided others to buy by issuing false orders. , Pushing up the price of Bitcoin.

Interestingly, some traders suggested that Joe007 was one of the reasons for the rapid pullback of the Bitcoin price on January 15. Bitfinex CTO Paolo Ardoino also agreed on Twitter. The view is that with the removal of the selling wall and the drop in bitcoin prices, Joe007 took advantage of the scarcity of orders over the weekend to drive bitcoin prices below $ 10,000.

(Odaily Planet Daily Note: Buy wall refers to the transaction icon formed when market participants buy a large amount of an asset at a single price, and is intended to prevent the market price from falling. Sell wall is intended to prevent the price from rising.)

So, is Bitcoin's price trend really being controlled by the giant whale?

In response to the above problems, Odaily Planet Daily and Chain.info have found on the basis of on-chain data research that there is no evidence for "giant whales" to manipulate currency prices. On the contrary, according to data, most of these "giant whales" are currently watching the market The "little whale" are busy hoarding coins.

"Large whale" wait and see, "little whale" keeps hoarding coins

In theory, if you have BTC block data for a full node, you can restore the entire network transfer history every hour since the first block was born in 2009. But the data of more than 200 G is obviously not easy to handle, and many retail investors have never used Bitcoin's on-chain transfer function except for depositing and withdrawing funds or transferring assets between exchanges.

So what does it mean when a large amount of money appears on Bitcoin's blockchain network? According to the summary of the Planet Daily, there are 4 main possibilities:

- A large amount of funds bought a large amount of BTC at one time (but at the same time meant that the original large holders of money sold a large amount of BTC at one time);

- Exchange consolidation accounts (more common);

- Large players transfer BTC to the exchange in preparation for realizing (also mean that the market is facing the risk of hitting the market);

- The banker spent a few dollars to transfer accounts to scare retail investors and take advantage of the opportunity (less likely).

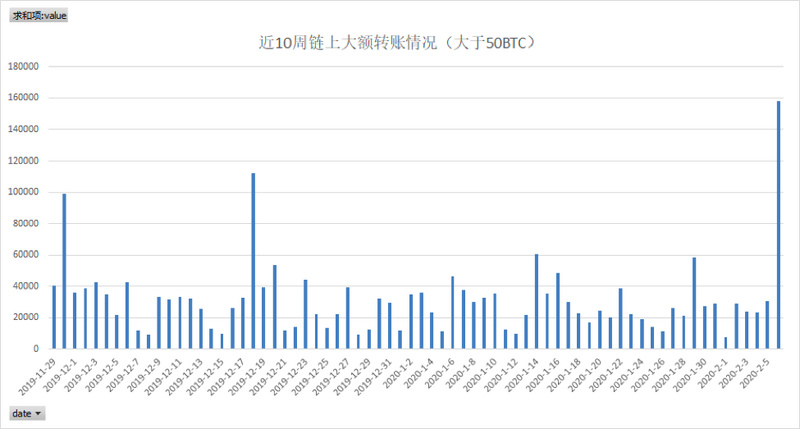

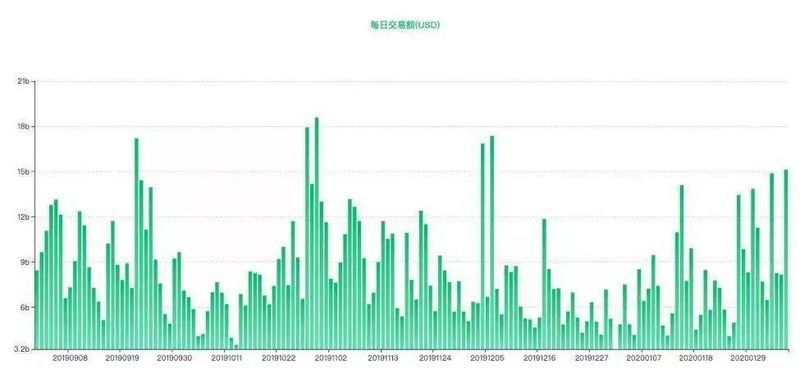

According to the on-chain data provided by Chain.info, we found that in the past ten weeks, neither the large amount of on-chain transfers (greater than 50 BTC) nor the total amount of on-chain transfers increased significantly.

If the daily transaction amount on the chain picks up slightly in dollar terms, there will be almost no change in large transfers (a large number of transfers on February 6 came from a single entity, which is an accident. After removing the accidental factor, the large transfers on that day (Total is about 45,000 BTC).

This shows that a large number of "giant whale" holding coins are still waiting for market development, and have not acted because of recent market changes.

Source: Chain.info

Source: Chain.info

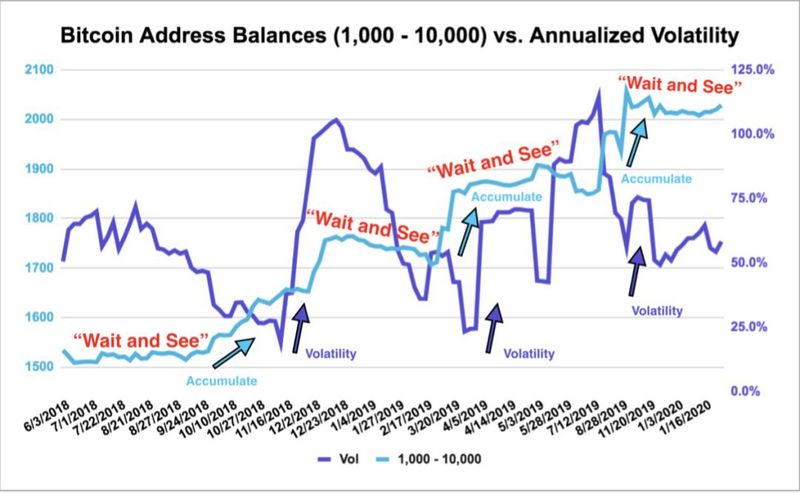

In addition, according to the latest report from crypto exchange Kraken, medium-sized "whales" holding 100 to 1,000 bitcoins are hoarding more bitcoins.

The analysis of the report indicates that from January 3, 2020, the growth in the number of "whale" (large bitcoin holders) addresses has been stagnant. In January, people holding more than 100 bitcoins held a "wait and see" attitude on whether to continue to store coins, while at the same time, "little whale" with 10 to 100 bitcoins continued to store coins.

Source: Kraken

In February, when the price of bitcoin was about to break through the $ 10,000 mark, the number of "whales" holding 100 to 1,000 bitcoins surged, that is, the "little whale" holding 10 to 100 bitcoins was on the hoard. The mood of the coin stage continued to the "whale" of 100 to 1,000 bitcoins later.

Kraken analyzed, "Also, this also means that the above-mentioned hoarding sentiment will immediately cause the resonance of the" whale "holding 1,000 to 10,000 bitcoins, allowing them to enter a new stage of hoarding."

"Whales" are constantly hoarding coins to show that people are treating Bitcoin as a value storage asset. The price of bitcoin rose from $ 3,120 in December 2018 to just over $ 10,000 in February 2020, further illustrating that people have increased their exposure to this alternative asset.

Just last month, blockchain data analysis company Glassnodes pointed out that retail investors have a similar "coin hoarding" sentiment. Glassnodes said that since the bottom of the bitcoin price formation in 2018, the number of addresses with a balance of 0.1 to 1 bitcoin has increased by 10%.

Today, large coin hoarders have experienced similar emotional changes, and people hope that the price of bitcoin will continue to rise until 2020.

However, Kraken predicts that the above coin hoarding will end in the next few weeks or months, and the volatility of Bitcoin price will reappear. This dynamic change of "coin hoarding before volatility" will further absorb the liquidity of the market and cause a market situation in which supply exceeds demand in the future, thereby promoting the emergence of a new round of rising bitcoin prices.

Head exchange has significant lead in adding new BTC users

Is there more data to support retail entry?

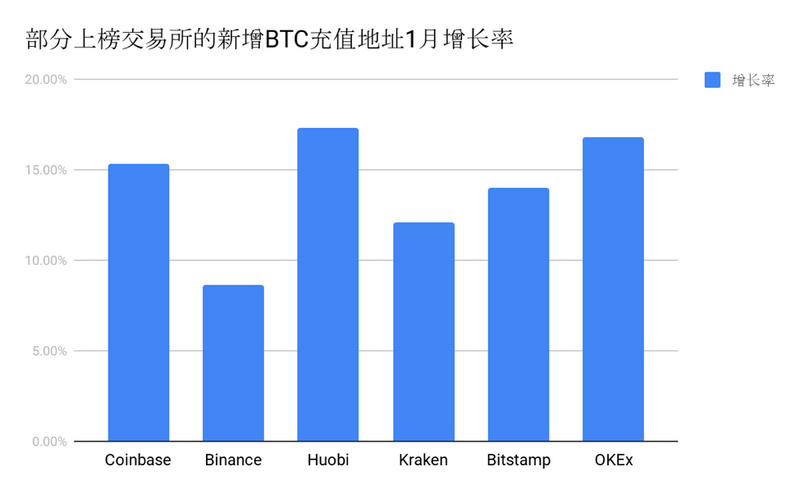

However, we found that due to the driving effect of halving the market, the user data of the exchanges and the computing power of the BTC network have performed well recently, and the leading exchanges have a significant lead in adding new BTC users.

Source: Chain.info

Judging from the number of new BTC recharge addresses, Coinbase added 1271 more BTC recharge addresses in January than the second and third place of Binance and Huobi combined, which is an absolute winner. But since the Coinbase deposit address can be changed, this number may be slightly higher than the real value.

Judging from the ratio of newly added recharge addresses to the total recharge address (the "growth rate"), except for Binance, which is less than 10%, the remaining five are in the range of 12% to 17.3%, with little difference. Huobi had the highest growth rate of new recharge addresses in January, followed by OKEx.

OKEx Although the number of new BTC recharge addresses is not as good as the top three, it still has an advantage in terms of growth rate. This also shows that there are still significant differences in target users and user habits among different exchanges, as they are head exchanges.

Source: Chain.info

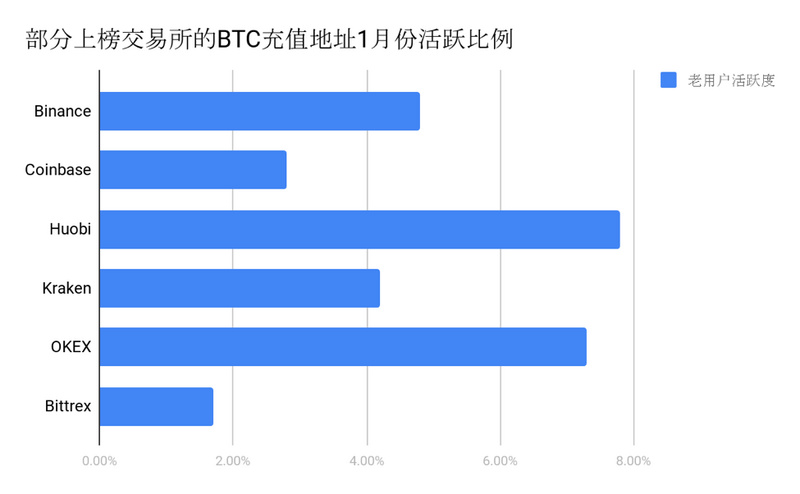

The January active recharge address ("active user") data further confirms the regularity of new recharge addresses. The "active recharge address" here refers to the exchange recharge address that existed before January this year, and can be regarded as the active situation of "old users".

Source: Chain.info

From the list, we can see that although the top three have changed positions, Binance, Huobi, and Coinbase still rank among the top three. And because the recharge address of Coinbase is exchangeable, the active level of its existing address is not high. Similar to the growth rate of users, the activity of old users of Huobi and OKEx is also dazzling, much higher than other exchanges.

Source: Chain.info

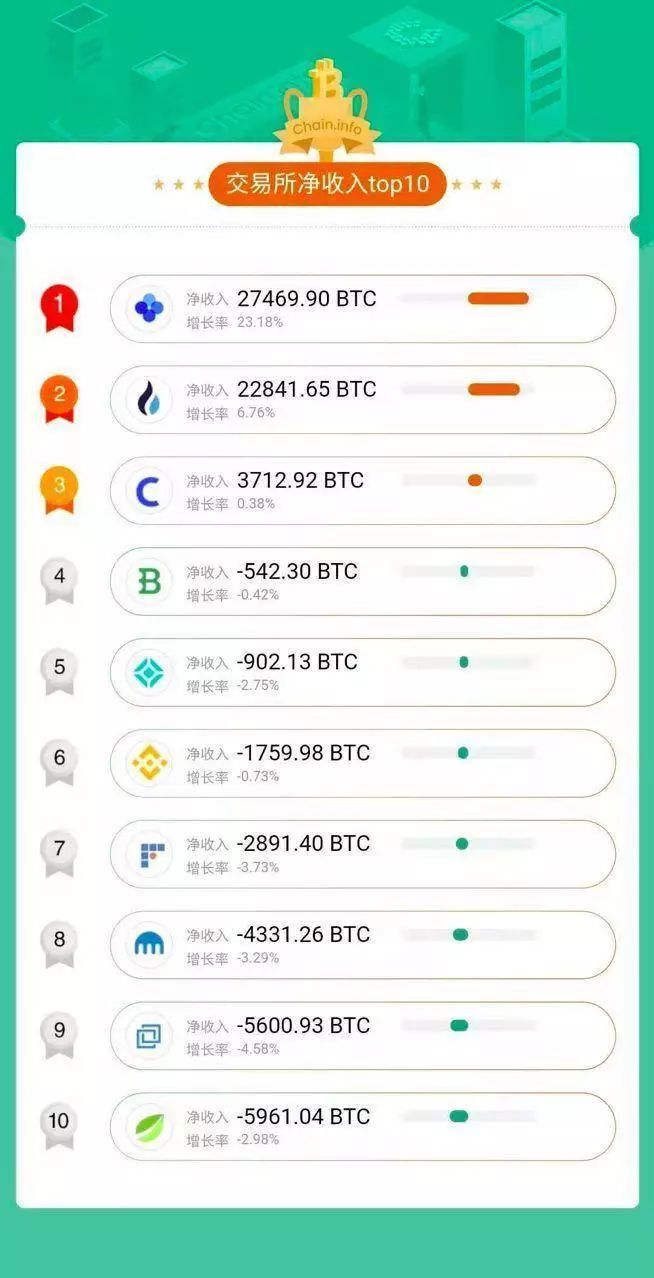

The changes in BTC balances of different exchanges are very different. Most exchanges were in a state of net outflow of BTC in January. According to Chain.info's guess, most of the funds outflow from these exchanges flowed into some of the inflowing exchanges. An angle proves the enhancement of the head effect.

Source: Chain.info

Judging from the balance on the chain, the winners in January are undoubtedly OKEx and Huobi. The two exchanges' BTC balances in January increased by 27469.9 BTC and 22841.65 BTC, respectively.

The balance on the third Coinbase chain only increased by less than 4000 BTC, and the rest of the listed exchanges were in a state of net outflow.

Taken together, the biggest winner of the inter-exchange competition in January this year is likely to be Huobi. Judging from data such as the number and growth rate of new recharge addresses, the active status of existing users, and changes in on-chain balances, Huobi is in the top three positions. Binance and Coinbase have advantages in terms of the number of users and growth, but the existing users are generally active, and the addition of users has not brought about the increase in the balance on the chain, which may mean that the average recharge amount of users is not large. OKEx has a small user base, but has some advantages in terms of user loyalty and average net worth.

Bitcoin market outlook: there is still a risk of callback in the short term, and long-term positives remain

Although there are small whale actively hoarding coins and trading positive signals for all retail investors' admission trend, in the short term, the callback of Bitcoin will end quickly and return to the upward trend?

Odaily Planet Daily reminds investors that from the current on-chain data, BTC is still facing a callback risk in the short term.

Generally speaking, the large amount of large transfers on the chain is statistically a strong bullish signal. The larger this value is, the more active BTC's value network is. According to Metcalfe's Law (Odaily Planet Daily Note: the value of a network is equal to the square of the number of nodes in the network, and the value of the network and the number of users connected to the network) Proportional to the square), the higher the value of this network, the BTC market should rise.

According to the above figure, in the past ten weeks, the large amount of on-chain transfers (greater than 50 BTC) and the total amount of on-chain transfers, we have found that there has not been a centralized large-scale transfer on the chain in the near future, which to some extent reflects the current lack of market momentum Situation, there is still a downside risk in the short term.

However, in the long run, BTC still has outstanding benefits, and it may be a big push.

According to a report from the exchange Kraken, small and medium-sized bitcoin "whales" are busy buying coins at this time, and this situation will end in the next few weeks or months. This action has not yet affected today's market prices.

The "whales" behavior of "stuck coins first and then fluctuates" will further absorb the liquidity of the market, leading to a situation of oversupply in the market, thereby pushing the price of bitcoin to a new high in the next few weeks or months .

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How to achieve effective supervision through distributed key technology?

- Detailed DCEP future use scenarios-low-cost cross-border payments

- Research | How Blockchain Solves Financing Problems

- Half a year of research and development can't beat BM's mouth? Isn't Voice worth looking forward to?

- Perspective | How will blockchain develop with the development of quantum computing and AI

- Zhang Jian: FCoin is expected to be unable to pay approximately 7000-13000 BTC

- Analysis of CBDC International R & D (3): Who will master the "Adamian" of CBDC?