Five biggest misunderstandings about Eth2.0: ETH2.0 will never be launched? Will this fork produce two kinds of ETH tokens?

Editor's Note: The original title was "Five Biggest Misunderstandings of Eth2.0"

Foreword: For many people, ETH2.0 is a flower in the mist, it seems to understand. At the same time, there are many misunderstandings about ETH2.0. It takes more information and longer time to really understand ETH 2.0, but this is normal because it is a new thing. Many stages of it are still being researched, and there is no final specification. So, in author Trenton Van Epps's view, what are the biggest misunderstandings of ETH2.0 at the moment? This article was translated by "CoLi" from the "Blue Fox Notes" community.

You may have heard that ETH 2.0 will be launched this year. Maybe you've seen some talk from Devcon V, or maybe you've seen the new testnet block browser from Etherscan, Bitfly or Alethio. Yes, it is being launched.

However, in the disillusionment of the bear market, there have also been some misunderstandings. I collected some of the most common misconceptions, including their background, corrections, or provenance.

- Libra thinking about anchoring the US dollar as a single currency launch? The reason behind it is not simple

- Data Analysis | Do you really understand the computing power, block rate, and profit of the Filecoin network?

- Bitcoin is soaring, industry investment is heating up, and the air has come … you urgently need a cheat for customs clearance!

Here is a list of five misconceptions:

- "ETH2.0 will never be launched"

- "The transition to ETH2.0 will lead to the immediate abandonment of ETH1.0"

- "This fork will generate two ETH tokens"

- "All ETH2.0 decisions are made by Vitalik"

- "ETH2.0 is the all-round solution to the challenge of ETH1.0"

Myth 1: "ETH2.0 will never be launched"

According to the various situations we have, ETH2.0 will be launched in 2020. The storage contract bytecode has just been formally verified by Runtime Verification, which means it can be deployed to the mainnet. Prysm, Lighthouse, and Nimbus have been iterating with long-used testnets and have recently switched to the mainnet specification. Every week brings innovative client optimization, larger testnets, and well-informed pledgers. (Blue Fox Note: Prysm, Lighthouse and Nimbus are the three main ETH2.0 clients)

Although it has definitely been a long way since the refactoring began in mid-2018. But the timetable has been set. The best estimate for client developers is that Phase 0 will be launched this summer.

* Attestant.io: "Sometime in the second or third quarter"

* Paul Hauner, @ 43min: "Midyear"

Specifically, you can follow "Eth2.0 Quick Update" by Danny Ryan or "New Progress of ETH2.0" by Ben Edgington.

Misunderstanding 2: "The transition to ETH2.0 will lead to the immediate deprecation of ETH1.0"

Before merging the two protocols, ETH1.0 will coexist with ETH2.0 for at least a period of time. This includes the history of the chain status, the DeFi applications built on it, and all NFT crypto tokens.

This is a staged scene shown by asset fusion, formed by participants.

ETH2.0 is divided into several phases. These phases are being researched, developed, and deployed, and ETH 1.0 will still operate normally. However, as these stages mature and deploy, there will be a period of time when the ETH 1.0 status will be fully integrated into the ETH 2.0 system. On Ethresear.ch you can see the latest advice on how to achieve this: alternative proposals for early ETH1.0 <-> ETH2.0 fusion.

Only after a thorough study of all options and their trade-offs can ETH 1.0 be fully integrated. This is the right approach to security awareness, as opposed to arbitrarily closing services and trying to squeeze timelines. Phased brings many benefits.

First, it's good risk management to divide the code into discrete function blocks. Researchers, client implementers, and auditors can more easily infer the protocol architecture by evaluating it in a manageable part. Second, it allows for parallel research, implementation, and testing, leading to faster rollout of the mainnet. Now we see the benefits of this model: Both Phasery Labs and Lighthouse have Phase 0 public testnets, while Phase1 and Phase2 are still ongoing.

Myth 3: "This fork produces two ETH tokens"

In the long run, there will be only one asset. All ETH in circulation today will eventually run on ETH2.0 and become first-class citizens. Once ETH 2.0 proves its stability and is properly prepared for joining the agreement, the convergence will occur over time.

Most ordinary users don't need to worry, they should not try to buy any token called "ETH2". Vitalik sums it up nicely in the recent ETH2.0 AMA:

"If you only hold ETH and want to keep your funds, then in all current proposals, there is no risk within five years." (Blue Fox Note: Vitalik means, to the current proposal and changes That said, for at least 5 years, if users only hold ETH, there is no need to worry about the impact of the update on holding. For example, it is not necessary to upgrade ETH1 tokens to ETH2 tokens for the time being.)

Some people think that the network upgrade means that the two will continue to exist. Most of the "hard forks" are network upgrades, which will give developers better functionality or mitigate attack vectors. Although uncommon, controversial forks that divide communities can sometimes cause both assets to persist. A well-known example is the 2016 hard fork that split the Ethereum community into an ETH community and an ETC community.

The transition from ETH1 to ETH2 will not lead to any similar splits, as PoS and sharding were expected by the community from the beginning. The key lies in the subtlety of this transition period: that is, after the launch of the beacon chain, ETH 1.0 was incorporated. During this period, ETH token assets will perform similar functions, but are divided into two domains. Over time, they will merge into the same interchangeable market. This is a rough illustration of the transition of basic assets:

1. In the next few months, audited storage contracts will be deployed to the ETH1.0 mainnet. Potential ETH2.0 pledgers expect Phase 0 (Beacon Chain) to launch and store Ether. The deposited ETH is locked and cannot be transferred out of the contract.

2. At some time after this, Phase 0 will go live. These participants who deposit into ETH become pledgers: they verify the blockchain and receive rewards through newly issued tokens on ETH2.0.

3.Phase1.5 phase proposal allows ETH1.0 to be one of these shards, avoiding some more complicated trade-offs, such as final gadget (providing ETH2.0 loan guarantee to ETH1.0) or two-way bridging (in PoW and PoS Transfer assets between chains). Stateless models that can do this are now under study.

At any time before full integration is completed, third parties (such as exchanges or pledged service providers) may create derivatives and IOUs to achieve the liquidity of ETH that is pledged or temporarily out of circulation. However, these are derivatives of actual ETH created by third parties, not actual ETH. Given its degree of difficulty and the trust needed, it remains to be seen how large it will work and how large it can be.

Myth 4: "All ETH2.0 decisions are made by Vitalik"

Despite Vitalik's key role, he is just a researcher and contributor to the larger network. For example, Danny Ryan has assumed the role of a key coordinator, acting as a bridge between researchers and client implementers. Over the past year, the team has further expanded its scope: these include:

- Ethereum Foundation Core Research Team

- 8 active client implementation teams

- Qulit team

- Ewasm team

- TxRx research

- Stateless Ethereum Research

- Robust Motivation Team

Some ETH2.0 implementers at the September 19th Interoperability Seminar: No Vitalik among them! (Photo by Danny Ryan)

There are about 75 major developers, and the pool of individual contributors is growing. Ben Edgington has a good description of this in his ETH2.0 article published at the end of the year:

"So, as a developer community, we try to operate as openly as possible and encourage participation through developer conferences, GitHub issues, formal updates, informal updates, and other channels. Everyone is welcome to participate, and there are indeed many people involved. We foster organic growth and watch out for too much control from either party. In a way, our approach is similar to Linux, and it has become the dominant player in most of the world's computing. "

In the words of Joe Lubin,

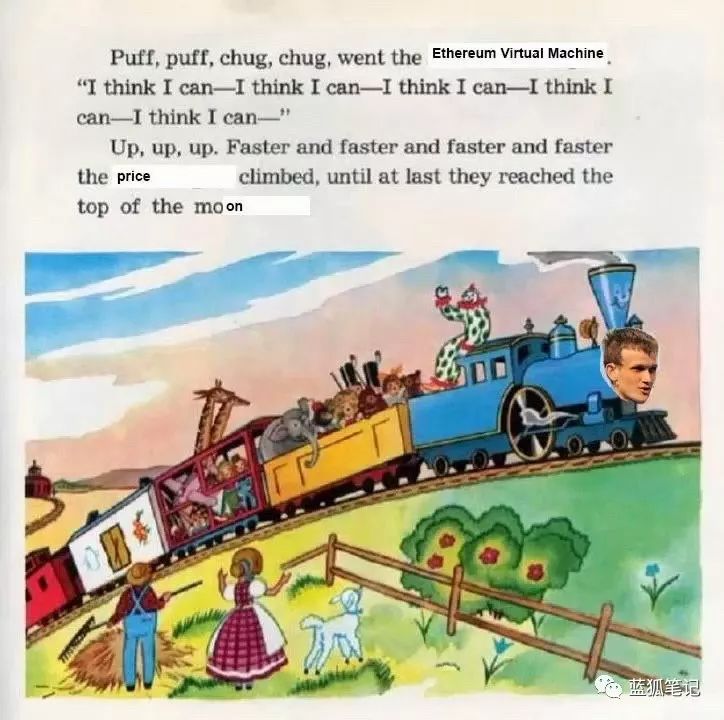

"If Vitalik is on vacation for a while, the Ethereum machine will only continue to change"

Play this game at Devcon 6 Opening Carnival

Myth 5: "ETH2.0 is the all-round solution to the challenge of ETH1.0"

ETH 1.0 has exposed important issues inherent in the frontiers of distributed systems, applications without trust, and community cohesion. ETH2.0 will bring more benefits, but for public chains that do not require permission, they still face a series of similar challenges. Whether it's version 1.0, 2.0, or 3.0, these challenges won't go away. The community still needs to pay attention to the following aspects:

- Developer experience

Realize a smooth transition from ETH1.0 to ETH2.0 for builders. What's the best way to ensure that developers have the tools they need to continuously create and innovate? Ensure funding for infrastructure on Gitcoin.

- Network upgrade (fork coordination)

This requires continuous communication with community members, the knowledge and commitment to upgrade, and the promotion of network upgrades. At least in the beginning, ETH 2.0 will hard fork and need to manage its path of continuous improvement, although this will stabilize over time.

- Community cohesion

Communities are not a whole, and each segment has its own preferences. Which EIP to include? Where should resources go? These are all part of the collaborative social maintenance that Ethereum depends on.

- Security of smart contracts

Whether you like it or not, people still write flawed smart contracts. eWASM is expected to allow other languages to work with EVM, which means that framework design for best practices in these broader areas is needed.

- More people involved

The community, and the protocols it promotes, are only as strong as their core update capabilities. Organizations like ETHGlobal need to expand their mandates.

- dApp UI

What can be drawn from the end user? We need to continue developing unmanaged products that can be used by new users. ETH2.0 introduces protocol finality, but this will never affect most end users.

- Sustainability of public goods

It's important to give builder funding. ETH2.0 will need to look at its support mechanism for all execution teams, perhaps through voluntary customer fees. Support for open source projects on Gitcoin!

That said is just a small part of the challenges ahead. Although maintenance work is not sexy, it is essential to advance solutions to issues that prevent community cohesion. In other words, the Ethereum community needs to weave the ideal for value transfer: to create and maintain infrastructure that is essentially license-free. In summary, keep in mind that someone is building these protocols.

Risk Warning: All articles of Blue Fox Notes can not be used as investment advice or recommendations. Investment is risky. Investment should consider personal risk tolerance. It is recommended to conduct in-depth inspection of the project and make good investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How to become a successful Bitcoin HODLer? Must have at least these three basic qualities

- Ministry of Finance: National PPP Comprehensive Information Platform (New Platform) goes online, using blockchain and other technologies

- Attackers make a net profit of 350,000 US dollars. Can DeFi not only immoral arbitrage, but also centralization?

- DeFi Weekly Selection 丨 bZx Event Reflection: What Does Flash Loan Mean?

- Without Voice in China, still say "game changing"?

- The loan agreement bZx was manipulated to make "Lightning Loans" popular, and to understand the secrets of Lightning Loans that must be repaid in 13 seconds

- Will Bitcoin price eventually break through $ 10,000? There are three things to consider here