Dry goods | Central Bank Digital Currency Events

He also felt from the mouth of Mr. Mu, that he was shocked and nervous about the libra white paper event released by Facebook on the global social networking site on June 18 this year.

Of course, the whole world is very nervous. We have compiled the central bank's digital currency research memorabilia, and we have realized that the central bank's digital currency has been launched since 2014. The establishment of the research team to today can be said to be divided into research and development, attaching to the first long period and the second Libra white paper. After that, a period of rapid and efficient development. In August this year, Mu Changchun said, “Since last year, the relevant personnel of the Digital Money Institute has been 996. To do related system development, the central bank’s digital currency can now be said to be ready.” The emergence of Libra is not possible. Based on the 996, the unit is 8107?

The central bank digital currency project is called DCEP (Digital Currency Electronic Payment), which is a digital currency and electronic payment tool. It is an alternative to banknotes and has unlimited legal liability. It is not allowed to refuse to accept DCEP in China.

The way of issuance is still the same as that of banknotes. The People’s Bank prints out, the commercial bank pays the money issue fund to the People’s Bank, then “takes” the DECP, “takes” it to the outlets, and then the people go to the outlet to redeem DECP or open an account (digital currency). Account) Converting cash into a central bank digital currency is one such process, and this process is also the process of placing existing banknotes. At present, from the information disclosed, DECP is an alternative to M0, does not involve M1, M2, and is guaranteed by the central bank.

- Sudden! OKEx Korea will remove 5 kinds of anonymous coins, or related to the new FATF regulations.

- Viewpoint | Bitcoin Volatility Misunderstanding: Volatility does not mean that it cannot be a good means of storing value

- QKL123 Quote Analysis | Black Swan Event, Helping Bitcoin Quotes (0916)

That is to say, the existing banking system is still needed, and the bank's payment and settlement needs to be upgraded and matched, including user-oriented terminal applications, all of which require simultaneous innovation.

In addition, Alipay and WeChat payment will not be eliminated for the time being, because the existing mobile payment is bound to the bank card, and there is no need to bind the physical object in the future, because DCEP is digital, and on the other hand, the payment scenario is more convenient and convenient, as long as There is a DCEP digital wallet on the mobile phone, which does not require a network. As long as two mobile phones touch each other, the transfer function can be realized. This means that when the mobile phone signal is not good and the WeChat Alipay is out of order, the DECP will be smart.

Specifically, look at the central bank's digital currency memorabilia and experience the rhythm and frequency of information release in the past five years.

Year 2014

The central bank set up a special research group to issue legal digital currency to demonstrate the feasibility of the central bank issuing legal digital currency.

April 11, 2014

Zhou Xiaochuan Boao Forum Sub-forum "The Future of the Central Bank"

– The central bank can't talk about whether to ban Bitcoin, because Bitcoin is not activated by the central bank, and it seems that Bitcoin is more like an asset and a collectible, a bit like a collection of stamps, rather than a currency tool.

– As an asset transaction, Bitcoin is not within our jurisdiction, and there is no question of banning it.

2015

The People’s Bank of China issued a series of research reports on digital currency, and the central bank’s prototype plan for issuing legal digital currency has completed two rounds of revision.

Early 2016

The People's Bank of China held a digital currency seminar for the first time and clarified the strategic goal of the central bank to issue digital currency. Preparations for the establishment of a digital currency research institute and professional recruitment, pointing out that the central bank digital currency research team will actively tackle key technologies of digital currency, study multi-scenario applications of digital currency, and strive to launch digital currency issued by the central bank as soon as possible.

February 13, 2016

Interview with Zhou Xiaochuan's Caixin Weekly – Digital currency as a legal tender must be issued by the central bank, and blockchain is an optional technology.

November 18, 2016

The 2017 Recruitment Plan of the Institute of Printing Science, directly affiliated to the official website of the People's Bank of China, shows that it is proposed to recruit six professionals with master's or doctoral degrees to conduct digital currency research and development, which makes digital currency once again a hot spot of public opinion. A central bank's recruitment information revealed that the life of the banknote has entered the countdown.

December 2016

China Digital Money Research Institute, the digital currency research institute directly under the central bank was formally established, and Yao Qian, the leader of the preparatory group of the Digital Money Research Institute of the People's Bank of China, served as the director. The "13th Five-Year National Informationization Plan" issued by the State Council was first incorporated into blockchain technology. The accelerated launch of digital currency and the policy support of the 13th Five-Year Plan are expected to push blockchain technology to usher in new opportunities for development. It is reported that Yao Qian, former deputy director of the Science and Technology Department of the People's Bank of China, served as the director of the Digital Monetary Research Institute. The deputy director was appointed by the former deputy director-level cadre of the Science and Technology Department and the director of information technology of the Silk Road Fund. The institute will have seven divisions with different divisions of labor.

July 3, 2017

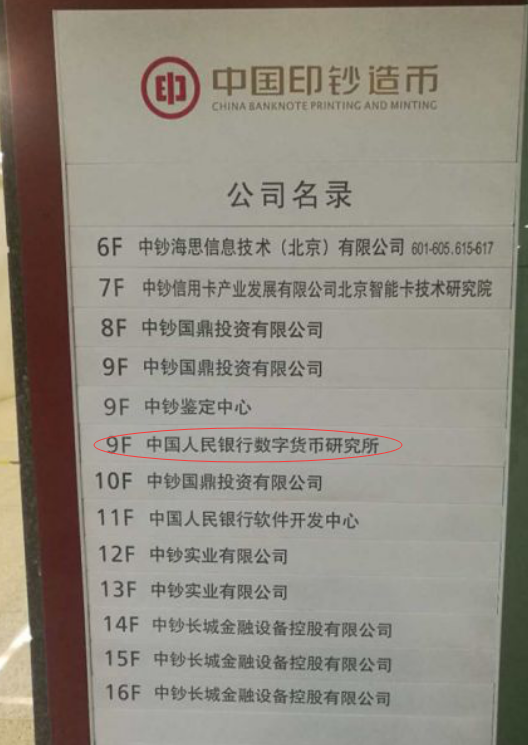

The Central Bank Digital Currency Institute was formally established in Beijing.

According to information released by the central bank, the Digital Money Institute is a research institution of the central bank that specializes in the technology and application of digital currency. The Patent Enquiry System of the State Intellectual Property Office learned.

September 4, 2017 Stop ICO

March 9, 2018

Zhou Xiaochuan, Press Conference on the theme of "Financial Reform and Development" at the 13th National People's Congress

– The Central Bank Digital Money Research Institute is cooperating with the industry to organize distributed R&D and relying on the cooperation with the market to develop digital currency. The research and development name used by the central bank is called "DC/EP", DC, digital currency, which is digital currency; EP, electronic payment, is electronic payment.

June 15, 2018

The central bank's digital currency research institute's foreign investment shows that it invested 2 million yuan in 2018 to set up Shenzhen Financial Technology Co., Ltd., which is currently the only financial technology technology development company wholly owned by the central bank digital currency research institute.

March 21, 2018

Zhou Xiaochuan G20 Finance Minister and Central Bank Governors Meeting

– Encrypted assets may trigger a series of challenges and problems, such as illegal transactions, money laundering and terrorist financing, which may affect the transmission of monetary policy. Currently, there is doubt about the supporting role of crypto assets in the real economy. China supports the issue of cryptographic assets and digital currency in the G20. Strengthen policy coordination.

June 14, 2018

Zhou Xiaochuan 2018 Lujiazui Forum

– Be wary of purely speculative cryptocurrencies, and finance must serve the real economy.

In October 2018, according to the official website of China Securities, Yao Qian, former director of the Digital Currency Research Institute of the People's Bank of China, officially became the deputy secretary and general manager of the China Securities Depository and Clearing Co., Ltd. After the former director Yao Qian went to the general manager of China Securities Depository and Clearing Co., Ltd., the director of the Central Bank Digital Money Research Institute has been vacant.

The position of director of the Central Bank Digital Money Institute has been vacant for 11 months. Mu Changchun became the second director after he took office.

November 18, 2018

Zhou Xiaochuan's 9th Caixin Summit

– Digital currency development may be paralleled by multiple schemes. Based on the distinction between the concept of digital currency by the Bank for International Settlements (BRS), the digital currency can be divided into the digital currency of the central bank, the digital currency of the private sector, and the digital currency of PPP (public-private partnership).

– Decentralization is not the core issue in the payment system and is still worth studying.

– The private sector can also participate in financial infrastructure services, such as payment systems and digital currency systems, but must have a public spirit.

May 8, 2019

Zhou Xiaochuan Tsinghua University Tsinghua Wudaokou Global Masters Lecture Hall

– If piloting digital currency, 100% cash provision should be considered;

June 18, 2019

Facebook launched the Libra coin, and the Libra white paper was officially launched! Sensational world! This day not only brushed the circle of friends, it is estimated that the central bank personnel also work overtime to have a meeting and discuss it? (It is said that people in the central bank’s digital currency research began working overtime in 996)

July 5, 2019

Zhou Xiaochuan Shanghai Jiaotong University Shanghai Senior Finance Institute 10th Anniversary

– Digital currency should consider the impact on the transmission of monetary policy, which is also a consideration for financial stability.

July 8, 2019

Mu Changchun issued a statement on Caixin.com that Libra must be included in the central bank's regulatory framework. Mu Changchun said that Libra created a convertible digital currency that flows freely across borders. The emergence and development of such stable currencies, whether from the perspective of monetary policy implementation or macro-prudential management, cannot be separated from the support and supervision of the central bank, as well as the regulatory cooperation between central banks and international organizations.

July 8, 2019

The launching ceremony of the Digital Finance Open Research Program and the first academic seminar

Wang Xin, director of the Central Research Bureau: The State Council has approved the central bank to organize the development of central bank digital currency. He also said that the central bank's digital currency will help improve the effectiveness of monetary policy, optimize the central bank's monetary payment function, and increase the central bank's monetary status and the quantity of money. At the same time, however, financial technology has increased the risk of financial disintermediation and brought about regulatory arbitrage risks. The next phase of the central bank may delve into issues related to encrypted digital currencies such as Libra

July 9, 2019

Zhou Xiaochuan China Foreign Exchange Management Reform and Development Seminar

– China can entrust a "commercial entity" to issue central bank digital currency. Hong Kong's monetary system allows "commercial entities" to issue banknotes backed by their private assets, from which China can gain experience.

-Libra indicates that there will be a more global and strong currency in the future. In the future, there may be a more internationalized, globalized currency, a strong currency that causes the major currencies to exchange relations with it. This thing is not necessarily libra, but from the trend of recent years, there will be many institutions and people trying to establish a currency that is more conducive to globalization.

July 9, 2019

Mu Changchun published an English commentary article in "Bloomberg", re-emphasizing that Libra must be included in the central bank's regulatory framework. Mu Changchun also said that Libra may cause exchange rate arbitrage and competing for printing in different currencies. It is necessary to let the renminbi convertible as soon as possible to resist the erosion of Libra.

August 2019

Mu Changchun recorded the course

As of August 4, 2019

The Central Bank Digital Currency Institute applied for a total of 74 patents involving digital currency

August 10, 2019

At the 3rd China Financial Forty Forum, Mu Changchun first announced the adoption of the “two-tier operating system” for the central bank’s digital currency, while claiming that the central bank’s digital currency is “out of the box”.

August 18, 2019

The Central Committee of the Communist Party of China and the State Council issued the "Opinions on Supporting Shenzhen's Pioneering Demonstration Zone with Chinese Characteristics", and mentioned the support for the innovative application of digital currency research and mobile payment in Shenzhen. China's legal digital currency shows signs of accelerating landing.

August 22, 2019

According to the overseas edition of the People’s Daily, the person in charge of the People’s Bank of China said in public that the digital currency system is under development and the “digital renminbi era” is coming.

August 10-12, 2019

At the third China Finance Forum for the Forty People, the Deputy Director of the Central Bank's Payment and Settlement Department, Mu Changchun, said that the digital currency research institute under the central bank began the development of the digital currency system as early as 2018.

August 27, 2019

Shenzhen Financial Technology Co., Ltd. (owned by the Central Bank Digital Money Research Institute), has released 33 job postings in Lagou.com, 18 positions related to technology, and also recruited products, design, marketing, sales, and risk compliance. , legal, human resources. In addition, blockchain architects, platform/mobile senior architects have salary levels of 50k-100k, and senior economists, senior operations engineers, senior technical experts, and security architects are paid between 40k and 80k.

This means that the timetable for the launch of digital currency is accelerating. In addition to digital currency, the field of financial technology is also an important direction for the central bank's digital currency research institute. Recently, the Shenzhen Institute of Financial Science and Technology under the Institute is intensively recruiting technical talents. The company's business scope includes financial technology related technology development, technical consulting, technology transfer, technical services; financial technology related system construction and operation and maintenance. Related listed company stocks rose!

September 4, 2019

Mu Changchun “acquired” the “Technology Finance Frontier: Libra and Digital Currency Outlook” paid courses on the knowledge payment platform, and the number of purchases has reached 25,130 (before the press release).

September 6, 2019

Mu Changchun, deputy director of the central bank's payment and settlement division, was appointed director of the Digital Money Institute.

Finally , Libra was mentioned. In Mu Changchun's research, there are mainly two words "hidden dangers", and the four words "have a huge hidden danger." Facebook's users of 2.7 billion, this huge base is enough to threaten the central bank's monetary policy and exchange rate policy, affecting the international monetary system. For Libra, an ambitious project, we see that our country's official is cautious to study and see it as “a potential world-class monetary change”, but if Libra is not included in regulation, it is a huge hidden danger. The asset reserve of its basket of currencies is not linked to a basket of currencies, so the stability of the currency cannot be achieved. Because it will be affected by fluctuations in the exchange rate between the currencies of the reserve assets, it will also be affected by fluctuations in market expectations, and Libra itself will generate sentiment and currency multipliers, which will involve a series of loans, debt scales, etc. problem.

In addition, Mu Changchun mentioned that it is also very important: Libra does not sell directly to the public, but authorizes dealers to sell. The association sells Libra to dealers, who then sell Libra to the public. Of course, this order is actually reversed. The dealer first collects the money and then buys Libra, which is the action of the dealer to buy Libra. Only then occurs at the top of the blockchain node. This is its two-tier technology and operating system. Facebook is like this, the responsibility of their anti-money laundering and anti-terrorism financing to the dealers and other institutions, including users, that is, what problems you go to the following dealers, because the user information is not mine.

Blockchain owner BlockChainer believes that the central bank's digital currency needs to complete the upgrade of the legal currency technology system. In this process, it needs to find a balance with commercial banks and existing mobile Internet head enterprises. Security and risk control are always the first, first the national currency. The security of the system, then the security of operations, the security of transaction payments, and finally the efficiency and convenience. How can we do in the history of world currency? The answer is almost over.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How does Vitalik evaluate Ethereum Eco-Privacy, DeFi and Ethereum 2.0?

- A picture to understand the world currency and market

- Is DeFi a flash in the pan? Fund big coffee Pomp believes that automation finance is the future

- ETH breaks the daily resistance and leads the mainstream currency

- 500,000 new ASIC mining machines are sturdy, BTC's entire network is breaking 100EH/S just around the corner

- What role should the IEO start in the second half?

- Viewpoint | The market is just around the corner, the bear market is coming to an end?