Ethereum token evolution: how will it develop in the future?

Author: Coin Metrics

Translation & Proofreading: Min Min & A Jian

Editor's Note: The original title was "Viewpoint | Ethereum token evolution"

In 2015, Ethereum ushered in a new era in the blockchain world: the era of tokens.

- Yesterday, 340,000 ETH on the Upbit exchange was stolen, but this server was attacked …

- Former Director of the Central Bank on Digital Currency, Blockchain Application and Fintech Development

- Opinion: "Patent thinking" may destroy China's blockchain industry, and open source is the trend

In a broad sense, "token" represents a utility or asset and is usually issued on a blockchain. In contrast, "coin" refers to a cryptographic asset that is native to a chain and is mainly used as currency ("coin" and "token" are common in some cases, but in the context of this article Is different). For example, BTC and ETH belong to the coin category, while MKR and BAT belong to the token category.

Before the birth of Ethereum, the concept of digital tokens existed in various forms. For example, "colored coins" can use BTC to tokenize an item without issuing a new asset. This process is called "coloring", that is, using the OP_RETURN opcode to mark a particular coin. Another way is to agree to use Satoshi (the smallest unit of BTC) to represent a certain asset in the real world.

However, Ethereum has adopted a completely new way to create tokens, which is more user friendly. With a simple smart contract, anyone can easily issue their own token on Ethereum.

Soon, thousands of tokens were released on Ethereum. With the skyrocketing types of tokens, it is urgent to solve the problem of token standardization to ensure that different types of tokens can be interchanged. ERC-20 implements a standard interface that can make transactions between different ERC-20 tokens easier and also make it easier for wallets and dApps to integrate ERC-20 tokens. In early 2018, ERC-721 was also adopted as a formal community standard, specifically to represent non-homogeneous tokens with digital scarcity (for example, a crypto cat or a unique cryptographic artwork).

Since then, the evolution of Ethereum tokens has continued to accelerate.

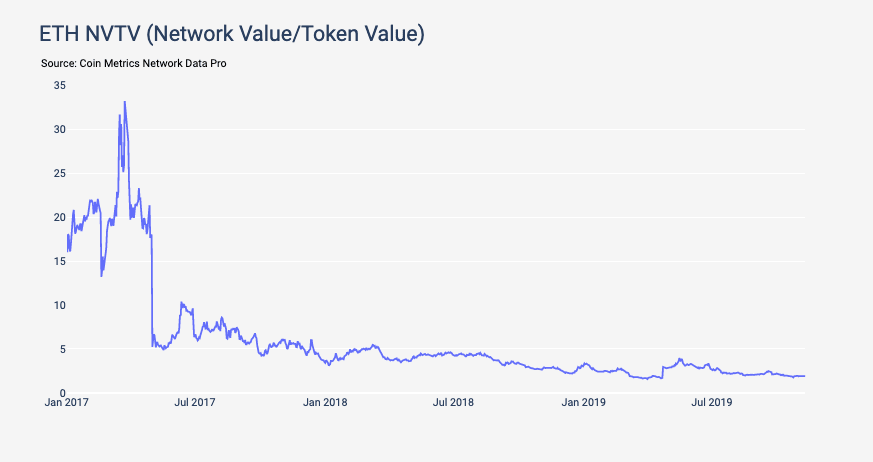

Total network value / token value ratio

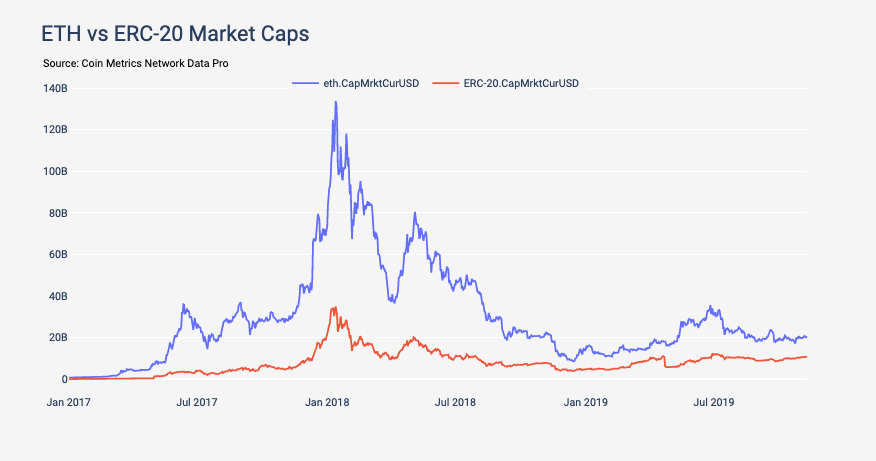

One way to measure the value of a token is to compare the market value of the native currency (ETH) on Ethereum with the total market value of all tokens published on the platform. As Chris Burniske proposed, we call it the "wide network value / token value (NVTV)" ratio.

We divide the market value of ETH by the total market value of several major mainstream ERC-20 tokens, which is worth this ratio. Although there are tens of thousands of tokens issued on Ethereum, we only select a few mainstream ERC-20 tokens to calculate the total market value. The specific list can be found in the footnote of the chart below.

Ethereum's NVTV ratio is steadily declining. On April 1, 2019, Ethereum's NVTV ratio dropped to 1.57, a record low. As of November 10, the ratio was 1.90.

ERC-20 assets: ant, bat, bnb, cennz, ctxc, cvc, dai, fun, gnt, gusd, ht, icn, knc, leo_eth, link, loom, gno, lrc, mana, mkr, omg, pax, pay , Poly, powr, ppt, qash, rep, salt, srn, tusd, usdc, usdt_eth, wtc, zrx

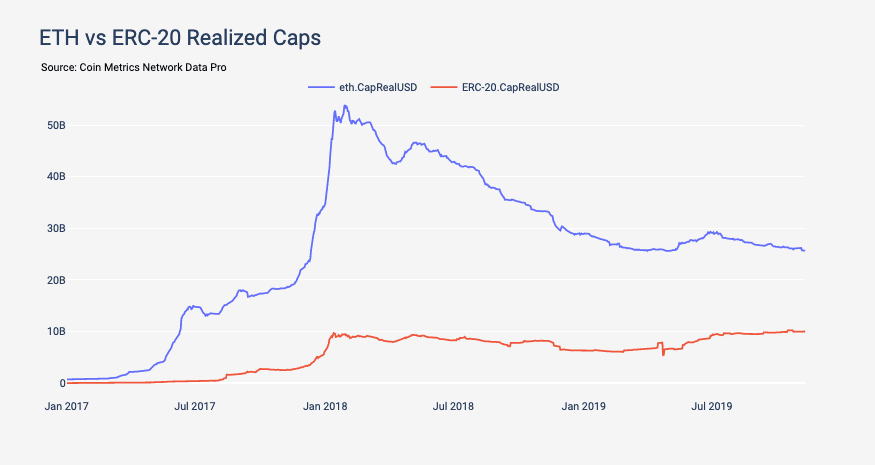

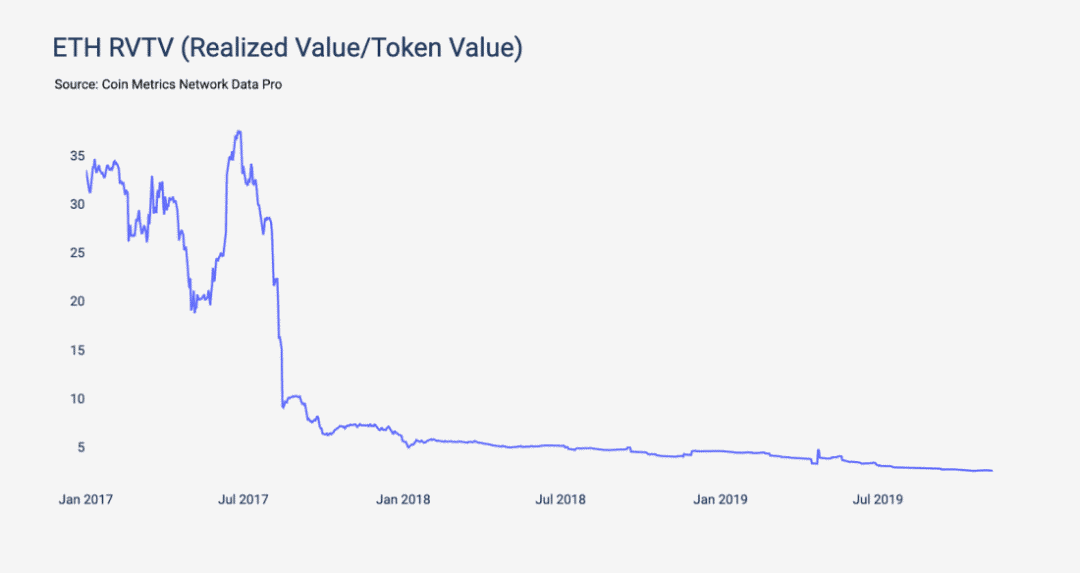

This situation is also reflected in the realized market value. Realized market capitalization is a measure proposed by Coin Metrics and is calculated based on the last changing price per unit of supply. In contrast, traditional market value is uniformly valued at current market prices. Realized market value can be used to measure the average cost base (cost base refers to the total amount of initial investment).

Judging from the realized market value, Ethereum's NVTV ratio has been steadily declining, and has now fallen to 2.57, a record low. It can be seen from the decreasing NVTV ratio that the ERC-20 token is steadily approaching ETH in terms of valuation.

Since mid-2018, this part of the growth has come mainly from a certain type of ERC-20 token: stablecoins.

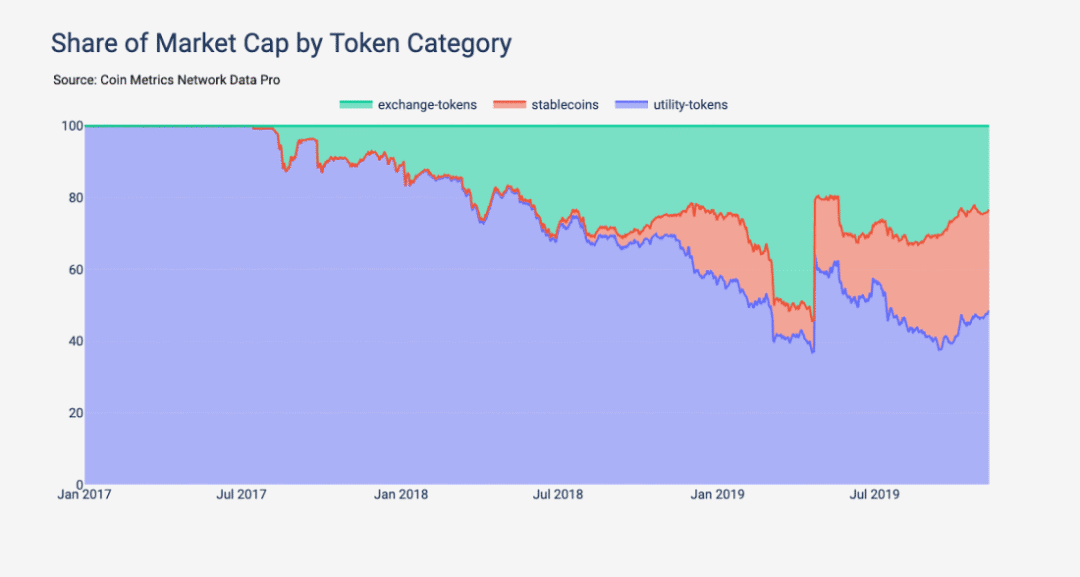

The following figure reflects the market capitalization of utility tokens, exchange tokens, and stablecoins. We use a simple method to abstractly classify these tokens; however, other classification methods can be used.

"Utility tokens" are a type of "ensure that buyers can use certain products in this network to fund the entire network (the definition is taken from BitcoinWiki)". Utility tokens are usually issued during the ICO boom, used to raise funds, as a payment method in the ecosystem, to obtain a certain service or function, or to participate in activities such as voting.

"Exchange token" is a type of utility token created by a digital currency exchange (such as Binance's BNB token). Exchange tokens are usually used to raise funds and used to deduct some transaction fees.

A "stable currency" is a type of token that anchors its value to another asset, usually a fiat currency such as the US dollar. By most measures, Tether is currently the largest stablecoin. Other stablecoins built on Ethereum include DAI, USDC, PAX, and TUSD.

Although the exchange token development momentum is strong in early 2019, BNB changed from the ERC-20 version to the mainnet version (Bin's own mainnet) in April, which caused the market value of exchange tokens on Ethereum to plummet.

On July 1, 2018, the total market value of utility tokens on Ethereum reached $ 7.52 billion, while the total market value of exchange tokens was $ 2.98 billion, and stablecoins were $ 109 million. As of November 10, 2019, the market value of utility tokens was $ 5.19 billion, the market value of exchange tokens was $ 2.55 billion, and the market value of stablecoins reached $ 3 billion, an increase of $ 2.8 billion over a year and a half ago.

The following figure shows the market share of each of the three types of tokens. For each category, the list of assets we have selected is shown in the footnote below.

Utility tokens: ant, bat, cennz, ctxc, cvc, fun, link, loom, gno, gnt, icn, lrc, mana, mkr, omg, pay, poly, powr, ppt, qash, rep, salt, sr, wtc, zrx

Stablecoin: dai, gusd, tusd, usdc, pax, usdt_eth

Exchange token: bnb, ht, knc, leo_eth

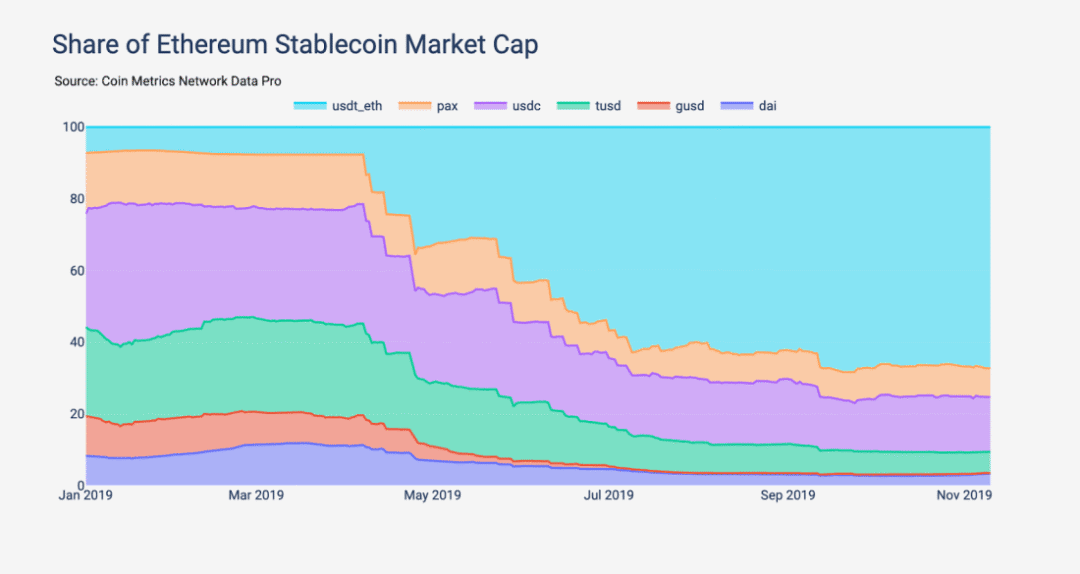

In addition, most of the growth comes from a stablecoin, Tether (USDT).

As we mentioned in the previous article on the state of the network, Tether is spread across multiple different protocols, the biggest two of which are the Omni protocol (built on the Bitcoin blockchain) and the Ethereum protocol. Over the past few months, Tether usage has shifted from a version based on the Omni protocol to a version based on the Ethereum protocol.

Transaction reversal

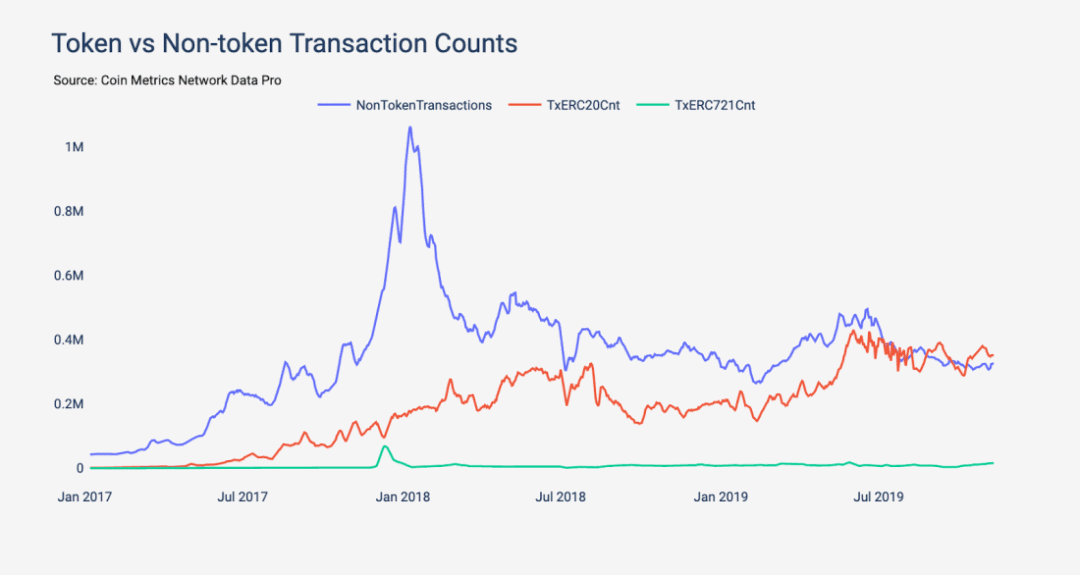

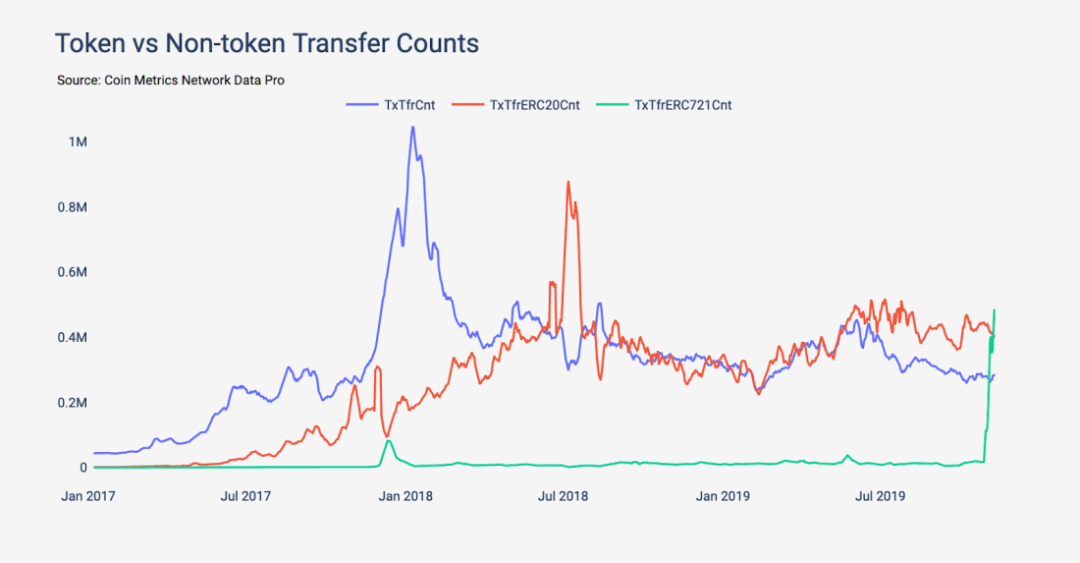

The total number of various types of token transactions on Ethereum has always been lower than the number of non-token transactions (that is, the total number of transactions minus the number of ERC-20 token and ERC-721 token transactions. The remaining transactions are mainly Are simple ETH transfers). However, since May 2019, token transactions have been outperforming non-token transactions. As of November 10, the daily number of ERC-20 token transactions was around 303,000, while the daily number of ETH transactions was around 290,000.

The following figure shows the number of ERC-20 token transactions (shown in red), the number of ERC-721 token transactions (shown in green), and the number of non-token transactions (total transaction minus ERC-20 token And ERC-721 token transactions, as indicated by the blue line), both use a 7-day rolling average.

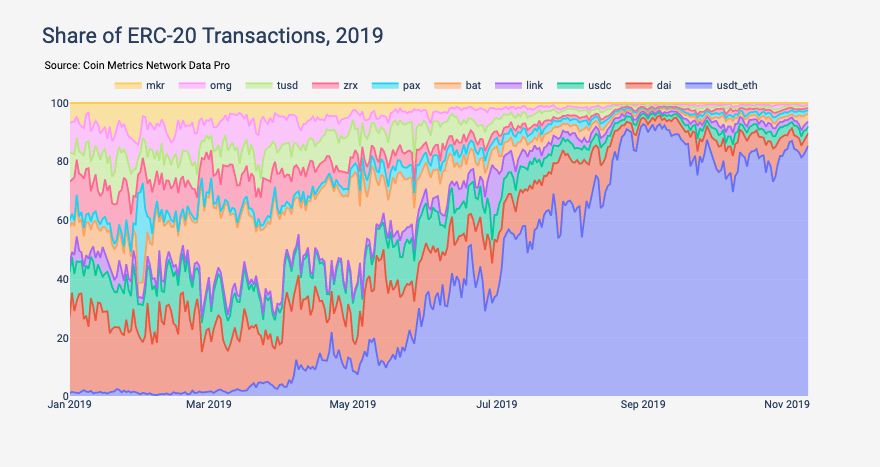

Many of the increase in the number of ERC-20 token transactions were brought by usdt. The following figure shows the market share of the top 10 ERC-20 tokens with the highest daily transactions in 2019 (calculated based on the 30-day average). usdt emerged in May, occupying 80% of the market share of the top 10 ERC-20 tokens.

ERC-721 rise

Although ERC-20 tokens have always been the main token type, ERC-721 tokens are on the rise.

As of the end of October, the number of ERC-721 token transfers had exceeded the number of ERC-20 token and ETH transfers. During the crypto cat boom at the end of 2017, the number of ERC-721 transfers reached a peak. In November, the number of ERC-721 transfers soared, exceeding the peak set by the crypto cat that year.

Compared to the number of transactions generated by each ERC-721 asset's actual trading activity, the total number of transactions reflected a slightly more comprehensive situation. Because each ERC-721 token is unique, many ERC-721 tokens are usually bundled together and then sent out through the same transaction. The figure below shows the number of ERC-20 token transfers (shown in red), the number of ERC-721 token transfers (shown in green), and the number of ETH transfers (shown in blue), all of which took 7 days Rolling average.

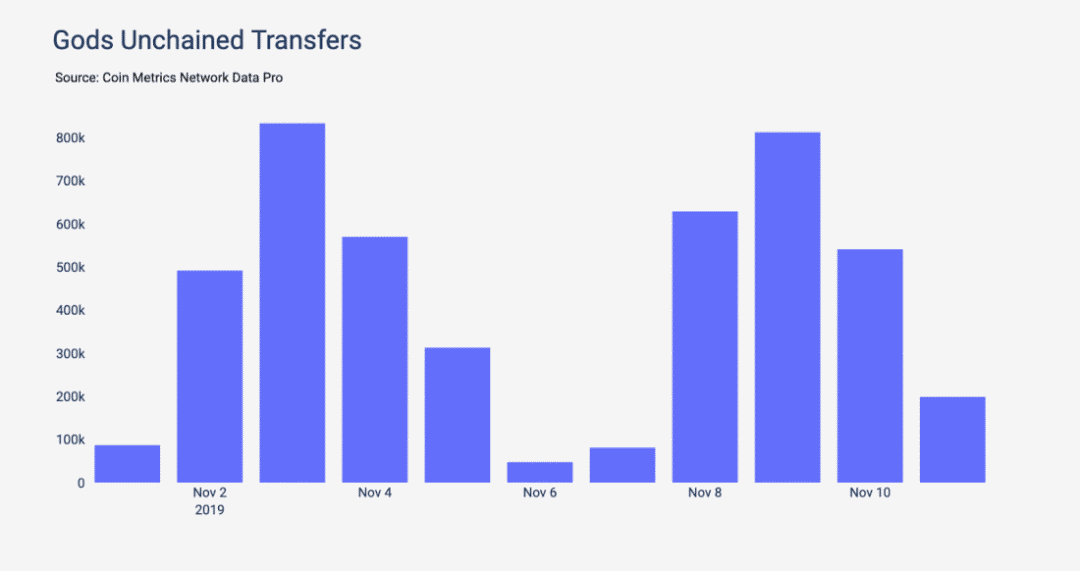

The reason why the number of ERC-721 token transfers rose sharply was mainly due to the card game "Gods Unchained" on Ethereum.

Gods Unchained is a trading card game similar to Hearthstone. Unlike Hearthstone, Gods Unchained is built on the Ethereum blockchain, and each card is an ERC-721 token. In other words, each user can truly own his or her own card and trade freely in the open market like other cryptocurrencies.

…

Although still in its infancy, Gods Unchained is one of the practical use cases for cryptocurrencies in the gaming industry. Players on the chain can control their assets in the game. In other words, their assets cannot be taken away or reviewed. There are many on-chain games using non-homogeneous tokens (NFT), and Gods Unchained is just one of them. NFT is also used in applications such as Ethereum Domain Name Service and on-chain games such as Decentraland, and various other types of games will emerge in the future.

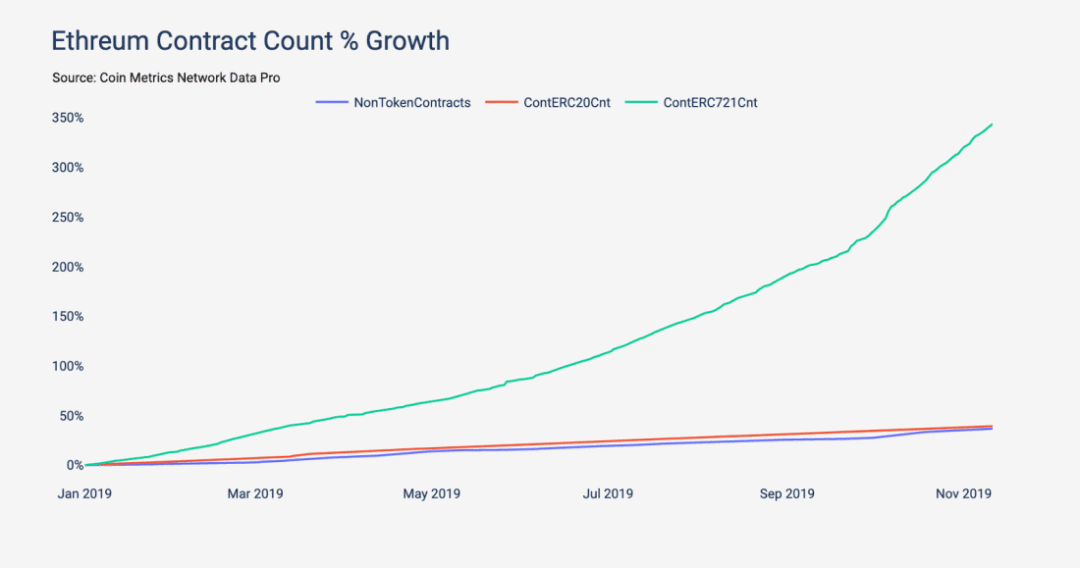

Although the number of ERC-721 contracts is still only 4,600, which is far less than the number of ERC-20 contracts with 184,000 (the number of non-token contracts also exceeds 12 million). The number of ERC-721 contracts is 2019 The year has witnessed rapid development. Since January 1, the number of deployed ERC-721 contracts has increased by nearly 350%, while the number of ERC-20 contracts and non-token contracts has increased by 39% and 36%, respectively.

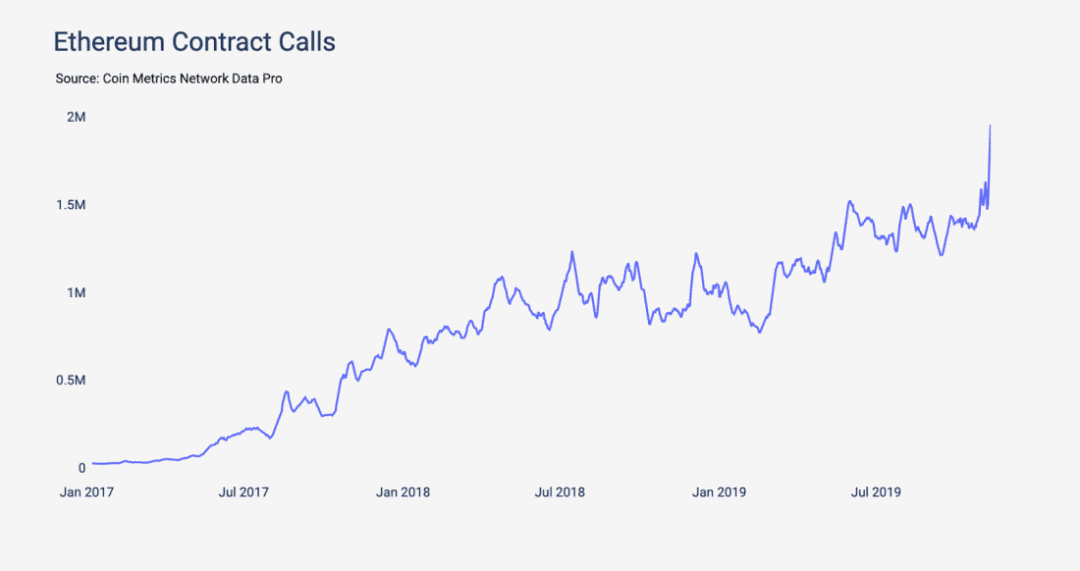

In addition, the overall usage of Ethereum smart contracts is growing. Ethereum contract call volume is steadily climbing, and recently reached an all-time high mainly under the influence of Gods Unchained. As the Ethereum smart contract economy continues to develop, tokens will become increasingly important throughout the ecosystem.

The following is a statistical table of the number of Ethereum contract calls based on the 7-day rolling average.

Ethereum tokens have developed tremendously in their short life cycle, and they are bound to change with further development. We will continue to pay close attention to the development of Ethereum's NVTV, stablecoin on Ethereum, and the development potential of ERC-721.

(Finish)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Ethereum Foundation: What is Phase 0 of Ethereum 2.0?

- Large-scale innovation of open financial applications on Ethereum, how does each application build this ecological space?

- Twitter CEO Jack Dorsey: Bitcoin's future will be in Africa

- Blockchain domain names: simpler, say goodbye to complex addresses

- QKL123 market analysis | Featured indicators show that Bitcoin price is undervalued (1128)

- Energy consumption is reduced by up to 100 times. University researchers propose new algorithms to rescue PoW mining with photonic chips

- Twitter will clean up inactive accounts, with Hal Finney an exception