Large-scale innovation of open financial applications on Ethereum, how does each application build this ecological space?

Author: Ivan Martinez

Translator: Unitimes_Louis

Editor's note: The original title was "Network Effects in Ethereum's Open Financial World"

As a vibrant and prosperous ecosystem, Ethereum has a network effect that promotes its exponential growth.

- Twitter CEO Jack Dorsey: Bitcoin's future will be in Africa

- Blockchain domain names: simpler, say goodbye to complex addresses

- QKL123 market analysis | Featured indicators show that Bitcoin price is undervalued (1128)

ETH as currency

Bitcoin, as a very simple design network, perfectly fits the concept of value storage. It is difficult for people to manipulate Bitcoin. Its main value comes from the fact that it is scarce and can maintain this strict scarcity regardless of the current geopolitical environment worldwide. Ethereum has a completely different monetary policy, which makes it more flexible and allows the use of Ethereum improvement proposals like EIP-1559 to submit more innovative changes.

Like Bitcoin, Ethereum is completely free of access and anti-censorship.It also has a complete decentralized application (dapps) ecosystem, which provides additional value and use. Some people may not understand how big this ecosystem is and its network effects. Most people probably only know ERC20 tokens that are mainly related to ICOs.

In fact, the large-scale innovations currently being conducted around open financial applications on Ethereum go far beyond ICOs with excessive speculation and worrying prospects . In this article, we will explore and outline this exciting ecosystem, and how each application builds and fills the space of that ecosystem.

The starting place—DAI

You may know that DAI is a stablecoin on the Ethereum network. If you don't know, I highly recommend you to read this article. A brief explanation: the price of ETH itself fluctuates violently, and what DAI provides to the ecosystem is stability. DAI is designed as a 1: 1 anchored dollar, which can serve as a stable guide price, which has never appeared on the previous Ethereum network. A huge benefit of DAI is that it allows applications on Ethereum to provide functions based on this widely accepted stablecoin, while still maintaining complete decentralization.

Having a stable coin that people trust on Ethereum makes this ecosystem expand in a way that has never been possible before! Although ETH can be used well as a currency, it is very difficult for a financial ecosystem to develop the ecosystem without any stable guide price.

What about stable coins such as USDT or USDC backed by reserves? Although these stablecoins can also function as stable guide prices, these stablecoins may also be controlled internally by their creators. This kind of control includes blacklisting or freezing transactions. If this kind of control is misused, it is simply terrible for dapps! Dapps cannot trust these stablecoins the same way they trust DAI, as this will mean that they need to trust the creators of these stablecoins to a large extent.

Currency flow via DAI

The phrase "currency flow" describes anything you can do with money. This means: (Relevant dapps are mentioned below, we will not study them for now)

- Consumption / Make Money-(Send Transaction)

Most people may have seen these currency flows, mainly thinking about cryptocurrency transactions and lending / borrowing. For most people, these currency flows are not much compared to those in the modern financial system.

But when you remove middlemen (such as banks or exchanges) from all these activities, some really amazing things happen. Recently, Compound's lending system has allowed us to see too many such things. When you lend your DAI in order to obtain a floating annualized rate of return of about 6%, not only you are earning interest, the Compound system that handles related operations actually also has the authority to delegate and transfer.

This allows members of the Ethereum community to simply lend their funds, and can provide additional funding for an organization or entity that needs funds without causing losses to both parties. You can easily lend your DAI for a short time! Once the required funds have been raised or you do not want to lend them any more money, you can easily withdraw all the funds you had when you started participating.

Imagine if banks were removed from the financial system and their profits were returned to users, rather than having users put their money in the bank and be exploited by the bank through currency inflation.

There are currently about 6.5 million knife positions in financial applications, thanks to DAI

There are currently about 6.5 million knife positions in financial applications, thanks to DAI

When it comes to DAI, I have too much to share. There are already a few in-depth economic analysis of DAI, you can read them here (I recommend that you understand how DAI works before diving into these articles).

The financial system in the open world

Now that we know the foundation of the stability of the Ethereum network, and how Compound provides loans / lending, let's see how each dapp on Ethereum works together with each other, generating network effects never seen before. This makes the so-called combinability or " currency lego ".

With the improvement of the user experience in the crypto space, we are beginning to see applications called " smart contract wallets ". Compared with standard wallets, smart contract wallets can give you more power to control your own funds, while maintaining the same or even better security.

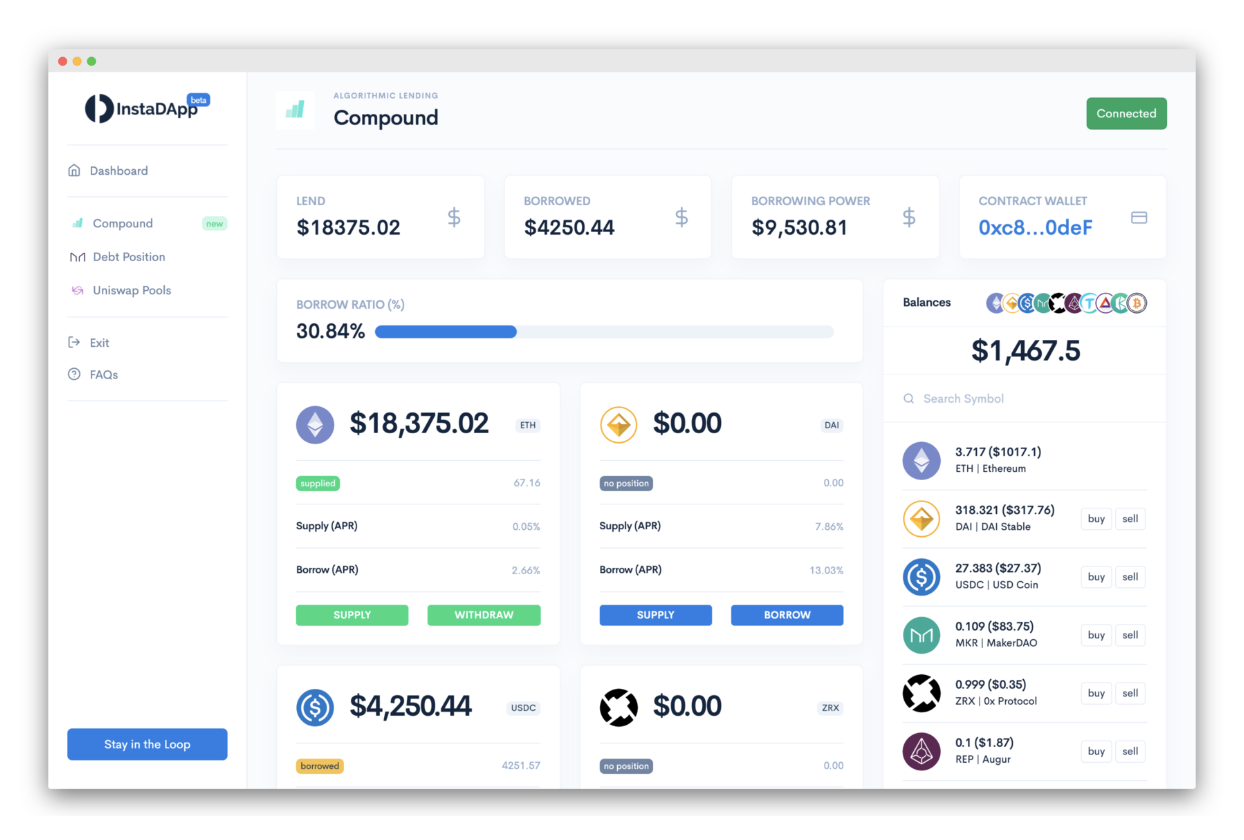

InstaDapp allows you to establish financial connections with the entire ecosystem through this platform

InstaDapp allows you to establish financial connections with the entire ecosystem through this platform

Applications such as InstaDapp and Argent are exploring a new way to connect many Ethereum dapps to each other in a non-sense way . For example, InstaDapp allows you to manage your MakerDao loans, Compound lending / borrowing, and niswap fund pools (these are currency flows) under the same layout, and it is usually compressed into one transaction instead of multiple transactions.

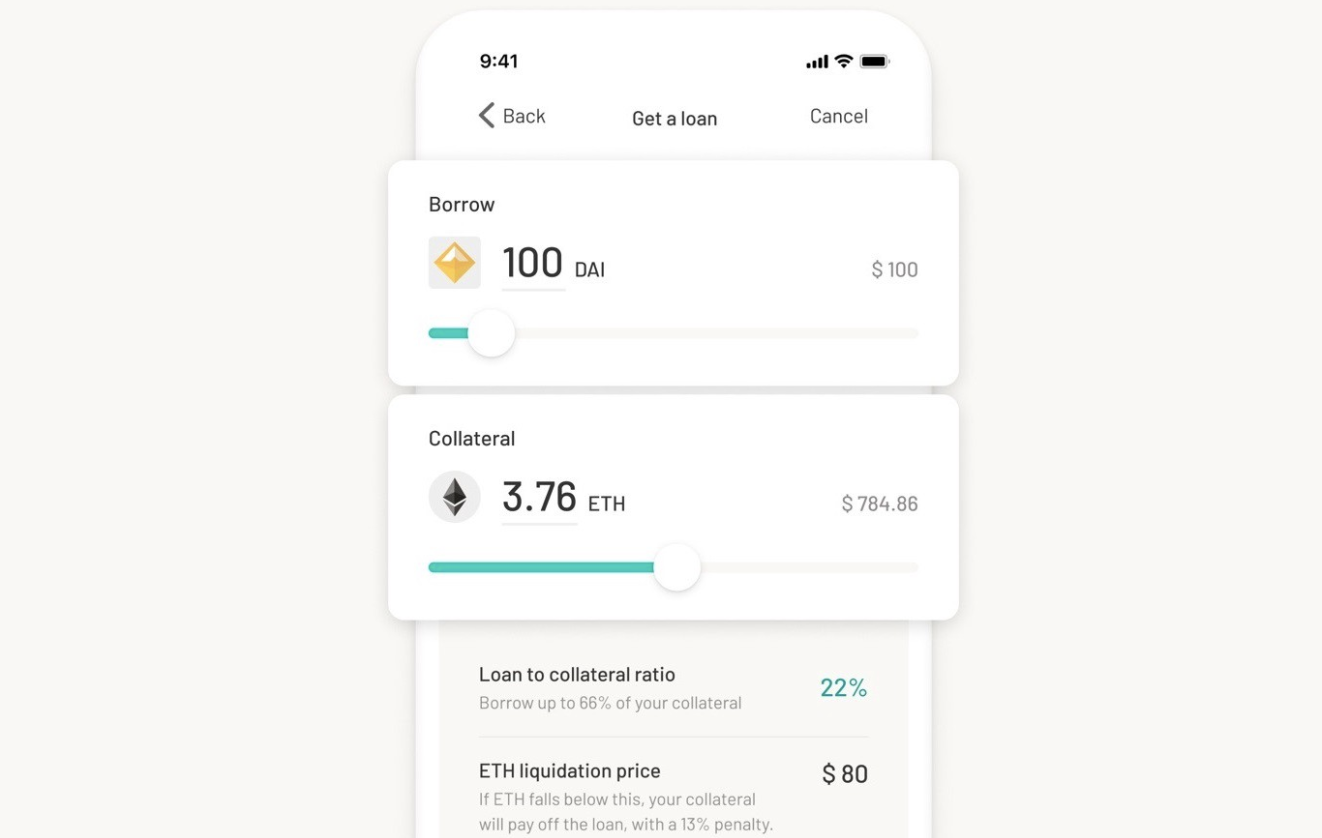

Argent is an easy-to-use application that allows users to easily interact with many dapps

Argent is an easy-to-use application that allows users to easily interact with many dapps

Argent (a mobile wallet) has a built-in exchange, and also supports the management of your Compound and MakerDao. They can operate in one transaction without fuel costs, and there is a user interface (UX) with a silky experience . So you can see how applications such as InstaDapp and Argent can abstract away the common complexities of dapps in different ways, making them more accessible and understandable.

Network effects of open finance

Now that you have seen how wallets simplify the complexity of dapps, let's look at how dapps interact with each other .

We start with Uniswap, one of today's leading decentralized exchanges (DEX). For those who haven't heard it yet, someone (note: the author refers to Uniswap founder Hayden Adams ) was inspired by a blog post by Vitalik in his mother's basement and developed Uniswap. After implementing a proof of concept, he submitted it to the Ethereum Foundation, received a $ 100,000 sponsorship from the foundation, and went live as the first programming project.

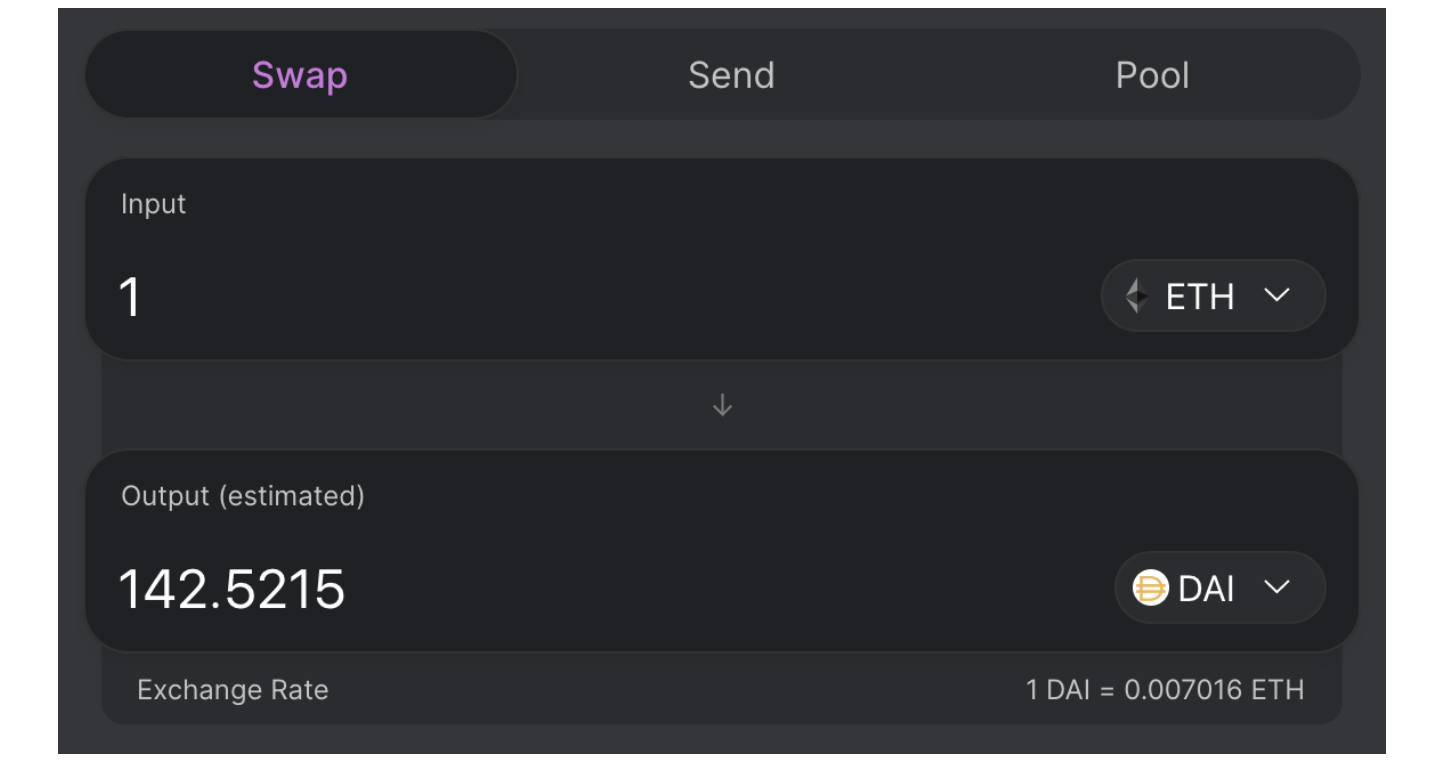

Trading with Uniswap

Trading with Uniswap

Today, Uniswap is a mainstream product in the field of decentralized finance that requires absolutely no trust and no one can manipulate. It supports trading pairs of any token, including DAI of course, and recently reached a transaction volume of $ 8 million! Although Uniswap receives the funding needed to create it, it does not charge a transaction fee! The only fee is charged by the user (aka market maker) who provides liquidity to this exchange.

As a reminder, there are many projects with similar functions to Uniswap, but none are as decentralized and open as it is, so Uniswap has risen to be the "mascot" of DEX.

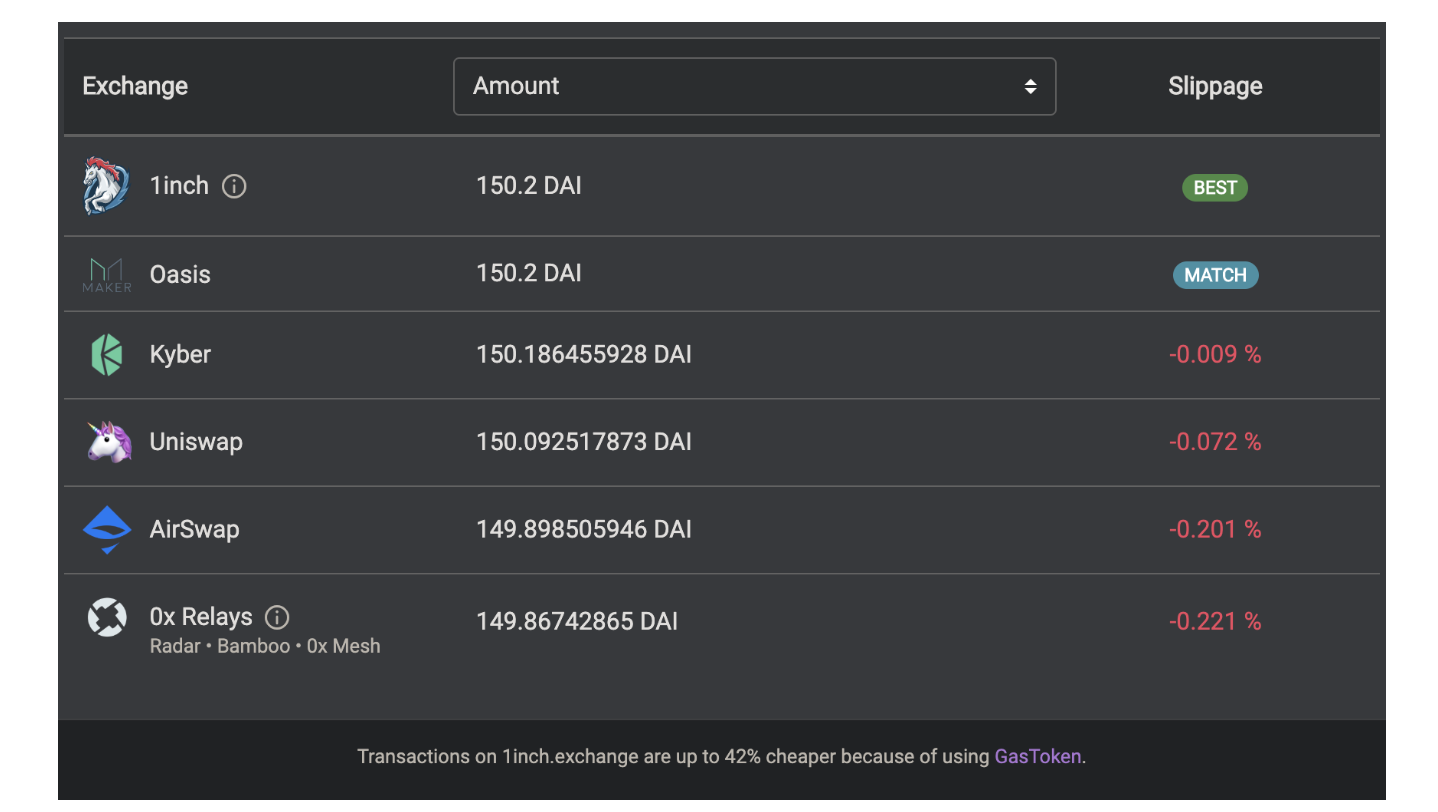

Also, one amazing result of the decentralized network effect we are seeing now is 1inchExchange, a hackathon project that acts as an aggregator for all leading DEXs. Aggregators are important because they not only provide liquidity to all the exchanges they use, but they also help all exchanges maintain similar prices.

1inch Exchange gives users all the best prices listed by DEX while making transactions cheaper

1inch Exchange gives users all the best prices listed by DEX while making transactions cheaper

Now, because Uniswap does have an ETH / USD trading pair (via DAI or USDC), we may be able to see other dapps on Ethereum use the ETH price on Uniswap as a method to monitor the current price. Currently, dapps on the Ethereum network cannot know the ETH price if they do not trust a service, so it is really good to use a decentralized price source.

We can also see that dapps like Set Protocol (Decentralized Fund Management Protocol) also use decentralized trading platforms such as Uniswap as a source of liquidity!

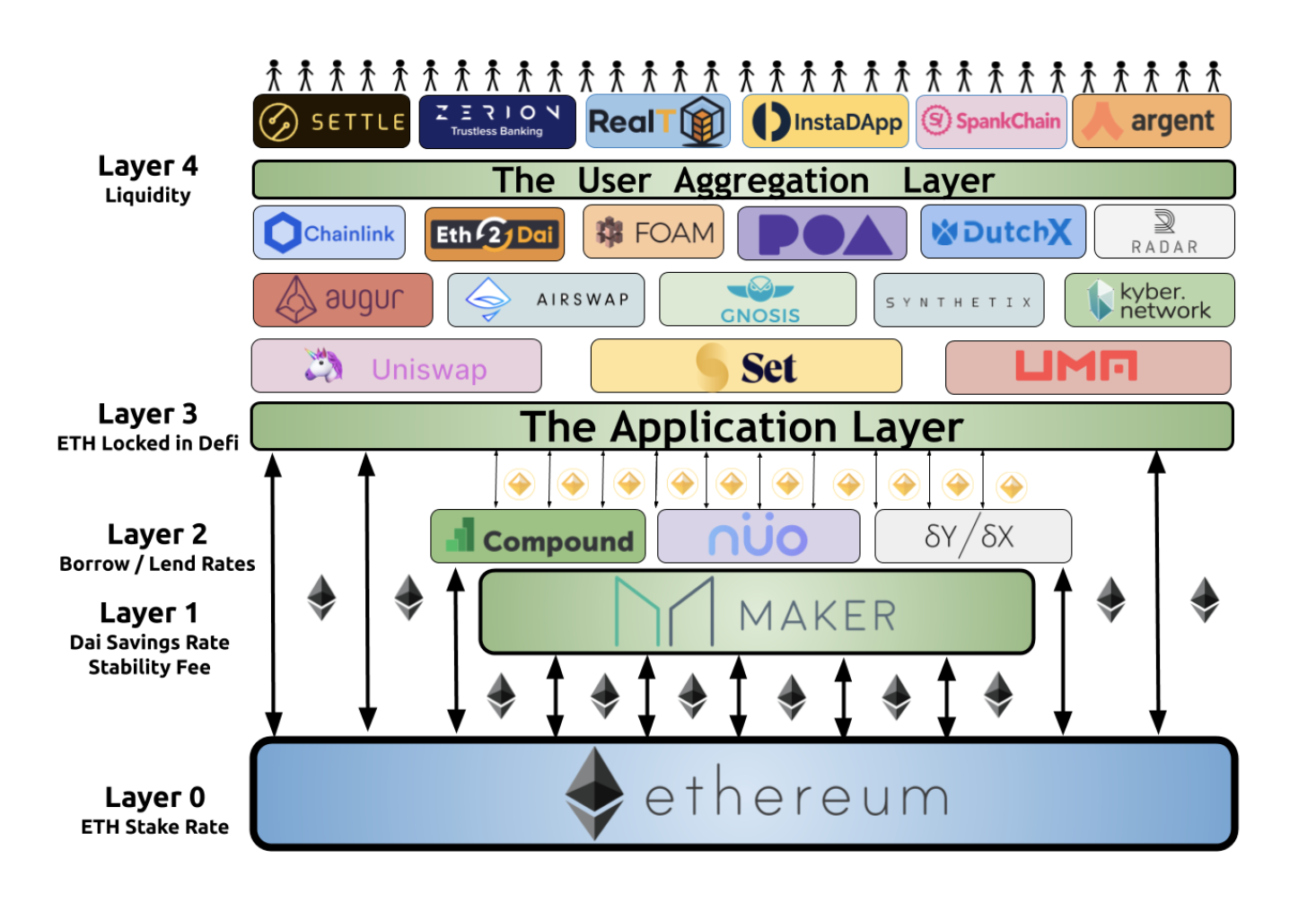

Financial system built on top of Ethereum

Financial system built on top of Ethereum

I hope you can see from the above picture how open finance on Ethereum is built based on other Ethereum applications.

MakerDao is built on Ethereum, with the goal of creating a stable layer with the help of DAI. Next, applications such as Uniswap, Set Protocol, and Compound use DAI to provide stable guide prices for value transactions, investments, and borrowing. Smart contract wallets such as Argent, InstaDapp, and Zerion directly eliminate the complexity of using dapps such as Uniswap directly, allowing these dapps to be used by anyone, anywhere, and provide additional features.

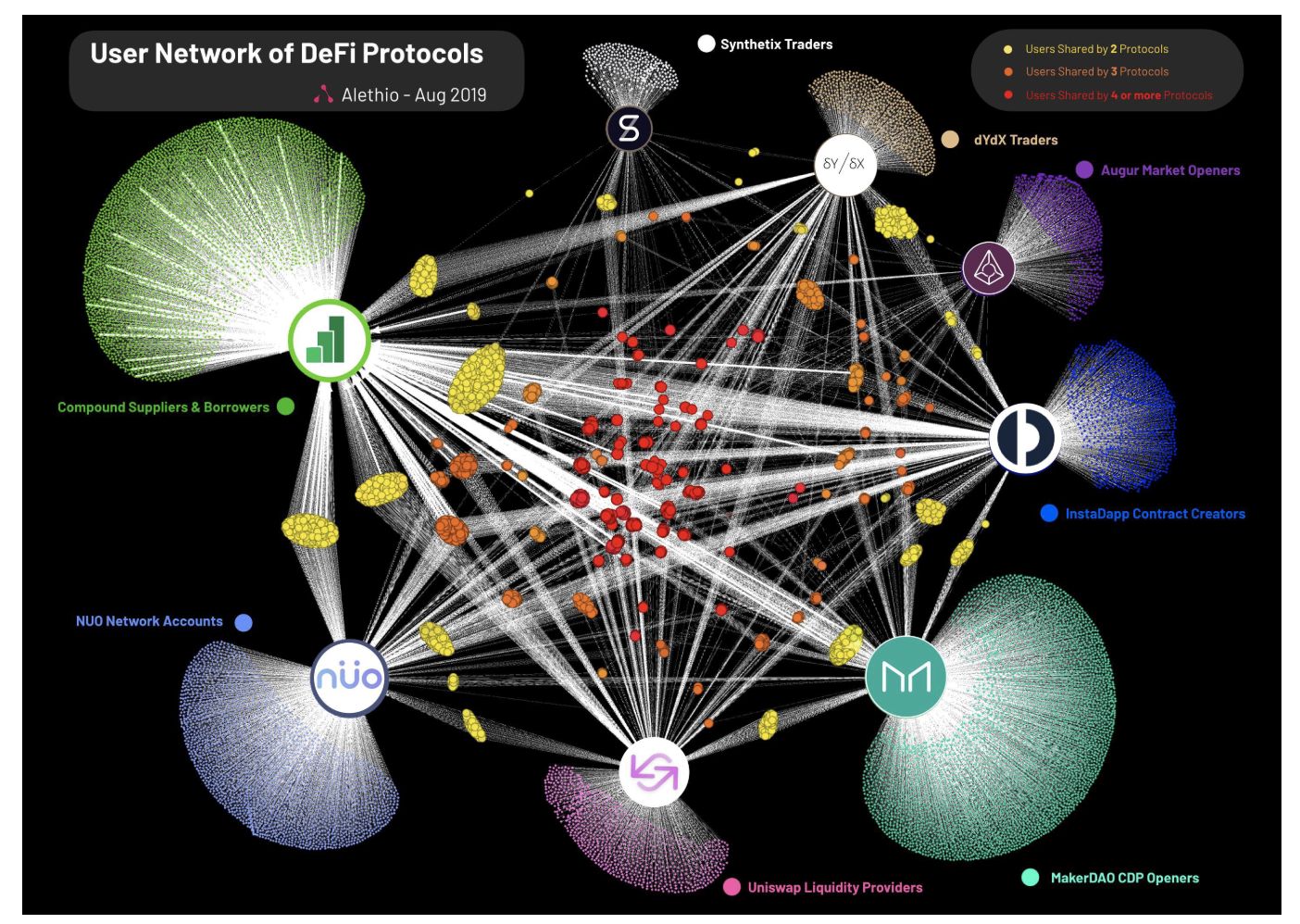

The image above by Messari shows how dapps on the Ethereum network interact with each other (as of August 2019)

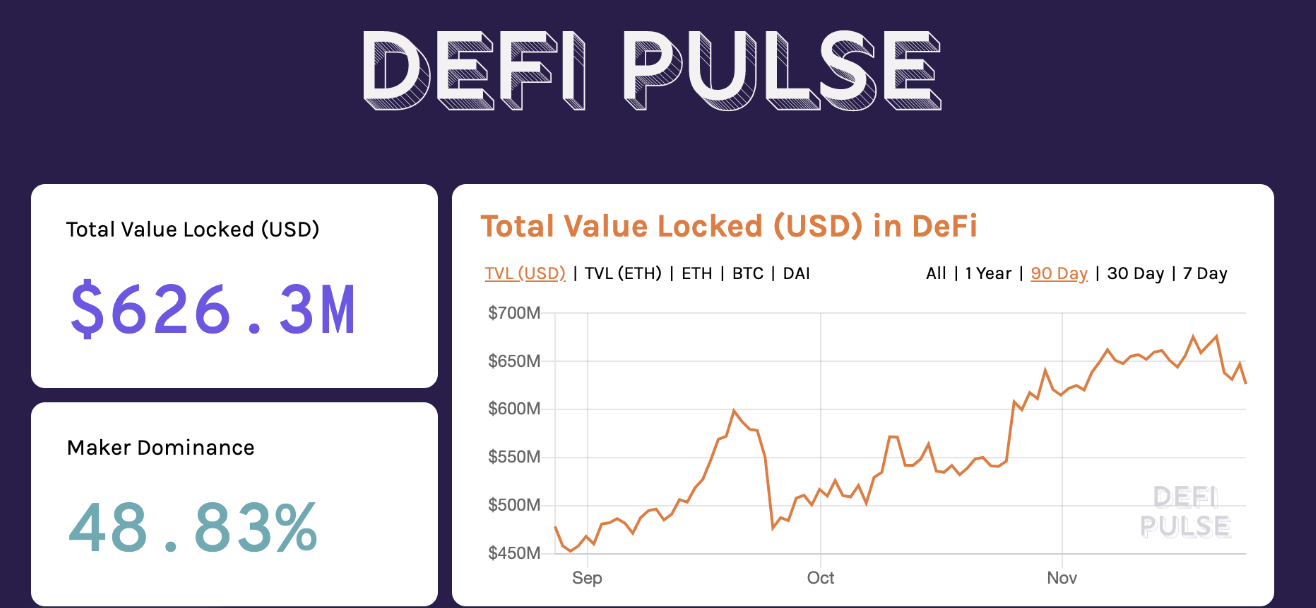

If you want to know how much these DeFi services are actually used, DefiPulse can take a look at all the top-level dapps. Since all these are financial applications in the same network, you can view the current network activity without restriction. Want to see Uniswap has uniswap.info, Want to see MakerDao has mkr.tools, MakerScan and daistats. Want to see loans have loanscan.

Hope you enjoyed this blog post, and if you liked it, please follow my team Prysmatic Labs on Twitter or me @ 0xKiwi_ .

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Energy consumption is reduced by up to 100 times. University researchers propose new algorithms to rescue PoW mining with photonic chips

- Twitter will clean up inactive accounts, with Hal Finney an exception

- Why is DeFi the second breakthrough in crypto history?

- Is a hardware wallet that uses Bluetooth to transfer data safe?

- European Central Bank board member: Globally stablecoin untested, may trigger risks in multiple policy areas

- Opinion: Can blockchain really save the debt economy?

- High-quality asset shortage, four-step analysis of whether digital assets are independent of traditional market conditions