Ethereum's Economic Bandwidth Theory: Billion Dollar Market for ETH

The demand for the Ethereum currency protocol is growing. In the past year alone, we can see that the total value of DeFi lock-in reached $ 700 million. (Blue Fox Note: Currently the total locked value has exceeded 1 billion US dollars)

Projects like MakerDAO and Compound utilize Ethereum's license-free financial infrastructure to create a new global financial paradigm. MakerDAO allows global access to stable value without trust. Compound opens the door to high interest income for people around the world.

What do they have in common? All of these monetary agreements require value without licenses and trust to fuel them. Where does the value come from? Not US dollars, nor Bitcoin, but ETH.

In short, ETH is the value without trust, which provides economic bandwidth for Ethereum's licenseless currency protocol.

- Bitcoin spending accuracy levels are improving

- Forbes: 5 major trends in blockchain and distributed ledger technology in 2020

- Interview with Babbitt 丨 Ten thousand bucks against the trend, focusing on supply chain finance

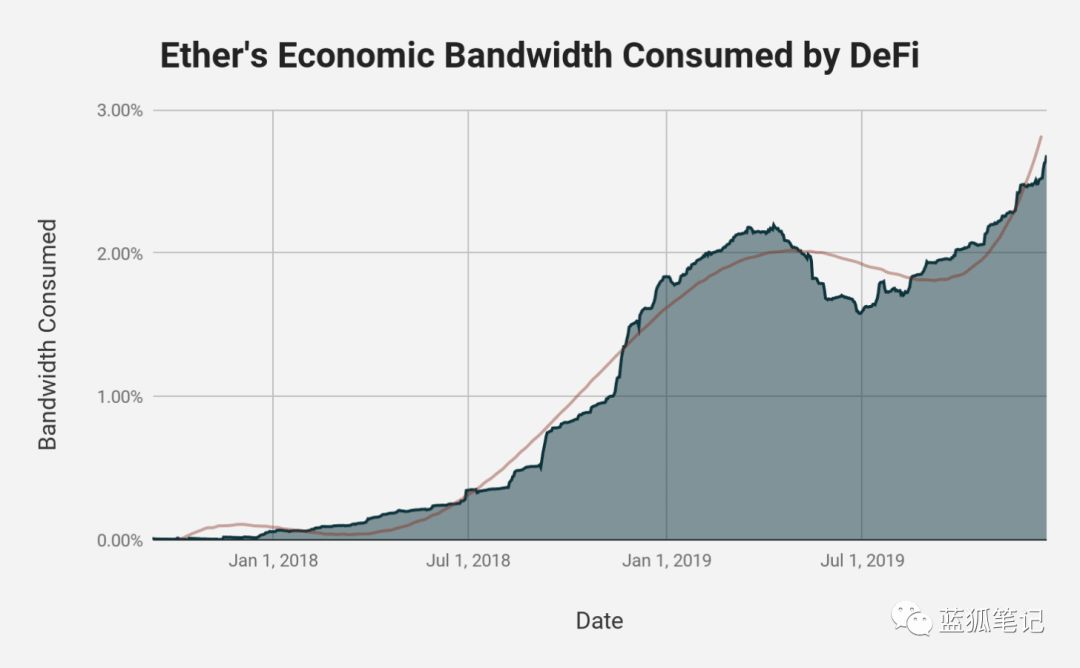

Over the past few years, these currency protocols have continued to consume more and more ETH economic bandwidth. By the second half of 2019, DeFi's consumption of ETH economic bandwidth has achieved substantial growth, and it is now consuming approximately 3% of the total ETH economic bandwidth.

In the new year, DeFi has locked 3 million Ethereum, accounting for about 2.7% of the total ETH circulation. (Blue Fox Note: The current locked amount is about 3.1 million ETH, which accounts for about 2.8% of the total circulation). In general, since the first outbreak in January 2018, DeFi has consumed ETH without the need for economic bandwidth Increasing. Although the ETH price is in a downward trend in 2019, the amount of ETH locked in DeFi is still increasing today.

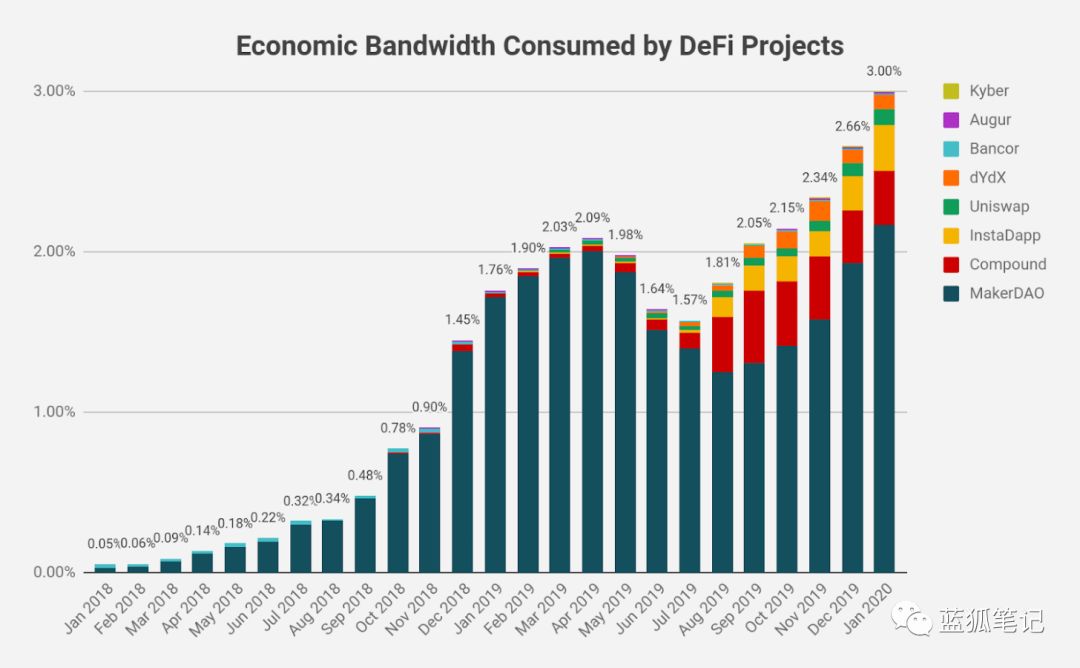

Projects competing for economic bandwidth

In early 2019, DeFi mainly consisted of two projects: MakerDAO and Bancor. Since then, dozens of new currency agreements have emerged, opening up their own niche markets in this area. Although MakerDAO continues to dominate license-free finance and consume 2% of the total economic bandwidth, we can see that demand from other lending agreements, derivatives, decentralized exchanges and DeFi products, for Ethereum Competition for economic bandwidth is becoming increasingly fierce.

We have seen the explosive development of Compound, Uniswap, and InstaDApp, which provide a license-free mechanism for lending, trading, and seamless asset management. All these projects are consuming the economic bandwidth that Ethereum does not need to trust. As of January 2020, Compound has consumed 0.34%, InstaDAPP has consumed 0.29%, and Uniswap has consumed 0.1%.

Synthetix, another license-free currency agreement, has also achieved phenomenal growth. It is a license-free synthetic asset distribution agreement built on Ethereum. Although the total locked-in value of the agreement is more than $ 160 million, it is omitted in this figure because it does not use the license-free value of ETH to collaterally generate synthetic assets.

Although the competition for ETH economic bandwidth is becoming increasingly fierce, we are only seeing the tip of the iceberg. As a historical comparison, THe DAO consumed $ 150 million worth of ETH in 2016. At that time, the total market value of Ethereum was $ 1.1 billion, that is, The DAO consumed 13.3% of the total economic bandwidth at that time.

Although the Ethereum community was in chaos at the time, this was an interesting benchmark that could be used to observe the consumption of ETH economic bandwidth by popular applications. If the unlicensed finance is a use case driven by the value of Ethereum, each large currency agreement can consume 5-10% of the total economic bandwidth of Ethereum to promote global finance, which is not impossible.

However, in order for ETH to successfully provide the world with license-free and trust-free financial services, it needs huge economic bandwidth to support it.

The importance of untrusted economic bandwidth

To build an economy without trust, you need value without trust. Only when there are encrypted native assets settled on a decentralized chain, can the value without trust be obtained. BTC and ETH can be viewed as untrusted assets in their respective networks.

The total flow value of these untrusted assets is the network's unlicensed economic bandwidth. In other words, the total economic bandwidth of Ethereum denominated in USD is the liquid market value of ETH.

Higher economic bandwidth is essential for Ethereum to achieve full financial success without licensing. The higher the economic bandwidth, the untrusted underlying assets of the network can drive more financial assets. If the value of Ethereum (calculated in U.S. dollars) increases by 10 times, then the ability of Ethereum to mortgage new financial assets will also increase by 10 times.

However, the total economic bandwidth of Ethereum is only 16.2 billion U.S. dollars. Therefore, Ethereum cannot even support the economy of a small country, let alone support the financial system of the entire world. (Blue Fox Note: The current total economic bandwidth of Ethereum has risen to more than $ 25 billion)

Potential market for economic bandwidth

Fortunately, there is no shortage of potential markets. The size of the global debt market is US $ 250 trillion, derivatives are US $ 542 trillion, and the stock market is close to the total value of US $ 90 trillion. The size of traditional capital markets is huge. So let's see if Ethereum is just the economic bandwidth needed to capture a small portion of traditional capital markets.

* DAI bandwidth requirements

MakerDAO smart contract leader Mario Conti has a goal to achieve a circulating supply of $ 1 billion by the end of 2020. (Blue Fox Note: Considering the current development speed of the DeFi market, this goal is not considered radical.)

Let us assume that this is true and that other factors within the system remain the same. MakerDAO's mortgage rate remains at around 250%, the ETH price remains at around $ 150 for the rest of the year, and the circulation supply is approximately 108 million ETH. In addition, in order to simplify the forecast, we assume that ETH is the entire composition of DAI mortgage assets.

In order for Dai to reach a circulating supply of 1 billion US dollars at the current price, it is necessary to lock up 15.34% of the total ETH at the end of the year in order to have sufficient economic bandwidth to achieve Conti's goal. This ratio is several percentage points higher than the peak of The DAO in 2016.

Now, let's assume that ETH has performed well this year. By the end of the year, the price could rise to $ 500, but still less than half of its all-time high. At the same time, it is assumed that the mortgage rate remains unchanged and is still about 250%. Then only 4.6% of the circulating ETH in the system needs to be locked, that is, about double the current 2% ratio. At the same time, the bandwidth consumption is the same as that of the current DeFi market Match.

* Let's talk about actual numbers

Ethereum's goal is to become an infrastructure that does not require financial licenses. A new, replaceable, digitally native financial system driven by the need to trust assets. Since Dai is stable ETH, it can be regarded as a basic exchange medium for non-licensed finance. In essence, we can consider the fiat currency market as a potential market for Dai.

What would happen if Dai served Argentina?

Now, let's assume that Conti's home country, Argentina, started to use Dai as the base currency for trading, and demand for the Argentine peso was declining. According to reports, Argentina's M1 money supply in October 2019 was $ 26.64 billion. M1 includes all easily disbursable assets and funds in the national economy, including physical currency and coins, demand deposits, traveller's checks and other deposits.

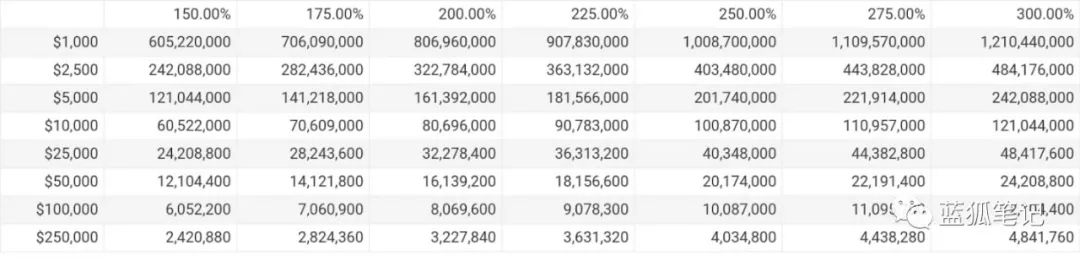

In view of the current situation of Argentina's financial system, let us assume that Dai has achieved great success and captured 51% of Argentina's M1 supply, which is 13.58 billion DAI in circulation.

Assuming the above mortgage rate and ETH price ($ 150) remain unchanged, then the MakerDAO system will need 226.4 million ETH lockouts (208.4% of total circulation) to supply 13.58 billion Dai. Given the plan for ETH issuance, this is obviously impossible. However, it does begin to show the importance of economic bandwidth.

The only realistic way that MakerDAO can provide so many Dais is to increase the economic bandwidth of ETH by orders of magnitude. (Alternatively, by using a larger percentage of trusted assets as collateral, but this would make Dai require permission)

Therefore, in order to provide sustainable economic bandwidth to become the basic exchange medium in Argentina, the price of ETH will need to reach a price between $ 2500 (locked to account for 12.5% of the total ETH supply) and $ 10,000 (locked Accounting for 3.13% of total ETH supply).

Given the corresponding ETH price and mortgage rate, the amount of ETH that needs to be locked in to reach 51% ($ 13.58 billion) of M1 supply in Argentina.

Given the corresponding ETH price and mortgage rate, the amount of ETH that needs to be locked in to reach 51% ($ 13.58 billion) of M1 supply in Argentina.

And this only counts Argentina.

Although from today's perspective, Dai's liquidity of 13.58 billion US dollars seems elusive, when you consider that the traditional capital market brings together trillions of dollars in value, this is actually just the future potential of the global financial system without permission a small part of.

Let's go one step further. In theory, Dai began to compete with the almighty dollar to make it a form of currency for global transactions. The dollar's M1 money supply reaches $ 4.034 trillion, assuming Dai can capture 10% of it, which can generate a supply of 403.4 million Dai.

Assuming a mortgage rate of about 250%, how much economic bandwidth does ETH need to provide to generate so many Dais? Even if the price of ETH reaches an all-time high of $ 1,400, 663.1% of the total circulating supply of ETH needs to be locked in order to provide sufficient bandwidth for 403 billion circulating Dai.

We need more economic bandwidth.

Assuming 46.42% of the total circulating supply is locked in MakerDAO, which is more than 3.5 times higher than the peak of the DAO in 2016, then the price of ETH needs to reach more than 20,000 US dollars in order to provide enough for the circulation of Dai of hundreds of billions of dollars Dai Economic bandwidth. If 18.75% of the total circulating supply is locked, the price of ETH needs to reach 50,000 USD to meet demand.

Finally, in order to keep the required amount of ETH locked in today's consumption rate range, assuming that it accounts for about 3.7% of the total economic bandwidth, then the price of ETH will need to exceed $ 250,000 to meet demand, and the total economy without trust Bandwidth (mobile market cap) can reach $ 27 trillion.

This is a 1665-fold increase from today's market value of $ 16.2 billion.

In view of the corresponding ETH price and mortgage rate, to reach 10% of the US M1 supply (403.4 billion US dollars), the amount of ETH that needs to be locked.

In view of the corresponding ETH price and mortgage rate, to reach 10% of the US M1 supply (403.4 billion US dollars), the amount of ETH that needs to be locked.

But wait, there's more …

We have just outlined MakerDAO, a currency-specific protocol for stable value without licensing or trust. However, there are dozens of emerging currency protocols that are competing for economic bandwidth and are targeting different potential markets.

Derivatives demand for economic bandwidth

The world's largest capital market today is the derivatives market, and as of June 2019, its nominal contract value has reached $ 640 trillion.

Let us assume that 0.1% of the global derivatives market can be absorbed by Ethereum's license-free finance in the future, that is, it can reach a nominal contract value of $ 640 billion.

So far, the mortgage rate of derivatives based on ETH collateral has not been tested in practice to a large extent. Therefore, we also need to assume the mortgage rate, and not only rely on circulating market data. With this in mind, we can make relatively fair assumptions based on the mortgage rates of different currency agreements in the market today. MakerDAO's average mortgage rate is 250%, while the average active mortgage rate of the derivative issue agreement Synthetix is 714%, and its mortgage asset is the native asset SNX.

Considering that in order to obtain stable and license-free value, derivatives are inherently more volatile than the MakerDAO system, and ETH is substantially more liquid than SNX, so we can assume that the mortgage rate of tokenized derivatives will be Located between 250-750%.

Therefore, let us assume that the underlying mortgage rate of a derivative contract collateralized by a liquid untrustworthy asset such as ETH is 350%.

If we want to make ETH-backed tokenized derivatives reach 640 billion U.S. dollars, then we need to lock in about 18.67% of the circulating ETH volume, then it needs Ethereum to provide a total economic bandwidth of 12 trillion U.S. dollars, and the ETH price Need to reach $ 100,000.

Going one step further, let us assume that Ethereum has captured 1% of the current derivatives market of 640 trillion U.S. dollars, and based on a 350% mortgage rate, and lock the same proportion of circulating supply (18.67%), then ETH It needs to reach $ 1,000,000 to provide sufficient economic bandwidth for the 6.4 trillion derivatives market.

* Economic Bandwidth Required by Synthetix

From today's numbers, we can imagine that Synthetix is almost impossible to successfully capture enough value through its native SNX alone to provide sufficient economic bandwidth for existing capital markets. The agreement will have to add other types of liquid mortgage assets to expand its economic bandwidth.

The agreement began to reach a capacity of more than 86% of its circulating tokens, which were used as collateral to generate synthetic assets. No more space is available for collateral, so the agreement must rely on the rise in SNX prices to expand its potential economic bandwidth. However, by adding ETH as a trustless collateral type, it can expand its total economic bandwidth by more than 100 times, allowing it to generate new synthetic assets.

In September 2019, the Synthetix community began to discuss the issue of adding ETH as a potential collateral type for the protocol. In general, given the above diagram and its impact on the economic bandwidth of the protocol, this is the obvious choice. (Note: It seems Synthetix is planning to add ETH to the mortgage asset type)

In short, once Synthetix adds more liquid and untrusted types of collateralized assets (such as ETH), it will be able to issue more assets.

To achieve this, the biggest thing the Synthetix community has to figure out is to consolidate its economic model for new collateral types and ensure that its value accumulates on SNX when issuing its synthetic assets with different mortgage assets through its protocols.

in conclusion

If Ethereum will create a new, alternative financial system that does not require licensing or trust, there will be no lack of demand for ETH as economic bandwidth in the future.

If you don't pay much attention to slow time, the next 20 years, the popularity of DeFi and permissionless finance will not be boring. Billions of people around the world can benefit immensely from today's financial system.

I hope this article can be used as a thinking exercise to understand the meaning of economic bandwidth without trust and the importance of the economy without trust. Of course, just like any other thinking exercise, the exact numbers should remain paranoid.

The main point here is that in order for a decentralized smart contract platform with native license-free and trust-free assets to provide the world with a license-free and trust-free economy, it requires its native assets to provide trillions of dollars of economic bandwidth. Today, no crypto asset (even all crypto assets cannot be combined) can provide enough economic bandwidth to meet this challenge.

With that in mind, there is still a long way to go before making meaningful progress towards the future of intermediary banks. It's long but exciting.

Risk Warning: All articles of Blue Fox Notes can not be used as investment advice or recommendations. Investment is risky. Investment should consider personal risk tolerance. It is recommended to conduct in-depth inspection of the project and make good investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Huang Qifan, Vice Chairman of China International Communications Center: Digitalization is disruptive, and blockchain technology solves the problem of digital economic infrastructure

- Bitcoin has risen by 40% in two months. How is this time different from the 2017 high?

- DeFi weekly selection 丨 "1 billion US dollars locked amount", "triple jump in deposit rates", the signal of the Ethereum bull market?

- Observation | Blockchain technology empowers epidemic prevention donations: how are Xiong'an Group and Alipay doing?

- Soaring 45% this year, Bitcoin broke another $ 10,000! "Half quotation" is expected to be hot

- Global government blockchain wrestling: digital currency is a fortress, China and South Korea lead government projects

- 40 banks apply for cryptocurrency custody service licenses, can Germany become the country of choice for the crypto industry?