Soaring 45% this year, Bitcoin broke another $ 10,000! "Half quotation" is expected to be hot

Source: Brokerage China

Author: Wang Junhui

In the face of greater uncertainty in the global capital market and commodity markets, since the Spring Festival holiday, the currency circle has seen a "Little Spring". After a few months of silence, Bitcoin has begun to attack again and The rise is more rapid.

Based on the price of GATE.IO, on January 3, the price of bitcoin dropped to US $ 6,875.93, and subsequently opened an upward channel, quickly breaking through the two major thresholds of US $ 7,000 and US $ 8,000. On January 27, the price rose and accelerated after breaking through 9,000 US dollars. After briefly hovering around 9500 and 9800, it broke the 10,000 US dollar mark on February 9 at around 11:00 am. The quoted price was US $ 10,105 as of press time, an increase of more than 45% from the end of December.

- Global government blockchain wrestling: digital currency is a fortress, China and South Korea lead government projects

- 40 banks apply for cryptocurrency custody service licenses, can Germany become the country of choice for the crypto industry?

- Fighting the new crown, the blockchain is late: Blockchain anti-epidemic application report

In fact, the price of Bitcoin in this market is not unique, and its rise and fall have the meaning of a wind vane. The strengthening of the price has driven the overall market to pick up.

Mainstream currencies such as BCH, ETC, EOS, and RXP have all become popular, and platform currencies such as BNB and HT have also risen collectively. Even many altcoins that have been silent for a long time seem to be "back to life", and some even pulled up more than 10%. According to rough statistics from Chinese reporters of the securities firm, in the USDT trading area of the GATE.IO platform, 10 currencies have increased by more than 20% The highest gain in altcoin SMT was 66%.

The market has generally expected this round of rise, and the logic behind it is very clear. On the one hand, halving the output of bitcoin will cause prices to rise. From past experience and logic, this has formed a relatively broad "consensus" in the currency circle. On the other hand, the current attributes of Bitcoin “digital gold” and “hedged assets” are increasingly recognized. Under the circumstance that global uncertainty risks increase and the market is generally sluggish, some inflows of hedging funds, No doubt it will drive prices up.

At the same time, the booming prices have caused IEO and other activities to rise. The booming market is accompanied by increased volatility, and investors need to pay close attention to risks.

Bitcoin breaks 10,000 yuan mark again, "halving the market" is expected to be hot

On February 9, the multi-platform bitcoin price quote broke the $ 10,000 mark, the first time since October 26 last year. The rally has lasted for almost a month. On January 3, the price of bitcoin dropped to a low of US $ 6,875.93, and then opened an upward channel, quickly breaking through the two major thresholds of US $ 7,000 and US $ 8,000. On January 27, the price rose and accelerated after breaking through 9,000 U.S. dollars. After briefly hovering around 9500 U.S. dollars and 9800 U.S. dollars, it broke the 10,000 U.S. dollar mark on February 9 at around 11:00 a.m. The quoted price was US $ 10,105 as of press time, an increase of more than 45% from the end of December.

In fact, the market has generally expected this round of rise, and the logic behind it is very clear. On the one hand, halving the output of bitcoin will cause prices to rise. From past experience and logic, this has formed a relatively broad "consensus" in the currency circle. On the other hand, the current attributes of Bitcoin “digital gold” and “hedged assets” are increasingly recognized. Under the circumstance that global uncertainty risks increase and the market is generally sluggish, some inflows of hedging funds, No doubt it will drive prices up.

Bitcoin halving means that the rewards received after producing new blocks are halved approximately every four years. This means that after halving, for each block produced, its corresponding Bitcoin reward is only half of the reward before halving. After Bitcoin came out in 2009, it rewarded 50 Bitcoins for each block mined. According to the rate of block production, the reward was halved about every 4 years, and the total amount was always 21 million.

Currently, Bitcoin has been halved twice, in November 2012 and July 2016, respectively. The third Bitcoin halving time is expected to occur in May 2020. At that time, Bitcoin will be halved from the current 12.5 to 6.25.

According to Satoshi Nakamoto's setting, a block will be produced in the Bitcoin blockchain network in about 10 minutes, and a certain amount of Bitcoin will be continuously mined. According to the setting, for every 210,000 blocks mined, the number of Bitcoins rewarded for mining blocks is halved by one. This is believed to be effective in gradually reducing Bitcoin's inflation rate and thus preventing hyperinflation. This is considered to be one of the biggest differences between the issuance of "digital currency" and fiat currency on the blockchain, and one of its most popular mechanisms.

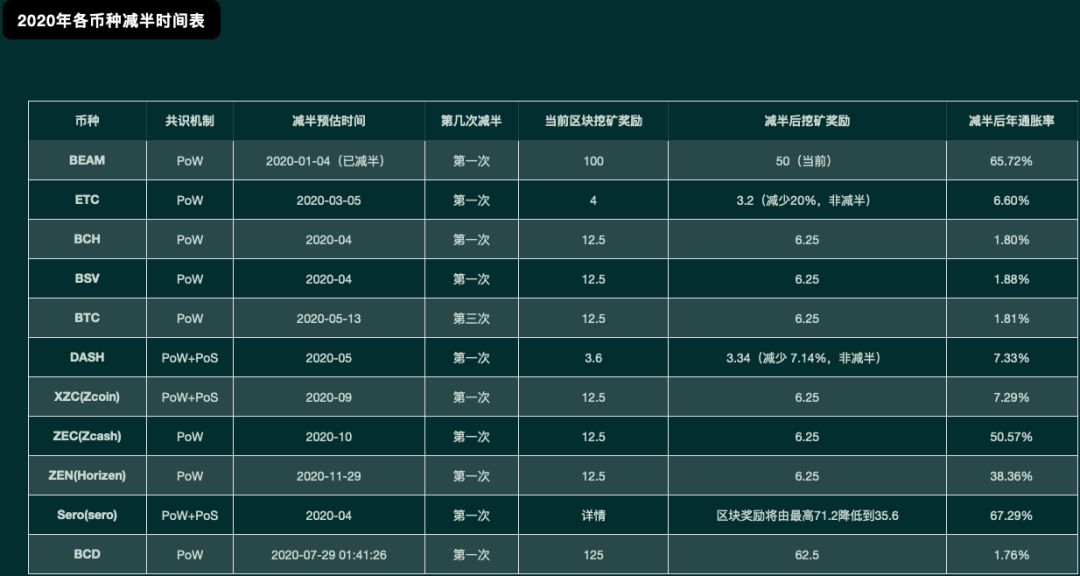

In addition to Bitcoin, many currencies will also have a "halving period" this year.

Source: gate.io website

The reason why the market expects the halving market is very high. On the one hand, it is because after a halving occurs, the output of bitcoin will decrease sharply within a certain period of time, and the difficulty of mining will also increase. On the other hand, because the first two Bitcoin halvings have indeed brought a bull market, most participants have high expectations for this "good".

"It is clear that the main reason for the promotion of this round of market is halving." Digital asset contract analysis tool contract Emperor CEO Du Wan analyzed the Chinese reporter of the securities firm. Since December 18, BTC has risen from Huobi 6,333 USD. To $ 9,700. The shock rose for 50 days. The ETC is about to be cut from 3.4 USD to 13 USD, and the BSV that is about to be halved rose from 75 USD to 455 USD at the highest level, and it is still around 360 USD. BTC will also be halved in May.

"Before this round of rally, BTC fell from US $ 14,000 to US $ 7,000. The bearish sentiment on the market was strong, and the expectation of halving fell again and again. It again verified that market sentiment is also a reference for the market. One more interesting thing, this round The rise breaks the rule that BTC will fall in the first month before the Spring Festival. "Du Wan said.

Can we stand the 10,000 mark this time?

This is the fourth time that Bitcoin has hit the $ 10,000 mark.

After the first three bitcoins exceeded 10,000 US dollars, they all fell back significantly within a few months. Under the influence of the expected halving, we still need to put a question mark on whether we can stand firm.

A number of people in the industry interviewed by Chinese reporters from brokerage firms said that despite the long-term optimism about the price of Bitcoin, there will be frequent shocks around 10,000 US dollars, and short-term fluctuations will be relatively large.

OKEx analysts believe that there is still about 3 months before the time point for bitcoin production reduction, and market expectations and speculation have just begun. In the next 3 months, we need to pay attention to two important points. One is the price level of 10,000 US dollars. The Bitcoin price will have multiple repeated callbacks before it reaches this position, with large fluctuations. The second is the price level of 15,000 US dollars. In the bull market, the price of bitcoin failed to break through this price level, and the current rise of $ 15,000 is expected to have a sharp shock.

Du Wan believes that the first quarter of 2020 will be a good rising cycle for BTC. The current short-term disk market, near 10,000 is an important chip trading area, BTC has also reached weekly on-line. According to the contract emperor's big data, the four major futures exchanges hold more than 3 billion funds. Among them, BitMEX positions exceeded 1 billion U.S. dollars.

"Historically, every time BitMEX's position reaches 1 billion U.S. dollars, a waterfall is triggered after a period of time? What will happen this time? It remains to be seen." Du Wan said.

As an alternative asset, bitcoin has the title of "digital gold". Its proponents believe that because its total amount is only 21 million, bitcoin can resist inflation as well as gold and has a hedging property.

This view is not without foundation. Unlike other mainstream assets such as stocks, futures, bonds, and commodities, which are greatly affected by the external environment, since the birth of bitcoin, its price trend has been relatively independent. Excluding the impact of several major direct policies, the rise and fall have become their own. If you look at the absolute price, compared with the price of a few cents at the beginning of the birth, it is incomparable, and it has maintained a good upward trend over a longer time span.

Marija Veitmane, senior diversified asset strategist at State Street, said gold and bitcoin prices are rising because investors don't seem to believe the stock market rebounded last year. Bitcoin, like gold, benefits from the fact that interest rates are low (or in some cases negative). Historically, Bitcoin, gold and other cryptocurrencies, and precious metals have performed well when investors bet that the value of large government-backed currencies will fall.

"The market has a new consensus on the weak dollar." Wittman said that Bitcoin and gold may continue to perform well as safe-haven investments.

Compared with the recent performance of asset prices in global markets, the above view seems to be corroborated. After four consecutive gains, U.S. stocks postponed the upward pace. As of the close of February 7, the Dow fell more than 270 points, a drop of 0.94%, the Nasdaq fell 0.54%, and the S & P 500 index fell 0.54%. The three major stock indexes in the European market closed collectively. The British FTSE 100 index fell 38.09 points, or 0.51%, to close at 7,467.70 points. The German DAX index fell 0.45% on the 7th. The French CAC40 stock index fell 0.14%. Brent crude futures fell $ 0.46, or 0.84%, to $ 54.47 per barrel.

At the same time, the price of gold rose, and the most active April gold futures price on the New York Mercantile Exchange gold futures market rose by 3.40 US dollars, an increase of 0.22%, to close at 1,573.40 US dollars per ounce. The Chicago Exchange (CBOE) volatility index VIX, known as the "panic index," fluctuated greatly, indicating that risk aversion is heating up.

With the frequent occurrence of various "black swan" incidents, this feature of Bitcoin has begun to receive more attention, especially its risk aversion properties have been hotly debated, and the attitudes of mainstream financial institutions such as Wall Street have also undergone subtle changes. Began a formal layout in the field of cryptocurrencies.

Fidelity Investments, a subsidiary of Fidelity Digital Asset Services in October 2018, is committed to providing comprehensive enterprise-level services for the security and transactions of digital assets such as Bitcoin, and to provide institutional investors with new encryption Currency related products. Last December, the company's president, Tom Jessop, stated that the company has done a lot of work on ETH and intends to support Ethereum in the new year at the request of customers. Fidelity is in talks with many traditional institutions to launch Bitcoin as an entry-level product to institutional investors.

In November last year, a report from Grayscale Investments, the largest digital currency fund, revealed that although the price of bitcoin fell by -23.3% during the same period in the second quarter of the year. But in the third quarter of 2019, the grayscale Bitcoin Trust Fund experienced the largest quarterly capital inflow of the product in six years ($ 171.1 million).

The report shows that on the entire platform of grayscale, the inflow of funds denominated in US dollars reached the highest level in the third quarter of 2019, reaching 254.9 million US dollars, an increase of more than 200% from the 84.8 million US dollars in the second quarter of 2019. Institutional investors represented by hedge funds are still a strong driving force for gray capital inflows, of which 84% comes from institutional investors.

Market rises, IEO needs to be wary

According to CoinMarketCap statistics, at present, the overall market value of digital currencies is about 276 billion U.S. dollars, and the market value of Bitcoin accounts for over 64%. The total market value of virtual currencies is close to the Bitcoin price curve.

However, compared with the previous bull market, this time the market is not a standout for BTC, but has driven the market to rise.

Mainstream currencies such as BCH, ETC, EOS, and RXP have all become popular, and platform currencies such as BNB and HT have also risen collectively. Even many altcoins that have been silent for a long time seem to be "back to life", and some even pulled up more than 10%. According to rough statistics from Chinese correspondents of the brokerage firm, in the USDT trading area of the GATE.IO platform, 10 currencies have increased by more than 20%. The highest gain in altcoin SMT was 66%.

It is worth noting that recently, platform currencies such as BNB, HT, and GT issued by various digital currency trading platforms have increased significantly. Among them, the price of OKB issued by OKEx has increased by 22.41% in the past 7 days, and BNB7 issued by Binance Day rose 26.79%, Huobi issued HT rose 14.95% in the past seven days.

In response, some people in the industry told brokerage Chinese reporters that the reason for the recent rise in platform currency is that multiple platforms will start a new round of IEO, that is, new digital currencies will be launched on the trading platform. The reporter found an "Announcement on Sales Rules for HyperDAO (HDAO) of the OKEx Jumpstart Ten Project" in the announcement area of the OKEx website, which adopted the IEO model.

It should be pointed out that for similar behaviors, including multi-national regulatory authorities such as the People ’s Bank of China have repeatedly warned, at the end of November last year, the central bank ’s Shanghai headquarters again named hype related to virtual currencies (such as ICO, IFO, IEO, IMO, and STO, etc.) Renovations and speculation are prevalent, prices are rising and falling sharply, and risks are rapidly gathering. Relevant financing entities raise funds or virtual currencies such as Bitcoin and Ethereum from investors through illegal sale and circulation of tokens, which are essentially illegal public financing activities without approval, and are suspected of illegally selling token tickets, illegally issuing securities, and Illegal fundraising, financial fraud, pyramid schemes and other illegal crimes have seriously disrupted the economic and financial order.

On January 14, the United States Securities and Exchange Commission (SEC) issued an announcement alerting the risks involved in participating in the IEO. The SEC states that the IEO may be in violation of federal securities laws and lacks protections for investors to register and issue tax-exempt securities. Public warnings indicate that IEO is touted as an innovation of ICO, with online trading platforms directly providing companies with instant trading opportunities for digital assets. But these online trading platforms are usually not registered with the SEC and may be inappropriately referred to as "exchanges." Such products may be used to induce investors to invest by misleading statements and promising falsely high returns.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- What are the top areas in Asia's top blockchain venture capital? Not DeFi anyway

- "Bitcoin Secret History": Bitcoin Forum Discussion on "Snack Machines"

- Investment management company VanEck: institutions should invest in bitcoin, small allocations will significantly increase ROI

- Sneak Peek, Ethereum 2.0 Deposit Contract Interface Flows Out

- Future decentralized data storage for blockchain

- Analysis: Bitcoin and its value growth logic for bull market entry

- Industry Blockchain Highlights: Central No. 1 File Named Blockchain Central Bank Trade Gold Blockchain Platform Business Volume Exceeds 90 Billion