Classification of Web3 Game Players Prototypes

Web3 Game Player Prototypes ClassificationAuthor: Vader Research; Source: Medium; Compilation: Sheng Du San, Translation Guild, SeeDAO

What kind of players do you want in your game?

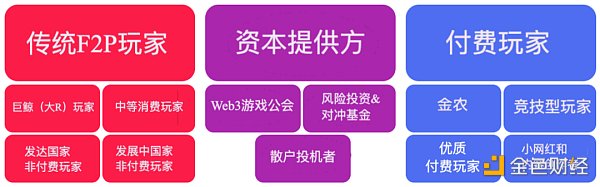

Web3 games allow trading in-game items on a permissionless decentralized marketplace in exchange for real money. This creates opportunities for participants with economic incentives to speculate and make money, while also enabling game developers to incentivize certain player behaviors through economic rewards. The complex and open nature of game economies has led to the emergence of new categories of participants, each with different motivations and behaviors – this article aims to classify these participant roles alongside existing Free-to-Play (F2P) participant roles.

Web3 games allow trading in-game items on a permissionless decentralized marketplace in exchange for real money. This creates opportunities for participants with economic incentives to speculate and make money, while also enabling game developers to incentivize certain player behaviors through economic rewards. The complex and open nature of game economies has led to the emergence of new categories of participants, each with different motivations and behaviors – this article aims to classify these participant roles alongside existing Free-to-Play (F2P) participant roles.

# F2P Players (Free to play) #

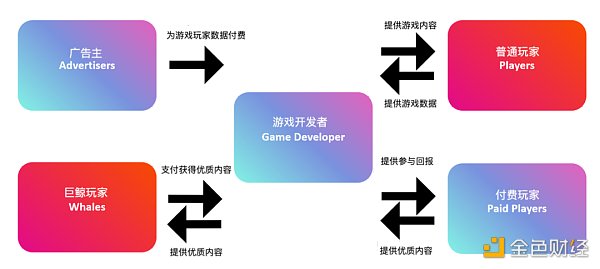

F2P players are traditional video game players – they play games because they enjoy the games, not with the expectation of receiving economic returns. For game developers, some F2P players are more valuable than others because they spend more time and effort on microtransactions within the game, or their attention is more valuable to advertisers.

F2P players are traditional video game players – they play games because they enjoy the games, not with the expectation of receiving economic returns. For game developers, some F2P players are more valuable than others because they spend more time and effort on microtransactions within the game, or their attention is more valuable to advertisers.

- Does the future of MakerDAO belong to Cosmos rather than Solana?

- How will the sued founder of Tornado Cash fight against the Federal Reserve?

- Intention The starting point of Web3 interactive intelligence

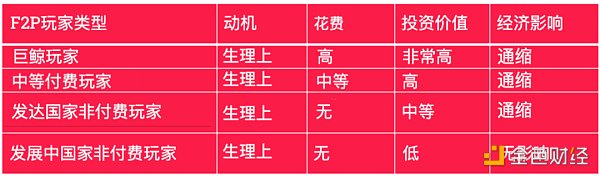

F2P Whales

F2P whale players are the elites among elites – they often spend a huge amount of money in the game. Whales enjoy paying for experiences related to power, social interaction, and more. A significant portion of revenue from F2P games may come from these individuals, and advertisers are willing to spend a large amount of money to capture their attention and sell them various products and services. They can spend anywhere from $500 to $100,000 per month.

F2P Moderate Spenders

F2P moderate spenders are the types of players that game economies desire for long-term health. Although they don’t spend as much money as whale players, they may spend more time playing the game and still spend a considerable amount of money. This money may be spent on battle passes, in-game microtransactions, and cosmetic items. They can spend anywhere from $5 to $100 per month.

F2P Non-paying Players from Developed Countries

These F2P non-paying players are players who do not spend money in the game but are not limited by their disposable income. Their attention is valuable to advertisers, and they also have the potential to become paying players. The total advertising revenue obtained from non-paying players from developed countries may range from $5 to $20 per month.

F2P Non-paying Players from Developing Countries

These F2P non-paying players are people who never spend money in the game. Additionally, their attention is not as valuable to advertisers because ordinary non-paying players from developing countries are seen as having little disposable income and a relatively low likelihood of converting into paying players. The total advertising revenue generated from ordinary non-paying players from developing countries may be around $1 per month.

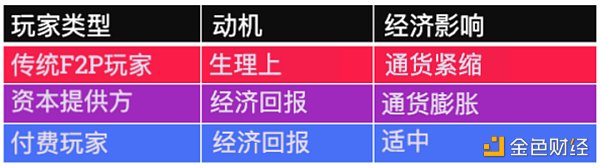

In short, the impact of most F2P players on the game economy is net deflation. This is because they are willing to spend more money in the game than what the game pays them (if the game pays them anything).

# Capital Providers #

Let’s first clarify a fact. The existence of any profit-making organization is to make money – organizations do not have emotions (and moral ethics). Founders, executives, and some shareholders may have emotions, but they also have a fiduciary responsibility to their shareholders/token holders to maximize the franchise value. Therefore, they always have to prioritize decisions that can maximize profit/value, rather than supporting moral causes.

Let’s first clarify a fact. The existence of any profit-making organization is to make money – organizations do not have emotions (and moral ethics). Founders, executives, and some shareholders may have emotions, but they also have a fiduciary responsibility to their shareholders/token holders to maximize the franchise value. Therefore, they always have to prioritize decisions that can maximize profit/value, rather than supporting moral causes.

A brand may appear to support moral causes (environment, peace, race/gender equality, etc.), but in reality, it may be a carefully planned PR campaign. This is because the conclusion reached by executives is that the economic and social costs associated with supporting a particular moral cause will generate positive investment returns, resulting in higher customer/employee retention and profitability, thus obtaining a higher franchise value.

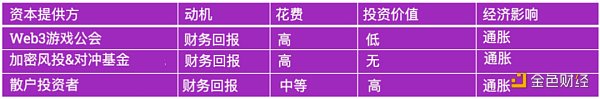

Web3 Game Guild

Web3 game guilds have economic incentives and their goal is to maximize revenue and franchise value through the allocation of funds, time, and labor. Guilds purchase in-game NFTs and lend them to gold farmers to earn income, and invest in early game tokens/NFTs for capital appreciation. Although guilds consume as much as F2P whale players, unlike F2P whales, they do not have physiological motivations and may not spend money on cosmetic items, broadband providers, or battle passes unless they can prove that their investment can generate positive economic returns.

The reason is simple: guilds with VC support and tokens listed for trading have a fiduciary responsibility to institutional and retail token holders, and need to maximize revenue to accomplish the task of long-term fully diluted market cap. Therefore, it cannot waste trust funds to purchase in-game cosmetics for the personal physiological motivations of executives.

A guild that earns millions of dollars in profit from a P2E game may purchase items from the game – but this is a PR strategy to demonstrate support for the game and prove that they are not just “money grabbers” in order to gain more investment opportunities in early game tokens or NFTs.

As an exception, some guilds do not have value-extracting characteristics and have a deflationary impact on the game economy, and this is the zero-sum betting model. For example, Guild A and Guild B each bet $10; the winning guild wins $18, and the game developer gets $2, while the losing guild gets nothing. With various token engineering, this model is becoming increasingly popular, leading to guilds investing heavily in their esports teams.

Another exception is that guilds can serve as a channel for deflationary users (note: players who consume more in the game than their income), and such guilds have both deflationary characteristics and value-extracting properties, similar to internet celebrities. In this way, the income extracted by guilds from the game can be reasonably regarded as the income they import through their own brand and distribution channels. There is another exception, as discussed by Carlos Perreira, guilds can become UGC creators/development agencies/training camps.

Generally, guilds generate relatively low advertising value for games. Although guild owners have high disposable income, those who play games and watch ads are often members of guild scholars, who often have lower disposable income and come from developing countries.

Crypto Venture Capital and Hedge Funds

Crypto venture capital and hedge funds are institutional investors; they have economic incentives and their goal is to exit at a price higher than the entry price. The time range and asset preferences may vary; VCs may prefer early private tokens/equity with a term of 2-3 years; while hedge funds may prefer tradable tokens/NFTs with a term of 1-180 days. Generally, these institutions are not very active in the game itself. In short, these are institutions that provide funds to the market, look for investment opportunities, and exploit market flaws.

Retail Speculators

The economic motives of retail speculators are similar to those of the aforementioned institutions. As part of chat groups, communities/forums, and DAOs, retail speculators either act collectively or act alone.

NFT and IDO whitelist hunters are always looking for major investment opportunities in the Gamefi field. They conduct extensive research on various projects and spend hours upon hours in Discord channels just to get on the whitelist for the launch of hot game NFTs.

Ponzi supporters calculate where they can get lucrative investment returns and enthusiastically participate in them. The projects they have invested in may include Axie Infinity, Thetan Arena, OHM, Luna, and STEPN. They seem to know where the profits will come from and enjoy the excitement and high returns, firmly believing that this market will keep going and dancing.

Ambitious traders bet on various tokens and NFTs, aiming to make a fortune from the price difference between entry and exit.

Although most of them are driven by economic motives, individuals may not be the most rational investors. Because they are willing to invest a significant amount of money in risky crypto projects, they may also have a strong tendency to gamble. A game with a carefully designed economic model can transform retail speculators driven by economic motives into players who bring deflation to the game economy.

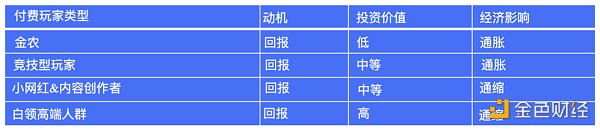

# Yield Players #

Gold Farmers

Gold Farmers

The economic motivation of gold farmers is very pure – they play games to make money. Their decision-making process of whether to play a certain game is based on a formula: how much money they can earn per hour, how much effort they need to put in, and the probability of making money. If driving for Didi can guarantee earning $5 per hour, while playing Axie can only earn $3 per hour – they may choose to drive for Didi. Free-to-play (F2P) players will play the core levels of the game and are willing to reinvest their physical/economic rewards into the game, playing until they complete all levels. Gold farmers are different, their interest lies in obtaining economic rewards as quickly as possible in order to cash out and extract value from the economic model.

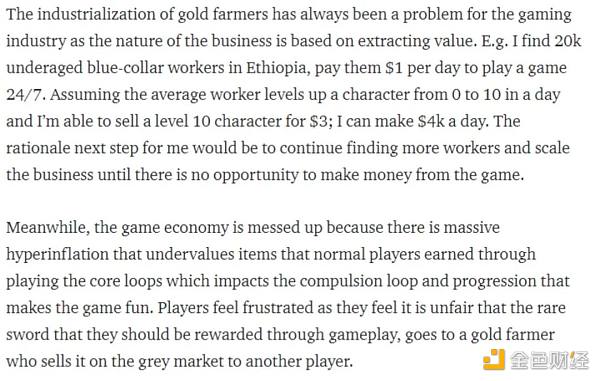

Institutional gold farming groups pose a bigger problem for the game’s economic system because they are more organized and efficient than individual gold farmers. They may pay fixed wages to child laborers in low-income countries or deploy complex bot robots. They will continuously extract value from the game economy until it is no longer profitable.

Source: What Killed MMO Games?

Source: What Killed MMO Games?

Competitive Players

Competitive players have excellent skills and consistently rank high on game leaderboards. They may not have economic motivations and are not just playing games to make money. Most of them start as F2P players, but as they improve their skills and perform well in the game, their rankings rise and they start earning money by winning competitions or becoming game streamers.

As they gradually build their personal reputation, these players may be recruited by esports teams to work for them in exchange for a stable salary and additional benefits. However, like any professional sports, the average income of these players will be limited by the size of the audience willing to watch the matches and their spending behavior.

NBA and soccer players can earn millions of dollars a year because there are a large number of viewers willing to spend hundreds of dollars a month on satellite TV to watch them. However, the scale of consumption by badminton or squash game viewers is different – therefore, the income of professional badminton players is much lower than that of professional soccer players.

This also applies to esports – even though the number of viewers for top esports tournaments may exceed the FIFA World Cup, the average spending per esports viewer is much lower than that of soccer viewers.

In other words, competitive players may not necessarily have an inflationary impact on the game economy because their presence attracts new players and additional participation from existing players (through streaming or playing together). One model that can truly bring deflation to the game economy is the zero-sum betting model, in which competitive players are willing to stay with the game and bet with their own game skills.

Micro-influencers and Content Creators

Micro-influencers and content creators represent powerful game distribution channels. Influencers attract and retain players through numerous activities. They build communities, and community members have confidence in their leaders and high levels of engagement. As a result, influencers have a very high conversion rate when promoting new games/products to their audience. Unlike esports players who earn income primarily through tournaments sponsored by game developers, influencers typically earn income by advertising new games/products/services. The performance of influencer promotion is relatively easy to measure, so the market will continue to reward influencers who have a positive impact on the game economy (deflationary impact).

Premium Paying Players

White-collar paying players are a new type of player described in detail in the article “Nightclubs and Web3 Games”. They have strong social skills, and their presence increases the retention and spending of players who interact with them. That’s why even though they may receive rewards, their overall impact is still deflationary.

Source: Nightclubs and Web3 Games

# Conclusion #

Creating an interesting game requires not only a strong core level, excellent art, and balanced rules, but also the biggest challenge for Web3 games is to maintain an open economy, optimize the distribution of economic incentives, and make players/communities willing to maximize LTV (Lifetime Value).

An open economy that doesn’t require permission will inevitably attract participants with economic motives who aim to invest less and earn more in the game. Web3 game developers should carefully assess and consider the types of players in their game. Therefore, the economic and rule design of the game should reward or punish certain types of participants and behaviors.

-

This classification method is based on qualitative analysis, observation, and user research. As we collect more on-chain and off-chain player or speculator behavior data from existing and upcoming Web3 games, we will be able to better understand different player prototypes and classify them.

-

Deflationary means that the money flow brought into the game economy by this player category is less than what it captures. Inflationary means that the money flow captured by this player category from the game economy is greater than what it brings in.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Will FTX liquidating $3.4 billion worth of crypto assets become the main culprit behind the market crash?

- Analyzing MEV on Friend.tech How is it executed? How is the profit made?

- SevenX Ventures Modular Smart Contract Account Architecture and Challenges

- Singapore vs Hong Kong TOKEN2049 ignites the battle of the twin cities in Web3

- Sovereignty vs Society The Contradictory Relationship Between Individual Freedom and Social Dependence

- How to Prove a Secret A Guide to Zero-Knowledge Proofs from Magicians

- Dune SQL and Ethereum Data Analysis Advanced Guide