Does the future of MakerDAO belong to Cosmos rather than Solana?

Might MakerDAO's future lie with Cosmos rather than Solana?Author: KODI; Source: Espresso; Compilation: Deep Tide TechFlow

When even Vitalik starts selling, you know the bear market is really bad.

Last week, the co-founder of Ethereum (ETH) sold approximately $580,000 worth of holdings.

But it doesn’t stop there. First, what he sold was not ETH, but MakerDAO’s governance token MKR.

- How will the sued founder of Tornado Cash fight against the Federal Reserve?

- Intention The starting point of Web3 interactive intelligence

- Will FTX liquidating $3.4 billion worth of crypto assets become the main culprit behind the market crash?

Why?

Because Maker co-founder Rune Christensen has recently caused a stir in the crypto community.

We know that Maker’s team has been considering launching their own chain as the final step of their Endgame plan.

However, no one, including myself, expected Rune to choose Solana as the underlying infrastructure, instead of an Ethereum L2 solution.

This latest eye-catching idea is not uncommon for Rune. No one knows his intentions and actions. But it is provocative and has attracted attention.

Don’t get me wrong, I like Solana and welcome more projects to launch new chains there.

But this decision is somewhat surprising, considering there are other choices that may be more suitable for the entire ecosystem.

In fact, Rune even mentioned that he had considered the Cosmos (ATOM) network.

The reason for choosing Solana is mainly because “the core of Cosmos is not built around efficiency… its maintenance and performance costs are higher”.

Solana’s design philosophy is exponential hardware capacity growth, where the blockchain should scale with the hardware. As hardware performance improves, Solana also improves accordingly. Therefore, Solana always outperforms Cosmos in terms of efficiency and performance.

However, Cosmos has other advantages in building AppChains that other ecosystems cannot match.

Advantages of Cosmos

Cosmos aims to build an interconnected blockchain network. The network consists of CometBFT (formerly Tendermint), Inter-Blockchain Communication Protocol (IBC), and Cosmos SDK.

CometBFT is a consensus algorithm that allows nodes to reach consensus on the network. Although it may not be the most advanced technology at the moment, it is still the most widely used consensus algorithm in the cryptocurrency field, even including some non-Cosmos chains like Binance Smart Chain. Therefore, it has been thoroughly tested in practice.

And it can still perform well. Cosmos chain Sei, which focuses on transactions, has just been launched with a speed of 20,000 transactions per second and a final confirmation time of 50 milliseconds. In comparison, Solana is one of the fastest chains with a maximum transaction volume of 10,000 transactions per second and a final confirmation time of 2.5 seconds.

But Cosmos SDK and IBC may be the most important features.

IBC can be said to be a revolutionary technology.

If you have ever tried to move assets from Ethereum to L2 (such as Arbitrum or Optimism), you know that you need to cross-chain the assets from the mainnet to L2 for trading.

However, cross-chain bridges rely on centralized validators who must “respect” asset transfers. If attacked, these validators can put funds at risk, as seen in vulnerability exploitation cases like Wormhole and Nomad.

Building secure bridges is extremely difficult. It’s no wonder that four out of the top five hacker attacks in the rekt (negative events) rankings are related to cross-chain bridges.

IBC solves all these problems. IBC messages are trustless, meaning they don’t require trust in intermediaries to function properly. The IBC protocol itself handles the validation of cross-chain messages.

This allows for the simple establishment of communication channels between different blockchains.

At the same time, the Cosmos SDK allows for easy and fast customization of blockchains that suit your application needs. It has various modules, each handling specific domains (such as governance or IBC connections).

This means that developers don’t have to reinvent the wheel every time they want to launch a new chain. They can focus on the core application logic while the SDK handles the heavy lifting in the background.

So why does Maker need to build a new chain on Cosmos (or Solana) when Ethereum is still the most popular DeFi chain?

Well, that’s also part of the problem.

A Heavy Burden

The data clearly shows that Ethereum still dominates the cryptocurrency space. Its DeFi ecosystem leads the blockchain industry in terms of TVL, stablecoins, and overall ecosystem activity.

The total value locked (TVL) on Ethereum exceeds $21 billion. If we include all Ethereum L2 and Rollup solutions, this number would exceed $24 billion. This is far greater than any other chain, including Binance Smart Chain ($5.5 billion), Polygon ($770 million), or Avalanche ($500 million).

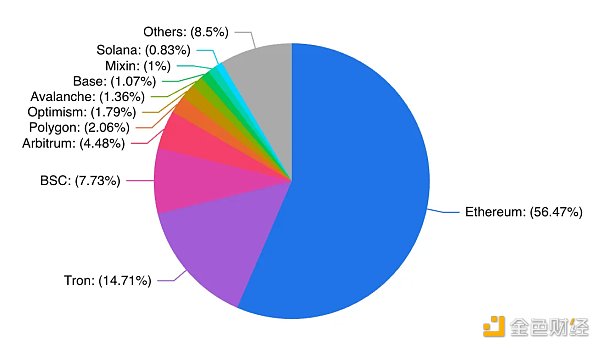

In addition, Ethereum has a dominant position in the stablecoin market, with a settlement volume of over $69 billion, accounting for over half of the total stablecoin market cap of $130 billion. The only chain that comes close is Tron, with a settlement volume of $44 billion, of which 92% is Tether (USDT).

This solidifies Ethereum’s position as the settlement layer for crypto assets.

However, all this activity also brings problems. Congestion, gas fees, and scalability limitations hinder the improvement of the Ethereum user experience, especially with the increasing number of applications.

In order to accommodate as many applications as possible on a single chain and maintain its functionality, we need to scale Ethereum through solutions like Rollups, cross-chain bridges, and state channels. As we have seen on Ethereum, this is not easy.

This is where Cosmos comes in.

Cosmos is built around the topic of AppChain. The core question is: instead of trying to put all applications into a single blockchain, why don’t each application build its own chain?

Cosmos believes that applications should form multiple chains, each designed specifically to host that application, and all chains should be connected through shared communication standards.

Letting Cosmos handle the boring and difficult parts (logic processing, security, governance) can provide you with a truly outstanding product experience on Ethereum.

A project can leverage the network effect and higher capitalization of Ethereum, while using Cosmos for backend logic, interoperability with other IBC chains, faster transactions, etc.

This is a combination we may see more of in the future. Cosmos chains as “co-processors” for Ethereum activate idle liquidity on Ethereum, reduce costs, and automate transactions.

Moreover, there is already a project that has realized Rune’s vision by launching a product on Ethereum while placing the backend on a separate chain.

Having the best of both worlds

Sommelier Finance is a protocol built on the Cosmos blockchain, aiming to extend the capabilities of decentralized finance based on Ethereum.

Due to Ethereum’s gas fees being more expensive than a bottle of Dom Pérignon champagne, Sommelier seeks to open opportunities for smaller investors.

The project currently offers two main services – liquidity mining and algorithmic trading strategies. For users, simply choose one of them, lock funds in the vault, and watch your beloved crypto assets grow gradually.

The algorithmic trading vault initially had some capital inflows, but it wasn’t until the main revenue vault arrived that the Total Value Locked (TVL) exploded in growth. This is not surprising. Here is a comparison of Sommelier’s “real revenue strategy” with blue-chip DeFi protocols:

Except for Maker, Sommelier outperforms any blue-chip protocol in terms of returns on ETH, BTC, and stablecoins. Even Maker’s 5% return on DAI is only a temporary measure to attract TVL and will drop to 3.19% in the coming weeks.

To achieve higher returns, the only way is to participate in riskier and more exotic revenue strategies, such as selling call options or providing liquidity (which can lead to potential losses).

Therefore, it is not surprising that Sommelier’s revenue vault dominates its Total Value Locked, with over $30 million locked, while the algorithmic trading vault has only $200,000.

So what is Sommelier’s secret weapon?

One advantage is that its strategies run off-chain, allowing resource-intensive algorithms to operate while protecting privacy.

But I believe its main advantage lies in its ability to leverage the strengths of Ethereum and Cosmos.

The Cosmos backend provides a sovereign foundation, handling governance, security, and cross-chain communication. This reduces costs by minimizing transactions on the Ethereum mainnet. Meanwhile, the user-facing frontend utilizes the vibrant Ethereum ecosystem.

If more developers realize the synergies between these networks, we may see a wave of innovative, Cosmos-based applications emerging that use Ethereum as the window for user interaction. Just as liquidity staking can inject much-needed liquidity into Cosmos, Ethereum-Cosmos hybrid products can also inject new vitality into this ecosystem.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Analyzing MEV on Friend.tech How is it executed? How is the profit made?

- SevenX Ventures Modular Smart Contract Account Architecture and Challenges

- Singapore vs Hong Kong TOKEN2049 ignites the battle of the twin cities in Web3

- Sovereignty vs Society The Contradictory Relationship Between Individual Freedom and Social Dependence

- How to Prove a Secret A Guide to Zero-Knowledge Proofs from Magicians

- Dune SQL and Ethereum Data Analysis Advanced Guide

- The Core Function of Data Availability in Layer2