EU Cryptocurrency Regulation Entering the Era of Unity Historical Review and Future Outlook

EU Cryptocurrency Regulation Unity Historical Review & Future OutlookAuthor: TaxDAO

As one of the world’s largest economies, the European Union plays an important role in demonstrating and leading the regulatory policies for cryptocurrencies. Studying the historical evolution and future trends of the EU’s regulatory policies on the cryptocurrency market is of great theoretical significance and practical value for understanding the legislative thinking and practical experience of the EU in this field, analyzing different regulatory models and their effects in various countries around the world, as well as exploring future cryptocurrency regulatory strategies and measures.

This article will analyze the history, current status, and future development direction of the EU government’s determination of the nature of cryptocurrencies and its regulatory policies (such as exchange regulatory systems, licensing systems, tax policies, etc.), in order to provide references and inspiration for policy making.

1 How the EU improves the framework for defining cryptocurrencies

- TaxDAO’s Response to the US Senate Finance Committee on the Issue of Taxation of Digital Assets

- US House Financial Services Committee Regulatory agencies should cooperate with Congress to establish regulatory rules.

- Recognition of the Property Nature of Virtual Currency and Issues Regarding the Disposal of Assets Involved in Cases

1.1 Initial regulations (2014)

As early as 2014, the European Central Bank (ECB) issued a report clarifying the definition of cryptocurrencies as “digital tokens that are not issued or supported by central authorities or public institutions, whose value depends on market supply and demand, and can be traded peer-to-peer through specific network protocols.” This was the EU’s first formal assessment of cryptocurrencies, laying the foundation for subsequent regulatory policies.

1.2 Challenges of terrorism and supranational currencies (2015-2019)

1.2.1 EU Fifth Anti-Money Laundering Directive (5AMLD)

On the evening of November 13, 2015, a series of terrorist attacks took place at seven locations in the city center and suburbs of Paris. This was the most serious act of violence in France since World War II and the most devastating terrorist attack in Europe since the Madrid train bombings in 2004. Similar terrorist attacks also occurred in Brussels in March 2016. These two disasters exposed the loopholes in the EU’s Fourth Anti-Money Laundering Directive (4AMLD), especially its neglect of the risks posed by cryptocurrencies and other financing channels.

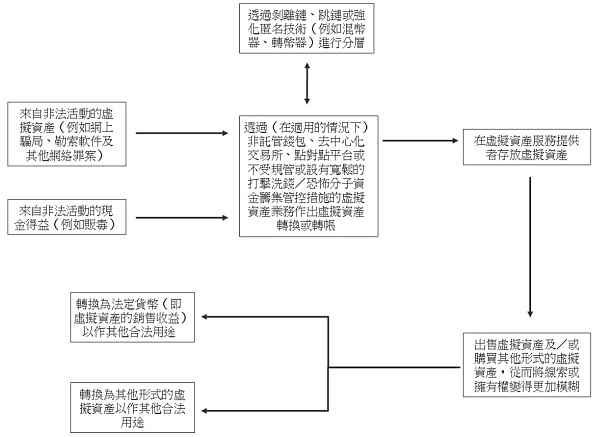

In order to strengthen the fight against money laundering and terrorist financing, the European Commission proposed a series of legislative proposals, including the establishment of the 5AMLD. Subsequently, the 5AMLD was adopted by the European Parliament and the Council in May 2018, and came into effect in January 2020. Its aim is to increase the transparency of financial transactions to combat money laundering and terrorist financing. One of the main provisions of the 5AMLD is that virtual currency exchange platforms and custodial wallet providers will be considered “obliged entities” and be subject to EU regulations. This means that they will face the same regulatory requirements as banks and other financial institutions, such as implementing customer due diligence controls, monitoring virtual currency transactions on a regular basis, and reporting suspicious activities to government entities.

However, as the 5AMLD belongs to the “Directive” type of EU secondary legislation, it does not have direct applicability and requires member states to modify their domestic laws to ensure implementation. Therefore, although the 5AMLD includes cryptocurrency service providers in the regulatory scope, it does not establish a unified and coordinated legal framework, resulting in different definitions, classifications, and regulations of cryptocurrencies in EU member states, which is not conducive to cross-border regulatory cooperation.

1.2.2 Challenges of Diem

Diem stablecoin is a global payment project proposed by Facebook in June 2019. Unlike ordinary cryptocurrencies, Diem relies on Facebook’s 2 billion global users and is pegged to a basket of currencies, giving it the status of an independent currency, which poses significant challenges to financial sovereignty and stability. In addition, Diem is issued in Geneva, Switzerland, which may have a significant impact on the future financial stability, monetary sovereignty, and public interests of the European Union. It has been warned by EU experts and institutions since its proposal.

Based on the regulatory framework of 5AMLD, it is unable to effectively deal with “supranational currencies” like Diem, and the loose definition of existing cryptocurrencies also poses difficulties for cross-border regulation. A new definition framework for cryptocurrencies is urgently needed.

1.3 MiCA Cryptocurrency Definition Framework (2020 to Present)

Under the pressure of cross-border regulation and the direct stimulation of Diem, the draft “Regulation on Markets in Crypto-assets (MiCA)” proposed by the European Commission in 2020 divides crypto-assets into three categories to unify regulation in EU countries. They are electronic money tokens (EMT), asset-referenced tokens (ART), and other crypto-assets (other than asset-referenced tokens or e-money tokens). The draft has been approved by the European Parliament and is expected to take effect in 2024.

-

Electronic money tokens: Cryptographic assets pegged to a single fiat currency, which are intended to serve as electronic substitutes for cash and can be used for payment or transfer. For example, electronic money tokens pegged to the euro belong to this category.

-

Asset-referenced tokens: Cryptographic assets pegged to multiple fiat currencies or other assets, intended to maintain stable value. Stablecoins are usually referred to as asset-referenced tokens.

-

Other crypto-assets: Any cryptographic assets that do not fall into the previous two categories, including most cryptocurrencies and utility tokens. Bitcoin, Ethereum, etc., belong to this category.

According to the classification of MiCA, stablecoins like Diem belong to EMT or ART and are subject to stricter regulatory requirements, such as whitepaper approval, reserve management, liquidity assurance, and information disclosure. However, MiCA does not cover other regulated crypto-assets, such as DeFi, NFTs, and security tokens.

2 Historical Evolution of Major EU Regulatory Policies

After reviewing the development of the definition of EU cryptocurrencies, let’s examine the historical evolution of its major regulatory policies. These regulatory policies are based on the framework of cryptocurrency definition and have similar time periods.

2.1 Starting and Exploring (2014)

2014 was the “year of cryptocurrency regulation” in the European Union. Prior to this, the EU did not have specific regulatory rules for cryptocurrency exchanges, only some general financial laws and directives such as AMLD4; whether these financial laws apply to cryptocurrency exchanges was also unclear.

2.2 Preliminary regulatory integration (2015-2019)

In 2015, the European Court made a ruling on whether Bitcoin transactions should be subject to value-added tax, determining that Bitcoin payments are a form of service payment and are subject to the provisions of the value-added tax regulations. At the same time, according to Article 135(1)(e) of the EU VAT Directive, it is considered that the exchange of cryptocurrency and fiat currency is exempt from value-added tax. This ruling provided certain tax advantages for cryptocurrency exchanges in the EU.

In 2018, AMLD5 included cryptocurrency exchanges in the scope of anti-money laundering and anti-terrorist financing regulations, requiring them to conduct customer identity verification, record transaction information, report suspicious activities, etc. This established certain compliance requirements for cryptocurrency exchanges operating in the EU. In the same year, the European Central Bank issued an opinion recommending the EU to establish a unified regulatory framework for crypto assets to address the potential impact of crypto assets on financial stability, consumer protection, and market integrity. This opinion is also one of the origins of MiCA.

During this stage, several important judicial and legislative measures marked the EU’s partial regulatory measures on crypto asset services, but the EU still did not form a unified and comprehensive regulatory framework.

2.3 MiCA’s unified regulatory framework (2020-present)

The upcoming MiCA imposes regulatory requirements such as licensing, registration, information disclosure, and behavioral norms on entities providing crypto asset services (including exchange services), and assigns corresponding regulatory functions to the European Banking Authority (EBA) and the European Securities and Markets Authority (ESMA). The introduction of MiCA will provide a clear and consistent regulatory framework for cryptocurrency exchanges within the EU and will also impact crypto legislation in countries around the world, accelerating the transition of the global crypto market from the “wild growth” stage to the “legal era”.

MiCA has established a detailed admission licensing system for crypto asset traders. Specifically, traders need to obtain CASP (crypto-asset service provider) licenses from the competent authorities of EU member states. All CASPs must comply with governance, asset custody, complaint handling, outsourcing, wind-down plans, information disclosure, and minimum permanent capital requirements, among others. Different CASPs have specific regulatory requirements to meet, such as:

- Custodians: need to establish custodian policies and regularly inform clients of their asset status

- Trading platforms: need to implement market manipulation detection and reporting systems, or publicly disclose current buy and sell prices and trading depth

- Exchanges and brokers: need to establish non-discriminatory policies and execute orders with the best possible outcomes and prices

3 Regulatory Approaches to Stablecoins, DeFi, and NFTs in the European Union

3.1 Stablecoins

Regarding stablecoins, MiCA has clear regulatory standards. MiCA requires stablecoin issuers to establish sufficient liquidity reserves at a ratio of 1:1 and partially in the form of deposits to protect consumers. They are also required to apply for a license and registration with the European Banking Authority (EBA). MiCA also limits the daily transaction volume and value of non-euro-backed stablecoins to 1 million transactions and 200 million euros.

3.2 DeFi

Currently, MiCA does not include DeFi in its regulatory scope due to the different information structure of DeFi compared to traditional finance, making it difficult to effectively regulate DeFi with standard policies. However, MiCA does not completely ignore the development of DeFi and is piloting an “embedded supervision” approach for DeFi, which involves automated supervision and enforcement of DeFi projects and participants through DLT technology. In 2022, the European Union has issued a public tender for the “DeFi Embedded Supervision Study” on Ethereum, with an estimated bid amount of 250,000 euros and a projected completion time of 15 months.

3.3 NFTs

While MiCA does not specifically use the term NFT, its specific textual descriptions do refer to NFTs. MiCA defines NFTs as cryptographic assets with uniqueness and non-fungibility compared to other cryptographic assets. MiCA’s regulation of NFTs is relatively lenient, requiring compliance with general rules on marketing communication, information disclosure, technical security, etc., without the need to submit a white paper or apply for a license. However, if NFTs involve copyright, intellectual property rights, or other legal issues, relevant legal provisions must be complied with.

4 Future Development Trends

The European Union’s regulatory policy for cryptocurrency assets has gone through a process from initiation to exploration and integration over the past few years. It is currently at a crucial turning point with the introduction and implementation of MiCA. MiCA will provide a unified and coordinated regulatory framework for cryptocurrency markets within the European Union and will have profound implications for the global cryptocurrency market. Based on this, we can foresee several future trends in the European Union’s regulatory policy for cryptocurrency assets:

Proactive regulation: The European Union’s regulatory attitude towards cryptocurrency assets is open and proactive. The regulatory principles are based on risk, technological neutrality, market-driven approaches, and international coordination. This means that appropriate regulatory measures will be taken for different types and scales of cryptocurrency assets, without discrimination or favoritism towards specific technologies or business models. The EU encourages market competition and innovation and cooperates and communicates with other countries or regions. The EU will also support research and pilot projects in the cryptocurrency asset field, such as the DeFi Embedded Supervision Study, to explore more advanced and adaptive regulatory approaches.

Rule refinement: The regulatory goal of the European Union (EU) for cryptocurrencies is to ensure the safety, reliability, transparency, and effectiveness of cryptocurrencies and prevent negative impacts on financial stability, monetary policy, payment systems, and consumer interests. Any cryptocurrency that wants to enter the EU market must comply with the rules of MiCA. With the implementation and enforcement of MiCA, the EU will continuously improve and refine its regulatory standards and measures for cryptocurrencies to cope with the rapid changes and diversification of the cryptocurrency market.

Trend towards integration: The regulatory framework of the EU for cryptocurrencies is a unified and coordinated framework aimed at eliminating regulatory differences and uncertainties among EU member states and promoting the integration and development of the internal market of the EU.

The EU has made significant progress and achievements in the regulation of cryptocurrencies. The EU needs to continue improving its regulatory framework for cryptocurrencies to adapt to the rapid changes and diversification of the cryptocurrency market, and to coordinate and cooperate with other countries or regions, aiming to achieve consistent regulation on a global scale. The EU’s openness, positivity, balance, flexibility, unity, and coordination demonstrated in the regulation of cryptocurrencies provide useful references and inspirations for other countries or regions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- DAC8 enters the stage of opinion review, the EU’s encrypted tax regulation is coming

- Focus on the metaverse and generative AI, four departments issue the Implementation Plan for the New Industry Standardization Pilot Project.

- Digital Asset Anti-Money Laundering Bill Faces Obstacles in the U.S. Senate

- An in-depth analysis of Hong Kong’s Web3 policies since the release of the ‘Declaration

- Five key points to watch in Hong Kong’s cryptocurrency policy in the next year after opening up retail trading

- Hong Kong Treasury Bureau’s Chen Haolian The development of Web3.0 should not undermine the stability of the financial system.

- Recent Amendments to Cryptocurrency-related Legislation in the US Congress