Explore: How to create a neutral, trust-free, scarce digital currency

From the perspective of geopolitical turmoil and lack of trust, this paper expounds the idea of establishing a neutral-based, trust-free digital currency that can prove scarcity, so as to get rid of the global trade war. Maybe not completely correct, but with some reference.

Russian President Vladimir Putin said:

"I think everyone is very clear now that the dominance of the West is coming to an end. I can't imagine an effective international organization without (Russia), India and China."

French President Mark Long said to diplomats on Tuesday: "We are witnessing the end of Western hegemony." He pointed out that the rise of Beijing and Moscow is a sign of a change in the world structure. "The world order is being shaken like never before…"

- Babbitt column | The end of the retail financing era, the beginning of the institutional financing era

- QKL123 market analysis | Bitcoin plummeted, "delivery day effect" pot? (0927)

- The number of lightning network nodes broke for the first time and increased by 3.17% in the past 30 days.

The following paragraph, taken from an article by Bloomberg, describes the ongoing trade war between China and the United States, which is actually only part of a broader currency war and public challenge to the global reserve currency hegemony:

"The Sino-US trade war has evolved into a larger war: a currency war. The devaluation of the renminbi prompted the US Treasury to list it as a "currency manipulator". Nevertheless, central banks around the world, including Thailand, India and New Zealand. Still following China.

In fact, this is not the first time that protectionism has fallen into the exchange rate. In fact, this is strikingly similar to the recurring currency devaluation and retaliatory tariffs of the 1930s. And there is no guarantee that a similar situation will not happen again. ”

"Historically, the status of the reserve currency is not stable."

Over time, we have witnessed the emergence, growth and extinction of many forms of reserve currency. The current major reserve dollar, once linked to gold:

In 1861, Treasury Secretary Salmon Chase issued the first American banknote. The Gold Standard Act stipulates that gold is the only metal that can be exchanged for banknotes and is priced at $20.67 per ounce.

Banknotes cannot be exchanged for gold, but should be exchanged on the basis of trust in the US Treasury and the Federal Reserve Bank's credit (including other countries and strategic opponents).

Therefore, in the face of increasing government debt, the continued printing of the US dollar is exacerbating the crisis of confidence and the unsustainable geopolitical situation.

Long before Trump shakes the public's trust in the Fed, a report released by the United Nations in 2010 suggested not to use the dollar as the only global reserve currency.

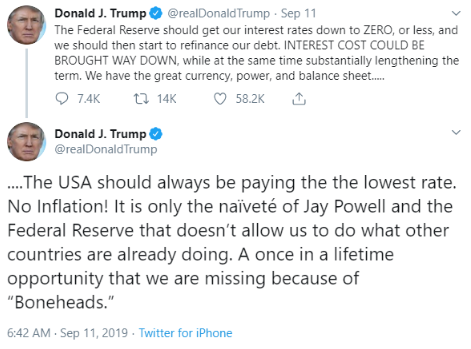

Since then, Trump has suddenly withdrawn from international agreements, alienated allies, disrupted world order, and exacerbated global market turmoil. He also accelerated the loss of public trust in institutions, banks, politicians, businesses and the media with his “excellent Twitter governance”.

When American financier Jeffrey Epstein was found dead in a prison cell (in suicide surveillance), the US political scene was in a big uproar, and the public speculated. Some nerds with the spirit of the times even question the structure of reality itself. Since we seem to be caught in a "more strange than the novel," the inverted clown world has been considering the possibility that we may be trapped in a virtual world manipulated by the capricious Galactic hegemon.

Trump wants to refinance US debt through low negative interest rates that the European Central Bank has been unable to maintain. As described by Fox Business, negative interest rates are often used as a last resort to stimulate economic activity, stimulating market participants to spend money instead of saving money.

“In general, banks pay deposit interest to depositors. But when interest rates become negative, the situation is reversed: depositors like the Fed need to pay banks. Historically, negative interest rates have been used as an economy. An extreme means of stimulating economic growth during the downturn."

At least, these are unknown areas of global monetary policy. So what happens when all the monetary policy tools used to alleviate austerity have been exhausted when the economy is in a downturn?

Does the existing financial system not work? Does anyone know?

“I have always agreed to abolish the Fed and use machine programs to keep the amount of money growing steadily.”

– Milton Friedman The billing system has become more and more fair and accurate since humans first recorded with sticks and stones.

In essence, Bitcoin is only a shared ledger on a distributed network, and the encryption economy incentive mechanism behind Bitcoin is maintained to encourage online participants to trade honestly and transparently.

Economic incentives promote collaboration. It is capitalism, game theory…and a solid currency. Its core functions are as follows:

1) Value storage 2) Communication medium 3) Accounting unit

For countries with weak government currencies such as Venezuela and Argentina, Bitcoin has become another way of storing value. It is sent in digital form and is the safest way to book and computer networks created by humans.

In addition, Bitcoin has also proven the concept of digital scarcity. Since Bitcoin's PoW algorithm requires a lot of computational power, the records are tamper-proof and cannot copy a single bitcoin.

Federal Reserve Chairman Jerome Powell publicly called Bitcoin "a speculative value-storing tool similar to gold." Historically, Bitcoin has been so popular because it is not easily forged.

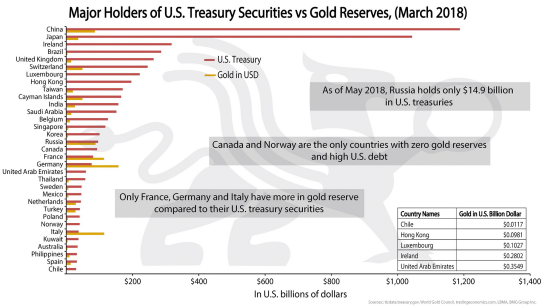

Due to the uncertainty of negative interest rates, currency wars and their impact on trade, central banks in Russia, China and other countries have been increasing their gold reserves to prevent the reserve currency from depreciating.

Can the United States really count on printing money to pay off debts while expecting other countries to act according to different rules?

China still holds a large amount of US Treasury bonds. Germany, France and other countries prefer to hoard gold, while some countries such as Canada and Norway do not.

In the context of inflation, negative interest rates and a fragile banking system (some reserve banks, bank runs and the spread of the crisis), the French currency appears to be competing for depreciation, while scarce assets such as Bitcoin and gold provide investors with a safe haven and are gradually appreciating. .

But how do you measure the scarcity of digital money?

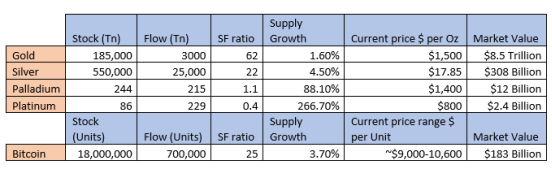

PlanB explains the mathematical principles behind Stock to flow (SF) in his article "Modeling the Value of Bitcoin with Scarcity", which can be used to relate scarcity to value.

Stock is the size of existing stocks or reserves, ie stocks.

Flow is the annual output:

Gold has the highest SF ratio of 62 (in other words, 62 years of production time to reach the current gold stock level), and silver ranks second with 22 SF.

The SF value for most commodities is only slightly higher than 1. Existing stocks are usually equal to or slightly below annual production. It is difficult for a commodity to obtain a higher SF value, because once someone starts to stock up, the price will rise and the output will increase (because it becomes more profitable) → the supply will increase and the price will fall again.

Bitcoin currently has 18 million stocks (a total of 21 million), and the supply is growing at a rate of about 700,000 per year, with an SF ratio of about 25.

Bitcoin's current 3.70% supply growth is based on 12.5 bitcoin mining awards (10 minutes out of the block) and is expected to be halved in May 2020. This will make Bitcoin's supply growth rate (or inflation rate) below 1.78%, which makes sense because it will be lower than the current global inflation rate of about 3%.

PlanB built a regression model based on these numbers, predicting that after the halving of Bitcoin, the market value will reach $1 trillion, which means that the price of each bitcoin will reach $55,000. Considering that the peak market value of Bitcoin in 2017 is around $300 billion, I don't think this is unreasonable.

“People ask me where the capital needed for the $1 trillion bitcoin market value will come from? My answer is: silver, gold, negative interest rate countries (Europe, Japan, the United States will implement negative interest rates), predatory government countries (Venezuela , China, Iran, Turkey, etc., billionaires and millionaires who hedge against quantitative easing (QE) and institutional investors who have found the best assets in the past 10 years."

——PlanB

Conclusion

If you have a script for a bitcoin movie between me and me, it can be written by yourself. Although there are still many challenges and disagreements that need to be overcome today, Bitcoin has not died despite the rumors flying around.

Because of the geopolitical turmoil and widespread trust erosion described in this article, the idea of creating a neutral, minimally trustworthy, and identifiable scarce digital currency to escape the global trade war has never been stronger.

International trade partners can never trust each other's legal currency as they trust a neutral, incentive-based consensus mechanism, encrypted secure distributed ledger.

Central banks may not be able to accept Bitcoin very quickly, but as this week's repo market turmoil shows, the existing financial system has begun to show its limitations, but it is gratifying that we have another Kind of choice.

Translator | Saline

Production | First Class (First.VIP), please keep this information.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Mine pool coin, the next platform coin?

- Invoices, justice, poverty alleviation, government applications have become the blockchain to take the lead in the field?

- Want to put Bitcoin and Ethereum into foreign exchange reserves, Venezuela has finally done a reliable thing?

- Notes | Multicoin essays sing empty anonymous coins, coins Ann released Defi research report

- Analysis | Differences in the four financing models of blockchain

- Interview with Gavin Wood: IPO can effectively constrain blockchain fraud

- Planning and Progress of Ethereum 2.0 | Vitalik Live Profile