Notes | Multicoin essays sing empty anonymous coins, coins Ann released Defi research report

Really Satoshi: The latest high-quality articles on 5 cryptocurrencies are selected today. Today's content includes: 1 Multicoin sing anonymous coin; 2 coin An info release Defi research report Part II: Arbitrage trading and trading strategy; 3 DeFi lending service ideal What is the interest rate model? 4 Tezos Agora will build a magnificent multi-DAO interactive platform for Tezos; 5 Defi service selection (revenue revenue)

Multicoin: Privacy is a feature, not a product of its own

This is the latest work of Multicoin Capital. I personally think it is very well written. If you look at it carefully, it is not written by King Kyle. It is no wonder that there is no Over Milked phenomenon. This is actually a small black text, because Multicoin is also shorting the anonymous coin double XMR and ZEC.

The main argument of the article is that a common platform like Bitcoin and Ethereum has provided enough privacy guarantees for most users, eliminating the need for privacy-focused niche market blockchains.

The author proposes that I agree with some points, such as the concept of perfect privacy. In theory, Zccash's privacy technology is perfect, but the perfect privacy brings a lot of trouble, such as too much anti-censorship. In fact, everyone's demand for privacy is also a pyramid pursuit, and most people do not need such perfect high-level privacy protection. And perfect privacy is costly.

- Analysis | Differences in the four financing models of blockchain

- Interview with Gavin Wood: IPO can effectively constrain blockchain fraud

- Planning and Progress of Ethereum 2.0 | Vitalik Live Profile

Bitcoin is the best anonymous currency. Even if Bitcoin's anonymity is not good, you can use some tools, such as mustard wallet, to achieve the anonymity you need. The same is true for Ethereum. With aztec or Tornado, more and more public chains will also increase the anonymity attribute, which will aggravate the anonymity of anonymous coins. The actual data also shows that although Monroe is the most common anonymous currency, less than 5% of the Darknet transactions are through Monroe, and most people still use Bitcoin.

Full text link: https://multicoin.capital/2019/09/24/privacy-is-a-feature/

Coin Safety Report: DeFi Series 2 – Arbitrage Trading and Trading Strategy

This is the second part of the Defi series report from the currency security info. The theme is to use the DeFi based ETF to explore arbitrage trading and arbitrage strategies. The original content of the report is a bit long, and the key points are listed below:

DeFi interest rate arbitrage refers to the difference in interest rates between the DeFi platforms. DeFi-CeFi arbitrage also exists when there is a difference in interest rates between the centralized and decentralized platforms.

Using arbitrage trading strategies, you can use low-interest asset borrowing to invest in assets that generate higher returns. From the perspective of the borrower, all existing DeFi platforms rely on excessive collateral requirements, which limits potential arbitrage opportunities.

Both DeFi and CeFi platforms may have some potential market inefficiencies, which can be explained by the following reasons: low liquidity, interest rate fluctuations, different platforms and protocol terms,

As the DeFi space matures, new opportunities are expected to become less and less. Assets and platforms have similar risk characteristics, and new platforms and agreements such as interest rate swaps may lead to broader trading opportunities.

Full text link: https://info.binance.com/en/research/marketresearch/defi-2.html

What is the most ideal interest rate model for DeFi lending services?

There are a variety of DeFi lending services based on reserve pools, and each service offers a different interest rate model that balances the needs of lenders and borrowers.

The main factor in this process is utilization. Utilization is an indicator of how much money has been borrowed (total borrowing). Generally, a higher utilization rate indicates a higher percentage of pools used for loans.

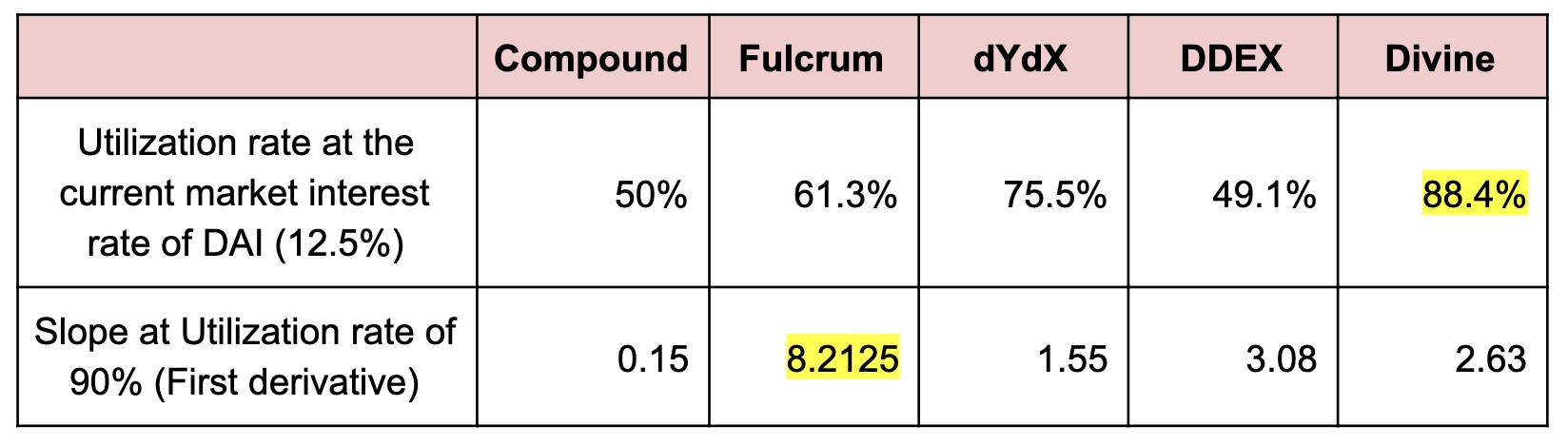

The author compares the different Defi lending service products and their DAI loan interest rate models: Fulcrum and Compound (linear model); dydx and ddex (polynomial mode); Divine (exponential model). The following is the analysis results (Note: the author is Divine):

Full text link: https://medium.com/@divine_protocol/what-is-the-most-desirable-interest-rate-model-for-pool-based-defi-lending-services-16ee2f88da25

How Tezos Agora creates new markets in the Tezos Federation

This article focuses on the impact and role of Tezos Agora. Tezos Agora will be a big market for gathering and discussion of Tezos network participants. This platform will eventually connect with multiple DAOs to determine the affairs of Tezos. We all know that Defi and DAO are the two most anticipated topics/directions in the blockchain week in Berlin. Defi chose Ethereum, and DAO's battlefield now has a lot of uncertainty. Tezos applications are very competitive, but There is a very good (and perhaps the best) chain to control the soil, and the final choice of the DAO theme is not Tezos, the results are a bit of a look.

There are references to founder Arthur Breitman and developer Jacob Arluck:

- Agora's vision is to be a platform to interact with multiple DAOs.

- A lot of the content is unknown, so my general opinion is that this requires experimentation.

- An underestimated concern is that a project has only one regulated DAO/Ministry using it to do too many things, such as Decred

Full text link https://medium.com/tezoscommons/potential-implications-of-autonomy-in-tezos-156c0310cd35

Defi service is carefully selected

Netizen fblauer wrote a Defi project and his views on Defi. I like some of his views about Defi, and then the project he pushed is actually okay. The title says that Defi is strictly selected but in fact it is more about revenue.

- Short-term trading of cryptocurrencies is over-hyped, while 95% are losing money. Everyone is afraid, and looking for Defi's low-risk and reliable income.

- Participating in Defi, the most suitable is the stable currency. Smart contracts are also audited, open source, transparent, and in some cases have insurance funds and decentralized governance.

- In the liquid category, Bancor is actually better than Uniswap, but Bancor needs to use BNT, BNT has volatility, so it is difficult to determine the income/yield rate.

- If you believe in token value, Staking is also a very good low-risk way to earn income.

Full text link: https://www.publish0x.com/defi-opfi/tested-and-curated-sources-incomerevenue-defi-services-sept-xkpoxo

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Bitcoin Core developer officially released Erlay BIP, Bitcoin is further upgraded from heavyweight

- Xiao Feng's latest speech: If it is just a "+ blockchain", you will be abandoned by the times.

- 2.0 is about to set sail. Will Ethereum turn to PoS to be an ETC counterattack?

- Facebook releases new version of LibraBFT protocol to reduce network complexity

- The Fold App is financing $2.5 million, and users can use BTC to buy clothes or pizza while earning BTC

- Wanxiang and Xiao Feng's blockchain map: you can see the "tip of the iceberg"

- Blockchain Technology Criterion: Besieged, Troubled Privacy Defender