Exploring Bitcoin: Explaining Bitcoin's Intrinsic Investment Logic

This article analyzes bitcoin assets in a simple way, combining the author's experience with cryptocurrency fund managers and start-ups to evaluate bitcoin in three ways.

· The uniqueness of Bitcoin · The social value of Bitcoin · The investment value of Bitcoin

The uniqueness of Bitcoin

To understand Bitcoin, you need to know what it has changed. Bitcoin's public key, private key, cryptography, distributed ledger, public database, proof of work, tokens and other technologies have existed for many years. It combines all technologies in a subtle and elegant way, creating the first computer sovereign platform and being separated from the state. Prior to this, the king, queen, national government and federal government represented sovereignty. They have the right to mint or print money. The emergence of the Bitcoin blockchain is the first time in human history that computer platforms have been used to represent sovereignty, using bitcoin as a common currency.

- Where are we in the mining cycle?

- Can the blockchain save the eleventh golden week that broke out every year?

- Review of the week | Bitcoin fell 20%, but Bakkt did not want to back this pot

Sovereignty first

Bitcoin becomes a decentralized sovereign

Bitcoin sovereignty is decentralized in nature. That is, Bitcoin does not require third-party verification to determine the authenticity of the transaction. Nodes and miners are two key factors in maintaining Bitcoin's decentralized sovereignty.

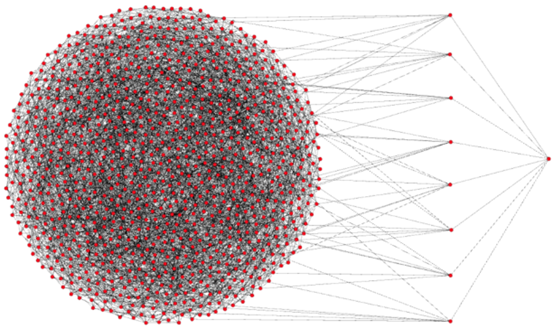

The degree of decentralization of Bitcoin depends on the number of nodes. A node is a key point in creating, receiving, or transmitting a message to broadcast a transaction on the chain. It is they that support Bitcoin to trade without third-party verification. The node can decide whether to perform a software upgrade. So far, the number of Bitcoin nodes is nearly 10,000 (20% more than Ethereum), and it is one of the most blockchains.

Bitcoin node (Source: Medium Blog)

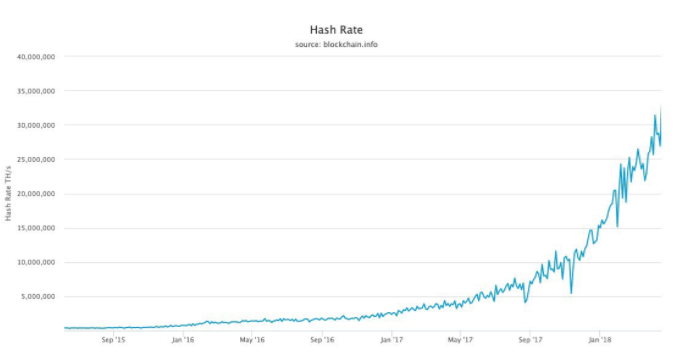

The miners protect and verify the security of the Bitcoin blockchain and the authenticity of the chain transactions. When miners are mining, they use the power to “package” the block and get Bitcoin as a reward. Today, Bitcoin's computing power consumes more than 7 megawatts per day, which is equivalent to the daily electricity consumption of a Swiss country. Compared with 2017, Bitcoin's computing power has reached the highest level in history and is currently at a 100 trillion hash rate.  Bitcoin hash rate (Source: Blockchain.com)

Bitcoin hash rate (Source: Blockchain.com)

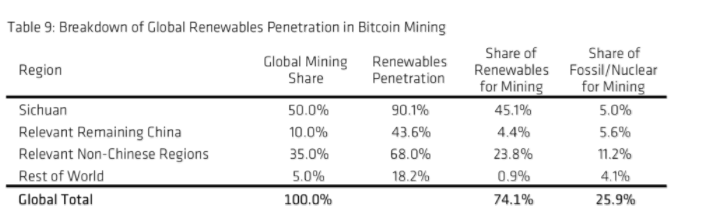

The greater the power, the more people invest in Bitcoin mining. As computing power increases, bitcoin security is higher. Many people attack the power consumption of Bitcoin to harm the environment. This is a bit alarmist. According to Coinshares data (pictured below), nearly 74.1% of Bitcoin's electricity comes from renewable sources (interestingly, 60% of Bitcoin power comes from China). The value of Bitcoin is directly proportional to the demand for computing power. Miners need to invest a certain amount of electricity to mine. If Bitcoin does not consume power, security will disappear and the network will be blacked out. When Bitcoin loses its power, it is no longer a sovereign computer, and ultimately loses its worth.  If the perpetrators want to destroy the Bitcoin blockchain, they will not only need to invest in mining machines, but also need enough power. According to the current scale of bitcoin computing power, the perpetrators will need more electricity per day than Switzerland. As computing power increases, Bitcoin is getting harder to break. Bitcoin has withstood a large number of hacking attacks so far. This is enough to prove the security of Bitcoin. It is expected that governments and businesses may attack Bitcoin in the future, as Bitcoin poses a threat to their power. Perhaps at that time, only time will tell the security and sovereignty of Bitcoin.

If the perpetrators want to destroy the Bitcoin blockchain, they will not only need to invest in mining machines, but also need enough power. According to the current scale of bitcoin computing power, the perpetrators will need more electricity per day than Switzerland. As computing power increases, Bitcoin is getting harder to break. Bitcoin has withstood a large number of hacking attacks so far. This is enough to prove the security of Bitcoin. It is expected that governments and businesses may attack Bitcoin in the future, as Bitcoin poses a threat to their power. Perhaps at that time, only time will tell the security and sovereignty of Bitcoin.

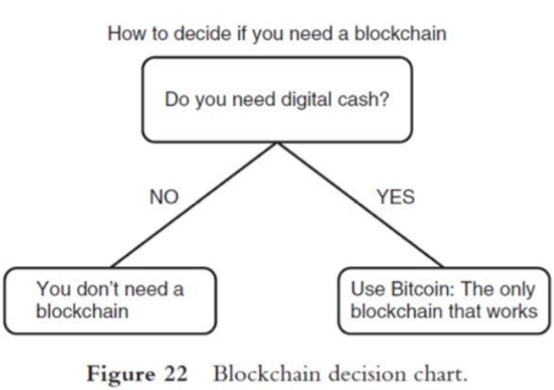

Blockchain myth

Valuable blockchain technology needs to meet two characteristics. First, "decentralization." Ensuring that individuals or organizations cannot easily tamper with blockchain transactions or damage infrastructure. If you can easily change the information on the chain, it shows that it is still a centralized system, and the blockchain technology loses its meaning. “Decentralization” is the ultimate goal of the blockchain. In the case of Bitcoin, “decentralization” means that Bitcoin achieves the ultimate goal of “decentralized sovereignty, people control money”. The only innovation in the blockchain is the establishment of decentralized sovereignty in the virtual world. Second, the autonomy, stability and scarcity of monetary policy also affect the value of the blockchain. After the blockchain issues tokens, once the token loses value, the blockchain itself loses its meaning. In the past 10 years, Bitcoin's monetary policy and distribution plan have not been in a gap, and the three characteristics of stable, predictable and limited quantity have given Bitcoin value. Most of the "blockchain technology" or "cryptocurrency" on the market cannot achieve these three points at the same time.

Bitcoin, not a blockchain

Many people are still in the quagmire and are caught in a more subversive perception of blockchain than Bitcoin. The blockchain is not a revolution that changes the world, but is synonymous with the marketing and speculation of investors and start-ups. Many start-ups have raised hundreds of millions of dollars from investors who are completely unaware of the blockchain. The phrase “bitcoin, not a blockchain” just corrects the current market situation of imbalance and under-education. The real subversive innovation is bitcoin, not blockchain.

Bitcoin, not the blockchain (Source: The Bitcoin Standard) The social and economic value of Bitcoin

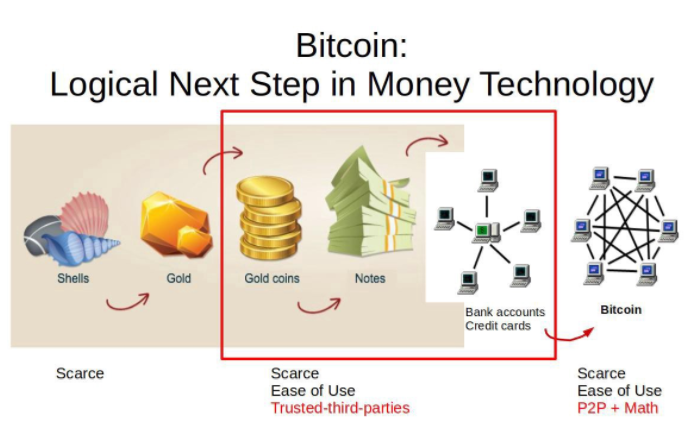

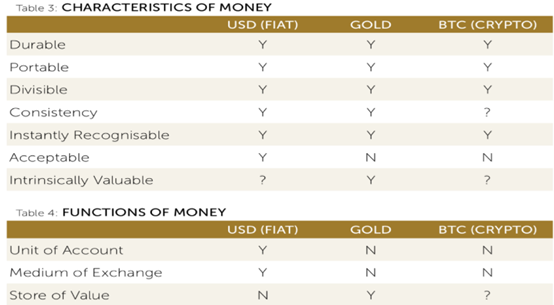

Contrast | Bitcoin, US Dollars and Gold

Because Bitcoin is not a company, there is no inherent value in the absence of profits or dividends. Bitcoin can be thought of as a currency that, like most currencies, has no intrinsic value. The reason why gold, the US dollar and national currencies are valuable is because of the state-oriented monetary policy behind them. The biggest challenge for Bitcoin today is how to gain broad social recognition.  Today, Bitcoin can be used for transactions and settlements worldwide. Bitcoin follows the same logic as gold for more than 2000 years or US dollars for 70 years, all of which are world currencies. As far as currency is concerned, bitcoin is even more scarce, opener and fairer than gold and dollars. Scarcity is because the code sets the number of bitcoins to 21 million. To change this value, you must obtain at least 51% of the miners' consent. Moreover, Bitcoin is not regulated by third parties, no one can tamper with the chain, and no one can stop using Bitcoin. It has brought unprecedented economic freedom to the world, just as the Internet brought freedom of information to society. In contrast, most people recognize the value of gold, which has existed for thousands of years, and Bitcoin cannot be compared with gold in terms of time and reputation. The advantage of the dollar is that it is now a global currency with a network effect that Bitcoin does not have. These advantages are not that Bitcoin can be replaced in a short time. However, perhaps one day, the public will realize the value of Bitcoin – a currency that cannot be expanded or controlled by third parties.

Today, Bitcoin can be used for transactions and settlements worldwide. Bitcoin follows the same logic as gold for more than 2000 years or US dollars for 70 years, all of which are world currencies. As far as currency is concerned, bitcoin is even more scarce, opener and fairer than gold and dollars. Scarcity is because the code sets the number of bitcoins to 21 million. To change this value, you must obtain at least 51% of the miners' consent. Moreover, Bitcoin is not regulated by third parties, no one can tamper with the chain, and no one can stop using Bitcoin. It has brought unprecedented economic freedom to the world, just as the Internet brought freedom of information to society. In contrast, most people recognize the value of gold, which has existed for thousands of years, and Bitcoin cannot be compared with gold in terms of time and reputation. The advantage of the dollar is that it is now a global currency with a network effect that Bitcoin does not have. These advantages are not that Bitcoin can be replaced in a short time. However, perhaps one day, the public will realize the value of Bitcoin – a currency that cannot be expanded or controlled by third parties.

Bitcoin, US Dollar and Gold Comparison (Source: Kitco)

Bitcoin becomes an intermediate currency and a non-political international clearing standard

If Bitcoin succeeds, it will not necessarily replace any of the national currencies. It can be an intermediate currency, above the national currency, as a neutral currency clearing system and value standard. We already have global, non-political metrics such as length in miles and kilograms in weight. These units of measurement will not change for political reasons, but since we abandoned the gold standard, there is no basic standard for measuring monetary value. Although the world currency is based on the US dollar, the US dollar is vulnerable to political influence and monetary policy and the long-term depreciation of the US dollar. Its value measurement standard is not perfect. In today's world of excess money, what we need is a non-political currency value standard.

Similarly, Bitcoin is likely to become a non-political international clearing standard. Today, only banks can participate in international or regional clearing networks (such as SWIFT, Fedwire, ACH, CHAPS, Visa and MasterCard). Individuals, businesses and governments can only participate in these clearing networks through banks. Using these clearing networks for remittances can take days, the process is opaque and costly, and sometimes political factors can affect remittances. Imagine an open platform on which individuals, businesses, and governments can conduct point-to-point customs clearance, regardless of time, place, quantity, ethnicity, and political ideology, at a reasonable and transparent cost. This will break the conventional monetary system, just as the Internet has broken the spread of information.

In the Bitcoin world, all currencies will be settled based on Bitcoin and Cong (the smallest unit of Bitcoin, approximately $0.0001). When your grandfather asked you how many bitcoins a dollar value? You can say 1 dollar = 9718 Cong. Oil = 19,000 Cong. The gross domestic product (GDP) of the United States = 5 million bitcoins. Taiwan’s national reserve = 100,000 bitcoins. Use bitcoin as a unit to exchange other equivalent currencies.

If other currencies are denominated in Bitcoin in the future, the world will be very different. When the currency depreciates, people tend to consume, because if they don't spend it today, they may depreciate. Today's financial institutions encourage customers to invest in order to ensure the value of their customers' assets. After all, investing in non-monetary assets is the only way to fight inflation. Even large financial institutions are affected by national monetary policy. If the monetary system is based on a non-inflationary currency, people will change their consumption habits and save more than they intended. As capital becomes conservative, future investments will be more cautious. As a scarce currency in the era of capital expansion, bitcoin can be a tool to fight inflation.

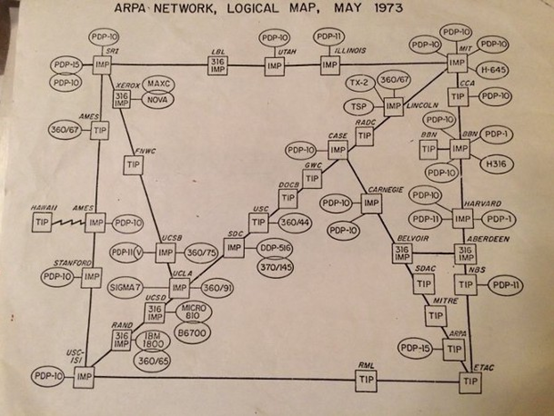

Bitcoin investment value

Bitcoin is an open source protocol. Unlike the company's history, the Bitcoin protocol history has not experienced prosperity, innovation, competition, and subversion (for example, Amazon subverts traditional retail, Apple replaces Nokia). Once the agreement is established, it is difficult to change. For example, we use IP (Internet Protocol) to transmit data over the network (CISCO tried a variety of protocols in the 1990s, but eventually IP became the best choice). Today we are still using the IP Internet Protocol. Attempts have been made to invent other agreements, but they have not been successful. Once the agreement is established and has certain network effects, it is difficult for the new agreement to surpass it. Currently, the Bitcoin protocol is the standard for the currency Internet and is irreplaceable.

TCP/IP protocol

Winner is king

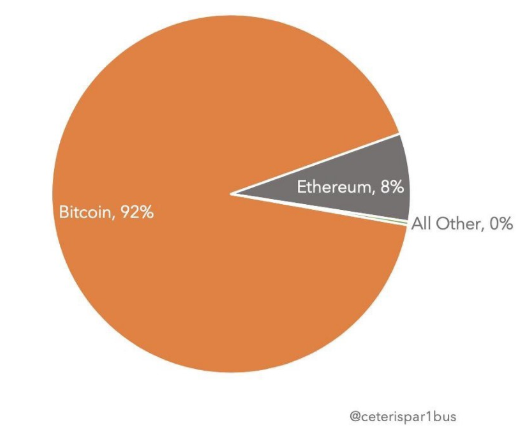

In the field of decentralization, the effect of the winner as king will become more apparent. At present, many new startups are experimenting with blockchain technology and applications, and even if they succeed, the possibility of replacing Bitcoin is minimal. There are more than 1,000 cryptocurrencies on the market, most of which have low transaction volumes, no senior engineers or large communities, and some have even returned to zero. In contrast, Bitcoin has worked well over the past 10 years. At present, Bitcoin has more than 60 million users, with an average monthly growth of 1 million users, and deals with billions of dollars in transactions every day. The total number of users of other cryptocurrencies is less than 5 million, and the transactions processed per day are less than 1% of Bitcoin (almost 92% of transaction fees come from Bitcoin's chain transactions).

Bitcoin's dominance in the cryptocurrency market (Source: @ceterispar1bus)

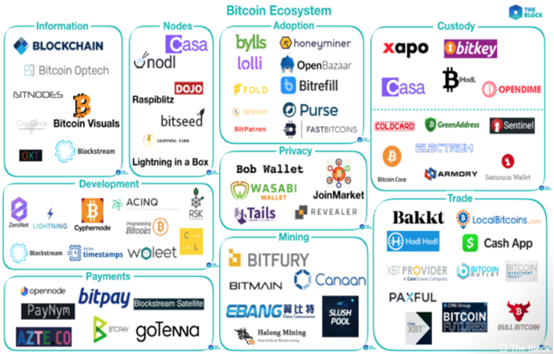

Today, Bitcoin has a certain network effect. If you want to replace it economically, you need to invest a lot of money, electricity, talent and hardware to replace the existing Bitcoin blockchain. In contrast, building on Bitcoin is a more cost-effective way. For example, the disputed transaction speed and high handling fees have been high. Bitcoin's block time is 10 minutes, and each block handles about 3,000 transactions. The user must wait 10 minutes before the transaction is recorded on the chain and the transaction takes an hour to complete. A fee of approximately $0.50 or more must also be paid to the miner. Lightning Network solves the problem of slow bitcoin transaction speed and high transaction cost. It builds on the second layer of decentralized networks above Bitcoin. It combines the underlying security with support for thousands of transactions per second and reduces transaction costs to 1 per C (0.00001 USD). As long as Bitcoin's security and sovereignty are not infringed, more second-tier technologies will be transferred to Bitcoin in the future, and more companies will participate in the establishment of the Bitcoin ecosystem. The development of the Bitcoin ecosystem will bring more value and practicality to Bitcoin.

Bitcoin ecosystem (Source: The Block)

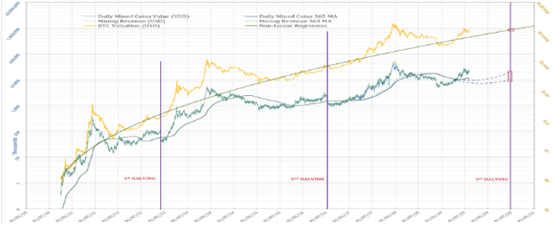

Bitcoin historical prices and trends

The 2017 ICO bubble is like a replica of the Internet bubble in 2000: in the short term, the technical value and prospects are seriously overestimated, and the price reflects the temporary pessimism of investors. Unlike the Internet bubble, Bitcoin has experienced three price plunge since 2010, with an average drop of 79%. Every time the price falls, it is followed by a new wave of price increases. In 2017, the bitcoin plunged the same as the previous two, which was a cyclical adjustment of the market and did not affect the long-term trend of Bitcoin. By April 30, 2020, bitcoin production will be halved for the third time, and the number of bitcoins generated in each block will be reduced from 12.5 to 6.25.

Bitcoin price history chart

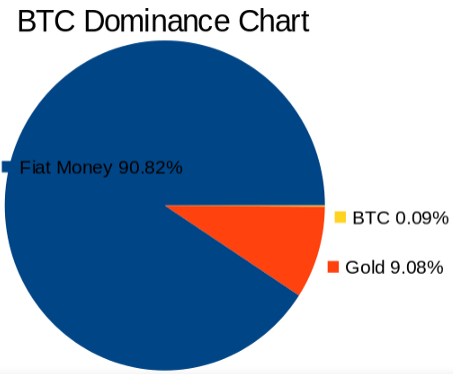

Bitcoin market size

The total market capitalization of Bitcoin is approximately $180 billion, accounting for only 0.09% of the gold and French currency markets. If Bitcoin eventually becomes an international value standard and clearing network, its value will far exceed gold. The total market value of gold is about $8 trillion. If the market value of Bitcoin is equal to gold, 1 bitcoin will be worth $300,000. If bitcoin is compared to a narrow currency in circulation (currently worth $40 trillion), 1 bitcoin will be worth $2 million. The reason why this is a conservative estimate is that the total amount of Bitcoin is limited and the total amount of legal currency is unlimited.

Bitcoin dominates the currency market

Bitcoin as the value of digital gold and non-related assets

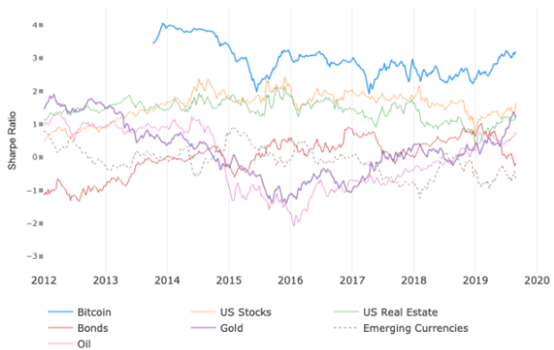

As a digital gold and non-related asset, Bitcoin is a tool for hedging financial risks. In today's turbulent world, Sino-US trade wars, bloody protests in Hong Kong and other geopolitical risks will further push up the price of Bitcoin. In the current market environment, traditional assets such as stocks, bonds and real estate have limited gains. For investors, finding an asset that is undervalued, risky and rewarding is even harder. Among all major asset classes, Bitcoin has the highest Sharpe ratio when measuring risk returns.

Sharpe ratio of Bitcoin to other assets (Source: @woobull)

Conclusion

Bitcoin was born in the 2008 financial crisis, when the news of the "Times Finance Minister's second bail-out of the Bank on January 3, 2009" was widely spread, claiming to solve the decline of the financial industry and the loose currency of the central bank. Policy status. Ten years later, social problems and financial risks remain undiminished. With the new round of financial crisis, bitcoin prices reacted strongly. Perhaps it is the only hope for mankind to get rid of the central bank’s reckless monetary policy and excessive government credit expansion. If Bitcoin succeeds, early investors will take the lead than others. Their understanding of the digital world of the future will lead the society forward. Bitcoin is an invention that changes the world. Its power and imagination far exceeds that of "tulips." Bitcoin opens up another possibility for society: it is a decentralized, peer-to-peer, digital, limited supply, transparent, open monetary system.

Author | Louis Liu Source | Medium Translation | First.VIP Tracey Reprinted please keep the information at the end of the article.

Editor's Note: The original title is "Analysis of the Intrinsic Investment Logic of Bitcoin"

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- ProgPoW enters the conspiracy cycle, Ethereum 2.0 upgrades or can end the farce

- Dialogue | Paying for the match: Who is better than the anonymous and stable coins?

- Regulatory barriers, executives acknowledge that Libra may postpone the release

- [Cold knowledge] Mine construction cost calculation method!

- RSK parent company announces acquisition of Spanish social giant Taringa to integrate its tokens into social applications

- Ruibo finally started on DeFi! Acquisition of Logos to create a Repo-based (XRP) DeFi ecosystem

- Google has been "quantitative hegemony" being screened, and the cryptocurrency community already has a solution?