Farce does not stop! LedgerX executives accuse CFTC of preferring its competitor Bakkt

This weekend, the cryptocurrency derivatives market staged a drama involving LedgerX executives and regulators, the US Commodity Futures Trading Commission (CFTC).

Executives at LedgerX, a US-based cryptocurrency exchange, claim that its main regulator, the CFTC, is unfair, and the CFTC prefers its old rival, Bakkt.

Paul Chou, CEO of LedgerX, issued a series of tweets alleging that the CFTC violated its commitments and conducted behind-the-scenes transactions.

Before the farce was staged on Twitter, the encrypted derivatives platform LedgerX saw an embarrassing "future oolong event" in August. The source told The Block that LedgerX's view was that the CFTC had given the company the necessary permits to launch physical delivery futures. However, after LedgerX announced on its social media that its Omni platform (originally marketed as an option and futures platform), a CFTC spokesperson told The Block that the company had not been approved to launch bitcoin futures for physical delivery.

- Exploring Bitcoin: Explaining Bitcoin's Intrinsic Investment Logic

- Where are we in the mining cycle?

- Can the blockchain save the eleventh golden week that broke out every year?

Now, two letters from CoinDesk reporter Nikhilesh De claim that the prejudice of CFTC's former chairman, Christopher Giancarlo, is the reason for the company's (futures products) being delayed.

Image source: CoinDesk

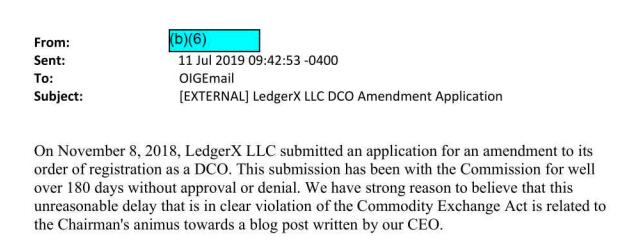

Among them, the letter dated July 11 states: “On November 8, 2018, LedgerX submitted a revised document for the registration of the Derivatives Clearinghouse (DCO). The document was submitted to the CFTC for more than 180 days and was not approved or Denial. We have every reason to believe that this unreasonable delay in the apparent violation of the Commodity Exchange Act is related to the hostility of the (CFTC) Chairman’s blog post written by our CEO."

CoinDesk said that it is not clear which blog post this letter specifically refers to.

Why does CFTC prefer CFTC competitors? This is not entirely clear, and although the insider told The Block, the LedgerX leadership believes that the CFTC is in the same league and is working more closely with Bakkt and ErisX. Other sources said that regulators generally favor existing market participants rather than new entrants.

However, CFTC spokesperson Michael Short told CoinDesk that he could not comment on the allegations in the letter, but in general, "the CFTC treats all registered entities equally," and LedgerX's business needs to be "widely considered", due to the review process. The company’s licensing strategy has changed over and over again.

Image source: Twitter

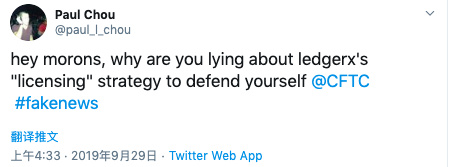

Short declined to give more details in the email. Paul Chou commented on Short's response, "Why do you lied about the so-called LedgerX 'License' strategy to defend yourself?"

There are many ways to get approval for a new futures contract. In contrast, rival Bakkt launched its own New York-regulated trust company, while ErisX and LedgerX decided to launch the market with DCO and DCM licenses.

- Odaily Planet Daily Note: LedgerX currently has a Swap Execution Facility (SEF), a Designated Contract Market (DCM), and a Derivatives Clearinghouse (DCO) license that allows it to clear options and swaps. LedgerX is waiting for the CFTC to approve its DCO license application revision document, which will allow it to liquidate options, swaps and futures.

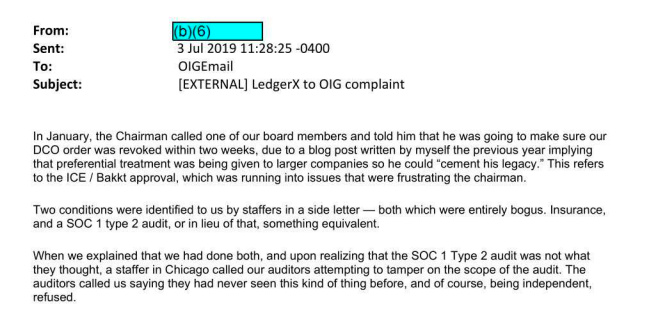

Previously when LedgerX claimed to launch the Bitcoin futures market, the CFTC stated that LedgerX only had licenses to operate the swap market. LedgerX stated that as part of its approval process, LedgerX was required to purchase insurance and conduct an SOC 1 Type 2 audit. The SOC 1 audit is a security audit conducted by several companies, including BitGo. LedgerX said in the letter that these two conditions are "completely forged."

The letter dated July 3 stated that the former CFTC chairman attempted to revoke LedgerX's license modification request and that a CFTC employee attempted to interfere with LedgerX's audit process.

Image source: CoinDesk

“In January 2019, the chairman of the (CFTC) called a board member of the company and informed that because a blog post I wrote last year suggested that a big company was being given preferential treatment, he would ensure that our DCO application was received within two weeks. Cancel…"

Image source: Twitter

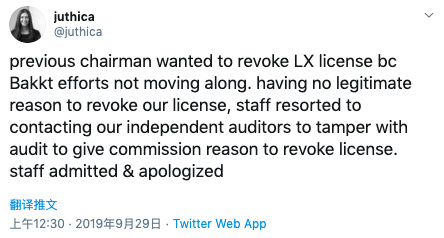

LedgerX Chief Operating Officer Juthica Chou (she is the wife of CEO Paul Chou) repeated this statement on Twitter. “The former chairman wanted to revoke the license of LedgerX because (at the time) Bakkt's efforts did not progress. Since there was no legitimate reason to revoke, the (CFTC) staff attempted to contact our independent auditors to tamper with the scope of the audit to provide reasons for the CFTC to revoke the license. The employee acknowledged (the behavior) and apologized."

- Odaily Planet Daily Note: Bakkt physical delivery of bitcoin futures officially started trading at 8:00 Beijing time on September 23.

In response to the statement that "employees are trying to tamper with LedgerX's audit process," CFTC spokesperson Michael Short said in the mail that this did not happen. At the same time, according to CoinDesk, Paul Chou was “expelled” by the CFTC Technical Advisory Committee.

Short told CoinDesk that dismissal was the result of a “consensus decision”. “Paul's capricious and unprofessional behavior has the potential to distract people from important issues,” he said.

When asked if the CEO's erratic behavior on Twitter would affect the approval of a contract, Short said frankly.

Paul Chou has not responded to The Block yet.

This article from at The Block , the original author: Frank Chaparro

Odaily Planet Daily Translator | Yu Shunzhen

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Review of the week | Bitcoin fell 20%, but Bakkt did not want to back this pot

- ProgPoW enters the conspiracy cycle, Ethereum 2.0 upgrades or can end the farce

- Dialogue | Paying for the match: Who is better than the anonymous and stable coins?

- Regulatory barriers, executives acknowledge that Libra may postpone the release

- [Cold knowledge] Mine construction cost calculation method!

- RSK parent company announces acquisition of Spanish social giant Taringa to integrate its tokens into social applications

- Ruibo finally started on DeFi! Acquisition of Logos to create a Repo-based (XRP) DeFi ecosystem