Where are we in the mining cycle?

" It's better to think about it from the perspective of over- and rectification than to think about it. "

— Howard Marks, Chairman of Oaktree Capital Since the price of BTC has rebounded from the long winter, mining demand for hardware has grown stronger. Bitmain was once a barbarian at the door of the bitcoin industry, but now it is in the face of a shortage of bitcoin mining machines. The mining giant's new generation of 7nm BTC miners has been completely sold out. Their latest products, the S17e and T17e, are sold out one minute after the start of the booking.

Bitcoin is not the only manufacturer of long queues at the door. MicroBT is a rising star. The company was founded by the former chief engineer of the ant mining machine S9. Its flagship product , the Whatsminer series, has eclipsed Bitcoin's product sales. At last week's Chengdu New Era Mining Summit, it was reported that since May, Shenma Mining has delivered 100,000 Shenma M20s / M21s, and it is expected that the output will exceed 200,000 by the end of September.

However, the growth rate of mining machine production still cannot keep up with the rising rate of bitcoin prices. When the computing power responds to price changes, it is always delayed. This is because the manufacturer's production capacity is naturally constrained by upstream suppliers. Original equipment manufacturers (OEMs) such as Bitland and Bit Micro are just designers of ASIC chips, a chip specifically designed for hash algorithm calculations. The actual production of the chip was carried out at highly advanced integrated circuit manufacturing plants such as TSMC and Samsung .

- Can the blockchain save the eleventh golden week that broke out every year?

- Review of the week | Bitcoin fell 20%, but Bakkt did not want to back this pot

- ProgPoW enters the conspiracy cycle, Ethereum 2.0 upgrades or can end the farce

Source: Bitinfochart

Custom ASICs can result in high one-time engineering costs. Chip makers spread these costs on mass-produced chips, which is why they only buy a lot of wafers at a time. These orders usually take 9 weeks or more to complete.

The time between order and delivery makes it extremely difficult for OEMs to anticipate demand and develop forward-looking business plans in advance. In the bull market at the end of 2017, no single manufacturer had enough inventory to meet the fast-growing demand. All mining machines are traded at a high premium in the secondary market. As a result, OEMs misjudged the overheating of the market at the time and produced too many machines. Bitcoin and its competitors had to digest their inventory slowly in 2018. In the second half of the year, they even sold the mining machine at a loss. This is why in 2018, although the price of Bitcoin fell throughout the year, its calculations did not stop climbing until the end of the year.

It is roughly estimated that Bitcoin has only successfully delivered about 40,000 S17 miners so far. This quite popular model uses chips based on TSMC's 7-nanometer process. This is the most advanced technology in the world, only TSMC does it. Chip manufacturers will give priority to large customers such as Qualcomm , Huawei and Apple, and first meet their demand for 7-nanometer chips. On the other hand, Bit Micro uses the Samsung 10 nanometer process. It's not as advanced as TSMC's 7-nanometer chip, but it's cheaper and much easier to produce. However, due to the growing production of 5G mobile phones, Samsung is still the bottleneck of Bit Micro.

Last month, Bitland issued a large order to TSMC, which will increase the production of 10,000 wafers per month from November. The order was allegedly prepaid in 100% cash. Each 12-inch, 7-nm wafer can cut about 3,000 chips, so 10,000 wafers should be enough to produce about 201,000 S17 Pro (about 11.7 E). This means that by the second quarter of 2020, only the Bit Continental Ant Mine can produce 55-65E. The existing network hash rate is about 85E, plus new orders from Bitcoin, plus other manufacturers' output, assuming that the currency price does not fall again, the bitcoin hash rate may be before the next halving event. double.

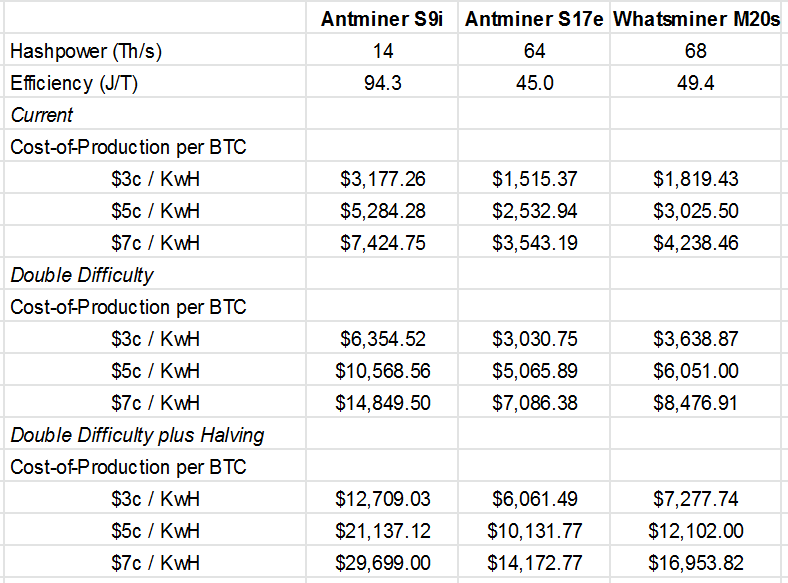

The soaring hash rate has depressed the miners’ ability to make money. What does this mean for the miners' production costs? The only variable that mine operators can really manage is their electricity price.

Taking the ant mining machine S9 as an example, the following are the production costs of bitcoin under different electricity costs:

Source: coinmetrics.io

More than half of the world's computing power is concentrated in several provinces in China. For the miners in these areas, April-October is no different from the festival, because local spring hydropower brings a lot of cheap electricity supply in spring and summer, basically reducing the miners' electricity bills to a negligible level. Last year, Sichuan Province suffered the worst rainy season in 57 years, but many mining facilities were built in these areas, and some even suffered from the catastrophe.

A local mine in Sichuan, China, was recently destroyed by heavy rainfall in the area.

In the last dry season, the volatility of prices gradually pulled the overheating power back to the level of break-even. Since the cost base of each mining operation is slightly different, the risk tolerance of each mine is different. We can only estimate the composition of the market production cost by observing how the ecosystem responds to these cycles in a high dimension.

We are currently in a very similar cycle phase to the fall of 2018: the bull market has sparked a huge interest in mining machines, and hardware manufacturers have struggled to meet the needs of the community. As the flood season ends, the price of Bitcoin continues to move sideways.

in conclusion

Using the parameters of the latest mining machines, predicting the growth of computing power, rising electricity prices, and halving rewards can predict production costs; using the numbers mentioned above as input values, we can safely say that the production costs of Bitcoin will increase significantly.

If the price of BTC plummets from the current level, we are likely to see the situation in the winter of 2018 re-enact: a large number of ant miners S9 mining machine will eventually be retired, the new machine will be sold at a reduced price, the mining business will be integrated, in the media A report similar to the "Death Spiral" will appear again.

All of these events are normal and are a natural part of the Bitcoin mining cycle.

Note: The above calculation does not include mine pool costs, maintenance costs and hardware purchase expenses. The actual production costs are much higher before the initial capital expenditures fully meet the balance of payments.

Disclaimer: Iterative Capital holds Bitcoin.

Written by: Leo Zhang

Compile: Zhan Wei

Source: Chain smell

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Dialogue | Paying for the match: Who is better than the anonymous and stable coins?

- Regulatory barriers, executives acknowledge that Libra may postpone the release

- [Cold knowledge] Mine construction cost calculation method!

- RSK parent company announces acquisition of Spanish social giant Taringa to integrate its tokens into social applications

- Ruibo finally started on DeFi! Acquisition of Logos to create a Repo-based (XRP) DeFi ecosystem

- Google has been "quantitative hegemony" being screened, and the cryptocurrency community already has a solution?

- Lightning Network Danger Vulnerability Details are disclosed, new versions of clients are not affected