The financial structure of the Ethereum Ecology: How does it work?

Ethereum is a platform that supports the construction of financial superstructures. User behavior in the financial superstructure creates a push-pull force that pushes and pulls the assets in which it runs. The indicators found at each level of the financial stack will explain the economic situation of Ethereum.

Overview

Ethereum is a set of layers built on top of each other. Each layer provides the foundation and stability for the upper layer to effectively express itself. Each level also has its own metrics that build and respond to market forces within the Ethereum economy.

Layer 0 – Ethereum

- Popular Science | Long-distance attack problem of PoS protocol

- Former Federal Reserve official 怼 Bank of England Governor: The idea of cryptocurrency replacing the US dollar is unreasonable

- Analysis: What opportunities, challenges and risks will be brought by blockchain technology for digitalization of securities?

ETH mortgage rate

Layer1 – MakerDAO

Stability fee; DAI savings rate

Layer2 – loan + loan

DAI amount – weighted average borrowing / supply rate

Layer3 – application layer

ETH locked in DeFi

Layer4 – liquidity

Trading volume of assets

The stability of each layer adds to the possibility of the above layers. This is why Ethereum development is so critical. Again, it shows the importance of building MakerDAO correctly, although it is not as important as building Ethereum.

If the two foundations of the Ethereum economy are adequately built, they will be able to support the building of a vibrant financial application ecosystem that can be managed entirely by code and interacting with market participants.

Layer 0: Global Bond Market

Metric: ETH pledge rate

Ethereum 2.0 will support ETH pledge. Users with 32 ETHs can verify online transactions on their computers and earn revenue. The size of the revenue depends on the size of the certifier pool. (Blue Fox Note: According to the current design, according to the size of the mortgage pool, the annualized return rate ranges from 1.56% to 18.1%. The smaller the pledge, the higher the return; the annual circulation is from 181,019 to 2,097,152 ETH; The inflation rate ranges from 0.17% to 1.56%. Considering the interest rate of ETH, the annualized return of ETH may be difficult to exceed 5%, probably around 3.3%, and the probability of pledge pool being 30 million ETH is greater. What will happen? Let's take a look at the ETH2.0 online.)

The PoS network is the beginning of a single digital bond market. With ETH as the currency, individuals with capital can pledge and then obtain low-risk returns. The return is proportional to the size of the capital and the time of pledge. It is a stable investment strategy for those who want low-risk, light-maintenance, ETH and Ethereum digital economies.

In the traditional bond market, you can buy bonds and notes from the US Treasury. When redeeming bonds and notes, buyers typically receive 1-3% of the proceeds. However, these interest rates are variable, they are freely traded as securities in the secondary market, and together generate a yield curve. In other words, when you buy a bond and you pledged your own dollar in the US economic network, you will receive a guaranteed return proportional to the size of your pledged asset and the maturity of the bond.

"I once thought that if there is a reincarnation, I want to be a president, a pope or a baseball player with a 40% hit rate. But now, I just want to go back to the bond market. You can scare everyone."

– James Carville, political adviser to President Clinton

The bond market controls everything. To date, it is the largest market for global securities, with $18 trillion, and the bond market is probably the most powerful guiding force for global capital.

The bond market has strength because they are the foundation of all markets. The cost of capital (or the interest rate of a bond) ultimately determines the value of a stock, property, or substantially all asset classes.

This is because the bond market and ETH pledged interest rates are the lowest level of their respective financial markets. They determine all market dynamics that exist upstream.

ETH2.0: Rebuilding the bond market

In ETH 2.0, the central government's functions and its fiscal reserves are written into the code of the agreement. The fixed pledge rate fixed in ETH 2.0 solves the problem of printing money by central agencies. In addition, the ETH pledged interest rate encourages capital to flow into the network and provide security for the blockchain.

In other words, the government issues bonds to develop the economy, and it supports the protection of the government and the economy. In Ethereum, the blockchain issues incentives to people who are pledged to pay for the security of the digital economy.

Layer 1: MakerDAO: Cornerstone

Metrics: DAI savings rate, stability fee

MakerDAO is where DAI is produced. In order for the DAI to be generated, the DAI producer, the CDP holder, promises to pay the stability fee. The stabilization fee is the loan interest rate and is also a tool for managing the price of the DAI in the secondary market.

Higher stability fee = higher DAI price

It also determines the cost of capital. Stabilization costs are a measure of projected return, a measure of the expected return on the debt generated by CDP holders using their mortgaged assets in a given year. If the stabilization fee is 20% and the CDP holders generate DAI, then they believe they can generate more than 20% of the revenue through these DAIs. The Stabilization Fee represents the “pull” of DAI's total market capitalization (Blue Fox Note: Stabilization Fee has a pull-down on DAI's circulation). The higher the stabilization fee, the less the supply of DAI.

MakerDAO announced the DAI savings rate in 2018. DSR is a tool that helps MakerDAO manage the price of DAI while also improving its ability to expand its market capitalization. Prior to the introduction of the DSR, all stabilization fees paid by CDP holders were used to destroy MKR (or PETH). This is the risk management fee charged by MakerDAO. Not all assets have the same risks, and some assets have little risk (such as tokenized US Treasury bonds).

The lower the risk of an asset, the more it tends to stabilize the DSR, rather than destroying the MKR. The higher the DSR, the higher the supply of DAI, because those who lock DAI in the DSR can get more rewards.

Left: no risk, fees paid to DSR ||| Right: risk, payment to MKR

Left: no risk, fees paid to DSR ||| Right: risk, payment to MKR

DSR is the twin brother of ESR. (Blue Fox notes: ESR is the ETH pledge rate). DSR allows you to get a return on risk-free exposure, a stable value currency with a highly predictable return value. DSR lures DAI out of the gravitational pull of the secondary market because it can permanently gain risk-free returns.

As long as DAI exists, someone has to pay a stabilization fee. If someone pays a stabilizing fee, then someone can capture the DAI paid to the DSR. More people pay the stability fee and more people can capture the interest rate of the DSR.

Layer 2: Borrowing

Indicator: DAI Weighted Average Borrowing Rate (WABR) & Supply Rate (WASR)

The DAI weighted average borrowing rate & supply rate originated from LIBOR, a financial instrument that measures the average borrowing cost of borrowing from various banks.

Weighted average borrowing rate and supply rate

The DAI weighted average borrowing rate and the weighted average supply rate are based on the average interest rate of all DAI loan/borrowing platforms. By weighting the average price and deriving interest rates and supply rates based on the trading volume of each platform (Compound, DyDx), a number is displayed, which shows the rate at which the DAI is supplied to or borrowed from the “market”. These two numbers will be useful metrics because money managers need data to support their decisions.

DAI market rate on June 29, 2019

Weighted average supply rate: 16.5%

(by lending DAI, the average annual rate of return is 16.5%)

Weighted average borrowing rate: 19.5%

(By borrowing DAI, paying an average of 19.5% annual interest)

(Blue Fox notes: At present, DAI's lending rate and borrowing rate have dropped, such as the recent Compound is about 12.9% and 8.1%)

Since the current daily price reflects the current day market status, these interest rates will change greatly in the future.

Layer 3: Application layer

Indicator: ETH locked in DeFi

This is the high-level currency, the expression layer, and the middle layer of the algorithm.

From:defipulse

From:defipulse

The application layer of Ethereum is a place where Ethereum becomes interesting.

What is the application layer of Ethereum?

The major innovation of Ethereum is to integrate “EVM” into the blockchain. "Virtual machine" is what the programmer calls "computer." The EVM of Ethereum is a way of calculating the local processing of the Ethereum blockchain. In other words, EVM allows Ethereum to run software and support digital assets (currency, property, tokens) in the software processing chain. This is the source of the term "programmable currency." The Ethereum application is basically computer software that programs the operation of currency or other assets.

Ethereum application layer: "Value Internet"

The programmable currency is very powerful. It is so powerful that researchers and developers at Ethereum have just touched the surface of what it can be. As in the 1990s, it was difficult to imagine how likely the Internet was, and the value of the Internet was showing early signs of the same rich prospects, with many possible applications and use cases. An important difference is that the Internet operates on data, while Ethereum runs on value.

The first large-scale applications of Ethereum

MakerDAO: Digital Native Stabilizer, DAI

Compound: Digital native automatic asset lending

Kyber Network: Chain-on-flow protocol that brings together the liquidity of various parts of Ethereum

Uniswap: Digital Native Automated Asset Exchange

Augur: Digital native forecasting market

dYdX: Algorithm Managed Derivatives Market

UMA (General Market Access) Agreement: Synthetic Asset Platform

0x: platform for orders placed on order book based exchanges

All of these apps represent a certain financial primitive. Each adds key building blocks to growing financial applications. Many of these applications are similar to the traditional financial services of centralized companies. Tokens generated by the UMA protocol can track the value of other assets, such as the NYSE's stock, giving global investors the opportunity to enter the stock market. dYdX is a platform for long and short assets, and is an alternative platform for other margin trading platforms such as TD Ameritrade or Robinhood. Augur is a platform for buying and selling the probability share of future results. Its products can theoretically be obtained in a centralized form, but are always subject to regulation. Uniswap is just an exchange, the same as the NYSE, but it is algorithmically managed to match buyers and sellers of any asset. Similarly, Compound who supports the pledge asset can borrow assets and pay the lender.

Below are descriptions of transactions between various agreements:

This picture shows the maturity of some of the early visions of encryption enthusiasts: the currency internet. The current Internet operates on data, and the new Internet operates on a value-based basis. As more and more value assets enter Ethereum, as more applications can program these assets, Ethereum's ability to create new financial products is growing.

This is how Ethereum grows its composite network effect. Each financial primitive adds another dimension to the choice of things that can be built on Ethereum. Each primitive is an individual Lego, and there are more and more Lego inside the Ethereum.

Financial stack

These platforms leverage DAI and Ether to operate. The trading volume of DAI and Ether, as well as the daily trading volume on these platforms, will be greatly affected by the Ethernet pledge rate (Layer 0) and the Stabilization Fee/DSR (Layer 1) and DAI WABR & WASR. These three indicators represent the rates generated by the three markets, which will determine the capital availability of all applications above.

Synthetic stack

Layer 0 is the algorithm-controlled commodity currency issuance layer. All new Ether releases are in Layer 0, and Layer 0 is the layer responsible for the security of the Ethereum blockchain. When security is low, Layer 0 releases more Ethers, but when security is higher, fewer Ethers are released (Blue Fox notes: that is, when ETH pledge is less, security is lower, Ethereum The network will reward more people with ETH and verify the transaction, which will reward more ETH. But when it is safe enough, the Ethereum release will be reduced, motivating users to transfer ETH to other more profitable places, such as the application layer. This is enough to ensure the safety of Ethereum while supporting Ether's move to a higher financial stack.

The ETH pledge rate determines the amount of gravity of Layer 0 towards the bottom of the stack, that is, the amount of gravity toward ETH.

Layer 1 is a stable layer. Layer 1 takes advantage of Ether released in Layer 0 and converts it into a stable form of DAI. Layer 1 supports individuals to manage their capital for long-term calculations because they can now make informed economic decisions because they know that DAI will represent similar value in the future.

Layer 1 is also the capital generation layer. Layer 1 is the layer in which individuals can directly coin, adding money to the macroeconomic pool of total money. The stability fee is the cost of the coin, which represents the cost of capital within the Ethereum.

The stability fee will generate a proportional DAI savings rate, which, like the ETH pledge rate, will also exert its gravitational effect on DAI in the financial stack. The DAI savings rate manages the scarcity of DAI, which can be compared to the scarcity of ETH pledge rate management ETH.

Layer 2 is the "capital availability" layer. Layer 2 determines the cost of borrowing, which is balanced by interest paid to the capital supplier. Layer 2 is the "Peer-to-Peer Credit Window" layer.

Compared to MakerDAO, the lending and borrowing of assets reduces the limit, but it also creates less systemic risk. At this level, you can borrow DAI, which usually requires less cost and a lower penalty in the liquidation event.

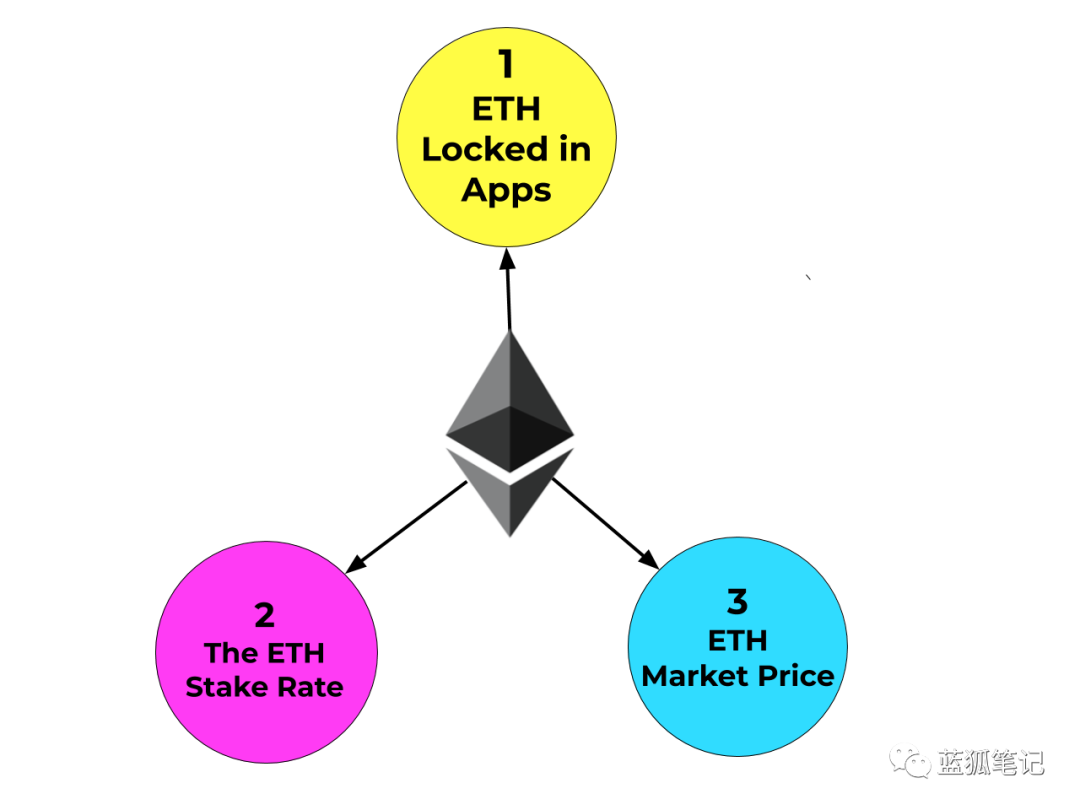

Ether can be one of three places.

Pledge

As a capital asset, Ether provides a regular dividend return.

2. Lock in the app

As a value store, Ether acts as a collateral in its financial ecosystem that does not require trust/no permission to participate.

3. Secondary market

In order to enter the above two services, the price must be paid in the secondary market.

This picture also applies to DAI. 1.DSR 2.SF 3.DAI price

This picture also applies to DAI. 1.DSR 2.SF 3.DAI price

The price of Ether depends on the common pull of 1+2 to 3

The pledge layer (2-ETH pledge rate) determines the basic rate of return for ETH. The risk-free ETH pledging rate provides a promised rate of return regardless of the rate of return found at the application level.

The application layer (1-ETH locked in the APP) reflects the market's need for financing. Supply and demand conditions in the market. In general, the market input from suppliers and lending is much higher than the amount of capital taken out, because borrowers can only borrow less than the value of their collateral. The ETH, which is worth $1,500, can lend a value of $1,000 to the ETH: Total Lock: 1/3 of the value of the ETH loan. (Blue Fox notes: In other words, due to over-collateralization, in fact more than 1/3 of the assets are locked.)

Each behavior has the same magnitude and opposite direction of reaction. Both System 1 and System 2 are intended to attract ETHs into their respective control ranges. Because the app has more attractive features and services, it always draws ETH out of pledge. The Ethereum Agreement provides a higher rate of return when there are fewer pledges. (Blue Fox Note: ETH's pledge layer and DAI generation layer and application layer will be attractive to ETH. These attractiveness depends on the respective rate of return provided, which causes the ETH value to flow.)

1 and 2 to 3 produce tension, which is the price of the Ethereum. In order to provide equal but opposite directions of pull on 1 and 2, Ethereum prices have appreciated in the secondary market. This is the fundamental aspect of the Ethereum bull market. Ethereum's virtual machine generates enough meaningful applications. Through ETH scarcity, ETH's pledge rate rises. At the same time, both mechanisms have a strong synergy with Ethereum prices in the secondary market.

Layer 4: User aggregation

The final layer. The liquidity provides a layer. Middleware layer. Interface layer. Effective market hypothesis layer.

Layer 4 is the last layer that appears because its structure and purpose depend entirely on the application under it. The better Layer 4 case is the cross-protocol bridge of InstaDapp.

InstaDapp builds a service that automatically transfers a person's debt from MakerDAO to Compound and from one lending platform to another to get better interest rates. InstaDapp generated 13 internal transactions to complete a single transaction executed by the user.

InstaDapp bridges the gap between MakerDAO and Compound, allowing users to cross bridges with a single transaction. By supporting easy and automatic transfer from protocol to protocol, InstaDapp will help increase liquidity for the Ethereum portion that is needed or deserved.

Settle Finance offers a similar service: a decentralized exchange interface that aggregates market data and provides the best exchange rates across all exchanges. Through a good interface to generate liquidity services, Settle can capture users and reduce their friction with Ethereum financial interactions. Settle can help provide the overall mobility and efficiency of the Ethereum ecosystem.

TokenCard presents an interesting aggregation scenario. By connecting a payment network like Visa to an encrypted credit card, TokenCard brings together users to provide volume for the decentralized exchange. Ample users of TokenCard debit cards can provide more transaction volume and liquidity for the application layer.

RealIT is a token-based real estate platform. Investors buy a share of the property and receive a daily share of the rent. RealIT increased the daily trading volume of DAI trading because it aggregated users with services and spread DAI throughout the Ethereum system. As more and more users use it, more property assets are sold, more rental income is converted to DAI, and sent to RealToken holders, increasing the mobility of the application layer.

Forecast and conclusion

- These indicators are always critical to measuring the Ethereum economy.

- Ethereum provides micro-level details of market behavior. An on-line analysis of how market forces work can be a profitable industry.

- These indicators will explain the public psychology more clearly than ever before.

- They will determine the state of the global macro economy.

——

Risk Warning : All articles in Blue Fox Notes can not be used as investment suggestions or recommendations . Investment is risky . Investment should consider individual risk tolerance . It is recommended to conduct in-depth inspections of the project and carefully make your own investment decisions.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Stable currency analysis: Most stable coins will not be used for large transactions except USDT

- Exchange Real Volume Report (on) | TokenInsight

- Gartner reports: Blockchain business is facing a test, the industry is still dark

- Bakkt also can't impact traditional cryptocurrency futures trading? – Coin, OKex, Matcha, and the same station

- Market Analysis: Bitcoin rebounds infinitely, still a short world

- Let’s listen to Jiang Zhuoer and Lu Haiyi’s understanding of the relationship between bitcoin price and computing power, as well as the price trend of this round.

- Is there a loophole in the Ethereum FAIRWIN smart contract? Detailed technical analysis is here