April 8th market analysis: BTC ETH is completed and continues to rise

Market sentiment: Fear & Greed Index 69 points (greed)

[BTC technical analysis]

On April 7th, the BTC/USDT volatility rose, and the daily line closed down the shadow line Yangxian cross star. On the line, the daily line relied on the 5MA. After the morning line change, it directly broke through the 260-day Maya line, showing that the bullish trend is strong. At present, the 10 moving averages will not keep up with the price increase. The rising relay will be completed and will continue to move forward. Today, the current round will rise to a new high. In the near future, 5555 points are the first pressure level, and 5764 points are the second pressure level. Most of the views, long and short feng shui moved up to 5155 points, 5100 points below there is no multi-station, the current suspension of chasing high, today expected to support $ 5,200, $ 5,155, the pressure fell $ 5,250, $ 5,350.

- Hard fork fork surge effect reappears! ETC announces "Atlantis" hard forks and soared more than 20%

- Quote analysis: ETH, which has been quiet for a long time, is starting to perform today?

- Market sentiment is on the verge of short-term risks but is quietly approaching

[BTC Trading Strategy]

On April 8th, if BTC/USDT has not exceeded $5,155, or lost $5,100, the station is empty. If it is steady at $5,155, stand on multiple sides, short-term operation: wait for oversold to do more than one, wait for overbought to make a single empty , sideways finishing does not make a single. Due to the random nature of short-term trading, if the HOPEX perpetual contract short-term operation is randomly communicated in the Andy community.

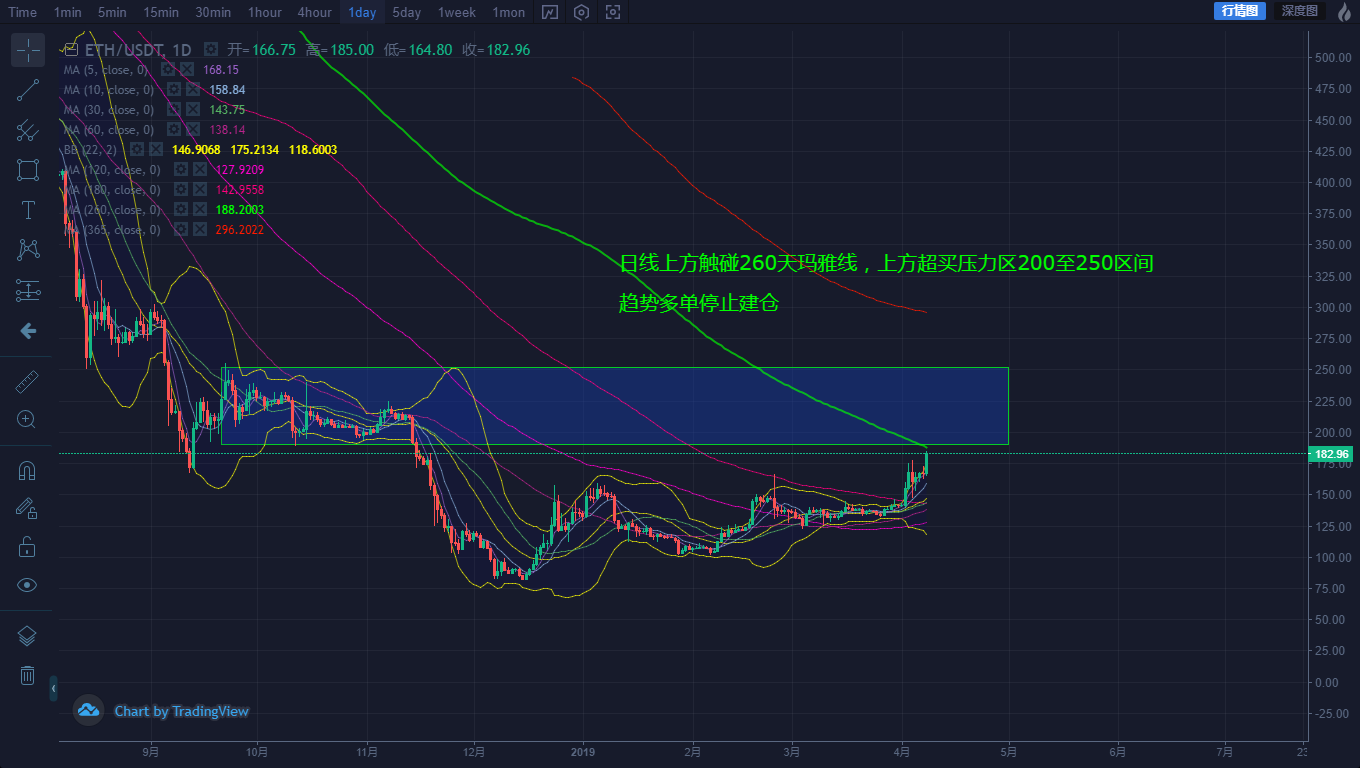

【ETH Technical Analysis】

On April 7th, ETH/USDT was slightly shocked and closed. The daily line received the cross star line. On the line, the daily line relay was completed and the new road was lifted. At present, the price of the first pressure level near the 260-day Maya line is 190. In the US dollar, there will be a short-term correction for the short-term buying of the daily line between 210 and 220. The low position will continue to hold more positions. The $200 will be suspended for long positions. Today, it is expected to support $178, $175, and the pressure is 185 US dollars and 188 US dollars.

[ETH Trading Strategy]

On April 8th, if ETH/USDT has not passed 170 US dollars, or lost 168 US dollars, stand by the side, if it is steadily 170 US dollars, stand many parties, short-term operation: waiting for oversold to do more than one, waiting for overbought to do a single empty , sideways finishing does not make a single. If the HOPEX perpetual contract short-term trading can be randomly exchanged in the Andy community.

【HT Technical Analysis】

On April 7th, HT/USDT weakly adjusted, and the daily line closed in the Yinxian line. On the line, the daily line showed a high stagflation, technical adjustment, and the current trend of the trend average 10-day moving average, waiting for the second round of the IEO to release the stimulus. Recently, the long and short winds and winds of 2.5 US dollars, short-term is not suitable for chasing high, long-term waiting for the callback to open positions, today is expected to support 2.65 US dollars, 2.55 US dollars, the pressure fell 2.70 US dollars, 2.75 US dollars.

[HT Trading Strategy]

On April 8th, if HT/USDT holds $2.72, it will stand on the sidelines. If you have not passed $2.72, or lost $2.70, stand by. Short-term operation: Wait for oversold to do more than one, wait for overbought to make a single empty, and do not make a single order.

Andy: Coin invites market analyst, currency world currency market analyst, AEX market analyst, market analyst, coin world city association Hangzhou president, fire coin community gold partner, Babbitt KOL I WeChat andy1300795608

Note: This analysis chart uses the fire currency network and the currency network technology chart.

Article content is for reference only and does not constitute investment advice. Investment is risky, and investors operate at their own risk.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- TokenInsight Critical Warning: The progress of these 40 projects has stagnated in the past four months

- Global Blockchain, Digital Assets Regulatory Policy and Practice – Latin America

- Science | What is Merkle Pollard?

- Gu Yanxi: Alternative Japanese Stabilizing Coin

- Quote analysis | Or the original formula, or familiar taste, cottage drainage, mainstream siphon

- 6 misunderstandings about Bitcoin and blockchain

- An artifact that allows you to hide in the chain and erase traces – Ethereum AZTEC Protocol Guide