Featured | Chris Burniske: BTC goes to gold, ETH goes to currency; every bitcoin bull market starts with miners surrendering

Today's content includes:

1 Chris Burniske: BTC will go to gold, ETH will go to the currency

2 Each bitcoin bull market begins with the miners surrendering

3 Binance's explosive rise story

- Interpretation of the new regulations of the National Development and Reform Commission: Is virtual currency mining allowed or restricted to the restricted or eliminated category?

- The market reacted to the message and the trend is still downward.

- Guangming Daily: Does digital currency replace banknotes?

4 Large-scale growth in the derivatives market and its impact on the future of Bitcoin

5 Skale: Introducing BLS-ROLLUP

Chris Burniske: BTC will go to gold, ETH will go to the currency

Chris Burniske's tweet about his views on Bitcoin and Ethereum and Defi. His point of view actually recognizes the marketing term “ETH is Money” and stunned the DCR.

In the long run, I hope that the goal of the asset is that value storage (eg, $BTC, $DCR, $ETH) is widely used as collateral rather than as an exchange medium.

Most of the world's population lives in hyperinflation; these inflationary assets are the assets that people want to use as a medium of exchange. People want to hold anti-inflation or deflationary assets because these promises from the supply curve are that they can store value well.

I am familiar with the bitcoin development curve written by @MustStopMurad. Eventually BTC becomes the medium of exchange, or @saifedean hopes to become the base of the global economy, but the data does not support the development of these stories.

Coinbase conducted a survey in 2016, and people are increasingly using BTC as SoV (value storage), and there are fewer and fewer exchange media.

My point is: BTC should learn like Ethereum. The “mortgage economy” brought by the emerging Defi allows Ethereum to expand its utility range with ETH as SoV, far beyond its purely exchange medium. Widely used collateral may also reduce its volatility.

Perhaps one day BTC's PoW-based SoV will be considered the world's "outside chain" collateral (external guarantee). At the same time, ETH as a PoS-based SoV will become the "chain" collateral of the Internet (endogenous security).

In the current financial and psychological framework of the world, this will bring BTC closer to gold and ETH closer to money.

Full text link: https://twitter.com/cburniske/status/1196083628461240323

Every bitcoin bull market starts with the miners surrendering

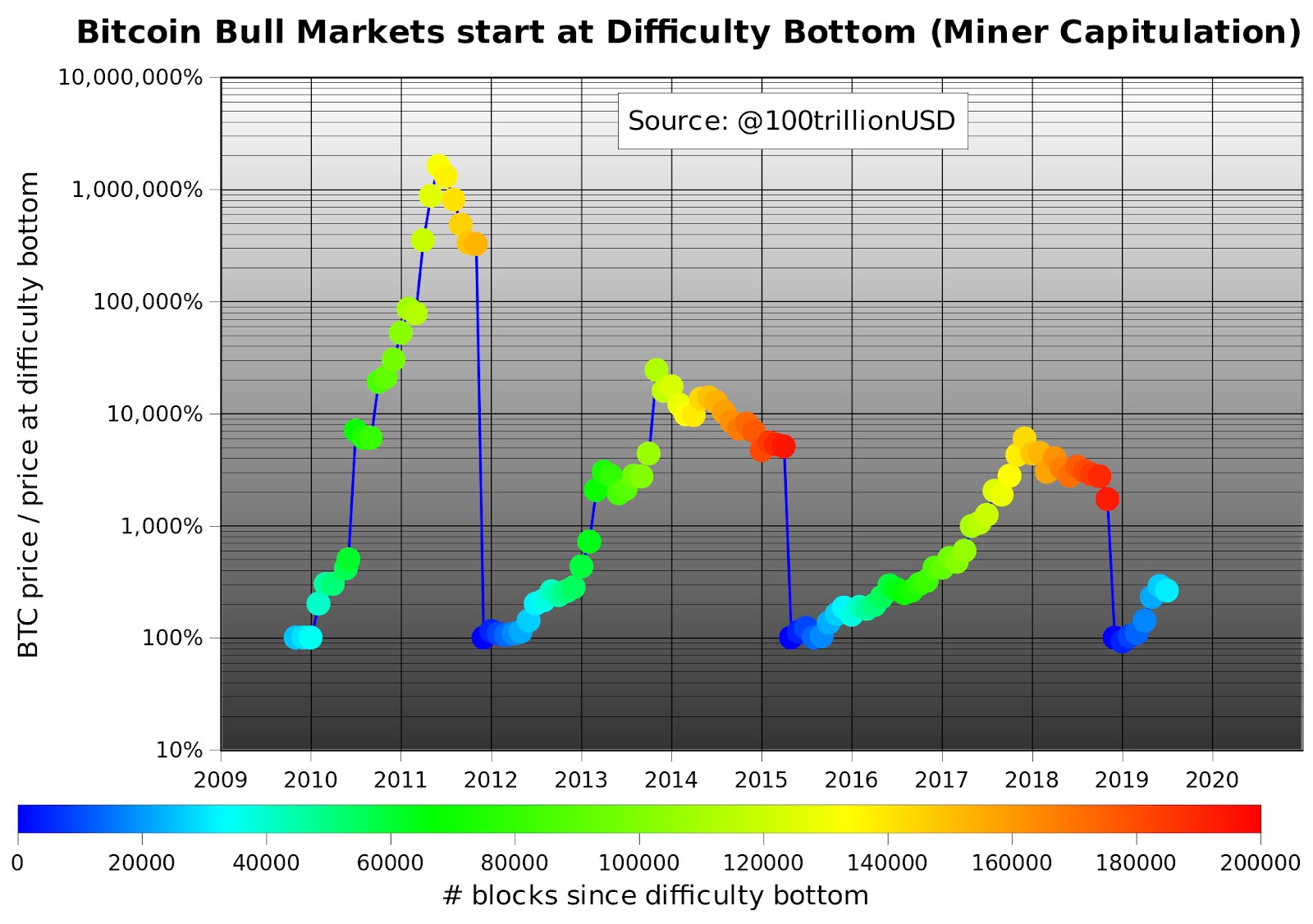

Mining difficulty may be an indicator of the BTC price. According to cryptocurrency research firm PlanB, the three major bull markets in the history of Bitcoin began after the mining difficulties reached the bottom.

When the mining difficulty reaches the highest level in history, the price of Bitcoin will drop sharply and continue to decline until a large part of the miners are unprofitable.

In the past decade, every time the bitcoin mining difficulty reached its lowest point, there will be a big bull market. In early 2012, the lowest point was reached in the second quarter of 2015 and the end of 2019.

Difficulty declines occur every 3–4 years, or approximately 20,000 blocks since the last time the mining difficulty was reached. According to the lower high trend shown in the figure, the next ATH of Bitcoin may be 1000-2000% higher than its price at the lowest mining difficulty of this cycle.

Full text link: https://medium.com/coinmonks/miner-capitulation-is-coming-d81b4e7b0ff5

The story of the explosive rise of Binance

This article mainly talks about the story of the rise of the currency, the leek can be seen, other exchanges can be seen, the entrepreneurs of the currency circle can also see. The length of the article is very large, so I picked up a lot of scattered points, which may be messy in context.

I found that the world's largest cryptocurrency exchange is not so much a formal company as a rebel, it is a denial of the traditional financial system.

Coin Security is strategically building something bigger than cryptocurrency exchanges: they are building the future of finance. ——Tushar Jain (Multicoin)

One night in August 2013 will fundamentally change Zhao Changpeng’s life. He is playing poker in Shanghai with two friends, BTCC Bitcoin Exchange founders Bobby Lee and Ron Cao, who were then partners at Lightspeed Ventures. Ron Cao has been talking about bitcoin, which is the first time Zhao Changpeng heard.

Zhao Changpeng is very interested. Soon after, he sold his house for $1 million and put it all into Bitcoin. Zhao Changpeng bought at 600 US dollars. Although he fell to 200 US dollars, Zhao Changpeng did not cut the meat and has been holding it until now.

On June 14, 2017, Zhao Zheng and the Hall of Fame in the Asian Encryption Community, including Neo founder Da Hongfei and Monaco (now Crypto.com) founder Kris Marszalek in Chengdu, China. The discussion involved the initial token distribution—startups received funding with a good idea, white papers, and the issuance of their own tokens. The White Paper promises: "With your help, Coin Security will build a world-class cryptocurrency exchange that will power the future of cryptocurrency finance." All it needs is its own token.

Investors who bought Binance Coin believe it will receive a 5-10x return. On the contrary, when it was launched on July 25, 2017, it quickly lost 20% of its value.

He was the one who persuaded Zhao Changpeng to become the Okcoin CTO. On the day of the appointment of Binance coin, the price of BNB woke up and soared by 1800% in just two weeks, from $0.13 to $2.45.

In the past 12 months, the currency has been busy. There are new announcements every day: first, leveraged trading, then margin trading. Now offer lending services, get rewards and peer-to-peer transactions. Because of the exhaustion of life, the currency is perfectly adapted to distributed office. Binance is no longer just an exchange, but it is also becoming a way of not just a company.

Binance will become DAO because it will become a financial services platform owned and operated by users. Exchange services are just the first financial services offered by Binance.

Full text link: https://decrypt.co/11327/the-inside-story-of-binance-explosive-rise-to-power

Large-scale growth in the derivatives market and its impact on the future of Bitcoin

We are seeing a thriving derivatives market showing that bitcoin is more healthy than ever. This paper examines the latest developments in bitcoin trading behavior and its many benefits to ecosystems.

In early 2019, Bitwise found that 95% of the bitcoin transactions reported on CoinMarketCap.com were fake. Alameda Research reports that although many exchanges do generate false volume data, the actual volume of actual transactions is much higher than Bitwise's findings.

The spot market trading volume (the value of unlevered physical bitcoin traded in legal tender) did not exceed the peak of the 2017/18 bubble. However, since the beginning of 2018, a new dynamic has evolved – using Bitcoin derivatives extensively.

The rapid growth in the use of derivatives is surprising, and the total trading volume of Bitcoin's spot and derivatives is currently at a level comparable to the 2017/18 peak.

Globally, the nominal value of a legal currency derivative contract is approximately $1 trillion. This is 6250 times larger than the market value of Bitcoin. Bitcoin has a lot of room for growth.

The increase in numbers is a step towards adopting Bitcoin to a greater extent. It provides a bigger entry point for Bitcoin. Greater liquidity makes it easier for larger financial institutions to enter the bitcoin market because: – market prices can be better trusted – it is easier to enter and exit the market with larger funds without significant price slips – Options and other derivatives provide multiple investment strategies

To sum up: – Bitcoin is more liquid than ever – this liquidity provides organizations with greater bitcoin traffic – Derivatives provide more revenue certainty for Bitcoin miners, so long-term commitment Bitcoin network. – A large amount of growth can precede the emergence of a large bull market

Full text link: https://medium.com/coinmonks/bitcoins-massive-volume-growth-1c62ce285e25

Skale: Introducing BLS-ROLLUP

The BLS-ROLLUP solution written by Skale in the Layer 2 project, they blasted the BLS-ROLLUP solution and announced the decision to include the BLS-ROLLUP in the SKALE production network. Each SKALE certifier will participate in the BLS-ROLLUP and profit from the BLS-ROLLUP fee. Skale's plan is very detailed, the internal strength is too large, only a brief introduction, the specific design and implementation can read the full text.

ROLLUP is a type of Layer 2 solution popular in Ethereum this year. The BLS-ROLLUP solution is an effective and secure way to accelerate transactions and smart contracts on the Ethereum main network using SKALE network while preserving Layer 1 security. Guarantee.

BLS-ROLLUP: – Instant safe and cheap – no waiting time required – no need to calculate heavy zkSNARKS / STARKS

The BLS-ROLLUP will be divided into two phases: – In Phase 1, we will use the SKALE network to help the ETH mainframe be a bit faster. This allows us to conduct approximately 50 ERC-20 token transfer transactions per second. – In Phase 2, we will use the SKALE network to further help the main network, which allows us to make approximately 350 transactions per second. – The long-term goal, along with the heavy software development of Phase III, will result in more than 1000 transactions per second, meeting or exceeding the total speed of the upcoming ETH 2.0 network.

Full text link: https://skale.network/blog/introducing-bls-rollup/

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Carrefour and Nestlé use the IBM blockchain platform to track infant formula supply chains

- Wait for a chance! Chinese version of the digital currency big guess

- BitMEX daily trading volume hit a new low in 2019, and market volatility may come soon

- "Legal Daily": "Blockchain + Rule of Law" to explore the application of new infrastructure technologies

- Former US financial executive: Libra may never make progress, let us look forward to the central bank digital currency

- "People's Court Newspaper": Let blockchain technology insert wisdom wings for wisdom court

- Inventory: 11 blockchain listed companies 蹭 hot spots were inquired, business is still in the exploration stage