Featured | Read the Ethereum community new favorite MarketingDAO

Today's content includes:

1. Read the Marketing DAO in one article.

2. Three financial fronts of the global digital currency war

3. History of cryptocurrency exchanges: look at the most powerful institutions in our industry

- Yao Yudong, former director of the Central Bank's Financial Research Institute: Called the Dawan District to try the digital currency first

- Grayscale Bitcoin Trust Fund submits registration application to SEC, investors may benefit

- A deep understanding of the role of luck in cryptocurrency investment: whether the quilt is to cut the meat or the dead bar

4, blockchain development company ranking

5. Value investment ignores “intangible assets”

Read the Marketing DAO in one article

This is MarketingDAO's "I understand MarketingDAO", which is intended to briefly introduce and explain what Markting DAO is and what to do.

Decentralized Autonomous Organization (DAO) is a new type of organization that attempts to coordinate group activities and utilize some form of "chain" governance. This is achieved by putting various standard organization functions into smart contracts, such as multiple signatures required for fund allocation, the process of creating, debating and approving or rejecting proposals, and the voting system of records. On the blockchain platform such as Ethereum, voting on governance proposals is recorded on the blockchain as a historical data set for governance proposals, the results, and related activities and funds used.

Marketing DAO is the fork of Moloch DAO, with a clear intention to promote marketing efforts and help better communicate the Ethereum and Ethereum eco-projects to the world. These efforts are aimed at both internal and external, but in the end, the direction of DAO will be determined by the people who own the shares and thus have a reputation in DAO. The use of DAO can greatly reduce the coordination costs of a group of people self-organizing and allocating capital. Due to the simplicity of operating Moloch DAO, it is easier to understand DAO and try it out. This provides DAO with more actual users to collect feedback. Marketing DAO is no exception, and the experience gained through it can be used to iterate future DAOs or subsequent DAOs. At the same time, it clearly aims to coordinate Ethereum marketing activities during the iterative process.

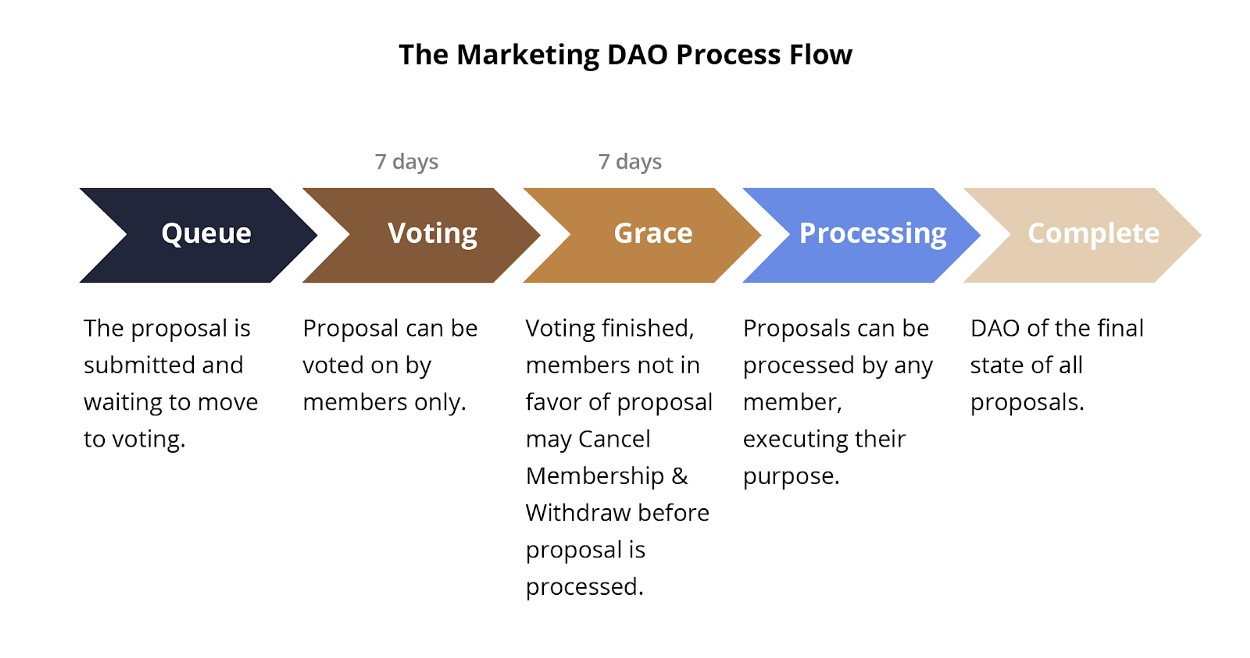

Proposal process

Proposal process

Proposal type

Three main types of proposals can be submitted to DAO, which will be submitted to members for voting. These recommendations go through the same process in DAO, but for different purposes.

– New member application proposal

– Grant or marketing action proposal

– Donation proposal

Full text link https://medium.com/marketingdao/marketing-dao-primer-5f9fca772397

Three financial fronts of the global digital currency war

The author is co-founder, CEO and chairman of Circle, a global financial services company, whose article focuses on his views on the financial landscape of digital currencies.

Leaders around the world ask what role the digital currency will play in the next decade and ultimately represent a broader political and economic landscape that will reshape the future system of international currencies. These rapid changes have led regulators around the world to work to address an economy that is beginning to reflect an open, global and interconnected information and communication Internet.

The basis for these transformations is the rapid development of public blockchain infrastructure, and there are now several competing approaches to building new financial systems on this infrastructure.

Open finance

The first represents native ecosystem participants, including Circle and Coinbase, which build a counter-coin-based stable currency, such as the US Dollar Stabilization Coin (USDC), on top of the public blockchain. These developments have enabled a wide range of developers and companies to build higher-level financial structures, such as decentralized loans and credit markets, payment services and trade finance tools.

Constrained by existing payment banking regulations in the United States and the European Union, these private market-based approaches are rapidly evolving and contribute to the pillars of the open financial movement.

2. Government operations

The second approach best represents the upcoming central bank digital currency in a number of countries designed to build a controlled, centralized and licensed infrastructure for the digital currency version of the renminbi.

Although this approach may be appropriate for some countries' economic and political models, this approach does not work in the face of an open Internet spirit and is unlikely to receive a warm response from the broader Internet development community.

3. Private consortium

The third approach, based on the proposed Libra Association and the Libra reserve currency, seeks to create a global digital currency of “top consortiums”.

Like the efforts of the central bank, Facebook's proposal creates a centralized, licensed infrastructure for the payment system that fundamentally limits the infrastructure's openness to developers and companies that want to build on it. Sex and accessibility.

The differences in the three approaches reflect different competitive worldviews, and governments, especially those responsible for the world's major trading currencies, must now work to address innovation in public cryptocurrencies with global Internet coverage. The choices they face and the decisions ultimately made by the relevant policy makers will have a huge impact on our future global economic system. At the same time, when governments study and discuss these topics little by little, technology innovators around the world are using encryption to rebuild the global economic system, which is a miracle of human creativity in our eyes.

Full text link https://www.coindesk.com/three-fronts-in-the-global-digital-currency-wars

The history of cryptocurrency exchanges: look at the most powerful institutions in our industry

This is a history without end. Indeed, it is clear from the various trends shaping today's market that the diversity of strategies used and the speed of iterations are increasing, if any.

The story of the exchange is a powerful shot through which you can learn the story of the entire cryptocurrency industry. They are both trends responders to consumer demand and trend makers, and the new products and services they offer will shape the expectations of this emerging market. They are a barometer of the regulatory environment and represent some of the most powerful institutions that can lobby the government for favorable regulatory approaches. The battle of the exchange will be the most intense battle in the industry.

- Bitcoin exchange

Mentougou is not the first exchange, but it may be the most iconic of the early Bitcoin exchanges. On January 5, 2010, Bitcoin Talk member dwdollar wrote: "Hello everyone, I am building an exchange. I have a big plan, but I still have a lot of work to do. This will be a real market, people will Being able to buy and sell Bitcoin each other. In the next few weeks, I should build a website with a basic framework, please be patient."

During this time, there was a big problem with payment processing and hacking, and the transaction was only bitcoin, and the market value of the entire bitcoin was only $1 million. Tradehill was one of the largest exchanges in the United States at the time, closed in February, and exchanges such as Bitcoinica and Bitfloor were also hacked. This period was an outbreak of Cambrian communication. Most will be forgotten by history. Companies such as Bitstamp (founded in 2011) and Coinbase (2012) will rise.

Like all the early exchanges, Mentougou struggled with payment processing. In October 2010, it gave up PayPal and temporarily used Liberty Reserve. McCalbe (and also the founder of Ripple) left the site shortly after launching the site. Mentougou was sold to Frenchman Mark Karpeles in March 2011. In the next three years, it will continue to be the world's largest bitcoin exchange. At peak times, it handled 70% to 80% of all bitcoin transactions.

As for the later stories, everyone knows that Mentougou was stolen and bankrupt. Mark Karpeles was arrested in Japan on charges of manipulating data. He was jailed for a year.

- Ark Currency Exchange

Ethereum has brought a lot of progress. Its core idea involves not only the exchange of values, but also the programmability of value exchange. At the same time, it also brings about the story of a large number of altcoins.

Coin is a successful case of the classic altcoin exchange. On the one hand, the amazing growth of the currency security reflects the capabilities of the CZ team. On the other hand, this also reflects the absolute madness of the ICO era. For a short period of time between mid-2017 and mid-2020, exchanges competed almost entirely on their ICO assets for long-tailed strategic competition.

Moreover, the currency has indeed introduced some innovations that will be replicated by many exchanges. Perhaps the most striking thing is the introduction of its BNB.

- Futures exchange

With the 18-year bear market, interest in the altcoin has weakened, ICO has died, and liquidity has evaporated. For many exchanges, this means the end of a relaxed period. The head of the exchange that is not worried at all is Arthur Hayes of BitMEX.

From the traditional financial world, Arthur Hayes has been less interested in the spot trading of long tail assets, and is more interested in the types of futures and other derivatives that make the mainstream market more efficient. One of the other advantages of these products is that Good traders can make money in bull and bear markets.

how are you today? Bitcoin has risen again since April 2019. If it is not a hot day of ICO, the market will be significantly better than the second half of 2018. We believe that at least four major trends today are shaping the exchange business model:

– Derivatives

– Platform currency, IEO, exchange public chain

– Decentralized exchange

– Compliance gap

Full text link: https://blog.nomics.com/essays/crypto-exchanges-history

Blockchain Development Company Ranking

This is the result of a comprehensive analysis of the blockchain development company. The author has created a quick checklist that outlines the things to keep in mind when choosing the ideal blockchain development company for your project, including:

Case number, quality and variety blockchain projects.

– team size

– Established

– social media

– Customer testimonials

This result may still be somewhat objective, or it may overlook a lot of domestic development companies, but it is also a good understanding of some to B companies. The original article introduced a total of 35 companies, the length is too large, the top five One.

Services provided by ConsenSys : blockchain use cases and technology development, custom blockchain development services, token development, risk development.

Major customers: Procter & Gamble, Microsoft, WWF, United Bank

Development project: DLT-based wholesale payment system, secure Ethereum enabled gateway and IoT project hardware and software, dynamic legal agreement software.

PixelPlex

Services provided: custom blockchain solution development, blockchain consulting, blockchain ecosystem development, private and public blockchain and exchange development, blockchain platform development, DApp development and auditing, DApp platform development, Cryptographic currency wallet and ICO development, smart contract, web development, AR / VR / mixed reality, artificial intelligence and machine learning, IoT applications, game development, mobile app development: Android, iOS, cross-platform.

Major customers: Microsoft, BMW, Mercedes-Benz, Oracle, Kazakhstan Telecom, QTUM

Development projects: blockchain platform and cryptocurrency development, platform development for asset-token companies, web development and design of P2P gaming platform, blockchain development for e-sports web platform, smart contract consulting and development initiated by crowdfunding, Customized apps for the media and Web development Content Studio.

LimeChain

Services provided: public and private blockchain development, custom blockchain development, decentralized application consulting, smart contract development, smart contract auditing and consulting, ICO and crowdsourcing services, ICO consulting.

Major customers: ARXUM, Vaultitude

Development projects: blockchain development of software companies, development of custom blockchains for scientific research, blockchain development of property protection companies, and many other major contributions to blockchain technology.

Accubits

Services provided: DApp and smart contract development, custom blockchain development, crypto token and exchange development, integrated blockchain services and ICO platform development, application development, artificial intelligence, enterprise solutions

Major customers: Dubai Land Bureau, Dubai Intelligent Systems, Dubai Police Department, Eduvalue, Etisalat, Landmark, APN health, Ausfinex, Monger

Developed projects: IT company's outsourced blockchain development, land registration on the blockchain, ICO platform, Dubai's encrypted asset exchange platform, Fintech's technology infrastructure, and other projects.

SoluLab

Services provided: Hyperledger blockchain development, blockchain smart contract development, cryptocurrency wallet development, ICO and cryptocurrency development, cryptocurrency exchange, STO development, DApps development, cross-platform mobile application development, mobile application design , Web development, Web design, wearable device application development, custom software development, SaaS development and maintenance. Major customers: Mistress Inc., EntreBahn, Versafit, Clean Router, EduWorlds, MaccaStudios

Developed projects: mortgage mortgage blockchain platform, entertainment and media blockchain platform, clinical trial data blockchain platform, EMR blockchain drive framework, cryptocurrency crowdfunding digital platform, drug supply chain blockchain platform, ICO and Crypto Native Wallet.

Full text link:

Https://hackernoon.com/top-blockchain-development-companies-2019-rebi3zo8

Death of value investment

This is an article about the contradiction between traditional stock market value investment strategy and investment technology growth stocks. The concept of “intangible assets” mentioned in the “overvalued” growth stocks is not bad.

Eleven years ago, institutional investors declared "the death of value investing." “The credit crisis is making a fundamental change in the economy at a numbing pace. As the credit crisis continues and the global economy deteriorates, Graham’s disciples may get worse.” Eleven years later, The situation has certainly not improved.

Since 2007, value investing (a company traditionally defined as trading at low prices relative to features such as earnings and book value) has been performing poorly since 2007 and continues into the explosive bull market for growth stocks. And technology companies with rising valuations are still growing rapidly.

Why does this happen?

Alex Roepers, founder and chief investment officer of Atlantic Investment Management, said: "To make a real rotation happen, you don't have to look at value, but growth.

Not everyone thinks the technology market is overvalued. The company’s investment approach has changed dramatically over the past few decades. Historically, when companies invest, most of their assets are tangible assets. Today, companies invest in more intangible assets, they are spent rather than capitalized, which means their books Value will not appear.

Chris Brightman, a CIO affiliated with the research institute, said that in any case, US accounting problems cannot explain the dominant position of growth stocks in the world. He pointed out that international accounting standards require the capitalization of many intangible assets, but not enough to explain the amount of things we see."

Full text link: https://www.institutionalinvestor.com/article/b1j0mvcy9792vt/Why-Value-Investing-Sucks

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Data Analysis | Tether Manipulation Behavior Is Not the Reason for the Bitcoin Bull Market in 2017

- The "USDT Collective Claims", which has attracted worldwide attention, is inseparable | full text translation

- Market analysis on November 20: BTC gradually approached the $8,000 mark, and the subsequent retracement space was limited.

- PayPal leads, YC participates, and cryptocurrency company TRM receives $4.2 million in financing

- Understanding the Zero Knowledge Proof Algorithm Zk-stark – Arithmetization

- Galaxy Digital launches two new funds targeting 1% of the wealthy

- Blockchain talent shortage: annual salary of 200,000, unable to recruit blockchain engineers