Cheung Kong Graduate School of Business Industry Observations Digital Currency: Where do you come from and where do you go?

Digital currency is not new. Bitcoin, which was born in 2008, is the first digital currency to truly enter the public's field of vision. It is also the digital currency with the highest market value. Looking at the history of bitcoin, it is also a number. On the one hand, the history of currency recognition and acceptance, on the one hand, the gradual increase of supervision, the increase of users and the enrichment of payment scenarios, on the other hand, the improvement of infrastructure and the improvement of trading mechanism have improved the user structure, thereby increasing the value of the currency. Stability.

Overall, the price of Bitcoin has experienced two rounds of rising and falling cycles, but in the 2019 cycle, the volatility of bitcoin prices has weakened. We believe that the core reason is the structure of investors and trading participants. There are significant improvements, and the back is based on two important driving forces: (1) the legal status and acceptance of Bitcoin has begun to increase, enabling it to be used in more trading scenarios; (2) Bitcoin industry chain infrastructure and trading mechanisms are more complete , which attracted more mature investors to enter the market.

In return to the essence, there are only two core functions of money: value storage and trading tools, which can assume both functions can become money. Among them, the value storage function is the driving force behind the creation of digital currency. From the perspective of the anchor currency change during the exchange standard system, the government-issued currency with a stronger credit base can often replace the government-issued currency with credit deterioration and become the new anchor currency.

From the practice of the issuance of government legal currency, the credit of the monetary authorities seems to be constantly challenged. For example, the US government does not have the ability to maintain a healthy fiscal position, and the federal fiscal surplus is negative for many years. In the end, the US government can only cover this fiscal deficit gap by further borrowing. Although there is a debt ceiling imposed on the US federal government, this so-called debt “ceiling” has continued to rise rapidly after 2008. The United States is monetizing its own fiscal gap through the special anchoring monetary status under the dollar-based system, which in turn imposes a coinage tax and exports inflation to the world.

- Regulatory observation: the two core characteristics of the blockchain are difficult to coordinate with GDPR

- Comment: Grin's problem is not privacy at all, but no one uses it.

- Former director of the Central Bank Financial Research Institute: Calling for the first test of digital currency in Dawan District

Under the background that the major monetary authorities around the world are continuing to “release water” and “loose”, the so-called “modern monetary theory” has emerged. The core view is that the government can circumvent the restrictions of the central bank’s independence. Through the financing of the central bank to repay the debt, and then the monetization of the fiscal deficit, the traditional economics worry about the monetary easing caused inflation is not terrible, can solve the problem by raising taxes and further expansion.

We agree with some of the views on the independence of the central bank in modern monetary theory, but on the whole, this trend of "modern monetary theory" is not only wrong but also dangerous. If the inflation suddenly rises with the easing of the easing, the government's borrowing costs will soar, and then quickly fall into the fiscal expansion – hyperinflation – the cost of borrowing soared – the negative cycle of further deterioration of the fiscal. More importantly, if an economy manages the deficit through monetization for a long time, completely ignoring fiscal discipline and monetary discipline, it will eventually continue to weaken the confidence of currency holders and abandon the currency.

The reason for the maturity of private companies to issue money is because of the second function of money – trading tools, trading and payment networks that require a wide range of participants, whether in C2C or C2B payment transactions, users are the core nodes of the network. For example, Libra's Facebook has had 2.32 billion monthly active users by the end of 2018, surpassing the number of any sovereign country, 1.67 times and 1.73 times of China and India respectively. The huge customer base is Facebook's digital currency. The basics.

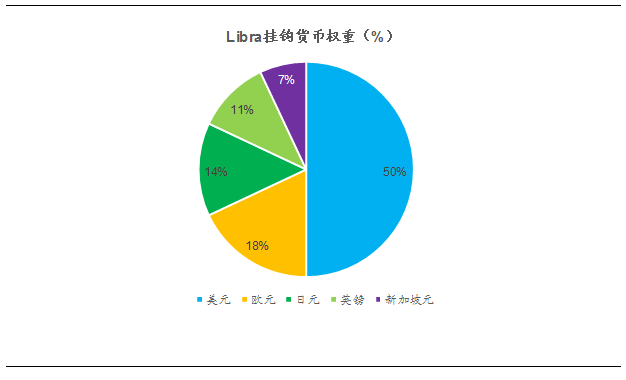

According to the Libra white paper, Libra is built on a secure, scalable and reliable blockchain backed by an asset pool that is intrinsically valuable and governed by an independent Libra association. Overall, Libra has two of the most important features – stable currency and decentralization. Libra mainly uses a basket of currencies to stabilize the currency. According to Facebook's internal letter to the EU on September 21, 2019, Libra plans to use 50% of the US dollar, 18% of the euro, 14% of the yen, 11% of the pound, Singapore. The ratio of 7% is linked to five major currencies. According to the white paper, the Libra Association will be the highest governing body for this emerging digital currency. As an independent institution, the Libra Association will work with its subordinate dealers to maintain the Libra currency ecosystem. In the future, the Libra Association will become the new central bank, and members of the association will be equivalent to members of the central bank, and will adjust the monetary policy by voting.

We believe that the Libra currently launched is only a transitional form of digital currency issued by private companies. In order to accept US regulation, Facebook, as a private company, chose to adopt a stable currency route linked to the existing sovereign currency when issuing new digital currency. Zuckerberg’s series of “de-renminbiization” and “Chinese cards” reflect the regulatory pressure Libra is currently facing.

In essence, the digital currency of the People's Bank of China and Libra are completely different forms of two currencies, and the credit support behind them is completely different from the mechanism of issuing coins. According to the statement of the relevant officials of the People's Bank of China, the main function of the central bank's digital currency is to replace the M0. The essence is the electronic cash, which still reflects China's sovereign credit. The use scenario is also expected to be different from the RMB cash. The significance of the central bank's introduction of legal digital currency is more to solve the risk of money laundering and illegal trading in the current cash trading market, and Libra's main application scenario linking a basket of currencies will be cross-border payment.

Looking ahead, we believe that the ultimate form of digital currency will be a purely private enterprise that is truly decentralized and not linked to the existing legal currency. The monetary authority may consist of a coalition of multiple private companies, including the total money supply. A series of monetary policies will be voted by the Alliance, and the stability of the currency will depend on the Union's currency discipline. We believe that this kind of digital currency may not appear in the short term. The core resistance lies in the fact that large-scale technology companies with the ability to issue coins and have such a large user base are subject to stricter supervision. Existing monetary authorities and regulatory authorities will not allow this. The loss of monetary sovereignty.

The boom in digital currency still needs to sound a wake-up call for central banks around the world. Hayek’s “competitive currency” era may have arrived. If there is no independence in monetary policy, discipline will be lost in the control of monetary aggregates. Sovereignty will face challenges. The legal currency issued by some sovereign governments may also be abandoned by the holders. That is to say, contrary to the traditional Gresham's law, the “good money” with more stable value will drive out the “bad money” with unstable currency. As we have seen in some emerging markets where hyperinflation and currency devaluation occur.

The originator of digital currency – the past and present of bitcoin

2019 has become a well-deserved "year of digital currency." On June 18th, Facebook released the Libra white paper, indicating that it plans to launch Libra, a new digital currency based on blockchain technology, in the first half of 2020 to establish a simple, borderless currency and count The financial infrastructure of a billion people. After that, Chinese officials frequently voiced the digital currency. In early August, the central bank’s second-half work video conference called for speeding up the pace of legal digital currency research and development. On September 24, the central bank governor Yi Gang said that the Chinese central bank’s research on digital currency has been Positive progress will be made, combined with electronic payments, the goal of digital currency is to replace a part of M0, not to replace M1 or M2.

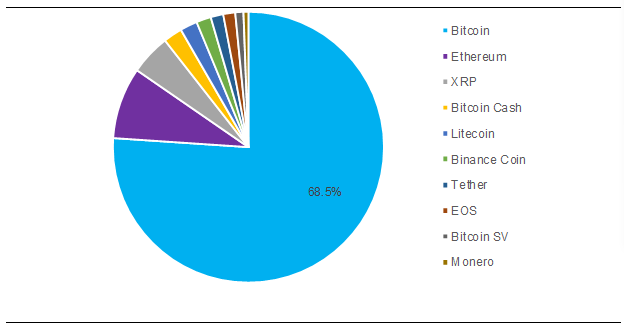

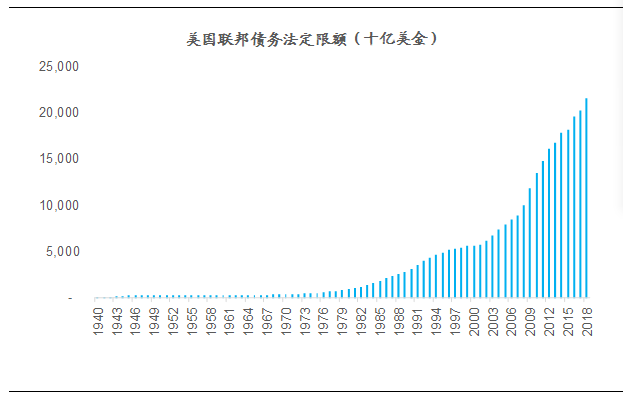

In fact, digital currency is not a new thing for the general public. The bitcoin that was born in 2008 can be said to be the first digital currency that really enters the public's field of vision. From the perspective of market structure, bitcoin occupies Two-thirds of the encrypted digital currency market capitalization is also the most important digital currency. Throughout the history of the development of Bitcoin, it is also a history of the recognition and acceptance of digital currency. On the one hand, the recognition of supervision gradually increases the user's increase and the payment scene is rich, on the other hand, the infrastructure improvement and trading mechanism. The soundness improves the user structure, which in turn increases the stability of the currency.

Chart 1: Bitcoin market value accounts for more than two-thirds

Source: Coinmarketcap

From 2008 to 2011, Bitcoin gradually became a monetary function, and the user community began to expand. Bitcoin was born after the global financial crisis in 2008. In October 2008, Nakamoto published a Bitcoin white paper and officially started running the Bitcoin network on January 3, 2009. In October 2009, the first bitcoin exchange rate introduced was 1 US dollar to 1309.03 bitcoin. The calculation method is to generate the electricity consumed by a bitcoin. Bitcoin has a value attribute for the first time. In May 2010, a Florida programmer exchanged 10,000 bitcoins for a $25 pizza coupon. Bitcoin had a trading function for the first time. It can be said that by this time, Bitcoin already has the true function of electronic money. From 2010 to 2011, Bitcoin gradually began to enter the mainstream media's vision, which led to the continuous expansion of the user community, which led to the first round of price increases, but the bitcoin traders at this stage were mainly programmers. The main geek group is basically a niche game that is self-entertainment.

From 2011 to 2013, Bitcoin prices fluctuated sharply under security and regulatory challenges. In June 2011, the MT.Gox website, which carried more than 70% of Bitcoin transactions, was hacked, resulting in the leakage of data from 60,000 users. Some hackers got the login rights of webmasters and sold a lot of fake bitcoins. For a time, the price of Bitcoin fell from $17.51 per share to $0.01 per piece. Since then, the bitcoin market has recovered slightly in 2012, but in 2013 it encountered a head-on blow from regulation. In December 2013, the People's Bank of China issued a circular prohibiting Chinese banks and payment institutions from directly or indirectly participating in Bitcoin exchange transactions. The ban applies only to government-owned banks and government-approved payments, and ordinary Chinese citizens can still trade Bitcoin. On December 18, 2013, the price of bitcoin fell to RMB 10,000 per unit in China (about US$330 per unit).

From 2014 to 2016, the bitcoin market developed at a low level. Despite the crackdown on regulation, the bitcoin industry chain is still under pressure. More and more companies are accepting bitcoin payments, and a series of mature investment institutions and investors including Sequoia, Softbank and Li Ka-shing. Also began to have a layout in the bitcoin industry chain.

From 2017 to 2018, the bitcoin market ushered in the first round of sharp rise and fall cycles. After a series of asset bubbles burst in 2016, more and more speculators and even institutional investors have turned their attention to the bitcoin market. At the same time, with years of low-key development, Bitcoin has gained more and more market participation. It is recognized that the trading function has also been greatly improved. Bitcoin ushered in the first round of the real "bull market", which rose rapidly from the low of $779 per year at the beginning of the year to $19,188 per month in December 2017. 20 times. However, this fiery market did not last long. After the price reached a high point, it quickly began to fall back, and investors suffered huge losses. On December 15, 2018, the value of Bitcoin fell to the low of the current cycle – $3,180 per piece.

After 2019, Bitcoin began a new round of repairs. Bitcoin rose from a low point all the way to $12,921 in June 2019, an increase of 285%. Since then, it has remained at a level of $9,000 per central level.

Chart 2: The price of Bitcoin has experienced two rounds of ups and downs, and the industry chain and investor structure have matured.

Source: Bitcoin official website

Overall, the price of Bitcoin has experienced two rounds of rising and falling cycles, but in the 2019 cycle, the volatility of bitcoin prices has weakened. We believe that the core reason is the structure of investors and trading participants. There are significant improvements, and the back is based on two important drivers:

(1) The legal status and acceptance of Bitcoin began to increase, enabling it to be used in more trading scenarios.

Bitcoin was under great regulatory pressure in the early days of its birth. The world's major regulatory authorities and monetary authorities lacked an understanding of this new thing. As the digital money market continues to develop, more and more relevant regulatory standards have been introduced. To provide a reference for establishing the legal status of the digital currency represented by Bitcoin, for example, the Financial Action Task Force of the Anti-Money Laundering has issued a cryptocurrency regulatory standard to provide reference for the formulation of regulatory policies for the relevant regulatory bodies of its member states.

With the establishment of legal status, digital currency-based transactions have begun to be recognized in some markets, the most representative of which is Japan. In April 2017, the Payment Services Amendment Act signed by the Japanese Cabinet came into force, officially incorporating the virtual currency trading business into the regulatory scope, recognizing that virtual currency such as Bitcoin has property value and can be used for payment and digital transactions. Thereafter, in March 2019, Japan renamed the “virtual currency” as “encrypted assets” through the draft amendments related to virtual currency. On the whole, Japan has given full respect to the payment function of digital currency, and more and more retailers are beginning to accept payments using bitcoin. For example, Lotte, a leading Japanese e-commerce company, announced in August 2019 The new e-wallet, Rakuten Wallet, supports bitcoin cash transactions. For a digital currency, the widely recognized trading function will help maintain the stability of the currency and is one of the important criteria for distinguishing digital currency from other pure speculative assets.

(2) The bitcoin industry chain infrastructure and trading mechanism are more perfect, which has attracted more mature investors to enter the market.

In the primary market of Bitcoin, a vertically deep industrial chain has been formed, in which leading enterprises are ready to move toward the capital market. The production of bitcoin is based on the workload proof mechanism, which solves a complicated problem through the computer's computing power. The reward of the workload proof is bitcoin. The essence of bitcoin mining is to repeatedly calculate the hash value of the random string and check it. Whether the results meet specific needs. In the industrial chain, mining machinery manufacturers, mine operators, and mining pool operators have flourished and have begun to take shape. Among them, the mining machine manufacturer as the power producer and mining machine supplier is the source of the bitcoin mining industry chain, and is also the industry chain player with the most mature business model.

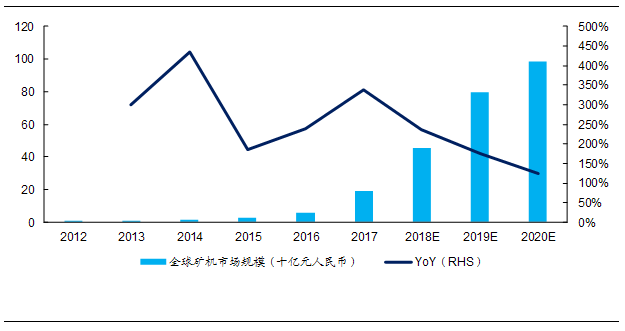

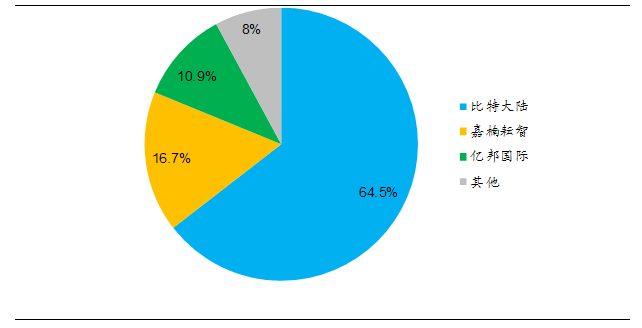

Jianan Zhizhi’s prospectus disclosed that the sales revenue of the global encrypted digital currency mining machine increased from 70 million yuan in 2012 to 19.3 billion yuan in 2017, with a compound annual growth rate of 186.5% and expected sales revenue to 2020. Will grow to 98.5 billion yuan. Due to China's lower energy prices, China's mines have 70% of the world's production capacity before the tightening of regulation in 2017, which has given birth to the world's largest mining machine market. According to calculations, China's three major mining machine manufacturers ——Butland, Jianan Zhizhi and Yibang International have a total of 92% of the world's computing power, and all three of them have previously submitted listing applications on the Hong Kong Stock Exchange, which ultimately failed. It is reported that there is a willingness to go public in the US.

Chart 3: Global mining machine market scale annual compound growth rate between 2012 and 2017 reached 186.5%

Source: Jia Nan Zhi Zhi Prospectus

Exhibit 4: China's three major miners have a total of 92% of the world's computing power

Source: Three mining machine manufacturers prospectus

In addition to the primary market industry chain, Bitcoin has begun to form a variety of exchanges and derivatives, thus providing better liquidity and pricing mechanisms in the secondary market, thereby reducing the speculative component of prices and reducing fluctuations. . Founded in 2012, Coinbase officially launched the first US-owned Bitcoin exchange in 2015. By 2019, it has become the largest cryptocurrency exchange in the US with more than 30 million users and $150 billion in transactions. the amount. The market forecast company's revenue in 2018 will reach 1.3 billion US dollars, mainly from platform trading commissions and revenues from its own encrypted assets. The company has obtained traditional financial institutions including the New York Stock Exchange, the Spanish BBVA Bank, and the Japanese Mitsubishi UFJ Financial Group. Investment in such famous investment institutions as Defengjie. In March 2018, the company further launched the index fund business.

Exhibit 5: Coinbase investors include many traditional financial institutions and well-known investment institutions

Source: Coinbase official website

In addition, the traditional exchange represented by the Chicago Mercantile Exchange is also entering this market. At the end of 2017, it launched the Bitcoin futures contract trading service. In September 2019, it announced that it will launch the Bitcoin option trading service in the first quarter of 2020. . The introduction of related derivatives will make Bitcoin a more mature financial asset and pricing will be more fair.

Digital currency: challenge the undisciplined monetary authority

Why do you need digital currency? To answer this question, you first need to go back to the essence of money, that is, to answer the question "what is money." Although there are still many disputes about the nature and nature of money under the framework of traditional finance, many theories including metalism theory, credit essence theory, and contract nature theory are proposed, but most of them have their own limitations. But there are only two core functions of money: value storage and trading tools. Both of these functions can be used as currency. Among them, the value storage function is the source of the creation of digital currency.

Early shells and gold and silver coins were naturally scarce, which made it possible to become a currency; but after the First World War, the gold stocks of the countries fell sharply, which was not enough to cope with the needs of the currency for post-war economic development, and thus dominated by the pound and the franc. The gold exchange was dominated by the standard system; the Great Depression and World War II completely defeated the credit base of the pound and the franc, and the dollar supported by the strong national power of the United States became the new gold-linked currency, the Bretton Woods system was established; the 50s and 60s of the last century War spending further increased the financial burden of the United States, forced to stop the dollar to exchange gold, the Bretton Woods system collapsed, and the world turned into the dollar standard. From the history of human currency exploration, whether it is the earliest shells, the metal currency represented by gold and silver coins, or the gold exchange currency system after the gold exchange currency system and the Bretton Woods system, the core is looking for a A currency with endogenous stable value, and starting from the exchange standard, the credit order of this price has been built on the credit of a certain government.

What if the government’s credit collapses? From the perspective of the anchor currency change during the exchange standard system, the government-issued currency with a stronger credit base can often replace the government-issued currency with credit deterioration and become the new anchor currency. However, from the practice of the issuance of government legal currency, the credit of the monetary authorities seems to be constantly challenged.

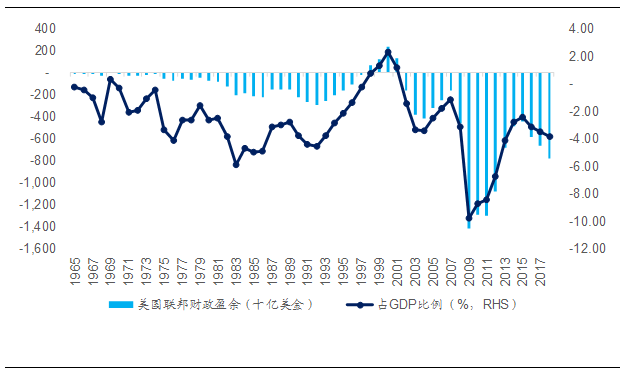

After the collapse of the Bretton Woods system, the United States no longer needs to commit to convert the US dollar into gold, and the exchange standard has become the dollar standard. Since the US economy was unique in the global capitalist system at the time, the US government's credit was widely accepted and had the basis for stabilizing the value of the US dollar. However, from the end result, the US government is not capable of maintaining a healthy financial situation. The federal fiscal surplus is negative for many years. From the establishment of the US dollar standard in 1974 to the global financial crisis in 2008, the US federal fiscal deficit accounted for an average of 2.47% of GDP. %, and further expanded to 5.34% after the financial crisis. After Trump became the US president, the overall fiscal policy remained accommodative, and the fiscal surplus accounted for a further expansion of GDP.

Exhibit 6: US federal fiscal surplus as a percentage of GDP continues to expand

Source: US Congressional Budget Office

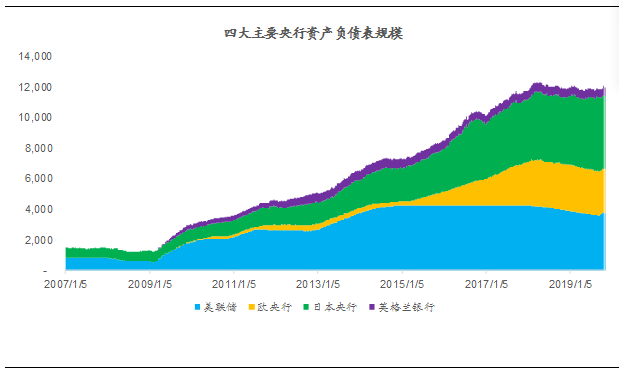

In the end, the US government can only cover this fiscal deficit gap by further borrowing. Although there is a debt ceiling imposed on the US federal government, this so-called debt “ceiling” has continued to rise rapidly since 2008, as of 2019. The US federal government's debt ceiling constraint reached 21.48 trillion US dollars, an increase of 116% compared to 2008 levels. The United States is monetizing its own fiscal gap through the special anchoring monetary status under the dollar-based system, which in turn imposes a coinage tax and exports inflation to the world.

Exhibit 7: The US government only raises the debt ceiling to cover the fiscal deficit

Source: White House Office of Management and Budget

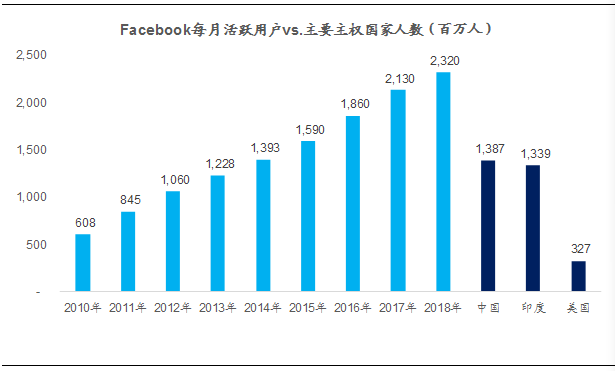

In fact, the United States is not the only government that has expanded its watch. After the global financial crisis in 2008, the monetary authorities of major developed countries have chosen to stimulate the economy through a combination of fiscal expansion and monetary easing. The total balance sheet of the world's four major monetary authorities, including the Federal Reserve, the European Central Bank, the Bank of Japan and the Bank of England, tripled at the end of the decade after the financial crisis, with the Bank of Japan and the European Central Bank expanding faster.

Exhibit 8: The balance of the world's four major central banks' balance sheets has tripled in 10 years.

Source: Federal Reserve / European Central Bank / Bank of Japan / Bank of England

Under the background that the major global monetary authorities are continuing to “release water” and “loose”, the so-called “modern monetary theory” has emerged. This theory originated in the 1990s, and the core view is that the government can Institutional circumventing the restrictions on the independence of the central bank, thereby repaying the debt through the financing of the central bank, and then monetizing the gap in the fiscal deficit, while the monetary easing that traditional economics is worried about causes inflation is not terrible, can be raised by raising taxes and further Expand the table to solve the problem.

We agree with some of the views on the independence of the central bank in modern monetary theory. For example, US President Trump has constantly criticized the Fed’s “cash” and “absurdity” under the leadership of Powell, and does not move at the moment when interest rate cuts and easing are needed, if Powell does not Raising interest rates and quantifying austerity, the US's GDP and stock market will exceed the current level, in addition to threatening to dismiss Powell.

But on the whole, this trend of "modern monetary theory" is not only wrong but also dangerous. The modern monetary theory is based on the fact that the continuous release of water does not significantly push up the inflation level, that is, the Phillips curve has failed, but the current theoretical research on the suppression of inflation is not deep, although the theoretical circles have proposed technological progress, globalization. Conjectures such as division of labor and weaker unions have not been confirmed. If the inflation suddenly rises with the easing of the easing, the government's borrowing costs will soar, and then quickly fall into the fiscal expansion – hyperinflation – the cost of borrowing soared – the negative cycle of further deterioration of finance.

In fact, the formation and breakdown of the economic bubble in the Japanese economy in the late 1980s and early 1990s was caused by ignoring inflation and continuing to loosen the currency. After the Plaza Accord, Japan cut interest rates in response to the trade recession brought about by the appreciation of the yen. Beginning in May 1989, the Bank of Japan began to raise interest rates, with special emphasis on pre-emptive measures to prevent inflation. Subsequently, with the rapid increase in inflation levels, interest rates quickly rose and asset price bubbles burst. Shortly before the Bank of Japan raised its interest rate for the first time, the Japanese Economic Planning Bureau said in its monthly report that "consumer prices are stable," and the prevailing view was that "the relationship between money supply and prices has not become Stabilization is in line with the view of the "modern currency theory" trend of thought.

More importantly, if an economy manages the deficit through monetization for a long time, completely ignoring fiscal discipline and monetary discipline, it will eventually continue to weaken the confidence of currency holders and abandon the currency. In fact, bitcoin emerged after the global financial crisis of 2008, the suspicion of central bank independence and the inflationary implications of fiscal gap monetization.

Hayek was the first economist to question the central government's monopoly on issuing legal tender. As early as 1976, Hayek proposed this point in the book "Non-State of Money." Hayek believes that because the government tends to impose a coinage tax through inflation in the process of monopolizing the currency, even moderate inflation will eventually lead to cyclical depression and unemployment. Money is no different from other commodities. Private companies are more efficient than government monopolies. The competitive currency mechanism between private issuers can abolish the government’s power to expand the money supply, and each bank that participates in the competition It will be realized that only by constantly adjusting its currency supply so that the currency value is moderate and the price level of a widely used basket of commodities is kept constant, it can attract the holders, otherwise it will not have the value storage function. And was abandoned. Hayek believes that the gold standard system is superior to other monetary systems, but people will eventually find that even gold is not as reliable as competitive currencies.

Because the conclusion is too far from being rebellious, Hayek has long been abandoned by the academic circles after proposing the competitive coinage theory of private enterprises. Even in the 1980s, when the liberal economic thought was the most popular, it failed to become a mainstream economy. Theory, until Facebook launched Libra, the market and academic circles exclaimed, Hayek's theory seems to be becoming a reality.

Change, right now

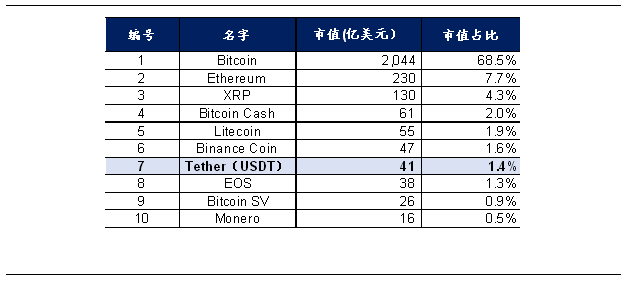

Why is the birth of privately-owned money issued 40 years later than Hayek’s theory? The core lies in the second function of money – trading tools, trading and payment networks require a wide range of participants, regardless of C2C or C2B payment transactions, users are the core nodes of the network. In the era when Hayek proposed this theory, no private enterprise can have enough users to challenge the sovereign currency, but with the rise of multinational corporations brought about by economic globalization, and the siege of the technology giants driven by the Internet era. Both have made the number of users in the private sector far beyond the single sovereign economy.

For example, Libra's Facebook has had 2.32 billion monthly active users by the end of 2018, surpassing the number of all sovereign countries, 1.67 times and 1.73 times of China and India respectively. The huge customer base is Facebook's digital currency. basis.

Figure 9: Facebook has 2.32 billion monthly active users as of 2018

Source: Facebook Annual Financial Report

According to the Libra white paper, Libra is built on a secure, scalable and reliable blockchain backed by an asset pool that is intrinsically valuable and governed by an independent Libra association. Overall, Libra has two important characteristics – stable currency and decentralization.

First, Libra is a statutory asset-backed stable currency linked to a basket of currencies. According to the credit support behind it, digital currency can be divided into three types: central bank digital currency, ordinary cryptocurrency and stable currency. The central bank digital currency is issued by the central bank, and the core credit support behind it still comes from government credit; ordinary cryptocurrency does not include Currency stabilization mechanism.

According to the currency stability mechanism, the stable currency can be further subdivided into legal asset-backed stable currency, digital asset-backed stable currency and algorithmic stable currency. The statutory asset-backed stable currency is issued by the issuer through the mortgage of assets such as US dollars and gold, and the credit is finally reflected in the credit of the dollar or gold behind it. Libra belongs to this category; The stable currency means that the user mortgages the digital assets held and deposits the currency according to the value of the currency. The credit is finally reflected in the credit behind the digital assets as collateral. In essence, this type of stable currency belongs to a class based on numbers. The “derivatives” of assets do not belong to the true digital currency; the algorithmic stable currency regulates the total supply of money through an endogenous algorithm to maintain the relative stability of the currency, and bitcoin can be treated as an algorithmic stable currency.

Since Bitcoin is obtained by mining mechanism, with the overall improvement of the overall network computing power, mining is more difficult to succeed, so the time required to generate a new bitcoin is also increasing. This mechanism can Better control of the inflation level is equivalent to the algorithm itself is the credit support behind this currency, but the core challenge is the computing power. For example, with the advancement of technologies such as quantum computing, the theoretical model of traditional computers has been subverted. It may greatly shorten the time required for bitcoin mining. For example, Google announced that its "Sikmo" superconducting quantum chip took only 200 seconds to complete the task that the world's most powerful computer takes 10,000 years to complete. If this scenario comes true, Bitcoin will face a surge in the total supply of money due to technological breakthroughs in the short term, and the subsequent collapse of the currency and hyperinflation.

Therefore, as a whole, the statutory asset-backed stable currency may still be the best digital currency technology path. At present, the most representative legal asset-backed stable currency is USDT, which is issued by Tether and is 1:1 linked to USD. According to Coinmarketcap data, the total market value of the stable USDT is ranked 7th in the global digital currency and is stable. More than 80% of the currency market.

Exhibit 10: The total market capitalization of the stable currency USDT ranks 7th in the global digital currency

Source: Coinmarketcap

Unlike USDT, Libra mainly uses a basket of currencies to stabilize the currency. According to Facebook's internal letter to the EU on September 21, 2019, Libra plans to use 50% of the US dollar, 18% of the Euro, 14% of the Japanese Yen, and the British Pound. 11% and Singapore's 7% are linked to five major currencies.

Exhibit 11: Libra plans to link five major currencies including US Dollar, Euro, Japanese Yen, British Pound and Singapore Dollar

Source: Public information

Second, Libra will become a decentralized currency. According to the white paper, the Libra Association will be the highest governing body for this emerging digital currency. As an independent institution, the Libra Association will work with its subordinate dealers to maintain the Libra currency ecosystem. For better cooperation with institutions such as the Bank for International Settlements, the Libra Association is headquartered in Geneva, Switzerland and is regulated by the Swiss Financial Market Regulatory Authority. In the future, the Libra Association will become the new central bank, and members of the association will be equivalent to members of the central bank, and will adjust the monetary policy by voting.

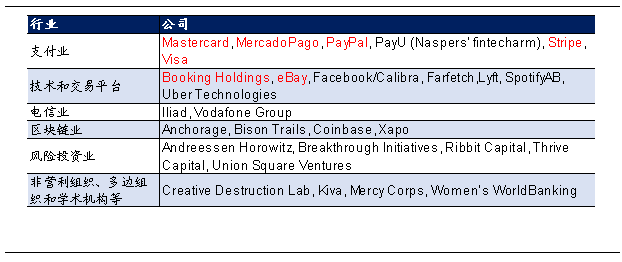

At the time of the white paper, the Libra Association consisted of 28 members, covering a wide range of industries, from payments, the Internet, e-commerce, telecommunications, investment, and non-profit organizations. According to the white paper, when the Libra was officially released in 2020, the number of founding members of the association will reach About 100. Members of the Libra Association have equal rights and obligations, and the Libra Association is governed by a board of directors whose duties include ensuring that the verifier node meets trading needs, issues Libra and manages reserve assets. All decisions of the association will be made through the board of directors, and two-thirds of the members will vote for the major policy or technical decision. In order to prevent voting rights from being held in one hand, no matter how many Libra members hold, a single founder, including Facebook, can only represent 1 vote in the board or 1% of the total votes, whichever is the greater.

But since October 2019, five payment service providers, including Paypal, MasterCard, Visa, Stripe, Mercado Pago, and large e-commerce eBay and online travel service provider Booking Holdings have announced their withdrawal from the Libra committee. The company's main consideration is that Libra still has a large risk of compliance, which also reflects Libra's current regulatory pressure.

Exhibit 12: Seven of the initial members of the Libra Association have announced their withdrawal

Source: Libra White Paper

We believe that the Libra currently launched is only a transitional form of digital currency issued by private companies. In order to accept US regulation, Facebook, as a private company, chose to adopt a stable currency route linked to the existing sovereign currency when issuing new digital currency.

In fact, from the composition of Libra's linked currency, it is clear that it is deliberately avoiding the inclusion of the renminbi in the currency basket. Referring to another important "super-sovereign currency" that anchors a basket of currencies – the International Monetary Fund's Special Drawing Rights (SDR), SDR is linked to five major currencies: the US dollar, the euro, the Japanese yen, the British pound and the renminbi. Currency, in which the weight of the renminbi is 11%. Among the Libra-linked currencies, the Singapore dollar has a higher correlation with the value of the renminbi. We believe that it is because of the stability of the currency, but it can achieve the purpose of “de-Chinaization”. Libra joined Singapore in the currency basket. yuan.

From the list of members of the association revealed in the white paper, Libra has a very obvious American brand. The vast majority of the first 28 member companies are American companies. In the question of the US Congress, Facebook CEO Zuckerberg has repeatedly played "China Card", saying that the Chinese central bank's digital currency plan will become part of the "Belt and Road" initiative and become an extension of China's influence in Asia and Africa. Diplomatic and economic policies, on the contrary, Zuckerberg has repeatedly mentioned that Libra will be mainly supported by the US dollar, and will expand the US's global financial leadership and promote American democratic values in the future.

We believe that Zuckerberg's series of "de-renminbiization" and "China brand" reflect the regulatory pressure Libra is currently facing. In fact, after the publication of the white paper, regulators around the world are generally cautious about Libra, and some countries even insisted on strictly blocking Libra. The US House of Representatives Service Committee and some Democrats asked Facebook to ban the development of the Libra project. The US Senate Bank, Housing and Urban Affairs Committee and the House Financial Services Committee held separate hearings on Libra; the Chairman of the Russian Duma Financial Committee explicitly prohibited Libra from paying in Russia. means. In terms of international organizations, the Bank for International Settlements (BIS) stated that technology finance projects such as Libra go beyond traditional financial regulation or pose challenges to the global banking system. If Libra is unable to obtain approval and support from national regulators, its cross-border remittance and other services will be difficult to carry out smoothly, and the scope and application scenarios will be greatly limited.

Zuckerberg’s comments on the Chinese central bank’s digital currency are also incorrect. In essence, the central bank’s digital currency and Libra are completely different forms of money, and the credit support behind it is completely different from the currency mechanism. According to the statement of the relevant officials of the People's Bank of China, the main function of the central bank's digital currency is to replace the M0. The essence is the electronic cash, which still reflects China's sovereign credit. The use scenario is also expected to be different from the RMB cash. The significance of the central bank's introduction of legal digital currency is more to solve the risk of money laundering and illegal trading in the current cash trading market.

Libra is different. The main application scenario of digital currency linked to a basket of currencies will be cross-border payment. Although traditional cross-border transactions still dominate, new cross-border transactions based on blockchain are developing rapidly. From 2010 to 2018, a total of 39 blockchain-based cross-border transactions, such as Ripple, were born. Applying the blockchain technology to cross-border payment can effectively solve the shortcomings of the traditional SWIFT settlement system, such as long payment period, high commission and cumbersome process, making payment faster, cheaper and safer. According to the related cost estimates in the "Bank-The Cost Cutting" white paper provided by Ripple, the use of blockchain technology for cross-border transactions can reduce the single cost from $20.9 to $12.2, a drop of about 42%.

Looking forward, we believe that the ultimate form of digital currency will be a purely private enterprise that is truly decentralized and not linked to the existing legal currency. The monetary authority may consist of a coalition of multiple private companies, including the total money supply. A series of monetary policies will be voted by the alliance, and the stability of the currency will depend on the league's currency discipline. We believe that this kind of digital currency may not appear in the short term. The core resistance lies in the fact that large-scale technology companies with the ability to issue coins and have such a large user base are subject to stricter supervision. Existing monetary authorities and regulatory authorities will not allow this. The loss of monetary sovereignty.

However, we believe that the boom in digital currency still needs to sound a wake-up call for central banks around the world. Hayek’s “competitive currency” era may have arrived. If there is no independence in monetary policy, it will be lost in the control of total money. Discipline, in the end, monetary sovereignty will face challenges. The legal currency issued by some sovereign governments may also be abandoned by the holders. That is, contrary to the traditional Gresham's law, the “good money” with more stable currency value will be unstable. "Expelled from the market, as we have seen in some emerging markets where hyperinflation and currency devaluation occur."

Author: Li Haitao

(The author is the vice president and professor of the Finance MBA Program of Cheung Kong Graduate School of Business)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Messari Research Report: A detailed explanation of the way encryption assets are issued

- The Monroe core team issued a security warning: the CLI binary file was corrupted and the user had to check it in time

- Non-joint office: Be wary of illegal fund-raising in the name of the blockchain

- Interview with David Marcus: Bitcoin's failure in payment has spawned Libra

- Community Perspectives | Reflections on the MOV patrol officer system

- Research | Bitcoin mining and video games: Who consumes more power?

- Observation | China blockchain builds a peak in global public opinion