Featured | What is the nature of the cryptocurrency phenomenon?

Satoshi Masamoto: 5 daily high-quality articles on cryptocurrencies are selected today. Today includes: 1) Iterative Capital: What is the nature of the cryptocurrency phenomenon; 2) Why altcoins are dying, after the short-term altcoin spring in January 2020 What it will be; 3) Figment insight into NuCypher; 4) Gauntlet: why Uniswap is a good oracle; 5) why ENS uses Ethereum without customizing its own blockchain;

1) Iterative Capital: What is the nature of the cryptocurrency phenomenon?

This is an in-depth paper written by Iterative Capital at the end of the year. It systematically reviewed the timeline of the birth of Bitcoin and the historical background of the cryptocurrency phenomenon. Collaborating, Iterative Capital gave its own answer on how to achieve the growth of the value of the cryptocurrency system.

In the final part of this thesis, Iterative Capital examines the potential impact of Bitcoin's success and expectations of its price, and explains why most altcoins are doomed to failure, and also points out the direction and value of investment that investors need to avoid May accumulate areas. Here are some excerpts:

Paradox of cryptocurrency

Despite some obvious paradoxes, cryptocurrencies have made headlines around the world. These contradictions include:

- Opinion: After the epidemic, blockchain will lead 15 new employment models

- Consensus Wang Maolu: Under the epidemic, how to use the blockchain to solve the problem of drug shortage?

- Breaking off is the strongest self-discipline development of the blockchain

- Although market enthusiasm persists, it lacks clear utility

- Disgusted by people on exactly half of Wall Street

- Copied by the smartest entrepreneurs in the world

- Despite fraud rampant, there is no killer app

- Popular in troubled emerging economies

"Subtle terror balance" during the miner's reign

In unlicensed cryptocurrency systems such as Bitcoin, large miners are also potential attackers. Their cooperation with the network is premised on profitability; if the attack becomes profitable, the big miners are likely to try it. Those who follow the development of bitcoin in recent years know that the topic of miners' monopoly is controversial.

Some participants believe that ASICs can disrupt the health of the network in various ways. In the case of centralized hash rate, the community is afraid that the miners will unite to launch a so-called 51% attack, that is, the miners who account for the majority of the hash rate can use this computing power to rewrite transactions and get the same funds to spend two Times. This type of attack is common in smaller networks because it is less expensive to implement a hash rate of 51% in these networks.

Any mining pool (or mining pool alliance) with more than 51% hash rate has "nuclear weapons" in the network. This is actually using the hash rate to hold the community hostage. This scenario is reminiscent of the Cold War-era nuclear strategist Albert Wohlsetter's view on the delicate balance of terror:

"Balancing does not happen automatically. First, because thermonuclear weapons provide a huge advantage to aggressors, great wisdom and realism are required to design a stable balance at any given level of nuclear technology. Second, The technology itself is changing at an alarming rate. Deterrence requires urgent and ongoing effort. "

Although large miners could theoretically launch an attack and reverse the consensus history to their advantage, they may also push the market to a disadvantageous position for them, resulting in a sudden plunge in token prices. Such a plunge in prices would make miners' hardware investments and currencies that they have earned in the past long-term holdings worthless. With highly concentrated manufacturing, a secret 51% attack is easier to implement.

"Structural tyranny" under core developers

Although malicious miners pose a constant threat to non-permitted cryptocurrency systems, the dominance of core software developers may equally be detrimental to the integrity of the system. In a network controlled by a small number of elite technicians, miners and full-node operators running the code may not be able to easily detect false changes to the code.

The community has taken various approaches to combat the huge impact of miners. Siacoin's team decided to produce their own Asic miner after learning about Bitmain's Sia miner. Communities such as Zcash are cautiously welcoming to ASICs. New projects such as GRIN have designed their hashing algorithms to be RAM (random access memory) intensive, thereby increasing the cost of manufacturing ASICs. Some projects like Monero have taken a tougher step and changed their hashing algorithm just to make a manufacturer's ASIC machine inoperable. The fundamental difference here is not "decentralization", but rather which faction controls the way the market values the generation of coinbase rewards; this is a struggle for control over the "golden goose".

Due to the highly dynamic nature of the decentralized network, prompt action on the concentration of power around miners may lead to the opposite extreme: concentration of power around head developers. The concentration of these two kinds of rights is very dangerous. The latter extreme can lead to unstructured tyranny, that is, without the wrong premise of a formal hierarchy of power, the community worships the main submitter in a personal worship.

The word comes from the social theorist JoFreeman, who wrote in 1972:

"As long as the structure of the group is informal, the rules of how to make decisions are known to only a few people, and the knowledge of power is limited to those who know the rules. Those who do not know the rules and have not been selected as enlightened , You have to stay confused or fall into paranoid delusions that something they do n’t know is happening. "

The lack of a formal structure can be an invisible obstacle for new contributors. In the context of cryptocurrencies, this means that despite the motivation to bring more development talent to the team (thus speeding up project development and increasing the value of the network), the open distribution governance system we discussed in the previous section is still May go wrong.

The dominance of a miner or developer may lead to changes in the development roadmap, which may damage the entire system. One example is the wrong decisions made by the "big block parties." Due to the willingness of some miners to support larger block capacity, the Bitcoin network was split into two on August 1, 2017, resulting in increased costs for full node operators. For blockchains that use proof of work, these operators play a vital role in enforcing their rules. Higher costs may mean a reduction in the number of full-node operators on the network, which in turn makes it easier for miners to disrupt the power balance for their own benefit.

Another example of an imbalance is the Ethereum Foundation. Although Ethereum has a strong community of DAPP (distributed application) developers, the core protocol is only determined by a small number of project leaders. In preparation for the Constantinople hard fork of Ethereum, the developers decided to reduce the mining reward by 33% without asking the miners for their opinions. Over time, alienating the miners' unions has caused the network to lose the support of a major stakeholder group (the miners themselves) and created new motivations for miners to attack the network for profit or revenge.

This paper from Iterative Capital is extremely exciting and valuable, and I highly recommend the reader to read the full text; I would like to thank the two authors, Chris Dannen and Leo Zhang, for their hard work, thank Katt Gu for the translation, and Multicoin Capital executive director Mable for their recommendations.

Iterative Capital: https://iterative.capital/

Chinese version: https://docs.google.com/document/d/1HAwJe_C0_TmmkwlGoeXO2bpdv0NKfu0_HvOFEUXecqw/edit?ts=5dfc01e1#

2) Why is altcoin going to die, what will it be after the short-term altcoin spring in January 2020?

Data provider CryptoRank reviewed the dead altcoins. A large number of altcoins appeared in 2017 due to the ICO frenzy. The IEO after the ICO is also not optimistic. As of July 2019, the average ROI of Binance IEO is 450% This number dropped to 72.92% after a month, while many other exchanges have a negative index.

The following chart shows the 10 assets that have fallen the most from their highest prices in 2019:

Bitcoin once captured the vast majority of market share, but during the altcoin boom in 2017, the dominant bitcoin market share dropped from 86% to 33%. Then altcoin began to lose value, and Bitcoin's market share soared again, reaching nearly 70% in 2019.

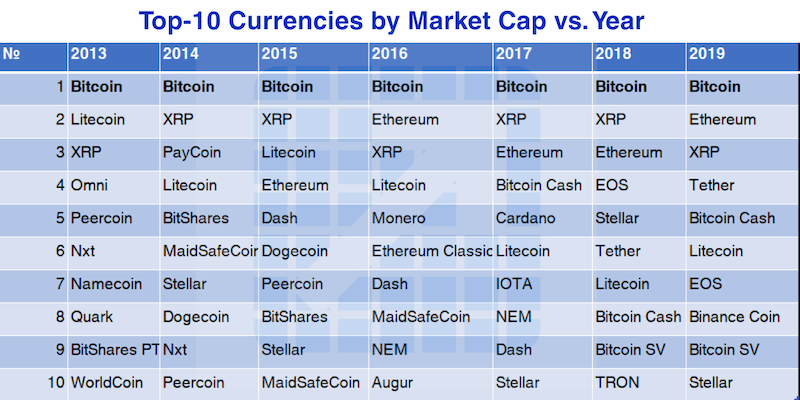

Since 2013, most of the top 20 tokens by market capitalization have almost completely disappeared, replaced by new assets. Projects like Namecoin, Peercoin, and Feathercoin have been replaced by Ethereum, Monero, and EOS. Not only did those once-popular projects disappear from the memory of the cryptocurrency community, but some were completely abandoned, and their token prices fell many times or lost liquidity on the exchange.

Why did altcoins die?

The altcoins disappeared so fast that there were sites to track such coins. There are 1,839 dead items on "Deadcoins" and 1,407 on "Coinopsy".

Most projects died in 2018, which is understandable because in 2017 with the prosperity of the ICO, a large number of altcoins appeared in the market. Unfortunately, they died as fast as they appeared.

By 2019, the number of abandoned projects has clearly dropped to the lowest level. This is because the market was relatively calm in 2018, Bitcoin was at the bottom, and the number of token sales and newly issued tokens decreased significantly. And in this case, fewer people want to deceive others, because it is more difficult to raise funds in the market.

The 4 most common reasons for the death of crypto projects: abandoned or close to zero transaction volume; blockchain scam projects; failed fundraising; purely a joke.

What happens next?

As before, the situation for most altcoins and exchanges has not changed. Exchanges continue to manipulate trading volume, and retail investors are chasing short-term profit opportunities.

Many altcoins continue to fall and will likely continue to fall to lower levels, losing value and liquidity. This is also the result of the fact that most projects are still in the start-up phase, and tokens that are unlocked after a few years will increase price pressure, and most tokens have no deflation or other mechanisms that help tokens remain liquid.

However, many are waiting for the spring of altcoins, as they showed extremely attractive profits in 2017. And in January 2020, many altcoins once again give people hope.

In 2020, large projects such as TON, Dfinity, Polkadot will enter the market, and large stable coins such as Libra can also bring additional liquidity to the market.

The concentration of funds in large market capitalized assets has increased. According to CryptoRank data, Top20 accounts for 87.6% of the total market capitalization. As small market capitalization assets continue to flow out, the dominance of these assets may continue to increase.

Full text link: https://medium.com/@cryptorank/why-are-altcoins-dying-and-what-might-happen-to-cryptocurrencies-soon-da525beaa3c8

3) Figment Insights into NuCypher

Crypto network operator Figment Networks participated in NuCypher's Incentive Test Network, a report they wrote about NuCypher.

NuCypher is building an encryption infrastructure for protocols and applications that protect privacy. Their key management system (KMS) is designed to address the limitations of current consensus networks to securely store / send / manage private and encrypted data.

NuCypher's main product, Umbral, is a proxy re-encryption scheme. It will enable the proxy entity to transform or re-encrypt data from one public key to another without the need to access the private key. They are also working on NuFHE, a fully homomorphic encryption library that allows arbitrary secure calculations of encrypted data.

Network Status

NuCypher's incentive test network is now running, and the second phase will continue until February 17. The first two phases require users to complete various tasks, such as staking, starting nodes, performing re-encryption, and regaining rewards.

The third phase (expected to begin on February 17th) will test its new token distribution mechanism called "WorkLock". Although not yet finalized, there will be a contribution period of 3 to 4 weeks.

Full text link: https://medium.com/figment-networks/figments-first-look-nucypher-6265298b09bd

4) Gauntlet: Why Uniswap is a good oracle

This is an article published on the Gauntlet blog of the encrypted network simulation test platform. Gauntlet recently published an analysis report on Uniswap, which is part of the report. The conclusion shows that there is no large-scale operation phenomenon found in the Uniswap market. Uniswap It seems to have good theoretical support, showing that Uniswap with stability can be a sufficiently decentralized market in practice and a stable price predictor. At the same time, it is important to have a large pool of funds, because all results depend on it.

Uniswap has become a popular alternative to classic order book exchanges and has become a universal mechanism for measuring the relative price between tokens on two chains (the contract that attempts to do this is often referred to as a "price oracle"). Surprisingly, although the basic idea of Uniswap is simple, the actual results are quite good: In the "real world", Uniswap seems to be able to accurately estimate the relative price of two assets compared to larger exchanges.

Uniswap's stability is also surprising because it does not seem to be affected by bad actors, who may try to manipulate prices for private gain.

For Uniswap users, these results may be intuitive because they see them in action. However, skeptics only regard this as a favorable result, and our analysis provides a mathematical framework for Uniswap to be a good oracle.

Full text link: https://medium.com/gauntlet-networks/why-is-uniswap-a-good-oracle-22d84e5b0b6c

5) Why does ENS use Ethereum instead of customizing its own blockchain

Brantly, head of operations at ENS, explains why using Ethereum and ETH is the best way for blockchain domain name services.

The Ethereum Domain Name Service (ENS) is so named because it only supports Ethereum addresses (ENS can support any cryptocurrency address, as well as non-blockchain data such as IPFS hash and Tor .onion addresses), but because it Runs on the Ethereum blockchain and uses ETH for payments.

Some history

The first well-known domain name project Namecoin launched its own dedicated blockchain in 2011.

To create a new blockchain-based application at that time, a new blockchain dedicated to this purpose must be launched (because it is difficult to develop applications on Bitcoin). This involves having to have enough knowledge to create and maintain a new Layer 1, promote a new mining community (grow) to improve security, and finally get people to really start using it.

Ethereum, launched in 2015, changed all that. Now it is easier for people to launch a new blockchain application that takes advantage of the security, user community and infrastructure of the existing Ethereum blockchain.

Launched on Ethereum in May 2017, ENS is an open source and non-profit project that takes advantage of these (and those mentioned below). ENS has quickly become the leading blockchain domain name project, integrating more than 100 wallets and dapps, and capturing more than 310,000 registered domain names.

Other similar projects have chosen Namecoin's path. For example, the Handshake blockchain and its affiliate token HNS have been launched not long ago, and the FIO blockchain and its token are also coming soon. (They have also unnecessarily created many new TLDs, and these TLDs will definitely conflict with the DNS domain name space in the end. We think this is not good for users and the use of blockchain technology in the field of Internet domain names.)

Benefits of customizing blockchain and tokens

There are several obvious technical advantages to running domain name services on a customized blockchain: less blockchain bloat, lower transaction speed and cost, and a smaller attack surface.

Benefits of using Ethereum and ETH

ENS believes that the advantages brought by the use of Ethereum and ETH far outweigh the custom blockchain and tokens.

Most obviously, the use of Ethereum means that ENS gains all the security, robustness, censorship resistance, decentralization, and regular protocol improvements of Ethereum.

There are other benefits that people may not know too:

- Composability and interactivity , such as using ENS to interact with smart contracts or DAOs;

- Ecosystem and infrastructure (support) , such as the ENS native ".eth" domain name is an NFT asset compatible with ERC721, so that the ".eth" domain name can be embedded in all NFT markets or wallets; ENS can also benefit from the existing foundation of Ethereum Facilities such as MetaMask.

Using ETH instead of own tokens means that users can enjoy all the conveniences of ETH, extensive token distribution, supporting infrastructure and market liquidity. And customizing blockchain tokens will only increase unnecessary friction.

Full text link: https://medium.com/the-ethereum-name-service/why-ens-uses-ethereum-and-eth-not-a-bespoke-blockchain-and-token-36f86727e71f

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Comment: What people need is "consensus" for outbreak data

- View | Industrial Blockchain 2.0 is a technology fusion upgrade

- Opinion | Will the alliance chain gradually disappear?

- Blockchain Weekly | Shanghai Supports Central Bank's Digital Currency Research Institute to Set Up Fintech Company in Shanghai

- Initially in 2020, 223 questionnaires from the community will tell you the development direction of the public chain

- Speculative POC: New consensus or speculation?

- China's Blockchain Technology Standardization: Exploration, Practice and Journey Beginning in 2016