DeBank plans to launch Layer2, and the wool party has already taken action?

DeBank to launch Layer2, wool party already taking action?Author: Loopy Lu

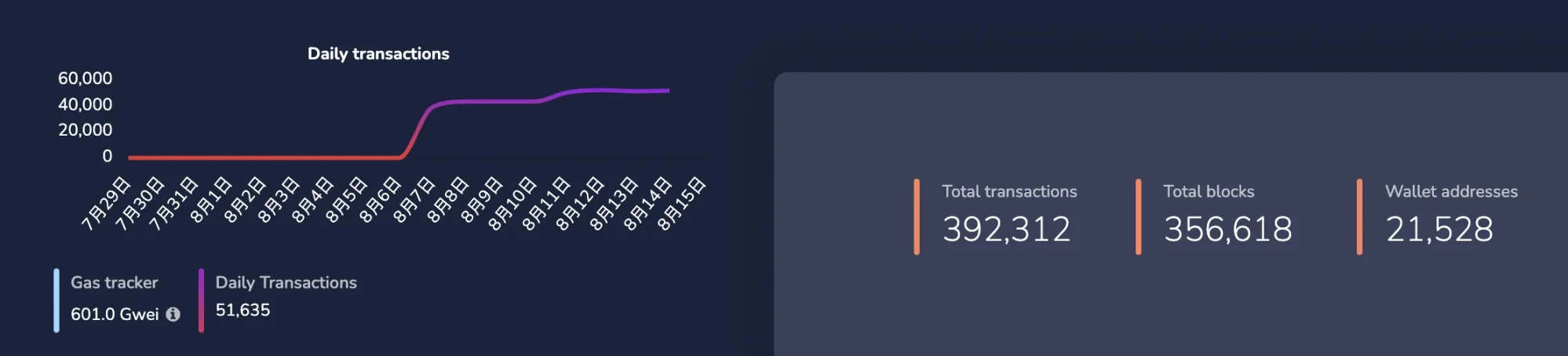

Recently, DeBank announced its plan for DeBankChain, another well-known player joining the altchain craze. According to official information, DeBank Chain will be built as a chain focused on social interactions, revolutionizing social interactions by adding an asset layer to social behaviors. The DeBank Chain testnet is now open, and the mainnet will be available before 2024. Data from the testnet chain browser shows that there are over 21,000 on-chain wallet addresses.

The opening of the testnet has also allowed the “wool party” to see the potential for wealth creation. However, various “wool party loss” incidents have occurred frequently recently. Can DeBank’s chain launch plan still enable the wool party to make money?

- Mining myself, mining out a 50% annualized return? Interpreting the Ve (3.3) game hidden behind the emerging star RDNT in the borrowing and lending market

- Cryptocurrency Track Weekly Report [2023/08/14]

- Deep analysis of ARB on-chain chips Users continue to increase their holdings, and most large holders are at a loss.

DeBank Chain: Low-Cost Social Chain

To understand DeBank Chain, we need to start with DeBank. DeBank is an established DeFi management panel where users can track their investment portfolios and use integrated trading functions for investment operations.

In December 2021, DeBank completed a $25 million equity financing at a valuation of $200 million, with Sequoia China leading the investment and participation from Dragonfly, Hash Global, Youbi, CoinbaseVenture, Crypto.com, Circle, and Ledger.

In January 2022, Debank launched the Web3 social platform and Web3 ID function, allowing users to follow whale trading dynamics, NFT market trends, track Mirror article updates, and real-time on-chain activities of Web3 friends through the platform.

In October 2022, DeBank also launched the Web3 native communication application DeBank Hi.

As a well-known established project, most investors (as well as media friends who frequently query on-chain data) are familiar with DeBank, so there is no need to elaborate further.

DeBank Chain is a new chain named after the DeBank brand, similar to the multiple L2s that have emerged recently, and this network is also based on OPStack development. DeBank stated that the chain has three advantages: maximizing the reduction of gas costs, providing a local experience similar to account abstraction, and ensuring the security of L1 assets.

Specifically, DeBank Chain has made significant progress in optimizing the consensus mechanism, reducing gas costs for single transactions by 100 to 400 times. The official also stated that in terms of providing a “next-generation” level of user experience, the chain provides a chain-level account abstraction system and integrates it locally. This allows users to enjoy an experience close to Web2 while remaining 100% compatible with the EVM standard.

In the new account system, transactions support signing with a dedicated L2 private key, reducing the use of L1 private keys in usage scenarios and enhancing the security of users’ L1 assets. This also provides a foundation for users to engage in higher-frequency operations, and the official believes that this feature “fully adapts” to the high-frequency nature of social interactions on our platform.

How to participate in “wool party”?

Currently, I have not found the RPC URL of DeBank Chain, so it cannot be manually added to MetaMask. However, the testnet is now integrated into Rabby Wallet and comes with a test coin faucet. If users want to experience it, they can use this wallet for now. The participation process is not complicated:

1. Download and install Rabby Wallet, import or create a wallet.

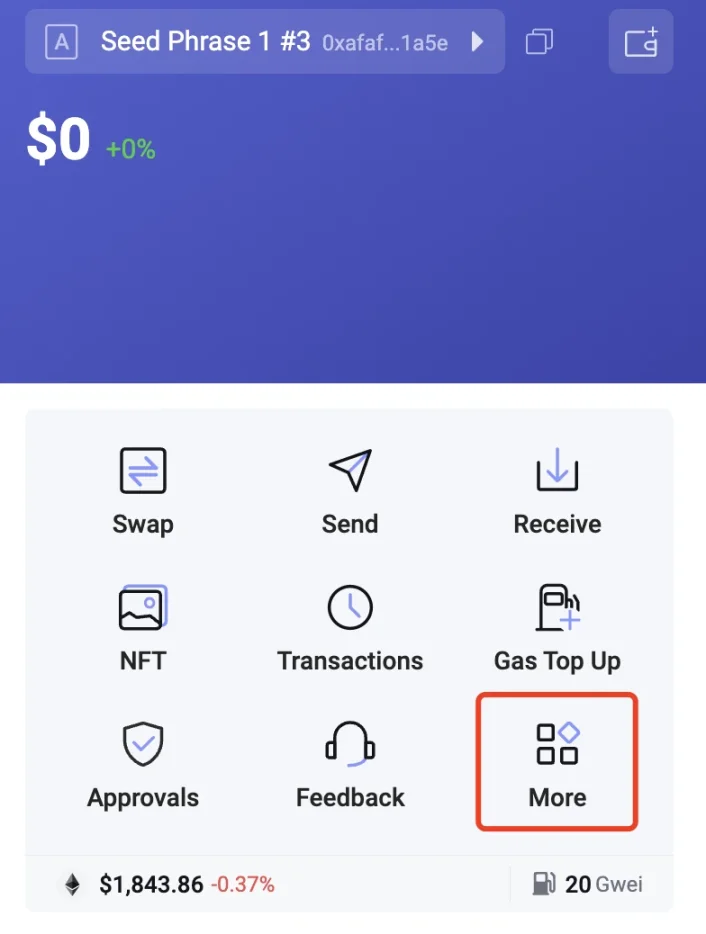

2. Find and click “More” on the main interface.

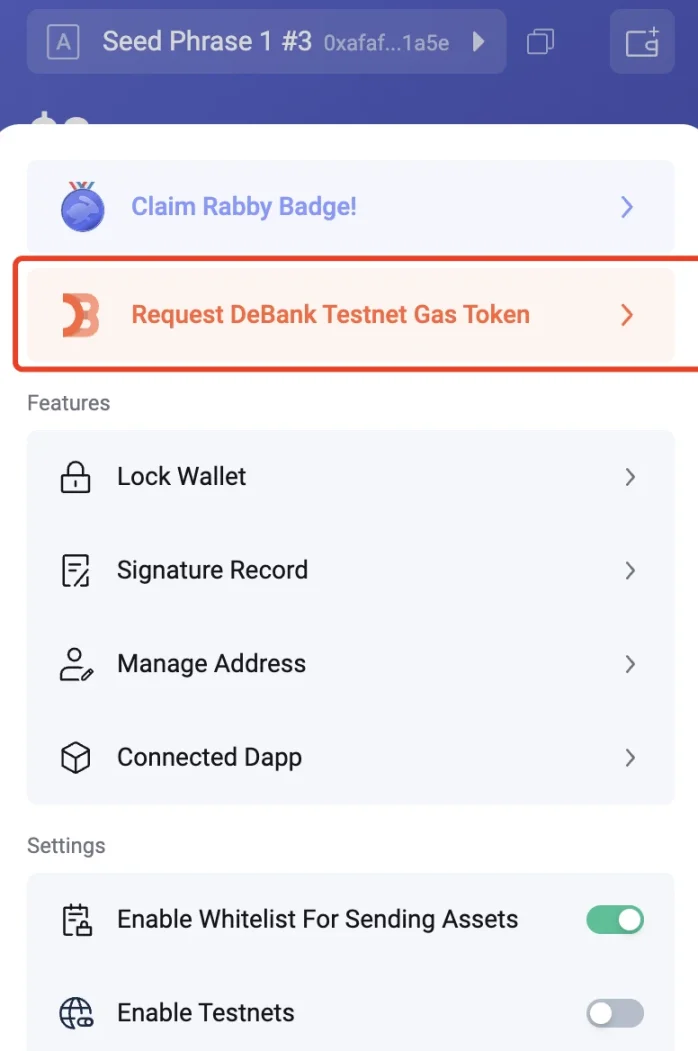

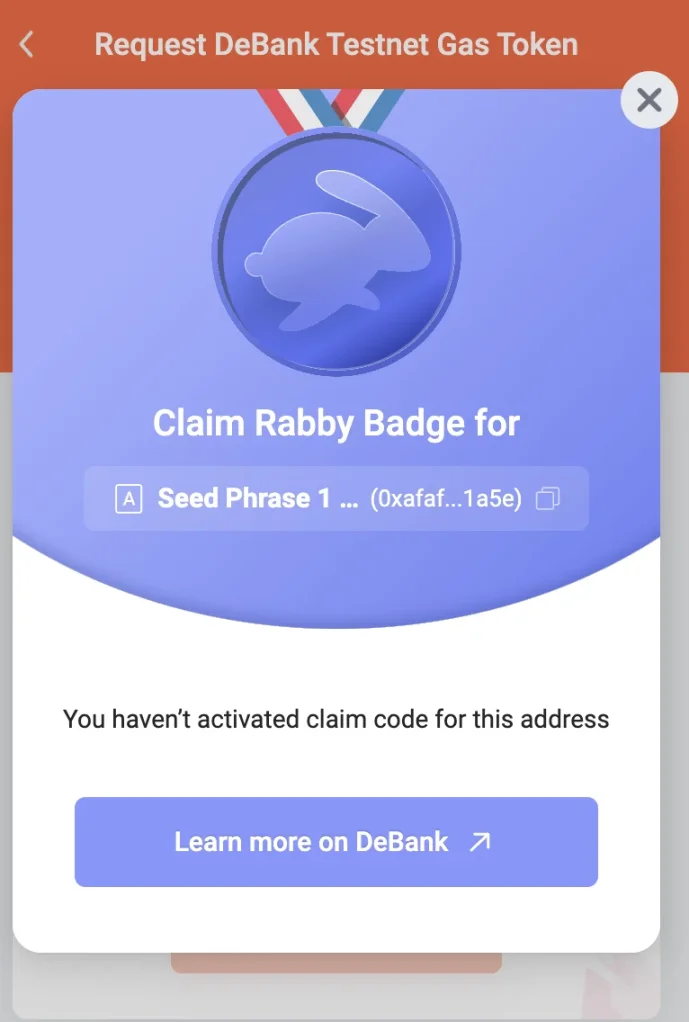

3. Click “Request DeBank testnet gas tokens”.

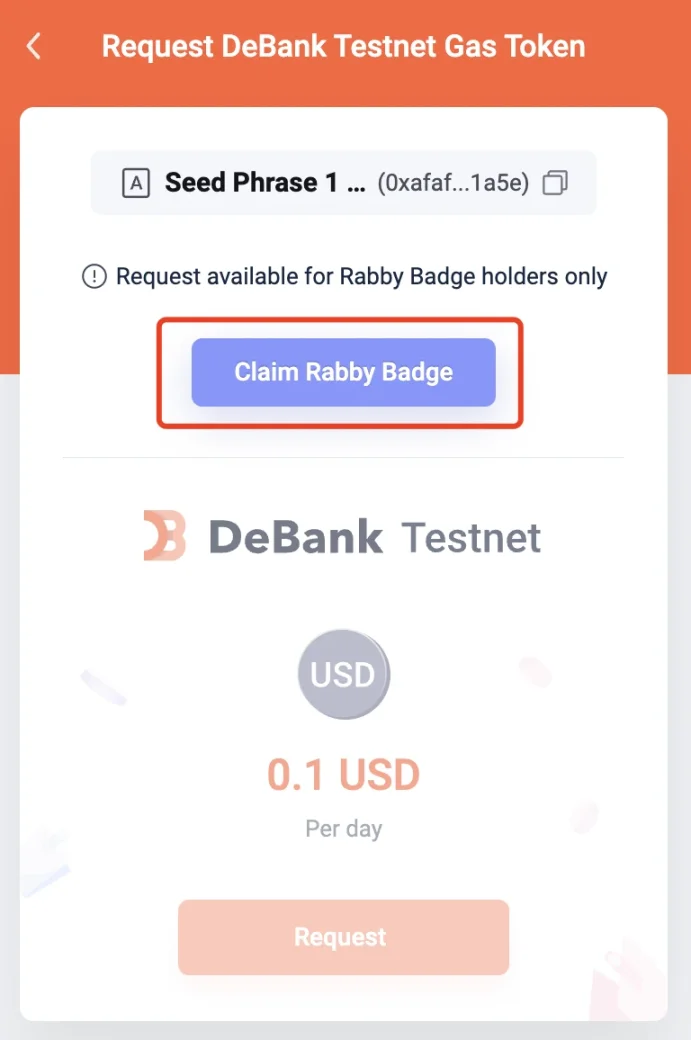

4. To receive testnet gas coins, you need to meet the prerequisite of holding the “Rabby Badge”. Users need to claim this badge first.

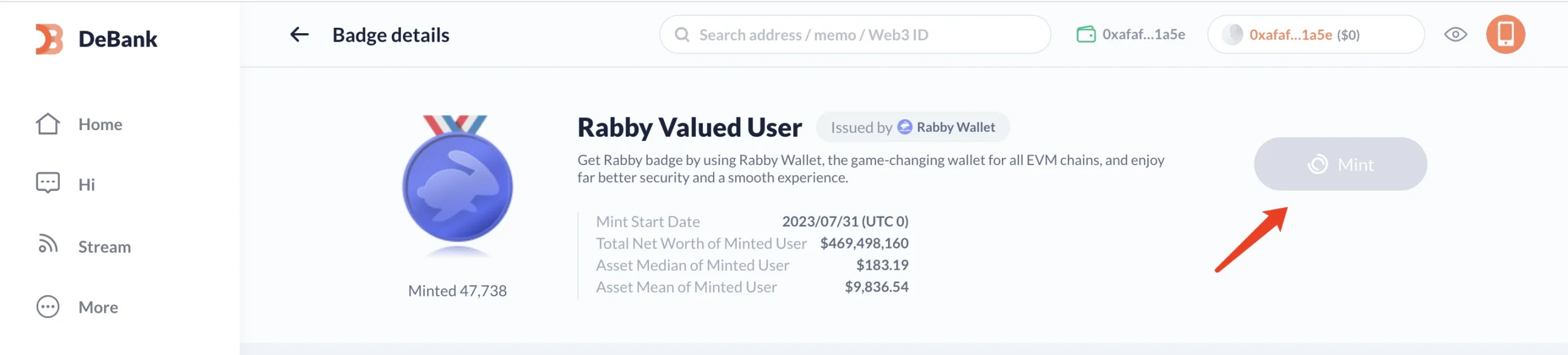

5. Follow the wallet instructions, you need to first go to DeBank and then mint a badge called “Rabby Valued User”.

6. Once you have the badge, you will be eligible to obtain gas tokens.

Airdrop rules leaked? Perhaps just a misunderstanding

It needs to be clarified that DeBank has not officially announced detailed airdrop plans at this time, let alone the specifications of the airdrop.

However, two weeks ago, DeBank’s github released a snapshot standard for “valuable Web3 users” and explained in the document that witch addresses, “sheep party” addresses, and low-value robot addresses are everywhere on the chain. This lack of accurate, comprehensive, and publicly available high-quality on-chain user data makes quick action lack a high-quality on-chain user data set. DeBank then selected a group of “valuable users” according to their standards and took snapshots of such addresses.

Their standards include: net assets > $1000; “Web3 ID” has been minted; TVF of the address in DeBank > 0.

It needs to be clarified again that this standard and the possible airdrop of DeBank Chain are not necessarily related. Many users have used this standard as a criterion for “lurking”, and have “brushed” their accounts in batches. The future results are unpredictable.

Looking back at recent airdrop events, we cannot help but notice an interesting phenomenon – airdrops have become increasingly difficult to get rich from, and there is even a risk of being counter-lurked.

In the early years, after the wealth effect brought by some large airdrops, more and more users have started to complete as many interactive operations as possible through data brushing, rather than real usage. And project teams are often willing to use this FOMO sentiment to continuously launch more on-chain interactive “tasks” to lure users to complete more interactive operations, adding popularity to the cold start of new products.

Recently, after several well-known projects successively announced the airdrop quotas, they have sparked the anger of the community due to the small number of airdropped tokens or high airdrop requirements.

With the imminent launch of DeBank, a new round of interactive airdrops will begin. Odaily will also be the first to report on the release of future airdrop details and results.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Exclusive|Interpreting the draft guidance principles of Taiwan’s Financial Supervisory Commission Can’t use the slogan To The Moon anymore?

- Depth Latest analysis of asset risk assessment for stablecoin TrueUSD (TUSD)

- Analyzing the Unique Aspects of Puffer Finance’s Design from the Perspective of Node Validation Rights

- In-depth Analysis of Base Standing on the shoulders of giants, emerging in the fiercely competitive Layer2 race.

- How can Base chain without tokens start Onchain Summer?

- Interpreting US Cryptocurrency Taxes General Taxation, Cryptocurrency Taxation, and Future Development Trends

- Outlier Ventures What pain points does the Web3 marketing model solve?