Survey of Blockchain Application of Electronic Bills

Overview

This article will start from the electronic bill industry and analyze the electronic bill and blockchain electronic bill industries as a whole in order to improve the industry map.

Report

Chapter I Overview of the Electronic Bill Industry

1.1 Overview of the Electronic Bill Industry

1.1.1 Definition of electronic bill

The core idea of electronic bills is to digitize physical bills. Electronic bills can be transferred, discounted, pledged, and collected like physical bills. The process of each bill business in the traditional bill business has not changed, except that each link is loaded with electronic processing methods, which has fundamentally changed the means and objects of our business operations. Electronic bills refer to the functions of paper bills on payment, use, settlement and financing, use digital networks to transfer money from one account to another, and use electronic pulses instead of paper to transfer and store funds. It is based on computers and modern communication technology networks, stores funds information in computer systems in the form of data messages, and implements the functions of traditional paper-based notes through the Internet in the form of invisible and inaccessible electronic information transmission. The so-called "data message" is the information generated, sent, received or stored by electronic, optical or similar methods, including but not limited to electronic data interchange (EDI), email, telegram, telex or fax.

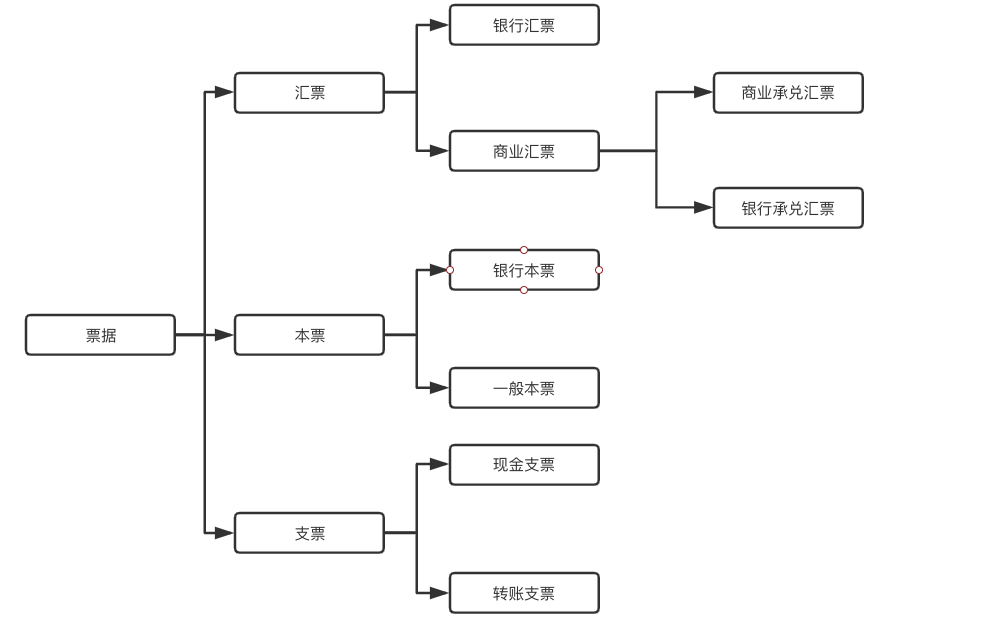

Classification of notes

- Annual Observation | Who can rule the blockchain?

- UN Secretary-General: we must embrace blockchain technology to better fulfill our mission in the digital age

- Ant Blockchain Darkness Chen Cang Has Initially Constructed a Global Network for Cross-Border Payments

Source: Standard Consensus

Source: Standard Consensus

There are two types of electronic commercial bills: 1 for bank acceptance bills and 2 for commercial acceptance bills.

Bank acceptance bill

Source: Internet public information

Source: Internet public information

A banker's acceptance bill is a bill issued by a depositor who has opened a deposit account with an accepting bank, which is applied to the account-opening bank and approved by the bank's review, guaranteeing that the specified amount is paid unconditionally to the payee or bearer on a specified date. Acceptance of a commercial bill of exchange issued by the drawer is the credit support given by the bank based on the recognition of the credit of the drawer.

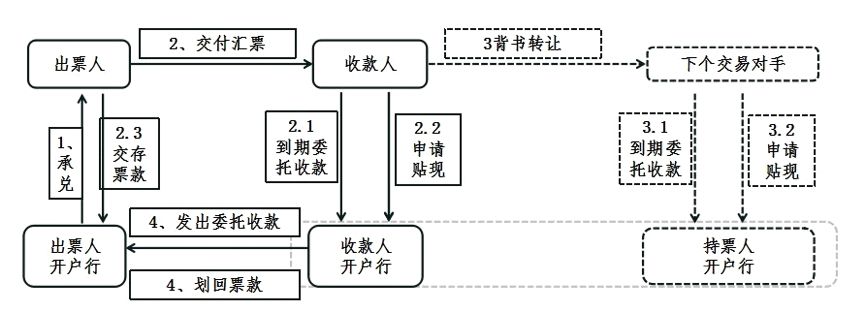

Bank acceptance bill discount process

Source: Internet public information

Source: Internet public information

trade acceptance draft

Source: Internet public information

Source: Internet public information

A commercial acceptance bill is a bill accepted by a payer other than a bank. Commercial acceptance bills can be issued and accepted by the payer, or they can be issued by the payee and accepted by the payer. The issuer of a commercial acceptance bill is a legal person or other organization that opens a deposit account with a bank. It has a real entrusted payment relationship with the payer and a reliable source of funds for paying the amount of the bill.

Commercial bill discount process

Source: Internet public information

Source: Internet public information

1. 1.2 Features and Value of Electronic Bills

The electronic bill has the following advantages:

(1) The extension of the period is conducive to short-term financing of enterprises

The term of use of electronic commercial bills is extended, and the payment term is up to one year from the date of issue, which is half a year longer than the term of paper bills. The cost of delivery and storage has been greatly reduced, and the efficiency of bill payment and settlement has been greatly improved. At the same time, the operating costs of Zijin Financial will also be significantly reduced. These advantages are conducive to the short-term financing of enterprises. In addition, commercial bills have been converted from paper to electronic, providing corporate customers with convenient and efficient payment and financing tools. Electronic business bills are accessed through online corporate banking, which is not limited by time and space in the use process, which simplifies procedures and reduces links. The transaction time is greatly shortened. Compared with other payment instruments and financing methods, the efficiency is greatly improved.

(2) The wide circulation range helps to form a unified national bill market

The electronic commercial money order system can also provide a complete electronic commercial money order service for corporate customers. From the perspective of business scope, electronic commercial bills "cover" all the functions of traditional paper-based bills. From the perspective of business processes, electronic commercial bills start from the issuance and acceptance to endorsement circulation, and finally to the income account. Operation has greatly reduced the operational risk of the bill business. Electronic commercial bills have a wide range of circulation, can be circulated nationwide, and are not restricted by regions. They help to form a unified bill market, promote the connection and development of financial markets, and facilitate fast and convenient transactions. The transaction of paper commercial bills requires the buyers and sellers to meet face-to-face after the meeting, which is long, costly and inefficient. After the implementation of electronic bills, enterprises, banks and other organizations can use computer networks to complete the various procedures of bill circulation, such as issuance, acceptance, endorsement, discounting, pledge, guarantee, redemption, and recourse, through the electronic commercial bill of exchange system. It can complete the circulation of the bills across the country and the world, and handle various bills business in real time, quickly and economically, greatly simplifying the transaction process and improving transaction efficiency.

(3) The electronic commercial bill of exchange medium is electronic, eliminating the risk of counterfeit and "clone" tickets

The electronic commercial bill of exchange medium is electronic, which greatly improves the security, can eliminate fake tickets and "clone" tickets, and can avoid the risk of loss and damage. E-tickets are not easily lost, damaged, and robbed. The electronic commercial money order system on the mature online banking platforms of various commercial banks uses a strict digital certificate system for encryption, and multiple protection methods are added to ensure the safety of electronic commercial money order use. That is to say, electronic bills are stored in the system, and their uniqueness, integrity, and security can be guaranteed through a reliable security authentication mechanism, which reduces the risk of paper bills. People can easily discern the authenticity of the bills, and they are not vulnerable to frauds such as counterfeit and "clone" tickets. In the current paper bills, the bill itself and the written seal are the means to identify authenticity. Although many anti-counterfeiting measures have been applied in the paper and printing process of bills, it is still very difficult to discern the authenticity by human eyes alone. Some criminals use forged and altered bill certificates and signatures to defraud banks and customers. Cases of funding occur from time to time. After the implementation of electronic tickets, the use of securely authenticated electronic data streams and reliable electronic signatures can suppress counterfeit and "cloned" ticket crimes.

(4) Electronic commercial bills can also meet the needs of group customers' bill pool management

Group companies with a high level of centralized management of funds urgently need to implement centralized management of bills. Prior to the introduction of electronic commercial bills of exchange, due to various factors such as cost, efficiency, and risk, centralized management of bills was difficult. The introduction of electronic commercial bills makes centralized management of bills simple. Enterprises manage electronic information of bills without physical transfer, which reduces costs, improves efficiency, and controls risks.

1.2 Basic Theory of Electronic Bill Mode

1.2.1 Basic framework

In recent years, with the continuous improvement of China's financial electronic level and the improvement of its financial infrastructure, bank drafts, cashier's checks and checks have been electronically implemented to varying degrees in terms of bank bill business, which has greatly improved security and efficiency. . The establishment of the national check image exchange system in 2007 realized the partial electronic processing of paper checks; in 2008, the business of banker's checks and bank drafts in three provinces and one city in East China was cleared through a small-value payment system, which realized electronic processing. However, relatively speaking, the electronic pace of commercial bills is relatively lagging behind, and its business processes basically use traditional manual and paper methods, with low efficiency and high risks, which is not conducive to the further development of commercial bills. Beginning in 2005, although some domestic commercial banks have actively explored and tried electronic bills and electronic bill applications, due to the lack of a unified centralized registration mechanism for bills and a cross-bank transaction platform, business development has been greatly restricted.

In order to further promote the development of domestic bill business and bill market, facilitate corporate payment and financing, and support commercial bank bill business innovation, on the basis of full research and demonstration, the People's Bank of China decided to organize the construction of an electronic commercial bill of exchange system in January 2008. The project was formally established and put into operation on October 28, 2009. Judging from the ECDS commissioning practice, the electronic bill business processing model has limited the circulation of electronic bills. The entire process of electronic bill business must be completed by three independent and interconnected electronic systems, namely the electronic service platform ECDS of the interbank bill market, the online banking system of financial institutions, and the electronic management system of internal bill business of financial institutions.

The electronic commercial bill of exchange system consists of a core functional module, namely the electronic commercial bill of exchange business processing, two auxiliary function modules of a paper commercial bill of exchange registration inquiry system, and a commercial bill of exchange discounted public quotation.

The electronic business draft business processing function module is the core module of the electronic business draft system. Through this module, centralized registration and storage of electronic business drafts issued by customers of various banks can be implemented, and an interconnected circulation and transfer platform is provided to realize the electronic business draft issuing and acceptance. , Endorsement, guarantee, prompt payment, recourse and other business processes. At the same time, it is connected to the in-house system of banks, financial companies and the modern payment system of the People's Bank of China, which can realize the financing transactions such as electronic commercial bills discounting, rediscounting, rediscounting, and instant transfer settlement of prompt payment. Ticket Pay (DVP).

The paper business draft registration and inquiry function module is a module that system participants must participate in. It can provide registration and inquiry services for paper bills acceptance, discounting, rediscounting, rediscounting, pledge, pledge release, loss and stop payment, etc. Realize the centralized registration and storage of the face information of paper commercial bills, and facilitate the inquiry of the discount and pledge business of paper commercial bills.

In the specific process of the financial institution's electronic bill business from acceptance, discounting, rediscounting and fund transfer, two basic conditions are required: first, the internal billing system and ECDS data docking; and second, the financial institution must be able to provide Corporate customers set up online banking and corporate customers are willing to accept corporate online banking business. After the above basic conditions are met, the "corporate online banking + ECDS" electronic bill business processing model has basically been established. This model has affected the liquidity and scope of business of electronic bills.

Chapter II Analysis of the Development of the Electronic Bill Industry

2.1 Analysis of Development Status of Foreign Electronic Bill Industry

2.1.1 Development Process of Foreign Electronic Bill Industry

Although electronic payment and the flow of funds are becoming more and more popular in China, the development and promotion of electronic payment is still in its infancy worldwide. The global market size for small retailers paying by check and cash is $ 19 trillion, while electronic payments are only $ 15 trillion. In France, the total value of electronic checks in a single country accounted for 71% of all checks in the European Union in 2013. This check is usually used for business-to-person (B2P) payments and electronic funds transfers, as payment records are easier to store and bulk payments are easier Safety applies to a large number of employees. However, the addition of other European economies larger than France also accounted for only the remaining 29%, which shows that the popularity of electronic payment is low.

On the other hand, personal-to-business (P2B) payments are mainly made through electronic payment methods, because consumers believe that personal-to-business (P2B) payments are more secure than paper payments, avoid carrying cash and faster; however, because With no set requirements and percentage fees, checks are financially beneficial for some businesses.

With the birth of alternative payment systems such as wire transfer, ACH, PayPal, and Apple / Samsung / Android Pay, electronic receipts have begun to lose their unique appeal. Vikram Pandit, former CEO of Citigroup, said that as business habits in the field are still based on paper, the latest advances in the field have not yet realized their potential, although the field has been partially automated and electronic . The negotiable instruments law is based on the abstract rights embodied on paper. It is actually delivered to transfer rights. Therefore, paper bills, especially paper checks, are more popular in the United States.

Regulatory environment

According to Article 3 of the Uniform Commercial Code and EU Directive 2014/65 / EU and EU 600/2014, the negotiable instruments law is still affected by concepts such as liquidity in the 19th century. Modernizing the regulatory environment is also not an easy task. For example, the U.S. banking system is highly fragmented, with more than 10,000 deposit institutions and thousands of different banks, some of which may be reluctant to invest or adapt to modernization, while the Federal Reserve does not have the regulatory authority to require changes to negotiable instruments.

Although the banking industry agrees that total electronicization is necessary, even a small number of banks that are not prepared to receive electronic documents have prevented the transition to electronic processing of the transactions initiated by negotiable instruments. At the same time, as more and more banks are willing to engage in this business, the urgency of developing a unified set of rules to manage e-check exchange infrastructure will become increasingly high.

The combination of the regulatory issues of the negotiable instruments law and various alternative payment systems undermines the entire legislative environment of the payment system. The increase in the number of non-bank payment intermediaries, coupled with the imbalanced supervision of payment intermediaries in the allocation of risks during the processing of payments, may bring unacceptable systemic risks to the soundness and reliability of various payment mechanisms . Different jurisdictions take different approaches to regulation; for example, U.S. history is market-driven and supports competition between public and private solutions to determine the development of different payment systems and subsequent legal responses.

Financial environment

Data on payments made using the most common negotiable instrument checks show that payments in different jurisdictions have declined significantly. In the United States, total commercial checks paid fell by 3.1% per year from 2012 to 2015 to $ 17.9 billion. In contrast, automatic clearing house (ACH) network payments increased by 4.9% to 19.3 billion, while credit card payments increased by 7.5% to 103.5 billion.

The US market uses checks far more than the rest of the world-more than half of business-to-business payments are still made by check. However, 51% of respondents to the Bank of America's 2017 Consumer Mobility Report found that the process of paying by check was painful, while 38% were upset by delayed or never-dated checks. Americans make an average of 38 checks a year, compared to 18 in Canada, 8 in the UK, and almost zero in Germany. In more extreme cases, Finland stopped issuing checks in 1993, the Netherlands stopped issuing checks in 2002, and Denmark stopped issuing checks in 2017.

In the banking industry, negotiable instruments depend on their structural and legal reforms. Currently, different “value-transfer system” alternatives exist, such as the electronic clearing house (ACH) network and wire transfers in the electronic ecosystem. A 2014 Fed study found that "at least 29 billion transactions, or 12% of total U.S. payments each year, can benefit from faster authorization, clearing, and settlement processes"; meaning that in addition to negotiable instruments, the current entire Payment systems all need structural improvements.

2.3 Analysis of the Development of China's Electronic Bill Industry

2.3.1 Development History of China's Electronic Bill Industry

On May 10, 1995, the Eighth Standing Committee of the National People's Congress, the highest legislative organ of the People's Republic of China, promulgated the "Law of the People's Republic of China on Bills." The Circulation Note Law, which entered into force on January 1, 1996, consists of seven chapters, covering general provisions, drafts, promissory notes, checks, applicability of the law to foreign circulation notes, legal liabilities, and supplementary provisions. Chapter II (Draft) contains detailed provisions on endorsement, acceptance, guarantee, payment and recourse. Subsequent sections discuss various types of negotiable instruments, such as checks, promissory notes, and foreign instruments, and use these provisions as a reference. Although the negotiable instruments law constitutes a comprehensive financial regulation, it may be more important to its unresolved issues than it is to resolve.

Without a clear explanation, the Circulation Note Law is actually a banking regulation, and one of the regulations issued at about the same time. It involves a series of transactions or activities involving the use of negotiable instruments, but they are mainly transactions in which banks participate, such as negotiating bills of exchange, although not necessarily (but often often) involving banks, cashier's checks and checks. The Circulation Note Law does not involve the use of promissory notes by private parties. It is in this regard that the "Circulation Instruments Law" best illustrates the Chinese government's understanding of the role that circulation instruments should play in the economy, and may be a general way of conducting economic activities. Resolving certain outstanding issues related to the Bills Act (if such issues are to be resolved) depends on the elaboration of detailed implementation regulations or clarification through practice or judicial interpretation.

The decision to address the use of negotiable instruments in a limited way reflects a tension in the Chinese government's current reform approach: to what extent should the country control economic activity? Should laws be adopted to promote individual economic activities and opportunities, or to promote national control over the process of economic growth?

The limited scope of the Circulation Bill Law indicates that the State Council insists that it is advisable for the state to further control economic development, and the circulation bill is actually a "tool" for the state to participate in and monitor the economy. Accordingly, the passage of the current form of the Circulation Note Law may reflect the government's unwillingness to promulgate laws to recognize or facilitate the creation of "money" by private individuals through the use of promissory notes.

However, the emergence of electronic commercial bills has made the bill business into a rapid development track. The opening of the Shanghai Stock Exchange at the end of 2016 marked the further prosperity of China's bill market. Under the guidance of "focusing on economic development", the nation's bill exchange market system has become increasingly mature.

In January 2008, the People's Bank of China made a decision to establish an electronic commercial bill of exchange system (ECDS) and promote the electronic commercial bill of exchange business. On October 28, 2009, the People's Bank of China completed the ECDS and went online for trial operation. ECDS is established on the basis of network and computer technology. It receives, stores, and sends electronic commercial draft data messages, and provides a business processing platform for electronic commercial draft currency payment, fund settlement and other related services. As of the end of 2016, the ECDS system was operating stably and the business was operating normally. The transaction amount of the main types of electronic bill business showed a wave growth trend.

From the perspective of the development of China's commercial bills in the past eight years from 2009 to 2016, it can be basically divided into two stages: the first stage is from 2009 to 2012, and commercial bills show explosive growth in both the number of settlements and the settlement amount. At the end of 2012, the number of commercial bills cleared in China increased from 8.215 million at the end of 2009 to 15.533 million, an increase of 1.89 times; the settlement amount increased from 9.62 trillion yuan to 16.06 trillion yuan, an increase of 1.67 times. The second stage is from 2013 to 2016. Commercial bills developed in a wavy manner. The increase in the number of settlements and the amount of settlements remained relatively stable after crossing a small hill. The number of settlements increased from 16,306,700 in 2013 to a peak of 19.0571 million in 2015, and recovered to 16.5645 million at the end of 2016; the settlement amount also showed the same development trend, increasing from 18.24 trillion yuan at the end of 2013 After 20.99 trillion yuan at the end of 2015, it fell back to 18.95 trillion yuan at the end of 2016.

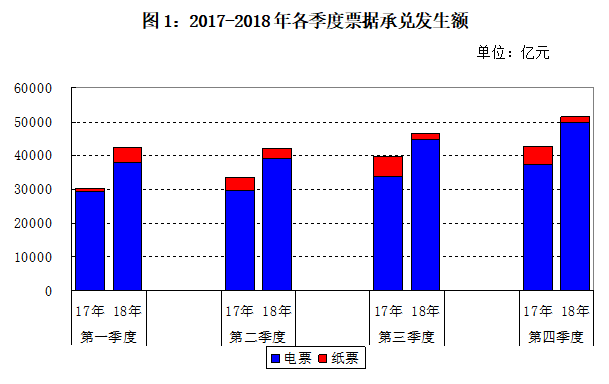

Different from the staged development of commercial bills of exchange, electronic commercial bills show a strong development trend and have maintained rapid growth. The amount of electronic commercial drafts has increased significantly in terms of both the amount of drafts and acceptances, and the proportion of electronic commercial bills has become higher and higher. In the first half of 2016 alone, the proportion of the acceptance amount and transaction amount (discount-discount) of electronic commercial bills accounted for 41% and 52% of the total bill acceptance and transaction amount, of which the transaction amount had exceeded half. Just two years later, in 2018, the total amount of electronic ticket acceptances reached 17.19 trillion yuan, accounting for 94.09%. The proportion of electric tickets has risen sharply.

Source: Commercial Ticket Circle

Source: Commercial Ticket Circle

2.3.2 Overview of the development of China's electronic bill industry

According to the survey by commercial banks, the paper bill business in 2017 showed a significant downward trend. In the whole year, commercial banks accepted paper commercial bills of 1.69 trillion yuan, a significant decrease of 69.23% year-on-year. , A year-on-year decrease of 89.68%; the balance of paper discounts at the end of the year was 86.419 billion yuan, a year-on-year decrease of 83.68%. At the same time, the acceptance balance of e-tickets has steadily increased quarterly, and the function of e-ticket settlement has been enhanced. In 2018, the amount of commercial bill acceptances was 18.27 trillion yuan, an increase of 3.63 trillion yuan or 24.84% over the previous year; the year-end acceptance balance was 11.96 trillion yuan, an increase of 2.18 trillion yuan or 22.25% over the beginning of the year. Among them, the annual electric ticket acceptance amount was 17.19 trillion yuan, accounting for 94.09%; the paper ticket acceptance amount was 1.08 trillion yuan, accounting for 5.91%.

While the electronic bill business is developing at a high speed, it is also facing some problems arising from the development.

1. The electronic bill business must rely on the corporate online banking and internal electronic bill systems developed by each institution. When an electronic bill accepted or discounted by one institution is discounted or re-discounted to other institutions, it may be due to The inconsistencies in the development and design modes and operation and use processes of online banking or internal electronic bill systems of various financial institutions have caused electronic bills to circulate among the same industry, and sometimes failures due to technical problems may affect transaction efficiency and willingness.

2. In the development model of corporate online banking electronic bill business, small and medium-sized financial institutions lag behind in the development and construction of corporate online banking systems due to their limited scientific and technological strength and limited resources, especially in rural financial institutions and financial institutions in economically underdeveloped areas. There is a gap between the development of bill business and large and medium-sized commercial banks and developed regions.

3. A considerable proportion of small and medium-sized enterprises have not yet conducted online banking at commercial banks. At the same time, enterprises in some industries have low levels of acceptance and familiarity with corporate online banking and electronic bills, and they must gradually understand and accept new types of business.

Chapter III Analysis of Blockchain Electronic Bill Market

3.1 History of Blockchain Electronic Bills

In recent years, the proportion of electronic bills in transactions has gradually increased. This shows that China attaches great importance to the development of electronic bills, and also shows the important status of electronic bills in economic life. Blockchain has a wide application space in the financial field, and the application of digital bills can become a breakthrough for its application in the financial field.

Zheshang Bank Blockchain Mobile Digital Money Order

On January 3, 2017, Zheshang Bank's mobile digital money order product based on blockchain technology was officially launched and the first transaction was completed, marking the true application of blockchain technology in the bank's core business. Zheshang Bank successfully established a mobile digital money order platform based on blockchain technology in December 2016.It can provide customers with the functions of issuing, signing, transferring, trading, and redeeming mobile digital money orders on mobile clients. Achieve open and secure bookkeeping.

Different from traditional paper and electronic bills of exchange, mobile bills will be stored and traded in the form of digital assets through the use of blockchain technology. They will be circulated within the blockchain system and will not be easily lost or tampered with stronger security and security. Non-repudiation. In addition, paper bills are electronicized to solve problems such as anti-counterfeiting, circulation and loss.

Ganzhou Bank launches blockchain ticketing business

On March 15, 2017, the nation's first single ticket chain business was launched at the Bank of Ganzhou, and the national monitoring operation management center of the ticket chain officially settled in Ganzhou. The ticket chain based on blockchain and internet technology is a new type of bill financing product. Shenzhen Blockchain Financial Services Co., Ltd. provides low-cost, fast and secure financing services based on bank acceptance bills held by customers to meet small, medium and micro The financing needs of corporate customers. The country's first single ticket chain business was jointly issued by Blockchain Financial Services and Ganzhou Bank, and the two sides jointly established a ticket chain national monitoring operation management center.

Digital Bill Trading Platform of Shanghai Stock Exchange

On January 25, 2018, the Shanghai Stock Exchange was successfully launched and the digital bill trading platform was commissioned. Industrial and Commercial Bank of China, Bank of China, SPD Bank and Bank of Hangzhou successfully completed the issuance, acceptance, discounting and rediscounting of digital bills based on blockchain technology on digital bill trading platforms.

The experimental production system of the digital bill trading platform combines the blockchain technology and the actual situation of the bill business to build a settlement method of "on-chain confirmation and offline settlement", which prepares for the connection with the payment system and explores the block The possibility that the chain system and the centralized system jointly connect applications. According to the real business requirements of the bill, a business process consistent with the bill trading system was established, and the data statistics, system parameters and other contents were consistent with the current management rules, which laid the foundation for the further expansion of the experimental production system business functions. And further strengthened the security protection, using the SM2 encryption signature algorithm for digital signature of the blockchain. Cryptographic equipment, including high-security level encryption machines and smart cards, were customized for participating banks and enterprises respectively, and software encryption modules were provided to improve development efficiency.

People's Bank of China Blockchain Checking System

On June 7, 2018, the People's Bank of China completed the work of a blockchain-based system that can digitize checks from domestic companies.

3.2 Technical Analysis of Blockchain Electronic Bills

Technology compatibility

On the blockchain, a negotiable instrument is a special contract with standardized terms and unique properties of liquidity, which can achieve standardization and portability in a digital environment. The future blockchain electronic bill platform (we can call it Circulation Bill 2.0) is a legal contract that is formed electronically, digitally signed and enforced by the smart contract process. The establishment of digital substitutes for all functions related to negotiable instruments requires description of each function and the functional equivalent or superiority of each alternative.

3.2.1 Creation of negotiable instruments

The negotiable instrument contains the following information: an unconditional payment slip, a digital signature of the manufacturer or drawer, the name of the drawee, and a description of the time of payment on request or on a specified date. Because paper circulation notes only fill in this information on standardized templates, circulation notes 2.0 will become electronic templates on which users can determine the amount, recipient's pseudonym and payment time. Thanks to the smart contract function, compared with traditional negotiable instruments, the payment time can be determined more flexibly. This function can detect real-life information in a timely manner through a smart oracle. Therefore, any predetermined time period can be set as the payment time.

3.2.2 Verification of negotiable instruments

Currently, banks act as providers of payment systems and are responsible for clearing and settlement of payments. Eliminating transaction intermediaries is a key feature of the blockchain; however, as mentioned earlier, validating transactions and recording them in the blockchain requires a sophisticated consensus algorithm that is both resistant to 51% attacks, efficient and relatively dispersion. Finding a suitable algorithm is challenging because most of the newer and possibly better algorithms are not challenged in terms of security. Therefore, conservative, generally accepted algorithms should be preferred.

On the other hand, the most popular consensus algorithms, POW and POS, have both been validated, and the above issues involve their efficiency and security. Semada is currently a suitable model on which to verify the transfer of negotiable instruments with certain modifications. Semada's design philosophy is based on reputation and inspires production collaboration by "connecting the reputation of experts with their proof of competence and production contributions (verified through a verification pool generated by public expense sent to the system). The system consists of reputation sub-tokens and expert workbenches that use their sub-tokens to answer verification requests in the verification pool, which is a mechanism for creating and distributing reputation.

The Semada infrastructure provides different expertise outside the network by publishing evidence of works outside the network to the verification pool, and other experts can decide whether to approve the integrity and authenticity of the work. However, the only required expertise for negotiable instruments is simpler than any other cryptocurrency (creating a block trade consisting of transactions). Therefore, the actual process will deviate from Semada's white paper. Although Semada's original model has more development experience, which provides an opportunity to accommodate expertise outside the network, the only expertise for Circulation Notes 2.0 is efficient, automated, and technically sound transaction verification by experts . Competition between experts (banks) in terms of reputation and fees will motivate them to reduce fees while still ensuring a sound automated transaction verification process. The key element of the authorizer consensus mechanism is the reputation of the guarantor, which is particularly compatible with the proposal, because for the banking industry, the proposal is mainly intangible and service-based, so the ability to provide quality services is from the perspective of the customer Is valuable, which turns into a competitive advantage.

The process begins with the endorser of the negotiable instruments, selecting experts based on their reputation and quotation. Here, multiple options can be provided in a simple user interface. These can include the lowest cost, highest reputation, or both. Pre-existing options can also facilitate this stage of automation, as the user can pre-determine his preferences for all transactions. Semada's white paper states that since Semada is built on the Ethereum blockchain, fees should be in Ethereum, but in this model, the legal currency on-chain is predictable (such as DCEP); therefore, it is calculated in fiat currency The fees should be distributed among all experts, weighted by the expertise tokens they hold.

In the second stage, the system casts a new reputation token with a preset conversion rate, and bets the cost and half of the shares in the name of the selected expert, thereby improving the accuracy of the work. The other half was bet on the experts without allocation. After the experts release proof of work, a verification pool is created and all experts use their reputation tokens to approve or disapprove work. In the most effective cases, one can envision the automation of this verification process and algorithmically select the correct vote. The winner of this process allocates the loser's share weight based on the expertise tokens they hold and votes in favor of the winning connection. If the release is approved, the previously unassigned minted reputation tokens will also be distributed among approvers, and in the case of unapproved, these tokens will be destroyed.

Semada's unique reputation-based consensus algorithm has multiple advantages: the cost-competitive element that attracts users ensures lower fees, invests half of the newly minted reputation tokens for selected experts, and further motivates all experts to reduce their fees. Significantly increase the number of its reputation tokens, which will lead to a higher percentage of fees obtained through the split. On the other hand, competition is limited to verifying costs, because it is not economically feasible, and from a competition law perspective, it is clearly predatory to provide a cost below cost.

Semada's algorithm can also resist Sybil and most attacks. Sybil attacks include obtaining multiple expert accounts to unfairly profit from the system; however, because Semada's model is weighted according to reputation, the number of reputation tokens determines only the power: an account with 1,000 reputation tokens has the same power as owning one The 1000 accounts of the token have the same or even more power. Another threat, most tyranny, describes corruption in the system. "The system showed its willingness to make decisions, and the decision focused more on following what was considered popular rather than what was right and right."

One solution in the Semada model is to use a weighted voting system in which people with higher reputations get more power, and popular decisions are also the right choice because powerful experts have the right decisions And enjoy a reputation for precedent and predictability. Since betting on reputation tokens is one of the basic motivations in the Semada model, we thought of the "nothing" problem of traditional bet proof algorithms. Although Semada encourages experts to take action through the validation pool in the interests of the system. As the winner divides the loser in the lost reputation token into parts, the process prevents experts from making corrupt attempts, which will ultimately lead to low reputation and unattractive users.

3.2.3 Blockchain governance

Validating transactions is just one aspect of blockchain governance. In fact, the "platform provider" needs to build the network itself by establishing an infrastructure and a set of rules. The first example of a blockchain application is a platform provider. These platform providers are individual groups of informal organizations, although today many fintech startups and even banks risk building blockchain networks. As a platform provider, as the designer of the entire system (including security measures) and the only suitable entry point for network-wide regulations and legal rules, it will bear great responsibility.

The platform provider must maintain a complete and continuous software platform and must enforce requirements for integrity, security, continuity of service availability, and any similar rules that need to be implemented centrally. In addition, although software flashing and reporting mechanisms are required to prevent any flash crashes, to ensure system stability, ex ante regulatory measures are essential to avoid any vulnerabilities or vulnerabilities. In order to achieve system stability, precautions must be taken at the expense of the irreversibility of the blockchain before any incorrect results produced by the wrong code are achieved or reversed, as is the case with Ethereum.

For the above reasons, the blockchain platform provider should be a legal person regulated by the state. In contrast, the check payment system provider is the bank, whether it is the payer or the depositary. As providers, they should bear the risk of any systematic loss other than the user's ability, thereby incentivizing them to adopt an appropriate but cost-effective level of security. At the same time, the platform provider of negotiable instruments 2.0 should be a bank, and the above-mentioned experts that affect the ability of the verification system are based on reputation. When a node is an entity or individual that is not regulated by a financial institution (in the case of negotiable instruments 2.0), the only entity that can apply relevant regulations and legal rules to the network and its nodes is the platform provider, as the recipient of these rules, It should be a fully regulated financial institution, such as a bank, and control the network through network software programming and access control. Although this will destroy the decentralized characteristics of the blockchain, accounts are controlled only by their respective nodes / users, which will be a challenge to the existing central database model. At the same time, technically, complex centralized risk management processes can be programmed to eliminate the possibility of threats to the assets recorded by users in the network required by any financial market, and enter it into the blockchain network as a smart contract in.

3.2.4 Endorsement

In blank endorsements, negotiability can be partially limited by determining how the instrument can be used. The smart contract function of the blockchain may help to establish this function. Unlike other payment systems, the circulation tools have unique value, which can enforce specific required functions and display proof. A blank endorsement requires only the holder's signature; the holder of the instrument holding the blank note is provided with sufficient capacity to transfer or cash. The signature information can be found in blockchain-based circulation tools, which also allows controllers to gain full capabilities on electronic records. It is essential that the requirement to have only blankly recognized instruments without defining the identity of the next holder makes paper documents vulnerable to intellectual property infringement. In addition, considering that the digital infrastructure of the blockchain is incompatible and lacks the identity of the assignee, the blank bill recognition system may not be included in "Circulation Notes 2.0".

On the other hand, its function is applicable to other types of endorsements because it provides a unique opportunity to technically limit the potential use of negotiable instruments. Full recognition that the next holder can be identified is compatible with the blockchain infrastructure and protects digital access from any external intervention. Similarly, qualified endorsements are compatible, and the endorser's liability needs to be limited in the event of payment failure. This limitation of liability is best coded in smart contracts that can circulate instruments. By verifying the digital signature of the transaction, you can verify previous approvals and make recommendations if necessary; it means that through this blockchain receipt, the evidence requirements for each particular endorsement are met.

One of the main principles of the traditional negotiable instruments is the legitimate bearer. A legitimate bearer is also called a good faith bearer. The consideration was paid in good faith for the entire amount, and the holder of a note that had apparently completed all the formalities and had not expired and was not refused was obtained. No defects were found in his predecessor's rights. Even if it is later discovered that the bill was obtained by improper means, the rights of the legitimate holder will not be affected. In addition, all notes obtained from a legitimate holder can enjoy the rights of the former holder as a legitimate holder even if the consideration (such as a gift) has not been paid. From a traditional policy point of view, the purpose of the holder to make rules at the appropriate time is to encourage the transaction of negotiable instruments through deprivation of defense, for example, the manufacturer refuses to pay for legal reasons or the third party claims ownership.

3.2.5 Smart Contract

Smart contract functions can enforce specific required functions and display proof. For negotiable instruments 2.0, the functional implementation is the responsibility of the endorser, and the method for determining negotiable instruments can be used, which are standardized implementations. Considering the fact that the costs of standard management contracts form, overall standardization within a transferable instrument is critical, and it is also important to facilitate the application of smart contracts. Conceptually, smart contracts are currently insecure and inefficient to some extent.

Smart contract properties bring higher technical and financial costs, as these contracts cannot be modified once they are executed, so they must be accurately written with fully defined code; and support for anonymous and one-time transactions. The unmodifiable feature comes from the decentralization and distribution of smart contract terms to each node in the blockchain, which means that the transaction relationships created by smart contracts must be fully formed and defined, which is in a changing and uncertain environment for contract processes It may not be possible.

Even if this is not the case, high technical and financial ex ante costs can still result from drafting and negotiating precise terms. Contracting parties will have to allocate greater resources to cope with greater uncertainty to predict future world conditions and set these forecasts in smart contracts, which may prevent parties from using smart contracts in the first place. However, the smart contract functions in Circulation Notes 2.0 have been fully standardized and relatively simple. This means that unmodifiability is an advantage, it eliminates the possibility of using a chain of responsibility or predetermined means and reducing financial and technical costs. Inflexible enforcement of smart contracts prevents parties from avoiding litigation and informally resolves contract disputes in order to strengthen business relationships and limit any opportunistic behavior. In contrast, the nature of negotiable instrument transactions is entirely financially driven, and the immutable implementation of smart contract terms is in the interest of contracting parties.

Conclusion

Through the Semada platform, this article provides the idea of creating a negotiable instrument platform in the second half. Investigating its fundamentals, the most important thing for bill demand is a transparent, fair and predictable system to promote certainty of results, security and efficiency. Based on the above design requirements, in the negotiable instruments industry, Semada-like platforms may be a future development direction.

risk warning:

- Beware of illegal financial activities under the banner of blockchain and new technologies. The standard consensus resolutely resists illegal activities such as illegal fundraising, online pyramid schemes, ICOs, various variants, and dissemination of bad information.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Blockchain 2.0, accelerate the integration of supervision and technology finance?

- Chinese version of fintech "supervision sandbox" debuts in Beijing, head of the central bank's business management department: will not be included in virtual currency and other institutions

- How is the development of Ethereum 2.0? Take a look at the latest progress

- Libra Association Vice-Chairman: Planned for European regulatory approval next year

- One article takes you to understand the current status of the DAPP market

- The growth mode of capitalism destroys the ecological environment? Talking about the circular economy under the blockchain

- How does the Interplanetary File System (IPFS) decentralize the network?