One article explains the reasons and subsequent effects of changing the consensus mechanism of Ethereum 2.0

Written by: Hao Kai, HashKey Capital Research

Review: Zou Chuanwei, Chief Economist of Wanxiang Blockchain, PlatON

Source: Chain News

The consensus mechanism of Ethereum 2.0 will change from PoW to PoS, which is an important change. In order to better understand this major change, we have written this article, hoping to explain to readers the reasons why Ethereum 2.0 changed the consensus mechanism with simple predictions, and analyze the requirements and restrictions for Ethereum 2.0 to participate in Staking. In addition, we also analyzed the impact of Ethereum 2.0 on the participants in the ecosystem after changing the consensus mechanism, and the possible changes in regulatory policies that may follow.

- Ethereum gas usage reaches a new high in one year, helping the currency price continue to rise

- Bank of England economist: Bitcoin's "digital gold" effect puts it in the embarrassment of "Article 22 military regulations"

- Bank for International Settlements: CBDC is on the road and 1.6 billion people will use it in the next three years

We believe that Ethereum 2.0 is an important stage in the development of Ethereum. In the long run, changing the consensus mechanism of Ethereum 2.0 is beneficial to the development of Ethereum.

According to the development roadmap of Ethereum, Ethereum is expected to undergo three phases: Frontier (frontier, July 2015), Homestead (homeland, March 2016), and Metropolis (metropolis, October 2017). Enter the Serenity phase in 2020, upgrading to Ethereum 2.0. There are many improvements in Ethereum 2.0, including:

- Consensus mechanism changed from PoW to PoS;

- The overall architecture has changed from a single chain to shard chains;

- The execution environment will be replaced by eWASM.

In the following, let us study the reasons and effects of the changes in the Ethereum 2.0 consensus mechanism.

Why Ethereum 2.0 changed the consensus mechanism

Ethereum is a global open-source public chain platform. Its purpose is to become a "world computer". In order to achieve this goal, the improvements and upgrades of Ethereum must move in the direction of becoming a more suitable public chain platform for building and running DApps. Ethereum 2.0's consensus mechanism was changed from PoW to PoS, which can better balance the "impossible triangle" problem, and try to balance the three elements of decentralization, scalability, and security as much as possible.

Decentralized

Decentralization is one of the core characteristics of the blockchain. Initially, Bitcoin designed by Satoshi Nakamoto was a completely decentralized peer-to-peer system, and each user could use a personal computer for mining. However, as the price of Bitcoin rises, a large amount of computing power continues to be added, making Bitcoin mining more and more difficult. At present, most of the computing power of Bitcoin's entire network is controlled by several head mining pools. The only way for ordinary users to participate in mining is to choose to join the mining pool.

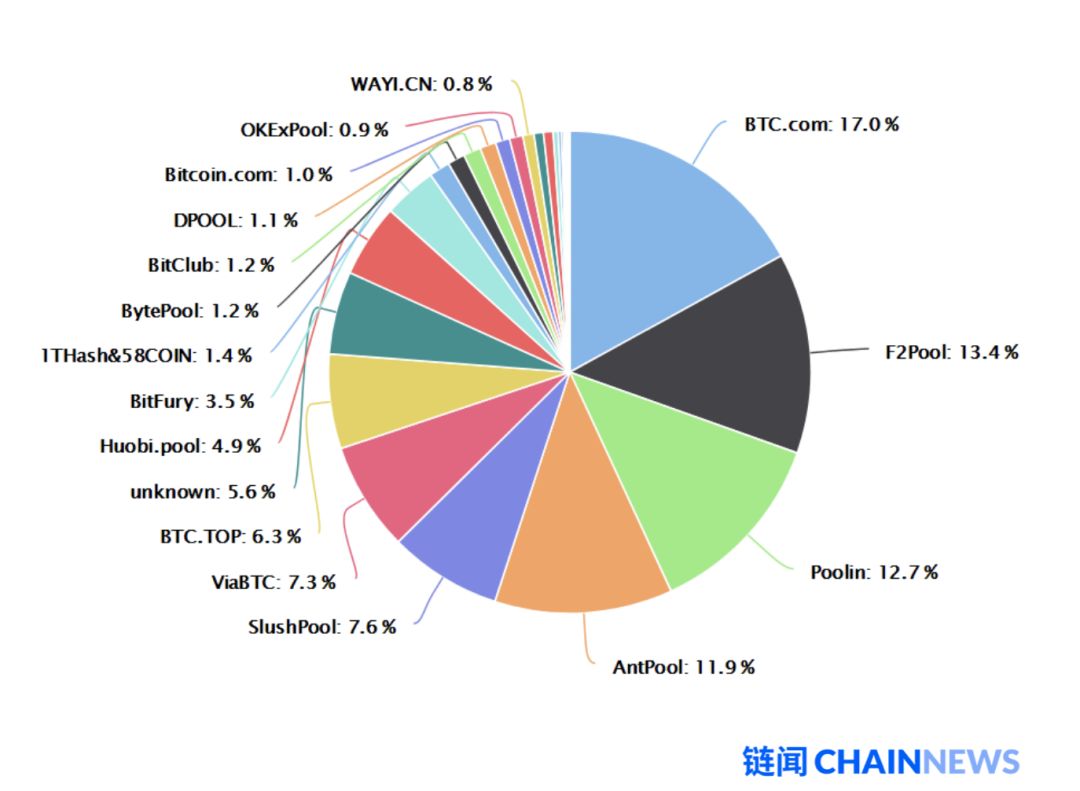

Bitcoin hashrate map, data source: btec.com, January 22, 2020

It can be seen from the above figure that the sum of the computing power of the top ten mining pools in Bitcoin exceeds 90% of the computing power of the entire network, and the degree of centralization is very high. Users can use their personal computers to mine the Bitcoin scene. Nor can it appear.

Like Bitcoin, Ethereum also adopted the PoW consensus mechanism when it went online. Although the design of the anti-ASIC mining machine is added to the mining algorithm of Ethereum, the degree of centralization of Ethereum is also very high.

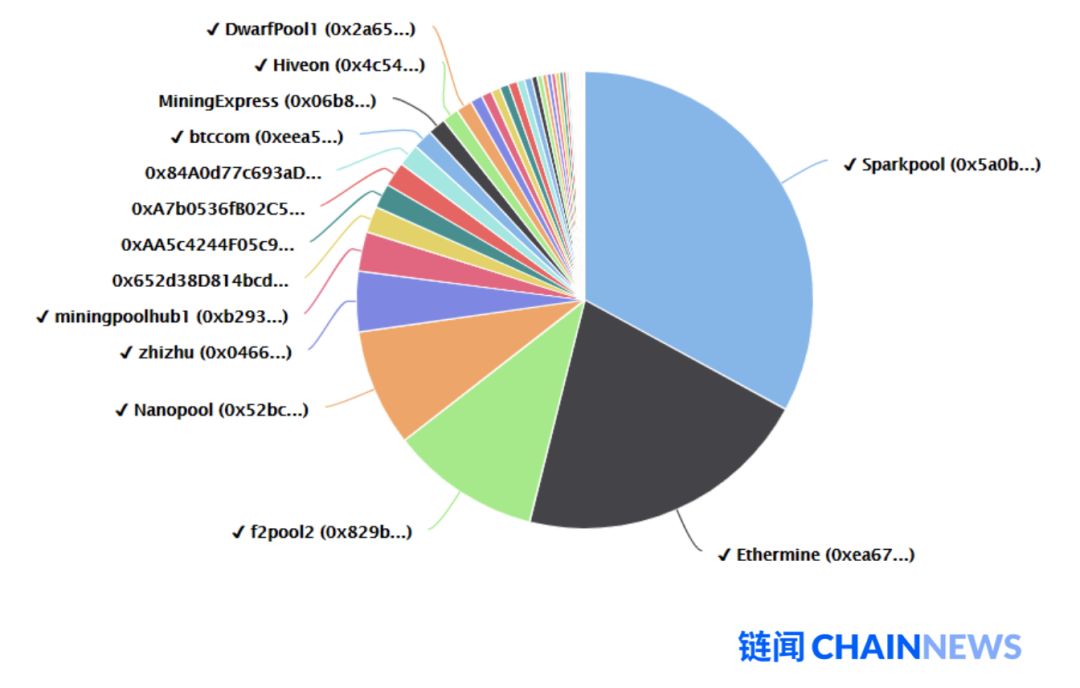

The following graphs and tables show the distribution of the computing power of Ethereum and the computing power of the top ten mining pools. It can be seen that the sum of the computing power of the top ten mining pools of Ethereum is also close to the computing power of the entire network. 90% of the total computing power of the top five mining pools reached 77%.

Ethereum hashrate map, data source: etherchain.org, January 22, 2020

Proportion of hashrate of Ethereum mining pool, data source: etherchain.org, January 22, 2020

From the actual operation of Bitcoin and Ethereum, it can be seen that the PoW consensus mechanism cannot guarantee decentralization, but will spawn a mining pool, making the entire system centralized. If the PoW consensus mechanism is continued, the degree of centralization of Ethereum will continue to increase, which runs counter to the spirit of blockchain decentralization. Therefore, from this perspective, improving the degree of decentralization is one of the reasons for Ethereum 2.0 to move from the PoW consensus mechanism to the PoS consensus mechanism.

Of course, many public chains that use the PoS consensus mechanism, such as EOS and TRON, also have centralization problems. In response to this phenomenon, Ethereum 2.0 also uses other restrictions, which will be introduced later.

Scalability

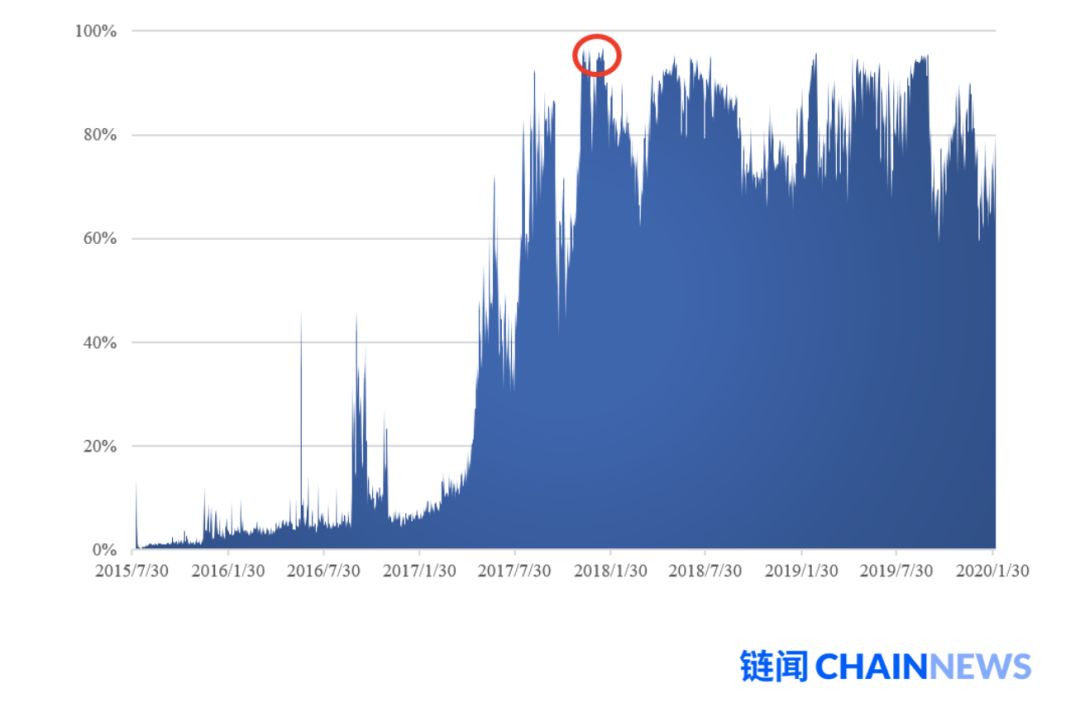

Scalability has always been an important factor that plagued the development of Ethereum. Ethereum's TPS is about 15 or so, which is far from meeting its position as a "world computer". In December 2017, a simple game Crypto Kitties congested the entire Ethereum network, and the utilization rate of the entire Ethereum network reached more than 90%, which is the red circle in the figure below. At present, the usage rate of Ethereum is about 70%. With the development of the Ethereum ecosystem, more and more DApps are deployed on Ethereum. Ethereum wants to host applications that require higher transaction speeds and must address scalability. Sexual problems.

Ethereum usage, data source: etherscan

It can be seen from the comparison in the following table that the performance of the public chain using the PoS consensus mechanism is significantly better than that of the public chain using the PoW consensus mechanism. Therefore, improving scalability is also the reason for Ethereum 2.0 to move from PoW consensus mechanism to PoS consensus mechanism.

Performance comparison of different public chains. The PoS consensus mechanisms in the table include such consensus mechanisms as DPoS, Pure PoS, etc. Data source: official websites and browsers of each public chain

It should be pointed out that many public chains that use the PoS consensus mechanism have high TPS in design, but there are no developers and users in the actual ecosystem. It's like a wide road in a city, but there are no vehicles on the road, which is equivalent to a waste of resources. This so-called high performance has no meaning. Therefore, while improving performance, Ethereum 2.0 must also pay attention to ecological construction.

safety

In terms of security, it is difficult to judge which of the PoW consensus mechanism and the PoS consensus mechanism is better. In the PoW consensus mechanism, the perpetrators need to have enough computing power. In the PoS consensus mechanism, the perpetrators need to have enough tokens, and the cost of evil is high. At present, Bitcoin is still the most secure blockchain, and the cost of evil is also the highest. Therefore, security is not the reason Ethereum 2.0 changed the consensus mechanism.

Although Ethereum 2.0 adopts PoS consensus mechanism does not mean higher security than before, there are still three points to explain.

- First, in the PoS consensus mechanism, nodes need to mortgage a certain number of tokens. For those who do evil, they can confiscate their mortgaged tokens, which is a deterrent to those who do evil.

- The second is that under the current incentive system, maintaining Ethereum full nodes does not benefit, and the number of Ethereum full nodes is declining. In Ethereum 2.0, the number of users who can participate in mining has increased significantly, and they are willing to maintain Ethereum The number of full-node users may also increase. From this perspective, the increase in the number of full-nodes also means that Ethereum is more decentralized and more secure.

- Thirdly, compared to the huge energy consumption of the PoW consensus mechanism, the use of the PoS consensus mechanism in Ethereum 2.0 is a more environmentally friendly and green choice. It does not need to consume a large amount of energy to maintain the system operation.

Ethereum 2.0 requirements for participating in Staking

Similar to the role of miners in the current Ethereum ecosystem, Ethereum 2.0 verifiers assume the responsibility of processing transactions and packaging blocks. The work of the verifier includes proposing new blocks and proving blocks proposed by other verifiers. The verifier of each block is selected by the beacon chain from a large set of verifiers.

Ethereum 2.0 randomly selects validators through a random number generator. The selected 128 validators will form a committee responsible for creating new blocks and obtaining corresponding block rewards. After every 64 blocks, the beacon chain will randomly choose a validator again. This method of regularly and randomly selecting validators can prevent collusion between malicious nodes to the greatest extent.

It should be pointed out that Ethereum 2.0 is also divided into several stages to implement. In Ethereum 2.0, stage 0 does not design shards. Shard design will be added from stage 1. Beacon chains need to be designed for each shard. Both choose the certifier committee.

Barriers to participation in Staking are low

In order to avoid the centralization of other public chains that use the PoS consensus mechanism, Ethereum 2.0 greatly reduces the threshold for ordinary users to participate in Staking. Ethereum users only need to mortgage 32 ETH through smart contracts to become validators. At the same time, 32 ETH is also the upper limit of the number of stakings for each account. If the amount of ETH held by the user is greater than 32, the excess balance will not bring any revenue, then the user must allocate these ETH to different accounts. It is required to minimize the benefits of centralized participation. In addition, Ethereum 2.0 does not have high hardware requirements, and ordinary personal computers can meet the requirements.

Ethereum 2.0 greatly reduces the threshold for ordinary users to participate in staking. This is a significant difference between Ethereum 2.0 and other public chains that use the PoS consensus mechanism.

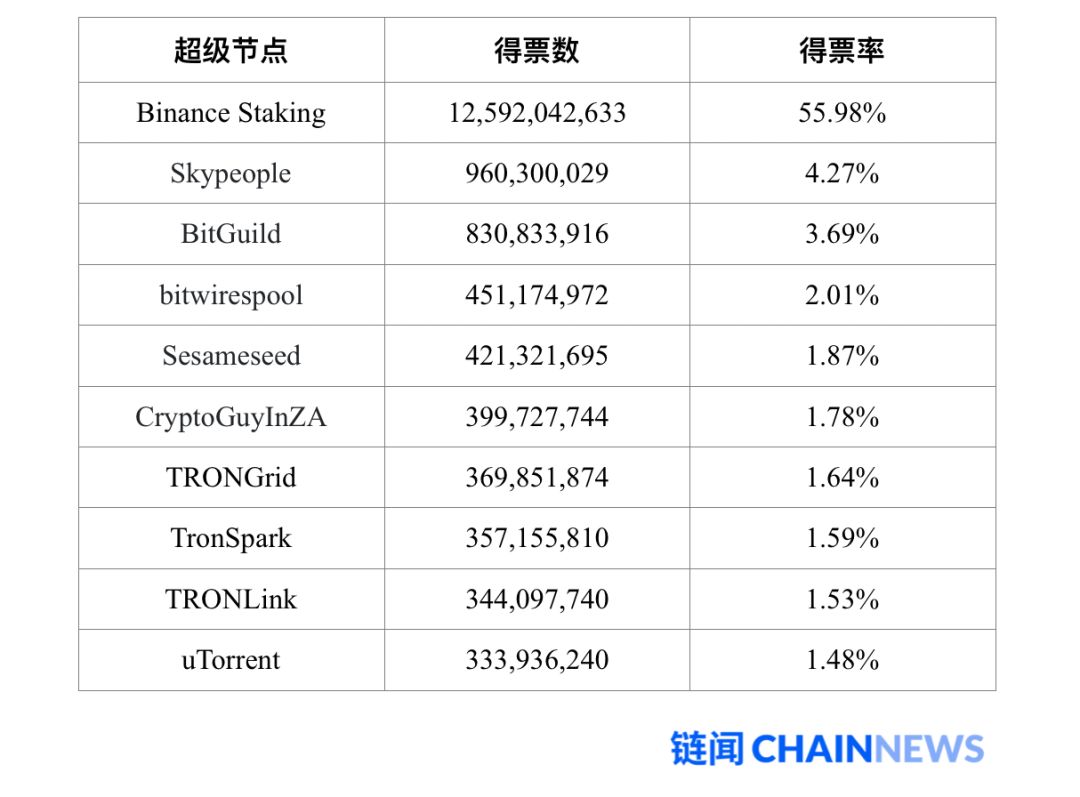

The following two tables show the votes obtained by EOS and TRON. As can be seen from the table, the top ten super nodes received more than 1% of votes. Although the number of votes won is not the same as holding these tokens themselves, ordinary users definitely do not have the funds and resources to get so many votes, and their only way to participate in the block production is to choose to join the Staking mining pool. Obviously, although these public chains also use PoS-like consensus mechanisms, their centralization problems have become very prominent.

EOS Super Node votes, data source: EOS Tracker

TRON Super Node votes, data source: tronscan

Many of the restrictions set by Ethereum 2.0 are designed to ensure the decentralization of the entire system as much as possible. This approximate requirement is actually not conducive to large currency holders participating in Staking. EOS and TRON use the DPoS consensus mechanism to protect the interests of large currency holders in the ecosystem. The following table is a simple comparison of mainstream public chains. The reasons for many restrictions set by Ethereum 2.0 can be explored from the table below.

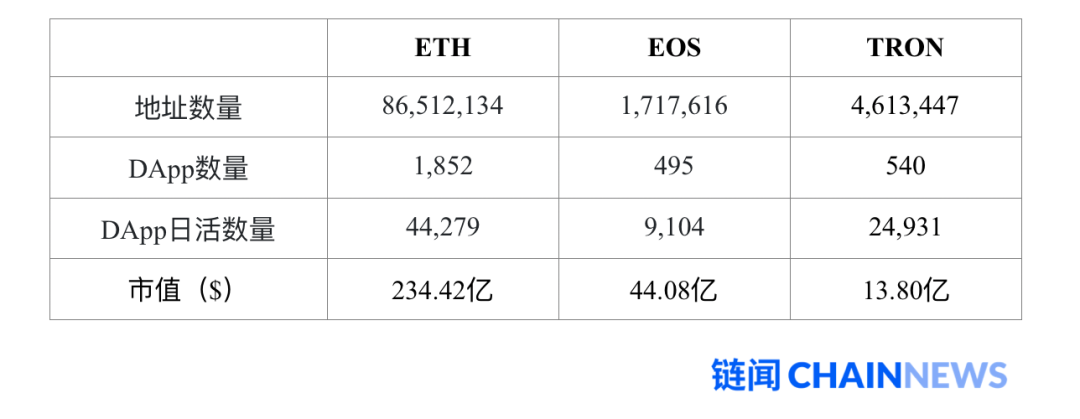

Comparison of ETH, EOS and TRON, data source: Block Browser, Coin Metrics, DApp.com, February 6, 2020

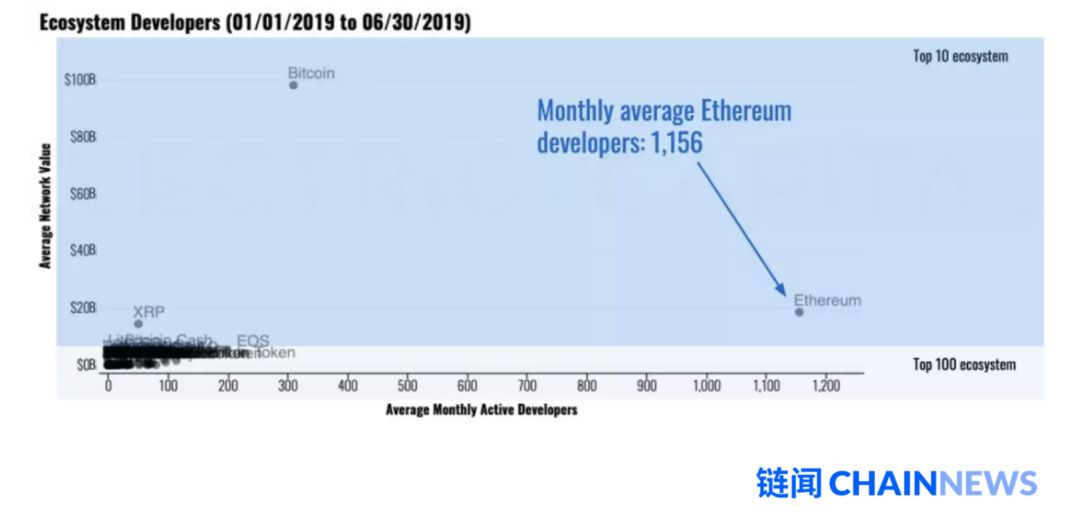

It can be seen that Ethereum far exceeds EOS and TRON in terms of number of addresses, number of DApps, daily activity and market value.At the same time, a report released by Electric Capital in 2019 shows that the number of developers in the Ethereum community is any other public chain. More than 4 times the number of developers. It is Ethereum's huge advantage and acceptance in the blockchain field that gives Ethereum the confidence to believe that even if strict restrictions are placed on Staking, there will still be a large number of users willing to participate in it.

Blockchain project market value and number of developers, data source: Electric Capital

Benefits of participating in Staking

For a public chain using the PoS consensus mechanism, the more tokens a user participates in staking, the higher the cost of evildoers and the more secure the entire network. The same is true for Ethereum 2.0. The more validators in the ecosystem, the more ETH is mortgaged, and the more secure Ethereum will be.

The block reward of Ethereum 2.0 is the driving force for users to participate in Staking. Ethereum will issue additional tokens through block rewards. At the stage of the PoW consensus mechanism, ordinary users do not have the ability to participate in mining by themselves, and the interests of currency users will be lost due to the ETH issuance. After the PoS consensus mechanism is adopted, ordinary users can participate Staking can offset the losses caused by the ETH issuance. In order to attract more users to participate in Staking, Ethereum 2.0 links the annual rate of return of validators to the amount of ETH mortgaged. When the amount of ETH mortgaged in the system is small, the annual rate of return of the validator will be very high. As the amount of ETH mortgaged increases, the annual rate of return of the validator will decrease.

The following table is the annual increase of ETH issued by EthHub, and the maximum increase of the increase is given in the table. If the verifier is punished, the actual increase will be smaller than this data.

ETH issuance, data source: EthHub

As can be seen from the table, when the amount of mortgaged ETH is small, the maximum annual return of the validator can reach 18%, which is a very attractive return that will allow more users to participate. When the amount of mortgaged ETH is large, the maximum annual income of the validator drops below 2%. This income is not attractive to some large currency holders, which can prevent them from collateralizing a large number of tokens to obtain income. According to a rough estimate by Vitalik Buterin, Ethereum 2.0 may lock about 10 million ETH.

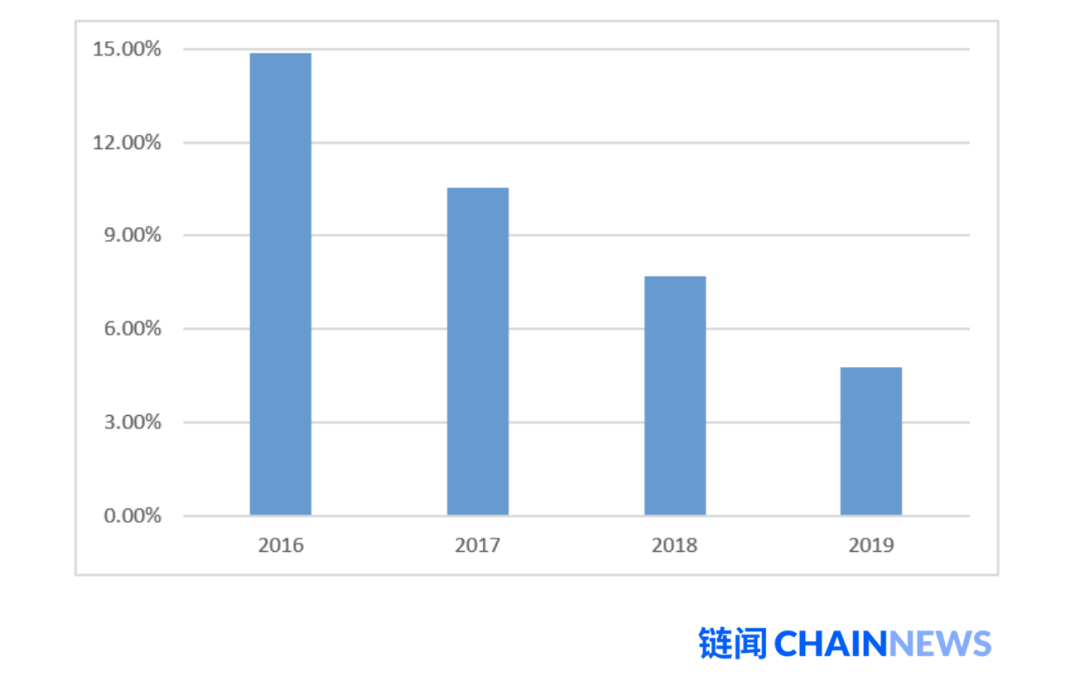

ETH inflation rate, data source: etherscan, calculation time is January 1st of each year

The inflation rate of ETH is decreasing year by year, and the inflation rate in 2019 is 4.76%. As can be seen from the table above “Annual Increase of ETH Issuance”, after the adoption of the PoS consensus mechanism, the inflation rate of ETH will further decline.

Impact of Ethereum 2.0

Ethereum's influence in the blockchain field is very large. Ethereum 2.0's transition from the PoW consensus mechanism to the PoS consensus mechanism will affect all participants in the ecosystem, including miners, node service providers, exchanges, and regulators. .

miner

The changes to the Ethereum 2.0 consensus mechanism have the greatest impact on miners. Although Ethereum 2.0 will not stop PoW mining immediately, and will make the two chains parallel for a period of time, the difficulty of subsequent mining will gradually increase, prompting miners to abandon mining, and eventually Ethereum will still be fully converted into a PoS consensus mechanism. At that time, the miners, miners and other equipment held by the miners will not play a role in the Ethereum ecology.

There are three possible paths that miners may choose next:

- The first is to completely abandon mining and follow Ethereum 2.0 to find its position in the new gameplay. Miners have suffered great losses;

- The second is to use current miners and equipment to mine tokens similar to ETC (Ethereum Classic) and leave the Ethereum community;

- Third, the miners have joined forces to hard fork Ethereum and continue to use the PoW consensus mechanism for mining on the forked chain.

Node service provider

Ethereum 2.0 is an opportunity that cannot be missed for all PoS node service providers, and it is also a very big challenge.

As can be seen from the table below, compared to the popular projects of PoS node service providers such as EOS, TRON, Tezos, and Cosmos, the market value of Ethereum is larger than the sum of the market value of these projects. Ethereum 2.0 will directly become the highest market value PoS project, and subsequent users participating in Ethereum Staking will also be very many. Therefore, Ethereum 2.0 is an opportunity that cannot be missed for all PoS node service providers.

Market value of popular PoS projects, data source: CoinMarketCap

However, as mentioned earlier, Ethereum 2.0 requires that the number of ETH mortgaged in each account is 32, which is a great limitation for node service providers. For other PoS projects, the node service provider only needs a few large servers to run. But for Ethereum 2.0, the node service provider may need to run hundreds or thousands of machines and accounts at the same time, which places high requirements on the service provider's operation and maintenance capabilities.

At the same time, node service providers also need to provide different services to different customers. For large customers holding a large amount of ETH, service providers need to help large customers allocate ETH to multiple different accounts; for small customers holding less than 32 ETH, service providers need to help small customers merge. For large-scale and reputable node service providers, these tasks can be achieved in a centralized manner; for smaller-scale service providers, smart contracts are needed to attract users. And there is fierce competition among node service providers. Therefore, Ethereum 2.0 is a big challenge for all PoS node service providers.

Exchange

Changes in the consensus mechanism of Ethereum 2.0 will not have a particularly large impact on exchanges. At present, many exchanges have established their own PoS mining pools, which use the digital currency hosted by users for Staking to obtain profits. After the consensus mechanism of Ethereum 2.0 is changed, these exchange mining pools will definitely participate in Staking.

Regulatory Authority

For Ethereum, the United States Securities and Exchange Commission (SEC) has made it clear that ETH is not a security digital currency; in Singapore, Japan and Europe, ETH has also been regarded as a payment digital currency or an application digital currency. ETH faces little regulatory policy risk.

However, after the consensus mechanism of Ethereum 2.0 is changed, the attitude of regulators towards Ethereum may change. In November 2019, Heath Tarbert, chairman of the U.S. Commodity Futures Trading Commission (CFTC), said that they were reassessing and analyzing the potential transaction with Ethereum 2.0 with the SEC. If Ethereum 2.0 is evaluated as a security digital currency, it will have a significant impact on ETH and the entire digital currency market. Of course, the Ethereum team will also express their opinions on this issue.

Think and summarize

There are many improvements in Ethereum 2.0, and the transition from PoW to PoS is one of the important changes. Improving the degree of decentralization and scalability of the entire system is the main reason for Ethereum 2.0 to change the consensus mechanism.

In order to avoid the centralization of other public chains that use the PoS consensus mechanism, Ethereum 2.0 greatly reduces the threshold for ordinary users to participate in Staking. At the same time, 32 ETH is the upper limit of the number of stakings for each account. This requirement minimizes the benefits of centralized participation. Ethereum's huge advantage and acceptance in the blockchain field give Ethereum the confidence to make strict restrictions on Staking.

Changes in the Ethereum 2.0 consensus mechanism will have different impacts on miners, node service providers, exchanges and regulators in the ecosystem. All parties need to respond to changes in the consensus mechanism in advance. In terms of regulatory policies, there is no clear conclusion at present, and it is not necessary to be too sensitive to policy risks for the time being.

Ethereum 2.0 is an important stage of the development of Ethereum. In the long run, changing the consensus mechanism of Ethereum 2.0 is beneficial to the development of Ethereum. From the test situation of Ethereum 2.0, Ethereum 2.0 will be successfully launched in the near future, which means that Ethereum will continue to squeeze the living space of other public chains. Ethereum 2.0 is highly competitive. The prosperity of the Ethereum ecosystem and the many developers in the community are the keys to maintaining Ethereum's leading position.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- DAO Incomplete Recent Report: Failed Experiments and Revival of Technology

- Inventory | Blockchain is not absent: 20 blockchain epidemic prevention applications are launched online in 14 days

- Observation | There are no investors in the blockchain project, only sponsors

- Charlie Munger: Negative interest rates make me very nervous, I hate things like Bitcoin

- China Daily: Epidemic prevention or control accelerates issuance of digital currencies

- Report: Blockchain investment growth in Central African countries will reach 400%, with a compound annual growth rate of 50%

- Blockchain helps epidemic prevention and control, Julu County, Hebei Province launches "hard core" management platform