Fosun co-founder Liang Xinjun: Why is 2020 a turning point in the development of blockchain?

Source of this article: Chaos University , with cuts

On November 12, 2019, Mr. Liang Xinjun, the co-founder of Fosun Group, made a "new economic momentum in the next two decades: "Digital Economy Ecology Shaped by the Blockchain Power of Mobile Internet" . In his speech, Liang Xinjun looked into the possible new kinetic energy of economic development in the future, and analyzed how the digital currency based on blockchain technology can empower the economy.

Why does the annual meeting be a turning year for the development of blockchain? How does digital currency solve the challenge of asset management? Where might the vent of the blockchain be?

01 What problems have big data, AI and blockchain solved?

- "Zhejiang Shoot" applies blockchain technology to the auction of scientific and technological achievements for the first time

- How should the blockchain play? We talked to the Nobel Laureate in Economics

- Beijing financial technology pilot "regulation sandbox", analysts: digital currency is expected to enter the pilot

02 Why is it that 2020 will be a turning year for blockchain development?

Blockchain 3.0 technologies (cross-chain, sidechain, partition, sharding, etc.) can improve the performance of the blockchain, improve ease of use, operability, and scalability. Most of these technologies are expected to mature in 2020.

People and:

a. China lists blockchain as a national core competitiveness technology and will greatly promote the commercial landing of blockchain in a multi-centralized and alliance chain manner

b. Singapore's first sandbox institutions will officially enter the actual operation phase

c. The financial system represented by the US JP Morgan Coin will realize a new generation of banking infrastructure (integration of payment, clearing and settlement) in the form of alliance chains

03 What is the significance of blockchain technology?

c. Blockchain makes sharing economy, energy and information easier

Greatly reduce the trust cost between B2B and B2C, increase transaction speed, reduce transaction and resource sharing costs

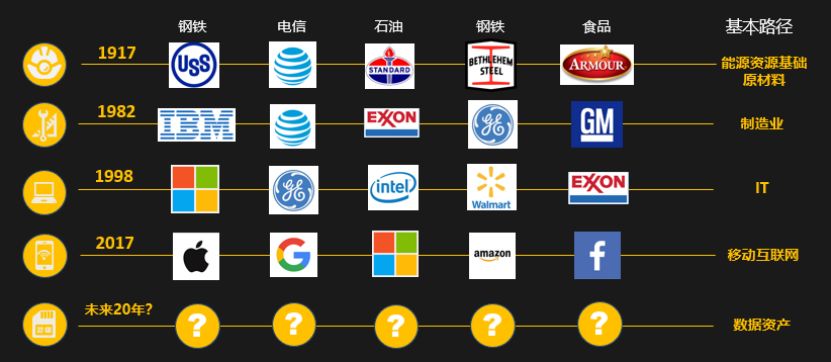

04What is the economic momentum in the next 20 years?

In the next 20 years, data assets will become the main driving force for economic growth.

05What are the challenges of global asset management?

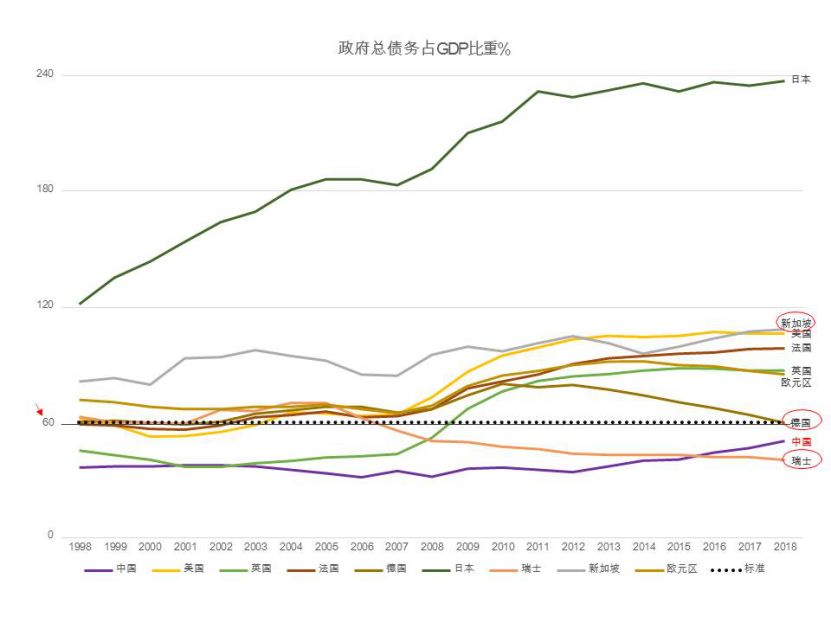

Figure: Total government debt as a percentage of GDP

Figure: Total government debt as a percentage of GDP

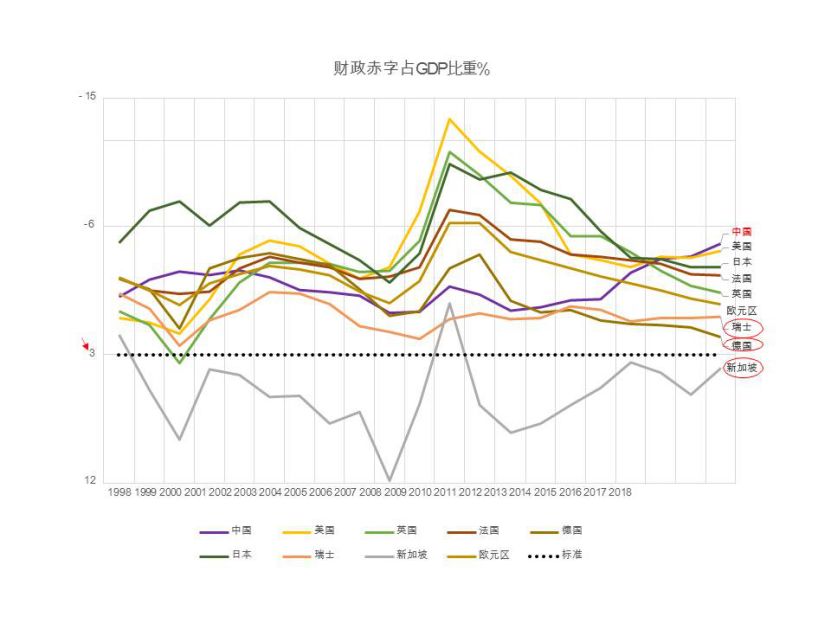

Chart: Fiscal deficits in each country as a percentage of GDP

06 What are the disadvantages of modern currency theory?

07What are the characteristics and development trends of digital currencies?

According to BlockChain.com statistics, the number of Bitcoin user wallets has exceeded 43 million, and the number of Ethereum user addresses has exceeded 78.87 million.

08How to understand the value of digital currency?

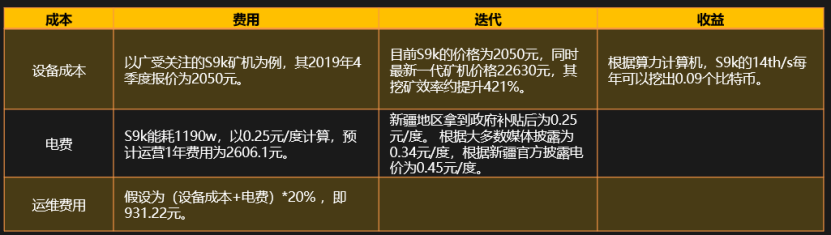

There is an interesting perspective on Bitcoin:

Bitcoin is a good intermediary for storing cheap electricity locally and distributing it globally. This is a digital way to export high-efficiency power generation and “arbitrage” in inefficient power generation areas.

09What is a stablecoin and what does it mean for the asset market?

10 What is the future of the blockchain industry?

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How much BTC does Satoshi Nakamoto have, and where are they placed?

- US Treasury Secretary: Fed will not issue digital currency in five years, and does not oppose Facebook to create digital currency

- The era of digital currencies is getting closer: starting with cash in circulation and used in small retail scenarios

- Research report: Bitcoin software version changes in 7 years, where is the biggest change?

- Technical Dry Goods | Deep Understanding of Zcash's Zero-Knowledge Proof System

- Opinion: Three Common Misunderstandings of Blockchain Technology

- BTC and the "Great Wealth Transfer" of Millennials