Global central bank digital currencies accelerate, DCEP development process inventory

Source: Digital Fiat Research Institute

Fintech mainly refers to the use of cutting-edge scientific and technological achievements (such as artificial intelligence, blockchain, big data, cloud computing, Internet of Things, etc.) to transform or innovate financial products, business models, business processes, and to promote financial development to improve quality and efficiency. Class technology. China's fintech is in a period of vigorous development, policies continue to help, and the industry is expected to usher in accelerated development.

1.2020 is expected to become the first year of global central bank digital currencies

In the field of digital currencies, countries around the world have made great efforts. According to the official website of the Bank of Japan, on January 21, they formed a central bank digital currency group with the European Central Bank and the Bank of England to jointly evaluate the possibility of a central bank digital currency (CBDC). The group also includes the Bank of Canada, the Swiss National Bank, the Bank of Sweden and the Bank for International Settlements (BIS).

- Blockchain expansion, DeFi, Bitcoin halving … Pantera drew these priorities for 2020

- Starting | Deng Jianpeng: The Rule of Law Approach to Blockchain Supervision

- Analysis of CBDC international R & D dynamics (1): Seven giants form a group, "synthetic hegemony CBDC" will be born?

At present, many countries have made substantial progress or expressed interest in issuing digital currency research and development by central banks. European Central Bank President Lagarde said at a press conference in December 2019 that the Central Bank's Digital Currency Special Committee has been set up to accelerate efforts to study the phenomenon of digital currencies, and is expected to reach a conclusion in mid-2020.

Anxin Securities analysis said that by combing the global dynamics, it can be clearly felt that the global central banks are speeding up to cope with Libra planned to be promoted in 2020, and the global central bank digital currency competition has begun. 2020 is expected to become the first year of global central bank digital currencies.

2.The People's Bank of China basically completed the top-level design of legal digital currency

With the support of policies, in recent years, innovative technologies such as AI, big data, and cloud computing have been widely used in the financial industry. The cutting-edge technology investment of financial institutions has continued to increase, and China has also supported policies on the exploration of central bank digital currencies. Frequent, explored for many years.

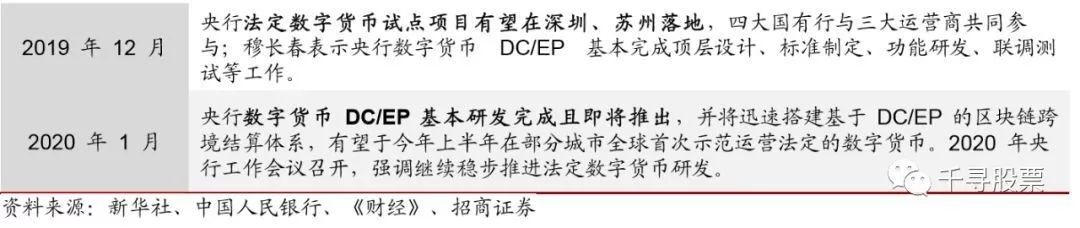

According to Caijing, the central bank ’s statutory digital currency pilot project led by the People ’s Bank of China, including the four major state-owned commercial banks of Industry, Agriculture, China, and Construction, and China Telecom, China Telecom, and China Unicom is expected to be launched in Shenzhen, Landed in Suzhou and other places. There are differences in this pilot. The previous pilot will go out of the central bank system and enter real service scenarios such as transportation, education, and medical care, reaching C-end users and generating frequent applications.

On January 10th, the WeChat public account of the central bank released the article "Inventory of financial technology in the central bank in 2019", which stated that the central bank basically completed the top-level design of legal digital currency, standard formulation, Function research and development, joint debugging and testing. Carry out solid research on digital currencies, and track and study the international frontier information of digital currencies.

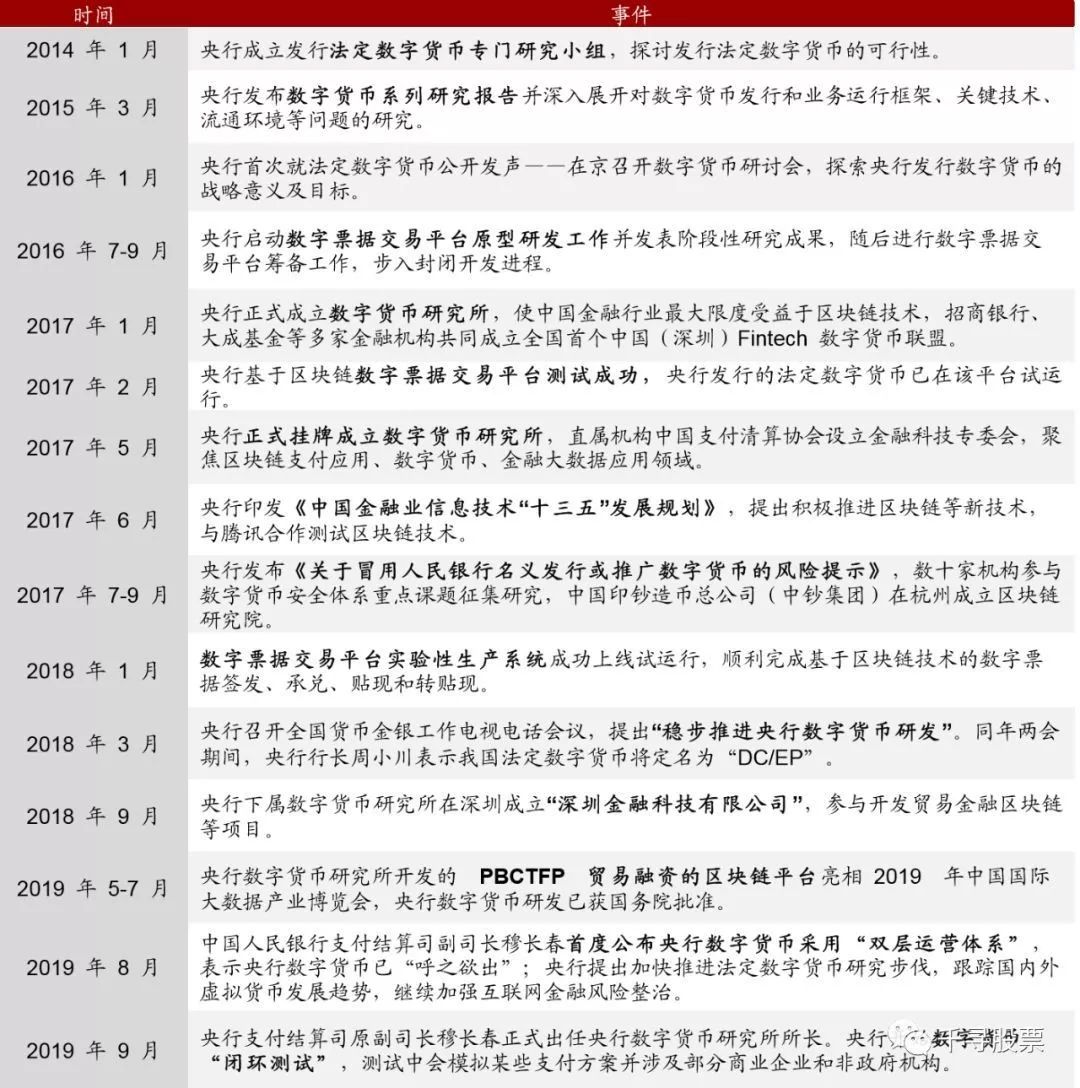

The following table is the process of China's central bank's research and development of digital currencies organized by China Merchants Securities:

After five years of research and development, the research and development of the legal digital currency DC / EP developed by the People's Bank of China has advanced rapidly in 2019, and is expected to start trials this year.

3.What are the benefits of central bank digital currencies?

CITIC Construction Investment has summarized the following three advantages:

(1) On the one hand, reduce the cost of printing, issuing, and storing bills and coins. The replacement of physical currency can enable the central bank to complete closed loops of currency forecasting, statistics, and management that cannot be achieved due to anonymity, improving efficiency and accuracy. At the same time, the central bank's large-value clearing system will be replaced by an automatic clearing mechanism, reducing the intermediate settlement link and directly moving from payment to clearing link, thereby reducing transaction costs and improving transaction efficiency; on the other hand, domestic cash (M0) accounts for M2 The proportion dropped from 11% in 1998 to the current 4%, and offline payments are mostly dominated by third-party institutions such as credit card banks, WeChat / Alipay. If DC / EP with high credit rating is introduced in the future, it will reshape the competitive landscape of the payment industry and strengthen the central bank and commercial banks' control over currency investment.

(2) Protect private privacy and meet the needs of anonymous payment. It is different from the “tightly coupled accounts” method in which electronic payment must be completed through traditional bank accounts. The central bank's digital currency is "loosely coupled accounts", which can be used to transfer value away from traditional bank accounts, which greatly reduces the dependence of the transaction on the account to achieve controllable anonymity. At the same time, the widespread use of CBDC and the withdrawal of banknotes will help combat tax evasion, money laundering and other illegal activities.

(3) Improve the efficiency of monitoring currency operations and enrich monetary policy instruments. The interest-bearing design of the CBDC and the gradual withdrawal of banknotes will help the macroeconomic stability. The issuance of the central bank's legal digital currency will make it possible to collect data such as currency creation, bookkeeping, and flow in real time. After the data is desensitized, it will be analyzed in depth through technical means such as big data to provide currency investment and formulate and implement monetary policy Provide useful reference to strengthen the effectiveness of the deposit reserve ratio, interest rate and other policies. Policies such as the deposit reserve ratio and interest rate affect commercial banks, enterprises, and residents to adjust their economic activity decisions by affecting the liability structure, asset structure, and financial asset prices of commercial banks, thereby promoting the effective play of monetary policy.

4. The central bank's digital currency will be an important investment theme in 2020

Guosheng Securities Looking forward to 2020:

(1) As more and more institutions and funds enter the cryptocurrency field, we expect the market size of stablecoins to continue to expand in 2020.

(2) With the further development of infrastructure such as public chains, and the landing of various applications and financial services on the chain, in the long run, competition between various types of stable coins may begin in terms of application scenarios.

(3) Achieving security and credibility under regulatory compliance has become the primary issue that needs to be addressed in the development of stablecoins.

(4) Once governments of various countries start accepting or issuing central bank digital currencies, competition from central bank digital currencies outside the currency circle is bound to reshuffle the existing stablecoin landscape. From an industry perspective, stablecoins have clearly become a bridge between the digital world and the real world. With the entry of central bank digital currencies, the industry will also usher in a shuffle.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Why we are only at the beginning of the currency revolution

- Perspective | Pledged Profit Model for Productive Asset Tokens

- Comment: How will the epidemic affect the blockchain industry?

- Twitter launches bitcoin emoji, sparks cryptocurrency community binge

- New research: blockchain smart contracts will increase company data quality by 50%

- Viewpoint | The Route Choice of Digital Currency from the "Internet Standards Controversy"

- First Deputy Governor of the Bank of France: The stablecoin provides a plan to improve the payment system, but there are risks that need to be addressed