Wall Street Journal Binance Empire on the Verge of Collapse

Binance Empire on the Verge of CollapseSource: The Wall Street Journal

Compiled by: LianGuaiBitpushNews Mary Liu

After the collapse of FTX, the world’s largest cryptocurrency exchange seems to be Binance. However, less than a year later, Binance itself is in trouble.

Under the threat of enforcement actions by US regulators, Binance’s cryptocurrency empire is “on the brink of collapse.” Over the past three months, more than ten executives have resigned, and the exchange has already laid off at least 1,500 employees this year to reduce costs and prepare for a decline in business. Despite still holding a significant position in the cryptocurrency field, Binance’s dominance is weakening.

- A Shenzhen University alumnus who graduated just a year ago donated 50 million yuan to his alma mater, and his first bucket of gold may have come from cryptocurrency.

- Binance He Yi’s Open Letter Perseverance and a Light Boat Will Cross Ten Thousand Mountains

- Andre Cronje The Lone Ranger’s Network Odyssey

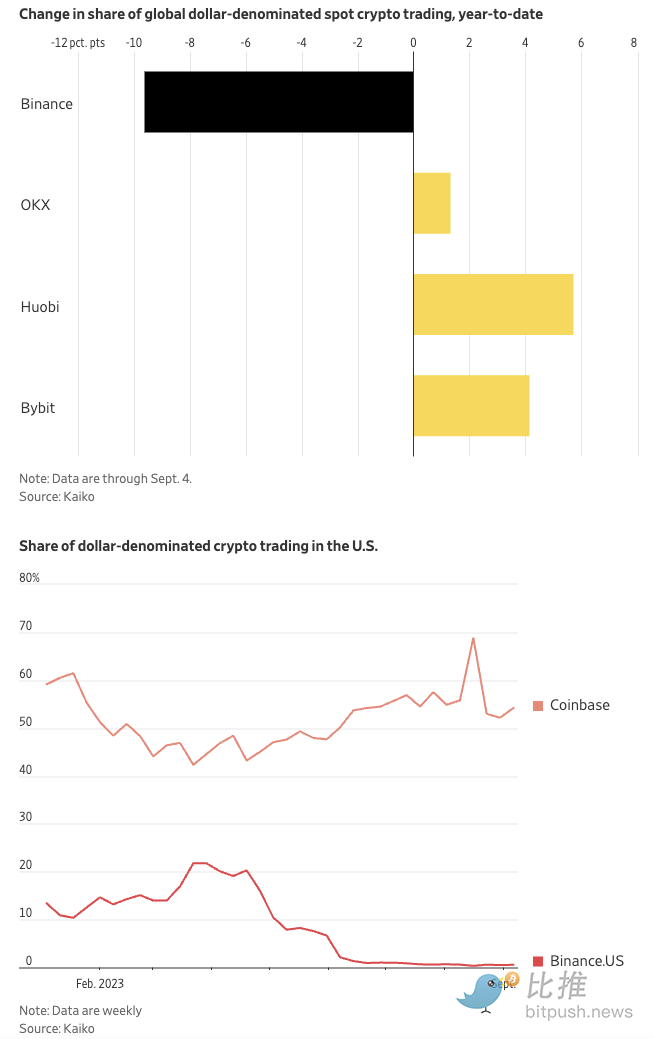

According to data provider Kaiko, Binance currently processes about 50% of cryptocurrency trading volume, down from about 70% at the beginning of the year.

The challenges faced by Binance will have a huge impact on the cryptocurrency industry due to the exchange’s massive scale. Industry participants and observers say that if Binance were to collapse, other exchanges would fill the void. However, in the short term, market liquidity could evaporate, leading to a significant drop in token prices.

An institutional trader told The Wall Street Journal that his company has conducted risk simulations to quickly withdraw assets from Binance in the event of a collapse.

Binance Co-founder and Chief Marketing Officer He Yi pledged to overcome these challenges in a letter to Binance employees last month.

She wrote, “Every battle is a matter of life and death, and the only thing that can defeat us is ourselves. We have won countless times before, and we need to win this time too.”

Binance is a frequent investor in third-party cryptocurrency projects and other projects. Binance has invested in X (formerly Twitter), and Binance Co-founder Zhao Changpeng is one of the most well-known figures in the cryptocurrency field.

Anthony Georgiades, General Partner at Innovating Capital, which focuses on growth-stage companies, said, “If Binance disappears, you can’t quantify what will happen to the industry because it has been responsible for fostering a lot of innovation and growth.”

According to sources, the US Department of Justice has been conducting a year-long investigation that could lead to criminal charges against Binance and Zhao Changpeng (CZ), as well as billions of dollars in fines.

Binance is also facing a lawsuit from the US Securities and Exchange Commission (SEC), accusing it and CZ of illegal operations and misusing customer funds in the US. The company has acknowledged past mistakes but states that customer funds are safe and is committed to compliance.

A spokesperson said, “We have been working tirelessly, not only to learn from past lessons but also to continue investing in teams and systems that ensure user protection.”

Binance was launched in China in 2017, although it claims to have no headquarters and its employees are scattered around the world. Traders from almost all over the world can access its global website, but due to the ban in many countries, the number of users is declining. In Europe, more and more countries are closing the “door” to cryptocurrency exchanges.

Binance.US, the US exchange of Binance, is also experiencing a sharp decline in business activities, with its CEO, legal director, and risk director recently resigning.

According to a presentation seen by The Wall Street Journal, at a virtual meeting of Binance.US earlier this month, shortly before their departure, CEO Brian Shroder said that the exchange’s revenue has declined by 70% this year, and executives expressed frustration.

CZ is a major shareholder of Binance.US and Binance’s global exchange. Shroder told employees that CZ needs to address “regulatory issues, place his Binance.US shares in a confidential trust, or sell his shares” in order for the US platform to maintain its growth momentum. He said these steps would enable the company to establish banking relationships and obtain licenses.

A spokesperson for Binance.US declined to comment.

According to insiders, Binance and the Department of Justice have been in discussions for several months, and there have been internal discussions at Binance about whether CZ should step down from the leadership.

The Wall Street Journal previously reported that CZ insisted on continuing to lead the company, which frustrated some executives who believed his departure would improve the company’s chances of survival.

The turmoil in the company has also affected employee morale.

Based on information seen by The Wall Street Journal, employees confronted and criticized CZ at a summer meeting after layoffs.

An anonymous employee asked CZ in a chat during an all-staff meeting, “Some of the people who were laid off received 0 days’ notice and/or found out they were laid off because they couldn’t log into the system anymore. How is this showing respect for employees? Isn’t two weeks’ severance pay enough respect?” Nine other employees also voted in favor. This question was not answered.

Another stumbling block for Binance emerged at the end of August when The Wall Street Journal published an article about Binance customers using sanctioned Russian banks. According to The Wall Street Journal, the US Department of Justice has also been investigating whether Binance may have violated US sanctions against Russia.

A source familiar with the matter said that after The Wall Street Journal’s report, the Department of Justice questioned Binance about its use of banks, and Noah Perlman, Binance’s Chief Compliance Officer, met with DOJ officials to discuss their concerns.

The source said that pressure from the Department of Justice was partly the reason why CZ decided to start scaling back Binance’s operations in Russia, which was once one of Binance’s most important markets. In the following two weeks, Binance banned customers from using sanctioned banks and forced executives managing its Russian operations to resign, stating that it is considering a full “withdrawal” from Russia.

CZ still shows a positive attitude in public. On the day when the executives in Russia left, he wrote on X, “We are a community, let’s continue building!”

However, according to informed sources, CZ has been privately hiring new lawyers to handle the Department of Justice’s case. He himself has been staying at his home in the United Arab Emirates, a country that does not have an extradition treaty with the United States.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Popular Token Simple Rating CRV Achieves the Best Performance, OP Only Has Speculative Value

- Mixin’s aftermath of being stolen about 200 million US dollars Compensation plan includes bonds, Li Xiaolai’s Weibo questioned Where is the users’ money?

- Market value doubled within a year, will Azuki be knocked down How much longer can Pudgy Pengunis remain popular?

- Hot discussions among peers, uncovering the little-known stories of market maker DWF Labs and Lianchuang.

- Weekly Financing Report | 18 public financing events; Cryptocurrency gaming company Proof of Play completes $33 million seed round financing, led by Greenoaks and a16z.

- Weekly Notice | The deadline for FTX customers to submit claims will be September 30th; Bitget old users need to complete KYC verification before October 1st.

- Unveiling SBF’s Defense Draft of up to 250 pages I did what I believed was right.