Green BTC Theory: The Link Between BTC, Power Consumption, and Green Energy

BTC price movements and fluctuations

- BitMEX study says Bitcoin remains "fantasy" as unit of account

- Libra Association Vice Chairman: Libra is building a governance model that disrupts the payment industry. Three tasks need to be completed before launch

- Too boring at home during the Chinese New Year? Recommend a blockchain book list

BTC was the first digital secret asset drafted by Satoshi Nakamoto in 2008. Initially, the price of BTC has been below $ 10 and is driven by a small tech community. In 2013, the price of BTC spiked above $ 1,000. In the years since, BTC has fluctuated around $ 400. In 2017, the price of BTC reached a record high of nearly 19,000 US dollars. At the time, the overhyped market pushed BTC to a market value of $ 300 billion. Subsequently, the market integration called the "digital currency winter" began, and the BTC price fell below $ 4,000. By the time this article was written in early 2020, the price of BTC had risen to $ 8,770 with a market capitalization of about $ 159 billion. The BTC network is operated and protected by more than 10,000 public nodes with a calculation speed of 116 EH / s. These calculations consume a lot of power. Electricity consumption is equivalent to electricity consumption in Austria or Venezuela.

We see and will continue to see very high volatility, which is an incomprehensible phenomenon driven by strong changes in market expectations. Some "experts" believe that BTC will soon disappear and will be hindered by regulation. This will cause the BTC price to approach $ 0. Other "experts" predict future prices of $ 100,000, $ 200,000 or more. This will bring the BTC market value to $ 1.8 trillion and $ 3.6 trillion, respectively. At present, the market value of gold has reached between $ 7.5 trillion and $ 9 trillion. Therefore, the ratio of BTC market value to gold market value is expected to be between 0% and 40%. Although the upper limit is high, the expected difference is large.

Government is overseeing digital assets

In recent years, startups, businesses, governments and academia have been inspired by blockchain technology. Not only are they interested in decentralized digital assets, they are also interested in enterprise-oriented distributed ledger technology (DLT) systems. The value of this technology will eventually become clearer over time. Therefore, startups and businesses need regulatory support. The government is also taking action, and Switzerland is proposing new legislation to include both digital assets and DLT in legislation. From January 1, 2020, Germany launched "Encryption License". Liechtenstein and Malta have well-established legal frameworks. China vigorously promotes blockchain technology, but is skeptical of the first issuance of virtual currencies and some digital assets. Although the US legal system is fragmented, it is working in this direction. According to the situation in different countries, different related regulations will be formulated, and digital assets will be incorporated into the legal framework of a country, and investor protection will be increased accordingly. This may also attract institutional investors to invest in digital assets.

Summary: Digital currency enthusiasts and startups have driven the development of digital assets. They are calling for clear rules, and governments are responding by stepping up regulatory measures. With technology and legislation in place, companies can now actually apply crypto technology and invest in digital assets. In short, the technical and legal foundations of the coming years have been or are being established. Therefore, we have reason to believe that with the proliferation of blockchain technology, BTC prices may rise accordingly.

The structure of BTC and the importance of mining

The architecture of the BTC system, especially the mining process, is similar to the mining of physical gold. BTC mining companies are also "mining" BTC. They do this by buying and running specific mining hardware. This requires power, equipment and human resources to build the IT infrastructure. All of these mechanisms are based on the PoW consensus mechanism.

To be precise, there is a significant difference between the BTC network and gold: if the price of gold rises, gold companies will increase their mining efforts. This may lead to increased supply. Since the supply of BTC is inelastic, the supply of new BTC will not increase with the increase in the resources invested. If a mining company uses new hardware and new power sources to expand its mining business, it will increase its newly mined BTC share. However, the amount of newly mined BTC within the network will not change.

BTC is generated according to a predetermined schedule, so that the supply of new BTC can be determined in advance. This schedule is actually impossible to change the amount of new BTC generated. Recently, when investigating the scarcity of BTC, stock flow models have become popular. Researchers have found that there is a highly significant correlation between the liquidity value of BTC as a scarcity indicator and its market value.

Here are the important mechanisms that apply: If the BTC price goes up, new mining companies will start their business. Conversely, if the price of BTC drops, some mining companies will stop operating. Although BTC prices are highly volatile, mining activity is not the only factor affecting BTC prices. The following three factors are particularly important: First, the price and efficiency of mining hardware. Second, operating expenses such as refrigeration equipment, space, and IT personnel. The third and most important factor is the price of electricity. This article focuses on the relevance of the latter because the mechanism of the BTC network implies the need for green power. Other articles have explained these mechanisms in detail, especially regarding the input factors of BTC mining.

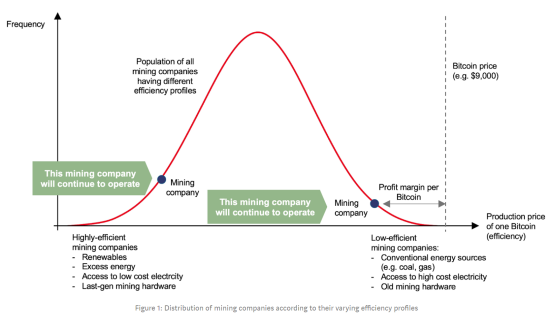

When BTC prices fall, which mining companies will exit?

The following is a very important question: which mining companies will exit when the BTC price drops. Here, we can assume that the mining company's population is diverse. There are some mining companies near China's coal-based power plants. Other mining companies are located in Northern Europe or Canada (cold weather helps cool the hardware). These mining companies have different mining hardware (from different manufacturers) and therefore have to pay different power costs and different labor costs. This has led to a wide distribution of the efficiency of various mining companies, which is simply measured by the sale of BTC's revenue and expenditures on electricity, hardware, site and human resources. This distribution reflects the production cost of a BTC. As with gold, the cost of producing a BTC is different for the entire mining company (see Figure 1). At this point, the true distribution cannot be observed empirically. For simplicity, we assume that efficiency is closely related to profitability.

So, if the BTC price drops, which mining companies will stop mining business? In the entire distribution system, the least profitable will be those companies that produce BTC at a cost higher than the market price. These mining companies will sell the newly generated BTC at a loss (see Figure 2). Recall that the decline in BTC prices will reduce revenue and profitability. Therefore, according to the principle of efficiency allocation, inefficient mining companies will stop operating, while efficient mining companies will continue to work. These companies ensure the "survival" of the BTC network, even at a lower hash rate.

Mining companies with access to low-cost electricity enter BTC network

Which energy sources provide the lowest cost of electricity?

Now, the next related question is: Which energy sources can provide the lowest cost of electricity? According to experts from power companies, these energy sources are mainly hydropower, but also solar and wind energy.

Artificially operating coal and natural gas-based power plants need to purchase and consume resources such as oil and natural gas. There are no such procurement costs based on renewable energy sources such as water, wind or sunlight. In addition, coal and natural gas-based power plants require higher maintenance costs to maintain mechanical components such as boilers, heaters, condensers, and cooling towers. However, using renewable energy requires only maintenance of generators and mechanical parts. Another point is that the use of coal and natural gas has a higher cost of filtering exhaust gas. Moreover, not all energy production facilities have such equipment.

Renewable energy sources such as water, wind, and solar energy have lower average marginal costs than traditional energy sources. According to an expert from a utility company, coal and natural gas-based power plants generate electricity at a price of 3-8 Euro cents per kWh, while hydroelectric facilities and windmills generate electricity at 2-4 Euro cents per kWh .

In addition to this common fact, the BTC network has other benefits. Fluctuations in renewable energy (such as the length of the wind, sun, and rainy seasons) and a fixed demand pattern (day and night cycle) will cause excess energy so that utility companies have to burn electricity to avoid overloading the power network. Power that is not needed by the grid and cannot be stored needs to be consumed. This is the cheapest form of electricity for the BTC network.

In the past, the excess power consumed by the BTC network was mainly provided by Mongolia's coal and natural gas power plants, and their capacity exceeded local demand. The same is happening in the United States, where energy-intensive industrial bases have been abandoned, but power plants are still there. If these power plants have been completely devalued, they can offset the purchase costs of oil and gas, leaving these traditional power plants to a lesser extent as a powerful source of electricity for mining companies. This type of power plant has a long life cycle and is likely to run for decades.

People also tend to use brand-new renewable energy, just like some hydropower stations in Canada, they are dedicated to mining BTC. As a result, BTC may lead to "isolated" special power networks locally, where dedicated power production equipment only supplies power to mining companies.

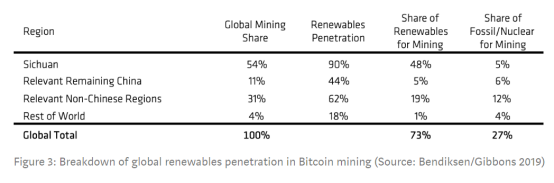

Based on the above facts, recent research shows that the share of renewable energy supply BTC networks exceeds 50%. As shown in Figure 3, 73% of the BTC network comes from renewable energy. We believe that this proportion should continue to increase. Recall that a mining company that has access to low-cost electricity will bankrupt other companies that only have access to high-cost electricity. Compared with traditional energy, renewable energy (especially water and wind energy, not necessarily solar energy) produces cheaper electricity. Therefore, mining companies that will be "renewable-based" will be "based on fossil fuels" Mining companies squeeze the market. This logic can increase the proportion of renewable energy in the total energy consumed by the BTC network.

Will the demand for low-cost power resources drive research and development for efficient power supplies?

As the shift to low-cost electricity has already taken place in this highly competitive market environment, sufficient equipment will be required to use the cheapest energy source and convert it into electricity in the most efficient way. As mentioned above, the proportion of electricity provided to the BTC network through hydropower, solar power and wind power should steadily rise.

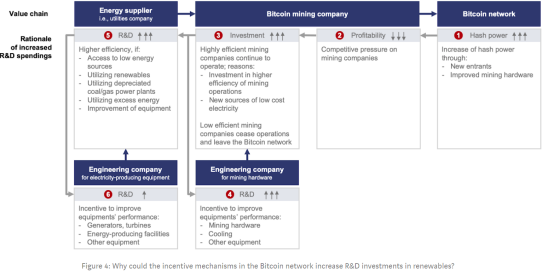

In addition to powerful mining hardware, mining companies mainly need low-cost energy. This in turn requires energy suppliers and engineering companies to invent and deploy efficient power supply facilities. This mechanism is called "priority" and is a way to rank energy based on rising marginal costs. Therefore, both engineering companies and energy producers should increase their R & D efforts to improve these facilities and related equipment. The reason for this is simple: investments in upstream engineering companies and energy suppliers should increase energy efficiency and utilization so that mining companies can make a profit downstream. This relationship is shown in Figure 4.

Increasing investment in research and development will result in the following: Engineering companies and energy suppliers will hire engineers who can improve power generation facilities. Therefore, in the middle of R & D, these R & D investments may even help improve the efficiency of electricity production. Potential R & D results may be applied to power plant engineering not related to BTC.

By the way, this also applies to mining hardware manufacturers and cooling equipment. In fact, new cooling systems (such as air flow optimization) have been developed to cool mining hardware, thereby reducing power consumption to some extent.

in conclusion

It is a recognized fact that BTC networks consume a lot of power. However, the important question is what type of energy is used to sustain the BTC network (ie the battle between fossil fuels and renewable energy). In this article, we explained that the reward mechanism of BTC is beneficial for mining companies that can obtain low-cost electricity. Recent studies have shown that more than 50% of BTC networks use renewable energy.

We believe that efficient mining companies will force inefficient mining companies to go bankrupt. Therefore, efficient mining companies will need energy-producing equipment to enable them to achieve this high efficiency in order to maintain profitability and continue the company's business. This will prompt engineering companies and energy suppliers to improve equipment and increase research and development efforts to improve power generation facilities and related equipment.

If the price of BTC rises sharply, these mechanisms will be stronger: the demand for renewable energy and excess energy will increase, so that the development of these facilities and equipment will increase accordingly. We have two reasons for this. First, renewable energy power generation, especially hydropower stations, is cheaper than fossil fuel power generation. Second, excess electricity from renewable sources is neither needed nor stored, and can be used for mining.

From this, we provide evidence for the hypothesis that in the medium term, BTC can play a role in improving the efficiency of electricity production. Although BTC consumes huge amounts of electricity, we also believe that BTC can promote R & D investment in the use and acquisition of renewable energy.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- How will a new coronavirus outbreak affect the cryptocurrency market?

- How can blockchain projects be profitable? | Back to common sense

- Schnorr upgrade makes Bitcoin "private"? In fact not the case

- Read ZK Rollup and Optimistic Rollup in one article: Ethereum's important expansion direction

- ChainsMap Weekly Report: Data Decrease During Long Holiday, Binance Bitcoin Inflow Declines 44%

- Science | What is a blockchain browser?

- Simple, boring and tedious Bitcoin