Rule | Centralized governance is inevitable

How the commission will take over the blockchain

In the world of corporate governance, small shareholders do not vote at all, and large institutional investors outsource voting rights to professionals called agency consultants [1]. A similar phenomenon occurred in the dPoS blockchain, with token holders entrusting funds to the bet pool.

Inconsistent governance across crypto networks

The spirit of distributed networks is the lack of central authority with unilateral control. This usually manifests itself in a system in which various stakeholders have a certain degree of influence on the development and operation of the agreement. They range from token holders to master nodes, from core developers to ecosystem participants (miners, exchanges, etc.) and are usually a diverse group. But according to the agreement, only a small number of stakeholders can have tangible power.

- The operating system of the future encrypted digital world: smart contracts

- Singapore's cryptocurrency regulatory law takes effect, companies worldwide can apply for a license

- Looking at PoS governance through Cosmos 23 (Part 1)

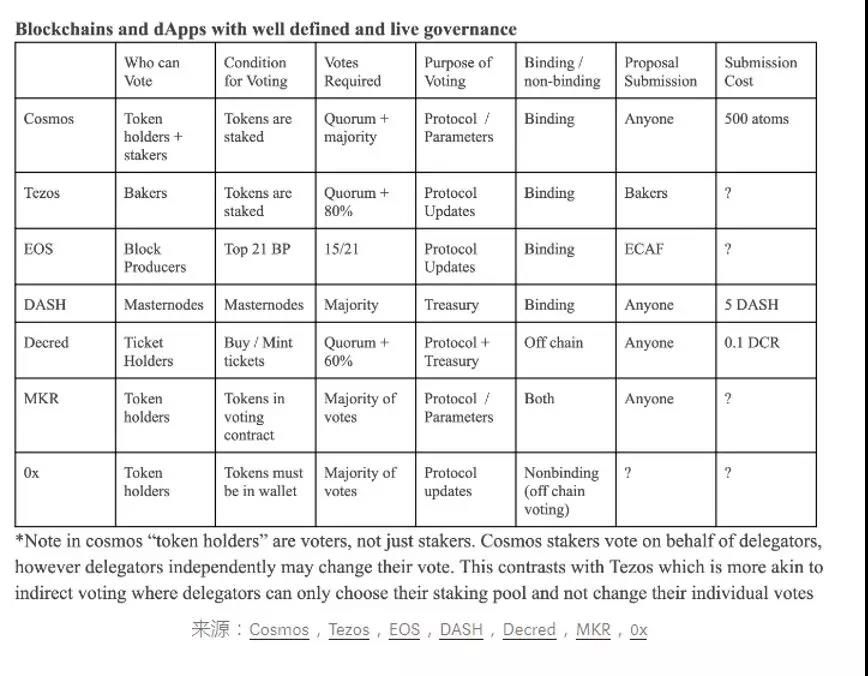

The governance process for each protocol is slightly different, and different norms and traditions must be understood. And these processes are not static-the Ethereum EIP process has changed over the years. Even if we only focus on token-based voting and ignore escrow and key management, the voting process is still inconsistent. For MKR holders, the token must be locked in the voting contract. In Decred, tickets must be created or purchased for casting. In PoS, the protocol token must be locked to a certain number of blocks before the vote can be accepted, and the binding time must be canceled before the principal can be switched. What about those pesky mandatory (non-binding) resolutions and non-binary votes?

Governance impact is difficult to quantify

Towards the end of governance, Dash has a pool of funds where the masternode can vote on various proposals that are usually related to marketing. The subject matter is understandable to non-technical people, and "bad" voting has little impact on the agreement itself.

Conversely, the impact of some technical governance proposals is difficult to infer-should the updated Dai savings rate be 0, 1 or 1.75 or 8 in MakerDAO or any value in between? The cost of adverse consequences can destabilize and disrupt entire ecosystems. Higher interest rates are great for Dai owners, but at what price? Which indicators should be optimized for, and is there a KPI? Consider users without administrative rights?

Governance Metagame

Once you know how to vote, and especially what to vote for, how should one deploy his political capital? It doesn't matter if your votes are insignificant. However, if you are a large token holder with limited political capital, you must be careful about how they work.

Back to the Makerdao example. Should MKR holders express their intentions by submitting a non-binding "vote"? If so, should it take place at the beginning or end of the voting period, or should it only take part in administrative voting? Because Cosmos / Tezos should play a passive or active role in governance, should you only vote on upcoming proposals, or should you draft, code and submit your own proposals? Should its proposal be submitted immediately or wait for all existing proposals to be packaged in hopes that the community will be more focused in the next era of governance?

But how strong is one's political capital after the current voting period? Or how much voting power will their supporters have because delegates may have redistributed the tokens? In addition to the governance outcome itself, there is also a voting meta-game, and it must play its part cautiously in the actual policy of agreement governance.

Agency consultancy work will focus on governance

Most token holders are passive, they just hold tokens for gains and collateral to prevent losses caused by inflation. And, if they've been building a portfolio of assets to maximize their returns for a given level of risk, there may be more than one asset. Processing the various governance plans and recommendations for each agreement can take a significant amount of time. Even if portfolio management is their full-time job, people are busy.

In the stock world, index funds and mutual funds both manage portfolios of thousands of stocks. Why do they only care about the governance of small-cap stocks that account for 0.06% of their portfolio, even if they are large shareholders? Agency consultants have met this market demand and they have been commissioned to spend all their time evaluating and voting on governance proposals on behalf of clients. All the client needs to do is set some voting preferences, such as favoring ESG and favoring a diverse board, and then disappear.

Crypto networks need these actors to fill the governance gap. Of course, they have to pay them, which is already a bet. So wouldn't it be nice to tell the agent advisor to focus on the scalability of a protocol and block the xyz collateral types of stablecoins? Or are they proactive, drafting proposals, implementing regulations and actuarial risk assessments [2]? They can handle all the complex issues of blockchain governance, tracking emerging politics and allegiance …

Token holders are now delegating power

Although it is not common to use independent [3] proxy advisors for dApps, delegation is the status quo in dPoS and PoS systems [4]. In those agreements, the highest stakeholder (based on total equity) can actively participate in consensus and governance. In order to be the highest risk bearer, you must either be a large token holder or entrust other token holders. If you delegate their tokens to the stake out pool, they are using a proxy advisor. Or, if your tokens are in Coinbase these days, or any collateralized exchange on your behalf.

Traditionally, proxy consultants perform the voting process on behalf of their clients, but because consultants may run out of your funds, you cannot just hand over the keys in the cryptographic keys. In order to securely delegate the chain, the voting mechanism must be independent of the expenditure mechanism [5]. dPoS and PoS protocols usually have these functions built-in [6]. But for dApps, more infrastructure must be created because large MKR holders do not vote, because their tokens must be moved from the refrigerator to the voting contract. Regardless of whether the solution is SGX, MPC or some smart contract, infrastructure must be created to separate voting from spending [7]. With this welcome, there will be a future of more centralized and institutionalized governance.

Interesting idea

• Sun Yi pointed out that governance control can be divided into two categories: controlling external assets (for example, Ethereum locked in smart contracts) and controlling only internal assets (for example, Ethereum inflation rewards). This can lead to unexpected results for the parent agreement. What would happen if only n% of the Ethereum were in circulation due to stakeout and DeFi, and a sudden increase in circulation?

• What happens to your governance if your tokens are in a token set or comparable contract.

• When does the agreement implement permanent voting? Although there are smart solutions here.

• Will the exchange allow its users to vote with the tokens they have deposited?

• What happens if you want to lend tokens and have a dividend? (The default is not what happened in the stock world)

• What kind of damage can rogue agent consultants cause? And the resource mechanisms that the protocol will build to address this threat (such as exiting the game: MakerDAO emergency shutdown or REP universal fork)

• If someone delegated their management token to be a work token, then a DAO token?

• What if there are multiple types of tokens with different voting rights? Just like Google Class B has 10 times the voting power of Google Class A. (There is also no voting right for Class C shares. It is strange that Class A has a premium of less than 1% compared to Class B, which means that shareholders do not value governance.) Alternatively, variable voting rights may be generated based on the size of the equity pool, forcing delegates to gain trade management rights to optimize fees (thanks to Tullon Bank).

• What if the biggest bet providers colluded and let the developer funds pay their own addresses to their own addresses in a dividend or more politically meaningful way, that is, burned addresses?

• Acting consultants are acquiring new regulations in the corporate world

footnote

1. The proxy consultant submits proxy votes on behalf of his client. The vote itself was submitted by a proxy, as historical shareholders (even major shareholders) did not want to attend the annual shareholder meeting in person. Some listed companies do not even hold annual shareholders' meetings in person.

2. Tarun from Gauntlet points out how to perform an actuarial risk assessment

3. The basis of the agreement / dApp often makes professional risk / governance recommendations to the community. These recommendations are usually accepted by voters, but they are not independent third parties.

4. Yes, there were mining pools before that, but the connection between the allocation of hash power and the pool that supports a specific fork is not as strong as token-based voting.

5. At some level, this is not in line with "Dark DAOs", and by creating this separation, it also makes buying votes easier. Interestingly, the protocol implementation system makes delegation more difficult through "complete proof of knowledge" or other forms of forced resistance. This is important because it proves that the key holder has full control over their key and that the briber has no partial control over the key (for example, they can sign a ticket but cannot transfer funds).

6. In the Sans bond pool in Tezos, the principals give full control of their tokens to the staker. Tezos also has regular pooling capabilities.

7. Or more simply, a dApp can have a special voting key derived from a private key.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Why build a unified blockchain underlying infrastructure? | Back to common sense

- Depth | The fiat digital currency elephant dances, the industry is changing

- Cai Weide: From the era of big data to the era of blockchain, new thinking and new architecture of Internet

- Popular science | Public chain is not a blockchain in the future. The alliance chain will become a blockchain business application leader

- Multiple blockchain companies support Hubei's anti-epidemic situation; Tether launches gold stablecoin | Weekly Spring Festival Edition

- Five friends of the Ministry of Industry and Information Technology: Blockchain has become a "technical singularity" to accelerate social change

- Science | Ethereum Battle for the Jedi!