Simple, boring and tedious Bitcoin

General public chain design principles

Second, the legal state decision mechanism . A common database can only have one legal state, and cannot be down or misused. Therefore, there is a need for a state change decision scheme (often referred to as the consensus mechanism), which must be able to select and decide on the only global update of a limited size (often referred to as transactions and blocks) within a fixed time.

The blockchain system must have a symmetry of accessibility and the capacity of the stakeholder group of the state information object: Any stakeholder group of any state information object can become a sample maintainer of the common database with a low threshold and directly interact with the global state , Or interact with the state through other means.

- Quotes: Bitcoin rises suddenly, affected by suspected CIA airliner shot down

- Rule | Centralized governance is inevitable

- The operating system of the future encrypted digital world: smart contracts

Generally speaking, although the maintenance of common consciousness is beneficial to the stakeholders of all status information objects. But at the physical level, in order to prevent the tragedy of the commons, there must be an arbitrary form of expected income for the sample maintainers of the common database to motivate people to participate in the labor of this record. Once this revenue is actually generated, its ownership must be guaranteed to be recorded in a common database in the form of a legitimate global state.

Because this expected profit exists in cyberspace in the form of bits, the sample maintainers in classical blockchain systems tend to calculate server costs on a fiat currency basis. Therefore, the motivation of participation of the sample maintainer is entirely based on the consensus of the fiat currency price on the expected return of all stakeholders in the status information.

End of State Information Object

It is easy to understand that the core problem of the public chain network is the motivation of node operators. There is no doubt that at the beginning of a cold start, nothing is simpler, more like a blank sheet of paper, and more imaginative than a string of binary numbers.

The function of the numbers recorded in the Bitcoin system is not important. What is important is that its ownership is based on cryptography, has a large and small relationship, and can be transferred, so it has a price and can be traded.

You can think of it as "money" and it can be stored in value. You can also think of it as air and it's fun to play. You can even think of it as a "atonement ticket." Whoever holds it can redeem it and sell it. The only sign of group consensus is that some people are willing to buy , and why these people buy is not important.

But it can be simply reasoned: those who buy it feel that it can be sold at a higher price, that is, more people will buy it. How to make more people buy? Tell them Bitcoin is a great invention, an unprecedented paradigm shift. The implication is that you can get rich if you buy it. The deeper meaning of getting rich is that you need to encourage more and more people to believe in the greatness of Bitcoin, and then you sell high-value coins to those who believe in you.

It must be noted that the Bitcoin system and all smart contract systems behave differently, but there is no fundamental difference. If you ignore the role as a transfer fee, Bitcoin has only a subjective value . In contrast, the tokens of the smart contract platform have both a subjective value and a so-called objective value , which is the fuel value for performing decentralized calculations. The so-called objective value means that the value of fuel use does not shift with human subjective will, but always exists. But it is interesting that this false objective value completely depends on the subjective value, that is, if no one thinks that the smart contract platform tokens have a subjective value, no one will charge such tokens for calculation, that is, running nodes to work. Many people think that the "anti-censorship" characteristic of the blockchain is actually based on the subjective consciousness of the sample maintainers about some "cryptographic bits".

In a centralized system, the role of fiat currency is not transferred by the individual's subjective will, that is, if it is rejected, it will be considered an illegal crime and punished. This arbitration mechanism requires the existence of an external third party. And the essence of "decentralization" is the conversion from "allow or not" to "believe it or not." As long as it can be sold, it is valuable. The transaction price and liquidity itself contain all the consensus sentiment. It can be considered that the off-chain transaction behavior that is actually taking place has all the effective information to explain the group's perception of the entire system.

In summary, the essence of the decentralization of the blockchain system is the "subjective imagination" of the bit number. The "bit number" must have ownership and be able to transfer on the chain . The fundamental driving force for maintaining its operation is "someone is willing to buy", and the implicit assumption is that "you will make money when you buy it."

There are two other important possibilities here. First, according to the foregoing, the public chain system is used to record a kind of high-value status information that needs to be frequently changed, and its historical ledger does not necessarily need to be kept permanently, and the "number" as a node incentive can also be only a small part of it . A large amount of storage space can be used to record anything, that is, to keep state information objects not limited to those related to "air incentives" . In theory, when the underlying security is sufficient, the public chain system can be used to save any ordinary information without ownership or assets endorsed by third parties.

There are two other important possibilities here. First, according to the foregoing, the public chain system is used to record a kind of high-value status information that needs to be frequently changed, and its historical ledger does not necessarily need to be kept permanently, and the "number" as a node incentive can also be only a small part of it . A large amount of storage space can be used to record anything, that is, to keep state information objects not limited to those related to "air incentives" . In theory, when the underlying security is sufficient, the public chain system can be used to save any ordinary information without ownership or assets endorsed by third parties.

Second, weaken the assumption that node operation is not considered an economic behavior. Suppose 10 years later, edge computing and personal devices are much more powerful than they are now. Everyone joins a decentralized network out of some moral or interest factor. The operation of the public chain will be completely changed. The author believes that the transformation of all production relations must depend on the development of productive forces. In the information world, changes in the order of magnitude of equipment and transmission speeds are the only soil for new technologies. After the equipment resources are extremely rich, the transition from centralization to decentralization is really possible.

Bitcoin subculture

"Seeing his funny response to a roller coaster-like ups and downs, I feel particularly fun."

Before radio communication was invented, any cross-regional information transmission must be limited by space. However, under the blessing of electronic communication, human beings achieved the first time to synchronize information transmission across regions, and the information delay was nearly penetrated to zero.

By the same token, the history of technology has also been divided into two due to the birth of Bitcoin. Bitcoin does two things: first, it achieves objective scarcity and ownership of an intangible object for the first time. Generally speaking, information can be copied indefinitely. Bitcoin has established scarcity of information through cryptographic confirmation and price consensus. On the other hand, for any personal possession of objective objects , there is the possibility of external violence to plunder it. Sex. The non-physical nature of Bitcoin makes any authority's ability to interfere with its ownership as low as the physical limit . But the side effect of this advantage is that individuals are equally vulnerable to losing ownership of Bitcoin. In common sense, most human minds cannot afford this single point of risk.

Second, the bit nature of Bitcoin makes it possible to change its ownership regardless of spatial barriers and with almost no delay. Before that, any object with objective scarcity was limited by space because it couldn't get rid of physicality. As long as the network communication can be reached, Bitcoin can be considered as instantaneous (in fact, there is a confirmation delay).

If you haven't understood the most powerful logic of bitcoin now is "rising", then I can only say that you don't understand the above.

With the main characteristics that make people rich, all the words are correct: digital gold, value storage, commodities, interstellar currency.

No need to think more, Bitcoin's most effective propaganda tool is "rich money " . The supply-side people will never allow Bitcoin to enter the infinite decline channel in order to become rich (miners and coin-tuners). They will "smartly" perform in the market and short in turns to attract more risk enthusiasts outside the circle This game.

So how to get rich through Bitcoin?

There are two main types of speech.

First, Tun Coin . The market principle of TunCo's richness is to tighten the supply side, so only a few new entrants can easily create a price revolution. The bulls used a crazy pull to attract external funds to join, the senior Tunbian party picked up the shipment, the Xiaobai Tunyuan party did not move, and the pure leek took over. When the price was smashed to a low point again, the senior Tuncoin Party entered again and started a new cycle.

There is a bottleneck in this method: the highest point of each round must be higher than the previous round, otherwise the spiritual belief that most Tun currency parties never trade cannot be maintained. So digging for new chives is very important. For a long time, the Bitcoin community has taken a two-pronged approach, using a combination of "rich wealth anxiety" and "tall liberalism" to bombard in a series. But this method currently encounters a bottleneck: in addition to the widespread risk aversion, understanding these high concepts and the threshold for buying Bitcoin is a bit of a hassle for most people who don't like to use their brains.

Second, casinos . The cryptocurrency trading market is a 7×24 worldwide low-threshold capital game. With the blessing of instruments such as contracts and options, this feature is further amplified. As an existence that is not widely recognized by state-level capital, the fundamentals of Bitcoin are basically on the supply side of the mining and TunCoin parties. Since the hot contract in 2019, many young myths about getting rich have spread throughout the currency circle. "Traders" have become role models for young people's financial freedom.

It can be summarized this way that cryptocurrency is a wealth distribution behavior based on mathematical trust (for the first time in history) and has nothing to do with production and creation . How much is allocated depends on your boarding and alighting time. To put it simply , its values are: refusal to work and persist in speculative wealth. Like most things that are popular among young people, Bitcoin can make people's adrenaline soar , and this is the "subculture" of Bitcoin.

At present, this feature is in line with the world view of "Millennials" worldwide. They have nothing to worry about since childhood, and they will directly face an oversupply economic pattern after adulthood. Many of them do not have the urgency to participate in labor, and some of them will immediately inherit a lot of wealth from their parents: those who invest in the real economy During the weak cycle, it is quite reasonable for young people to invest their assets in the Bitcoin market.

The main characteristic of capitalism is that the purpose of all market actions is to obtain more capital , not to make the best allocation of resources. The bitcoin market is the best and fastest harvesting place in the world: because there are still many small whites to be slaughtered because of the low threshold for buying and selling, they cannot enter the traditional commodity market at all.

New Year's Eve, all the big names in the currency circle either go to Europe to relax, or go to Hokkaido for ski vacations. You sitting in front of electronic equipment due to the epidemic situation, you should think about it: what is it to preach on the train? Or is it just "Get in, get rich, get out", be a transaction machine without emotion, or just turn around and leave?

The tragedy of bitcoin's commons lies in the fact that those who get on the bus must bear the hard work of preaching , because the price of getting on the car of the old guns is very low, and the bottom line of the price is lower than the later ones. Too much- they don't care about fluctuations at all, and they have enough money to make Fomo. (If you find a person preaching bitcoin on social media all day, the price of getting on the car is definitely not low.)

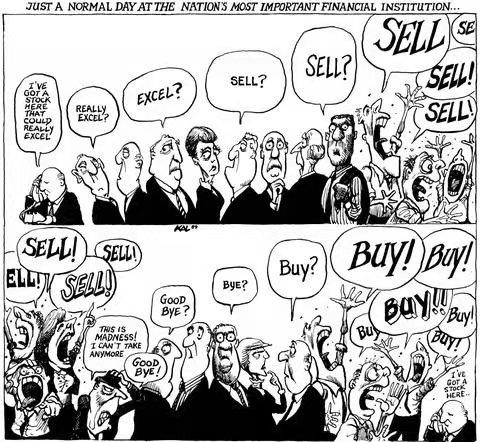

When you see those latecomers jumping up and down because of a small price fluctuation, the big brother's heart has no emotion, and this indifference comes from this.

As you can imagine, the lives of big brothers are so simple, boring, and tedious.

(Image source: Zhu once's boring life)

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Singapore's cryptocurrency regulatory law takes effect, companies worldwide can apply for a license

- Looking at PoS governance through Cosmos 23 (Part 1)

- Why build a unified blockchain underlying infrastructure? | Back to common sense

- Depth | The fiat digital currency elephant dances, the industry is changing

- Cai Weide: From the era of big data to the era of blockchain, new thinking and new architecture of Internet

- Popular science | Public chain is not a blockchain in the future. The alliance chain will become a blockchain business application leader

- Multiple blockchain companies support Hubei's anti-epidemic situation; Tether launches gold stablecoin | Weekly Spring Festival Edition