Function hidden in the LianGuaiyLianGuail stablecoin code can freeze assets and clear addresses.

Hidden in the LianGuaiyLianGuail stablecoin code is a function that can freeze assets and clear addresses.Author: jk

LianGuaiyLianGuail Stablecoin Released

On Monday, LianGuaiyLianGuail launched its latest ERC-20 stablecoin, PYUSD. Similar to mainstream stablecoins, PYUSD is pegged to the US dollar, with a 1:1 exchange rate. It is backed by US Treasury bonds, cash, and other equivalent assets, with monthly reserve reports audited by accountants. LianGuaiyLianGuail states that this asset is primarily designed to simplify online virtual transactions and facilitate direct funding for developers. This initiative marks the first exploration in this area by a major US financial company.

After this news was made public, LianGuaiyLianGuail’s stock price rose by over 2%, reaching a high of nearly $65; however, the following day, the stock price quickly dropped from around $65 to $62.65, currently trading at $62.79.

- LD Capital Understanding the Current Situation of CyberConnect in One Article

- Web3 advertising startup HypeLab has completed a $4 million financing round, led by Shima Capital and Makers Fund.

- Onchain Summer has started. How to play with the Base chain?

LianGuaiyLianGuail’s stock price on Monday. Source: Google Finance

According to the official website of LianGuaiyLianGuail, eligible US customers will be able to:

-

Transfer LianGuaiyLianGuail USD between LianGuaiyLianGuail and compatible external wallets;

-

Make peer-to-peer payments using PYUSD;

-

Select LianGuaiyLianGuail USD as a payment option at checkout;

-

Convert any supported cryptocurrency of LianGuaiyLianGuail to LianGuaiyLianGuail USD.

LianGuaiyLianGuail’s President and CEO, Dan Schulman, stated, “The transition to digital currencies requires a stable tool that is both native to digital and easily connected to fiat currencies like the US dollar. We are committed to responsible innovation and compliance, as well as a track record of providing customers with new experiences, which provides the necessary foundation for driving digital payment growth with LianGuaiyLianGuail USD.”

Code of LianGuaiyLianGuail Stablecoin

This week, there has been extensive discussion about the “business impact and impact on existing stablecoins” of PYUSD. Here, Odaily Star Daily would like to further understand PYUSD from a technical perspective.

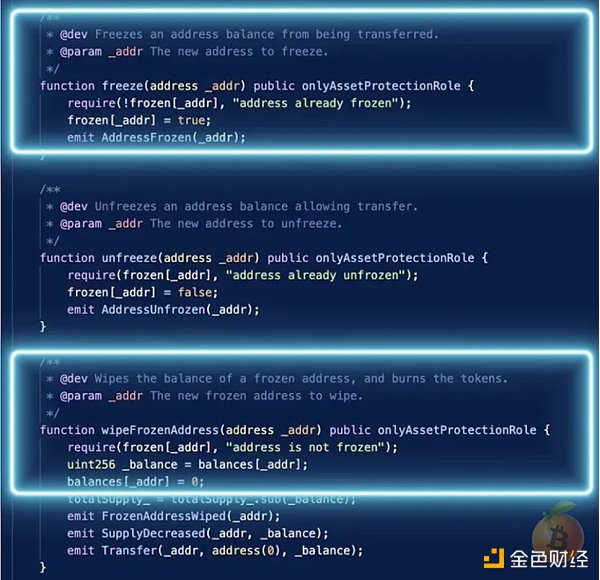

After LianGuaiyLianGuail’s press release, the official Bitcoin Twitter account @Bitcoin posted a message: “What do you think of this code in the LianGuaiyLianGuail stablecoin?”

Code of LianGuaiyLianGuail stablecoin. Source: Bitcoin Official Twitter

As highlighted in the image, two functions appear: Freeze and Wipe Frozen Address. This means that the LianGuaiyLianGuail official can freeze or unfreeze wallet addresses deemed malicious through centralized operations, and can also clear all assets in that address. Although the generation of blocks is immutable, LianGuaiyLianGuail can still, in effect, prohibit certain transactions or freeze assets in certain addresses through this code.

In other words, centralized institutions can perform many operations that were previously impossible on the blockchain. Although this authority can prevent many fraud and hacking incidents in the crypto world, it is considered a violation of the decentralized spirit of blockchain and the crypto world in the traditional sense.

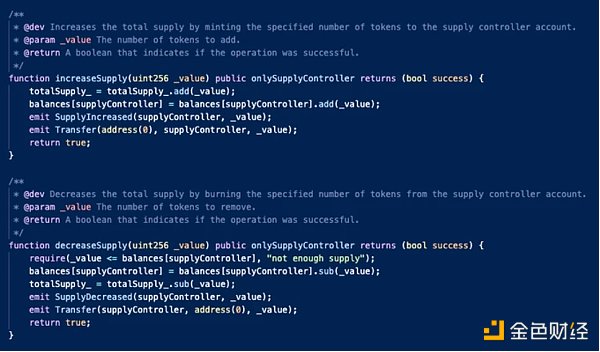

Similarly, Twitter user @0x Cygaar also posted a tweet revealing more centralized operations in the LianGuaiyLianGuail stablecoin:

LianGuaiyLianGuail stablecoin code. Source: @0x Caggar Twitter

“So this LianGuaiyLianGuail stablecoin contract:

-

Was written in a very old version of Solidity;

-

Allows the owner to pause all transfers;

-

Allows the owner to freeze addresses to prevent operations;

-

Allows the administrator to arbitrarily increase or decrease the total supply;

It is at least centralized, but relatively transparent.”

For a long time, the crypto world has advocated the principle of decentralization, believing that digital currencies should break free from central control in traditional financial systems and achieve true freedom and fairness.

Looking closely at the above features of PYUSD, the ability to increase or decrease the maximum supply may be reasonable: if users continuously purchase or mint more PYUSD with more USD assets until it exceeds the maximum supply, there should be a function to increase or decrease the supply. However, compared to similar compliant stablecoins like USDC, LianGuaiyLianGuail, as both the issuer and trading platform, has additional capabilities such as pausing transfers and freezing addresses.

Reactions

The examination of the LianGuaiyLianGuail stablecoin code has caused quite a stir in the crypto world. In the comment sections of the aforementioned tweets, many cryptocurrency users expressed their concerns, with keywords related to regulation and centralization appearing frequently.

Twitter user @mdhaf.eth said, “LianGuaiyLianGuail is already notorious for freezing accounts without user permission (usually due to internal policies or external influences). This (PYUSD) may make more people aware of crypto assets, but most people won’t delve into the underlying code or the ethical standards of the company. It’s not surprising, but it is disappointing.”

However, there are also a considerable number of people who have expressed different opinions. User @LawLingo said, “This is a common thing. $UDST, $USDC, and $USDD all have this feature. Any acceptance of cryptocurrencies is good.” She believes that widespread adoption must occur first for decentralization to gradually manifest. After investigation, Circle’s terms on its official website state that in certain cases, USDC can refuse to process transactions or suspend user services, “if we reasonably believe the transaction is suspicious, involves fraud or improper conduct.” However, Circle also explicitly states, “All transactions made through the USDC service are irreversible and non-refundable.” In comparison, LianGuaiyLianGuail has significantly greater control and is more centralized in terms of the permissions and control over PYUSD on the LianGuaiyLianGuail platform.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- LianGuaiWeb3.0 Daily | Hong Kong-listed companies have approved a budget of $5 million to purchase cryptocurrencies.

- Grasp the opportunity of MEKE public beta and seize the core of Binance Chain Odyssey.

- Analyzing the Landscape of Investment DAOs Definitions, Categories, Structures, and Design Space

- Exploring the Potential of SocialFi Decentralized Social Media

- 5 key risks of USD stablecoins that the Federal Reserve is most concerned about

- From Isolation to Collaboration The Significance of Data Pipelines in Web3

- Analyst The top 15 performing stock ETFs of the year are all related to cryptocurrencies.