US Treasury Bonds Drive the RWA Track to Heat Up How Can Players with Different Genes Innovate?

US Treasury Bonds fuel RWA track, how can diverse players innovate?Original author: flowie, ChainCatcher

The coverage of RWA, which has always been popular, is very wide. It covers different types of assets such as stablecoins, bonds, stocks, and real estate, and how they can be integrated with blockchain.

However, looking at the rise of the RWA track this year, it is mainly driven by US Treasury bonds. The projects with high TVL in the RWA field are mainly US Treasury bond projects, and the layout of RWA by DeFi protocols such as COMP and MKR, which have experienced significant increases, is also mainly focused on US Treasury bonds. The introduction of US Treasury bonds to the blockchain is currently the most typical case of RWA.

And why US Treasury bonds have become the cornerstone of this round of RWA narrative, we have repeatedly mentioned in previous articles. One of the most direct logic is that under the continuous interest rate hike by the Federal Reserve, the rise in US Treasury bond yields has caused many DeFi protocols or crypto investors to turn to obtain risk-free high-yield returns from US Treasury bonds.

- Considering from two perspectives integrating Fantom with OP Rollup to connect Fantom to Ethereum.

- Messari Optimism data analysis shows that it is the fastest-growing ecosystem in the past 30 days, with a market value growth of over 50%.

- Bittrex reaches settlement with SEC Agrees to pay $24 million fine

But apart from the very clear demand for returns, one rarely mentioned pain point is that the entry barrier for US Treasury bond investment has always been high. Even for US citizens, the cumbersome KYC and account opening processes have excluded most people, let alone non-US citizens. At this time, how to integrate off-chain US Treasury bonds with the blockchain in a compliant manner, reduce the investment threshold for US Treasury bonds, and bring the returns of US Treasury bonds to blockchain users is a practical problem faced by many projects with practical value but full of obstacles.

Bringing US Treasury bonds to the blockchain is not easy. As Multicoin Capital co-founder Kyle Samani said, “This is a standard issue. You need to get all relevant parties, such as issuers, underwriters, fund managers, auditors, buyers, sellers, brokers, banks, etc., to agree on the new standard.”

Not only the tokenization of US Treasury bonds, but also the tokenization of other assets such as the bond market, stocks, and real estate, to introduce off-chain assets from the traditional real world to the blockchain, also involve the participation of many intermediaries such as government regulators and management agencies. The compliance issues and legal risks involved are quite complex.

Perhaps we can start with the aspect of bringing US Treasury bond returns to the blockchain, which is currently the most representative and relatively easier to standardize, to understand the process and practical obstacles of implementing RWA, and to summarize how players in this track innovate in reducing user usage thresholds and increasing liquidity.

How can players with different genes bring US Treasury bond returns to the blockchain?

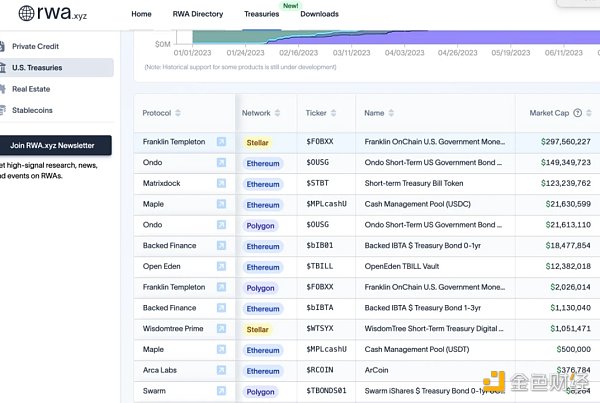

The seemingly emerging introduction of US Treasury bonds to the blockchain has long been brewing. In addition to tokenized US Treasury bond funds from asset management companies, new players in the on-chain US Treasury bond protocol are committed to tokenizing US Treasury bond returns and stablecoin protocols indirectly bringing US Treasury bond returns to crypto users through asset reserves and other means. According to the statistics from the RWA data research platform rwa.xyz, the tokenized US Treasury bond market alone has exceeded 680 million US dollars (excluding indirect introduction methods), and the average maturity yield of on-chain US Treasury bonds exceeds 4%.

1. Asset Management Companies That Have Laid Out Early: Arca, Franklin Templeton, WisdomTree

Asset management companies with a bias towards traditional finance may be among the first players to target tokenization of US bonds. In 2020, Arca, a digital asset management company, registered a fund with the US SEC that invests in US Treasury bonds. This fund is also known as a Blockchain Transfer Fund (BTF) and is regulated by the US Investment Company Act of 1940. Arca Labs, the innovation department of Arca, can convert shares of this US Treasury bond fund into tokens called ArCoin and store them on the Ethereum blockchain. Purchasing ArCoin is equivalent to subscribing to Arca Labs’ US Treasury bond fund. The pricing of ArCoin is based on the net asset value of the fund.

The ultimate ownership of ArCoin is maintained by a transfer agent regulated by the SEC and operated by Securitize, a blockchain company specializing in the tokenization of real-world assets. Currently, investors (both US and non-US) who have gone through Securitize’s KYC/AML process or have a Securitize ID can purchase ArCoin. Arca only accepts subscriptions in US dollars.

Franklin Templeton, the largest publicly traded fund management company with assets under management exceeding trillions of dollars, also launched a government money market fund called FOBXX on the Stellar blockchain in April 2021. FOBXX is the first US registered mutual fund that uses a public blockchain for transaction processing and recording of share ownership. It is regulated by the US Investment Company Act of 1940 and is one of the most strictly regulated products offered by Franklin Templeton. FOBXX is currently the largest player in the tokenization of US bonds.

The transfer agent for FOBXX keeps official records in a bookkeeping form, and the blockchain serves as a secondary record. In April of this year, FOBXX expanded to Polygon.

According to the FOBXX official website, at least 99.5% of its total assets are invested in securities fully backed by the US government, cash, repurchase agreements, or cash equivalents. Each share of the FOBXX fund is represented by a “BENJI” token, with the price of the BENJI token stable at $1. FOBXX distributes the income from US Treasury bonds to BENJI holders, who are the shareholders of the FOBXX fund, through its developed application Benji Investments app.

The target market for BENJI is US investors, and both retail and institutional investors can participate. To invest in FOBXX, investors must have an exclusive on-chain wallet for transactions (created by the fund’s transfer agent during account opening) and complete transactions such as purchases through the Benji Investments app. The private keys associated with the investor’s wallet are held by the fund’s transfer agent. Currently, investors cannot purchase BENJI with stablecoins. The BENJI tokens purchased by users are only vouchers for receiving income from US bonds and do not have much leverage.

Currently, FOBXX has a total asset size of nearly $300 million, with the Stellar Foundation injecting $20 million into it. The annualized rate of return for FOBXX in the past year is 3.75%.

Wisdom Tree, one of the major ETF providers in the United States, also has a deep layout in tokenized US debt. In January 2022, Wisdom Tree announced the launch of a new fintech product directly targeting consumers. The product, called “Wisdom Tree Prime,” aims to provide US investors with selected investment opportunities from government debt to cross-asset categories, and its product fund shares will be represented in token form on the blockchain.

In December, the SEC approved WisdomTree’s 10 digital fund portfolios. Like Arca’s products, these funds are products of the 1940 Investment Company Act and are issued on the Stellar chain and Ethereum chain. The transfer agent will keep the official records in book entry form, and the blockchain will only serve as a secondary record. Investors also need to make purchases and other transactions through the WisdomTree Prime mobile app they launched.

From the WisdomTree official website, it can be seen that WisdomTree Prime has related US Treasury products, including Short-Term Treasury Digital Fund (WTSY X), Floating Rate Treasury Digital Fund (FLTT X), 3-7 Year Treasury Digital Fund (WTTS X), 7-10 Year Treasury Digital Fund (WTST X), Long-Term Treasury Digital Fund (WTLG X), and TIPS Digital Fund (TIPS X). Among them, the Short-Term Treasury Digital Fund (WTSY X) manages approximately $1 million in assets. However, the product is still in testing and has not been opened to a wider audience.

According to WisdomTree, the target users of WisdomTree Prime are not institutional crypto investors, but US retail investors. Currently, Stride and Galileo are their payment partners, and users can pre-deposit funds to their Prime accounts through ACH transfers and then store the returns in Dow Fu Bank. In addition, the WisdomTree Prime Visa debit card will initially be provided as a virtual card and can be used for payment with Apple Pay, Google Pay, and Samsung Pay. After that, a physical debit card will be issued soon.

Overall, this type of asset management company’s approach to tokenizing US debt is almost identical, operating in a way that tokenizes fund shares. Holding fund token shares and the requirements for investing in funds are the same. The holders of fund token shares need to register their addresses as the whitelist of the fund. Addresses not on the whitelist will not be executed in transactions. Investors generally need to be US residents and only support fiat currency transactions and not transactions with stablecoins or other cryptocurrencies. In this case, the blockchain mainly plays the role of secondary bookkeeping, and the transfer agent for the fund’s official records is still managed in book entry form.

That is to say, although this type of asset management company’s exploration of tokenizing US debt is relatively strict in compliance, it only applies the blockchain technology as a simple accounting method and does not have much connection and liquidity with the decentralized finance (DeFi) world.

It is worth mentioning that Compound founder Robert Leshner, who announced the establishment of a new company called Superstate on June 29th, is also planning to operate in a way that tokenizes fund shares similar to the above-mentioned traditional financial institutions, according to the application submitted. However, Robert Leshner has a background related to the US Department of the Treasury, so whether this operating method will bring new gameplay is also worth looking forward to.

2. Stablecoin Players that “Go with the Flow”: MakerDAO, Frax Finance

Compared to the asset management companies mentioned above, stablecoin protocols like Maker indirectly earn income from US Treasury bonds by using the treasury assets to allocate them.

MakerDAO, which has been widely discussed recently for its layout in real-world assets (RWA), has been increasing its investments in US Treasury bonds this year. As one of the earliest DeFi protocols to explore RWA, MakerDAO initially explored investments in solar energy, real estate, and other RWA assets. However, due to the high risk of default associated with these assets, there was not much progress in these areas.

For MakerDAO, diversifying asset allocation not only considers substantial income growth but also reduces reliance on a single asset, thereby reducing single point risks. Previously, nearly half of MakerDao’s asset reserves came from stablecoins in the Primary Stablecoin Module (PSM), with nearly 70% being USDC. In other words, MakerDao had to bear the risk of USDC de-pegging without generating any income.

In contrast, US Treasury bonds are almost risk-free interest rate products, and with the continuous increase in US bond rates due to interest rate hikes, MakerDAO’s layout of US Treasury bonds is almost a natural choice. According to official data, as of May, MakerDAO’s RWA investment portfolio reached 2.34 billion DAI, mainly used to purchase US Treasury bonds. According to the Dune panel, over half of MakerDAO’s income comes from interest-generating RWA assets.

With considerable revenue growth, MakerDAO has also raised the DAI deposit rate multiple times this year, initially from 1% to 3.49%, and recently directly increased it to 8%, surpassing the risk-free rate of 5% for its underlying asset, the US dollar. The goal is to expand the usage of DAI and DSR.

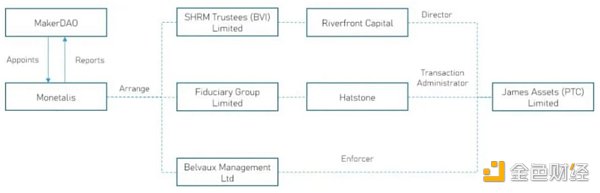

It is worth mentioning that MakerDAO does not use an asset issuance platform to allocate US Treasury assets, but instead holds them through a trust legal structure. According to the MIP 65 proposal, MakerDAO entrusts Monetalis to design the overall legal framework. Monetalis is based on a trust legal structure in the British Virgin Islands (BVI) to achieve on-chain and off-chain interoperability.

Through this trust structure, MakerDAO is able to convert reserve assets into fiat currency, have the custodian bank purchase US Treasury ETFs to obtain corresponding returns, and then distribute protocol income to DAI holders by increasing the DAI deposit rate.

Currently, in addition to MakerDAO, the algorithmic stablecoin protocol Frax Finance has also been exploring the use of assets such as US Treasury bonds as collateral. Frax Finance faced a similar dilemma as MakerDAO in the past, namely an excessive reliance on USDC as collateral. In early 2021, the de-pegging of USDC caused both DAI and Frax to drop below $0.9, further driving Frax Finance to strengthen its reserves and reduce reliance on USDC.

Earlier this year, Frax Finance revealed in an interview that its 2023 plan includes opening a main account with the Federal Reserve (FMA) to directly hold US short-term bonds. However, many crypto KOLs regarded this plan as almost “fantasy”, and Frax Finance has not disclosed any further progress on this.

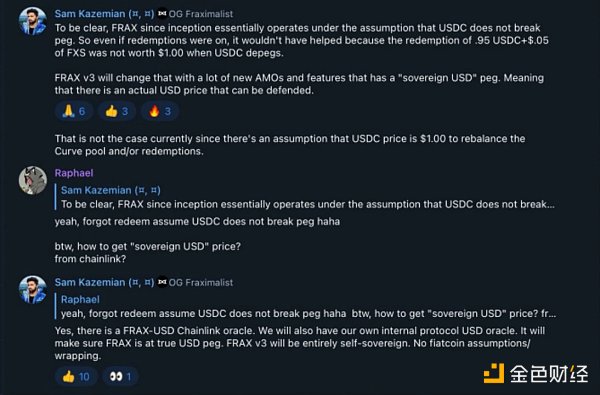

In the upcoming Frax V3 version, some progress on RWA asset reserves such as US bonds is revealed. In July, Sam Kazemian, the founder of Frax Finance, mentioned the idea behind this upgrade during interaction with the community: FRAX has been operating under the assumption of being pegged to USDC since its inception. However, when USDC is no longer pegged, the redemption value of 0.95 USDC + 0.05 USD FXS is less than 1.00 USD. Therefore, FRAX V3 will change this situation through many new AMOs and functions tied to “sovereign dollars”.

On August 7th, the founder of Frax Finance released a proposal to “use FinresPBC as the off-chain RWA partner for FRAX V3”. FinresPBC is a stablecoin technology service provider. The proposal mentions that FinresPBC will provide services to the Frax protocol, including holding US dollar deposits, issuing and redeeming LianGuaixos USDP and Circle USDC stablecoins, as well as holding, purchasing, and selling US Treasury bonds. FinresPBC will publicly release a complete asset breakdown and report of all reserves held for the Frax protocol on a monthly basis.

However, for projects like Maker DAO that use trust law to introduce US bond yields, crypto KOL @kenjisrealm, who focuses on RWA research, believes that there are still risks such as asset defaults, agent risks, and regulatory risks. In particular, the 2024 Corporate Transparency Act in the United States will require even DAOs to disclose the actual controllers and influential stakeholders, which conflicts with the existing RWA framework of Maker DAO.

Mindao, the founder of dForce, stated that if MakerDAO sets up a trust to hold US bond assets itself, it would have fewer operational risks than using indirect methods like Circle. More importantly, this model will affect the overall landscape of the stablecoin market, and decentralized stablecoins may have the opportunity to overtake. Introducing interest from US bonds into decentralized stablecoins is more attractive than centralized stablecoins. It can adjust the risk composition of underlying assets more flexibly in terms of profitability and programmability.

3. Cryptocurrency newcomers seeking to lower investment thresholds: Ondo Finance / Flux Finance, Matrixdock / T Protocol

Whether it is traditional financial asset management companies tokenizing US bonds or stablecoin protocols indirectly providing returns to stablecoin users through trusts, the tokenization of US bonds in these cases does not have market circulation and is essentially an off-chain model. The limitations of this model are also evident. The tokenization of US bonds by traditional asset management and crypto asset management companies mainly targets non-crypto investors in the United States, requiring strict KYC and subscription through dedicated apps, and does not support cryptocurrency subscriptions. The investment threshold remains relatively high. Stablecoin protocols only confine the returns to users holding stablecoins.

For encrypted users, they still face the pain point of how to invest more idle encrypted assets into US bonds with low barriers. For DeFi projects, they need to consider how to distribute US bond returns to encrypted users in a compliant and low-threshold manner through tokenization.

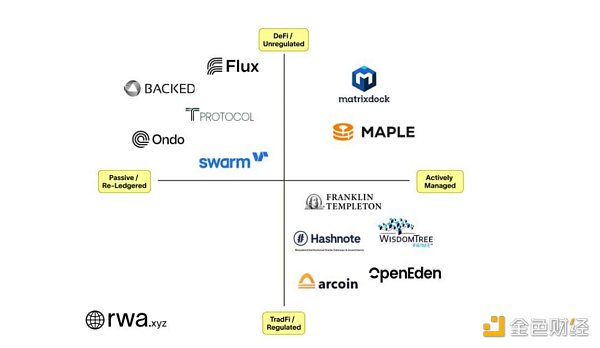

Currently, the RWA research platform rwa. xyz has listed Ondo Finance / Flux Finance, Matrixdock / T Protocol, Maple, Backed, Swarm and other DeFi protocols exploring the tokenization of US bonds in its latest research report. However, due to compliance requirements, most tokenization protocols for US bonds require KYC, and there are obvious restrictions on regions, which also means that they face the problem of limited issuance scale.

But compared to the tokenization of US bonds by traditional asset management companies, their compliant way of introducing US bonds onto the chain is different. In addition, they support the use of stablecoins, which is relatively more convenient in terms of operations. The following text selects some tokenization protocols for US bonds with relatively higher TVL and some exploration in bypassing KYC for brief analysis.

Ondo Finance, founded in 2021, has team members with rich backgrounds in institutions and DeFi protocols such as Goldman Sachs, Fortress, Bridgewater, and MakerDAO. Earlier this year, Ondo Finance announced the launch of a tokenized fund, providing institutional investors with opportunities to invest in US Treasury bonds and institutional-grade bonds.

Compared to the cumbersome registration process of mutual funds, Ondo Finance chooses to use the exemption issuance of funds. However, this means higher requirements for investors, which need to meet the requirements of qualified investors and qualified buyers defined by the SEC, that is, individuals or entities that invest at least 5 million US dollars. Qualified investors can invest in USDC or USD, and USDC is converted into USD through Coinbase and then purchased US Treasury bond ETFs through Clear Street, a broker that provides bulk brokerage platforms for institutional investors. The income is then distributed to institutional investors in tokenized form.

Such investment thresholds are still high, but the lending protocol Flux Finance launched by Ondo Finance allows ordinary investors to indirectly obtain income from US bonds. Flux Finance allows OUSG holders to pledge OUSG and borrow stablecoins. As a stablecoin provider in the Flux Finance lending pool, it can indirectly obtain income from investing in US bonds without KYC. Currently, Flux Finance has a total supply of nearly 40 million USD.

Compared to the exemption issuance of funds, the blockchain bond platform Matricdock launched by Matrixport chooses to establish a Special Purpose Vehicle (SPV) as the issuer of purchasing and holding US Treasury bonds. Matricdock has launched a product called Short-term Treasury Bill Token (STBT) based on US Treasury bonds. According to compliance regulations, it still requires customers to undergo KYC and register their addresses on the whitelist. It has a minimum investment requirement of 10 USD and does not provide services to customers in mainland China, Singapore, the United States, Canada, and other regions.

Similar to OUSG, STBT allows users to invest with stablecoins. STBT transfers stablecoins into fiat currency through its issuer for “third-party custodians” to purchase underlying government bonds. However, currently it does not disclose the “third-party custodians” like Ondo Finance.

It is worth mentioning that Matrixport has introduced the permissionless US Treasury bond investment protocol T protocol to explore reducing investment thresholds. Compared to Ondo Finance, which indirectly introduces permissionless US Treasury bond returns for crypto users through the lending protocol Flux Finance, T Protocol achieves permissionless US Treasury bond investment by wrapping the S T B T issued by MatrixDock.

According to HashKey’s report “HashKey: Tokenization of RWA using US Treasury Bonds as an Example”, the T B T token launched by T Protocol is a wrapped version of S T B T. After investors deposit stablecoins into T Protocol, T Protocol mints T B T and entrusts a partner to purchase S T B T when it accumulates to 100,000 USDC. T B T is pegged to 1 USD and can be redeemed through the protocol, providing US Treasury bond returns through rebasing. There is also a non-rebase version called w T B T. HashKey believes that behind T B T is the protocol’s purchase of S T B T and the USDC reserves that have not yet been used to purchase S T B T, and T Protocol acts as an intermediary between non-Matrixdock users and Matrixdock. T B T is also a potential competitor to stablecoins.

Summary: What are the noteworthy impacts of US Treasury bond RWA on DeFi?

Combining the aforementioned protocols for introducing US Treasury bond returns on-chain and some analysis in Mint Ventures’ podcast review article “RWA: Compliance, Segmented Track, and Prospects”, the noteworthy impacts of US Treasury bond RWA on the crypto market mainly include:

Firstly, it retains crypto funds on-chain and slows down capital outflows. After a long bear market, it is difficult for idle stablecoins and other crypto assets to find low-risk and profitable opportunities. US Treasury bond RWA to some extent fills this demand and slows down capital outflows on-chain. From a longer-term perspective, the founder of dForce, Mindao, proposed a thought: stablecoins have tokenized the US dollar, but the native interest of the US dollar has not been tokenized before. A currency cannot become a true currency without its own interest. When these two are combined, it means that we have fully tokenized the US dollar currency onto the blockchain, which is significant.

Secondly, it impacts the stablecoin landscape. On the one hand, stablecoin protocols like MakerDao reduce dependence on centralized stablecoins like USDC by allocating assets to US Treasury bonds, reducing operational risks and attracting a large number of users to hold their stablecoins with their returns. On the other hand, many US Treasury bond investment platforms like T protocol and OpenEden inject new forces into the stablecoin market competition by issuing stablecoins to help users obtain profitable US Treasury bond exposures.

In addition, with the compliance of US Treasury RWA and some technical explorations bridging between crypto finance and traditional finance, it may provide reference significance for other RWA assets to enter the crypto market.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Decentralization and economies of scale

- ENS Governance Activity Statistics and Related Indicators

- In-depth Analysis of Full-Chain Game Core MUD Engine and World Engine

- Evening Must-Read | Layer2 attack on the city strategy pool, Ethereum’s king of public chains throne is more secure

- Eths and other inscriptions continue to trade at a premium, is Ethscriptions Summer coming soon?

- Ethena Labs Founder Stablecoins need to focus on liquidity rather than decentralization

- SEC’s Terraform ruling provides implications for handling the Coinbase case