Can tech giants bet on Web3 wallets to become a leverage point in the industry?

Can tech giants leverage Web3 wallets in the industry?Author: Hedy Bi, Oke Cloud Chain Research Institute

At the time when LianGuaiyLianGuail launched its stablecoin and sparked industry discussions, the public chain Aptos announced its partnership with Microsoft yesterday to explore innovative solutions related to asset tokenization, digital payments, and central bank digital currencies. Despite Bill Gates’s ambivalent attitude towards cryptocurrencies, Microsoft has been laying out Web3 since 2015, a full five years earlier than LianGuaiyLianGuail. However, whether it is Microsoft starting from technical cloud services or LianGuaiyLianGuail starting with the support of LianGuaixos Trust for encrypted payments, both giants are converging on the Web3 payment space. Not only are tech giants focusing on Web3 payments, but also the native cryptocurrency company Circel recently released its own programmable Web3 wallet.

Why do LianGuaiyLianGuail, which already has a good user experience, and Microsoft, which is stable and profitable in Web3 cloud services and investments, still need to delve into Web3 payments? What is the motivation behind leading Web3 technology companies such as Circel, OKX, and MetaMask investing heavily in Web3 wallets?

- What is the impact of improving the token economics of $RLB? What is its potential?

- Analyzing the first zk-fraud-proof system, the combination of Optimistic Rollup and ZKP

- The Metaverse applies continuous decoding of the ‘hard technology’ of the Hangzhou Asian Games.

Archimedes once said, “Give me a lever long enough and a fulcrum on which to place it, and I shall move the world.”

Web3 wallets may become the fulcrum for new and old tech giants to leverage the growth of the Web3 space.

Decentralized Trust

For users, using Web3 payments, especially Web3 self-custody wallets (hereinafter referred to as Web3 wallets), is as reassuring as keeping gold or jewelry in their own home safe. There is no need to go through banks or other financial institutions, nor to store one’s data on third-party cloud platforms or company servers. This charm is bestowed by the distributed technology behind Web3, where users can store their private keys by using Web3 wallets, and the private key information is saved on a local server.

Web3 self-custody wallets and payment companies (such as LianGuaiyLianGuail, which implements Web3 payments in collaboration with MetaMask) like OKX Web3 Wallet, MetaMask, and WalletConnect have significant differences in technical architecture, security and control, and on-chain applications.

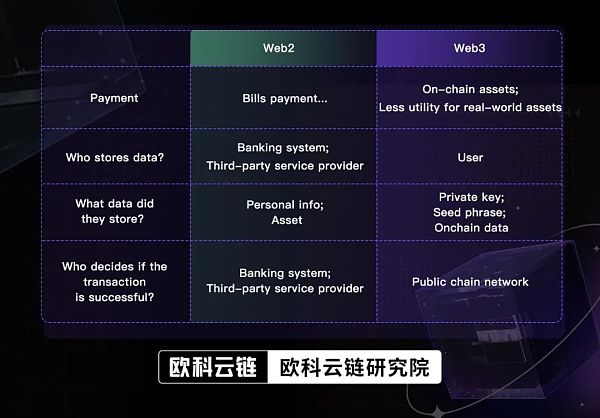

1. Product Architecture: Taking user Alice’s transfer as an example, the difference between Web3 wallets and the payment apps we currently use can be clearly seen from the comparison in the figure below. When Alice initiates a transaction, from user-initiated transaction to account identity verification, and then to confirmation and execution of the transaction, the process of traditional payment companies is on third-party servers or cloud servers cooperated with the company, where a centralized institution holds users’ personal sensitive information and transaction data. On the other hand, the operation of Web3 wallets is on a decentralized blockchain, and functions such as transfers are executed through smart contracts, which means that in terms of technology, users are truly in control of their assets.

Specifically, users use private keys to control and manage on-chain assets, just like having a digital signature pen exclusively for you. Only by using this pen to sign, can others verify the signature to confirm that it is your intention. Your transactions will be broadcasted and confirmed across the entire blockchain network, ultimately completing the transaction.

2. Control and Security: If Alice chooses to use a payment app on her smartphone, she needs to trust a third-party institution to protect her assets and personal information. Since the third-party institution can collect, use, and share user data, there is a risk of sensitive data leakage or misuse. In terms of security, traditional payment companies face the risk of a single point of failure. If the centralized server encounters a failure or attack, users may not be able to access their assets or conduct transactions.

In contrast, when users use a Web3 wallet, they can independently manage their assets by controlling the private keys, without needing to hand over their assets and data to others. Therefore, the storage of private keys becomes a major challenge.

Image: User recording mnemonic words (using mnemonic words to restore the private key and gain access to the wallet and on-chain assets)

According to OKLink’s data, in 2022, the largest losses of user digital assets are caused by private key leaks and losses, reaching up to $930 million, accounting for about 40% of total losses. Leading Web3 wallets in the industry, such as OKX Web3 wallet and MetaMask, have supported the Account Abstraction (AA) technology to implement social recovery of private keys: by splitting the private keys into multiple parts and distributing them to designated individuals for segmented safekeeping, when users need to recover their private keys, they can contact and collect a sufficient number of key parts to regain access to their wallets.

This not only enhances the security and flexibility of Web3 wallets but also seamlessly connects to the user experience. Last week, we also mentioned that OKLink has supported the resolution of AA accounts and Uop (User Operation) queries, allowing users to accurately view their on-chain records through blockchain explorers. In addition to social recovery, MPC (Secure Multi-Party Computation) non-private key wallets are also at the forefront of industry technology. For example, OKX Web3 wallet has pioneered the emergency export function, realizing a truly decentralized self-custody non-private key wallet.

“Balancing security and convenience is never easy.” Elbert Xu, the product owner of OKX Build, said during a discussion with OKG Research.

In the following image, let’s summarize the differences between Web2 and Web3 payments:

Image: Comparison between Web3 wallet and Web2 payment

Image: Comparison between Web3 wallet and Web2 payment

3. Decentralized Applications (DApps): Once Alice easily navigates the Web3 wallet, she can start experiencing Web3 surfing, connecting her Web3 wallet to decentralized finance (DeFi), NFT markets, and metaverse games. Web3 wallets not only support the management of encrypted assets but also allow participation and expansion in various DApps on different blockchains.

Currently, most payment companies can only provide storage and transfer functions for a few major cryptocurrencies through partnerships with encryption technology companies. Payment companies act as payment gateways in this arrangement.

Take the Ethereum ecosystem, which is the most active in terms of DApps, as an example. According to OKLink data from OKEx Cloud Chain, as of today, the total locked value (TVL) on the chain has reached 44.88 billion US dollars, achieving several tens of times growth within 3 years. Web3 wallets are tools closely integrated with the DApp ecosystem, providing direct access and use of DApps. Currently, with OKX Web3 wallet as an example, users can access more than 5,500 DApps through it, and the wallet has already integrated more than 500 DApps. On the other hand, Web2 payment apps mainly focus on traditional centralized payment and transfer functions, and cannot directly interact with DApps.

Web3 Wallets are Moving Towards “Walletless” Experience

In addition to providing a keyless solution so that users no longer have to worry about saving private keys, one of the leading directions Web3 wallets are working on is the “walletless” experience embedded in use cases, which is also becoming a trend. Take NBA Top Shot as an example. Initially, users will see the option to purchase NFT collectibles, while the wallet acts as the custody account for these digital assets in the background. The presence of plugins and mobile applications will continue to diminish. In order for Web3 to become mainstream, Web3 wallets should not be discovered by users, but rather be deeply integrated into the scene to provide a seamless and integrated user experience.

As more and more payment companies enter the Web3 space and include cryptocurrencies as one of their asset categories, this will attract a lot of attention from users in the crypto field. “This is a long-term benefit for the industry, because the efforts of admission, reputation, public education, and other payment companies will encourage more people to accept blockchain and blockchain-based business applications,” said Austin Champbell, a professor at Columbia Business School, in an interview with OKG Research.

However, we believe that this is only the tip of the iceberg in terms of progress in Web3 payments. The true advantage of Web3 wallets lies in giving users a higher level of security, privacy protection, and control without relying on centralized institutions.

Web3 wallets are the gateway to the future digital economy. Through Web3 technology, individual users can become participants in the digital economy, driving the establishment of an increasingly decentralized and non-monopolistic economic and social model, which will redefine our understanding of digital assets and value.

Note: Web3 wallets are digital wallets designed for interacting with decentralized applications based on blockchain technology, used for storing and managing digital assets. They typically come in self-custody and custodial wallet types. The Web3 wallets discussed in this article refer to Web3 self-custody wallets.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- US Treasury Bonds Drive the RWA Track to Heat Up How Can Players with Different Genes Innovate?

- Considering from two perspectives integrating Fantom with OP Rollup to connect Fantom to Ethereum.

- Messari Optimism data analysis shows that it is the fastest-growing ecosystem in the past 30 days, with a market value growth of over 50%.

- Bittrex reaches settlement with SEC Agrees to pay $24 million fine

- Decentralization and economies of scale

- ENS Governance Activity Statistics and Related Indicators

- In-depth Analysis of Full-Chain Game Core MUD Engine and World Engine