POW track turns red and heats up Dynex, coin price soars several times, facing multiple community doubts behind

Dynex's POW track is turning red and heating up, causing its coin price to soar multiple times. However, the project is now facing several community doubts.Author: Nancy, LianGuaiNews

Looking at the current cryptocurrency market, most of the popular public chains are based on the POS model, and it seems difficult for POW to come up with a heavyweight work, especially after Ethereum switched to the POS mechanism. However, recently, new POW internet celebrities such as KasLianGuai and Dynex have attracted market attention to the POW track.

Among them, Dynex, which leverages the AI trend and focuses on the narrative of “neural morphology computing platform,” has not only attracted many miners to participate but also attracted attention in the secondary market due to its tens of times increase. However, at the same time, Dynex has begun to face multiple doubts from the crypto community, with negative news constantly emerging, such as allegations of fraud by the founder and plagiarism of the whitepaper.

Self-proclaimed to build a neural morphology supercomputing blockchain, attracting attention through price manipulation

According to official introduction, Dynex is a neural morphology supercomputing blockchain based on the DynexSolve chip algorithm. It aims to provide computing power for machine learning, financial technology, biopharmaceuticals, and other fields by using the Proof of Useful Work (PoUW) method to improve the speed and efficiency of the decentralized network.

- Can tech giants bet on Web3 wallets to become a leverage point in the industry?

- What is the impact of improving the token economics of $RLB? What is its potential?

- Analyzing the first zk-fraud-proof system, the combination of Optimistic Rollup and ZKP

Dynex network nodes are composed of PoUW miners, allowing any miner to perform Dynex chip calculations and obtain native token $DNX as a reward, thereby achieving high-speed and efficient execution of computations in a decentralized network, even surpassing quantum computing. Moreover, Dynex adopts a completely anonymous peer-to-peer transaction privacy method, and its token $DNX has no ICO, no pre-mining, and no team reservation.

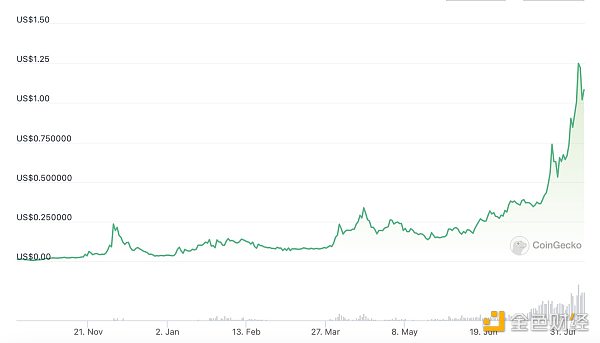

Many ordinary investors find it difficult to verify the technology (which we will elaborate on later in the article), but Dynex’s market performance is impressive. CoinGeoko data shows that since the beginning of this year, the price of $DNX has increased by more than 34.7 times.

In terms of computing power, according to the hiveon.com computing power management platform data, as of August 10th, the computing power of $DNX accounted for 18%, ranking first among the listed POW coins on the platform, far exceeding projects such as KAS, ETC, and RVN.

In addition, according to Mining Pool Stats data, as of August 10th, Dynex’s network computing power was 1.09 GH/s, ranking 38th. Over the past six months, Dynex’s computing power has also shown an upward trend, although there was a temporary decline due to algorithm upgrades, it quickly recovered. In terms of computing power distribution, the top three mining pools account for nearly 84.4% of the total.

Founder was previously punished by SEC for fraud, whitepaper suspected of plagiarism

As Dynex gains popularity, doubts about whitepaper plagiarism and the project team’s background have also arisen. Dynex is an anonymous team, and anonymous identities are not uncommon in the Web3 world that emphasizes decentralization and privacy. However, this means that once these projects behave maliciously, it will be difficult for users to hold them accountable.

Regarding the anonymity of the team, according to the Dynex Chinese channel, the parent company of Dynex is a chip company based in Northern Europe, which has not been publicly disclosed due to tax and other issues. However, the community does not accept this explanation. Some community members have discovered fraudulent behavior by Dynex founder Daniel Mattes. According to LinkedIn, Daniel Mattes is an Austrian internet entrepreneur and venture capitalist who has founded several companies, including artificial intelligence company 42.cx, VoIP company Jajah, and mobile payment and ID recognition startup Jumio.

As the former CEO of Jumio, Daniel Mattes was charged by the US SEC in 2019. According to SEC public documents, Daniel Mattes deceived investors before the company went bankrupt by not only falsely reporting company revenue but also secretly selling company stocks without reporting them. Although Daniel Mattes neither admitted nor denied these allegations, he ultimately agreed to pay over 17 million USD in settlement and is no longer allowed to lead publicly traded companies in the United States.

In addition, according to Twitter user @OlivierHelden, the predecessor of Dynex may be DeepQ, which not only has a similar neural morphology chip project but also has the same Adobe Stock Flash serial number as the promotional video on YouTube for DeepQ, which is completely identical to the promotional video on the Dynex official website (the Dynex video is currently 404 and cannot be displayed). Interestingly, some community members revealed that their account was banned from accessing after inquiring about the relationship between DeepQ and Dynex in the Discord community.

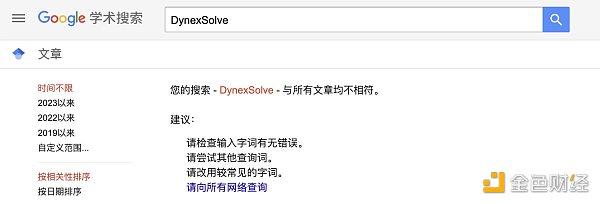

In addition to the team’s background, the two core advantages promoted by Dynex, DynexSolve and PoUW, have also been questioned for their authenticity. According to KOL @陈剑Jason, Dynex can convert any modern GPU into an analog neural morphology computing chip using DynexSolve, but this revolutionary technology has not been supported by any publicly available papers to date. Furthermore, neural morphology computing has not been applied in the real world and is still in the exploratory stage by top universities, the US military, Intel, and IBM.

Regarding PoUW, analyst 陈剑Jason stated that for a blockchain, PoUW is non-standard in the beginning, process, and ending stages. The quantity and frequency of tasks are non-standard, the difficulty and time required to complete tasks are non-standard, and the verification of task results is non-standard. As a result, it is fundamentally impossible to generate stable blocks and effectively verify, making the chain lack basic usability.

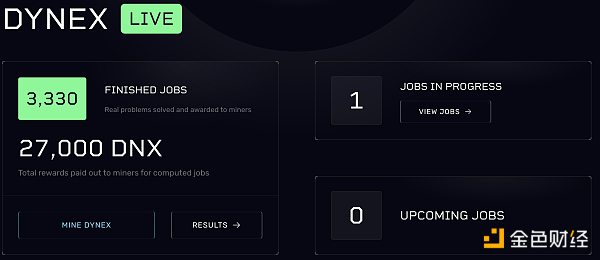

It is worth mentioning that 陈剑 also pointed out that the Dynex official website shows that 3300 tasks have been completed, but currently, only 1 task is in progress, and all of these tasks are black boxes without any knowledge of what they are doing and without any entry point to publish tasks.

Regarding these technical issues, some community members believe that the fact that Dynex can conduct ML public testing demonstrates that its technology can withstand public scrutiny. However, the current public testing has been postponed multiple times due to technical issues.

In addition, the Dynex whitepaper also contains copy-pasting behavior, as shown in the image below, where some content of Dynex is almost identical to the whitepaper of MemComputing, a US company that holds a patent for digital memory computing (DMM).

Comparison of Dynex and DMM white paper

In summary, it is not surprising that Dynex is favored by funds in the wave of AI and the popularity of the POW concept. In particular, with the popularity of KasLianGuai and the trend of POW mining, as well as a large number of mining machines being idle after Ethereum shifted from POW to POS, Dynex has become the migration target for miners. As a project that requires strong technical research and development capabilities, it is reasonable for the community to have various doubts for the sake of their own interests. However, in order to dispel market concerns, “hard power” needs to be demonstrated.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- The Metaverse applies continuous decoding of the ‘hard technology’ of the Hangzhou Asian Games.

- US Treasury Bonds Drive the RWA Track to Heat Up How Can Players with Different Genes Innovate?

- Considering from two perspectives integrating Fantom with OP Rollup to connect Fantom to Ethereum.

- Messari Optimism data analysis shows that it is the fastest-growing ecosystem in the past 30 days, with a market value growth of over 50%.

- Bittrex reaches settlement with SEC Agrees to pay $24 million fine

- Decentralization and economies of scale

- ENS Governance Activity Statistics and Related Indicators