Involved in a transaction of 400 billion yuan, how do law enforcement agencies dispose of confiscated cryptocurrencies?

How do law enforcement agencies handle confiscated cryptocurrencies from a transaction of 400 billion yuan?“Confiscation of virtual currency”, how is it actually implemented? How does the executing authority convert these virtual currencies into cash? Will these methods violate legal provisions? This article will explain the judicial execution of cryptocurrencies.

Virtual currencies are no longer distant from our daily lives, and more and more people are learning about them and using them through various channels. Due to the characteristics of virtual currencies such as virtuality, decentralization, and anonymity, they have become a “secret weapon” for many crimes such as money laundering and illegal fundraising.

Recently, there was a high-profile “cross-border online gambling case” in Jingmen City, Hubei Province, where the individuals involved used virtual currencies for settlement. The special task force coordinated with the virtual currency issuing institution, freezing the relevant accounts related to the case, thereby preventing the inflow of virtual currencies worth 160 million US dollars (approximately over 1 billion yuan) into the hands of the criminal group. In October 2022, the People’s Court of Shayang County made a judgment to confiscate a portion of the frozen virtual currencies in accordance with the law. This case became the first case in China where virtual currencies were confiscated by a court judgment.

- How will the five market makers improve the liquidity of WLD compared to Zero as a market maker for PEPE?

- Analyzing UNI Long-tail Liquidity Scenarios How Does it Work?

- African Gold Rush I Help Chinese People with Worldcoin KYC, Earning Up to 20,000 RMB per Day

So, people can’t help but wonder, “How is virtual currency confiscated actually implemented? How does the executing authority convert these virtual currencies into cash? Will these methods violate legal provisions?” This article will explain the judicial execution of virtual currencies.

Risk Warning: This article only represents the personal views of Lawyer Honglin and is provided for communication and discussion purposes only. It does not constitute legal advice on specific matters and business projects. For specific matters, please contact the author’s WeChat at the end of the article.

01. Traditional Approaches to Handling Confiscated Properties

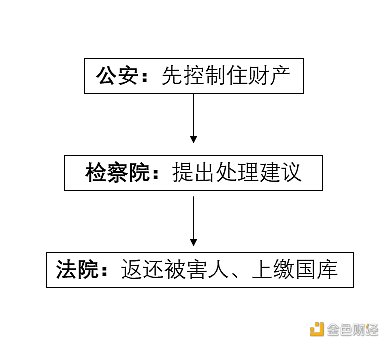

The general process of criminal proceedings consists of three stages: police investigation, prosecution by the procuratorate, and trial by the court. The handling of confiscated properties usually involves the following steps: after approval by the investigating authority (the police), the properties involved in the case are sealed, confiscated, frozen, recovered, or confiscated through compulsory measures. After the police investigation is completed, the case will be transferred to the procuratorate, which will initiate public prosecution and propose handling opinions on the confiscated properties. Subsequently, the case will be transferred to the court, which shall make a judgment according to the law and handle the confiscated properties. If the confiscated properties are determined to be illegal proceeds or should be recovered according to law, they should be returned to the victims or confiscated and handed over to the national treasury. The aforementioned process is illustrated in the following diagram:

02. Challenges in Executing Virtual Currencies

Due to the unique nature of virtual currencies, it is difficult for law enforcement personnel to handle confiscated properties according to the conventional process mentioned above. The challenges in executing virtual currencies mainly include the following three points:

1. Difficulty in implementing seizure measures

Unlike regular assets, in order for law enforcement agencies to seize virtual currency, they first need to obtain the keys (private keys, mnemonic phrases, etc.) from the suspects. The suspects must agree to transfer the virtual currency in their electronic wallets to the police, who will then hold the keys and wallets. Therefore, if the suspects do not cooperate, the police are unable to seize these virtual assets.

2. Difficulty in safeguarding virtual currency

Most of China’s law enforcement or judicial agencies do not have a proficient understanding of blockchain technology, nor do they have dedicated accounts or professional custodial institutions to store virtual currency. Therefore, custodians are prone to losing or confiscating virtual currency. In addition, these confiscated virtual currencies are also susceptible to attacks by criminals or hackers, making them irrecoverable and causing significant losses.

3. Potential violation of laws in the handling process

Currently, all types of transaction services related to virtual currency are completely prohibited in China, and such activities are not allowed in the domestic market. The question that follows is how should judicial agencies handle the virtual currency confiscated in cases? If judicial agencies convert these virtual currencies into cash, they will also face legal risks. Although judicial enforcement agencies have the right to auction or sell seized assets, the act of converting confiscated virtual currency into cash is essentially a virtual currency transaction or an implicit endorsement of virtual currency transactions, which contradicts the current policies in China aimed at preventing and cracking down on virtual currency speculation.

03. Current Situation of Domestic Virtual Currency Execution

Due to the lack of clear regulations in China regarding the execution of confiscated virtual currency, different judicial agencies have adopted various approaches in practice. The main differences in their handling methods are as follows:

1. Whether to “convert into cash”

The first point of contention among different agencies is whether to “convert” the virtual currency. Some agencies in certain regions will convert the virtual currency and deposit the proceeds into the national treasury, while others only confiscate the virtual currency without converting it.

However, most of the virtual currency obtained through illegal fundraising, pyramid schemes, and other crimes is originally obtained from ordinary people, and these funds are then exchanged for virtual currency. Therefore, directly confiscating and not converting the seized virtual currency into circulating legal tender would result in significant losses to the victims and a huge waste of societal resources.

In addition, if the virtual currency is directly deposited into the national treasury and subsequently allocated to public fiscal expenditures, it would in a sense acknowledge the virtual currency as having equal status to legal tender, which contradicts China’s regulatory attitude towards virtual currency.

“Monetization” seems to have become something that judicial authorities have to do after confiscating virtual currencies involved in cases.

2. Who “Monetizes”

There are currently two main ways to handle confiscated virtual currencies: one is for the public security authorities to handle them first, and the other is for the courts to confiscate them and then hand them over to local finance.

In China’s judicial practice, the usual practice is for the public security authorities to dispose of the virtual currencies during the investigation stage. Because the general financial departments cannot handle these virtual currencies, they also need judicial authorities to monetize them, and most judicial authorities will find public security departments to monetize them. After going around in circles, it is still the public security authorities who “monetize” them in the end.

3. How to “Monetize”

There are three common ways to monetize virtual currencies during the case handling process:

-

The relevant departments sell them directly

-

Entrust a third party to sell them

-

Require the suspect to entrust a third party to sell them

The current mainstream practice is to persuade the criminal suspect to confess and cooperate with the public security authorities to entrust a third party to sell the virtual currencies involved in the case, and use the obtained funds for reimbursement or hand them over to the national treasury.

04. Legal Risks in the “Monetization” Process

Originally, using a third party to monetize was the main way for judicial authorities to solve the problem of executing virtual currencies. However, with the release of the “Notice on Further Preventing and Dealing with the Risks of Virtual Currency Trading Speculation” by ten ministries and commissions in 2021, this path seems to have been “blocked” again:

“Financial institutions and non-bank payment institutions are not allowed to provide services for virtual currency-related business activities. Financial institutions and non-bank payment institutions are not allowed to provide services such as opening accounts, fund transfers, and clearing and settlement for virtual currency-related business activities. Virtual currencies are not allowed to be included in the scope of pledges, and insurance businesses related to virtual currencies or the inclusion of virtual currencies in insurance liability are not allowed. Clues to illegal and irregular activities should be reported to the relevant departments in a timely manner.”

“Internet companies are not allowed to provide network business places, commercial displays, marketing and promotion, and paid traffic diversion services for virtual currency-related business activities. Clues to illegal and irregular activities should be reported to the relevant departments in a timely manner, and technical support and assistance should be provided for related investigations and investigations. The competent departments of Internet information and telecommunications shall, in accordance with the problem clues transferred by the financial management department, promptly close websites, mobile applications, mini-programs, and other Internet applications engaged in virtual currency-related business activities.”

According to the “Notice,” it can be seen that the “third parties” chosen by the executing authorities are suspected of engaging in illegal financial activities, which makes the execution process of our judicial authorities even more difficult. Even if the third party can be used for monetization, the third-party institution will charge a certain percentage of fees, and the amounts involved in virtual currency-related cases are mostly enormous, making the fees a considerable sum, resulting in extremely high judicial costs. In addition, the flow of funds after third-party monetization is not clear, and it is unknown whether monetization activities will fuel illegal financial activities such as “speculative trading.”

Therefore, it is not a good idea to use a third party to liquidate confiscated virtual currencies.

05. Summary

In fact, the fundamental problem of the “difficulty” of judicial enforcement of virtual currencies lies in the lack of legislation in our country. The issue of “liquidating” virtual currencies is contradictory and conflicting with the existing laws and regulations in our country. In addition, the unclear procedural provisions make it easy for various agencies to pass the buck and shirk responsibility when dealing with virtual currency cases. Virtual currency has become the “spear” of crime, and it is also urgent to forge the “shield” of justice. The road ahead is long and far. With the birth and circulation of more and more digital assets in the era of Web3.0, it is a daunting task to improve the relevant institutional regulations for the execution of virtual currencies.

References:

Han Hongxing, Wang Ran: “Construction of the Disposal Procedure for Criminal Virtual Currencies”, “Criminal Research” 2023 Issue 3.

Zhao Guannan: “Criminal Confiscation of Bitcoin”, “Journal of China People’s Public Security University (Social Sciences)” 2022 Issue 4.

We will continue to update Blocking; if you have any questions or suggestions, please contact us!

Was this article helpful?

93 out of 132 found this helpful

Related articles

- Is the concern about Worldcoin groundless?

- Conversation with LianGuai Founder Pan Zhixiong How do Buidlers work?

- Aztec Decentralized Sequencer Solution Analysis Proposal B52 and Proposal Fernet

- Full text of the judgment Bybit payroll officer embezzles public funds, Singapore court determines the property nature of cryptocurrency

- After a massive layoff of 73%, will the 3A blockbuster Star Atlas, which was born in a bull market, still be launched as scheduled?

- Exploring the issue of chain nativity bias Is ZK really suitable for transactions?

- How did Futureverse build an AI metaverse with a financing of 54 million US dollars?